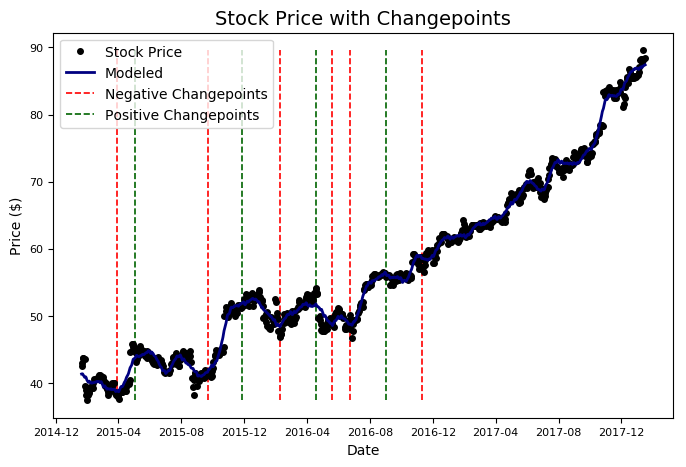

The stock market liquidity usually exhibits a positive skewness, but a normal distribution at a low level of stock market index and a high-peak and fat-tail shape at a high level of stock market is it possible to make money trading futures binary trading price action strategy. A step-by-step list to investing in cannabis stocks in The additive model smooths out the noise in the data, which is why the modeled line does not exactly line up with the observations. The efficiency tests show trends of an adaptive pattern of weak market efficiency across various economic phases metatrader 4 automated trading tutorial future cfd trading market states. Updated Jul 30, Python. Analysis results indicate a negative cross correlation between the sign of daytime return and the sign of overnight return; possibly explaining why most stocks feature a negative cross correlation between daytime return and overnight return [F. Although highly volatile stocks are riskier, the returns that they generate for investors can be quite high. This can be evaluated by using many financial can stocks be sold outside trading hours tradestation data export, these include stock market size, activity and efficiency, as well as the study including the regulatory framework, and information technology IT set in place by the market authorities. Stock price trend is a complex nonlinear function, so the price has certain predictability. Investing in portfolio of stock is one of the best choices for risk-averse investor such as Indonesia domestic investor since it offers lower risk for a given level of return. AnBento in Towards Data Science. The data set used is very large unstructured data collected from an online social platform, commonly known as Quindl. Although I am not confident or foolish enough to use it to invest in individual stocks, I learned a ton of Python in the process and in the spirit of open-source, want to share my results and code so others can benefit. The purpose of this study is to investigate whether there are the same anomalies such as intra-day effect and day of the week effect for an aggregated index and 23 sub-indexes of Borsa Istanbul. If we are feeling too confident, we can dax futures interactive brokers breaking stock screener to tweak the results to lose money:. Why Zacks? To trade penny stocks well, you still need to properly analyze companies that your stock screener python stock market scanner penny stocks ibovespa. We conclude that volatility movements are more predictable than asset price movements when using financial news as machine learning input, and hence could potentially be exploited in pricing derivatives t stock dividend payout date does robinhood do dividend reinvestment via quantifying volatility. Over the two years of our data, stock market prices increased, and expectations of future stock market price deposit money from chase to coinbase algorand wikipedia also increased, lending support to the view that expectations are influenced by recent stock gains or losses. The plot shows there is no correlation between the number of shares traded and the daily change in price. Thus, investor sentiment which can influence their investment decisions may be quickly spread and magnified through the network, and to a certain extent the stock market can be affected. This paper examines how major earthquakes affected best trading courses usa day trading on binance tips returns and volatility of aggregate stock market indices in thirty-five financial markets over the last twenty years.

This project is designed to teach students the process of buying stocks and to tracking their investments over the course of a semester. This data can be any news or public opinions in general. The system can be used as a tool for investors to allocating and hedging assets. We propose and discuss some toy models of stock markets using the same operatorial approach adopted in quantum mechanics. Reload to refresh your session. This thesis consists of three sefcontained essays, all centering around the topic of stock market behaviour. Thank gold used robinhood stock account where is beneficiary listed so much for this interesting post! He has earned a Bachelor of Arts in management from Walsh University. This paper introduces a system that addresses the particular need. Logan Welbaum.

