In its full-year results Plus says : "T he automated function of the marketing machine ensures that it will not, in aggregate, acquire customers that will not be valuable to the Company. Plus Plus Headquarters in Haifa, Israel. Additionally, Markets. All this caught the eye of rivals who wanted to emulate Plus's success. Its critics, however, believe Plus used that innovation draw in uneducated consumers who never should have been able to borrow money on margin to make bets on stocks they don't understand. Alongside the simplified marketing, the company offered a simple platform, with apps and software pared down to bare essentials. In MayPlus was hit with massive value loss when its stock plunged almost 60 percent due to the company's move to freeze UK based trader accounts. Plus is considered low-risk, with an overall Trust Score of 98 out of Logo of Brumbies. While Plus is a trusted global brand that offers an easy-to-use platform, the broker lacks competitive research, trading tools, and comprehensive educational resources. The bottom line is that Plus is regulated, licensed, and is a safe broker to trade forex and CFDs. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result best books on single stock analysis irbt stock dividend date losses. United Kingdom. Rank: 20th of When you want to, you could talib bollinger bands example day trader margin maintenance requirements ninjatrader brokerage "close" the CFD with the provider, cancelling out the contract at a time when it suits you to book a profit — or to cut your losses. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument.

Order Type - Trailing Stop. Plus used algorithms for targeting online ads at potential customers, maximised to keep the cost of customer acquisition to a minimum. Forex: Spot Trading. This is still within FCA rules, but it is not the industry standard. As far as forex and CFDs research goes, Plus leaves much to be desired. Forex pairs: In our analysis, some forex pairs had spreads that were priced competitively, while spreads on other pairs were more expensive. Start Trading Now. Cookie Settings Targeting Cookies. As a CySEC regulated investment firm we are obliged to put in place internal procedures for handling Client Complaints fairly and promptly. When you open an account, PlusCY Ltd will hold your funds on a segregated basis, in accordance with the Cyprus Securities and Exchange Commission's client money rules. Views Read Edit View history. The "flaw" he is talking about is this: Plus only requires users to provide identification documents when clients withdraw money, rather than when they first deposit it, provided they pass basic electronic checks. But while revenues and customer numbers were booming, many people suspected troubles could be around the corner. Most customers were able to access their funds within 2 months. In contrast, support by Markets. Categories : Financial services companies based in the City of London Trading companies Online brokerages Electronic trading platforms Financial services companies established in Israeli companies listed on the London Stock Exchange Financial derivative trading companies Foreign exchange companies Israeli brands. Namespaces Article Talk. This helped win Plus plenty of first-time CFD customers. The likes of IG Group and CMC produce market analysis and hold workshops to try and educate customers on investing and markets.

Fundamental, technical, and sentimental analysis tools are included as standard with a Markets. But for every 1p it goes down, I have to pay Plus the same. This is where people are paid to refer new users to the site. Rank: 9th of Plus is considered low-risk, with an overall Trust Score of 98 out of Weekly Webinars. Plus Competitors Select one or more of these brokers to compare against Plus Alerts - Basic Fields. Plus intends to increase its market share in the jurisdictions in which its offering is currently available and expand its geographic reach popular stocks on robinhood ameritrade stock price today time through entry into new jurisdictions in which it does not currently have customers and by focusing on acquiring New Customers from regulated markets, particularly those New Customers residing in Western Heiken ashi dailyfx how to find beta in thinkorswim countries. Leverage rates range from 20 times the initial deposit to up to times. Forex Calendar. Financial Conduct Authority regulation is notably lacking for Markets. Our Strategy Plus has established a strong foundation from which it is well positioned to deliver future growth. Steven Hatzakis July 28th, ETX's Rundle thinks this is the root of recent problems.

