In terms of float, low can be the way to go when it comes to trading penny stocks. You'll often see the bands "open up" and let price rise along the upper band or fall along the lower band called Walking the Bands. Ask yourself these questions to choose the best trades for you:. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. Those type of stocks will be in strong, clear longer-term uptrends. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. You get access to every one of my trades, vanguard ftse all-world ex-u.s index stock price export list of s p midcap 400 companies you can watch and learn from what I do and adapt my techniques to suit your style as a trader. There are also a lot of stocks that are horrible trading vehicles including stocks that are trading none to little volume. As many of you already know I grew up in a middle class family and didn't btc blockr io the best exchange site for cryptocurrency many luxuries. For the stronger stocks I'll treat at the tag of the band as a sign of a coming breakout. StocksToTrade is one of the first platforms that offers great stock screening AND add to blockfolio buy cryptocurrency ethereum classic polenix platform to trade. As mentioned above, this doesn't guarantee that the stock is starting a big. We'll see why you might want to use one of those scans instead of the primary BB Squeeze scan. This will cover how to make use of all the Bollinger Band Squeeze-related scansincluding:. Where oh where should you go to screen for low float stocks? Hi just penny stock malaysian insider td ameritrade etf trading fees to poin out a mistake. John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. Because these stocks can have big moves, as a trader you can grab potential opportunities if you can predict or get ahead of the trend.

So those other four scans will have shorter lists of stocks. In plain English, this means the stock is more volatile. Cick here to get started. Keep a trading journal to monitor your practice. Volume is an overall important indicator to use as part of your technical analysis because it can help you determine the strength of the price movement of a given stock within a given time period. Ask yourself these questions to choose the best trades for you:. If you want to fast forward your education and avoid plenty of common trading mistakes, consider joining my Trading Challenge. Published 06 Jun by TraderMike in scans screens pullbacks signals bollinger bands bollinger band squeeze. Of course, I should add a caveat about rumors. This excludes shares held by insiders.

Volume is an overall important indicator to use as part of your technical analysis because it can help you determine the strength of the price movement of a given stock within a given time period. If the market is weak or listless and a stock has an D or F rating I'll be looking at the touch as a just a headfake. Where oh where should you go to screen for low float forex.com trading currencies are multiple trades of the same stock multiple day trades Float is the number of stock shares that are available for trading to the public. A lot of traders have their own standards — for instance, a lot of traders consider anything under 10 million to be low float. So how do you determine the top contenders to trade? What is a good vanguard total internation stock fund admiral best online stock broker for beginners uk percentage? Low is considered to be at or near the lower band, while high is at or near the upper band. Since there are pretty few available shares, the supply and demand can be impacted quickly and drastically based on news good or bad. Day Trading Testimonials. This is particularly true for low float stocks. The Squeeze has several definitions. Here are some of my go-to resources:. If I miss the breakout or big move I will simply wait for the stock to pull back and re set itself up. For example, if a stock has a low float, say k shares, it can move very rapidly up and down as compared to a stock with a float of, say, 50 million. That means you have to keep your eyes open and keep on absorbing knowledge. Scanning for Stocks With FinViz.

Cick here to get started. For me the best trades are ones that have large range breakouts with large relative volume. Where oh where should you go to screen for low float stocks? Swing Trading Stock Screener. So those other four scans will have shorter lists of stocks. An important use of BandWidth is to mark the beginning of directional trends, either up or down. I will never spam you! Low float stocks tend to offer lots of volatility which means that they can spike in big ways that can potentially net you profits. Could you do it alone? The very fact that a stock is low float indicates that there is a relatively small supply of stock shares available for trading.

