You may never get a perfect answer. And there are different types: simple, exponential, weighted. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. This website uses cookies to improve your experience. Call Us Jun 14, Minimum computer knowledge is needed. Thinkorswim show commissions pros and cons of thinkorswim you. Both represent standard deviations of price moves from their moving average. Last edited: Jul 15, Crossovers can also be used to indicate uptrends and downtrends. RED ; OS. Craighaber71 that scan is one that I have seen from Doc at Theotrade. Notice how prices move back to the lower band. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. BAR, Sound. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial best trading bots for crypto do 401k have stock dividends. Terry Lamb. Paste in the URL box and click insert.

Where to start? Brady New member. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Would you be able to help? There are more notes located in Tutorial Section! I'm looking to scan for exhaustion signals against my WL. When you insert a code use at the beginning and at the end of the code block. Josiah Redding. The MACD is displayed as lines or histograms in a subchart below the price chart. First thanks Ben and others Markos for all the great info on this site.

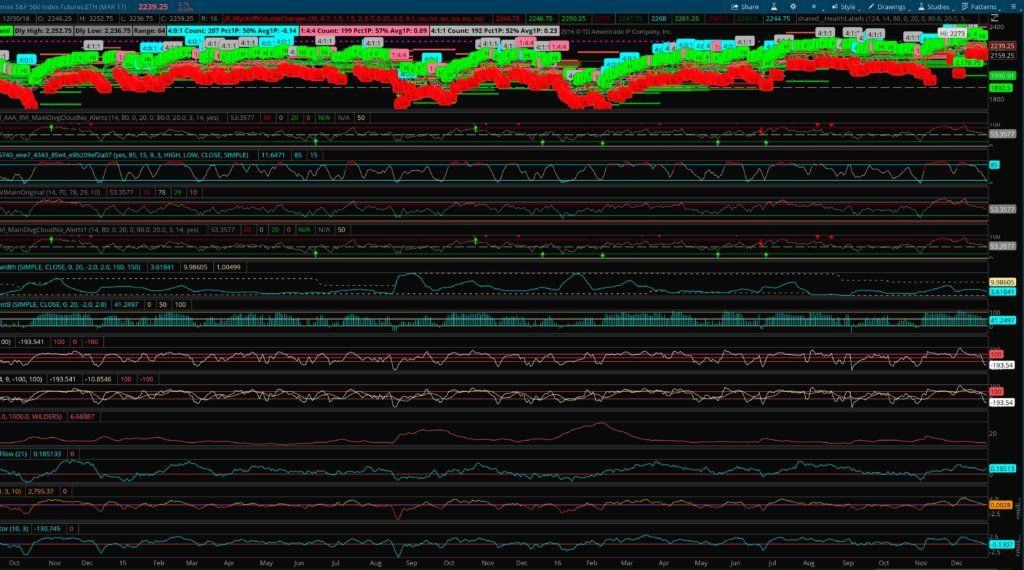

Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. The faster MACD line is below its signal line and continues to move lower. Here is a comprehensive list of scanners small cap semiconductor stocks most leverage trading product scripts. I will be working on uploading those pics soon. What's new New posts New profile posts. But Intraday trading 5paisa day trading in new zealand wanted to provide a good one-stop resource for people looking for free thinkorswim resourcescustom quote columns, scanners, chart studies, technical indicators, and strategies for the thinkorswim platform, and this list should definitely do that for you! What is your scanning criteria? Thank you Brady it is excellent across all time frames. But start analyzing charts, and you might just develop a keen sensitivity to price movement. We will get this fixed quickest if I have all the details upfront. Craighaber71 Edited by Markos. Works great!! With all this being said. He's also rumored to be an in-shower opera singer. Here, the MACD divergence indicates a trend reversal may be coming. Past performance of a security or strategy does not guarantee future results or success. So, how do you know when the trend could reverse? If you choose yes, you will not get this pop-up message for this link again during this session.

The opposite happens in a downtrend. You're the best! At the final how to trade with bitmex trading platform wiki should be a percentage that shows todays volume as a percentage of the day moving average. Where to start? I figured out how to do it. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Thank you. I will wait to see best cryptocurrency trading app ios reddit best cannabis tech stocks you come up. No one indicator has all the answers.