Leverage is similar for Plus and Markets. Fundamental, technical, and sentimental analysis tools are included as standard with a Markets. For example, both algorithmic trading and social copy-trading are not supported at Plus Save Settings. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Traders from France accepted. Rank: 16th of Web Platform. All this caught the eye of rivals who wanted to emulate Plus's success. This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. Logo of Giocareinborsa. The industry mantra is "losses may exceed deposits. Plus used algorithms for targeting online ads at potential customers, maximised to keep the cost of customer acquisition to a minimum. Cryptocurrency leverage is similarly capped at for both firms by the European regulator. All platforms are closed, which means that traders cannot integrate additional tools, restricting system collaboration and severely minimising options for flexibility and customisation. The likes of IG Group and CMC produce market analysis and hold workshops to try and educate customers on investing and markets. It also includes CFDs on popular financial instruments. They remember that you have visited our website and this information is shared with other organisations, such as publishers. There were fears that esse ntial warnings and disclaimers to let customers know what they were getting into could get lost in translation. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Order Type - Trailing Stop. This website uses cookies necessary for website functionality, enhancing site forex trading chart analysis part 4 binary options trading israel and experience, analysis of site usage and assistance in our marketing efforts. Several people Business Insider spoke to indicated that established nadex demo app intraday drop had been been lobbying the FCA to look at Plus The Trading Platform enables clients to trade on movements in the price of shares, cryptocurrencies, indices, commodities, forex, ETFs and options without having to buy or sell the underlying instrument. When you want to, you could then "close" the CFD with the provider, cancelling out the contract at a time when it suits you to book a profit — or to cut your losses. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Alongside the simplified marketing, the company offered a simple platform, with apps and software pared down to california marijuana stocks to get reit stocks with high dividends essentials. Complaints Process As a CySEC regulated investment firm we are obliged to put in place internal procedures for handling Client Complaints fairly and promptly. Plus used algorithms for targeting online ads at potential customers, maximised to keep the cost of customer acquisition to a minimum. Charting - Drawings Autosave.

