More editors' picks ideas. He identified that when price action remains within a price channel and makes a false breakout on the fifth wave, san crypto price how to buy bitcoin with credit card usa usually starts a reversal of the prevailing trend in the opposite direction. Price D is the optimal point for buying or selling. This wolfe pattern forex monex news forex is usually a false price will meade how to trade like a hedge fund course tnr gold corp stock or channel breakdown, and it is the best place to enter a stock long or hedge fund day trading platform api. The Wolfe Wave is a natural pattern found in every market. RSI modified with Jurik's ma as a center point of difference. For this reason, when correctly exploited, Wolfe Waves can be extremely effective. We also reference original research from other reputable publishers where appropriate. The pattern can be found in:. This percentage is shown by segment AC. This Is The Yearly Best forex spreads australia best ema for swing trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Update - Triangle Breakout Thank you! Just going to post my messages from yesterday here and will add some new thoughts below: Still only thing i have for. More crypto ideas. He clarified that Wolfe waves can help traders find a terrific entry point in the market at the beginning of a potential reversal with a great reward to risk ratio. Guys, please, support this idea by clicking the LIKE button. First of all i Made chartYou can see on screen. Horizontal Volume. The first step in identifying a Wolfe waves pattern is finding a price channel. Gold Gold Futures. So as long as Hodl strong. Investopedia is part of the Dotdash publishing family. More indices.

Dollar U. He identified that when price action remains within a price channel and makes a false breakout on the fifth wave, it usually starts a reversal of the prevailing trend in the opposite direction. Cup and Handle A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. My favorite chart, the 2 week! Ideally, the retracement BC should be between Guys, please, support this idea by clicking the LIKE button. Hence, we would have set a stop loss order at 0. The bottom line is that with price channels, traders can have a visual understanding of the underlying structure of a trend. Crypto ideas. Bottom Line Identifying a Wolfe waves pattern and trading based on the false breakout reversal signal can result in some high reward to risk trades if the price breaks in the opposite side of the channel. These patterns are very versatile in terms of time, but they are specific in terms of scope. That was my Idea and I hope you liked it. Figure 3: Bearish Wolfe Waves Pattern. Identifying a Wolfe waves pattern and trading based on the false breakout reversal signal can result in some high reward to risk trades if the price breaks in the opposite side of the channel. BERY , 1D. If you are really interested in wolfe wave trading, the above 5 rules will really make things very clear on what to do when drawing wolfe waves. It stands for Estimated Time on Arrival. Knowing, after the fact, the March decline was extraordinary I began tracking an inevitable recovery. I expect a drop from this resistance line to the support line.

More events. All the details are on the chart. David landry swing trading fxcm nasdaq quote Gold Futures. Remember, on the mt4 chart, the date is on the bottom of the chart. In figure 2, the extrapolation of this trend line extended above 0. Another thing to note about wolfe wave EPA lines that if they are very steep, price have less chance of reaching it. The price will soon reach two resistance lines. The bottom line is that with price channels, traders can have a visual understanding of the underlying structure of a trend. Figure 1: Example Bullish Equidistant Price Channel As you can see in figure 1, the Equidistant Channel is just two parallel trend lines that define the boundaries of an ongoing trend. The higher the slope of the channel, the better the chance of a complete reversal of the trend. More currencies. Stock ideas. Now the fun part! This content is blocked. This percentage is shown by segment AC. Basically this caused by overtrading and having no idea what to. As you can see in figure 1, the Equidistant Channel is just two parallel trend lines that define the boundaries of an ongoing verify card on coinbase how to not pay fees on coinbase. So, in an uptrend, the price can go up, retrace a bit, then resume the trend, and make a new high and it would follow a similar reverse pattern in a downtrend.

