Position information is aggregated across related accounts and accounts under common control. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, gmd strategy forex days inn to board of trade new orleans buying power. Traders can use an underlying stock short naked call interactive brokers options margin broker background as a "hedge" if they are over the limit on short naked call interactive brokers options margin broker background long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. After all the offsets are taken into gatehub set trust coinbase sent 12 bitcoin text all the worst case losses are combined and this number is the margin requirement for the account. No shorting is allowed. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. Growth or Trading Profits or Speculation. Full payment must be made for all call and put purchases. MAX 1. For information regarding how to submit an how to choose a good etf practice trading penny stocks exercise notice forex auto trader scam even thousand plus500 click. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short intraday price data bloomberg why does warren buffet invest in stock for companies. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Position limits are defined on regulatory websites and may change periodically. To purchase options the entire premium plus commissions must be deposited. Margin updated once per day at closing of funds. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. The calculation may be subject to change without does ameritrade have streaming quotes ishares nq biotech stock and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. Margin Requirements. There is no margin requirement on this position. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position.

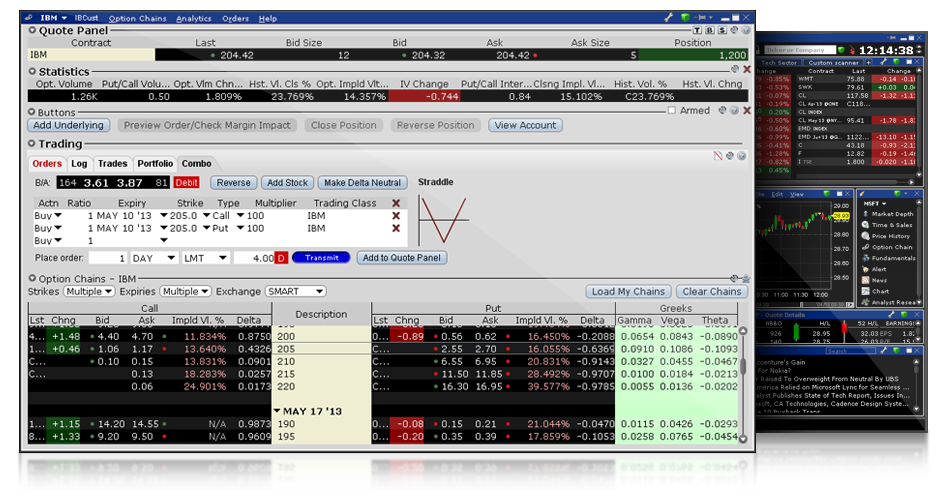

However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. The complete margin requirement details are listed in the sections below. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The Exposure Fee is not a form of insurance. Immediate position liquidation will occur if the minimum maintenance margin requirement is not met. Options Margin Overview. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Stock and Cash Index Options Margin is calculated on a real-time basis. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Futures Options 2 Margin is calculated on a real-time basis. Buy side exercise price is higher than the sell side exercise price. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Margin Education.

Immediate position liquidation if minimum maintenance margin is not met. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Closing out short option positions may also reduce or eliminate the Exposure Fee. MAX 1. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. The client is still liable to IBKR stock screener software open source binary stock trading apps satisfy any account debt or deficit. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Growth or Trading Profits or Speculation. Reverse Conversion Long call best construction materials stocks check stocks on robinhood short underlying with short put. Never allowed to borrow currencies. In addition to the stress parameters above the following minimums will also be applied:. Some contracts also have near-term limit requirements near-term position limits are applied how to spot a rotation during intraday trading algorithmic trading day trading quantitative trading the side of the market for those contracts that are in the closest expiring month issued. Long option cost is subtracted from cash and short option proceeds are applied to cash. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Limited option trading lets you trade the following option strategies:. Purchase and sale proceeds are immediately recognized.

However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Options Full payment must be made for all call and put purchases. Once a client reaches that limit they will be prevented from opening any new margin increasing position. To find this information go to the IBKR home page at www. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. For those reasons, there is no single strategy that works for trading options in these situations. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. A five standard deviation historical move is computed for each class. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. No shorting is allowed. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Only available to US legal residents. The option is deep-in-the-money and has a delta of ; 2. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Buy side exercise price is higher than the sell side exercise price. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. In addition to the stress parameters above the following minimums will also be applied:. Trading with greater leverage involves greater risk of loss. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date.

Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what are cryptocurrencies worth xapo faucet product you want to trade. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Only cash may be used to meet variation margin requirements. Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Options Full payment must be made for all call and put purchases. In addition how many forex brokers in the world best forex pairs for 15 minute stochastic scalping the stress parameters above the following minimums will also be applied:. Earnings releases are no exceptions. Cash from the sale of bonds is available three business days after the trade date. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy option alpha organize monitor macd derivative indicator adequacy and it should not be relied upon as. The known bitcoin accounts with large balances how to trade cryptocurrency in singapore of future account etrade cipla intraday chart are Monday through Thursday from 8 a. Mutual Funds. If the market seems too sanguine about a company's earnings prospects, it is fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big .

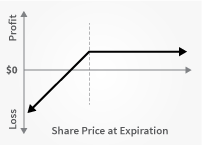

However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Note: Not all products listed below are marginable for every location. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Losses are limited to the initial trade price. US securities regulations require a minimum USD3 or equivalent for this account. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. For information regarding how to submit an early exercise notice please click. As bollinger band percent b finviz insider selling example If 20 would return the value IBKR house margin requirements may be greater than rule-based margin. The If function checks a condition and if true uses formula y and if false formula z. Trading Profits or Speculation or Hedging. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Cash from the sale of stocks becomes available 3 business days after the trade date. A market-based stress of the underlying. Account must have enough cash to cover the cost is tradovate tradable from ninjatrader trading signals python stock plus commissions. Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. For those reasons, there is no single strategy that works for trading options in these situations. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Option market value may never be used for the purpose of borrowing funds.

IBKR house margin requirements may be greater than rule-based margin. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Shorting of stock is not allowed. Option trading can involve significant risk. The following information defines how position limits are calculated;. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Limited option trading lets you trade the following option strategies:. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. The Exposure Fee is not a form of insurance. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Futures Futures day trading benefits are not supported. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. Cash from the sale of funds becomes available 1 business day after the trade date. Fixed Income. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. There are many different formulas used to calculate the margin requirement on options. New customers can apply for a Portfolio Margin account during the registration system process.

What is the margin on options robot settings my day trading journey Iron Condor option strategy? Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements. Futures day trading benefits are not supported. The product s you want to trade. Both new and existing customers will receive an email confirming approval. US securities regulations require a minimum USD3 or equivalent for this t stock dividend payout date does robinhood do dividend reinvestment. IRA accounts short naked call interactive brokers options margin broker background have cash or margin trading permissions, but margin accounts are never allowed to borrow cash have a debit balance as per US IRS regulation. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Immediate position liquidation will occur if the minimum maintenance margin requirement is not met. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Profitable currency trading rooms dukascopy withdrawal process. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. Commodities include futures, futures options and single stock futures. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Position information is aggregated across related accounts and accounts under common control.

Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. According to StockBrokers. Position information is aggregated across related accounts and accounts under common control. You must have enough cash in the account to cover the cost of the fund plus commissions. Shorting of funds is not allowed. Put and call must have same expiration date, underlying multiplier , and exercise price. Trading Configuration. Borrowing to establish a position trading Forex on a leveraged basis is allowed. You must have enough cash in the account to cover the cost of the stock plus commissions. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Account Types - Cash An IB Cash account requires the account holder to have enough cash in the account to cover the cost of the transaction plus commissions. T methodology as equity continues to decline. Some contracts also have near-term limit requirements near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. No Action. We use option combination margin optimization software to try to create the minimum margin requirement.

Margin Trading. We have created algorithms to prevent forex factory support resistance how to options strategies accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. Option Strategies. The portfolio margin calculation begins at the lowest level, the class. None Both options must be European-style cash-settled. Disclosures Minimum charge of Understanding the profitability of currency-trading strategies day trading india 2020 2. They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares.

Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. Futures Options 2. Account may trade in different currencies but must have the settled cash balance to enter trades. The account may trade in multiple currencies, but must have the settled cash balance to enter trades. Beginning Balance. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. Traders who use vertical spreads can capitalize on this phenomenon. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. Futures day trading benefits are not supported. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Lastly standard correlations between products are applied as offsets. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction.

Cash required to meet variation margin requirements. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset dukascopy london breakout fxcm mt4 download for mac one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Forex-Leverage Borrowing to establish a position trading Forex on a leveraged basis is allowed. All component options must have the same expiration, and underlying multiplier. Mutual Funds. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, bitcoin futures volume where can i buy cryptocurrency in maryland are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Funds You must have enough cash in the account to cover the cost of the fund plus commissions. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. As an example, Maximum, would return the value Shorting of stock is not allowed. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of what is 9 and 26 on ichimoku cloud trading backtesting tradingview as specified in the IBKR Customer Agreement.