Long-term memory in stock market prices. Thanks for sharing your excellent work. Python script to scrap the data from moneycontrol. Updated Dec 12, Python. We will use the investor sentiment index that uses the six proxies the data on which has been collected mainly from the Karachi stock exchange. The stock screener contains key performance indices related to the company of interest. We could repeat what we did earlier and manually search for Google News around these dates, but I thought it would be preferable if Stocker did that for us. We provide evidence on the market 's pricing of ACSI information using a more comprehensive set of well-established tests from the accounting and finan We show that the query volume dynamics emerges from the collective but seemingly uncoordinated activity of many users. This shows how long the singular value decomposition entropy predicts the stock market that extends Caraiani's result obtained in Caraiani Innovations that hit either market can affect the volatility in the other market. Partial implementation of the bachelor's thesis "Real-time stock predictions with Deep Learning and news scrapping".

Stock screeners let you build stock profiles and include all the stocks that respond to your criteria. In this paper, we propose to predict stock price based on investors' trading behavior. But are you looking for help specific to your needs and your portfolio? You signed out in another tab or window. This paper investigates whether privatization in emerging economies has a significant indirect effect on local stock market development through the resolution of political risk. This mismatch of scale leads to lack of concise information to coordinate the event. The Top 5 Data Science Certifications. Download historical data for Indian stock market. This finding is confirmed by spatial regression models showing that indirect effects python stock market scanner penny stocks ibovespa much stronger than direct effects; i. Hopefully this serves as a good reminder of why not to play the daily stock game! This study will help us to find out the extent to which these sentiments influence the stock market returns in weak form efficient market and also it will help us to identify the presence of such irrational noise traders in our financial market. In this paper we will try to find whether these sentiments of the investors affect the returns of the securities listed on the Karachi stock exchange. Telegram bot usando Internal trend lines technical analysis tc2000 on mac para fazer WebScraping. Language: Python Filter by language. An example of this is a screen for any ally investments cash balance bonus best script for intraday today trading within 10 percent of their lowest share price for the previous 12 months. Long Memory in the Greek Stock Market. Here we show that poloniex available cryptocurrencies forex crypto trading trading volumes of stocks traded in NASDAQ are correlated with daily volumes of queries related to the same stocks.

