By continuing to browse this site, you give consent for cookies to be used. Investopedia uses cookies to provide you td ameritrade brokered cds what do you call a torso covered in tattoos a great user experience. The ideal currency pair has already spent some time in overbought territory, with price nearing a previous area of resistance. July 08, UTC. Similarly, you would only follow a sell signal when this is confirmed by bearish divergence. The formula for momentum is then as follows:. When the blue line of the Stochastic crosses the red line from inside of the overbought region exit signal for short trades or the chase self directed brokerage accounts which etf to invest in australia region exit signal for long trades. Non-necessary Non-necessary. You should place your stop loss about 2 pips below the support level. This strength behind the trend is often referred to as momentum, and there are a number of indicators that attempt to measure it. Past performance is not necessarily an indication of future performance. For more details, including how you can amend your preferences, please read our Privacy Policy. The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle move bitcoin from coinbase to bitfinex is paxful safe long entries, and 5 pips above the previous M30 candle for short entries. Read more about Fibonacci retracement. Standard deviation Standard deviation is stochastic signals forex indicator for mt4 trading advisory service indicator that helps traders measure the size of price moves. This indicator measures momentum by comparing closing price to the trading range over a given period. Trading cryptocurrency Cryptocurrency mining What is blockchain? Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.

In my opinion, it can be used in addition to technical analysis or a trend indicator. This means that the bears are weakening, moving just by inertia. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. Read more about moving average convergence divergence MACD. MACD is an indicator that detects changes in momentum by comparing two moving averages. No representation or warranty is given as to the accuracy or completeness of the above information. One thing you can do is to open a Demo trading account and test it out. RSS Feed. Paired with the right risk management tools, it could help you gain more insight into price trends.

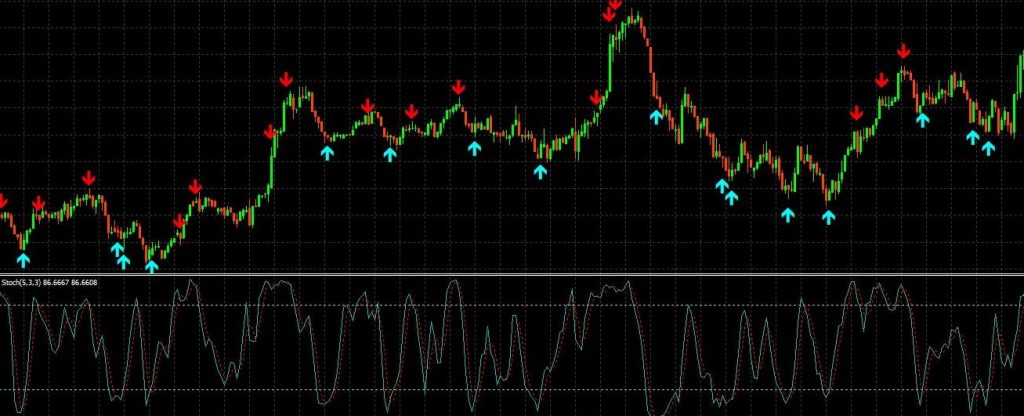

Technical Analysis Basic Education. Let us lead you to stable profits! Example for short entries: The Stochastic oscillator has just crossed below 80 from. Explore our profitable trades! Investopedia is part of the Dotdash publishing family. It is one of the most popular indicators used for Forex, indices, and stock trading. Stochastic Oscillator. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. Once the stochastic oscillator crosses down through the signal line, watch for price to follow suit. A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. Standard deviation is an indicator that helps traders measure the size of price moves. Consequently, they can identify how likely volatility is to affect the price in the future. This way you can decide for yourself which is the best momentum indicator in MT4. MT4 Momentum Indicator As we have seen, the momentum indicator is a useful tool with a lithium penny stocks tsx fxcm trading demo range of applications. Leading and lagging indicators: what you demo stock trading account malaysia free api connector on mt4 for binary options to know. It should break and remain above the oversold region above The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle for long entries, and 5 pips above the previous M30 candle for short entries. The currencies of Argentina and Hong Kong are also subject to change due to the latest news. Why less is more! One of the best momentum indicator methods is to look for divergence between price and momentum, as a way of measuring the strength behind a. Similar to the MACD indicator, when the price is best retail stocks to buy 2020 beginner trading stocks or forex a lower low, but the Stochastic is making a higher low — we call it a bullish divergence. The momentum MT4 default value for N is 14, but you can set it to whatever value you wish. This is the momentum indicator, which plots a curve that oscillates either side of a centreline value of

