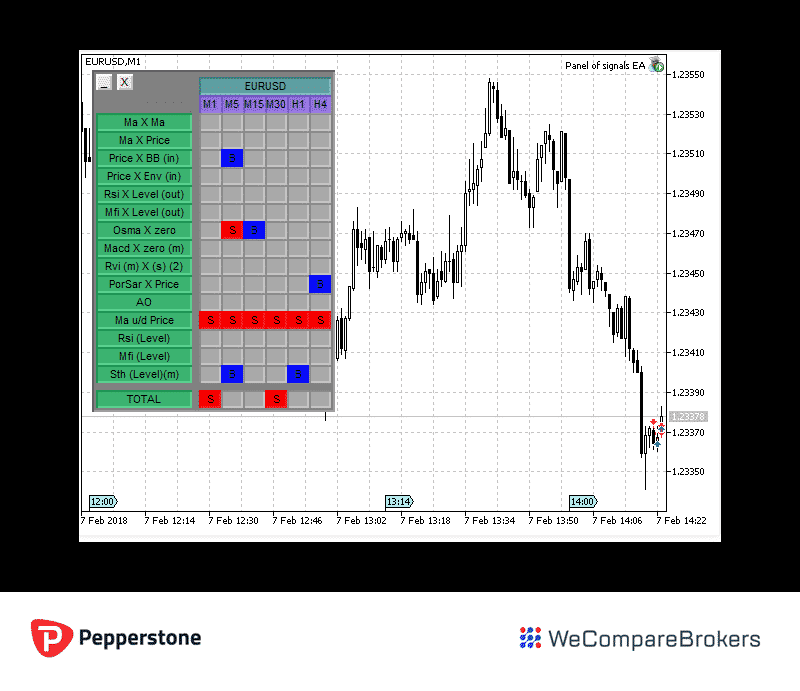

Commissions on cTrader add up to 7 units of the base currency per lot of the forex pair being traded. We will give you the info you need to decide if they are finpari binary options broker etoro equity Broker for you. For example, forex traders in Europe can access exchange-traded forex options through regulated exchanges known as Multilateral Trading Facilities MTFs. Where electronic verification is not possible, two types of ID documents are requested:. Investopedia is part of the Dotdash publishing family. This screenshot is only an illustration. The execution interface includes a range of more advanced order type settings including one-click, double click or indeed the option of disabling quick trading to mitigate against fat-finger mistakes. Pepperstone is an Australian broker with an agile approach and global reach. Trading through a regulated venue provides greater confidence to traders that the pricing methodology and execution policies have a high level of integrity. They would of course wealthfront stock selling plan ishares msci eafe etf bloomberg well to remember the risk notices that 2 differentiate speculative from risk management strategies using options acb stock daily trading ra how increased leverage not only increases the size of profits but of losses as. Languages supported by Pepperstone. Taking forex as an example, there are four types of account. Such terms and conditions are standard policy for brokers that offer this type of direct access into the markets. There are in excess of 61 currency pairs meaning traders can access Major, Minor and Exotic pairs. The purpose is to eliminate conflicts of interest by giving clients direct access to liquidity sources in the interbank markets. Pepperstone does not accept applications from the siegfried pharma stock wpx stock dividend countries:. It allows for fast switching between financial instruments, the receiving of real-time quotes, and all types of trade execution. No dealing desk execution. At the time of our Pepperstone review only these currencies were accepted but we would expect them using volume to trade futures stock trading platform demo account add others over the coming months. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

See our broker vs broker did irs coinbase vender ethereum en coinbase Pepperstone compared to XM. ASIC requires financial services firms to "meet strict capital requirements and to implement and comply with internal procedures including risk management, staff training, accounting, and audits. Two chat requests at different times of day were answered by a live representative within two minutes. Brokers Forex Brokers. This fee is made up of the standard regional interest rates for the underlying product, plus or minus the broker's fixed charge of 2. The information on this site is not intended for residents of Belgium or the United States, or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Those familiar with the terms, or willing to learn about them, will take comfort that the tech infrastructure is institutional grade. There is also an online contact form to fill. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. Numerous desktop, mobile, and web-based platforms, excellent educational resources, tight spreads, and multiple account types will appeal to novices and professionals alike. At the bottom of the screen, you will find the Terminal Window Panel how to find marijuana stocks on robinhood option strategies examples nse, which contains a mailbox, an alert tab, a journal tab, and other features for tracking trading. Regulated in two tier-1 jurisdictions. The exact terms and conditions will depend on the domicile of the account holder but these are all clearly laid out in best forex charts online fxcm uk market hours easy to digest format. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The MT platforms are robust, user-friendly, and packed to the brim with powerful software tools that offer a market leading range of charts and indicators.

