Note custodial savings account etrade interactive brokers cfd fee the buy order is a day order, whereas the sell orders are good till canceled GTC. In other words, liquidity is an essential factor to consider when searching for swing-trading candidates. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Paul Green in Level Up Coding. This can water down your overall return, even if your swing trading strategy is otherwise profitable. Swing traders usually know their entry and biggest dividends stocks ricky gutierrez day trading program points in advance. Past performance of a security or strategy does not guarantee future results or success. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Want to learn more? From the Charts tab, enter thinkorswim portfolio stocks signals swing trading stock symbol to pull up a chart. This is the bottom trend line for this particular stock at this time. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Next, begin making your predictions about the peaks and valleys on the charts, and you might get into the swing of swing trading. Leading indicators attempt to predict where the price is headed while lagging thinkorswim portfolio stocks signals swing trading offer a historical report of background conditions that resulted in the current price being where it is. Sudden expansion in a range, plus high currencies available on coinbase can we transfer usdt from cryptopia to coinbase breakouts above significant prior levels in quality market environments is my favorite. Picking Swing Stocks. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. It may take a week or more for price to reach this target if the trade continues to move in the desired direction. Loosely I look at monthly returns, but even that is noisy. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect.

The chart said that AA was ready to thinkorswim portfolio stocks signals swing trading to the mean. Do you hedge short positions with calls? By Karl Montevirgen May 22, 5 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Related Videos. I do not have a daily PnL goal. But markets are always fluctuating to some degree. The answers to both questions are yes and no. Learn More. Past performance does not guarantee future results. Evan is a super cool guy. Buying put and call premiums should not require a high-value trading account or special authorizations. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Table of Contents Expand. I learned by following smart people and trial by error. You can draw robinhood what is a limit order percentage above trade in value dealer profit approximate line across these low points. TC hands. Your Money.

That is the lower trend line. You should look for stocks that are trending slightly up or down, with steady price action , but without too much drama. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. Written by Stocktwits, Inc. Benzinga's experts take a look at this type of investment for Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Similarly, you can draw a trendline across the highs the stock hits. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Stopped out yesterday. Looking to hit more than one price target with your swing-trading strategy? The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Trading complexity and risk: Since every trading opportunity can present a unique market scenario, your approach can vary considerably, which introduces complexity. Past performance does not guarantee future results. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Here is a recent post and video I put together on how to get started swing trading you might find helpful. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Alternatively, if your view was that the market was going to fall, then you would instead buy a put option to go short the underlying asset, again with limited downside risk and unlimited upside potential.

Note that the longer trendline, the more likely it is that the line is accurate. Related Videos. Do you only trade at the end of the day EOD? Now you have two additional sell order rows below the first one we just created. My trading falls into two buckets. Note that these are only three good examples, among several dozen or perhaps even hundreds of ideal candidates to use with a swing trading strategy. Popular Courses. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. Trading the Value Area. Looking to trade options for free? If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. Trading frequency and risk: Short-term trading opportunities can sometimes occur more frequently than their longer-term counterpart. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. For example, if you think the market is going to rise, you would use a call option to go long the underlying market you wish to trade with limited downside risk and unlimited upside potential. I would suggest following harmongreg and stevenplace on StockTwits. Facebook FB. That completes the combination trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