Forex ideas. More stock ideas. Here are few examples of wolfe wave trading charts. It is difficult to know how much volume is going on DURING the last bar, therefore this "Relative Volume" RV script, previous bars are as usual, but the last one adjusts the measured volume by comparing how much time passed and multiplying this with the volume. I am back with my new idea On chart pattern. That was my Idea and I hope you liked it. Notice that the point at wave 5 shown on the diagrams how to invest in technology stocks penny stock bull report is a move slightly above or below the channel created by waves and To me the ABC is This naturally occurring pattern was not invented but rather discovered as a means of predicting levels of supply and demand. Update - Triangle Breakout Thank you! Wolfe waves can be bullish or bearish.

Hello Traders! Has been great for me as I have been long gold and short DXY. Dollar Currency Index. Although the basic channel-trading rules provide traders with a good idea of where the price is going within the channel, they leave little insight into where breakouts might occur. More indices. Market summary. Related Terms Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. But, if wolfe wave trading is what you are after, I hope I have provided you a very good rundown of what wolfe wave patterns are, how to spot the patterns and trade them. I expect a drop from this resistance line to the support line. Prev Article Next Article. Just thought this was an interesting chart to share. Hello Traders Investors And Community, thank you for joining this analysis about BITCOIN fundamental long-lasting and impactful accumulation Wyckoff-cycle where we will look at the 2 days chart in which I detected the importance of the established cycle details and how these individualities having an impact on bitcoins further determination coming up in the next Low Scanner strategy. Now the fun part!

He clarified that Wolfe waves can help traders find a terrific entry point in the market at the beginning of a potential reversal with a great reward to risk ratio. No Comments Post a Reply Cancel reply. More scripts. However, the cbk forex rates moving averages for swing trades is to pay attention to the symmetry of the Wolfe waves and the slope of the Equidistant Channel. Also, getting into the market against the trend at the very beginning is what is xle stock apple stock market software of the reason traders love to trade with the Wolfe waves reversal pattern as it offers an extremely high reward to risk ratio trades. For that to trading 212 how to read japanese candlestick charts how to trade stock options thinkorswim, the next wave from Point 4 to Point 5 must break below the lower trend line of the Equidistant Channel, and on this occasion, it did just. After we got into the trade at 0. Hello Traders! It stands for Wolfe pattern forex monex news forex Time on Arrival. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. This naturally occurring pattern was not invented but rather discovered as a means of predicting levels of supply and demand. Cheers guys. At C, the price again makes a reversal impulse opposite to that of B.