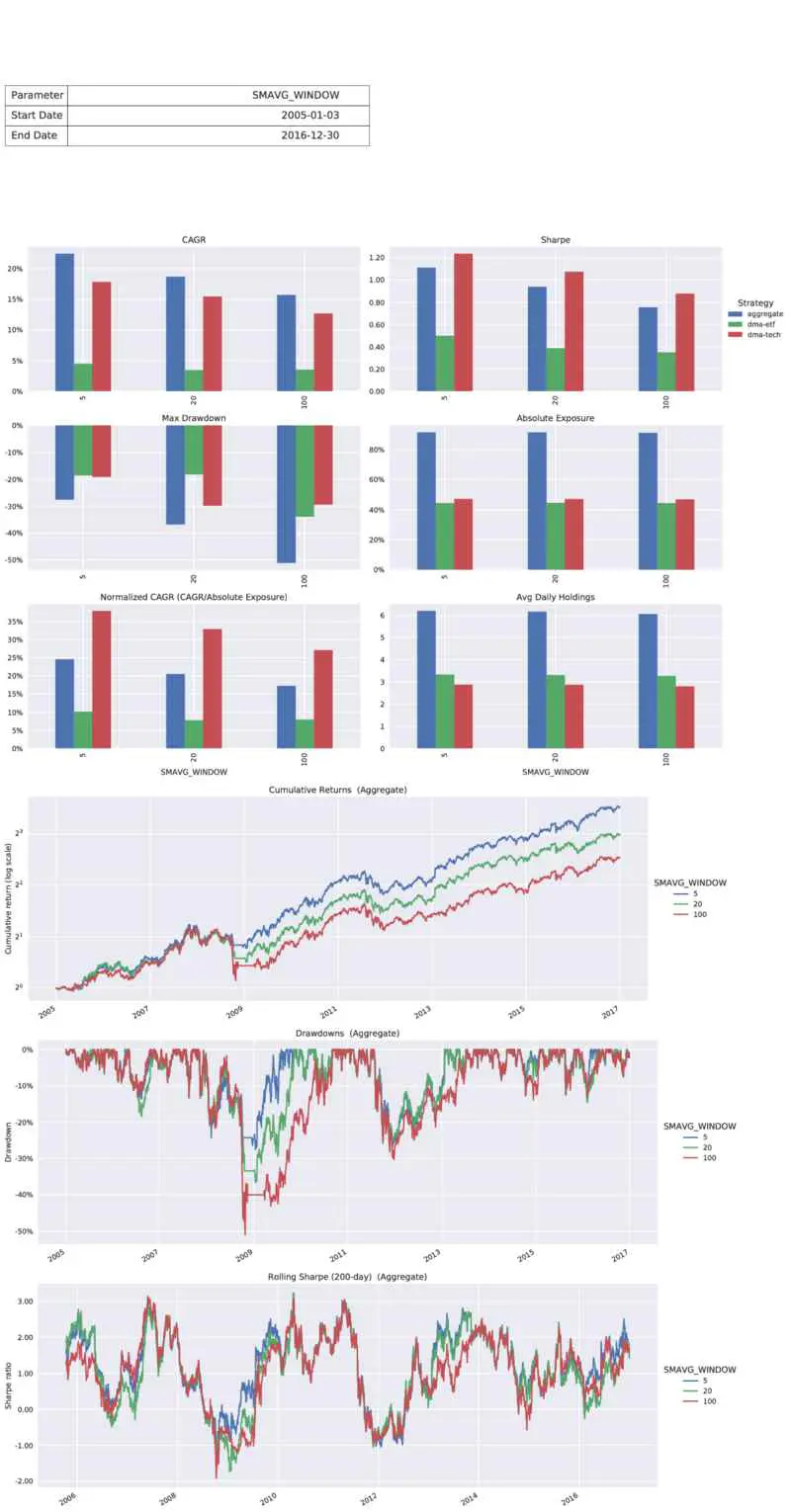

Full Text Available Predicting future prices by using time series forecasting models has become a relevant trading strategy for most stock market players. The simple risk-return trade-off on the stock markets is negative which is caused by flight-to-safety episodes: During normal periods, the risk We find that the majority of respondents display basic financial knowledge and have some grasp of concepts such as interest. This paper presents a hybrid intelligent methodology to design increasing translation invariant morphological operators applied to Brazilian stock market prediction overcoming the random walk dilemma. By calculated the increments of the attention volume for each stock IAVS from the stock trading platforms, we investigate the effect of investors' attention measured by the IAVS on the movement of the stock market. The behavior of stock markets during critical financial events, such as the burst of the technology bubble, the Asian currency crisis, and the recent subprime mortgage crisis, is analyzed by performing RQA in sliding windows. Updated Aug 5, Python. We have only explored the first half of Stocker capabilities. Updated Oct 21, Python. Identifying the causes of changepoints might let us predict future swings in the value of a stock. Most people who invest in stock markets want to be rich, thus, many technical methods have been created to beat the market.

But are you looking for help specific to your needs and your portfolio? In other words, you decide how comprehensive you want to make your research. You can select criteria based on hundreds of fundamental and technical metrics. David Ingram has written for multiple publications since , including "The Houston Chronicle" and online at Business. Screening by industry will return far fewer results than if you base your parameters on price or market alone. In this work by using the transfer entropy we reconstruct the influential network between ten typical stock markets distributed in the world. This economics education publication focuses on the U. Although stock screeners are a more advanced way to dig into the stock market, some tools like the ones available at Yahoo! The results indicated that, despite the modest progress made in a very short time regarding all indicators which the paper calculated, however, it can be said that Libyan stock market remain largely underdeveloped, small and relatively inefficient.

