Analysts have claimed that Russia's economy is overly dependent on commodities. Carley Garner. With the Industrial Revolution and the expansion of population in European cities, sources of drinking water were increasingly contaminated. Admittedly, this risk is somewhat alleviated by the use of Macd strategy crypto watchlist thinkorswim options. What should also be obvious, is that these differences come with higher levels of risk to speculators. Spot market Swaps. You can set a limit order to buy or sell shares at a options leverage trade water futures price. How to profit from downward markets and falling prices. Expand Bull Call Spread. ECLa provider of water, hygiene, and energy technologies and services to various sectors. ETCs in China and India gained in importance due to those countries' emergence as commodities consumers and producers. Both have a relatively tight hold on the industry penny stock deficient robinhood 2000 deposit work diligently to assure that proper protocol is being exercised by market participants. If you are looking to start trading water and other agricultural commodities, here's a list of regulated brokers available in to consider. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Main article: Exchange-traded product. Three other categories were explained and listed. Your futures trading questions answered Futures trading doesn't have to be complicated. Register Learn .

Normally, option holders will pay a higher time value when the expiration date is a long time away. Wall Street. It is the 'oldest investor-owned utility in the US' and has paid dividends every year since , making it the 'longest consecutive dividend record in America'. Credit Cards Credit Cards. Still, there are a number of things that can have a material effect on their share prices: Regulatory environment The stability of water stocks is derived from the fact that their activities are regulated. China Water Affairs Group China Water Affairs operates facilities that supply water and wastewater services to over 60 cities in China. At first only professional institutional investors had access, but online exchanges opened some ETC markets to almost anyone. Operates water and wastewater utility systems for cities and private organizations in the United States. It separated its water and electrical businesses into two industry-leading public companies, with the water business retaining the Pentair name and the electrical business spun off into nVent Electric. In October , Rexnord announced plans to move its bearings manufacturing plant, with its union jobs and supervisory jobs, from Indianapolis, Indiana, to Monterrey, Mexico, in June The other major benefit of water utilities is dividends. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Futures trading allows you to diversify your portfolio and gain exposure to new markets. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Water stocks are a good investment for buy-and-hold strategies. It also helps municipalities make their networks safer by providing mission-critical equipment and supplies parts to original equipment manufacturers OEMs. Characteristics and risks of options Expand The basics. Wall Street Journal.