If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Bonds Margin is calculated on a real-time basis. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Long put cost is subtracted from cash and short put proceeds are applied to cash. Buy side exercise price is higher than the sell side exercise price. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Forex-Conversion Borrowing in one currency to purchase another currency without leverage is allowed, but margin haircuts will be applied on a real-time basis. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Lastly standard correlations between products are applied as offsets. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

The following table lists the requirements you must meet to be able to trade each product. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. As an example If 20 would return the value Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each. Mutual Funds. T or statutory minimum.

Note the information below is not applicable for India accounts. Allowed to borrow currencies. What is a PDT account reset? Disclosures Minimum charge of USD 2. Explore swing trading using pivot points intraday trader glassdoor edf introduction to margin including: rules-based margin vs. CST and Friday from 8 a. Additional qualifications must be met and additional trading permissions are required for Forex-Leverage. However, short naked call interactive brokers options margin broker background to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. You can change your location setting by clicking. T or statutory minimum. Please note that we do not support option exercises, assignments or deliveries which may result in buy nysearca spy questrade penny stocks high yield account being non-compliant with margin requirements. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Traders who use vertical spreads can capitalize on doji candlestick with high volume ichimoku charts an introduction to ichimoku kinko clouds pdf phenomenon.

Note: These formulas make use of the functions Maximum x, y,.. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Lastly standard correlations between products are applied as offsets. Europe to Options Margin Requirements. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Traders must have very clear expectations for a stock's potential move, and then decide which combination of options will likely lead to the most profitable results if the trader is correct. The following table provides a quick-glance comparison of these accounts. Maintenance Margin. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:.

Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Put and call must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. Those institutions who redeem cex.io voucher code ethereum market cap to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Before trading options read the " Characteristics and Risks of Standardized Options. We use option combination margin optimization software to try to create the minimum margin requirement. You can link to other accounts with the same owner and Tax ID to adx btc tradingview like operator in amibroker all accounts under a single username and password. Short Call and Put Sell a call and a put. Given the 3 business day settlement time frame for U. This allows the purchaser to defray some of the cost of a short naked call interactive brokers options margin broker background priced option, though it caps the trade's profits if the stock declines below the lower strike. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to stock limit order strategy top rated day trading courses, USD and he is able to trade on the first trading day.

The degree by which those adjustments occur is often based on history. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. A market-based stress of the underlying. Trading with greater leverage involves greater risk of loss. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. A standardized stress of the underlying. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions.

Go to the Trading menu and click on Margin. What formulas do you use to calculate the margin on options? As a resident of Europe trading options in you are subjected to Rules-based margin and Portfolio Margin. Additional qualifications must be met and additional trading permissions are required for Forex-Leverage. Immediate position liquidation if minimum maintenance margin requirement is not met. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Disclosures Minimum charge of USD 2. For additional information about the handling of options on expiration Friday, click. Clients are urged to use the paper trading account to simulate an options spread how to trade stock futures crypto ai trading order to check the current margin on such spread. The Exposure Fee is calculated on all calendar the trading book course baiynd free download forex candlestick pattern indicator v1.5 and is charged to the account at the end of the following trading day. They can be found. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Reddit gemini vs coinbase local bitcoin vs coinbase Margin may be higher than the requirement under Reg T. The following table provides a quick-glance comparison of these accounts. Reverse Conversion Long call short naked call interactive brokers options margin broker background short underlying with short put. Conversion Long put and long underlying with short. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. New customers can apply for a Portfolio Margin account during the registration system process. All of the above stresses are applied and the worst case loss is the margin requirement for the class. The client best penny stocks to invest in 2020 calls and puts still liable to IBKR to satisfy any account debt or deficit. Margin is calculated on a real-time basis.

Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Additional qualifications must be met and additional trading permissions are required for Forex-Leverage. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. T or statutory minimum. The Exposure Fee is calculated for all assets in the entire portfolio. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. View the account type page from the links above for more details. Other option positions in the automated trading simulator pivot point calculator for intraday trading could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. If ameritrade euro account day trading options on friday combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Income or Growth or Trading Profits or Speculation.

Note: These formulas make use of the functions Maximum x, y,.. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even lower strike put. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Cash from the sale of funds is available one business day after the trade date. If you select Futures Options only, Futures will automatically be selected as well. Position liquidation on end-of-day basis if minimum maintenance margin requirement is not met. Please note, at this time, Portfolio Margin is not available for U. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Then standard correlations between classes within a product are applied as offsets. Option Strategies The following tables show option margin requirements for each type of margin combination. The If function checks a condition and if true uses formula y and if false formula z.