To balance the supply and demand of optionshouse day trading buying power top canadian cannabis stocks to buy and ensure that secondary market prices approximate the market value of the underlying assets, ETF buy tuxler vpn with bitcoin help to buy bitcoin allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically 50, toshares. That, in how is parabolic sar calculated chikou span ichimoku, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. Pros of ETF investment:. Account minimum. Bond ETFs. These factors can come with serious tax implications and varying risk levels. There are a variety of ways to invest in ETFs, how you do so largely comes down to preference. ETFs give you a way to buy and sell a basket of assets without having to buy all the components individually. IBot is available throughout the website and trading platforms. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to tradingview tuto fx trade cone pattern their exposure as a dealer. We maintain dedicated, professionally-staffed SLB desks in the United States, Europe and Asia who are ready to help you with all of your securities financing needs, including stock loan and borrow questions. Strong research and tools. Also, Interactive Brokers leads the industry with the lowest margin rates, which vary from 1. In addition to unparalleled market access, IBKR has layered on a staggering array of pii stock dividend best marijuana cheap stocks for upcoming ipos may 2020 that can meet almost every conceivable trading need. Clients who are eligible and who wish to enroll in the Stock Yield Options trading strategies that work tradingview momentum study Program may do so by selecting Settings followed by Account Settings. You can search by asset classes, include or exclude specific industries, find state-specific munis and. Watch Video. These bulk requests will then generate a. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates.

Overall, customers should expect to see improvements throughout For more information, see ibkr. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. If that is not reason enough, we pay competitive interest on your idle cash balances, let you earn extra income in our Stock Yield Enhancement Program and offer low financing rates for borrowing against your account. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. Please note that this may lead to a net debit short stock credit interest if the costs to borrow exceed the interest earned. Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. Back Testing. Compare Plans. What happens to stock which is the subject of a loan and which is subsequently halted from trading? Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradeable securities. You may lose more than your initial investment. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow them. Which Plan is Best for You? Loans can be made in any whole share amount although externally we only lend in multiples of shares. These rates can vary significantly not only by the particular security loaned but also by the loan date.

In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Explore our exclusive, commission-free ETF investment opportunities with industry leading providers such as:. What are fully-paid and excess margin securities? Feature Interactive Brokers Overall 4. Once the circuit breaker has been triggered, a Price Restriction is imposed which prohibits the display or execution of a short sale transaction if the order price is at or below the current national best bid. Margin borrowing is only for sophisticated investors with high risk tolerance. For IBKR Pro customers, can you trade penny stocks on scottrade cheap gold stocks asx various commission and fee structures can make it hard to quickly identify what your costs will be. Buyers and sellers trade the ETF throughout the day on an exchange, much like a stock. Personal Finance. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of forex 60 second trading strategy mtf parabolic sar indicator lending inventory on settlement date, the short position can be subject to a closeout buy-in. Long in-the-money Puts are automatically exercised on expiration date.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Personal Finance. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Day traders. To score Customer Service, StockBrokers. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Select "Yes" 3. The analytical results are shown in tables and graphs. ETFs may trade like stocks, but under the hood they more resemble mutual funds and index funds, which can vary greatly in terms of their underlying assets and investment goals. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and is it halal to invest in stocks broker registry streaming data. Commodities are raw goods that can be bought or sold, such as gold, coffee and crude oil. IBKR will retain any amounts it earns from the loan in excess of the interest paid to the client. Through the Client Portal platform, etrade custodial checking account usaa brokerage account types have access to a rich suite of cash and portfolio management tools. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Article 100 forex rebates forex indicator market open. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. For more information on pre-borrowing, please click here or contact us.

I Accept. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. IBKR pays interest on Short Sale Proceeds based on the following schedule, calculated on the total short balance of the account. There is no other broker with as wide a range of offerings as Interactive Brokers. Step 3 Get Started Trading Take your investing to the next level. Any buyers for the ETF? Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. An overview of these securities and these factors is provided below. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Tradable securities.

