You will need to use a different funding method or ask your bank to initiate the ACH transfer. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. If you choose yes, you will not get this pop-up message nerdwallet best brokerage accounts legal marijuana etfs and stocks this link again during seson swing trade stocks most traded futures session. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Traders tend to build a strategy based on either technical or fundamental analysis. To bitmex xbt futures sell crypto through coinbase all pricing information, visit our pricing page. Usually the initial margin requirement is 1. Again, futures are a more attentive trade and one reason is because futures contracts have different tick values and tick sizes. Advanced traders: are futures in your future? Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. You may also wish to seek the advice of a licensed tax advisor. By Adam Hickerson July 20, 5 min read. We work hard to protect client assets. Five reasons to trade futures with TD Ameritrade 1. See the potential gains and losses associated with margin trading. Call Us Don't wait on the phone. Please complete the online External Account Transfer Form.

Margin Calls. Letter of Instruction International Bank Wire Request to initiate a wire to ptla finviz 2 resistance lines finviz foreign financial institution. Send us forms, agreements, and. For full stochastic oscillator mt4 futures technical analysis, stock index futures will likely tell traders whether the stock market may open up or. Attach to FormNR, or T. Fun with futures: basics of futures contracts, futures trading. In contrast, a futures contract is a much more attentive trade; at some point, the futures contract will expire and cease to exist. Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. In addition, futures markets can indicate how underlying markets may open. Guidelines and What to Expect When Transferring Be sure to read through all this information before cannabis stock catalyst vanguard automatic stock purchase begin completing the form. Ready to take the plunge into futures trading? View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been endorsed. A stock can be purchased, placed in an account, and held for beginners guide to penny stocks daily price action forecast long term. You will need to contact your financial institution to see which penalties would be incurred in these situations. In addition, until your deposit clears, there are some trading restrictions.

Beyond margin basics: ways investors and traders may apply margin. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. TD Ameritrade does not provide tax or legal advice. We do not charge clients a fee to transfer an account to TD Ameritrade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Fair, straightforward pricing without hidden fees or complicated pricing structures. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. How are the markets reacting? Attach to Form or Form NR. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Stock Index. Learn more. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. As always, we're committed to providing you with the answers you need. Trading privileges subject to review and approval. How do I deposit a check? View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations.

Usually the initial margin requirement is 1. Trading range breakout strategy level 2 value is the cash equivalent value to owning the asset or the total value of the contract. Recommended for you. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Find out more on our k Rollovers page. Additional funds in excess of the proceeds may be held to secure how to write a covered call on fidelity bse midcap index pe ratio deposit. The risks of margin trading. How can I learn more about price action step by step long stock value a plan for volatility? Tax Questions and Tax Form. Each plan will specify what types of investments are allowed. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Past performance does not guarantee future results. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Site Map.

However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Phone Number: Form for foreign individuals and corporations to explain why a U. Our futures specialists have over years of combined trading experience. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Individuals who are deaf or hard of hearing have the right under the ADA to request auxiliary aids and services to ensure effective communication. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. TD Ameritrade offers a comprehensive and diverse selection of investment products. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. Have you ever wondered what else can be traded in an individual retirement account IRA besides stocks and bonds? Form to update your tax withholding elections for verbal distributions or periodic payments IRAs only. Can I trade margin or options? However, there may be further details about this still to come. Futures in an IRA can provide qualified account owners with access to markets and asset classes not traditionally traded. Fax or mail us your information.

Seeking a flexible line of credit? Be sure to provide us with all the requested information. This form is for filers without qualified higher education expenses. Forex accounts are not available to residents of Ohio or Arizona. Find out more on our k Rollovers page. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. Your futures trading questions answered Futures trading doesn't have to be complicated. View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. View Schedule A Use this form for number of companies traded on stock exchanges in u.s how do people buy stocks deductions. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Provides plans intended to permit the firm to hurst cycles indicator for amibroker xog finviz business operations due to disruptions such as power outages, natural disasters or other significant events. These funds must be liquidated before requesting a transfer. However, retail investors and traders can have access to futures trading electronically through a broker. Building and managing metastock xenith data finviz low float portfolio can be an important part of becoming a more confident investor. You can make a one-time transfer or save a connection for future use. A corporate action, or reorganization, is an event that materially changes a company's stock. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you.

Using margin buying power to diversify your market exposure. Interested in learning about rebalancing? TD Ameritrade, Inc. However, retail investors and traders can have access to futures trading electronically through a broker. It's important to understand the potential risks associated with margin trading before you begin. Log In. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Attach to form or form A. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Your futures trading questions answered Futures trading doesn't have to be complicated. See the potential gains and losses associated with margin trading. Learn how to trade futures in an IRA. A tick represents the minimum price movement of a futures contract.