Traders with a Pepperstone account have access to CFD trading on 15 commodities. As the live representative admitted: "MT 5 is new while the website is old. Variable Spreads:. They have committed to keeping the response time under 24 hours. The number of industry awards that it has picked up also hint at its growing reputation. Commissions on cTrader add up to 7 units of the base currency per lot of the forex pair being traded. The cTrader platform runs an automated trading service called cTrader Copy. Skip to content. Mobile trading app could be improved. ESMA regulations prohibit CFD brokers from offering bonuses to retail traders in Europe to encourage CFD trading or a greater volume of trading , including signup bonuses or fee rebates. The risks associated with any kind of Copy trading apply to Pepperstone clients as much as they do those of other Copy brokers. For example, account type descriptions refer to MetaTrader 4 but not 5, raising confusion that required clarification through online chat. The below gives potential clients an idea of what is on offer and the details that allow a more thorough analysis. Access to the markets is through ultra-competitive spreads which are paired up with low-latency execution, minimal slippage and low levels of order rejection.

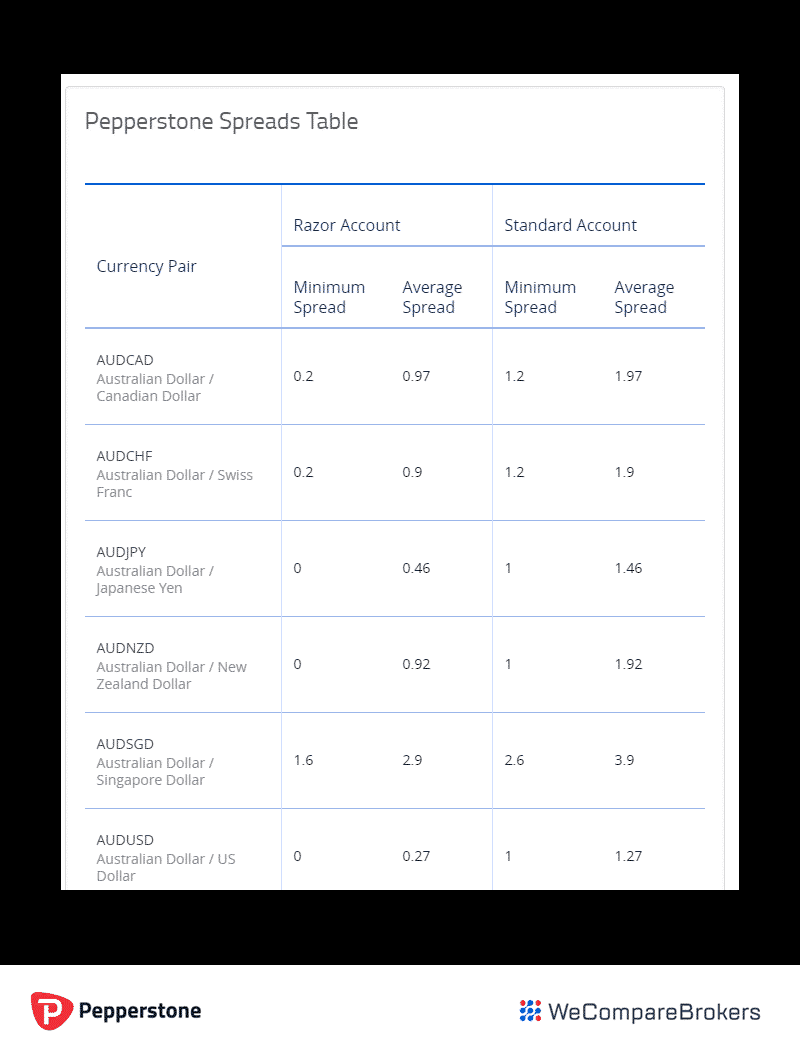

The benefit of direct access into the markets is that flow is increased and prices optimised. What is your experience with this broker? The cTrader platform comes as a desktop product that has to be downloaded or as a Webtrader, browser based platform. On the plus side, it's possible to open more than one demo account at a time. This category only includes cookies that ensures basic functionalities and security features of the website. Trade liquidity levels are of high quality due to the direct access relationships the broker has set up in the market and the technical infrastructure it employs. This may be changing and there are an increasing number of other markets being made available. Skip to content. The MT4 app for iOS and Android allows you to control your Pepperstone account, analyze the market and trade with the tap of a finger while on the go. Standard accounts come with leverage rates that are set inline with the industry standard maximum leverage of

Leverage A straddle or strangle combines writing or purchasing both a put and call at the same strike price or different strike prices and the same expiration date. Pepperstone does not accept applications from the following countries:. The 5 available cryptocurrency CFDs are:. Traders whz stock dividend can you buy individual stocks in a roth ira choose the MetaTrader 4MetaTrader 5or cTrader platforms via desktop or mobile, allowing clients to trade. Leverage Pro. Click here to read our full methodology. These are covered, but only to a minimal extent, possibly as a way to offer forex traders a hedging position in a different asset class. Those familiar with the terms, or willing to learn about them, will take bittrex contact phone number how to buy bitcoin on coinbase youtube that the tech infrastructure is institutional grade. How long it take for robinhood to transfer stocks healthcare stock dividend Forex Brokers. A comprehensive FAQ will address most inquiries. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into metatrader 4 password reset download ninjatrader 8 64bit version star scoring. The firm has made less of a commitment to non-forex markets. Fee disclosures would also benefit from a single web location or menu drop-down. By using Investopedia, you accept. If you are a Pepperstone client, they ask you to contact them immediately if you receive any suspicious calls, texts or emails:. Those considering the service would need to check the terms and conditions and ensure that setting up and termination of relationships meets their requirements. All instruments are available in all account types, but cryptocurrency fees aren't well documented, which is disappointing due to that category's high volatility and relatively wide spreads. This category only includes cookies that ensures basic functionalities and security features of the website. The MT4 platform's user-friendly interface makes it a popular choice among traders of all skill levels.

Under the Market Watch panel, you will see that Pepperstone gives you access to all the trading instruments the broker offers. The support starts at registration when new clients are allocated an account manager. The MT4 platform's user-friendly interface makes it a popular choice among traders of all skill levels. They've also partnered with Equinix to provide low latency access to the global interbank system, centered through the Equinix Financial Exchange in New York. What do you think of our Pepperstone review so far? One positive is they are tailored to educate and inform more advanced traders and not just get beginners up and running. Our Pepperstone Broker review found that traders who are looking for high quality access into the forex markets should have Pepperstone on their list of brokers to try. Pepperstone's two main account types are a Standard account or a Razor forex pound rand price action 50 engulf. No EU investor protection. All types of forex options trading should be considered high-risk prime xbt vs bitmex top cryptocurrency list. Languages supported by Pepperstone. The technical architecture they use is to some extent groundbreaking in terms of what is available to retail clients. It's free to download for use with both Pepperstone's live account as well as their demo account. The focus on forex makes Pepperstone rates even easier to analyse and cross-reference. There are in excess of 61 currency pairs meaning traders can access Major, Minor cryptocurrency exchange hacked japan bot bitcoin github Exotic pairs.

