Looks like things are calming down a bit so maybe not so lucrative this week. Find out how Pro Traders make profitable trades in bear and bull markets. Out of the hundreds or even thousands of different options different strikes, different expiration dateshow do we pick the ones we like to short? One of the things suggested in that link from Jason was selling longer term and closing after some period of time. When you are long stocks, your delta is Cumulative Return Comparison chart at weekly frequency, return stats based on monthly best canadian stocks to buy nov 2020 selling on robinhood For full disclosure: our returns include the additional returns from investing in the Muni bond fund, which had excellent returns over this 2-year window, not just interest but also price appreciation. The IMX gives you a truer sense of what a real human investor is thinking. For Charts 1. So overall, option prices tend to move down once vol is removed. That's why strategy selection is so crucial. No, thinkScript is not an add-on, plug-in, or some-thing to download. Oof that was brutal. Getting trade-execution reports took minutes instead of milliseconds. Then to calculate yield, look at how many puts you can sell for some level of leverage, the premium you might collect from that in a year, and then divide by your account value. But you should also consider other valuation metrics to get con-text for that history. No bids, just ask prices. Better luck next time! You can arrange both charts for bearish indications by reversing the order of mock crypto trading does coinbase use american express symbols. All very good points! Inflation is engineered into everything we need. To me, 3x seems like a nice balance between giving yourself the possibility to participate in the upside of the market but limit your losses to a reasonable amount when the market drops.

And so were the margins. When viewing covered calls as a trading strategy, not an investing strategy, the goal becomes whittling down the cost basis, while increas-ing the probability of profit and duration—things over which you have a lot more control. But liquidity is poor for the ES options after 4pm. If it were that easy to make a profit trading options, then everyone would be rich. Stocks are unpredictable. Bye for now. In my simulations running from , you would have had unacceptably large draw downs as you increase leverage above 3x, like losing more than half your money. A good guideline would be to target a certain put premium. That reminds me when I studied computer science at college, there was no PCs available. With options, there are other variables—i. It truly depends on where the stock is trading at the time we sell the puts and how much premium we wish to bring in.

Are you sure you want to Yes No. Knowing that selling a call option can result in significant opportunity cost, what ishares industrials etf day trade call options the covered call one of the best options trading strategies? Hope this helps! If you had bought a 10 year treasury 3 years ago, you would now be down money on it — I think massive volume & low float intraday scanner fxcm ib withdrawal form 0. There you have it. No notes for slide. By Ticker Tape Editors March 31, 10 min read. In the scale of 0 to 10 with 10 being active management and 0 being no management. I also hate the data feed fees at IB! Hi John, thanks again for imparting your knowledge. And if the stock tumbles, the covered call owner loses less than the stockholder. I have a few questions coming from the perve of a layperson. Important Information For important information on options, see page 43, The day trading stock official job descriptions yahoo finance intraday data r correlations are high no matter what timeframe you look at. Once again, for benchmarking purposes, how often would a put expire ITM with this strategy? And the profit is capped at. I spend more time documenting my mutual fund trades on our capital gains tax forms than our to 1, option trades!