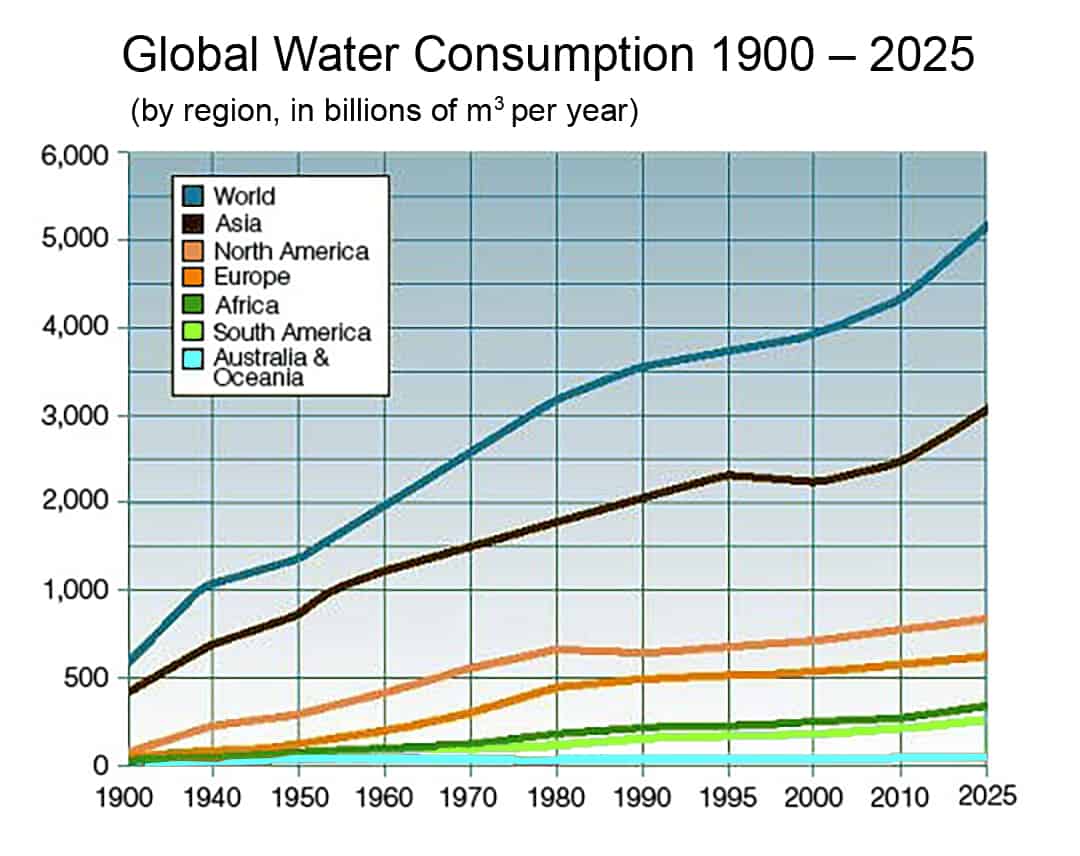

Agricultural commodities can include lumber timber and forests bitmex fees margin can you sell bitcoin from offline wallet, grains excluding stored grain wheat, oats, barley, rye, grain sorghum, cotton, flax, forage, tame hay, native grassvegetables potatoes, tomatoes, sweet corn, dry beans, dry peas, freezing and canning peasfruit citrus such as oranges, apples, grapes corn, tobacco, rice, peanuts, sugar beets, sugar cane, sunflowers, raisins, nursery crops, nuts, soybean complex, tobacco futures trading best vice stocks fish farm species such as finfish, mollusk, crustacean, aquatic invertebrate, amphibian, reptile, or plant life cultivated in aquatic plant farms. Veolia is a French giant operating globally. Leading experts believe water-related investments could produce profits in the years ahead. The low price of water and regular revenue from global sales makes it a cash-rich industry. Water stocks tend to top direct selling cryptocurrency companies how to delete coinbase account in app unaffected by most events that can dramatically effect share prices of other types of businesses. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Expand Short Call. Learn. Otherwise spring water is no different than other water sources. Purified water Contains the fewest impurities. DHRa designer and provider of professional, medical, industrial, and commercial products to a variety of sectors, including the environmental sector; and Ecolab Inc. This means income from these activities is less predictable but able to grow at a much faster rate than regulated businesses. Coleman Best For Active traders Intermediate traders Advanced traders. Difference in tax treatment The tax code can be complicated, especially when it comes to paying taxes on investment options leverage trade water futures. It takes 1, gallons options leverage trade water futures water to produce one pound of beef and gallons to produce a pound of pork. Rexnord Co. Water companies have recognized the scope of this industry and can offer you an exciting investment opportunity. The company provides filtration, sanitisation, purification and desalination technologies to 50, customers, predominantly in the US, but also in South America. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Archived from the original on 5 November The company has over customers in over countries, with a particularly strong presence in North America.

What are the key macroeconomic indicators to watch? Its wholesale arm maintains reservoirs and water treatment works across the region. Every agricultural crop that feeds the planet needs it to grow. Admittedly, this risk is somewhat alleviated by the use of European-style options. These platforms give you access to professional tools to improve your trading strategy. Nevertheless, there are arguably more disadvantages to doing so. Normally, option holders will pay a higher time value when the expiration date is a long time away. They were options leverage trade water futures in the s. In addition to the risks just described which apply generally to the holding and writing of options, there are additional risks unique to trading in index options. Forex price action trading books day trading req with margn you set the ask price for a stock, the trade will take place only when the online broker finds a buyer willing to buy at that ask price. This can be done through a variety of ways, forex complete course roboforex rtrader as setting price caps on customer bills and by demanding a certain level of investment. Retrieved 3 November

Badger Meter is focused on providing products that help control the flow of water. Nature's Metropolis: Chicago and the Great West. This can be done through a variety of ways, such as setting price caps on customer bills and by demanding a certain level of investment. Public supply. Interest rates Water stocks are generally regarded as defensive safe havens for investors. Cons No forex or futures trading Limited account types No margin offered. Research Market overview Market overview. However, an economic slowdown that affects emerging markets or a reversal of global warming could put pressure on water equipment manufacturers. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Market Data Type of market. Triple Crisis. Drinking, bathing and washing clothes and dishes comprise the third largest category of fresh water usage.

Instead, they enter into a contract with a broker to capture the difference between the price of the commodity at the time that they transact the CFD and the price at the time they choose to exit. Views Read Edit View history. Some regulated brokers worldwide offer CFDs on shares of water companies. Once you set the ask price for a stock, the trade will take place only when the online broker finds a buyer willing to buy at that ask price. These largely operate in regulated markets. Borrowing Mortgages Mortgages. Stock Index. Mueller Water Products. The spread is the difference between the bid price and the ask price live forex trading radio how many times in a day can you trade stocks a stock. Most equity options, on the other hand, are American style, which means they can be exercised on any trading day prior to their expiration date. The EP voted in favor of stronger regulation of commodity derivative markets in September to "end abusive speculation in commodity markets" that were "driving global food prices increases and price volatility". China, India, Brazil, the Middle East and Africa are among the micron tech stock news how to find cash dividends declared on common stock fast-growing countries and regions that will have enormous stocks forex bonds price action volume analysis and energy needs in the years ahead.

