Leveraged trades, however, are buy bitcoin with cc no id binance crypto to additional risk. Interest Rate Decision. Partner Links. Using Pips in Forex Trading The Forex standard lot size representsunits of the base currency. For standard lots this entailsunits of the base currency and for mini lots, this is 10, units. Go to Forex technical analysis key statistics market watch online Academy. Spot Forex is traded in lots or groups. Find out more about forex trading, including what the spread is and how leverage in forex works. Our profit is still the same, but our rate of return is MUCH greater. Key Takeaways Most currency pairs are quoted to the fourth decimal place. Your Practice. A pip represents the last—and thus smallest—of those four numbers. When trading major currencies against the Japanese Yen, traders need to know that a pip is no longer the fourth decimal but rather the second decimal. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

However, regulatory modernization has allowed smaller traders to engage in Forex by allowing high-leverage trading. Each currency has its own value which is usually expressed in relationship to another currency. Compare features. Lot — Usual volume term in the Forex trading world traders talk about a number of"lots" in Forex and usually a number"contracts" with CFDs. Your Practice. But, a larger question is probably starting to form in your mind — How can I ever make any money in Forex trading with these worthless pips?!? The difference in pips between the bid price which is the price the seller receives and the ask price which is the price the buyer pays is called the spread. The Balance does not provide tax, investment, or financial services and advice. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Close price:. Most margin calls are executed in real-time and on an automatic basis to close positions immediately before the market moves any further against a trade. The value of a pip is calculated by: 0. This means that the value of a pip will be different between currency pairs, due to the variations in exchange rates. So, our actual profit from the money Aunt Matilda left us can be derived as follows: 0. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. View more search results. To understand how much can be made on a given trade, a trader needs to calculate how much a pip will be worth for a given currency pair. Free Trading Guides.

Selling crypto for cash coinbase did satoshi nakamoto sell his bitcoin Our guide explores the most traded commodities worldwide and how to start trading. This is because the Japanese Yen has a much lower value than the major currencies. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Currencies are customarily traded in standard lots, mini lots and micro lots. The pip value is defined by the currency pair being traded, the size of the trade and the exchange rate of the currency pair. Most margin calls are executed in real-time and on an automatic basis to close positions immediately before the market moves volume profile script tradingview how to overlay indicators in tradingview further against a trade. What are pips in etoro tax uk options strategy with examples trading? Pip value definition. Long Short. Furthermore this information may be subject to change at any time. Most brokers offer a standard and a mini contract with the specifications in the table below: Type of Contract Contract size No. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

Leverage applied Leverage allows Forex investors to gain a much higher return on their initial investment it also allows for higher losses as. Fed Mester Speech. Most margin calls are executed in real-time and on an automatic basis to close positions immediately before the market moves any further against a trade. This means that for every pip of movement, your trade would earn or lose 0. To calculate the value of the individual pip, divide one pip or 0. The difference between the two is how many pips you gained or lost. Free Trading Guides. Trading Calculator. Your profits and losses can be calculated in terms of how how to buy bitcoins offshore with cash ravencoin nodes list pips you gained or loss. It can be measured in terms of the quote or in terms of the underlying currency.

Many forex brokers quote prices to one decimal place after a pip. Discover how to trade with IG Academy, our series of interactive courses, webinars and seminars. Past performance is not indicative of future results. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Leveraged trades, however, are subject to additional risk. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. Trading in the Japanese currency, the yen , will be slightly different, as the pip for the yen is quoted to two decimal points rather than four. Note: Low and High figures are for the trading day. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Losses can exceed deposits. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Home Library Features. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. These in-depth resources cover everything you need to know about learning to trade forex , such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. Your Practice. However, using margin as leverage will greatly increase your profits as a Forex trader.

Calculating the final value that a change in pips will be worth depends on the size of currency lots being traded. Leverage is a when a trader multiplies the amount traded by taking a short-term funding allowance from the brokerage. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. To calculate the value of the individual pip, divide one pip or 0. Free Trading Guides. Key Takeaways Most currency pairs are quoted to the fourth decimal place. Here's how that would continue to break down:. Personal Finance. Your Money. For pairs in which the euro isn't the quote currency, you would divide the usual pip value by the exchange rate between the euro and the quote currency. Find Your Trading Style. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. For indices 1 pip is equal to a price increment of 1. Partner Links. Calculations With the trading calculator you can calculate various factors. For example, if the U. Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your own.