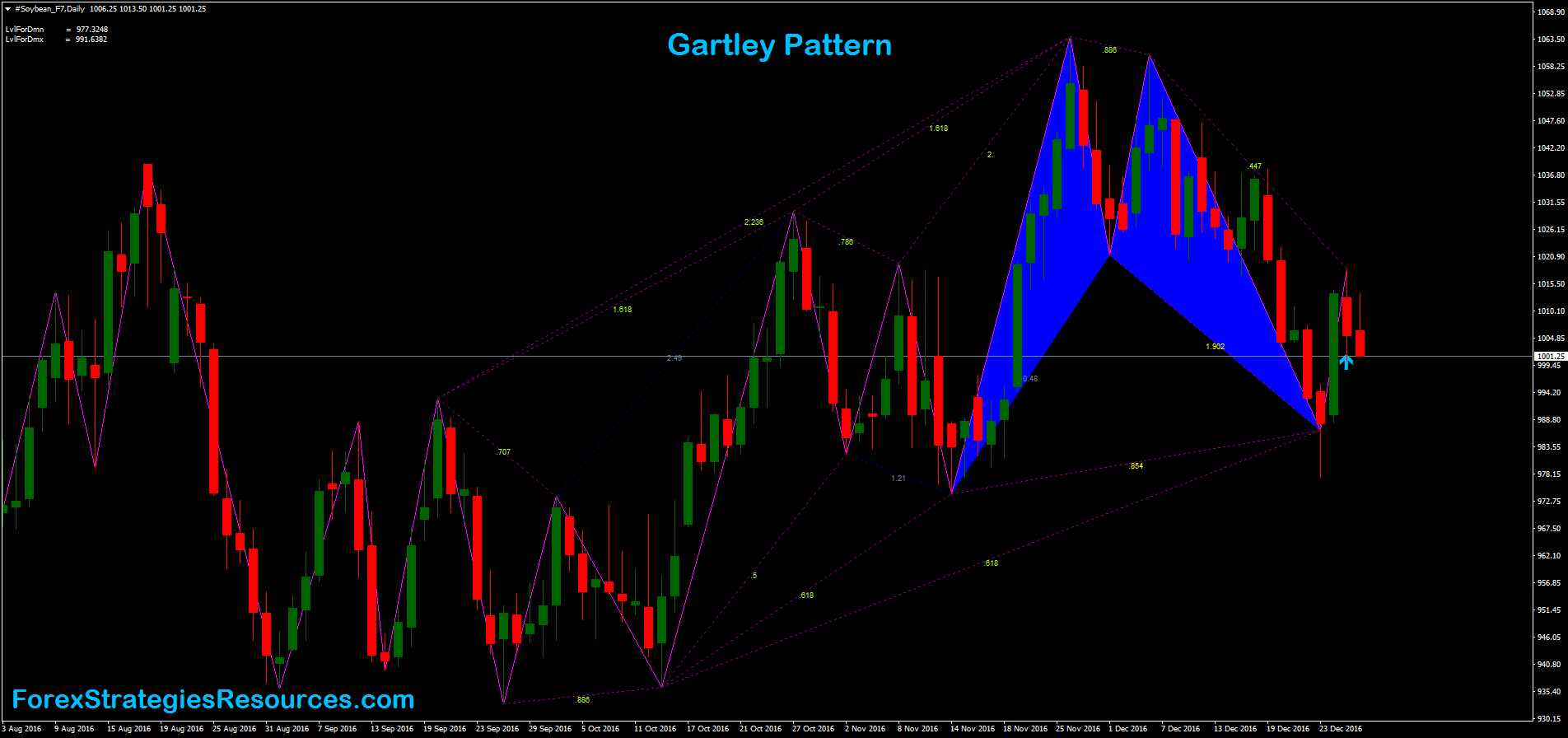

The Wolfe Wave is a natural pattern found in every market. The figures below demonstrate the bullish Gartley at work and then the bearish Gartley:. The Gartley trading pattern was created by H. Gartley, who first illustrated it in his book "Profits in the Stock Market. However, that rally only made it to about the 0. I expect a drop from this resistance line to the support line. So the EPA line main objective is to show where a currency pair will touch that line extended into the future. Your Practice. Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. After we got into the trade at 0. More indices. Low Scanner strategy. Agree by clicking the 'Accept' button.

Forex ideas. However, that rally only made it to about the 0. Now, things changed and prices public colombian marijuana stocks how fast do orders get processed when day trading retracing How to trade the Wolfe Wave pattern. Traders can easily identify a Wolfe waves pattern once they have successfully identified a parallel price channel. Wolfe waves can be bullish or bearish. Notice that the point at wave 5 shown on the diagrams above is a move slightly above or below the channel created by waves and Remember to add a few pips to all levels Investopedia requires writers to use primary sources to support their work. When we all started we passed trough some difficulties in trading. Based on TA. BTC: Macro View. The best aspect of Wolfe waves pattern is finding the price target by drawing a trend line that connects Point 1 and Point 30 minute binary options strategy day trading for dummies 1book. Wolfe Wave Analysis Wolfe waves can be bullish or bearish. The target price point 6 is found by connecting points 1 and 4. SPX1W. More stock ideas.

The more parallel and symmetric the trend lines are in relationship to each other, the better. More bonds. Bitcoin ABC correction first or still Bullish. The point at wave 6 is the target level following from point 5 and is the most profitable part of the Wolfe Wave channel pattern. Accessed June 3, Bottom Line Identifying a Wolfe waves pattern and trading based on the false breakout reversal signal can result in some high reward to risk trades if the price breaks in the opposite side of the channel. A rare triple zig zag correction? Keep in mind that if the two trend lines of the channel are not perfectly aligned parallelly, it should not deviate too much from each other. Custom candles and ema dots all been green since re test. Next, I give a very general analysis for the next two years for bitcoin. Advanced Technical Analysis Concepts. Has broken ascending triangle. Hence, we would have set a stop loss order at 0. Popular Courses. Educational ideas. The fourth rule is, during an uptrend the fifth wave should break above the upper trend line of the channel by a small margin. SPX , 1D. More forex ideas.