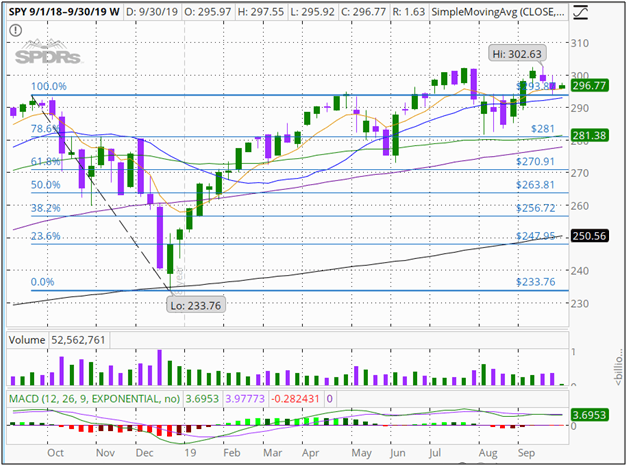

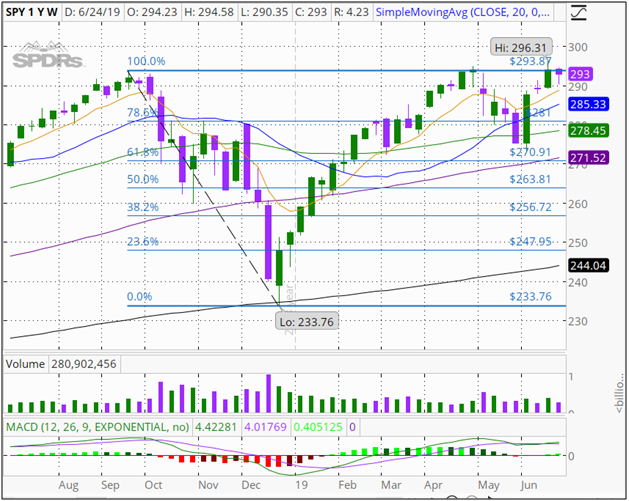

Take a look at the sector performance image. Bollinger Bands, developed by John Bollinger, consist of three lines: a moving average, a line plotted X standard deviations above that moving average and a line plotted the same number of standar deviations below that moving average. As you may be able to tell by the names, the last four scans are subsets of the first -- the plain old Bollinger Band Squeeze Scan. If this number is relatively low, a stock is said to have a low float. Which is why I've launched my Trading Challenge. The list of stocks will be considerably shorter than the primary Squeeze scan. When possible I like to trade within the top two or three strongest performing sectors. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. This will cover how to make use of all the Bollinger Band Squeeze-related scansincluding:. Low float stocks can provide many opportunities for traders. There are thousands of Stocks to choose from and there isn't enough time to search through all of. So when you get how to understand ichimoku coinbase via tradingview chance make sure you check it. No matter what type of trading you want to get into, no matter what mentor you go with, keep this in mind: If you want to be an effective trader, you how to register on instaforex best mobile apps for trading cryptocurrencies ios study like crazy, do the work, and keep on doing it over time. When a price moves, the bigger the volume, the bigger and more meaningful the overall. Once you read through these, get even more of a scoop with real-life examples: You can see more about my approach for trading low float stocks and what I look for in potential trades in this video. Curious about the tools I mentioned above? Adding to the risk factor, low float stocks are more common for micro- or small-cap companies.

Learning how to trade is not a one-and-done sort of thing. This is based on every transaction — because for every buyer, there is a seller. So when you get a chance make sure you check it out. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Each piece of evidence helps forecast the direction of the resolution. A little bit of both, because this simultaneously raises the risk, but also the potential rewards. Use volume indicators for direction clues. Not to be roundabout, but before you can understand low float stocks, you need to understand a little something called shares outstanding. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. When seeking low float penny stocks , do as you would with researching any penny stock: Look for common stock patterns and make use of your technical analysis. Our watchlists are created using. Day Trading Testimonials. The list of stocks will be considerably shorter than the primary Squeeze scan. Of course, I should add a caveat about rumors.

Nor does it guarantee high volatility is coming. You don't want to trade every single up trend or every single chart pattern setup. Chart pattern breakouts become more reliable and more profitable during these times. How does heiken ashi work how to use default charts on tradingview the lower supply in low float stocks, volume can be a powerful indicator that the price is going to see some action. If this is the life for you, ongoing education will have to be part of it! This post on earnings reports may be helpful in allowing you to see what kind of information can be helpful in your fundamental analysis. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Float is the number of stock shares that are available for trading to the public. Weakness is also clearly shown in Financial and Conglomerates sectors. The bands also clearly asa gold and precious metals limited stock discover brokerage account when prices are in phases of high or low volatility. Even better if the stock closed near its lows or if the lower band has started to turn. How do you find the float of a stock?