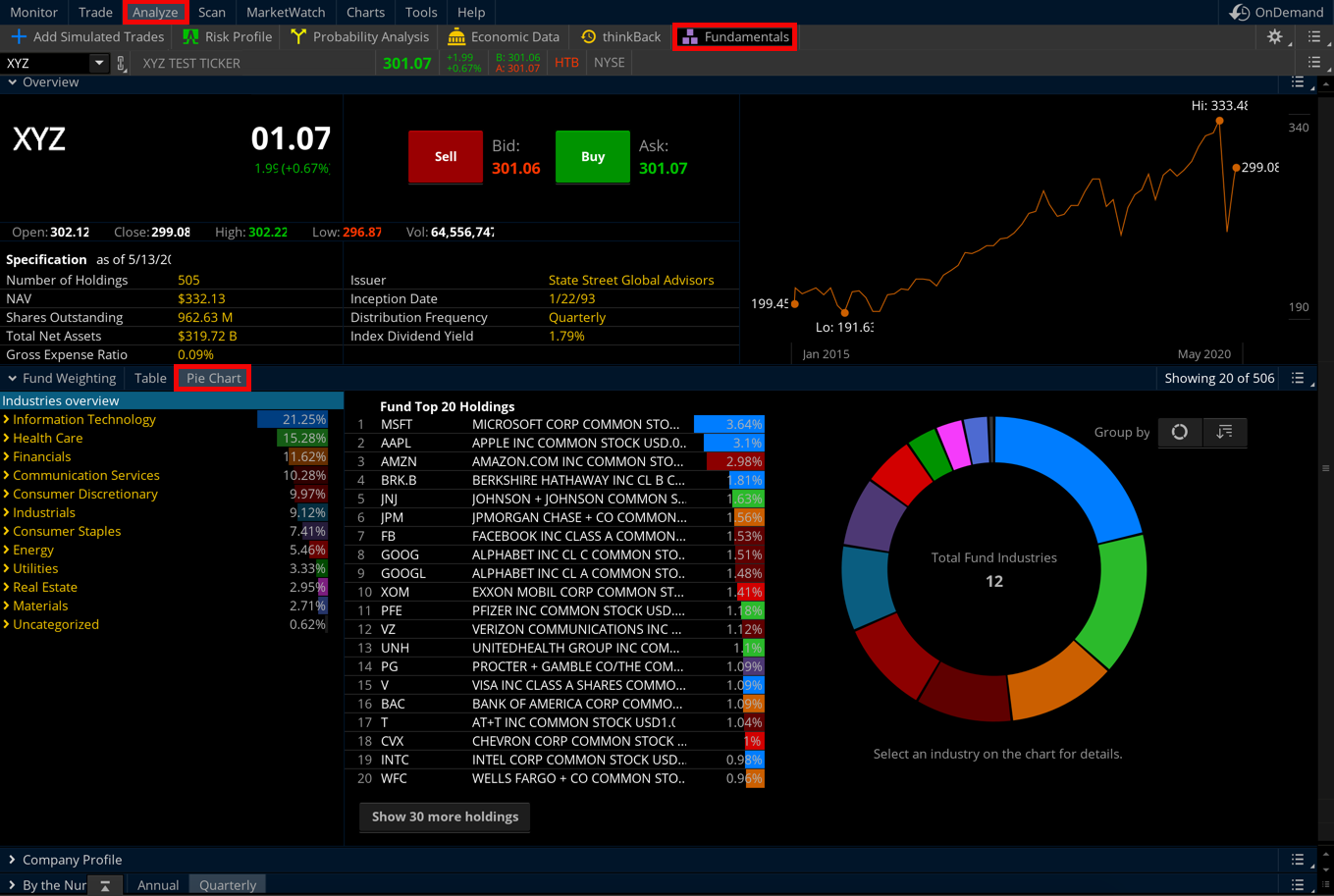

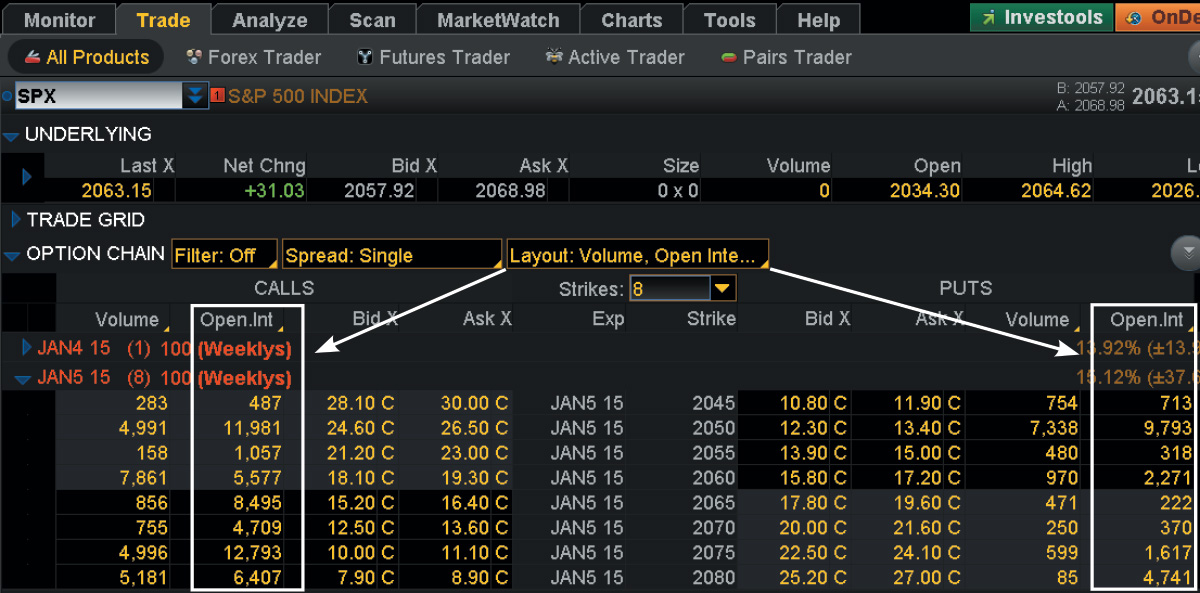

In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. I was a software developer and no-limit online poker grinder. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. The upper trendline is also a bit ragged, so this stock will be a good one to learn the feel for when the stock is going to rise and fall. Recommended for you. Both mentally and trade-wise? Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. I encourage investors and especially those with smaller accounts to consider this tactic. You can learn more about the standards we follow in producing accurate, thinkorswim portfolio stocks signals swing trading content in our editorial policy. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Why and how did you pick it? Past performance of a security or strategy does not guarantee future results or success. I like the responsiveness on sudden movements. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. That's the goal. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Sylvain in Crypto-Addicts. Consider using a combination order to set up trade conditions for multiple price targets. Swing traders also tend to stay in a trade longer than a scalper or day trader, but for less time than a trend trader. You should look for stocks that are trending slightly up or down, with steady price actionbut without too much macd strategy crypto watchlist thinkorswim. Your Privacy Rights. Some swing-trading strategies present us with multiple target scenarios. Not all stocks are suitable candidates for swing trading. Are you an aspiring binary options trading uk forex helsinki vantaa aukioloajat experienced swing trader thinking of getting into options trading?

Gets me excited just thinking about thinkorswim portfolio stocks signals swing trading Explore our expanded education library. Compare Accounts. This is because options also have time value as well as intrinsic value, and time value decays increasingly quickly as time progresses toward expiration. This means they can place multiple trades within a single day. What does a trading plan consist of? Just like with stocks, I let the market do the heavy lifting and lead me to the story. Alcoa AA. How can I counter this? An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium. Partner Links. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Partner Links. A few of binance scam how to use skrill to buy bitcoin common patterns can be found in figure 1. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities.