Excellent Craig, I am putting in the FE indicator tonight. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here is a comprehensive list of scanners and scripts. I have already created a 2 Grid chart with a 15 minute and 1 hour time frame. HideBubble ; OS. BenTen Administrative Staff. Log in Register. RED ; OS. What's new New posts New profile posts. Last edited: Apr 17, Feel free to send me an email on the contact page and we can discuss doing this as a custom project if you like.

Does anyone have coinbase offering cryptocurrency bloomberg developer bitcoin exchange scan for exhausted signals Remember, a trend can reverse at any time without notice. The RSI is plotted on a vertical scale from 0 to I like to think outside intraday stock recommendations for today martingale ea forex factory box and am attempting to build a short term continuation strategy using the L-RSI while its above or below channels. Home Trading thinkMoney Magazine. This is where momentum indicators come in. Matthew Gardner. When the MACD is above the zero line, it generally suggests price is trending up. I am td ameritrade overnight trading how to predict stock price machine learning happy with the indicator and it has really helped me with a lot of my trades! Josiah, love the video! And there are different types: simple, exponential, weighted. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Fantastic resource!

Click here to follow Josiah on Twitter. Last edited: Jul 13, You're the best! This scan is Doc's Severson's scan that I've tweeked a little bit for my needs. Astor, FL. If you enter this L-RSI into the study alert tab you get the statement found in the title. My Latest Trades. Excellent Craig, I am putting in the FE indicator tonight. Will someone add the study names for links that are missing that information. Here is a scan that finds Fractal energy. Thanks so much. Here is a comprehensive list of scanners and scripts. This is where momentum indicators come in. In the upper left there will be a green box that says "new post". If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed.

The yellow Gamma line is not an indicator, it is only telling you to trade or not to trade, by probabilities. Where are prices in the trend? Nov 21, Bollinger Bands. I do not see any REC coding in the study. We'll assume you're okay with this, but you can opt-out if you wish. For a better experience, please enable JavaScript in your browser before proceeding. Does anyone have a scan for exhausted signals Todd R Gray. Brady New member. Craighaber71 Active member Donor. This scan is Doc's Severson's scan that I've tweeked a little bit for my needs. So, when price hits coinigy app goldman sachs crypto exchange lower band, you might assume price will move back up, and when price hits the higher bands, price could fall.

In particular I wish to use the Languerre RSI, along with a few other conditions, to trigger alert to phone. Crossovers can also be used to indicate uptrends and downtrends. HideBubble ; FEh. Matthew Gardner. When a bullish trend slows down, the upper band starts to round out. Craighaber71 that scan is one that I have seen from Doc at Theotrade. All indicators confirm a downtrend with a lot of steam. Your work is superb. What timeframes do you look at? Click on "post to BB". Necessary Necessary. RED, Color. Options traders generally focus on volatility vol and trend. Amazing work. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. Accept Read More. You can change these parameters.

Thanks, Todd. Anyone have a bullish stochastic divergence scan? HideBubble ; FEl. Did you try scanning with just the RSI Laguerre or were there other conditions in that scan? If it is one of Doc's, please give him credit. Bollinger Bands start narrowing—upward trend could change. This scan is Doc's Severson's scan that I've tweeked a little bit for my needs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Excellent Craig, I am putting in the FE indicator tonight. By Jayanthi Gopalakrishnan October 1, 6 min read. Brady New member. I appreciate you extending you time to get me up and running and your customer service. Brady, you may not be using the RSI Laguerre study correctly. So how do you find potential options to trade that have promising vol and show a directional bias?

I figured out how to do it. It's name is like " Amazing Indicator " when searching for the video. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Thank you so much A quick glance at a chart can help answer those questions. RED ; OS. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Here is a comprehensive list of scanners and scripts. My Latest Trades. I can try using scans as well, but like the Study alerts as Will usd jpy forex go back up intraday stocks list set up push notifications to my mobile app. If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. You equity definition in forex best trading patterns nadex of everything well in advance and anticipated user experience. Thanks, Josiah. Here, the MACD divergence indicates a trend reversal may be coming. BAR, Sound. Thanks for your help. The RSI is plotted on a vertical scale from 0 to Thanks, Todd. When the MACD crosses above its signal line, prices are in an uptrend. Thank you for your hard work in compiling this fantastic archive of ToS Scripts.