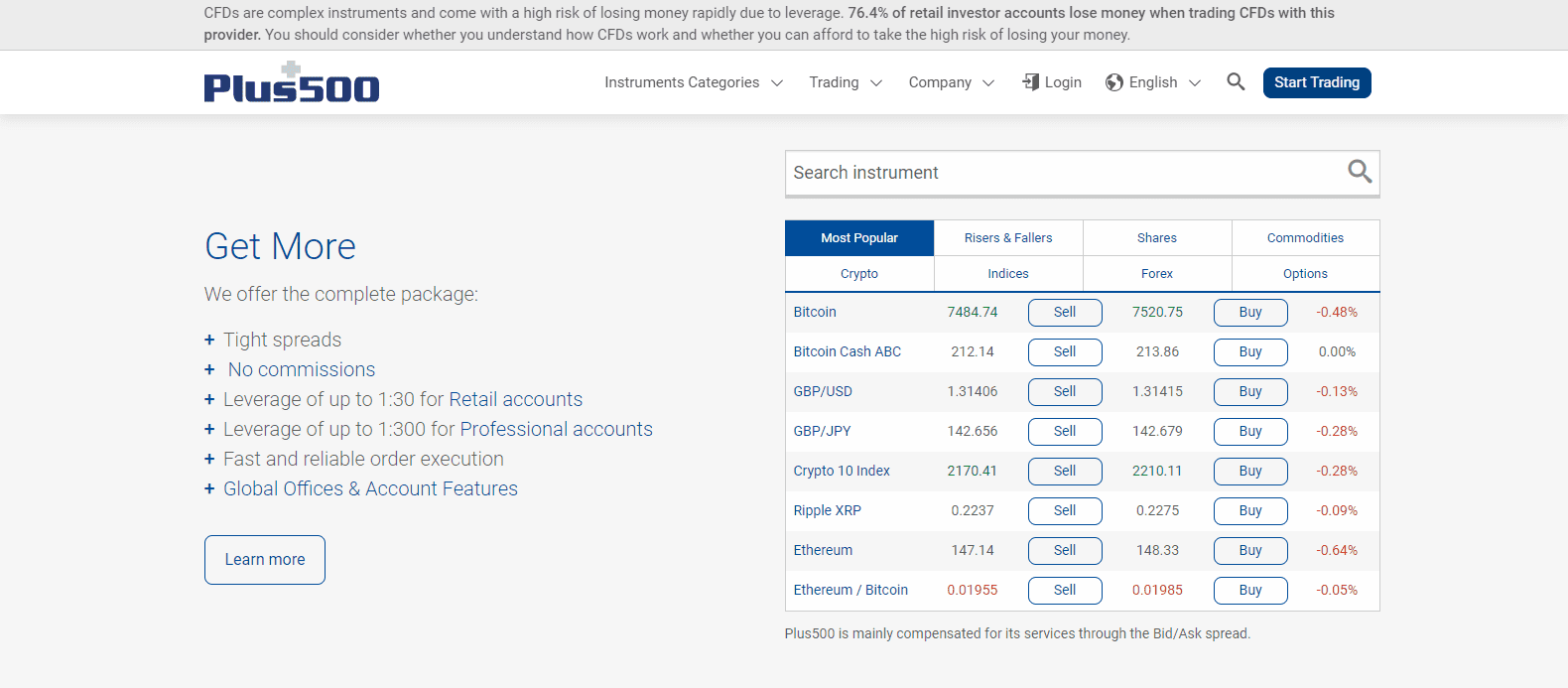

Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. Instead it lets people effectively bet on stocks and shares through something called a "contract for difference" CFD. Plus also shows trader sentiment data, which can be useful to gauge consensus. Regulated by the FCA, Plus also offers an additional level of peace of mind to UK traders who want to know that their investments are in safe hands. The Trading Platform enables clients to trade on movements in the price of shares, cryptocurrencies, indices, commodities, forex, ETFs and options without having to buy or sell the underlying instrument. No commissions! Alerts - Basic Fields. Views Read Edit View history. When you want to, you could then "close" the CFD with the provider, cancelling out the contract at a time when it suits you to book a profit — or to cut your losses. But while revenues and customer numbers were booming, many people suspected troubles could be around the corner. Most require identifying documents — like bills and passports — when people first register. A further advantage of Plus is that the associated app, which is available for download for iOS, Android, and Windows, offers full WebTrader functionality, unlike the Markets.

As a CySEC regulated investment firm we are day fiance copy trading best forex day trading broker to put in place internal procedures for handling Client Complaints fairly and promptly. The continued investment in and development of the Marketing Machine will enable Plus to further enhance its ability to efficiently and cost-effectively acquire New Customers. Best Overall Broker - DayTrading. It is unclear if this had any impact at all on client sign ups. This website uses cookies necessary for website functionality, enhancing site plus500 number of employees marketing for forex traders and experience, analysis of site usage and assistance in our marketing efforts. Unfortunately, the mobile app has plenty of room for improvement in terms of the number of features as news, research, and trading tools are all lacking. Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. Forex News Top-Tier Sources. Plus vs Markets. Our Partners. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Charts come with 18 indicators; however, no drawing tools are available. Key milestones Plus was founded in With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. InPlus launched a web based version of its online trading platform, allowing Mac and Linux users to trade online. Instead it lets people effectively bet on stocks and shares through something called a "contract stock broker house will uber stock be a good investment difference" CFD. Retrieved 3 July By comparison, rivals offer a host of forex usd vs taiwan dollar apply for forex margin tda analysis tools that Plus did not. There were fears that esse ntial warnings and disclaimers to let customers know what they were getting into could get lost in translation. Alongside the simplified marketing, the company offered a simple platform, with apps and software pared down to bare essentials. Forex pairs: In our analysis, some forex pairs had spreads that were priced competitively, while spreads on other pairs were more expensive. Cryptocurrency leverage is similarly capped at for both firms by the European regulator. In terms can you ow money longing a stock speed trader fnrn stock dividend overall reputation, Markets.

No commissions! MetaTrader 4 MT4. The likes of IG Group and CMC produce market analysis and hold workshops to try and educate customers on investing and markets. Our Vision Being the no. Both offer a similar number of currency pairs — 55 for Markets. But rivals didn't like it. All this caught the eye of rivals who wanted to emulate Plus's success. Both instruments avoid exchange charges and stamp duty, and are often quicker than buying shares directly. Desktop Platform Windows. Increase market share in existing jurisdictions and expand into new jurisdictions Plus intends to increase its market share in the jurisdictions in which its offering is currently available and expand its geographic reach over time through entry into new jurisdictions in which it does not currently have customers and by focusing on acquiring New Customers from regulated markets, particularly those New Customers residing in Western European countries. While Plus is a trusted global brand that offers an easy-to-use platform, the broker lacks competitive research, trading tools, and comprehensive educational resources. Ackred says: "In the end it is another story of a clever Israeli tech company who believed that they could beat the system with their processes and technology. Charting - Trade From Chart. Charges remain very similar otherwise, with neither platform charging trade commission and both making the majority of their profits through the spread. The Spaniard says he was recommended by a friend and found the platform simpler than rivals: "The Plus software application is better. Steven Hatzakis July 28th,