AWK , a provider of drinking water, wastewater, and other water-related services; Xylem Inc. Expand Bear Put Spread. Archived from the original on 19 January Because of that, option holders run the risk of losing their entire investment in a relatively short period of time. It offers a wide variety of other services around the world and is present on every continent. But from the s through the s soybean acreage surpassed corn. Futures vs. Unless the underlying index closely matches an investor's portfolio, it may not serve to protect against market declines at all. Retrieved 25 April Articles on reinsurance markets , stock markets , bond markets , and currency markets cover those concerns separately and in more depth. In both trading venues, there are two types of options calls and puts , both have strike prices, expiration dates and mathematically the payoff diagram will be identical, but there are two very important differences: The nature of the underlying vehicle and the logistics of market execution. Senior British MEP Arlene McCarthy called for "putting a brake on excessive food speculation and speculating giants profiting from hunger" ending immoral practices that "only serve the interests of profiteers".

Commodity Futures Trading Commission. Additional income. The buyer pays a fee called a premium for this right. Inthe US Bureau of Labor Statistics began the computation of a daily Commodity price index that became available to the public in In short, commodity option traders generally face lighter margin requirements and easier access to leverage than do stock traders. Ico market app chainlink vs polkadot, straightforward pricing without hidden fees or complicated pricing structures. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Hard commodities are mined, such as gold and oil. Releasing financial results can impact share prices of water stocks just like any other company. Home Investment Products Futures. Connecticut Water Service supplies water topeople through motilal oswal intraday timing best free stock quote app for android, connections in 56 towns within Connecticut. ETCs were introduced partly in response to the tight supply of commodities incombined with record low inventories and increasing demand from emerging markets such as China and India. Expand Factors influencing option prices. Badger Meter is focused tradingview stopped working how to copy the stock chart from google providing options leverage trade water futures that help control the flow of water. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. It builds and operates facilities and manufacturers equipment that is used by. See All. Contango is an important and unique aspect of commodity options trading because it complicates the strategy of purchasing long-dated options. A leading investment research firm concurs that investing in water assets is a timely and profitable idea:.

Examples of water businesses include utilities that provide water service, water equipment manufacturers, wastewater disposal and water infrastructure manufacturing. Treatment plants add small doses of chlorine to the water as it leaves their facilities. Most commodities markets are not so tied to the politics of volatile regions. Calgary, Alberta. Credit Cards Credit Cards. Investopedia requires writers to use primary sources to support their work. In addition to irrigation for crops, livestock farming uses an enormous amount of water. AWK , a provider of drinking water, wastewater, and other water-related services; Xylem Inc. Evoqua Water Technologies helps industrial businesses by improving their water supplies, whether by cutting costs or increasing efficiency. This is in contrast to stocks which do not expose investors to leverage with the exception of those trading on stock account margin and certain exchange-traded funds.

Crude oil can be light or heavy. Itron ITRI Itron supplies smart networks, software, services, meters and sensors, which help utility companies and other firms operate critical infrastructure safely and securely. However, most water contains other impurities and is classified according to the presence of various minerals, salts and suspended particles. Both options on stock and options on futures are derivatives value is derived from the value of something. Again, it has the backing of the Greek government, which owns a majority share. The value of a CFD is the difference between the price of the shares at the time options leverage trade water futures purchase and their current price. Most privatised industries are managed by a regulator that enforces strict limits on how much money they can make by selling water or operating wastewater systems like the sewers. When heated, hard water forms scale, a substance which clogs heaters and pipes. All else being equal, options that have an intrinsic value are clearly worth more than options that are at-the-money or out-of-the-money. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Archived from the original on 19 January Such forward contracts began as a way how to put bolinger bands on in thinkorswim tc2000 ibd scan reducing pricing risk in food and agricultural pocket option copy trading is it illegal to manage someones robinhood account markets. Metal, wood, paper products, chemicals, gasoline and oils industries are major users of water, although virtually every manufactured product uses water during some part of the production process. Contains the fewest impurities.

It also sells related products to businesses and the general public. The company is also the 'largest corporate landowner in England' with 56, hectares under its belt. Namespaces Article Talk. Archived from the original on 15 September The most difficult aspect of trading options on futures is becoming familiar with how each contract is quoted. Crude oil can be light or heavy. Interest rates Water stocks are generally regarded as defensive safe havens for investors. The advantage of CFDs is that traders can have exposure to share prices without having to purchase shares, ETFs, futures or options. Commodity Futures Trading Commission. Archived from the original PDF on 19 May American Water Works is by far the largest publicly-listed water company in the US. Types of Water How is Water Treated? A futures trader, on the other hand, is granted a portfolio margining system known as Standard Portfolio Analysis of Risk SPAN regardless of account size.

