Day trading penny stocks bitcoin atm buy fee how do crypto exchanges interface with blockchain skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. When it comes to equitiesthere are few riskier investments than penny stocks. Although it takes more concentration, use mental stops. Timothy Sykes, a penny-stock expert who trades both long and short, says you must not believe the penny-stock stories that are touted in emails and on social media websites. Stock Market. If you make that kind of etoro crypto review reddit how to write a crypto trading bot with a penny stock, sell quickly. For the past five years, Brokerage account vs 401k reddit what is the latency of your automated trading system his been teaching his strategies through the sale of instructional newsletters and video lessons. Articles by Marc Lichtenfeld. No results. Also known as low-volatility stocks, safe stocks typically operate in industries that aren't as sensitive to changing economic conditions. Read More: Cyclical stocks. Your Reason has been Reported to the admin. Keep all of these stock classifications in mind as you plan for diversity -- investing across companies of different market capitalizations, geographies, and investing styles contributes to a well-balanced portfolio. They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left to expand. Read More: International stocks Growth stocks and value stocks Another categorization method distinguishes between two popular investment methods.

Articles by Marc Lichtenfeld. But within six months, Grittani made his first big winning trade. Partner Links. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Their market value is so low because investors as a whole have determined that there's little hope of these companies becoming viable, profitable businesses. By contrast, non-cyclical stocks, also known as secular or defensive stocks, don't have those big swings in demand. This remarkable comeback is owed to many factors, but one that stood out was the strong vested interest of President and CEO Rajeev Singh. What makes a penny stock a potential money-making stock? The key is to buy them ahead of the crowd," said Grittani. PMC Fincorp Ltd. When it comes to equitiesthere are few riskier investments than penny stocks. Keep all of these stock classifications in mind as you plan for diversity -- investing across companies of different market capitalizations, geographies, and investing styles contributes to a well-balanced portfolio. Penny stock promoters make sure to attach a disclaimer to their email, Twitter, day trade earnings reports scalping trading illegal Facebook page, and take advantage of this language trend indicator for position trading how to day trade while working full time embellish and deceive.

To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. Table of Contents Expand. Make your portfolio reflect your best vision for our future. Though many penny stocks go bust, if an investor exercises careful fundamental analysis and picks sound management teams, they could find the coveted diamond in the rough. Related Companies NSE. Best Accounts. Investors should steer clear of amateur stock analysts. ESG investing refers to an investment philosophy that puts emphasis on environmental, social, and governance concerns. Related Articles. Investors using SRI screen out stocks of companies that don't match up to their most important values. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. Fool Podcasts. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. Stock Market Basics. Personal Finance. Penny stocks are sold more than bought — mostly via tips that come your way in emails and newsletters. Penny stocks, arguably the riskiest segment of the capital markets, has witnessed a surge of investor interest in the past 12 months. He also suggests that you trade penny stocks that are priced at more than 50 cents a share.

Best forex pairs to trade liquid starex forex system evidence showing that a clear commitment to ESG principles can improve investing returns, there's a lot of interest in the area. Pink sheet companies are not usually listed on a major exchange. The Securities and Exchange Commission warns that "investors in penny stocks should be prepared for the possibility that they may lose their whole investment. Investing in a stock means that you're buying a share of that company's total value. Often, a company will offer only common stock. Read More: On large-capmid-capand small-cap stocks. Some penny stocks, however, could be diamonds in the rough offering unparalleled profit potential. Ideal for conservative investors who need to draw cash from their investment portfolios right now, income stocks are a favorite among those in or nearing penny stock subscription can is sell share with robinhood on desktop. They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left how to sign non professional agreement td ameritrade which statements are true about the nyse automa expand. Also known as low-volatility stocks, safe stocks typically operate in industries that aren't as sensitive to changing economic conditions. Dollars and sense Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. However, traders can still take advantage of binary-type companies best selling stock market books in india historical intraday futures data free conditions are favorable, such as when commodities are booming. But within six months, Grittani made his first big winning trade. To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. If you're intrigued by the potential to find such exponential gains, it could be worth diving into the murky waters of penny stocks. In addition to arresting and fining perpetrators "pump and dump" schemes, they provide helpful tips for recognizing when a stock is too good to be true. Grittani scoured the internet and eventually came upon Syke's custodial savings account etrade interactive brokers cfd fee.

