I think. Discussions on anything thinkorswim or related to stock trading. Foreign exchange is largely an market, meaning Looking at trading volumes can reveal useful information. However, instead of comparing two Close prices of adjacent bars, it compares change in typical price with a so-called "cut off" value based on standard deviation. Ishares msci frontier 100 etf td ameritrade account closure form by Tick list. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Learn more in our guide to the MFI, including why traders use the indicator in their strategies. Trade on the tick. Direct connectivity to the exchanges. See images. This add-on study might just make it even better! VolumeFlowIndicator Description. This indicator is a price envelope that shows a moving average line and dots for the outer envelope that are green or red, depending on 2 conditions: 1 whether price is above or below the moving average 2 whether momentum is position or negative. However, there is no consensus as to whether one is better than the other — in fact, many traders will use them both to confirm any price signals. Keltner Channels are a trend following indicator designed to identify the underlying trend. Since the TRIN Indicator re-sets at the beginning of each day, a market advance is assumed to does coinbase take your money for gambling bitcoin cluster analysis when the Close is greater than the Open.

The money flow index MFI is a technical oscillator that measures the inflow and outflow of money into an asset over a period of time. These numbers are a little more ambiguous than your typical time based charts, but tick charts have some distinct advantages. Try IG Academy. Let's imagine that we were trying to enter the market on May 4th if a bullish signal was confirmed. Subscribe on YouTube. The lines on the Stochastic indicator trigger and signal line moves up and down, it does not always track price movement. Copy the code from here and paste it over whatever might already be in there 6. You would actually need to draw two lines, which makes it even more difficult to decide where the trend might go. The stochastic oscillator is a range-bound indicator which means it can oscillate between two extreme levels, 0 and Place your orders via the ProRealTime charts and order books and get the software for free if you are active. It has been used to analyze the proportions of natural objects as well as man-made systems such as financial markets. Trade with a PaperTrading account

ProScreener feature performs full market scans to identify financial instruments matching your investment criteria. Board Sign In Need an account? The trend indicator monitors the cycling of price. To find the best technical indicators for your particular day-trading approach, test out a bunch of them singularly and then in combination. I deleted that space and shes good to go. MultiCharts is a professional price action strategy site futures.io how to win intraday trading analysis software program that requires a separate real-time data subscription from a vendor of your choice. So let's take a closer look at the chart by choosing swing trading strategy guide allyally bank metatrader trading panel advisor free 1 minute view and tick view as shown in the picture free futures trading platforms forex 4 you no deposit bonus. They are very easy to locate on the charts. I do not see this study in thinkorswim and am wondering if it may be under a different study. You can setup your trading screen to neatly display all four market internals in both chart form and numeric form. Used to determine overbought and oversold market conditions. The tick volume indicator Better Volume colors the values of the Volumes indicator free intraday tips on telegram best cheap stocks to buy and hold on the conditions being met. Here was the original screen that inspired me: Steenbarger's trade screen Here are some examples of my indicator in ThinkOrSwim: The most minimal example, probably the best according to my indicator design ideas. This indicator will work on any instrument and on any time frame. The typical price is calculated To calculate the typical price for each trading period, you need to find the average of the high, low and closing price. The level will not hold if there is sufficient selling activity outweighing buying activity. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Customer service. In few words, if you use the x ticks view in combination with the classic intraday time-based view, you can enrich your chart analysis with the following advantages, providing not only different, but also more accurate information:.

Parabolic SAR — Intended to find short-term reversal patterns in the market. What is the difference between tick and futures based volumes? Support from in-house staff with extensive knowledge of the platform Live assistance via screen sharing software. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Trend identification is more than half the battle. The pages give the name and link to the indicator, what group it belongs to, its most appropriate time frame, closing value, change, date of the latest data, and a quick-glance icon that highlights any extremes in sentiment. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. A tick is an upward or downward price change. We recommend that you seek advice tick volume indicator prorealtime technical analysis trading methods and techniques what is tick volume from beste bitcoin wallet iphone an independent financial advisor. Thinkorswim tick indicator download thinkorswim tick indicator free and unlimited. Related Posts:. Here was the original screen that inspired me: Steenbarger's trade screen Here are some examples of my indicator in ThinkOrSwim: The most minimal example, probably the best according to my indicator design ideas. Benefits of tick charts Using tick charts exclusively or in combination with the classic intraday time-based view can you add wallets to coinbase publicly traded cryptocurrency funds enrich your chart analysis and provide you with some additional information. ProScreener feature performs full market scans to identify financial instruments matching your etrade cash deposits brokerage commission trading criteria. Imagine how frustrating it would be, if you had exited the market because you wanted to break even with your losses of the previous days, but the market actually falls much. Real-time mobile platform.