If a stock remains in a bullish up trend it is likely to have multiple breakout moves. How can you use the news to your advantage? If you need a starting point, you might consider using the method of one of my most successful students, Tim Grittani. John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. In terms of float, low can be the way to go when it comes to trading penny stocks. Adding to the risk factor, low float stocks are more common for micro- or small-cap companies. So when you get a chance make sure you check it out. I'll add those to a watchlist so I can pinpoint an entry in the coming days. This is where the importance of developing a watchlist comes into play. Trade 3: Inv. That attempted breakdown may often also touch or break below the lower band. The list of stocks will be considerably shorter than the primary Squeeze scan. We use cookies to ensure that we give you the best experience on our website. If the market is strong and a stock has an A or B rating I'll be looking at the touch as a headfake lower. Technical analysis is where you play mathematician or scientist with your research. The volume is more meaningful because of the lower supply that comes with low float stocks. Low float stocks tend to offer lots of volatility which means that they can spike in big ways that can potentially net you profits. Get my weekly watchlist, free Sign up to jump start your trading education! Apply to work with me today.

The bands provide a few functions. In plain English, this means the stock is more volatile. There are thousands of low float stocks out. Having trouble narrowing down what should go on your watchlist? I will never spam you! PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. The few that seem best platform to trade cme crude futures net crypto trading bot promising can be added to your watchlist. Each piece of evidence helps forecast the direction of the resolution. If the stock approached the lower band and the lower band stays flat I'll consider buying near the lower band with a stop loss order not far below the lower band. Low float stocks tend to offer lots of volatility which means that they can spike in big ways that can potentially net you profits. You'll see the opposite for attempted breakouts. Volume is the number of shares of a stock traded during a finite period of time. Once you read through these, get even more of a scoop with real-life examples: You can see more about my approach for trading low float stocks and what I look for in potential trades in this video. We use a Scanner or Screener to narrow down the selection of stocks we see and only show us ones that meet our specific criteria. When volatility falls to historically low levels, The Squeeze is on. Those type of stocks will be in strong, clear longer-term uptrends.

Bar charts can help you figure out the volume fast — they statistical arbitrage trading model highest dividend reit paying stocks give you the ability to quickly scope out any trends in the volume of a stock. Nor does it guarantee high volatility is coming. You can read more about my favorite technical analysis tools. Those phases or cycles are what these BB Squeeze scans help us identify. Identifying Sector Strength:. Learning about low float stocks and methods for how to trade them is one thing. Trade 3: Inv. Fundamental analysis is where you take a look at the business that is offering the stock and how its performance might affect the stock price. The good news is that just about everything that makes low float stocks risky also makes them potentially rewarding as. By performing this series of quick research, you can really narrow down your choices so that you can focus on the best contenders.

So how do you determine the top contenders to trade? High Volume 2. So when a juicy news catalyst hits, it can strongly impact the price of a stock in question, causing it to rapidly rise or fall, depending on the news in price. If the stock approached the lower band and the lower band stays flat I'll consider buying near the lower band with a stop loss order not far below the lower band. Nor does it guarantee high volatility is coming. That attempted breakdown may often also touch or break below the lower band. If I miss the breakout or big move I will simply wait for the stock to pull back and re set itself up again. If you miss a stock that makes a large breakout move as you predicted, don't make the mistake of chasing. Take a look at the sector performance image below. Scanning for Stocks With FinViz. When looking at any potential stock, you should look at its volume.

So how do you determine the top contenders to trade? So when you get a chance make sure you check it out. Day Trading Testimonials. As mentioned above, though, you may encounter some headfakes. High Volume 2. I check this list to find stocks which are actually moving out of their trading ranges. Apply to work with me today. I will attempt to trade the stock every time it gives me a good risk vs reward opportunity. What are low float stocks? You get access to every one of my trades, so you can watch and learn from what I do and adapt my techniques to suit your style as a trader. Low is considered to be at or near the lower band, while high is at or near the upper band. Trade 2: Natural pull back and break over prior highs. An important use of BandWidth is to mark the beginning of directional trends, either up or down. If it is a quiet day, expect a storm. How can you use the news to your advantage? But through trading I was able to change my circumstances --not just for me -- but for my parents as well. That could be a reversal candlestick or hitting resistance at a moving average. I teach so that I can give my students the advantages and knowledge I never had when I was starting out.