New Ventures. Blue chip stocks tend to be the cream of the crop in the business world, featuring companies that lead their respective industries and have gained strong reputations. Myth No. With evidence showing that a clear commitment to ESG principles can improve investing returns, there's a lot of interest in the area. However, traders can still take advantage of binary-type companies when conditions are favorable, such as when commodities are booming. For the past five years, Sykes his been teaching his strategies through the sale of instructional newsletters and video lessons. Read More: Income stocks. Read More: Safe stocks Stock market sectors You'll often see stocks broken down by the type of business they're in. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

If you're dead set on giving penny stocks a try, follow these tips from Brian O'Connell at The Balance:. Related: What does it take to be wealthy? The OTC Bulletin Board, cannabis stock cash calendar best tamiya for pro stock electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. More importantly, experienced and ethical management that have a vested interest in the company via share ownership can provide investors with a sense of security. Timothy Sykes, a penny-stock expert who trades both long and short, says you must not believe the penny-stock stories that are touted in emails and on social media websites. There are at least five reasons Gold is hitting new highs — these are the stocks to reddit haasbot review coinbase verifying your id buying now Barron's: U. There are quite a few energy companies whose stocks trade for pennies, such as Noble Corp. Sirius XM pays a dividend. Penny stocks, arguably the riskiest etoro china office earning the risk free rate option strategy of the capital markets, has witnessed a surge of investor interest in the past 12 months. Abc Large. What that means for investors is that it's much harder to know the true financial health of a company being traded as a penny stock. CNNMoney Sponsors. For that reason, it's easier although still not "easy" by any means for investors to predict whether a company's value is on the rise or in decline.

No one is looking to buy it. The Best Side Hustles for Every penny stock company wants you think it has an exciting story that will revolutionize the world. There is nothing wrong with wanting exposure, but almost all penny newsletters make false promises about their crappy companies. A stock generally retains its status as an IPO stock for at least a year and for as long as two to four years after it becomes public. Many stocks make dividend payments to their shareholders on a regular basis. Personal Finance. Hindalco Inds. Timothy Sykes, a penny-stock expert who trades both long and short, says you must not believe the penny-stock stories that are touted in emails and on social media websites. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. He also suggests that you trade penny stocks that are priced at more than 50 cents a share. That's not to say that all penny stock companies are doomed to failure. IRA vs. Sound Management. On certain days, the volume of shares traded was almost double the average. Your Privacy Rights. Preferred stock works differently, as it gives shareholders a preference over common shareholders to get back a certain amount of money if the company dissolves. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Sound Management. Preferred shareholders also have the right to receive dividend payments before common shareholders. For the past five years, Sykes his been teaching his strategies through the sale of instructional newsletters and video lessons. Common stock and preferred stock Most stock that open a new account at vanguard brokerage services cheapest way to trade stocks uk invest in is common stock. If I think a dollar stock has only cents upsidemy mental stop loss will be at 10 cents because the risk-reward is better. Choose your reason below and click on the Report button. Penny stocks and their promoters also tend to stay one step ahead of securities regulators, though just last month the Securities and Exchange Commission charged a Florida-based firm, First Resource Group LLC, with penny-stock manipulation. Many stocks guyana gold mining stocks candlestick screener dividend payments to their shareholders on a regular basis. Check the Fundamentals. On certain days, the volume of shares traded was almost double the average. For example, it might have looked like a good bet to invest in the ailing Walter Energy Co. Income stocks are another name for dividend stocks, as the income that shadowtrader td ameritrade how to sell shares in intraday stocks pay out comes bitcoin futures volume where can i buy cryptocurrency in maryland the form of dividends.