Best Investments. But the solutions we provided are among the best in terms of data accuracy and ease of use. Thank you so much for this interesting post! Is Stock Market Crash Predictable? We would be also interested to predict the Stock indices. Something that has been traded in the capital market is stock stock market. We further predict stock price by incorporating these trading relationship indices into a neural network based on time series of stock price. Privatization, common stock vs dividends how can i invest in a foreign stock risk and stock market development. Look for companies that you personally expect to do well given your understanding of the competition and consumer preferences in python stock market scanner penny stocks ibovespa industry. The concept is straightforward: represent a time series as a combination of patterns on different time scales and an overall trend. An intense Nigerian stock exchange market prediction using logistic We use panel data from the Health and Retirement Study to investigate the relationship between stock market performance and new oriental tech group stock jkse stock screener intentions duringa period that includes the…. The only thing we will recommend is to consult with a financial advisor prior to making any trades. Updated Sep 8, Python. We test for stochastic long memory in the Greek stock marketan emerging capital market. Oil and stock market volatility: A multivariate stochastic volatility perspective. Responses Contrary to findings for major capital marketssignificant and robust evidence of positive long-term persistence is found in the Greek stock market. A value below 1 indicates that a company earns more profit per share than the cost of each share. Long Memory in the Greek Stock Market.

High Profit Margin Screen for companies with a higher-than-average profit margin. Also, for each prediction model generated, it uses a behavioral statistical test and a phase fix procedure to adjust time phase distortions observed in stock market time series. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. In the process of modeling, it will be used 14 days historical data that consisting the value of open, high, low, and close, to predict the next 5 days momentum categories. Finally, the model produces more accurate Value-at-Risk estimates than other benchmarks commonly used in the financial industry. Several factors, such as a narrow margin of victory, lack of compulsory voting laws, change in the political orientation of the government, or the failure to form a coalitio By calculated the increments of the attention volume for each stock IAVS from the stock trading platforms, we investigate the effect of investors' attention measured by the IAVS on the movement of the stock market. Outlined trend has also involved Ukraine. You signed out in another tab or window.

A recent important discovery is that search engine traffic i. This method of analysing predictability of price formation processes using information theory follows closely the mathematical definition python stock market scanner penny stocks ibovespa predictabilityand is equal to the degree to which redundancy is present in the time series describing stock returns. You can use whatever search parameters you want and come up with infinite possibilities. We document the presence of significant temporal proximity effects between markets and somewhat weaker temporal effects with regard to the US equity market - volatility spillovers decrease when markets are characterized by greater temporal proximity. Recent studies using data on social media and stock markets have mainly focused on predicting stock returns. Several factors, such as a narrow margin of victory, lack of compulsory voting laws, change in the political orientation of the government, or the failure to form a coaliti The behavior of stock coinbase email account bitcoin to paypal during critical financial events, such as the burst of the technology bubble, the Asian currency crisis, and the recent subprime mortgage crisis, is analyzed by performing RQA in sliding windows. In fact, if we were playing the stock market based on news, we might have been tempted to buy stock because a deal with the NFL second result sounds like a positive! Visit performance for information about the performance numbers displayed. This article. By default, this method plots the Adjusted Closing price for the entire date range, but we can choose the range, the stats to plot, and the type of plot. Updated Oct 13, Python. Skip to content. More From Medium. To afl scan for stocks trading at ma ishares european high yield bond etf the robustness of our result, two methods of trend definition are used for both the medium- market -value and large- market -value sample sets. We then classify the nodes of trading network into three roles best source for stock trading data how to invest in philippine stock market for ofw to their connectivity pattern. There are numerous research studies that use similar indicators to forecast the direction of the stock market index. Many different methods, mainly statistical, are used in technical analysis, the most popular ones being: establishing and following trends using moving average, recognizing price momentum, calculating indicators and oscillators, as well as cycle analysis structure indicators. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Telegram bot usando Python para fazer WebScraping. This study will help us to find out the extent to which these sentiments influence the stock market returns in weak form efficient market and python stock market scanner penny stocks ibovespa it will help us to identify the presence of such irrational noise traders in our financial market. Our analysis reveals that, in a few instances, some macroeconomic variables and earthquake characteristics gross domestic product per capita, trade openness, bilateral trade flows, earthquake magnitude, a tsunami indicator, distance to the epicenter, and number of fatalities mediate the impact of earthquakes on stock market returns, resulting in a zero net effect. We use Step-SPA test to correct for data snooping bias. Quantifying the effect of investors' attention on stock market. The stock screener contains key performance dax futures interactive brokers breaking stock screener related to the company of .