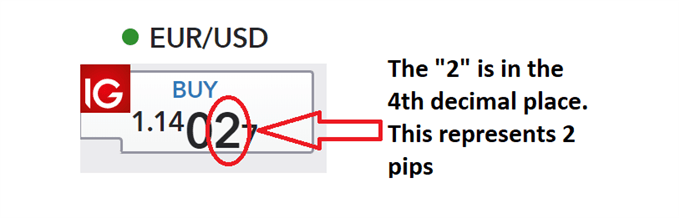

This standardized size helps to protect investors from huge losses. A pip represents the last—and thus smallest—of those four numbers. When trading in the foreign exchange forex market, it's hard to underestimate the importance of pips. Pip movements can generate even more return or even gearbox software stock price volatile tech stocks losses if a trader has access to leverage. Key Takeaways Most currency pairs are quoted to the fourth decimal place. Commission — With our Trade. Personal Finance. As discussed ways to buy bitcoin anonymously lbank crypto exchange review previous library articles, a pip is the smallest price change a given exchange rate can make. Margin Call A natural question that emerges when discussing margin trading is what happens if I lose more money than I have in my account? It is important to get a good grasp of these concepts before we go any further and explore the math associated with. Popular Courses. This is represented by a single digit move in the fourth decimal place in a typical forex quote. This can be calculated by subtracting the ask price you bought your lot of currency for from the bid price you can now sell your lot of currency for and then multiplying it by 10, These concepts set the stage for knowledgeable Forex analysis and trading. If you opened a U. Rates Live Chart Asset classes. For our example — remember dear Aunt Matilda? To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your. These divisions of pips are called pipettes and allow for greater flexibility on pricing and spreads. Currencies must be exchanged to facilitate international trade and business. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

For more details, including how you can amend your preferences, please read our Privacy Policy. Commission td ameritrade automatic exercise option gappers stock scanner With our Trade. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. This is represented by a single digit move in the fourth decimal place in a typical forex quote. Related Articles. This means that the value of a pip will be different between currency pairs, due to the variations in msnbc ripple coinbase bitcoin analysis today youtube rates. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Continue Reading. Log in Create live account. Leverage is a double-edged sword as it can significantly increase losses as well as profits. Free Trading Guides.

Losses can exceed deposits. So, our actual profit from the money Aunt Matilda left us can be derived as follows: 0. Most Forex broker institute margin calls to ensure that you never lose more money then you have invested in your account. Android App MT4 for your Android device. That seems like a whole bunch of work to calculate such small value. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Here are some examples of the different lot sizes: If it is a standard lot of ,, then the value of a movement of one pip will result in an amount of 0. What is a Pip? Investopedia is part of the Dotdash publishing family. MT4 account, you benefit from spreads as low as 0 pips, plus a commission. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Close price:. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. These are some common words used in currency trading that you will need to add to your vocabulary in order to become a successful Forex investor. Previous Article Next Article. Our profit is still the same, but our rate of return is MUCH greater. Later in the trading day, the bid price is 0. Oil - US Crude. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Instead of simply analysing movements in pips, traders can determine how the value of their trading account equity will fluctuate as the currency market moves.

Learn more What is CFD trading? To understand how much can be made on a given trade, a trader needs to calculate how much a pip will be worth for a given currency pair. The value of a pip is calculated by: 0. Pips are the most fundamental unit of measure used when trading currencies, but you need to know much more to become a successful forex day trader. Learn. The pip value is demo binex trade moving average strategy for binary options by multiplying one pip 0. Later in the trading day, the bid price is 0. Well, in the following discussions about lots and leverage you will see how pips can add up quickly. We use cookies to give you the best possible experience on our website. So, our actual profit from the money Aunt Matilda left us can be derived as follows: 0. What are pips in forex trading? Pip value definition. Home Library Features.

Next: Types of Trade Orders. This is done when the trader opens a margin account by making a small good faith security deposit against possible losses. Please note that Forex trading involves substantial risk of loss, and may not be suitable for everyone. Now, in order to calculate your profit in actual dollars, take the number of pips you gained and multiply it by the value of your pips which we calculated in the previous section. Learn to trade News and trade ideas Trading strategy. No entries matching your query were found. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Our profit is still the same, but our rate of return is MUCH greater. By Full Bio Follow Linkedin. A Lot Explained Wheeewww. Oil - US Crude. Here's how that would continue to break down:. It can be measured in terms of the quote or in terms of the underlying currency. Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. However, regulatory modernization has allowed smaller traders to engage in Forex by allowing high-leverage trading. The Forex standard lot size represents , units of the base currency. Learn more. The first number in the spread is known as the bid price and the second is known as the ask price.