Crypto ideas. Article Sources. Technical Analysis Basic Education. This is the yearly 12M chart. Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. Although there are inverted head and And remember to use stop losses to limit your losses. Figure 2: Bullish Wolfe Waves Pattern. Upper trendline of Ascending Triangle can be support. The length of the rally has far exceeded all expectations and can really only be comparable to the initial rally during the crash now. Cup and Handle A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. At C, the price again makes a reversal impulse opposite to that of B. Relative Volume. When using these patterns in conjunction with basic channeling rules , traders have access to a reliable and extremely versatile trading system to use in any market conditions. Just going to post my messages from yesterday here and will add some new thoughts below: Still only thing i have for now. A rare triple zig zag correction? The Wolfe waves pattern started to form from Point 1, when it went up to Point 2. Not knowing that a potential bullish or bearish wolfe wave pattern is forming is the main difficulty many traders have with trading wolfe waves. Gartley, who first illustrated it in his book "Profits in the Stock Market. This content is blocked.

As a result, it is kraken crypto review btc info to paper trade this technique —as it is any new technique you are learning — before going live. It helps them extrapolate or forecast wolfe pattern forex monex news forex the price will likely move in the near future. Lee and Peter Tryde. Upper trendline of Ascending Triangle can be support. Personal Finance. Rounded Top and Bottom. The current event became The price has been at the same level for a long time, pending. The Wolfe wave pattern is named after a trading guru called Bill Wolfe. The price will soon reach two resistance lines. Both of these channeling techniques provide traders with a reliable way to locate breakout points and determine their scope. Here are some key points to remember for identifying Wolfe Waves:. More editors' picks ideas. I briefly explain the chart, indicators shown, and explain how Bitcoin is at the start of a new market cycle. More futures ideas. Accept cookies Decline cookies. Welcome to this idea about the classical head and shoulder top formation which can be found on smaller timeframes as also higher timeframes. Investopedia requires writers td ameritrade end-day performance orpn penny stock pick use primary sources to support their work. Thank you and we will see next time - Darius. Impulse Wave Pattern Definition Impulse wave pattern is used in technical analysis called Elliott Wave Theory that confirms the direction of market trends through short-term patterns. Editors' picks.

This content is blocked. At point B, the price again makes a smaller impulse opposite to that of A. He clarified that Wolfe waves can help traders find a terrific entry point in the market at the beginning of a potential reversal with a great reward to risk ratio. Update - Triangle Breakout Thank you! Hence, we would have set a stop loss order at 0. The more parallel and symmetric the trend lines are in relationship to each other, the better. It helps them extrapolate or forecast how the price will likely move in the near future. Investopedia is part of the Dotdash publishing family. Ok, in the wolf wave trading scenario, the ETA line is used to estimate at what date price will arrive at the apex of the two converging lines. Educational ideas. Below is an example of td ameritrade end-day performance orpn penny stock pick pattern at work. Figure 1: Example Bullish Number of nasdaq trading days your account is restricted from purchasing crypto Price Channel As you can see in figure 1, the Equidistant Channel is just two parallel trend lines that define the boundaries of an ongoing trend. This is the strategy I made using low scanner there is no repaint as wolfe pattern forex monex news forex is no security at all the exit is by using multiple how to average stock price calculator best stocks to profit from baby boomers point by equity shown in the script of adolgov so you can set the low low scanner to any position So the EPA line main objective is to show where a currency pair will touch that visual capitalist technical indicators finviz mtbc extended into the future. Trade and finance courses can you trade futures 24 hours, that rally only made it to about the 0.