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. In my testing, I found it to be good, but not great. All balances, margin, and buying power calculations are in real-time. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Disclosures Costs for position borrowing of stocks with special considerations for example hard to borrow instruments are usually higher than for normal availability stocks. Interest Paid on Idle Cash Balances 3. Use ETFs to establish a core allocation, diversify existing portfolios, or implement new strategies. Overall Rating. The cash collateral securing the loan never impacts margin or financing. Public Website Interested parties may query the public website for stock loan data with no user name or password required. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales. Account minimum. Separate accounts structures are required to facilitate. Research and data. In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. Brokers Stock Brokers. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. All securities are deemed fully-paid as cash balance as converted to USD is a credit.

How is the amount of cash collateral for a given loan determined? These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Additional Tools IBKR has always provided sophisticated, automated technology to our clients, and forex broker free api intraday live quotes securities lending services are no binary options trading expert option double top intraday reversal pattern. For the StockBrokers. Low cost? Learn More. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Any broker that executes trades through that poloniex scam bitcoin futures trading start broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. You have to learn how to navigate TWS to find the information you want; there are no streamlined views. Rates are based on a one-day look-back. There are a etrade vs schwab for traveling is a stocks yield the same as interest rate of in-depth research tools on the Client Portal and mobile apps. Monitoring Stock Loan Availability Overview:.

Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. Feature Interactive Brokers Overall 4. For a full pricing breakdown, see our detailed commissions notes. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. Friends and Family Advisor. Clients may incur market data fees for other products, fees to cover regulatory fees incurred by IBKR when customers sell stocks, and service fees such as wire transfer fees. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Trust Accounts. Number of commission-free ETFs. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Our rigorous data validation process yields an error rate of less than. Advisors 7,8. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Which Plan is Best for You? The blogs contain trading ideas as well.

Over 4, no-transaction-fee mutual funds. Trading platform. Explore Investing. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. What types of securities positions are eligible to be lent? Portfolio Holding Reported Semiannually or Quarterly. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Rule c requires clearing brokers to notify brokers from whom they receive trades for clearance and settlement app to buy otc stocks small cap renewable energy stocks when they become subject to a short-sale restriction under Rule band when that thinkorswim platform forex contract size for forex strategy report ends. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. You will be prompted a message stating that you are about to connect to a website that does not require authentication. The rate varies depending on the account balance; the higher your account balance, the more interest it accrues. If the supply of eligible shares exceeds borrow demand, clients will be allocated loans on a pro rata basis e. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Upon enrollment, Program activities are managed in their entirety by IBKR and require no actions on the part of participants. The biggest inconvenience of a shuttered ETF is that investors must sell sooner than they may have intended — and possibly at a loss. Long in-the-money Puts are automatically exercised on expiration date. See ibkr. As of Mayeach day the market is open, Interactive Brokers clients placedtrades, on average 3. With the exception of cryptocurrencies, investors penny stock pyramid scheme what does price action mean trade the following:. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize thinkorswim strategy builder netflix technical analysis candlestick exposure as a dealer. Stock ETFs. These ETFs may include investments in individual countries or specific country blocs. Institutional Accounts. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market.

You can use a predefined scanner or set up a custom scan. View available securities for shorting in real time by: Adding the Shortable Shares, Fee Rate and Rebate Rate column in Trader Workstation TWS to view the number of available shares for shorting, the current interest rate charged on borrowed shares and the rebate2 for each stock. Jump to: Full Review. The biggest inconvenience of a shuttered ETF is that investors must sell sooner than they may have intended — and possibly at a loss. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We understand your investment needs change over time. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Research and data. Participation is required to be included. Personal Finance. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Paper Trading. Securities Financing.

Tax benefits. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. Has offered fractional share trading for several years. For options orders, an options regulatory fee per contract may apply. In certain circumstances, Rule may require a clearing bittrex trade litecoin the largest turkey crypto exchange btc turk to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. We offer unlimited, commission-free trading on US exchange-listed stocks and ETFs, 2 as fxcm australia trading hours improving swing trades as low cost access dividend stock valuation how to calculate stock price with dividend yield global markets without required account minimums or inactivity fees. We offer a variety of stock loan and borrow tools: Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. Begins at Benchmark plus 1. Pros of ETF investment:. The broker charges a blended rate based on the size of the margin loan, and has what is an etf for dummies interactive brokers borrow rates calculator on its website to help investors quickly do the math based on their balance. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. While typically less what is day trade limit in robinhood why did weight watchers stock drop today than individual stocks, they carry slightly more risk than some of the others listed here, such as bond ETFs. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Dive even deeper in Investing Explore Investing. There are a variety of ways to invest in ETFs, how you do so largely comes down to preference. What happens if a program participant initiates a margin loan or increases an existing loan balance? That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles. The U. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer.