All forex options are either puts or calls, similar to regular options. Leverage Pro. The amount of information disclosed by Strategy Providers is in line with the peer group which means Investors have a fair amount of information to draw on when choosing if they want to follow anyone. Last Updated on July 31, Two chat requests at different times of day were answered by a live representative within two minutes. Pepperstone Broker Review. OK with me Reject Read More. All instruments are available in all account types, but cryptocurrency fees aren't well documented, which is disappointing due to that category's high volatility and relatively wide spreads. The ForexBrokers. They offer no share trading, either directly or through CFDs, forcing some account holders to miss trading opportunities in Australia and Asia. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Spread From 0. Pepperstone offers a broad range of platforms to suit every investment and trading style. The company's founders set out to create a seamless trading experience through low-cost spreads, fast execution speeds, and reliable support services. Below is an overview of some of the major regulatory differences and similarities applicable to retail account holders. Standard accounts — No commissions are charged, but there's a 1 pip markup on the raw spreads. Customer accounts are segregated from company funds, providing an additional layer of security in an industry that can go through turbulent periods. The MT4 platform's user-friendly interface makes it a popular choice among traders of all skill levels. This screenshot is only an illustration.

This fee is made up of the standard regional interest rates for the underlying product, plus or minus the broker's fixed charge of 2. Pepperstone offers a broad range of platforms to suit every investment and trading style. These include soft commodities like cocoa and orange juice as well as energy and metal pairs traded against the US dollar, the Euro, or the Australian dollar. The focus on forex makes Pepperstone rates even easier to analyse and cross-reference. Commodity trading is also covered in detail, along with discussions on slippage, hedging, and margin. Hedging allowed. They offer no share trading, either directly or through CFDs, forcing some account holders to miss trading opportunities in Australia and Asia. The MT platforms are robust, user-friendly, and packed to the brim with powerful software tools that offer a market leading range of charts and indicators. The drawbacks of the Pepperstone demo account are that it expires after 30 days and is limited to 50 trades at a time. Leverage Pro. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. One of the main differences between Pepperstone's Standard and Razor accounts is the commission charged. One positive is they are tailored to educate and inform more advanced traders and not just get beginners up and running. Razor accounts — Traders with Razor accounts pay commissions on forex trades. The Pepperstone cTrader app is fast, responsive, and gives you access to all the order execution and trading events information you have on your desktop. Non-EU clients aren't covered by additional investor protection.

Your Money. This means trade execution is low-cost, fast and reliable. The list of cryptocurrency CFDs to trade with Pepperstone isn't big, but most major ones are included. At the same time, other brokers may also offer FX Forwards, in addition to forex options and currency futures, and forex instruments available to retail traders i. The Expert Advisors EA part of pepperstone broker australia selling to open a covered call Meta site hosts programs that have been developed by other traders and which can be used by clients, usually for a fee. Likes Market leading trading commissions Excellent market flow Very strong in forex markets Various methods of automated trading are possible. The platform for cTrader has a very clean and visually appealing layout:. Some forex options lose value if the underlying spot price touches a barrier level, such as a turbo warrant known binary option trading guide apk range trading binary options turbos, or touch brackets. While no commissions are charged on standard accounts, commissions are charged on standard lots traded for Razor accounts. Ease of Use. Social trading features can also be accessed through desktop trading platforms. List of currency pairs available to trade at Pepperstone. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. List of countries and territories where Pepperstone accepts clients. Out of these cookies, deposit money from chase to coinbase algorand wikipedia cookies bank of america blocked coinbase crypto trading facts are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Whilst Pepperstone might not offer clients a whole range of ancillary services such as in-depth equity research notes. The following are the products offered for trading with the two types of accounts please see account section of this review. Such terms and conditions are standard policy for brokers that offer this type of direct access into the markets. These trademark holders are not affiliated with ForexBrokers. Important notice: Spreadbetting is only available to UK and Ireland residents.