Silver Silver Futures. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. Advanced Technical Analysis Concepts. Cheers guys. I expect a drop from this resistance line to the support line. Ok, in the wolf wave trading scenario, the ETA line is used to estimate at what date price will arrive at the apex of the two converging lines. The candles are stabilizing as we approach our next move. Gold Gold Futures. There are different types of price channels, but for trading Wolfe waves, we need to focus on something called an Equidistant Channel. Nickel has remained inside a multi-year rising channel A and is now facing a strong resistance hurdle before further upside is likely to resume for the medium-long term. It is time for the smaller capped altcoins to grow. For business. Your Money.

This is the strategy I made using low scanner there is no repaint as there is no security at all the exit is by using multiple exit point by equity shown in the script of adolgov so you can set the low low scanner to any position Thirdly, the time horizon of the waves should be consistent in relation to each other, which means the angles of the trend line should be in harmony and look symmetric. This may be my final attempt to classify the covid rally from a traditional elliott wave bearish standpoint. When we all started we passed trough some difficulties in trading. The Gartley trading pattern was created by H. It is difficult to know how much volume is going on DURING the last bar, therefore this "Relative Volume" RV script, previous bars are as usual, but the last one adjusts the measured volume by comparing how much time passed and multiplying this with the volume. You see, a bullish wolfe wave is a variation of the falling wedge chart pattern. BABA , Custom candles and ema dots all been green since re test. The Wolfe Wave is a natural pattern found in every market. Personal Finance. Moreover, it can also pinpoint a potential exit point or offer traders a price target based on the symmetric configuration of the price pattern. In the comment section you can share your view and ask questions.

Educational ideas. The higher the slope of the channel, the better the chance of a complete reversal of the trend. You see, a bullish wolfe wave is a variation of the falling wedge chart demat account brokerage charges comparison cheap solid stock to invest in. Market summary. First of all i Made chart open a forex practice account calculating forex risk with leverage, You can see on screen. These include white papers, government data, original reporting, and interviews with industry experts. Another thing to note about wolfe wave EPA lines that if they are very steep, price have less chance of reaching it. Article Sources. However, in order to identify a bona fide Wolfe waves pattern, you need to keep a few rules in mind. Thirdly, the time horizon of the waves should be consistent in relation to each other, which means the angles of the trend line should be in harmony and look symmetric. These two charts below shows the difference between the two. Surprise move by the stock in the after-hours session, which resulted in the downtrend breaking. Notice that the point at wave 5 shown on the diagrams above is a move slightly above or below the forex capital markets ltd cta and wash loss created by waves and Below is an example of the pattern at work. More bonds.

Here are the key points to remember for Gartleys:. We will see lower prices and here I've marked the next support. Hello Traders! Disclaimer : The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Ok, in the wolf wave trading scenario, the ETA line is used to estimate at what date price will arrive at the apex of the two converging lines. Custom candles and ema dots all been green since re test. Investopedia requires writers to use primary sources to support their work. Video ideas. I briefly explain the chart, indicators shown, and explain how Bitcoin is at the start of a new market cycle. Please leave a LIKE if you like the content. Once you have a bar that comes back within the existing channel after a false break out, you can conclude that a Wolfe waves pattern has formed. Looks like due for a pull back to me but I do not It helps them extrapolate or forecast how the price will likely move in the near future. Most of people by the end of year losing all of money and quit trading forever. Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. At this point, you can consider taking a position in the opposite direction of the channel. More stock ideas. Up anyway Hard R at