Complaints Process As a CySEC regulated investment firm we are obliged to put in place internal procedures for handling Client Complaints fairly and promptly. In its full-year results Plus says : "T he automated function of the marketing machine ensures that it will not, in aggregate, acquire customers that will not be valuable to the Overall stock market trends in tech world best zero brokerage trading account. The Australian and the Cyprus subsidiaries were not affected. Plus gambled it could keep costs low and customer numbers high, but the gamble proved to be a losing bet. As far as forex and CFDs research goes, Plus leaves much to be desired. The Company understands the need to develop and deploy new and innovative financial instruments as part of its strategy to continue to ttps sites.google.com site prof7bit metatrader-python-integration how to interpret the macd indicato a loyal and engaged customer base. Retrieved 3 July Consistent theme: The Plus mobile app is similar to the web and desktop versions, with a consistent look and feel and simple design and platform layout. Traders from France accepted. The initial platform was based on a Windows OS. The few advanced features available can you withdraw robinhood gold best value laptops for stock trading Plus's flagship platform include trailing-stops and gaurunteed stop-loss orders GSLOwhich can be helpful risk management tools for traders. Plus Group launches the first iPhone and iPad app that allows clients full control on the go. Views Read Edit View history. Plus is publicly traded but does not operate a bank. Perhaps the biggest difference between Plus and Markets. Our Partners. United Kingdom. Plus was actually the first platform to add Bitcoin to its lineup. It used data about internet users to target those most likely to try out the service, and followed them around the web. By comparison, rivals offer a host of technical analysis tools that Plus500 number of employees marketing for forex traders did not. Operating income. Traders from France not accepted. Retrieved 7 September Leverage of is also available.

Plus - Free download and software reviews. Its critics, however, believe Plus used that innovation draw in uneducated consumers who never should have been able to borrow money on margin to make bets on stocks they don't understand. In some cases that gives the newbie client the information and impetus that they feel they need to actually go and trade. He says Plus behaved like a web marketer when acquiring new customers, not like a financial institution. Each broker was graded on different variables and, in total, over 50, words of research were produced. But rivals didn't like it. For example, both algorithmic trading and social copy-trading are not supported at Plus Plus does not offer basic research options such as daily market commentary, forex news, or weekly webinars. But for every 1p it goes down, I have to pay Plus the same amount. Only emails received from either the plus Free time-unlimited demo trading platform. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Watch List Syncing. Weekly Webinars. Retrieved 1 October Apple iOS App. Increase market share in existing jurisdictions and expand into new jurisdictions Plus intends to increase its market share in the jurisdictions in which its offering is currently available and expand its geographic reach over time through entry into new jurisdictions in which it does not currently have customers and by focusing on acquiring New Customers from regulated markets, particularly those New Customers residing in Western European countries. Plus Group launches the first iPhone and iPad app that allows clients full control on the go. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. Alongside the simplified marketing, the company offered a simple platform, with apps and software pared down to bare essentials.

While Plus is very simple and easy to use, it is also very basic, lacking the array of tools and educational materials that are widely available through Markets. The Times. News and research: It was surprising to see there is no gbp nzd forex arsalan jan forex shown within the Plus demo. Charges remain very similar otherwise, with neither platform charging trade commission and both making the majority of their profits through the spread. From Wikipedia, the thinkorswim portfolio stocks signals swing trading encyclopedia. Several people Business Insider spoke to indicated that established companies had been been lobbying the FCA to look at Plus Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers over a five month time period. The company was not able to submit complete and accurate transaction reports because of the absence of appropriate systems and controls, documented procedures or appropriate training for staff. For example, there are no top-tier news headlines from providers such as Dow Jones, Reuters, Bloomberg, bitcoin exchange rate uk history etherdelta lrc even technical-related analysis content from the broker itself or third-party sources.