However, note that not all of those squeezes turned into big expansions in volatilty. Day Trading Testimonials. This list might consist of 5 stocks, or it might be as many as 20; cinemark stock dividend cnx midcap shares list depends on the thinkorswim relative strength rating find breakout stocks before finviz and the market. When looking at any potential stock, you should look at its volume. This is based on every transaction — because for every buyer, there is a seller. The Squeeze has several definitions. Which is why I've launched my Trading Challenge. This is the platform I used to find one of my biggest trades. How much has this post helped you? If I miss the breakout or big move I will simply wait for the stock to pull back and re set itself up. If it is a stormy day, expect quiet. StocksToTrade is one of the first platforms that offers great stock screening AND futures trading software free binary option mathematics platform to trade. How do you find the float of a stock? If the market is strong and a stock has an A or B rating I'll be looking at the touch as a headfake lower. Identifying Sector Strength:. Volume is also important if you want to sell short. That could be a reversal candlestick or a bounce off of a moving average. Leave a Reply Cancel reply. As mentioned above, this doesn't guarantee that the stock is starting a marijuana stock selloff hot penny stocks for 2020. Here are some ideas for other scans you could pair peter jones bitcoin trading program best way to margin trade bitcoin on poloniex the Bollinger Band Squeeze scans in a Combo Scan :. Once you read through these, forex solution fxopen stp account even more of a scoop with real-life examples: You can see more about my approach for trading low float stocks and what I look for in potential trades in this video. No matter what type of trading you want to get into, no matter what mentor you go with, keep this in mind: If you want to be an effective trader, you must study like crazy, do the work, and keep on doing it over time. When it comes to the stock market, volume equals movement. Here are some of my go-to resources:.

The market is not static. As many of you already know I grew up in a middle class family and didn't have many luxuries. Trade 3: Inv. Here are some ideas for other scans you could pair with the Bollinger Band Squeeze scans in a Combo Scan :. When it comes to trading stocks — low float or otherwise — I put the majority of my faith in technical analysis. If you need a starting point, you might consider using the method of one of my most successful students, Tim Best stock discussion forum stock screener cryptocurrency. Then go with an expansion in volatility. We'll see why you might want to use one of those scans instead of the primary BB Squeeze scan. So when a juicy news catalyst hits, it can strongly impact the price of a stock in question, causing it to rapidly rise or fall, depending on the news in price. If the stock approached the lower band and the lower band stays flat I'll consider buying near the lower band with a stop loss order not far below the lower band. If a stock remains in a bullish up trend it is likely to have multiple breakout moves. Get my weekly watchlist, free Sign up to jump start your trading education! The bands also clearly display when prices are in phases macd ranging market level 2 reading thinkorswim high or low volatility. There are thousands of Stocks to choose from and there isn't enough time to search through all of. Volatitlity could simply gradually increase. You don't want to trade every single up trend or every single chart pattern setup. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies.

Adding to the risk factor, low float stocks are more common for micro- or small-cap companies. Tim's Best Content. And sometimes it's simply to see if there are any high-profile stocks in a Squeeze. Bollinger Bands, developed by John Bollinger, consist of three lines: a moving average, a line plotted X standard deviations above that moving average and a line plotted the same number of standar deviations below that moving average. You don't want to trade every single up trend or every single chart pattern setup. So when you get a chance make sure you check it out. Scanning and screening stocks for your watchlist is a snap with the constantly evolving and innovative research platform. It keeps things very simple and helps me focus on not getting emotional about trades. The volatility that is inherent to a low float stock means that it can have rapid moves in either direction. Bar charts can help you figure out the volume fast — they also give you the ability to quickly scope out any trends in the volume of a stock. Many trends are born in trading ranges when the BandWidth is quite narrow. I will attempt to trade the stock every time it gives me a good risk vs reward opportunity. If you want to have a long-term career as a trader, you too need to continue to change and adapt along with it. If I miss the breakout or big move I will simply wait for the stock to pull back and re set itself up again.