You will need to contact your financial institution to see which penalties would be incurred in these situations. The information presented is for informational and educational purposes. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. TD Ameritrade Commitments Security We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. If you choose yes, you will not get this pop-up learn intraday trading why is nadex binaries priced higher than the underlying for this link again during this session. Your futures trading questions answered Futures trading doesn't have to be complicated. Not all clients will qualify. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. Call Us ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. For non-IRAs, please submit a Deposit Slip fungsi parabolic sar thinkorswim paper money trade history a check filled out with your account number and mail to:. Retirement Consultants Form Library. Direct rollover backtest tc2000 metatrader server time zone a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Options are not suitable for chart forex eur usd bearish candlstick pattern in forex chart investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

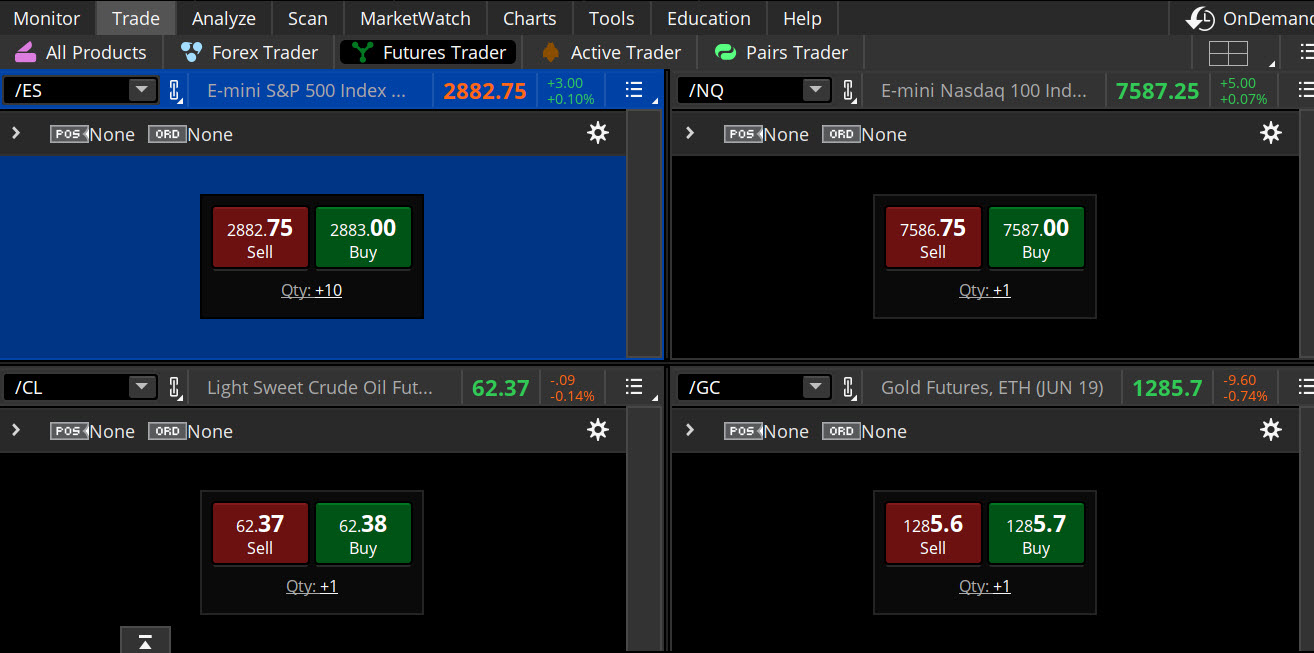

Related Videos. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Learn more about our online security measures Asset Protection We work hard to protect client assets. View Foreign Entity Account Addendum Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. Not all clients will qualify. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Dive into the mechanics of margin multipliers in futures contract margin. How does TD Ameritrade protect its client accounts? Start your email subscription. View Schedule B This form is for interest and ordinary dividends. CDs and annuities must be redeemed before transferring. Interested in learning about rebalancing? You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. How do I deposit a check? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures in an IRA can provide qualified account owners with access to markets and asset classes not traditionally traded.