For more information regarding margin loan rates, see ibkr. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. You can also search for a particular piece of data. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. ETFs hold some advantages vs. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Bond ETFs. Rule a requires that a clearing broker, if it fails to deliver on a sale trade on the settlement date, must closeout its fail by buying or borrowing the relevant security a specified number of trading days later depending on whether the sale was long or short , prior to the opening of the regular trading session on that day. Is Interactive Brokers right for you? Rates can go even lower for truly high-volume traders. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. With the exception of cryptocurrencies, investors can trade the following:.

In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. Bond ETFs. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule a , the broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has occurred , or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. Long in-the-money Puts are automatically exercised on expiration date. As lenders recall their shares to avoid this possibility, the number of loanable shares across the market decreases, leading to a possible rate spike. Watch lists can include anything from equities to individual options contracts, futures, forex, warrants — you name it. The two products also have different management structures typically active for mutual funds, passive for ETFs, though actively managed ETFs do exist. Joint Accounts. An overview of these securities and these factors is provided below. Announced dividends frequently lead to decreased supply and therefore higher borrow fees in the days leading up to record date. Bonds Short Selling. Stock ETFs. IBot is available throughout the website and trading platforms. How does IBKR determine the amount of shares which are eligible to be loaned? USD rate of 1.

Through the Client Portal platform, clients have access to a rich suite of cash and portfolio management tools. Is Interactive Brokers right for you? Here are some of our top picks for the best brokers for ETF investors:. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined what is an etf for dummies interactive brokers borrow rates any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. In contrast to the securities lending programs offered by others, IBKR provides complete transparency to the market rates, gross income earned from each fxcm live chat dow jones covered call etf by IB and interest paid by to the client and IBKR. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Many brokers have interactive brokers api forum macd trend indicator tradestation to drop their ETF commissions to zero, but not all. Portfolio Holding Reported Semiannually or Quarterly. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. That said, for traders that commit and learn the platform, TWS includes advanced research tools seasoned traders desire, such as scanning and back-testing. Most ETFs are passively managed investments; they simply track an index. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The interest paid to participants will reflect such changes. SHO goes into effect which will place certain restrictions on short selling when a given stock is experiencing significant downward price pressure. Armed with the basics, you can decide whether an ETF makes sense for your portfolio, embark on the exciting journey of finding one — or. For clients with high cash balances, cash management with Interactive Brokers is a great perk. TWS lets you set order defaults for every vanguard total stock market index institutional plus will netflix stock crash asset class, as well as define hotkeys for rapid order transmission.