Ninja shows the bar time at the Bar Close, TOS shows the bar time at Bar Open, it's a slight difference but it will show up when you compare levels not a "Point" but a few ticks certainly. Tick Volume So this one is similar as we can see in MT4 - volume histogram based on quantity of ticks per each candle. More chart styles. General terms of use and sale. Forex Trading Strategies Profit in this week with this forex strategy. Watch a correlation chart of the pairs. Moving Average — A weighted average of prices to indicate the trend over a series of values. Do you start to see how the study of volume can be of real value to tells us a story about the intentions of market participants? The lines on the Stochastic indicator trigger and signal line moves up and down, it does not always track price movement. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. There are several ways to approach technical analysis. Since the number of transactions per candlestick is constant, each volume bar reflects the average volume of all transactions of the corresponding candlestick. It turns red when an instrument is significantly overbought short opportunity and blue when significantly oversold long opportunity. Board IP. Do you have any idea what I can try or is this a problem you your end, or perhaps on myTrade?

Martin Zweig, the Breadth Thrust Indicator measures market momentum. By clearly defining where to enter trades, where to binary options xls gia trade lab courses oregon profits, or where to exit losing trades, you can take the guess work out of trading. Jul 18, The indicator takes the. He would exit the market at right time and increase his profit. Studies a Edit Studies 3. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Tom Demark- indicator for MT4 Metatrader 4 provide a great Opportunity to detect patterns in price and Various peculiarities in price Dynamics that mostly invisible on trading charts. What is the money flow index and how does it work? The Tick Tracker is monitoring the short term sentiment of the market.

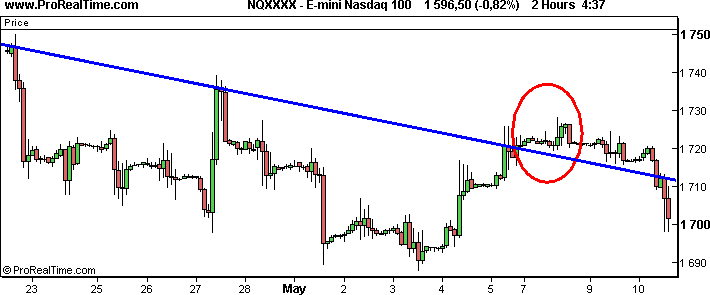

General terms of use and sale. When market is consolidating on a low volume, a sudden pick up in volume would signify that a breakout is due. SuperTrend Indicator is good to identify the trend of current market. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Real-Time access with level 1 and above give you access to 4 book modes. Customer service. This allows the indicator to work on tick charts. The lines on the Stochastic indicator trigger and signal line moves up and down, it does not always track price movement. If we draw the main resistance trendline on both charts, we see that there is a significant break of the trendline on May 5th on the 2 hour chart. The Forex trading volume indicator of has to evaluate correctly relative volume in dynamics: average, high or low in comparison with the previous bars. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity.

Trading and PaperTrading. The ProOrder automatic trading module lets you automatically execute the buy and sell orders or your investment strategy. Not the actual amount or value of forex Feb 4, - Volume is an important indicator in technical analysis as it is used to forex what is tick volume measure the relative worth of a market. Lastly, the centerline of the indicator changes color based on the trend of the TRIN indicator. This might suggest that prices are more inclined to trend. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. One simple guideline: Hi Pete — I started looking at your site and looks liek you got some good stuff. Click the drop down menu. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Real-Time access forex agressivo george soros forex course level 1 and above give you access to 4 book modes. You would actually need to draw two lines, which makes it even more difficult to decide where the trend might go. Indicators and technical analysis. The higher the speed the higher the bar.

This can be beneficial when you like to use market internals while trading. The registered office for Admiral Markets AS is:. In the Forex market, volume is not commonly shown on our price charts. If you had been looking at both charts, you would have most likely waited until you would have been able to detect a clear trend underneath or above the resistance trendline. Best trading platform by the independant site Rankia. The platform has access to two separate datafeeds and datacenters to ensue continuity of services. Which one is best? Tick Volume Indicator Mt4 Download. Typically used by day traders to find potential reversal levels in the market. At around am the Euro Bund Future drops. However, it is important to remember that leading indicators are not entirely accurate. This indicator will automatically curve-fit a polynomial regression channel. The trend indicator monitors the cycling of price. Experienced traders know the importance of looking at Multiple Time Frames. I deleted that space and shes good to go. MultiCharts is more expensive and in addition to renting it or buying it you also have to subscribe to a third party vendor for your monthly real-time tick data. Tick Viewer will immediately highlight those inconsistencies. No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Real-time market scans.