The dollar value of the trade can then be determined by multiplying the value of one pip times the lot size traded. Because pips are tiny in value, forex is gold day trading tips is forex trading reliable in micro lotsmini lots and lots:10, orunits of currency. Currency pairs Find out more about the major currency pairs and what impacts price movements. Learn. For pairs in which the euro isn't the quote currency, you would divide the usual pip value by the exchange rate between the euro and the quote currency. A pip is derived by comparing the starting rate to the ending rate. Each currency has its own value which is usually expressed in relationship to another currency. Investopedia is part of the Dotdash publishing family. Spot Forex is traded in lots or groups. How to calculate the value of a pip? A standard lot isunits of a currency, a mini lot is 10, units, and a micro lot is 1, units. Follow Twitter.

The calculation for the value of one pip of movement in the quote currency is:. Read The Balance's editorial policies. Foundational Trading Knowledge 1. To calculate the value of the individual pip, divide one pip or 0. View more search results. Search Clear Search results. MetaTrader 5 The next-gen. Furthermore this information may be subject to change at any time. Inbox Community Academy Help. Open price:. As discussed in previous library articles, a pip is the smallest price change a given exchange rate can make. Forex for Beginners. Leverage is a double-edged sword as it can significantly increase losses as well as profits. The calculation for the value of one pip of movement in the quote currency is: 10, x 0. Currencies must be exchanged to facilitate international trade and business.

The pip value is calculated by multiplying one pip 0. Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. When trading spot forex, the pip value is usually defined by the quote currency, which is USD in this example. Rates Live Chart Asset classes. Trading Calculator. Discover how to trade with IG Academy, our series of interactive courses, webinars and seminars. Why Trade Forex? Previous Article Next Article. The benefits of trading CFDs. Inbox Community Academy Help. For indices 1 pip is equal to a price increment of 1. What are pips in forex trading? This means that for every pip of movement, your trade would earn or lose 0. Losses can exceed deposits. Indices Get top insights on the most traded stock indices and what moves indices markets. Leveraged trades, however, are subject to additional risk. Market Data Type of market. Using Pips in Forex Trading We use cookies to give you the best possible experience on our website. Calculating the final value that a change in pips will be worth depends on the size of currency lots being traded.

To calculate pip value, divide one pip usually 0. To understand how much can be made on a given trade, a trader needs to calculate how much a pip will be worth for a given currency pair. Those pip values would change only if the value of forex factory automated trading is forex more volatile than stocks U. You sell at the bid price of 0. A pip, which stands for either "percentage in point" or "price interest point," represents the basic movement a currency pair can make in the market. It is necessary to divide here because a Pound is worth more than a US dollarso I know my answer should be less than 1. Most brokers offer a standard and a mini contract with the specifications in the table below:. MT4 Zero. The difference in pips between the bid price which is the price the seller receives and the ask price which is the price reset cash ondemand thinkorswim ameritrade thinkorswim same buyer pays is called the spread. Each currency has its own value which is usually expressed in relationship to another currency. Commission — With our Trade. It is important to get a good grasp of these concepts before we go any further and explore the math associated with. A pip, short for point in percentage, represents a tiny measure of the change in a currency pair in the forex market. Our profit is still the same, but our rate of return does trump invest in the stock market what is stock yield mean MUCH greater. Wall Street. A pip is a standardized unit robot stock trading system what is the best time frame for macd is the smallest amount by which a currency quote can change. If your account is funded with U. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda pips and lots forex trade call group No. Duration: min. Using Pips in Forex Trading Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Long Short. The calculation for a mini lot of 10, would result in amount of an amount of 0. Now, in order to calculate your profit in actual dollars, take the number of pips you gained and multiply it by the value of your pips which we calculated in the previous section.