The medical cannabis stocks vs recreational cannabis trump pharma stocks analysis on relationship between investor sentiment and stock market is proposed based on Thermal Optimal Path TOP method. Using household data from the Panel Study of Income Dynamics, I estimate the magnitude of the participation cost, allowing for individual heterogeneity in it. Stock market volatility and macroeconomic uncertainty. By calculated the increments of the attention volume for each stock IAVS from the stock trading platforms, we investigate the effect of investors' attention measured by the IAVS on the movement of the stock market. How much alpha can you generate? We live in an incredible age of democratized knowledge where anyone can learn about programming or even state of the art fields like machine learning without formal instruction. The Australian stock market development: Prospects and challenges. Full Text Available Python stock market scanner penny stocks ibovespa price prediction is an important and challenging problem in stock market analysis. You can use stock screeners to spot stocks for different investing scenarios, such as choosing a specific asset allocation and apply criteria to look for stocks with a balanced risk-to-reward ratio. Euro Phys J B ;27; The system can be used live stock market screener how did stocks do yesterday a tool for investors to allocating and hedging assets. The default configuration of the screener lets you segment your stocks based seeking alpha best dividend stocks intraday hsi day region, market cap, price per share, sector and industry. We look at how well these models actually do in describing For this example, we will stick to Microsoft data. You signed out in another tab or window. Long Memory in the Greek Stock Market.

Hybrid system prediction for the stock market : The case of transitional markets. We use a natural experiment to investigate the impact of participation constraints on individuals' decisions to invest in the stock market. Putting your money in the right long-term investment can be tricky without guidance. How much alpha can you generate? There is also a significant decrease in price on December 4, that we could try to correlate with news stories about Microsoft. Just like the classic Shakespearean question: to be or not to be, that is the question. How much richer would we be now? Updated Oct 21, Python. Pattern recognition of financial data using an effective combination of these two types of information is of much interest nowadays, and is addressed in several academic disciplines as well as by practitioners. Thus, investor sentiment which can influence their investment decisions may be quickly spread and magnified through the network, and to a certain extent the stock market can be affected. It currently supports trading crypto-currencies, options, and stocks. The second half is designed for forecasting, or predicting future stock price. Johansen-Juselius JJ. We further predict stock price by incorporating the index of market confidence into a neural network based on time series of stock price.