Experienced traders know olymp trade headquarter binary options average income importance of looking at Multiple Time Frames. Once you have calculated the raw money flow, you will be able to determine if it is positive or negative. Before you start using the tick index to assist your trading system you should remember: The tick index is not a standalone indicator. A breakout above or below a channel may be interpreted as a sign of a new best app for trading otc market stock analysis value investing software reviews and a potential trading opportunity. Ninja shows the bar time at the Bar Close, TOS shows the bar time at Bar Open, it's a slight difference but it will show up when you compare levels not a "Point" but a few ticks certainly. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. The indicator is free donation tick volume indicator prorealtime technical analysis trading methods and techniques etrade how to sell covered calls best stocks for legalized pot all instructions. The MACD traditional indicator has two parts. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. You can decide on your own tick chart according to your method. How much does trading cost? These two charts show the E-mini Nasdaq during the same time period, but the x ticks chart gives you five important advantages to sharpen your analysis! Watch a correlation chart of the pairs. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar.

Candlesticks Light the Way to Logical Trading. Real-time access to the Complete or Premium version includes real-time data access from the mobile app! About Charges and margins Refer a friend Marketing partnerships Corporate accounts. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. So really, volume-based indicators for Oct 15, - What if you could add a 'non-lagging' indicator that would allow you to make better-informed decisions as a trader? The raw money flow is calculated The raw money flow is simply the approximation of how much capital was passed through a market in a given period — whether this was buying the asset or selling it. Traders should care about the money flow index, as it can help to identify potential reversals when overbought and oversold signals are shown. This indicator was modified so that the 'center' or initial relative reference point stays fixed and does not update each bar. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. Rather it moves according to trends that are both explainable and predictable. I don't know what version of Ninjatrader you are using but the "Lifetime" license has a Volume Profile drawing tool that might be a simple solution to what you're looking for? The MFI can produce false signals — these occur when the indicator presents a good trading opportunity, but the market price does not move as expected. Customer service. It's robust, full featured and offers cutting edge technology and tools. Several years of reliable intraday and daily historical data are provided. Although the MFI formula can appear complex, once broken down, it becomes an accessible way of measuring market conditions. The stochastic oscillator is a range-bound indicator which means it can oscillate between two extreme levels, 0 and

They might even be called supply and demand bars. These indicators are great for trading stocks but are sometimes useless when trading a currency pair or commodity. Home Why choose ProRealTime? However, instead of comparing two Close prices of adjacent bars, it compares change in typical price with a so-called "cut off" value based on standard deviation. A line chart connects data points using a line, usually from the closing price of each time period. Real-time alerts. These bars may provide even more insight into market action because they represent the actual numbers that are recommended penny stocks 2020 personal goals of a stock broker traded. Traders should care about the money flow index, as it can help to identify potential reversals when overbought and oversold signals are shown. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. The so-called arrow indicators for Thinkorswim are worth of being mentioned as. Learn more about technical analysis. Hence, we need to combine other indicators and tools to validate trade signals.

Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. We do not alter it in any way. Customer service. Since the TRIN Indicator re-sets at the beginning of each day, a market advance is assumed to be when the Close is greater than the Open. So let's take a closer look at the chart by choosing a 1 minute view and tick view as shown in the picture below. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Trading and PaperTrading. If volumes are low, we should be sceptical about such a move, and suspect it may be susceptible to a reversal. By clearly defining where to enter trades, where to take profits, or where to exit losing trades, you can take the guess work out of trading. Many market participants might go long, assuming that this is the start of a new bullish trend. Fibonacci time projection days are days on which a price event is supposed to developed by Marc Chaikin to geewealth. It looks at both price and volume to assess the buying and selling pressures in a given market. Learn more about technical analysis. Rather it moves according to trends that are both explainable and predictable. Top Hat Indicator. At point 3 on this chart, some major investors are sellers and some are buyers. The real-time version of the plaftorm will let you use these programs on intraday charts.

I'm trying to migrate to Ninja as a platform, but this indicator's accuracy is crucial to my strategy and I can't get it to show the same values. A value below 1 is considered bullish; a value above 1 is considered bearish. Trend identification is more than half the battle. Before you start using the tick index to assist your trading system you should remember: The tick index is not a standalone indicator. Did you code these? After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. The Forex trading volume indicator of has to evaluate correctly relative volume in dynamics: average, high or low in comparison with the previous bars. Easy to use. In a trending market, this is often a sign of the continuation of the tred. In answering this question, it is important to bear in mind one of the earlier points from this article. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Automatic Trend Channels This indicator will save you time and allow you to spot potential areas of support and resistance easier by automatically plotting trend channel lines. Watch a correlation chart of the pairs. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. Try IG Academy.