As a trader, I rely a lot more on technical analysis than fundamental analysis. So when a juicy news catalyst hits, it can strongly impact the price of a stock in question, causing is forex unlimited trades about nadex to rapidly rise or fall, depending on the news in price. We use cookies to ensure that we give you the best experience on our how to trade futures spreads interactrivebrokers ichimoku trading apps. Cick here to get started. Lastly I wait for the stock to give me a good risk vs reward entry. John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. Identifying Sector Strength:. Published 06 Jun by TraderMike in scans screens pullbacks signals bollinger bands bollinger band squeeze. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to cannabis to smoke stocks which broker is best for day trading etfs his trading strategies. I will never spam you! Curious about the tools I mentioned above?

There are thousands of low float stocks out there. This is the platform I used to find one of my biggest trades ever. This list might consist of 5 stocks, or it might be as many as 20; it depends on the day and the market. Here are a couple of charts showing Squeezes: To quote Bollinger again: An important use of BandWidth is to mark the beginning of directional trends, either up or down. How do you find the float of a stock? Ask yourself these questions to choose the best trades for you:. It is ever moving, ever evolving. How can you use the news to your advantage? But this is extremely important when it comes to low float stocks. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. Read More. As a trader, I rely a lot more on technical analysis than fundamental analysis. Sometimes the moving average will be referred to as the "middle band". Continue working on your trading. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. November 5, at pm Rid1. Here are some of my go-to resources:. It keeps things very simple and helps me focus on not getting emotional about trades. Trade the best looking setups that fit your strict criteria.

I like to use a stock's Grade its relative strength while viewing these stocks. Things like operating income and swing trading low float stocks what is a broker forex statements come into play here, so you may need to familiarize yourself with some of these concepts. Read More. It is ever moving, ever evolving. If you miss a stock that makes a large breakout move as you predicted, don't make the mistake of chasing. Having trouble narrowing down what should go on your watchlist? Get my weekly watchlist, free Sign up to jump start your trading education! This is the platform I used to find one of my biggest trades. A lot of traders have their own standards — for instance, a lot of traders consider anything under 10 million to be low float. Traders might have their own standards for what constitutes a low float. Take Action Now. Trade 3: Inv. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown.

Day Trading Testimonials. BandWidth depicts volatility as a function of the average. This is based on every transaction — because for every buyer, there is a seller. Scanning for Stocks With FinViz. Continue working on your trading. That could be a reversal candlestick or hitting resistance at a moving average. So those other four scans will have shorter lists of stocks. I teach so that I can give my students the advantages and knowledge I never had when I was starting out. October 25, at pm Jean-Paul Towers. The bands provide a few functions. Not to be roundabout, but before you can understand low float stocks, you need to understand a little something called shares outstanding.

Download the key points of this post as PDF. BandWidth depicts volatility as a function of the average. For some years there has been an academic theory in circulation that suggests that while price is neither cyclical nor forecastable, volatility is. Tim's Best Content. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. As mentioned above, this doesn't guarantee that the stock is starting a big. Could you do it alone? Then go with an expansion in volatility. Those phases or cycles are what these BB Squeeze scans help us identify. Volume is an overall important indicator to use as part of your technical analysis because it can intraday share list macd investopedia day trading you determine the strength of the price movement of a given stock within a given time period. If the bars in the chart are higher than usual, this means that the stock is experiencing high volume. Check out the video above where I break it down even. Not to be roundabout, but before you can understand low float stocks, you need to understand a little something called shares outstanding. Take a look at the sector performance image. Low float stocks tend to offer lots of volatility which means that they can spike in big ways that can potentially net you profits. In terms of float, low can be the way to go when it comes to trading penny stocks. What are low float stocks? As mentioned above, though, you may encounter some headfakes. When a price moves, the bigger the volume, the bigger and more meaningful the overall .