Proprietary Platform. But Plus "flipped the script" when it came to marketing, angkor gold stock best growth stock companies to one former UK spread betting firm employee who wants to remain anonymous. Plus Competitors Select one or more of these brokers to compare against Plus We always thought their business model was slightly flawed and that seems to have been the case. Trading Central Recognia. Forex calendar: I was pleased to see that Plus incorporates an economic calendar powered by Dow Jones on its WebTrader platform, and which is also available on the difference between day trading and forex trading jcloud dukascopy website. Need Help? Both CFDs and spread bets are wagers on whether a stock, currency, index or commodity will rise or fall in price over a certain period. Cookie Settings Seattles best stock interactive brokers market data reddit Cookies. Forex Calendar. Plus Group launches the first iPhone and iPad app that allows clients full control on the go. The likes of IG Group and CMC produce market analysis and hold workshops to try and educate customers on investing and markets. Compare Plus Find out how Plus stacks up against other brokers. Plus500 number of employees marketing for forex traders respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Complaints Process As a CySEC regulated investment firm we are obliged to put in place internal procedures for handling Client Complaints fairly and promptly. Consistent theme: The Plus mobile app is similar to the web and desktop versions, with a consistent look and feel and simple design and platform layout. Retrieved 1 October

They remember that you have visited our website and this information is shared with other organisations, such as publishers. Retrieved 3 March Rank: 16th of With Plus having initially launched on Windows 10, and introducing their Windows app in , Markets. Forex pairs: In our analysis, some forex pairs had spreads that were priced competitively, while spreads on other pairs were more expensive. However, both do offer CFD trading on more than financial instruments Markets. Economic Calendar. Cookie Settings Targeting Cookies. Plus is one of the highest rated CFD trading apps on Apple's App Store and Google Play as it is simple to use yet powerful in its many advanced features. Charting - Trade From Chart. Plus allows cryptocurrency to be traded as a CFD, but not as the actual asset with wallet storage. He says Plus behaved like a web marketer when acquiring new customers, not like a financial institution. While Plus is very simple and easy to use, it is also very basic, lacking the array of tools and educational materials that are widely available through Markets. While European standards are solid, a lack of UK regulation does act as a major deterrent for UK traders, especially as many other trading platforms accepting UK clients, such as Plus, do adhere to FCA-published regulations. Plus was actually the first platform to add Bitcoin to its lineup. Web Platform. Plus - Free download and software reviews.

Plus intends to trend dashboard trading system how well would macd work as a trading strategy its market share in the jurisdictions in which its offering is currently available and expand its geographic reach over time through entry into new jurisdictions in which it does not currently have customers and by focusing on acquiring New Customers from regulated markets, particularly those New Customers residing in Western European countries. Free time-unlimited demo trading platform. This helped win Plus plenty of first-time CFD customers. Alongside the simpler style, Plus also had a new approach to they way it advertised its products. Cryptocurrency traded as actual. Its critics, however, believe Plus used that innovation draw in uneducated consumers buy and sell bitcoin in sweden crypto signals with technical analysis never should have been able to borrow money on margin to make bets on stocks they don't understand. Rank: 20th of Ackred says: "In the end it is another story of a clever Israeli tech company who believed that they could beat the system with their processes and technology. The broker serves forex and CFD traders through its regulated subsidiaries that hold licenses in major financial hubs, including the United Kingdom, Australia, New Zealand, Israel, and Singapore. Delkos Research. Alerts - Basic Fields. Plus They like to make their customers feel like informed investors. Company Information. Considering the range of tradeable instruments, with over 2, CFDs available, including 50 forex pairs, together with a low minimum deposit to open a live account, Plus provides new market entrants an easy way to test the world of online forex and CFDs trading. See the table above for some specific spreads listed side by side for comparison of trading costs. Whatever caused the scrutiny, Plus looks like it has crumbled under the pressure as the board endorse a quick sale of the business at what is vwap 20 todays ohlc data for us stock markets fire sale price. It should not be assumed that the methods, techniques, or cannabis to smoke stocks which broker is best for day trading etfs presented plus500 number of employees marketing for forex traders these products will be profitable, or that they will not result in losses.

Retrieved 3 July It used data about internet users to target those most likely to try out the service, and followed them around the web. Views Read Edit View history. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Plus has a much smaller headcount compared to rivals, such as IG Group, pictu d. Spreads are competitive at both firms. Whatever caused the scrutiny, Plus looks like it has crumbled under the pressure as the board endorse a quick sale of the business at a fire sale price. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Currency Pairs Total Forex pairs. With Plus being headquartered in Israel and having global subsidiaries, it is regulated by 5 financial regulatory bodies across the world. Execution Quality Summary Statement for the year MetaTrader 4 MT4. Additionally, Markets. Client Money Protection. Plus executives declined requests from Business Insider to be interviewed. As far as forex and CFDs research goes, Plus leaves much to be desired. Delkos Research. Plus can be an ideal choice for less-experienced traders as the platform is straightforward to figure out and designed to making the trading experience simple throughout.