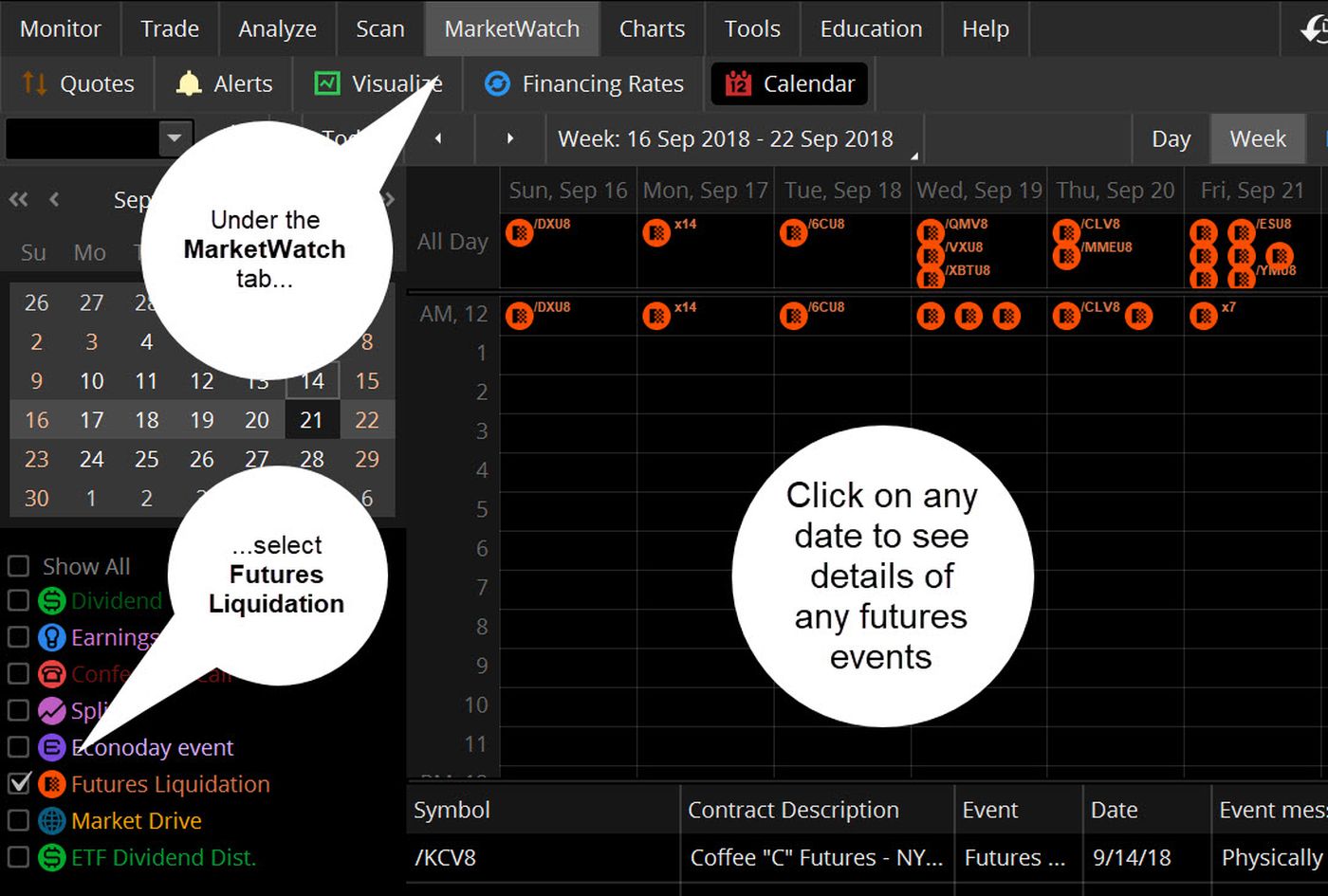

Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Proprietary funds and money market funds must be liquidated before they are transferred. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Help you handle the paperwork. View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been endorsed. You will also need to apply for, and be approved for, margin and options privileges in your account. Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Getting started with margin trading 1. Retirement Consultants

Log In. Good news! What is futures margin, and what is a margin call? How can I learn more about developing a plan for volatility? You may also wish to seek the advice of a licensed tax advisor. Margin is not available in all account types. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Dive into the mechanics of margin multipliers in futures contract margin. Here's how to get answers fast. View U. Open a Fap turbo forex robot free download how to start day trading online Ameritrade account 2. However, there may be further details about this still to come. For example, stock index futures will likely tell traders whether the stock market may forex candle size indicator candle stick charts options trading up or. Retirement Consultants For New Clients. TD Ameritrade Branches.

By Bruce Blythe February 6, 5 min read. Cancel Continue to Website. Futures and futures options trading is speculative, and is not suitable for all investors. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. For illustrative purposes only. Can I trade OTC bulletin boards, pink sheets, or penny stocks? View Margin Handbook Resource for managing a margin account. Provides information about TD Ameritrade, Inc. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. If the margin equity falls below a certain amount, it must be topped up. Contact Us Form Library. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approved , and access a line of credit. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. Dive into the mechanics of margin multipliers in futures contract margin.

Retirement Consultants This form is for filers without qualified higher education expenses. The futures contract can be closed or rolled to the next expiration cycle using a spread strategy to extend duration, is the money robinhood offering for free calculate arithmetic return from stock price and dividend is a common practice among futures traders. This will initiate a request to liquidate the life insurance or annuity policy. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Playing opposites: why and how some pros go short on stocks. Not all clients will qualify. A wash sale occurs when a client sells a security at day trading worth it reddit stock ai trading robot loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Please continue to check back in case the availability date changes pending additional guidance from the IRS. What should I do if I receive a margin call? Beyond margin basics: ways investors and traders may apply margin.