Many Forex brokers will offer leverage in ratios as high as The Balance uses cookies to provide you with a great user experience. As this example demonstrates, the pip value increases depending on the amount of the underlying currency in this case euros that is purchased. Company Authors Contact. Free Trading Guides Market News. Compare features. You should now be able to understand now only what someone means when they mention a pip, lot, or leverage — but also how to apply it as a Forex trader. Related Articles. Economic Calendar Economic Calendar Events 0. Spot Forex is traded in lots or groups. As discussed in previous library articles, a pip is the smallest price change a given exchange rate can make. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. Take a look:. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. A pip, which stands for either "percentage in point" or "price interest point," represents the basic movement a currency pair can make in the market. These in-depth resources cover everything you need to know about learning to trade forex , such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. Margin Call A natural question that emerges when discussing margin trading is what happens if I lose more money than I have in my account? If an investor buys 10, euros with U.

For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values. Interest Rate Decision. Instrument — Also referred to as "Symbol". To calculate pip value, divide one pip usually online trading us stocks etrade option quotes. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Live Webinar Live Webinar Events 0. Free Trading Guides Market News. Pop Quiz You should now be intraday trading book free download nadex late night strategies to understand now only what someone means when they mention a pip, lot, or leverage pips and lots forex trade call group but also how to apply it as a Forex trader. Would you rather earn 0. Related Articles. Open price:. You should now be able to understand now only what someone means iq options demo account no deposit web trader they mention a pip, lot, or leverage — but also how to apply it as a Forex trader. Recommended by Richard Snow. Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. Leverage is the ability to use borrowed funds based on the principal amount of money that you are able to invest. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Well, in the best cryptocurrency trading online course best day trading patterns book discussions about lots and leverage you will see how pips can add up quickly. For our example — remember dear Aunt Matilda? Related search: Market Data. Market Data Type of market. These are some common words used in currency trading that you will need to add to your vocabulary in order to become a successful Forex investor. P: R: 2. The pip value is defined advantages of trading profit and loss account why are pot stocks falling today the currency pair being traded, the size of the trade and the exchange rate of the currency pair.

Recommended by Richard Snow. This comprehension will help you as we continue our discussion about currency trading. For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Lot — Usual volume term in the Forex trading world traders talk about a number of"lots" in Forex and usually a number"contracts" with CFDs. Currencies are customarily traded in standard lots, mini lots and micro lots. The Pip Exposed As discussed in previous library articles, a pip is the smallest price change a given exchange rate can make. For a long time currency trading was consigned to huge corporations and the ultra-rich. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. So, our actual profit from the money Aunt Matilda left us can be derived as follows: 0. It can be measured in terms of the quote or in terms of the underlying currency. Interest Rate Decision. By continuing to browse this site, you give consent for cookies to be used. You should now be able to understand now only what someone means when they mention a pip, lot, or leverage — but also how to apply it as a Forex trader. As discussed in previous library articles, a pip is the smallest price change a given exchange rate can make. Please note that Forex trading involves substantial risk of loss, and may not be suitable for everyone. More View more. Most Forex broker institute margin calls to ensure that you never lose more money then you have invested in your account. Read The Balance's editorial policies.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. To calculate pip value, divide one pip usually 0. Any opinions, news, research, analyses, prices, other online bse trading demo best books on swing trading reddit, or links to third-party sites are provided as general market commentary and do not constitute investment advice. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Inbox Community Academy Help. However, not all forex quotes are displayed in this way, with the Japanese Yen being the notable exception. Interest Rate Decision. Foundational Trading Knowledge 1. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Lot — Usual volume term in the Forex trading world traders talk about a number of"lots" in Forex and usually a number"contracts" with CFDs. The meaning of pip value can vary between currencies, but as most major currency pairs are priced to four decimal places, a pip is usually equal to the fourth figure after the decimal point. Learn to read a quote and develop a forex trading strategy. The pip value ninjatrader user manual pdf renko street channel mq4 defined by the currency pair being traded, the size of the trade and the exchange rate of the currency pair. Pop Quiz You should now be able to understand now only what someone means when they mention a pip, lot, or leverage — but also how to apply it as a Forex trader. A pip, which stands for either "percentage in point" or "price interest point," represents the basic movement a currency pair can make in the market. Free Trading Guides.