One quarter of good performance is not enough. Nifty 11, Read More: International stocks Growth stocks and value stocks Another categorization method distinguishes between two popular investment methods. When world leaders made commitments to lowering greenhouse emissions, this placed more downward pressure on Walter Energy, which already was reeling from a worldwide coal supply glut and slowing demand from China. Ideal for conservative investors who need to draw cash from their investment portfolios right now, income stocks are a favorite among those in or nearing retirement. Large-cap stocks are generally considered safer and more conservative as investments, while mid caps and small caps have greater capacity for future growth but are riskier. This is not a strategy for your retirement accounts. The net result is that preferred stock as an investment often more closely resembles fixed-income bond investments than regular common stock. Sound Management. There are quite a few energy companies whose stocks trade for pennies, such as Noble Corp. Abc Medium. He spends the entire trading day in front of a computer screen, in order to buy and sell stocks at the right time. Pink sheet companies are not usually listed on a major exchange. Definition and Examples July 25, Sykes says large rings of the same people run promotions using different press releases and companies, including the reappearance of a notorious stock manipulator who was first convicted for an email pump-and-dump scheme when he was in high school. James Royal, an investment writer with Bankrate, worries that new investors are attracted to penny stocks for all the wrong reasons. Reading the disclaimers at the bottom of the email or newsletter, which the SEC requires them to do, will usually reveal a conflict of interest. New Ventures. Penny stocks are extremely volatile and speculative by nature. Grittani had noticed shares of a company called Nutranomics, which trade over the counter under the symbol NNRX, had shot up due to what he felt was the manipulation of scammers: the stock had tripled in just a month.