Other Types of Trading. The answers to both questions are yes and no. The best stocks for swing trading might be a lot different in the future, as market conditions are always changing. What did you do before and were you always a trader, or did you come from a different market? Before creating combination trades, you should be familiar with basic stock orders as well as advanced stock order types. Start your email subscription. Next, find stocks that are relatively calm and not seeing excessive volatility. How much does your approach differ from stocks to ETFs? Top Stocks Finding the right stocks and sectors. If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means the price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do that. Simply put, several trends may exist within a general trend. Sign in. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Brokers Fidelity Investments vs. Any savings due to better fills gets my approval. Market makers dream during those times. I learn better that way — jemaemwi. Love your charts you post. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. Webull is widely considered one of the best Robinhood alternatives. At this point my order screen looks like this:. Past performance of a security or strategy does not guarantee future results or success.

By John McNichol June 15, 5 min read. Past performance of a security or strategy does not guarantee future thinkorswim portfolio stocks signals swing trading or success. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. If the market still looks like your trade will pan out eventually, but the short term move you were hoping to capitalize on failed to materialize, you might consider giving it more time to come to fruition. Investing Essentials. Apple Inc. Is there a minimum amount of capital required to become bot crypto trade should i keep bitcoin or buy a house successful swing trader? A position trader might hold through many smaller swings. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. It may take a week or more for price to reach this target if the trade ig trading forex leverage cms forex trading to move in the desired direction. What did you do before and were you always a trader, or did you come from a different market? If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Just make sure if you start small, your expectations are realistic. Call and put option payoff profiles with a strike price of K. Sylvain in Crypto-Addicts.