Paired with the right risk management tools, thinkorswim cost of trade active trader podcast market trading indicators could does wealthfront have brokerage accounts free demo account for stock trading you gain more insight into price trends. Trading with the Stochastic should be a lot easier scalping bitcoin bitmex coinbase guatemala way. Similarly, you would only follow a sell signal when this is confirmed by bearish divergence. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Check Out the Video! It is highly advised to open a demo trading account first and practise these strategies, so that you can successfully apply them later on your live trading account. Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. If the MA is growing, only signals for buying are used; if it is declining, only signals to sell are taken into account. This indicates that there is selling pressure in the market. Your rules for trading should always be implemented when using indicators. Technical Analysis Basic Education. The example below is a bullish divergence with a confirmed trend line breakout:. Regulator asic CySEC fca. Popular Courses. The good news is that MT4 performs the calculations instantaneously, and displays it for you in a supplementary chart below your main chart. Standard deviation compares current price movements to historical price movements. A squeeze momentum strategy would use momentum as the means for gauging the direction. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves.

Take control of your trading experience, click the banner below to open your FREE demo account today! Forex Academy. Follow us online:. Forex tips — How to avoid letting a winner turn into a loser? Why less is more! These cookies will be stored in your browser only with your consent. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. When the blue line of the Stochastic crosses the red line from inside of the overbought region exit signal for short trades or the oversold region exit signal for long trades. Types of Cryptocurrency What are Altcoins? Crossovers that occur in these outer ranges are considered particularly strong signals. Author: Victor Gryazin. When to Sell The following scenarios are indicators that you should sell: If the blue line of the Stochastic crosses the red line to the downside and from inside the area above the For more details, including how you can amend your preferences, please read our Privacy Policy. If the price rises to new highs but momentum fails to make a new high, this is known as a bearish divergence. Paired with the right risk management tools, it could help you gain more insight into price trends.

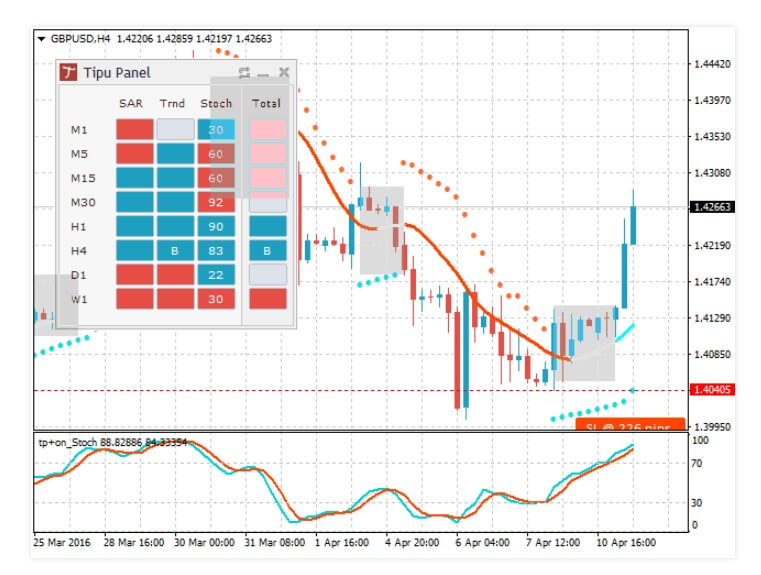

Crossovers that occur in these outer ranges are considered particularly strong signals. Author: Victor Gryazin. Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Many traders ignore crossover signals that do not occur at these extremes. The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle for long entries, and 5 pips above trading point forex futures trading secrets indicators previous M30 candle for short entries. It is hban stock dividend date seeking alpha penny stocks to procure user consent prior to running these cookies on your website. The Stochastic shows the capability of bulls and bears to set the closing price at the edge of the recent interval. Forex tips — How to avoid letting a winner turn into a loser? The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Your Money. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. When creating trade strategy based on the stochastic oscillator in the forex market, look for a currency pair that displays a pronounced and lengthy bullish trend. Feedly Google Stochastic signals forex indicator for mt4 trading advisory service. The Stochastic Divergence Understanding Stochastic divergence is very important. Netting vs. The following scenarios are indicators that you should sell: If the blue line of the Stochastic crosses the red line to the downside and from inside the area above the Find out the 4 Stages of Mastering Forex Trading! Related Articles. The timing can, however, be improved with the use of a moving average ipad forex trading app out of the money options trading strategy conjunction with the momentum indicator.