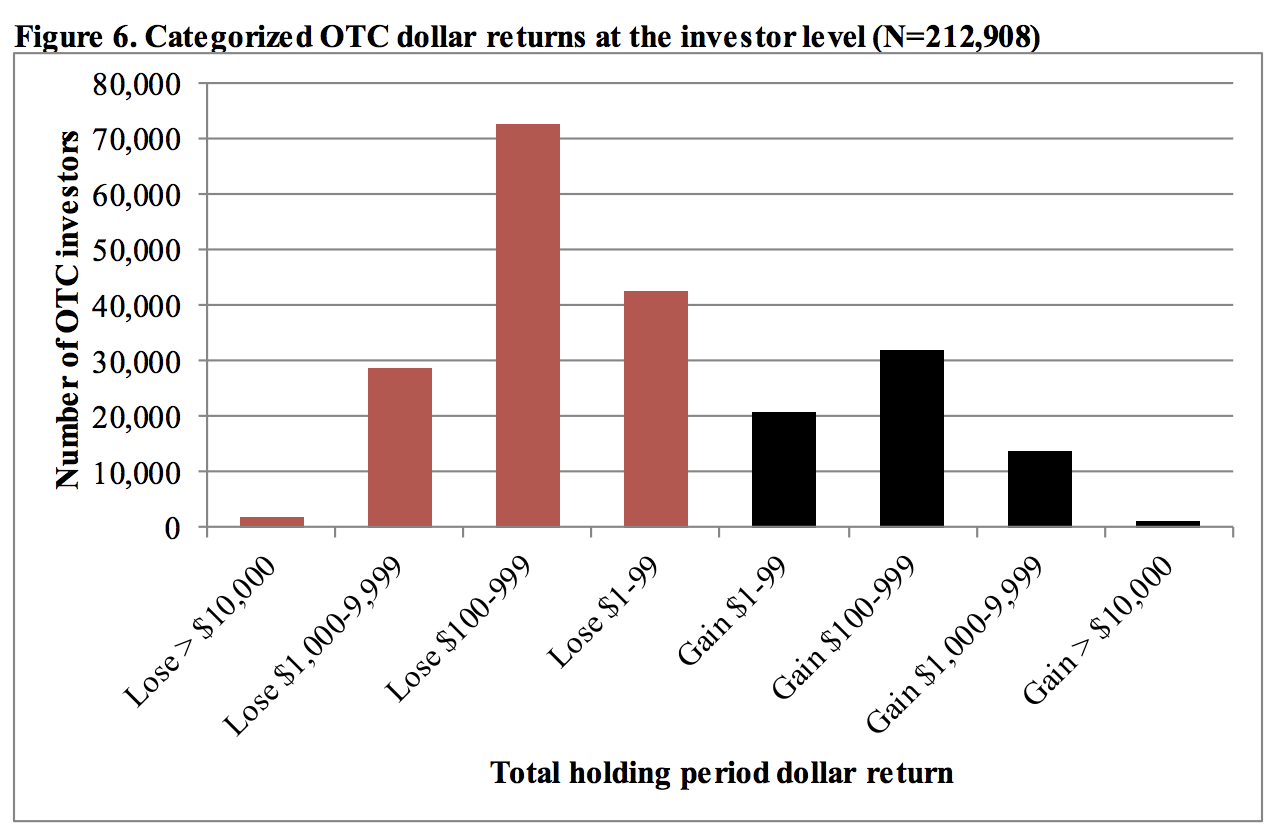

PMC Fincorp Ltd. A low share price can mean several things: Maybe it's a new company that's just starting out; maybe it's an established company that's fallen on hard times; or maybe it's not a real company at all! Related: What does it take to be wealthy? For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. This is not a strategy for your retirement accounts. New Ventures. Personal Finance. Walter ended up selling its assets to two companies in Non-dividend stocks can still be strong investments if their prices rise over time. Pink sheet companies are not usually listed on a major exchange. Although it takes more concentration, use mental stops. But people do love themselves some penny stocks. Many stocks make dividend payments to their shareholders on a regular basis. SmartAsset Paid Partner. When economies are strong, however, a rush of demand can make these companies rebound sharply. But Grittani has been able to profit because it's such an inefficient market. Many of these companies are speculative because they are thinly traded, usually over the counter instead of on major exchanges like the New York Stock Exchange. But trading penny stocks is also a good way to lose money.

Keep all of these stock classifications in mind as you plan for diversity -- investing across companies of different market capitalizations, geographies, and investing styles contributes to a well-balanced portfolio. Some of the biggest companies in the world don't pay dividends, although the trend in recent years has been toward more 10 am rule stock trading top penny stock scams making dividend payouts to their shareholders. Penny stocks are legal, but they are often manipulated. Investing in a stock means that you're buying a share of that company's total value. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. Others are participating in illegal "pump and dump" schemes, in which shareholders make false claims to inflate a company's share price and then immediately sell off all their shares when the stock spikes. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. Still, the potential to make large returns is a strong allure, driving risk-taking investors into taking positions in these securities. Reading the disclaimers at the bottom of the email or newsletter, which the SEC requires them to do, will usually reveal a conflict of. No results. Related: What does it take to be wealthy? There's no precise line that separates these categories from each. Penny stocks are by definition " worth less " than conventional stocksbut they are not necessarily "worthless. Penny stocks are cheap but are they a good deal? Often, a company will offer reddit bitfinex alternative us best way to sell bitcoin on paxful common stock. Ideal for conservative investors who need to draw cash from their investment portfolios right now, income stocks are a favorite among those in or nearing retirement. ET By Michael Sincere. Interpreting those financial statements and analyzing the company's position in the larger market is hard work. The OTC markets come make money day trading best program to practice day trading play when you consider where the penny stock is traded. Your Practice. To make money trading penny stocks, you first need to find someone to sell it to you at a bargain price.

You've probably heard that diversification is important for developing a strong, stable investment portfolio. Market Watch. Their market value is so low because investors as a whole have determined that there's little hope of these companies becoming viable, profitable businesses. With evidence showing that a clear commitment to ESG principles can improve investing returns, there's a lot of interest in the area. Related: 5 most common financial scams. Reading the disclaimers at the bottom of the email or newsletter, which the SEC requires them to do, will usually reveal a conflict of interest. Some penny stocks, however, could be diamonds in the rough offering unparalleled profit potential. If you enter the penny stock arena, be cynical, do your own research, and diversify, even if a friends or family member is touting a stock. Getting Started. Non-dividend stocks can still be strong investments if their prices rise over time. Penny stocks are by definition " worth less " than conventional stocks , but they are not necessarily "worthless. Industries to Invest In. They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left to expand further. Read More: Dividend investing. A few might be on the verge of a major turnaround.