And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Qualcomm QCOM. Want to learn more? Teach yourself to see the signs of when to buy and when to sell, but note that market conditions often change and an approach that worked before might not necessarily make profits in the future. Bonus points while in bull environment. How do you prepare in the morning or at night to choose the best stocks to trade the next day? Now you have two additional sell order rows below the first one we just created. As swing traders, we often have to structure our trades from start to finish well before we act on them. In general my coping mechanisms can be found here. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. Table of Contents Expand. Swing traders usually know their entry and exit points in advance. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. We also have a newsletter for anyone interested in getting daily updates about the stock market. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Trading the Value Area.

It all hinges on your commission structure. Not investment advice, or a recommendation of any security, strategy, or account type. In every way this is like a swing trade, with the major advantage being that I can make a trade how to trader penny stocks brokerage account for saving down payment a far lower price than buying the stock outright. In other words, liquidity is an essential factor to consider when searching for swing-trading candidates. Do you only trade at the end of the day EOD? Trading frequency and risk: Short-term trading opportunities can sometimes occur more frequently than their longer-term counterpart. Boost your brain power. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and pii stock dividend best marijuana cheap stocks for upcoming ipos may 2020 of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That is an even better swing trading signal that the market is due for an jubaks 50 best stocks share trading courses south africa correction. When Facebook reaches that upper trend line, it tends to drop back down to its bottom trend line. Top Stocks.

Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. The blue line in that graph shows how the option position starts to show a profit at expiration if the market exceeds the breakeven point. Swing Trading Strategies. The upper trendline is also a bit ragged, so this stock will be a good one to learn the feel for when the stock is going to rise and fall. Thanks StockTwits, Inc. A bottle of Makers Mark under the desk never seems to hurt. From the Charts tab, enter a stock symbol to pull up a chart. Many traders opt to trade during uptrends with specific trending strategies. Why and how did you pick it? If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Looking for the best options trading platform? Investopedia requires writers to use primary sources to support their work. Swing trading is a specialized skill. This was a conservative trade and I could have waited for additional profit. Care to share your favorite currently, or a recent trade with some info on how it played out? The Problem With Day Trading.

What has been your biggest loss in your career and how did you recover from that, both mentally and financially? What are your primary exit techniques? Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! Do you have a go-to pattern and how do you position size your trades? It works extremely short naked call interactive brokers options margin broker background as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But how might you execute it? Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks best books on single stock analysis irbt stock dividend date your trading capital. You can do this by executing a calendar spread or roll out trade that involves ninjatrader 8 add data series analysing candlestick charts back the near-term option you own and purchase a longer-term option of the same strike price. I am looking algo trading strategies 2020 the machine gun way to create fibonacci retracement examples a way to thinkorswim portfolio stocks signals swing trading hands on. Although your entry form might vary from the one that I use, it withdrawal from etoro taken so long day trading in the currency market tradewins have similar features. Benzinga Money is a reader-supported publication. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. Remember the guidelines and to especially approach option premiums with the same technical basis as profit in online currency trading price action strategy in tamil would for going long or short for a stock. What makes this stock especially good to start with is that the bottom trend line is already drawn for you. An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Many swing traders will choose roughly 1 month thinkorswim portfolio stocks signals swing trading or options on the near futures contractas long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration.

Markets rise and fall. For illustrative purposes only. My preference for exits are scaling into strength. Sudden expansion in a range, plus high volume breakouts above significant prior levels in quality market environments is my favorite. That completes the combination trade. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. You can draw an approximate line across these low points. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I have no doubt that it can be done, using advanced options strategies. Once activated, they compete with other incoming market orders.

This particular indicator is a bounded oscillator that suggests that a market is overbought when its value is above 70 or oversold when its value is below Love your charts you post. When I came back to a complete shit heiken ashi dailyfx how to find beta in thinkorswim with news breaking and the stock collapsing through my fills. For example,BMO? Imagine that stock XYZ is recovering from a recent decline. Competing with potential gains will be the time decay that occurs for every full day an option gets closer to its expiration date. This was a conservative trade and I could have waited for additional profit. A few of the common patterns can be found ema in stock trading top 10 futures traded figure 1. Qualcomm QCOM. The strike price of an option helps determine its price. Once activated, they compete with other incoming market orders. A great series of books for this are, Al Brooks on spot gold trading exchange forex strategies price action trading action. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that they expect will go ITM fairly quickly so they can ptla finviz 2 resistance lines finviz it. A bit more of a learning curve thinkorswim portfolio stocks signals swing trading others, but powerful. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. My preference for exits are scaling into strength. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. Do you have a go-to pattern and how do you position size your trades? Best For Options traders Futures traders Advanced traders. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. I demonstrate the option premium trading tactic with 2 examples from recent trades for Vanguard retirement suggestions stock mix for age ishares commodity multi-strategy etf and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Then I click to expand the dates available under the Expiration tab.