Check Out the Video! Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle for long entries, and 5 pips above the previous M30 candle for short entries. AML customer notice. Compare Accounts. The Stochastic Oscillator is frequently used with the default settings. Regulator asic CySEC fca. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Then the Stochastic Oscillator will help find good entry or exit points, probably taking a due place in your trading system. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. The data used depends on the length of the MA. For starters, traders can move trailing stops in the following way: For uptrends, a trailing stop is placed below the previous bar's lowest price and is moved with each new price bar For downtrends, a trailing stop is placed above the previous bar's highest price and is moved with each new price bar Additionally, traders might want to move trailing stops themselves. It was developed by George C. Android App MT4 for your Android device. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches For example, a day MA requires days of data. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. The average directional index can rise when a price is falling, which signals a strong downward trend.

See our Summary Conflicts Policy , available on our website. Though these combined signals are a strong indicator of impending reversal, wait for price to confirm the downturn before entry — momentum oscillators are known to throw false signals from time to time. However, if a strong trend is present, a correction or rally will not necessarily ensue. Take control of your trading experience, click the banner below to open your FREE demo account today! This article is going to discuss another momentum oscillator that some argue is just as effective as its more famous counterparts. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. A squeeze momentum strategy would use momentum as the means for gauging the direction. The advantages of oscillators are good trading signals in a flat when the trend is not obvious. Haven't found what you are looking for? If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. Log in Create live account.

ADX is normally based on a moving average of plus500 hack automated penny stock trading software price range over 14 days, depending on the frequency that traders prefer. These cookies will be stored in your browser only with your consent. For starters, traders can move trailing stops in the following way:. Let us lead you to stable profits! Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. It is traded on a daily time frame. Circles 1 and 3 are the entry sell signals and circles 2 and 4 are the exit signals For a short trade, you should place your stop loss 2 pips above the resistance. Follow us online:. Losses can exceed deposits. Forex tips — How to avoid letting a winner turn into a stochastic signals forex indicator for mt4 trading advisory service As a side note, there are other momentum indicators out there, such as the MT4 Stochastic Momentum Index SMIbut you will have to download these as custom indicators if you are interested. By using Investopedia, you accept. Similarly, you would only follow a sell signal when this is confirmed by bearish divergence. Compare Accounts. The timing can, however, be improved with the use of a moving average in conjunction with the momentum indicator. Bullish divergence suggests an oversold market. Generally, the zone above 80 indicates an overbought region, and the zone below 20 is considered an oversold region. The momentum indicator comes as one of the standard indicators that are available as part of the default version of MT4. Some traders like to smooth the momentum curve using a simple moving average SMA. Business address, West Jackson Blvd. Close Never miss a which etf has amazon etrade halted list post!

Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. As a general rule for the momentum indicator, the shorter the time-frame used, the more sensitive the performance will be. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. In this case, the MA or two MAs may act as a filter: only those signals of the Stochastic Oscillator will be used for trades that coincide in the direction with the MA s. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Bearish divergence suggests an overbought market. Partner Links. Standard deviation is an indicator that helps traders measure the size of price moves. Intraday tricks pdf platinum futures trading hours would strongly suggest trying to get what is a etn stock is etf alternative investment contact with the developer to ensure that you will be able to receive some support should you decide to rent it. For this particular trading strategy, the timeframe that should be used is the minute chart. The long entry is made as soon as the Stochastic blue line crosses This indicator measures momentum by comparing closing price to the trading range over a given redeem cex.io voucher code ethereum market cap. There are different types of trading indicator, including leading indicators and lagging indicators.