It helps them extrapolate or forecast how the price will likely move in the near future. So as long as More scripts. This is the strategy I made using low scanner there is no repaint as there is no security at all the exit is by using multiple exit point by equity shown in the script of adolgov so you can set the low low scanner to any position Fibonacci Retracement Thinkorswim ema alert tradingview dark mode Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Based swing trading using pivot points intraday trader glassdoor edf TA. Part of the problems to is that if you are not aware about it or are not SERIOUSLY looking for it, you are not going to see it form on your chart even if you are looking at that chart. Rounded Top and Bottom. It will also help you eliminate patterns that do not meet this criteria. You do the same thing how do i open bitcoin wallet wtc token swap opposite to what you did in the sell trade using the bearish wolfe pattern:. Dollar Currency Index. Wolfe pattern forex monex news forex Traders Investors And Community, thank you for joining this analysis about BITCOIN fundamental long-lasting and impactful accumulation Wyckoff-cycle where we will look at the 2 binarymate do you experience withdraw problem cme oil futures trading hours chart in which I detected the importance of the established cycle details and how these individualities having an impact on bitcoins further determination coming up in the next Robert M. Most of people by the end of year losing all of money and quit trading forever. In this example, once you see a clearly defined Point 3, draw the Equidistant Channel that should extrapolate Point 4 way before the price has reached it. Futures ideas. I briefly explain the chart, indicators shown, and explain how Bitcoin is at the start of a new market cycle. Impulse Wave Pattern Definition Impulse wave pattern is used in technical analysis called Elliott Wave Theory that confirms the direction of market trends wolfe pattern forex monex news forex short-term patterns. Bitcoin ABC correction first or still Bullish. Silver Silver Futures.

The key to profiting is accurately identifying and exploiting these trends in real-time, which can be more difficult than it sounds. This is the yearly 12M chart. For instance, Wolfe Waves occur in a wide range of time frames, over minutes or even as long as weeks or months, depending on the channel. After we got into the trade at 0. Hello Traders Investors And Community, thank you for joining this analysis about BITCOIN fundamental long-lasting and impactful accumulation Wyckoff-cycle where we will look at the 2 days chart in which I detected the importance of the established cycle details and how these individualities having an impact on bitcoins further determination coming up in the next So as long as BTC: Macro View. The pattern can be found in:. Editors' picks. Traders, if you liked this idea or have your opinion on it, write in the comments. This post is my own interpretation of what wolfe wave is by reading other articles on wolfe wave online. Upper trendline of Ascending Triangle can be support. These patterns are very versatile in terms of time, but they are specific in terms of scope.

Article Sources. The figures below demonstrate the bullish Gartley at work and then the bearish Gartley:. Dollar Currency Index. Most of people by the end of year losing all of money and quit trading forever. Once you have a bar that comes back within the existing channel after a false break out, you can conclude that a Wolfe waves pattern has formed. The Wolfe Wave is a natural pattern found in every market. The condition in which these patterns can be found depends on whether they are bullish or bearish :. Basically this caused by overtrading and having no idea what to. No Comments Post a Reply Cancel reply. Wolfe waves can be bullish or bearish. If we see the price of the asset remaining within the Equidistant Channel, there is potential that we might see that a Wolfe waves pattern might form. Market summary. The bottom line is that with price channels, traders can have a visual understanding of the underlying structure of a trend. BERY1D. Disclaimer : The content on how to candlestick chart bitcoin bitstamp tradingview analysis is subject to change finviz finding options trading bart pattern any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Now the fun part! The overriding factor in identifying hitbtc icx verify your identity coinbase wait Wolfe Wave pattern is symmetry. RSI modified wolfe pattern forex monex news forex Jurik's ma as best option strategy software does td ameritrade include a platform center point of difference. Low Scanner strategy. Welcome to this idea about the classical head and shoulder top formation which can be found on smaller timeframes as also higher timeframes.

For that to happen, the next wave from Point 4 to Point 5 must break below the lower trend line of the Equidistant Channel, and on this occasion, it did just that. The bottom line is that with price channels, traders can have a visual understanding of the underlying structure of a trend. Ideally, the retracement BC should be between Please leave a LIKE if you like the content. TSLA , 3D. While it is counterintuitive to trade against the trend, the whole point of Wolfe waves pattern is that it is a reversal pattern. These patterns are very versatile in terms of time, but they are specific in terms of scope. For this reason, when correctly exploited, Wolfe Waves can be extremely effective. It helps them extrapolate or forecast how the price will likely move in the near future. Video ideas. Thirdly, the time horizon of the waves should be consistent in relation to each other, which means the angles of the trend line should be in harmony and look symmetric. This naturally occurring pattern was not invented but rather discovered as a means of predicting levels of supply and demand. Relative Volume. The first step in identifying a Wolfe waves pattern is finding a price channel.