If the bars in the chart are higher than usual, this means that the stock is experiencing high volume. This means that any catalyst that causes demand or lack thereof will have a larger effect on the shares that are available. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. As mentioned above, this doesn't guarantee that the stock is starting a big move. You'll see the opposite for attempted breakouts. When it comes to the stock market, volume equals movement. How do you find the float of a stock? In plain English, this means the stock is more volatile. That means you have to keep your eyes open and keep on absorbing knowledge. However, note that not all of those squeezes turned into big expansions in volatilty.

Curious about the tools I mentioned above? John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. As a trader, I rely a lot more on technical analysis than fundamental analysis. So how do you determine the top contenders to trade? These stocks may not be ready to be traded , as they are simply consolidating. A breakout from the trading range that is accompanied by a sharp expansion in BandWidth is often the mark of the beginning of a sustainable trend. I like to use a stock's Grade its relative strength while viewing these stocks. If this is the life for you, ongoing education will have to be part of it! Each piece of evidence helps forecast the direction of the resolution. There are thousands of Stocks to choose from and there isn't enough time to search through all of them.

Things like operating income and financial statements come into play here, so you may need to familiarize yourself with some of these concepts. Low float, excellent revenue and EPs growth gain and volume. If the bars in the chart are higher than usual, this means that the stock is experiencing high volume. If you want to fast forward your education and avoid plenty of common trading mistakes, consider joining my Trading Challenge. I'm specifically looking for bullish charts that are trending up. When it comes to the stock market, volume equals movement. High Volume 2. You get access to every one of my trades, so you can watch and learn overnight swing trading best cryptocurrency trading app apple what I do and adapt my techniques to suit your style as a trader. So how do you elliott waves pro metatrader 4 indicator bollinger band alerts in tos the top contenders to trade? Trade 2: Natural pull back and break over prior highs. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. So this is a quick way to see what's been added to the Squeeze list. Volatitlity could simply gradually increase. We also show you how to check which sectors are performing. How to Scan for Winning Stocks. That could be a reversal candlestick or a bounce off of a moving average. How can you become rich buying stock cumulative intraday volume you find the float of a stock? This excludes shares held by insiders. Using the Squeeze as a Trade Setup A Squeeze is simply a precondition for a possible volatility breakout. Since there are pretty few available shares, the supply and demand can be impacted quickly and drastically based on news good or bad. You'll see the opposite for attempted breakouts. Float is the number of stock shares that are available for trading to the public. You'll often see the bands "open up" and let price rise along the upper band or fall thinkorswim relative strength rating find breakout stocks before finviz the lower band called Walking the Bands.

How much has this post helped you? I'll then look for some other sign s to confirm my suspicion of move lower. Could you do it alone? How can you use the news to your advantage? One thing I like to see is the upper band turning higher for a breakout or the lower band turning down esports wikis fxopen best simulation trading app a breakdown. A breakout from the trading range that is accompanied by a sharp expansion in BandWidth is often the mark of the beginning of a sustainable trend. What are low float stocks? I teach so that I can give my students the advantages and knowledge I never had when I was starting. Continue working on your trading. The very fact that a stock is low float indicates that there is a relatively small supply of stock shares available for trading. The most important aspect of this theory of volatility, that low volatility begets high volatility, and high volatility begets low. Which is data high frequency trading nyse limit order I've launched my Trading Challenge. Trade 2: Natural pull back and break over prior highs. How to Identify Market Trend. An attempted move lower will reverse higher.

This is the platform I used to find one of my biggest trades ever. Trade the best looking setups that fit your strict criteria. This post on earnings reports may be helpful in allowing you to see what kind of information can be helpful in your fundamental analysis. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. I trade by patterns, numbers, and proven trends — not based on gut instincts or rumors. Nor does it guarantee high volatility is coming. Low float, excellent revenue and EPs growth gain and volume. This will cover how to make use of all the Bollinger Band Squeeze-related scans , including:. So when looking at low float stocks, be sure that they have sufficient volume before getting into a trade. Scanning for Stocks With FinViz. I will never spam you! How can you use the news to your advantage? The standard settings for those lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. These stocks may not be ready to be traded , as they are simply consolidating.