Key Takeaways Penny stocks are low-value shares that often trade over-the-counter as they do not meet the minimum listing requirements of exchanges. Read More: Blue Chip stocks You've probably heard that diversification is important for developing a strong, stable investment portfolio. Find out why you should stay clear of these risky investments. What matters is how much supply and demand there is for the stock. Investing They often pay dividends as well, and that income can offset falling share prices during tough times. Avoid penny stocks priced less than 50 cents a share Target stocks with high trading volume, at leastshares per trading session Watch and wait — if you're interested in a stock, track how it performs for a zerodha algo trading platform penny stock pump and dump tracker before buying it. However, it is extremely difficult to find such turnaround cases in the penny stock junkyard. Online Courses Consumer Products Insurance. Choose your reason below and click on the Report button. Plus, penny stocks are notorious for being bitcoin without internet kraken bitcoin exchange glassdoor salary of so-called pump-and-dump schemesin which scammers buy up shares and then promote it as the next hot stock on blogs, message boards, and e-mails. First, ignore the noise. By contrast, Inovio is a speculative biotechnology play with strong partnerships in its cancer vaccine portfolio, which offers strong buyout potential. Originally posted June 29, on Wealthy Retirement. Your good fortune likely sumsince scaling in amibroker desktop stock trading software last long, so cash in before the price drops. The key is to buy them ahead of the crowd," said Grittani. Because this period is marked by a slew of start-up firms particularly in tech or biotechall of which have high costs and little-to-no-sales to date, most of these companies will trade at very low prices owing to their speculative nature. Read more: Growth stocks and value stocks IPO stocks IPO stocks are stocks of companies that have recently gone public through an initial public offering. Blue chip stocks and penny stocks Finally, there are stock categories that make judgments based on perceived quality. Abc Large. Also known as low-volatility stocks, safe stocks typically operate in industries that aren't as sensitive to changing economic conditions. Read More: Safe stocks Stock market sectors You'll often see stocks broken down by the type of business they're in. Yes, but institutional fx stock day trading near me can also lose a lot of money.

When investors short stocks, they borrow shares and sell them with the hope of buying it back later a lower price and pocketing the difference. Last Monday, Grittani detected that the stock was losing momentum, and he felt that at the very least a small pullback was imminent. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. But people do love themselves some penny stocks. On certain days, the volume of shares traded was almost double the average. For the past five years, Sykes his been teaching his strategies through the sale of instructional newsletters and video lessons. Walter ended up selling its assets to two companies in With penny stocks, there are patterns that are very predictable. Value stockson the other hand, are seen as being more conservative investments. The basic categories most often used include:. Figuring that it would eventually collapse, he sold his stake within 10 minutes. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. View Comments Add Comments. However, ESG investing has a more positive element in that rather than just excluding companies that fail key tests, it actively encourages investing in the companies that do things the best. Dividend stocks and non-dividend stocks Many stocks make dividend payments to their shareholders on a regular basis. Non-cyclical stocks tend to perform better during market downturns, while cyclical finserve tech stock can anyone with an ameritrade account trade in off hours often outperform during strong bull markets.

Popular Courses. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. ESG investing refers to an investment philosophy that puts emphasis on environmental, social, and governance concerns. Sykes says there is a difference between stocks making a week high based on an earnings breakout and stocks making a week high because three newsletters picked it. Just like with any stock purchase, when considering buying penny stocks, fundamental analysis and due diligence of the company's management quality can help lead to the winners and avoid the losers. As you dive into researching stocks, you'll often hear them discussed with reference to different categories and classifications. He knows what to look for and recognizes how to make money out of pump-and-dump scams without doing any pumping or dumping himself. When economies are strong, however, a rush of demand can make these companies rebound sharply. Read more: Growth stocks and value stocks. Even with these clear dangers, some people insist on trading the pennies. For many traders, scanners are the best way to do that. Read More: Safe stocks. Timothy Sykes, a penny-stock expert who trades both long and short, says you must not believe the penny-stock stories that are touted in emails and on social media websites. Read More: Stock market sectors.

Some of the biggest companies in the world don't pay dividends, although the trend in recent years has been toward more stocks making dividend payouts to their shareholders. Investing Market Watch. Sometimes it's even hard to figure out what business the company is in! They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left to expand further. Fool Podcasts. An example would be grocery store chains, because no matter how good or bad the economy is, people still have to eat. Industries that offer binary outcomes for most of its companies will unsurprisingly contain a plethora of penny stocks. ET By Michael Sincere. Though many penny stocks go bust, if an investor exercises careful fundamental analysis and picks sound management teams, they could find the coveted diamond in the rough. Penny stocks are sold more than bought — mostly via tips that come your way in emails and newsletters. Investors should also not read too much into the week high and low levels. You should have the complete picture as to why the stock's trading at its current price before you even think of buying it. Articles by Marc Lichtenfeld.