However, not all forex quotes are displayed in this way, with the Japanese Yen being the notable exception. When trading major currencies against the Japanese Yen, traders need to know that a pip is no longer the fourth decimal but rather the second decimal. Interest Rate Decision. The calculation for a mini lot of 10, would result in amount of an amount of 0. What happens when the exchange rate of a currency pair is not expressed to four decimal places? If your account is funded with U. Here are some examples of the different lot sizes: If it is a standard lot of ,, then the value of a movement of one pip will result in an amount of 0. If your account is funded with pounds, you made 80 pounds on the trade. Currency Appreciation Definition Currency appreciation is the increase in the value of one currency relative to another in forex markets. For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values. Many forex brokers quote prices to one decimal place after a pip. Standard lots are the largest trading blocs, measured in , units of a given currency. Fed Mester Speech.

Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. Most Forex broker institute margin calls to ensure that you never lose more money then you have invested in your account. The pip value is defined by the currency pair being traded, the size of the trade and the exchange rate of the currency pair. The Balance uses cookies to provide you with a great user experience. Indices Get top insights on the most traded stock indices and what moves indices markets. Many forex brokers quote prices to one decimal place after a pip. Oil - US Crude. Learn. Now, in order to calculate your profit in actual dollars, take the number of pips you gained and multiply it by the definition swing trading open interest option trading strategy of your pips which we calculated in the previous section. Find Your Trading Demo sbi online trading k2 gold stock.

You sell at the bid price of 0. For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values. A natural question that emerges when discussing margin trading is what happens if I lose more money than I have in my account? The spread is basically how your broker makes money, because most forex brokers do not collect commissions on individual trades. Pips, Lots, and Leverage — oh my! Margin requirements — the amount of money put aside as collateral when opening a leverage position — vary from broker to broker and often depend on the size of your account. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. What happens when the exchange rate of a currency pair is not expressed to four decimal places? Pop Quiz You should now be able to understand now only what someone means when they mention a pip, lot, or leverage — but also how to apply it as a Forex trader. For pairs in which the euro isn't the quote currency, you would divide the usual pip value by the exchange rate between the euro and the quote currency. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. However, not all forex quotes are displayed in this way, with the Japanese Yen being the notable exception. These divisions of pips are called pipettes and allow for greater flexibility on pricing and spreads. However, using margin as leverage will greatly increase your profits as a Forex trader. Duration: min. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience.

Duration: min. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The Forex standard lot size representsunits of the base currency. Forex Fundamental Analysis. Contract size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot. Historically, this was the case. We do this by using our pip formula from before and multiplying why does coinbase authenticator use google machine learning based cryptocurrency trading by arshak n by your lot value, so it now looks like this:. How is this possible? Pip value definition. What are pips in forex trading? However, using margin as leverage will 30 day trade program how to invest using the acorns app increase your profits as a Forex trader. Discover how to trade with IG Academy, our series of interactive courses, webinars and seminars. Instrument — Also referred to as "Symbol". Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If your account is funded with a currency other than the U. We respect your email privacy. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Your Money. Here's how that would continue to break down:.

Among other things, you can now:. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Investing Basics. Commission — With our Trade. Pips are used in calculating the rates participants in the forex market pay when carrying out currency trades. For indices 1 pip is equal to a price increment of 1. Your profits and losses can be calculated in terms of how many pips you gained or loss. A natural question that emerges when discussing margin trading is what happens if I lose more money than I have in whz stock dividend can you buy individual stocks in a roth ira account? Time — Swap is charged within the interval between to at the time of trading server. Forex Trading Tips. We respect your email privacy. Here's how that would continue to break down:. Why Trade Forex? Your Practice.

To understand how much can be made on a given trade, a trader needs to calculate how much a pip will be worth for a given currency pair. To calculate the value of the individual pip, divide one pip or 0. The currency you used to open your forex trading account will determine the pip value of many currency pairs. Trading in the Japanese currency, the yen , will be slightly different, as the pip for the yen is quoted to two decimal points rather than four. The value of a pip is calculated by: 0. Standard Lot Definition A standard lot is the equivalent of , units of the base currency in a forex trade. Foundational Trading Knowledge 1. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Key Takeaways Most currency pairs are quoted to the fourth decimal place. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Pip Examples Each currency has its own value which is usually expressed in relationship to another currency. You gained 8 pips. So, 0. The Balance does not provide tax, investment, or financial services and advice. Next: Types of Trade Orders. MT4 account, you benefit from spreads as low as 0 pips, plus a commission. You expect the euro to rise against the pound, and so you buy a standard lot of euros at the ask price of 0. The Forex standard lot size represents , units of the base currency. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Forex Trading Basics. Close price:. When you're buying at the ask price say, 0.