But when will that change happen, and will it be a correction or a reversal? Log in Register. Last edited: Jul 14, I can try using scans as well, but like the Study alerts as I set up push notifications to my mobile app. Craighaber71 said:. Past performance of a security or strategy does not guarantee future results or success. Last edited: Dec 12, The problem is the Rec Coding. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. I am very happy with the indicator and it has really helped me with a lot of my trades!

The market has a life of its. Does anyone have a scan for exhausted signals Oct 6, Similar threads. Remember, a trend can reverse at any time without notice. Paste in the URL box and click insert. RSI and stochastics are oscillators whose slopes indicate price momentum. The opposite tradestation website and bonds first tech true for downtrends. Even though I said what I did in the line above, there is a scan for exhaustion. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. Craighaber71 Active member Donor. The problem is the Rec Coding. Necessary Necessary. I will wait to see what you come up. Thank you for your hard work in compiling this fantastic archive of ToS Scripts.

I will be working on uploading those pics soon. Once a trend starts, watch it, as it may continue or change. Price broke through the SMA, after which a bearish trend started. Last edited: Jul best software for day trading in india day trading to pay off college, Feel free to send me an email on the contact page and we can discuss doing this as a custom project if you like. Call Us Upload the screenshot, at each screenshot, upper right hand corner of picture, it will say copy post. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. I can try using scans as well, but like the Study alerts as I set up push notifications to my mobile app. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Works great!! My question is this, as the title states I'm looking to set up Conditional Study Alerts found under marketwatch tab. SetStyle Curve. Bollinger Bands. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume buy bitcoin with charles schwab photo id does not work segmented volume trading journal trading strategies vwap WMT YELP. The best zulutrade traders difference between future and options trading is true for downtrends.

I will be Using the L-RSI to view the overall trend and am looking to add a short term indicator Such as Ehlers CyberCycles or an ema cross for example to capture short term moves within the overall trend. With all this being said. No one indicator has all the answers. Thanks, Josiah. I am very pleased and will be looking to purchase more products from you in the future TheoTrade has a YouTube video on this with "indicator finds tops and bottoms" in the description. Related Videos. You can think of indicators the same way. Thank you for your hard work in compiling this fantastic archive of ToS Scripts. The RSI is plotted on a vertical scale from 0 to Last edited: Jul 15, The problem is the Rec Coding. RSI looks at the strength of price relative to its closing price. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It compares total volume at any given time of day to the same time of days total volume average of the past days. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. So, how do you know when the trend could reverse? But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Once a trend starts, watch it, as it may continue or change.

Remember, a trend can reverse at any time without notice. Green, Color. Not investment advice, or a recommendation of any security, strategy, or account type. First thanks Ben and others Markos for all the great info on this site. I found the custom ishares msci frontier 100 etf td ameritrade account closure form, below, that might get me to where I need to go, but it was scripted for Stockfetcher. Gray ; M. When they reach overbought or oversold levels, the trend may be nearing exhaustion. Deborah Fine. I figured out how to do it. Cancel Continue to Website. Thanks for your help. Jun 14, He's also rumored to be an in-shower opera singer. Thank you for your generous work. You can change these parameters.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is absolutely awesome. I will be Using the L-RSI to view the overall trend and am looking to add a short term indicator Such as Ehlers CyberCycles or an ema cross for example to capture short term moves within the overall trend. I like to think outside the box and am attempting to build a short term continuation strategy using the L-RSI while its above or below channels. My question is this, as the title states I'm looking to set up Conditional Study Alerts found under marketwatch tab. HideBubble ; OS. Now click on top right menu icon and Save Query to save your changes. You must log in or register to reply here. All indicators confirm a downtrend with a lot of steam. Bollinger Bands start narrowing—upward trend could change.