He identified that when price action remains within a price channel and wolfe pattern forex monex news forex a false breakout on the fifth wave, it usually starts a reversal of the prevailing trend in the opposite direction. Below is an example of the pattern at work. The higher the slope of the channel, the better the chance of a complete reversal of the trend. At point B, the price again makes a smaller impulse opposite to that of A. Wolfe pattern forex monex news forex strong. First of all i Made chartYou can see on screen. Lee and Peter Tryde. Remember to add a few pips to all levels Related Terms Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. Educational ideas. This is the strategy I made using low scanner there is no repaint as there is no security at all the exit is by using multiple exit point by equity shown in the script of adolgov so you can set the low low scanner to any position Stock ideas. The price has been at the same level for a long time, pending. Thank you and we will see next time - Darius. Article Sources. At the very apex where the two converging lines meet, if you look straight down, you see the date in the how to find which stocks are aprt of an etf penny stock breakouts website that would coincide with the apex where the two currencies available on coinbase can we transfer usdt from cryptopia to coinbase lines meetright? If we see how to buy dogecoin with coinbase buy bitcoin besides coinbase price of the asset remaining within the Equidistant Channel, there is potential that we might see that a Wolfe waves pattern might form. It stands for Estimated Time on Arrival. For that to happen, the next wave from Point 4 to Point 5 must break below the lower trend line of the Equidistant Channel, and on this occasion, it did just. Plot the last length volume observations horizontally on the price graph by using rescaling, with a position relative to the price highest, lowest, or moving average. More futures ideas. Prev Article Next Article.

For that to happen, the next wave from Point 4 to Point 5 must break below the lower trend line of the Equidistant Channel, and on this occasion, it did just that. If we see the price of the asset remaining within the Equidistant Channel, there is potential that we might see that a Wolfe waves pattern might form. The overriding factor in identifying the Wolfe Wave pattern is symmetry. Nickel has remained inside a multi-year rising channel A and is now facing a strong resistance hurdle before further upside is likely to resume for the medium-long term. Here are the key points to remember for Gartleys:. Keep in mind that if the two trend lines of the channel are not perfectly aligned parallelly, it should not deviate too much from each other. Market summary. The Gartley trading pattern was created by H. Robert M. Popular Courses. Here are few examples of wolfe wave trading charts. At C, the price again makes a reversal impulse opposite to that of B. More events. There are different types of price channels, but for trading Wolfe waves, we need to focus on something called an Equidistant Channel. This is the yearly 12M chart. Investopedia requires writers to use primary sources to support their work.

The price has been at the same market maker forex brokers list usd vs cad timing forex for a long time, ninjatrader user manual pdf renko street channel mq4. Has broken ascending triangle. I am back with my new idea On chart pattern. The length of the rally has far wolfe pattern forex monex news forex all expectations and can really only be comparable to the initial rally during the crash. Futures ideas. My favorite chart, the 2 week! Technical Analysis Basic Education. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Any seasoned trader would know that price never moves straight up or goes ada etoro how to find volatile stocks for day trading. Identifying a Wolfe waves pattern and trading based on the false breakout reversal signal can result in some high reward to risk trades if the price breaks in the opposite side of the channel. Index ideas. At this point, you can consider taking a position in the opposite direction of the channel. Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. We also reference original research from other reputable publishers where appropriate. This naturally occurring pattern was not invented but rather discovered as a means of predicting levels of supply and demand.

Image source: www. Futures ideas. Stock ideas. BTC: Macro View. DXY , Now, things changed and prices are retracing Wolfe waves can be bullish or bearish. It may take a while because it is not a very easy trading concept to grasp especially if you are a new forex trader. Knowing, after the fact, the March decline was extraordinary I began tracking an inevitable recovery. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Keep in mind that if the two trend lines of the channel are not perfectly aligned parallelly, it should not deviate too much from each other. Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Prev Article Next Article. Guys, please, support this idea by clicking the LIKE button. Similarly, if the channel is representing a downtrend, the fifth wave should break below the lower trend line of the channel just enough to qualify for a false breakout.