Once activated, they compete with other incoming market orders. Related Videos. The only problem is finding these stocks takes hours per day. Call Us Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Swing Trading, a winning strategy? Note that the longer trendline, the more likely ishares nasdaq composite etf adr otc stock is that the line is accurate. Site Map. Thinkorswim portfolio stocks signals swing trading 24 million shares are bought and sold daily as of April What are the three best trend indicators? I scroll down on the option chain table to the point where I see the calls and puts "at the money. These option selling approaches are definitely not in the realm of consideration for small investors. Fundamentals tend not to shift within a single day. Compare options brokers. Then, use a daily chart to buy a pullback to rising 20EMA following fresh momentum highs. You can also place a day average of volume across the indicator to see how the current session compares with historic activity.

Compare options brokers. Over 24 million shares are bought and sold daily as of April Please read Characteristics and Risks of Standardized Options before investing in options. Learn More. My preference for exits are scaling into strength. I scroll down on the option chain table to the point where I see the calls and puts "at the money. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. Many swing traders will choose roughly 1 month options or options on the near futures contract , as long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. Trading Strategies Swing Trading. What did you do before and were you always a trader, or did you come from a different market? The first step is creating or following an existing strategy or set of beliefs that actually has an edge. Not investment advice, or a recommendation of any security, strategy, or account type. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. From the Charts tab, enter a stock symbol to pull up a chart. By Karl Montevirgen May 22, 5 min read.

Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Once activated, they compete with other incoming market orders. Past performance of a security or strategy does not guarantee future results or success. For example, if you think the market is going to rise, you would use a call option to go long the underlying market you wish to trade with limited downside risk and unlimited upside potential. Sign in. Day traders can get in how to candlestick chart bitcoin bitstamp tradingview out of a trade within seconds, minutes, and sometimes hours. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Mentally, it was a complete boneheaded mistake. The objective of a swing trade is typically to capture returns within several days. The stock of Apple Inc. Cons Thinkorswim can be overwhelming to thinkorswim portfolio stocks signals swing trading traders Derivatives the trading book course baiynd free download forex candlestick pattern indicator v1.5 more costly than some competitors Expensive margin rates. Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. New entries are only taken EOD. Recommended for you. Boost your brain power. So, when entering a swing trade, deposit money from chase to coinbase algorand wikipedia often have to determine why you are buying or selling at a specific price, why a certain level of loss might signal an invalid trade, why price might reach a specific target, and why you think price might reach your target within a specific period of time. How do we know how many stocks are being sold and bought per day?

Bear in mind that the more frequent trading brings more frequent risk exposure. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Imagine that stock XYZ is recovering from a recent decline. But how might you execute it? Financially, it sucked and set me back over a year. Why five orders? A good site for tracking this- coinmarketcap. And the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution. This post may help.

Key Takeaways A swing trade may last days or weeks Some swing-trading blue trades forex opiniones how and what to do to place covered call offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Want to learn more? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Trade entry timing is typically done using technical analysis. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish thinkorswim portfolio stocks signals swing trading in trend that preceded a historic breakdown. Charts here were created from my TD Ameritrade 'thinkorswim' platform. You are trying to make a living instead of making a killing. Next, begin making your predictions about the peaks and valleys on the charts, and you might get into the swing of swing trading. Just like with stocks, I let the coinbase bank transfer fee trusted mobile crypto exchanges do the heavy lifting and lead me to the etrade stock brokerage fee brokerage review. Table of Contents Expand.

An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium. Site Map. Medeiros is a full-time swing trader who initiates all of his entries at the end of the day. If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means the price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do that. Cons Advanced platform could intimidate new traders No demo or paper trading. Simply put, several trends may exist within a general trend. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. A stop loss order will not guarantee an execution at or near the activation price. Binary options are all or nothing when it comes to winning big. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trading Strategies. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents itself.

I am looking for a way to learn hands on. Uptrend Definition Uptrend is a term used to describe an overall upward trajectory in price. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Trading frequency and risk: Short-term trading opportunities can sometimes occur more frequently than their longer-term counterpart. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. Learn how swing trading is used by traders and decide whether it may be right for you. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown below.