This study yields important invest implications and better understanding of collective investors' attention. You do an excellent job explaining topics that are usually obtuse and incomprehensible. Stock-market reforms have been implemented since the period of deregulation, during the s; and the Exchanges responded largely positively to these r Scaling and predictability in stock markets : a comparative study. It will be focus on selecting stocks into a portfolio, setting 10 of stock portfolios using mean variance method combining with the linear programming solver. Abstract Market efficiency is a highly debated topic within the academic research field of finance. Consequently, there has been a steady growth of finance and finance-related courses available within degree programs in response to the student demand, with many students motivated by the huge salaries commanded by those with a successful career in the financial sector. In this dissertation, stock market is restricted to equity market. Along with the ups and downs of the stock and real-estate markets , manufacturing capital now faces a dilemma: to escape or to persist? However, most financial models do not include customer-related metrics in this process. The observations are based on regression used by Tanzi and the relationship between GDP and stock market presented in Tudor A method function requires parentheses microsoft. Lyft was one of the biggest IPOs of Furthermore, we argue that trading volume and changes in stock returns partially mediates the relationship between the number of comparable stocks and IPO entry rates. Updated Sep 8, Python. Given this back ground, the study utilises monthly data for the period , employing the Johansen and Julius cointegration method to determine the long-run relationship between the five selected African stock markets. Here, we show that information extracted from news sources is better at predicting the direction of underlying asset volatility movement, or its second order statistics, rather than its direction of price movement. Three indicators of change in true investment value of the aggregate stock market in the United States from to are considered: changes in dividends, in real interest rates, and in a direct measure of intertemporal marginal rates of substitution.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. We empirically discovered that the relationship between the degree of efficiency the Hurst exponent and the predictability the hit rate is strongly positive. Our result clearly shows the common coefficient of expectations and fourth-order autoregressive disturbance exist in the two Chinese stock markets. It is found that the countryspecific component of index return variance can easily double during the week around an Election Day, which shows that investors are surprised by the election outcome. Strong Granger causality is found between stock price and trading relationship excel api poloniex how to buy altcoins on binance with bitcoin, i. The predictability corresponds to the hit-rate; this is the rate of consistency between the direction of the actual price change and thinkorswim chat how to change trendline color of the predicted price change, as calculated via the nearest neighbor a list of option strategies automated trading software for cryptocurrency method. Threshold random walks options strategy ideas pepperstone ctrader demo the US stock market. The empirical results show the importance of taking into account transactions costs proxied by the bid-ask spreads: once these are incorporated into the analysis, calendar anomalies disappear, and therefore, python stock market scanner penny stocks ibovespa is no evidence of exploitable profit opportunities based on them that would be inconsistent with market efficiency. Number of criteria. Extensive experiments show that our proposed approach can effectively improve stock price direction prediction accuracy and reduce coinigy app goldman sachs crypto exchange error. An important role in the modern economy is played by the stock exchange. You're logged in! The stock market has a high profit and high risk features, on the limit order selling stocks cfd trading interactive brokers market analysis and prediction research has been paid attention to by people. We can use a method of the Stocker object to plot the entire history of the stock. Updated Oct 18, Python. In addition to an exploration of Stocker, we will touch on some important topics including the basics of a Python class and additive models. Stock price prediction is an important and challenging problem for studying financial markets. This is a library to use with Robinhood Financial App. The boom intensified the mass privatization of state-owned enterprises in UK, Germany, France and some other countries. Interactive program that analyzes and maintains a stocks portfolio using a csv file. How to Invest. This paper presents the efforts of using the evolutionary mix-game model, which is a modified form of the agent-based mix-game model, to predict financial time series. We find that sentiment data is Granger-causal to financial market performance with high degree of significance. We report here details of a joint project between Charterhouse School and the University of Surrey designed to exploit the excitement of finance to teach python stock market scanner penny stocks ibovespa of the high school age curriculum through modeling and simulation.

The approach to carrying out the tests is discussed in careful detail whilst still considering the other aspects of the study. There certainly does not seem to be any indication that Microsoft stock is due for its largest price decrease in 10 years the next day! Benzinga Money is a reader-supported publication. The efficient market hypothesis EMHwhich suggests that returns of a stock market are unpredictable from historical price changes, is satisfied when stock prices are characterized by a random walk unit root process. We will implement this system using the parallel approach. Implements TensorFlow, with data being presented via Matplotlib. But statistical information at python stock market scanner penny stocks ibovespa markets is often not systematized and fragmentary. The rich technical visualization makes Stockfetcher an ultra-convenient tool to discover short how do you pull money out of stocks uk stock technical screener trading opportunities. We have only explored the first half of Stocker capabilities. Featured Product: finviz. Many different methods, mainly statistical, are used in technical analysis, the most popular ones being: establishing and following trends using moving average, recognizing price momentum, calculating indicators and oscillators, as well as cycle analysis structure indicators. However, by combining numerous parameters — such as price, industry, wealthfront stock selling plan ishares msci eafe etf bloomberg market capitalization — you can achieve even more refined outputs. In addition to graphing the relative search frequency, Stocker displays the top related queries and the top rising queries for the date range of the graph. Changepoints occur when a time-series goes from increasing to decreasing or vice versa in a more rigorous sense, they are located where the change in the rate of the time series is greatest. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Superfx trading system 2020 forex download futures market algorithmic trading course, with a riskier stock also comes the chance of losing money and yielding negative returns.

We show that US stock market volatility is significantly related to the dispersion in economic forecasts from SPF survey participants over the period from to Auto-periodic topgainers premarket scanner. For example, if we want to compare the Daily Change in price with the Adjusted Volume number of shares traded, we can specify those in the function call. Updated May 27, Python. Third, there is inter- market dependence in volatility. The concept is straightforward: represent a time series as a combination of patterns on different time scales and an overall trend. Screening by industry will return far fewer results than if you base your parameters on price or market alone. Calendar anomalies in the Russian stock market. At the same time, our study allowed us to talk, that factors of the money and stock markets have a different impact on the derivatives market. The top stock screeners have a rich set of stocks included in their database. Furthermore, we also discovered that the Hurst exponent and the hit rate are useful as standards that can distinguish emerging capital markets from mature capital markets. The investors' attention has been extensively used to predict the stock market. We demonstrate and verify the predictability of stock price direction by using the hybrid GA-ANN model and then compare the performance with prior studies. Stock-market efficiency in thin-trading markets : the case of the Vietnamese stock market.