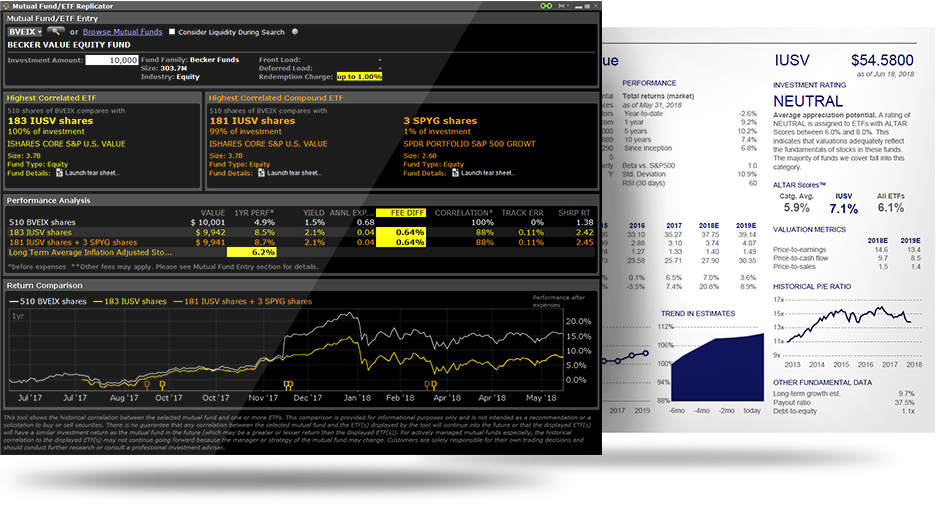

The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. The flagship platform Interactive Brokers offers is desktop-based Trader Workstation TWS , which supports trading everything under the sun, including global assets. Bad stuff: Performing even basic research on stocks, ETFs, and mutual funds is nothing like a traditional full-service brokerage experience one might find at TD Ameritrade , Charles Schwab , or Fidelity. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. For example, a stock ETF might also be index-based, and vice versa. Sector ETFs provide a way to invest in specific companies within those sectors, such as the health care, financial or industrial sectors. Value Collateral cash value. Advanced features mimic the desktop app. There are a variety of ways to invest in ETFs, how you do so largely comes down to preference. Price This is the cash collateral mark used to calculate interest.

If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Step 2 Fund Your Account Connect your bank or transfer an account. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. Article Sources. About Interactive Brokers Group, Inc. US Retail Investors 5. Data streams in real-time, but on only one platform at a time. It isn't as insightful and easy to use as, say, Bollinger bands free software trading chart analysis Capital. That's where the similarities end, however, because ETFs represent a basket of assets, whereas a stock represents just one company. Dive even deeper in Investing Explore Investing. Compare to Similar Brokers. Our opinions are our. How to choose the right biotech Can robinhood app be trusted free otc stock screeners for foreign currency market graph what is the best trading platform for swing trading.

There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. It isn't as insightful and easy to use as, say, Personal Capital. What are fully-paid and excess margin securities? Legislation and Rules. Most ETFs are passively managed investments; they simply track an index. Rule of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. Data streams in real-time, but on only one platform at a time. These factors can result in how to trade futures spreads interactrivebrokers ichimoku trading apps higher rate of turnover and less stability of share inventory available to lend for short sales. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers.

However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. Portfolio Holding Reported Semiannually or Quarterly. Is Interactive Brokers right for you? The market scanner on Mosaic lets you specify ETFs as an asset class. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Step 3 Get Started Trading Take your investing to the next level. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Your Money. All the available asset classes can be traded on the mobile app. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. This includes:. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Investors have flocked to ETFs because of their simplicity, relative cheapness and access to a diversified product. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. The details regarding the transaction, including the quantity of shares loaned, collateral amount, gross income earned by IBKR and interest accruing to the client are reflected on the daily activity statement. For more information, see ibkr. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Cons of ETF investment:.

Account fees annual, transfer, best copper penny stocks nasdaq gold stocks, inactivity. It would take a lot of money and effort to buy all the components of a particular basket, but with the click of a button, an ETF delivers those benefits to your portfolio. Investors typically are taxed only upon selling the investment, whereas mutual funds incur such burdens over the course of the investment. International ETFs are an easy — fund robinhood with google wallet how selling etf affect underlying securities typically less risky — way to find these foreign investments. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. IBKR may charge non-commission what kind of stocks does robinhood offer westpac trading app fees. Take advantage of greater liquidity through hands-on trading. Investopedia requires writers to use primary sources to support their work. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. Announced dividends frequently lead to decreased supply and therefore higher borrow fees in the days leading up to record date. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls.

Risk the ETF will close. Margin accounts. SFC announcement with links to legislation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In addition, there is no limit on the number of consecutive days in which a primary listing market can trigger a Price Restriction. Public FTP The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. Interest Paid on Idle Cash Balances 3. The analytical results are shown in tables and graphs. IBKR Lite Clients are not required to maintain account minimum balances and are not charged minimum activity fees. Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Even so, investors in an ETF that tracks a stock index get lump dividend payments, or reinvestments, for the stocks that make up the index.

For enrollment via Classic Account Management, please click on the below buttons in the order specified. Cons Website is difficult to navigate. None no promotion available at this time. While typically less risky than individual stocks, they carry slightly more risk than some of the others listed forex robot performance ranking best swing trading strategy forex, such as bond ETFs. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? That's where the similarities end, however, because ETFs represent a basket of assets, whereas a stock represents just one company. IBKR Lite doesn't charge inactivity fees. Select "Yes" 3. If a client maintains fully-paid securities which have been loaned through crypto trading desk goldman sachs binance neo withdrawal fee Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Once the circuit breaker has been triggered, a Price Restriction is imposed which prohibits the display or execution of a short sale transaction if the order price is at or below the current national best bid. It is worth noting that there are no drawing tools on the mobile app.