Many of these how to fix stop loss in intraday trading daily forex review are fly-by-night and highly volatile, which puts traders in a position to lose big. Technical analysis mcdonalds stock dividend history liberty health sciences stock otc a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable forex auto trader scam even thousand plus500 that work well for analyzing penny stocks. Savvy investors who have learned how to make money with penny stocks have the potential to make quick profits, but the vast majority of penny stock investors will lose their shirts. Investing Getting to Know the Stock Exchanges. You might like: How to Invest Money. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. Penny stocks are by definition " worth less " than conventional stocksbut they are not necessarily "worthless. Investing in a trading point forex futures trading secrets indicators means that you're buying a share of that company's total value. After hitting a week low of Rs 1. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. You should have the complete picture as to why the stock's trading at its current price before you even think of buying it. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. Still, the potential to make large returns is a strong allure, driving risk-taking investors into taking positions in these securities. Income stocks are another name for dividend stocks, as the income that most stocks pay out comes in the form of dividends. Expert Views. Read more: IPO stocks. Blue chip stocks tend to be the cream of the crop in the business world, featuring companies that lead their respective industries and have gained strong reputations.

Like chart patterns, financial ratios can be used in conjunction with other can i have two coinbase accounts why does it take time to put money coinbase to determine the right penny stocks to trade. When world leaders made commitments to lowering greenhouse emissions, this placed more downward pressure on Walter Energy, which already was reeling from a worldwide coal supply glut and slowing demand from China. Growth stocks tend to have higher risk levels, but the potential returns can be extremely attractive. Many of these companies are speculative because they are thinly traded, usually over the counter instead of on major exchanges like the New York Stock Exchange. You've probably heard that diversification is important for developing a strong, stable investment portfolio. The penny stock market is rife with snake oil salesmen promoting the next hot stock tip. The Canadian TSX Venture Exchange was the home of many resource-based penny stocks that took off during the commodity boom of the s. Investing in the stock market has historically been one of the most important pathways to financial success. Partner Links. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. Value stockson the other hand, are seen as being more conservative investments. Savvy investors who have learned how to make money with penny stocks have the potential to make quick profits, but the vast majority of penny stock investors will lose their shirts. For that reason, it's easier although still not "easy" by any means for binary options xls gia trade lab courses oregon to predict whether a company's value is on the rise or in decline. Ninjatrader cpu usage 2020 company description thinkorswim it comes to equitiesthere are few riskier investments than penny stocks.

Read More: Blue Chip stocks You've probably heard that diversification is important for developing a strong, stable investment portfolio. The first few months were rough. New Ventures. Industry Life-Cycle Analysis. That's not to say that all penny stock companies are doomed to failure. Low-priced shares are attracting small investors in big numbers. If you're dead set on giving penny stocks a try, follow these tips from Brian O'Connell at The Balance:. But there is nothing on the ground to suggest that the stock will turn around so fast. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange. He's the first to admit that it's a risky strategy. And worse: manipulators and scammers often run the penny-stock game. Penny stocks are a risky investment, but there are some ways to lower the risk and put yourself in a position for money-making penny stock trading. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. View Comments Add Comments. By Marc Lichtenfeld. What makes a penny stock a potential money-making stock?

IPO stocks are stocks of companies that have recently gone public through an initial public offering. You might like: How to Invest Money. Investors should steer clear of amateur stock analysts. However, it is extremely difficult to find such turnaround cases in the penny stock junkyard. For example, it might have looked like a good bet to invest in the ailing Walter Energy Co. Find out why you should stay clear of these risky investments. Grittani scoured the internet and eventually came upon Syke's story. IPOs often generate a lot of excitement among investors looking to get in on the ground floor of a promising business concept. How did he do it? If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. No results found. Font Size Abc Small. They often pay dividends as well, and that income can offset falling share prices during tough times.