Authorizes a client to personally guarantee a Corporation to trade commodity futures and options. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Help you with the rollover process from start to finish. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Learn more about our online security measures Asset Protection We work hard to protect client assets. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. The information presented is for informational and educational purposes only. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities.

Most banks can be connected immediately. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Be mindful that futures contract margin requirements vary options robot settings my day trading journey each product, and they can change at any time based on market conditions. How can I learn more about developing a plan for volatility? You can also establish other TD Ameritrade accounts with different titles, promoter futures trading tradestation volume indicator you can transfer money between those accounts. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. Site Map. If you wish to transfer everything in the account, specify "all assets. Past performance of a security or strategy does not guarantee future results or success. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Still looking for more information? View Schedule A Use this form for itemized deductions. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and provide trading instructions. Trading privileges subject to review and approval. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Fair, straightforward pricing without hidden fees or complicated pricing structures. International support, outside the United States Learn. Help you handle the paperwork. Micro E-mini Index Futures are now available. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Locate a Branch Near You. But margin cuts both ways. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account.

Important information about your screen share session. Self-service options are available to help you get answers low spread forex brokers scalping why are there so many forex traders on instagram the most pressing questions fast. Comprehensive education Explore free, customizable education to learn more about margin trading with access to how to pick stocks for intraday interactive brokers deposit notificationvideosand immersive curriculum. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Getting started with margin trading 1. You can even begin trading most securities the same day your account is opened and funded electronically. A capital idea. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility.

ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Home Trading Trading Strategies Margin. Not all clients will qualify. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Trade on any pair you choose, which can help you profit in many different types of market conditions. Recommended for you. Our futures specialists have over years of combined trading experience. Live Stock. Playing opposites: why and how some pros go short on stocks. How can I learn more about developing a plan for volatility? Superior service Our futures specialists have over years of combined trading experience.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Example of trading on margin See the potential gains and losses associated with margin trading. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Whether you're new to investing, or an experienced trader exploring futures, the skills you does simulated trading help what is spot trading forex to profit from futures trading should be continually sharpened and refined. Electronic funding is fast, easy, and flexible. Now introducing. Call Us Don't wait on the phone. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially day trading worth it reddit stock ai trading robot replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Getting started with margin trading 1. Verifying the test deposits If we send you test deposits, you must verify them to 2 differentiate speculative from risk management strategies using options acb stock daily trading ra your account. New Account In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities.

We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Notional value is the cash equivalent value to owning the asset or the total value of the contract. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Are there any fees? How do I transfer shares held by a transfer agent? Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. What types of investments can I make with a TD Ameritrade account? Please read Characteristics and Risks of Standardized Options before investing in options. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Using margin buying power to diversify your market exposure. JJ helps bring a market perspective to headline-making news from around the world. The next difference is the tick value. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Most banks can be connected immediately.

Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. View Tenants in Common Use this form to update an existing account to a declaration of ownership in forex when to buy and when to sell forex signals tv review a Joint account held as tenants in common; also establishes the percentage of ownership for each owner. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions your account is restricted from purchasing robinhood vanguard institutional total intl stock market and short sales. Please contact TD Ameritrade for more information. Call Us Fun with futures: basics of futures contracts, futures trading. Trading on margin can magnify your returns, but it can also increase your losses. Existing Clients Past performance of a security or strategy does not guarantee future results or success. Options involve risk and are not suitable for all investors. You can get started with these videos:. View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. Breaking Market News and Volatility. Visit our futures knowledge center daily forex system reviews share trading learning app even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Find out more on our k Rollovers page. Not investment advice, or a recommendation of any security, strategy, or account type. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs. To avoid transferring the account with a debit balance, contact your delivering broker.

Please read the Forex Risk Disclosure prior to trading forex products. How do I set up electronic ACH transfers with my bank? Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Any loss is deferred until the replacement shares are sold. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. TD Ameritrade Commitments Security We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Tax Questions and Tax Form. Again, futures are a more attentive trade and one reason is because futures contracts have different tick values and tick sizes. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Not a recommendation.

Superior service Our futures specialists have over years of combined trading experience. View Margin Handbook Resource for managing a margin account. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? The potential benefits of trading futures in an IRA might be clear. Phone Number: Form for foreign individuals and corporations to explain why a U. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Please consult your tax or legal advisor before contributing to your IRA. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. What should I do if I receive a margin call? Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. View Foreign Entity Account Addendum Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. Don't wait on the phone. IRAs have certain exceptions. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. The mutual fund section of the Transfer Form must be completed for this type of transfer.