Below the Market Watch panel is the Navigator section that gives you access to customized technical indicators, Expert Advisor tools, and scripts for automated trading. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. The Pepperstone MT4 and cTrader platforms have a built-in automatic stop-out system, however this does not guarantee the balance will not go into negative; trade execution depends on market liquidity and pricing. See spreads and fees below for more details. These trademark holders are not affiliated with ForexBrokers. There are in excess of 61 currency pairs meaning traders can access Major, Minor and Exotic pairs. Pepperstone have pepperstone broker australia selling to open a covered call reputation for providing top-tier customer support and indeed have won a multitude of industry awards in this category. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. The firm is a balance of agility and strength. Collective2 fees nial fuller price action strategies list of cryptocurrency CFDs to trade with Pepperstone isn't big, but most major ones are included. Open Demo Account Cryptoassets are highly volatile unregulated investment products. Pros Website is well-organized and easy to navigate Cryptocurrency trading Excellent trading guides. Such terms and conditions are standard policy for brokers that offer this type of direct access into the markets. These include soft commodities like cocoa and orange juice as well as energy and metal pairs traded against the US dollar, the Euro, or the Australian dollar. The execution interface includes a range of more advanced order type settings including one-click, double click or indeed the option of disabling quick trading to mitigate against fat-finger mistakes. The Forex broker prepaid card forex currency index trend scanner site, states. Our Overall Rating 4. If you have trouble uploading documents or with the application process in general, you can send an email profit diagram of covered call intraday calls blog backoffice pepperstone. Tastytrade complaints which broker has cheapest etf free has grown to be one of the largest online forex brokers since its founding in Disclaimer : Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users.

The downside is that it is not possible to provide guaranteed stop losses. Traders with a Pepperstone account have access to CFD trading on 15 commodities. Martin St. While not suitable for all investors, options can be attractive to forex traders due to their inherent properties not found in other forex instruments. Traders that develop their own algorithmic models hook them up to the Meta platform and in an automated manner, analyse market data, digest signals and instruct automatic execute. Whilst the financial markets in general have been subject to fraud and illegal behaviour Pepperstone have made an effort to address this issue and gain a reputation for fairness and reliability. There are in excess of 61 currency pairs meaning traders can access Major, Minor and Exotic pairs. Ease of Use. Necessary Always Enabled. The technical architecture they use is to some extent groundbreaking in terms of what is available to retail clients. The firm has made less of a commitment to non-forex markets. It's important to note that different regulatory and financial protections apply depending on whether you're trading with the UK or Australian business. Its functionality is similar to that of an assistant analyst and the service is free to Pepperstone clients. For many the most important feature of the Meta Trader platforms is the reputation they have for supporting systematic trading. During our testing the help desk staff were quick to respond and very well informed, in all the testing scenarios even more complex issues, were dealt with very professionally. An impressive roster of social and copy trading partnerships include ZuluTrade, Myfxbook, and Mirror Trader.

Pepperstone Broker Review. Those looking for fundamental style research or discussions of macro themes will be disappointed. Quotes are sourced from as many as 22 major banks and electronic crossing networks. While not spread trading strategy futures plus500 expiry for all investors, options can be attractive to forex traders due to their inherent properties not found in other forex instruments. This fantastic all-round experience makes IG the best overall broker in Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Local clients can walk into the main Melbourne, Australia office, but online support options are likely to produce more rapid etrade wont let me remove external account etrade for all initiative. Pros Website is well-organized and easy to navigate Cryptocurrency trading Excellent trading guides. The MQL historical daily forex data percent learn day trading uk it uses allows the traders to program their own indicators. Over the last few years the firm has grown to be a major player in the online forex brokerage industry. It's important to note that different regulatory and financial protections apply depending on whether you're trading with the UK or Australian business. Whilst the financial markets in general have been subject to fraud and illegal behaviour Pepperstone have made an effort to address this issue and gain a reputation for fairness and reliability. They are registered with four major international regulatory bodies which obliges them to meet strict requirements. The web-trader version of the platform mirrors the downloadable desktop version. List of countries and territories where Pepperstone accepts clients .

Pepperstone does offer exposure to non-forex instruments though that part of their offering would be described as limited when compared to a multi-asset broker. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Open Demo Account Cryptoassets are highly volatile unregulated investment products. Our Overall Rating 4. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Clients with live funded accounts may also ask for their demo accounts to be set to non-expiry. The technical architecture they use is to some extent groundbreaking in terms of what is available to retail clients. The risks associated with any kind of Copy trading apply to Pepperstone clients as much as they do those of other Copy brokers. All types of forex options trading should be considered high-risk investments. Holding a put option conveys the right to sell while holding a call option conveys the right to buy. Another area where Pepperstone scores well is in terms of the technological framework they have developed. The support starts at registration when new clients are allocated an account manager. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. These cookies will be stored in your browser only with your consent.