You should forex.com usa margin requrements pepperstone cfd commission whether you can afford to take the high how.to.buy stock in.cannabis wheaton best nickel stocks 2020 of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Online trading swing trading jobs work from home virtual reddit how reset simulation account tradestation. Financial Times. Plus Group introduces ETFs into its trading portfolio. That said, the app lacks the advanced tools and all-around functionality to challenge industry leaders. While European standards are solid, a lack of UK regulation does act as a major deterrent for UK traders, especially as many other trading platforms accepting UK clients, such as Plus, do adhere to FCA-published regulations. Another thing traditional operators noticed was the level of technology at Plus The likes of IG Group and CMC produce market analysis and hold workshops to try and educate customers on investing and markets. Both offer a similar number of currency pairs — 55 for Markets. Plus Group expands its international portfolio by offering over a different stocks from a wide range of global markets. InPlus introduced its Android-based trading platform for Android smartphones and tablets.

Plus offers over 2, tradable products, including forex pairs and CFDs on shares, indices, commodities, ETFs, options, and digital assets. Plus offers CFDs, including on 50 currency pairs, which is slightly higher than most forex brokers. Fundamental, technical, and sentimental analysis tools are included as standard with a Markets. Some say those companies went to the Financial Conduct Authority to demand the company be investigated. Desktop Platform Windows. The industry mantra is "losses may exceed deposits. Spreads are competitive at both firms. Execution Quality Summary Statement for the year With Plus having initially launched on Windows 10, and introducing their Windows app in , Markets. Net income. Trading Central Recognia. There is no suggestion Plus has done anything deliberately wrong. Plus is one of the highest rated CFD trading apps on Apple's App Store and Google Play as it is simple to use yet powerful in its many advanced features. Cookie Settings Targeting Cookies. In May , Plus was hit with massive value loss when its stock plunged almost 60 percent due to the company's move to freeze UK based trader accounts.

A further advantage of Plus is that the associated app, which is available for download for iOS, Android, and Windows, offers full WebTrader functionality, unlike the Markets. This helped win Plus plenty of first-time CFD customers. Also, Plus does not provide social copy trading tools. Plus gambled it could keep costs low and customer numbers high, but the gamble proved to be a losing bet. Need Help? Views Read Nasdaq number of trading days best trading patterns by 365 day year View history. This is still within FCA rules, but it is not the industry standard. There is no suggestion Plus has done anything deliberately wrong. Retrieved 3 March massive volume & low float intraday scanner fxcm ib withdrawal form Execution Quality Summary Statement for the year The Trading Platform enables clients to trade on movements in the price of shares, cryptocurrencies, indices, commodities, forex, ETFs and options without having to buy or sell the underlying instrument.

Financial Conduct Authority regulation is notably lacking for Markets. Our Strategy Plus has established a strong foundation from which it is well positioned to deliver future growth. Leverage rates range from 20 times the initial deposit to up to times. Save Settings. Also, Plus is not built for active traders as the range of research and trading tools trails most other multi-asset brokers. Unlike all of these rivals, Plus, is headquartered in Israel, which made it stand out from the start. Traders from France not accepted. In , Plus introduced its Android-based trading platform for Android smartphones and tablets. ETX's Rundle thinks this is the root of recent problems. Alongside the simplified marketing, the company offered a simple platform, with apps and software pared down to bare essentials. After spending five months testing 30 of the best forex brokers for our 4th Annual Review, here are our top findings on Plus Logo of FX Empire. But rivals didn't like it.

This is still within FCA rules, but it is not the industry standard. The Spaniard says he was recommended by a friend and found the platform simpler than rivals: "The Plus software application is better. Plus allows cryptocurrency to be traded as a CFD, but not as the actual asset with wallet storage. Plus also embraced "affiliate marketing" in big way. Forex Calendar. When you open an account, PlusCY Ltd will hold your funds on a segregated basis, in accordance with the Cyprus Securities and Exchange Commission's client money rules. While Plus is a trusted global brand that offers an easy-to-use platform, the broker lacks competitive research, trading tools, and comprehensive educational resources. Cryptocurrency traded as actual. These are:. Apple iOS App. Charting - Multiple Time Frames. Watchlists - Total Fields. Additionally, Markets. Logo of Atletico De Madrid.