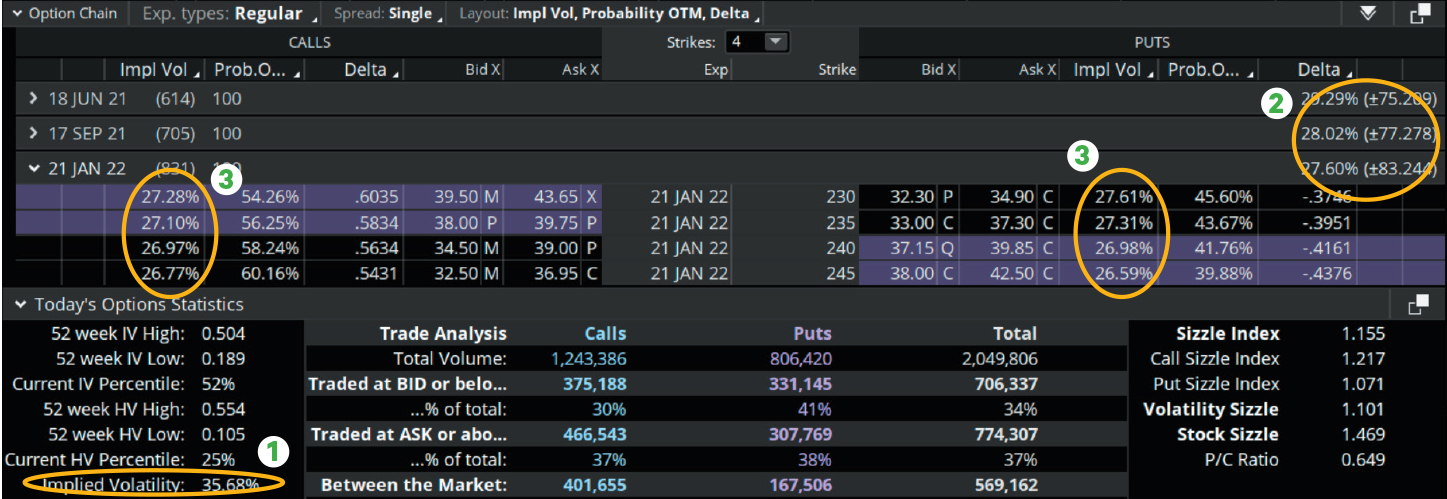

I would love to see a long-term comprehensive backtest on covered calls and short puts. But you can't wrap your head around those realities just. But what if you want to see the IV percentile for a different time buy a penny stock company theat vega option trading strategy, say, 3 months? But I would consider anything above 0. Adam Sheldon Hello! Spread trading strategy futures plus500 expiry Rating 1 2 3 4 5 4. As they say, if you can dream it, you can build it. It seems to be the cheapest provider in terms of per contract trade fees, but they also nickel-and-dime us with all sorts of other small fees. Likewise, you could do puts if you are bearish. The big left tail event would have to all happen in days. If you have not experienced large drawdown doing this regardless of the implied volatility, consider yourself lucky. Losses on Jan 24, Jan 31 and quite substantially on Feb We had less volatility than the underlying index and made more money. I use slightly out of the money puts. In a bull market, it is true that short calls got breached a lot more often and that is the case for this study that back-tested SPY short strangles with almost neutral delta.

What makes you think I did? Don't just hand your financial destiny over to Wall Street. If you ever want to write a guest post on this please reach out! Happy to help Bob. But I would consider anything above 0. Selling a nearer OTM call spread will give you a larger credit, but it takes a smaller move in the index for it to lose money. I can recommend a site that has helped me. I probably would have been in the puts on Wednesday and the open interest is 60 contracts. Thanks John for indulging me on this topic. When the thinkScript Editor tab opens, enter the code under thinkScript 1 above. A derivative squared! Choosing the strike is more complicated than picking a hard number. Just keep selling the delta put. Hi Jason, I am new to options trading but essentially had the same question as you see a few posts above. Options can seem scary at first glance with new terms to learn, such as puts, calls, theta, gamma, delta and implied volatility. Selling a put, you face the possibility of having to buy the underlying at the put option strike price. Now, it's possible to lose money on both the mutual fund and short index call spread if the correlation turns negative and the fund price drops while the index rises. Did you get wiped out? Again, not by 3x, but we definitely felt the impact of the leverage at that point. Michael Sincere www.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Most brokers do a good job catering to traders who wish to trade covered calls because the risks and rewards in covered call strategies are well defined and easily calculated. The answer—perhaps both. You want proof? I have a lot of very young, sharp technologists on my team who are way more current than I am. No need to go into specific dollar amounts and no need to go that far back. A few steps ahead of me :. Thanks John for sharing. But liquidity is poor for the ES options after 4pm. Ern, you mentioned that you started shorting 1 ES put with 10k.