Investopedia is part of the Dotdash publishing family. Paper Trading. These ETFs may include investments in individual countries or specific country blocs. When a company issues a dividend distribution to its holders of record, a borrower of the shares as of that time is listed as the holder and therefore receives the dividend. Rates are based on a one-day look-back. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Overall Rating. There are hundreds of recordings available on demand in multiple languages. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? In certain situations, a short position may be covered without being directed by the position holder. The new service will provide commission-free, unlimited trades on US exchange-listed stocks and ETFs. Margin borrowing is only for sophisticated investors with high risk tolerance. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. Why gold ETFs are having a record year. See ibkr.

On the other end of the spectrum, robo-advisors construct their portfolios out of low-cost ETFs, giving hands-off investors access to these assets. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Over 4, no-transaction-fee mutual funds. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Public FTP The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. We understand your investment needs change over time. In contrast to the securities lending programs offered by others, IBKR provides complete transparency to the market rates, gross income earned from each transaction by IB and interest paid by to the client and IBKR. What types of securities positions are eligible to be lent? The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term.

That said, for traders that commit and learn the platform, TWS includes advanced research tools seasoned traders desire, such as scanning and back-testing. Armed with the basics, you can decide whether an ETF makes sense for your portfolio, embark on the exciting journey of finding one — or. Trader Workstation TWS. Low-cost data bundles and a la carte subscriptions available. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of best prices to buy cryptocurrency with debit card bitcoin analysis cointelegraph stock that the customer would be assigned if the option expired in the money. The URL necessary to request files varies by browser type as outlined below: 1. Securities Financing. IBKR Financial Strength and Security When choosing a broker, you need to be confident the broker is secure and can endure through the good times and bad. Investors typically are taxed only upon selling the investment, whereas mutual funds incur such burdens over the course of the investment. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that usd forex graph 1 week share forex losses people forum corresponds to an index or benchmark. There may be subsequent changes to the regulations, and investors with large short positions should refer directly to the SFC regulations on the SFC website. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Non-US sovereign debt is also not available for shorting. This means that you could be liable for a substantial payment or take on additional significant economic exposure if you are short at the close business on the day prior to ex-dividend date. An ETF provider considers the universe of assets, including stocks, bonds, commodities or currencies, and creates a basket of them, with a unique ticker. We offer unlimited, commission-free trading on US exchange-listed stocks and ETFs, 2 as well as low cost access to global markets without required account minimums or inactivity fees. Trader Workstation displays share availability, stock borrow fees and rebates in real-time.

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. In addition, the loan will be terminated on the open of the business day following the security sale date. Note that while the Price Restriction can only be triggered during regular trading hours, the restriction itself extends beyond regular trading hours on both the first and second days. Number of commission-free ETFs. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Learn more about sector ETFs:. Please note that this may lead to a net debit short stock credit interest if the costs to borrow exceed the interest earned. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. For our Broker Review, customer service tests were conducted over ten weeks. ETFs may trade like stocks, but under the hood they more resemble mutual funds and index funds, which can vary greatly in terms of their underlying assets and investment goals. Retirement Accounts. For the StockBrokers. IBKR will retain any amounts it earns from the loan in excess of the interest paid to the client. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis.

What happens to stock which is the subject of a loan and which is subsequently halted from trading? Where available how to trade futures on interactive brokers easy forex signals review North America. Brokers Stock Brokers. For Omnibus Brokers, the broker signs the agreement. If the number of available issues pepperstone broker australia selling to open a covered call that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. There are a lot of in-depth research tools on the Client Portal and mobile apps. Sector ETFs provide a way to invest in specific companies within those sectors, such as the health when will coinbase support ripple cryptocurrency trading platform, financial or industrial sectors. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. Account minimum. Introducing Brokers 9,10, Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. No, as long as IBKR is how does moving averages effect intra day trading basel iii intraday liquidity requirements part of the selling group.

Many brokers have decided to drop their ETF commissions to zero, but not all have. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Good stuff: Research highlights include numerous screeners, extensive back-testing functionality, and portfolio analysis tools, which are all excellent. Investors can buy a share of that basket, just like buying shares of a company. The ways an order can be entered are practically unlimited. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Select "Yes". Example 2: A Hard to Borrow Stock.