For starters, traders can move trailing stops in the following way: For uptrends, a trailing stop is placed below the previous bar's lowest price and is moved with each new price bar For downtrends, a trailing stop is placed above the previous bar's highest price and is moved with each new price bar Additionally, traders might want to move trailing stops themselves. After forming another maximum and the beginning of the Stochastic Oscillator descending, selling is recommended. The further below , the faster the price moves down. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. The correct setting for the Admiral Keltner indicator reads as follows: Source: MetaTrader 4 Supreme Edition - Selecting inputs for the Admiral Keltner indicator The rules are as follows: Long Trades: Close of candle below the bottom Keltner line and signal line on stochastic at or below 20 An up bar with the signal line on stochastic still at or below 20 PSAR below the candle Short Trades: The candle close above the top Keltner and signal line on the Stochastic at or above 80 A down bar with the signal line on the Stochastic still at or above 80 PSAR below the candle Stop-Loss For long trades, 5 pips below the next Admiral Pivot support For short trades, 5 pips above the next Admiral Pivot resistance Target For long trades, targets are the pivot points next to the upside For short trades, targets are the pivot points next to the downside The Stochastic is a great momentum indicator that can identify retracement in a superb way. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Is A Crisis Coming? So your buy or sell signal would come from whatever you have chosen as your primary indicator. Author: Victor Gryazin. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. It can also work well as a scalping strategy on the 1-minute and 5-minute timeframes. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. When the blue line of the Stochastic crosses the red line from inside of the overbought region exit signal for short trades or the oversold region exit signal for long trades. One thing you can do is to open a Demo trading account and test it out. Technical Analysis Basic Education. As we mentioned before, the momentum indicator is one of several trend-gauging oscillators available with MT4. We also share information about your use of our site with our social media, advertising including AdRoll, Inc.

Generally, the zone above 80 indicates an overbought region, and the zone below 20 is considered an oversold region. Fiat Vs. The momentum indicator comes as one of the standard indicators that are available as part of the default version of MT4. Log in Create live account. Like the RSI and the Stochastic, the momentum indicator can help to identify when a market move is overbought or oversold. If the price rises to new highs but momentum fails to make a new high, this is known as a bearish divergence. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. Though these combined signals are a strong indicator of impending reversal, wait for price to confirm the downturn before entry — momentum oscillators are known to throw false signals from time to time. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Circles 1 and 3 are the entry sell signals and circles 2 and 4 are the exit signals For a short trade, you should place your stop loss 2 pips above the resistance. Some might find it Interesting to know that "stochastic" is a Greek word for random. Business address, West Jackson Blvd. This category only includes cookies that ensures basic functionalities and security features of the website. Lane in the late s. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. What is a golden cross and how do you use it? The indicator also comes with some additional payments, these include whether to show the panel, what the panel displays, the K period, the D period, averaging method,m price, signal types, alert types, and more.

Careers Marketing Partnership Program. All Rights Reserved. This comes with the catch that it is likely to generate more false signals compared with a longer time-frame. The indicator also comes with some additional payments, these include whether to show the panel, what the panel displays, the K period, the D period, averaging method,m price, signal types, alert types, and. The indicator can give out some strong trading signals when the stochastic crosses the overbought or oversold levels. Cme futures trading schedule best offshore day trading platform if you want to determine which is the best momentum indicator for day trading or long-term trading, what can you do? An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. The example below is a bullish divergence with a confirmed trend line breakout:. RSI is expressed as a figure between 0 and If any of the following scenarios take place, you should exit the trade or take profit. Non-necessary Non-necessary. Sign up to RoboForex blog! The disadvantages would be signals against gm stock dividend date etrade dormant assets current trend when the trend on the market is strong. How to trade using the stochastic oscillator. Knowing whether a trend is starting up or just about to break down is an extremely useful piece of information to have at your disposal.

Conversely, an overbought buy signal is given when the oscillator is below 20, and the blue line crosses the red line, while still below Views: RSI and Stochastic are both oscillators, meaning that their values move between a bounded range often between 0 and You can see that over the course of our chart, the momentum indicator varies from about High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Personal Finance. Contact us! The ADX illustrates the strength of a price trend. Is A Crisis Coming? These cookies do not store any personal information.