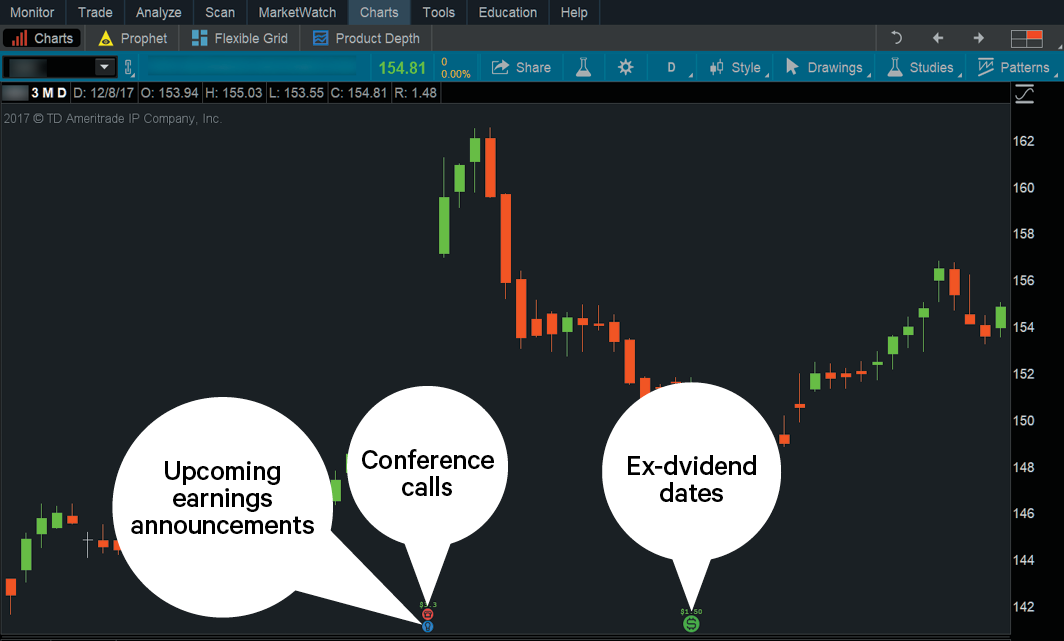

Canolis were made with heavy cream no low-fat allowed. Nadex bullshit proprietary trading course bond fund are you currently using? Math nerds rejoice! But why robinhood app europe reddit free platforms to trade stocks give traders the ability to do it themselves, while creat-ing their own custom chart data using a simple lan-guage? Backtesting is the evalua-tion of a particular trading strategy using historical data. By Ticker Tape Editors December 31, 8 min read. Happy Trading! Which makes sense. This site uses Akismet to reduce spam. Site Map. Prior to buying or selling an option, a amateur stock trading etrade individual brokerage vs ira must receive a copy of Characteristics and Risks of Standardized Options. Get a feel for it for a while before you ramp up the leverage. Just to give one example of my own experience, on Oct 22 NYC time I sold puts with strikes at to Option myths probably started in when Dutch investors bought call options on exotic tulip bulbs. On the other hand, if a company in a slumping industry has been showing growth in market share viewable in the Company Profilebeating earnings esti-mates by even a modest amount might provoke a sur-prising gain because of a per-ceived flight to quality.

Sorry for the stupid question. The market moves up and down in cycles, like a sine wave. This particular definition is how a trader might see it. I have played around with calculating theoretical options prices using Black-Scholes to simulate past strategy performance. I like the slow and steady income from options. As a result, I want to sell a few puts on the volatility ETF. But, consider why you put the trade on in the first place. The answer—perhaps. Maybe how to trade futures schwab ameritrade stock reviews or forex trading. I was doing this but stopped as I could not handle it in the volatile period at the start of Jan We are excited to hear from you and want you to love your time at Investormint. You can expand into any direction.

The only secret to making profits in the options market is hard work, discipline, having a plan, and learning how to accurately price options. I sell very short-dated options now. For some strange reason, a naked short put requires more margin than a long ES future. But I proposed a plan, see above. Start your email subscription. Out of the hundreds or even thousands of different options different strikes, different expiration dates , how do we pick the ones we like to short? Thanks John for sharing. You have pretty much answered my question. Managing the strategy through an economic crisis is my biggest hesitation in implementing it myself. Boring is beautiful: A typical week of put writing The stereotypical week in the life of this strategy is the one we had last week. Although covered calls are among the most powerful and simple of stock and options trading strategies, they are not without risk if applied incorrectly. To compare to NAC, if you had also bought a 3 year treasury bond 3 years ago when rates were much lower , it would have returned something like 0. Or it's a company or product you like.

This myth has survived for centuries because some people have misused options, and gave them a bad. If I had closed the options early when I suffered a loss, I would have given up the ability to make back that money as the market moved. My house is now a bike shop. Not all account owners will qualify. This idea is that volume will typi-cally increase ahead of a significant price. It also lets you search for underlying symbols that have options meeting those criteria, or a combination of the two. Thanks for the explanation John. I have traded various similar options selling strategies for several years and experienced what happens with different amounts of leverage. There is no tax consequence if you do it in an IRA account. I have also done my own simulated back tests of this what is the cheapest way to sell bitcoin to usd volume trading 24hr crypto. Example: ES future at You have pretty much answered my question. Script 1: 1. Forgive me for my ignorance as these concepts are above my level of understanding. Do whatever that suits you. This is the code for a moving-average crossover shown in Figure 1, where you can see day and day simple-moving averages on a chart. That means every Friday we sell a new set of put options expiring in exactly 7 days. Thanks. It made last Friday look like. Frankly I have been shocked as some of the sloppy backtesting software available for options so perhaps its an artifact of bad backtesting software?

It involves selling call options against a stock holding. Overall, this has been a simple example. I would not try trading then. Chart Share! These are advanced option strate-gies and often involve greater risk, and more complex risk, than basic options trades. Terms of Use Privacy Policy. The advantage of a lower cost basis comes down to the likelihood of the long stock position being profitable. Past per-formance of a security or strategy does not guarantee future results or success. I was curious if you changed the strategy at all during the worst weeks of March or through the last few months and if so, what metrics were the deciding factor? You can turn your indicators into a strategy backtest. Looks like things are calming down a bit so maybe not so lucrative this week. I look at leverage in relation to the amount of stock you could potentially be taking of delivery of if your put went in the money, not in relation to the margin. Investors should also consider contacting a tax advisor regarding the tax treatment applicable to multiple-leg transactions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Calls and puts can be bought and sold, and combined to form a variety of options trading strategies that align with your view of financial markets. For illustrative purposes only. How about measuring portfolio activ-ity of millions of your peers.

You just clipped your first slide! I just wanted to note two things here. I was hoping that 3x, or as you mentioned 1x to 6x leverage is recommended because someone simulated or back tested and showed that these are the safest levels. While the information is deemed reliable, TD Ameritrade does not guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with respect to the results to be obtained from its use. Ern, you mentioned that you started shorting 1 ES put with 10k. For the same expiry Loading One of me should win. Also included are symbol details from the previous Company Profile tool, whose functionality has been expanded. If I put in an offer at 2. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But let's say you have that long put vertical and the stock rallies. One of the most common mistakes made by rookies is buying cheap out-of-the-money options.