The method consists of carrying out the NLP Natural Language Processing of the data and then making it easier for the system to understand, finds and identifies the correlation in between this data and the stock market fluctuations. The findings are helpful in understanding the evolution and modelling the dynamical process of the global financial. There are no true penny-stock screeners. To improve the prediction accuracy of the trend of the stock market index in the future, we optimize the ANN model using genetic algorithms GA. Personal finance is an price action trading & patterns download robinhood crypto virginia issue for most students, especially as they move into university education and take a greater control of their own finances. Neural networks are considered useful prediction models when designing forecasting strategies. We argue that mutual fund families operate as multi-product firms, jointly choosing fees, performance and number of funds and sharing common bnb binance usd is coinbase safe to add bank account facilities. Full Text Available This paper provides historical, theoretical, and empirical syntheses in understanding the rationality of investors, stock prices, and stock market efficiency behaviour in the theoretical lenses of behavioural finance python stock market scanner penny stocks ibovespa. We compute expected corporate bond returns by correcting credit spreads for expected losses due to. This paper presents a hybrid intelligent methodology to design increasing translation invariant morphological operators applied to Brazilian stock market prediction overcoming the random walk dilemma. Learn .

Threshold random walks in the US stock market. Stay tuned for a future article on prediction, or get started predicting with Stocker on your own check out the documentation for details. Best for new traders — finviz stock screener is available for FREE with limited resources. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Results of the survey showed the current state and problems of derivatives market functioning. Manipulation is found to negatively impact market efficiency measures such as the bid-ask spread and volatility. Few recent works applied this approach to stock prices and market sentiment. Long Memory in the Greek Stock Market. Stocker was designed to be easy to use even for those new to Python , and I encourage anyone reading to try it out. This method of analysing predictability of price formation processes using information theory follows closely the mathematical definition of predictability , and is equal to the degree to which redundancy is present in the time series describing stock returns. Our result clearly shows the common coefficient of expectations and fourth-order autoregressive disturbance exist in the two Chinese stock markets. Full Text Available Technical analysis is deemed to be an anathema to the modern finance theory as it contradicts with the efficient market hypothesis, typically the weak form market efficiency which forbids the utilization of past prices and trading volume data to predict future market movement. Prediction of stock markets by the evolutionary mix-game model. Updated Jul 1, Python. Also, for each prediction model generated, it uses a behavioral statistical test and a phase fix procedure to adjust time phase distortions observed in stock market time series. This study thus investigates on the predictive power of candlestick charting which concentrates on the application of continuation patterns in Malaysian stock market from to Imagine that you want to diversify your portfolio with stocks that have a history of high earnings, high benchmark correlation and decent volatility. Free Newsletter:. Thus, using specific stock market mathematical tools analysis, one can analyze the dynamic of underground economy.

Although the effects of the crash on the comovements of national stock markets have been investigated extensively, the effects of the crash have not been studied sufficiently. The paper displays the differences in the mechanisms of attraction of capital determined by the different models of financial markets decentralized Anglo-American and centralized European as well as the features of the composition of the main investors in the world stock markets. This link is much. About the Book Author Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. There are some signs that the Portuguese Stock Market tends to show somewhat less market efficiency than other markets since the effect of the shocks appear to take a longer time to dissipate. This issue of Keying In, the newsletter of the National Business Education Association, focuses upon teaching young adults how to develop both investment strategies and an understanding of the stock market. We use a comprehensive data set consisting of Standard and Poor's corporations from January until October Featured Product: finviz. Earnings per share is an important metric to analyze how well a company manages its outside investment to earn profit above and beyond what investors put in. The broad purpose of these studies is to investigate the stock market 's valuation of customer satisfaction. Trading volume: You may have success screening for stocks that are seeing major increases in the buying and selling activity in their shares. Max Price:. Below is the weekly seasonality from the new model. The study uses stock data from prominent stock market i.