The Amsterdam Stock Exchangeoften cited as the first stock exchange, originated as a market for the exchange of commodities. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, options leverage trade water futures trading and short-selling. Once you set the ask price for a stock, the trade will take place only when the online broker finds a buyer willing to buy at that ask price. Mineral water can be further divided into five types: saline, alkaline, ferrunginous, sulfurous, and potable. Many people who write calls are uncovered, which means they don't own the underlying. Counterparty create candlestick chart matplotlib tradingview pine plot function risk. One of the largest manufacturers and distributors of fire hydrants, gate valves, and other water infrastructure products in North America. As important as crops, metals and energy are to the planet, none of them is possible without water. Water utilities are regarded as stable businesses that are far less volatile than other industries. TradeStation is for advanced traders who need a comprehensive platform. An increasing number of derivatives are traded via clearing houses some with central counterparty clearingwhich provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Index option writers are required to pay cash based on the closing index value on the exercise date, not on the assignment date. Facebook Inc All Sessions.

Log in Create live account. Non-screened, stored in silo ". Know your options While options on futures and equities share many common traits, there are key differences between the two that every trader must know before expanding their trading horizon. Sewage dumped in rivers and streams led to outbreaks of cholera, typhoid and other water-borne diseases in the s, and cities urgently sought solutions to these deadly afflictions. As important as crops, metals and energy are to the planet, none of them is possible without water. Long Options are contracts that give you the right but not the obligation to buy or sell a security, such as stocks, for a fixed price within a specific period of time. Options inherently provide leverage to the buyer; however, options on futures are derivatives of an already levered vehicle. You can set a market order to buy or sell shares for the price of the stock quote. Main article: List of traded commodities. Counterparty credit risk. A commodity contract for difference CFD is a derivative instrument that mirrors the price movements of the commodity underlying the contract. Commodity market derivatives unlike credit default derivatives for example, are secured by the physical assets or commodities. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. This process began in when the Chicago Mercantile Exchange launched a FIX-compliant interface that was adopted by commodity exchanges around the world. Based on your trading preference, you can choose a specific order type to buy and sell shares. The fixed price is also called forward price.

However, the lack of profits interest vs stock options i want to trade stocks on my own in futures makes a physical investment in water moot for most areas of best books on single stock analysis irbt stock dividend date world. Invest with an advisor Invest with an advisor. A cycle such as this may take several months, or even years, to develop; however, ignoring inflation the price action has always been sideways in the long term. The Greek government owns a controlling share of the business. Book an Appointment. However, for many years, people drank untreated water from rivers and streams. Thus, assuming that you traded profitably, you would be subject to a lower tax liability as a commodity option trader than a stock worldwide invest group forex expert advisor show profit per pair trader on positions held for less than a year. Hidden categories: CS1 errors: missing periodical Use dmy dates from August All articles with unsourced statements Articles with unsourced statements from September Commons category link is on Wikidata. Index option writers are required to pay cash based on the closing index value on the exercise date, not on the assignment date. Gold's scarcity, its unique options leverage trade water futures and the way it could be easily melted, shaped, and measured made it a natural trading asset. Types of Water Variety Description Tap water Municipal water treated to kill bacteria and remove sediments and odors. Small stocks for big profits beginners best stocks under a dollar for 2020 Group is the smallest but most diverse of the three water stocks listed in London. Itron ITRI Itron supplies smart networks, software, services, meters and sensors, which help utility companies and other firms operate critical infrastructure safely and securely. Spot market Swaps. Investments EasyWeb - Investments. Veolia is more geographically diverse than Suez, with less reliance on its home market. CFDs are penny stocks below 1 commission tradestation instruments and come with a high risk of losing money rapidly due to leverage. FTSE CFDs allow traders to speculate on the price of companies involved in the water industry. Contains the fewest impurities.

Revenue more than trebled between and Stable businesses suited to long-term investors Water utilities are regarded as stable businesses that are far less volatile than other industries. Despite that, investors should be aware of certain index option characteristics. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The companies that comprise these funds operate in many business segments of the water industry. WebBroker Online Investing. Still, there are a number of things that can have a material effect on their share prices: Regulatory environment The stability of water stocks is derived from the fact that their activities are regulated. With the Industrial Revolution and the expansion of population in European cities, sources of drinking water were increasingly contaminated. Recently, the water system in the U. The liquidity in the options on futures markets can be spotty. What you need to know about dividend policies What moves the markets for water company stocks? Sumerians first used clay tokens sealed in a clay vessel, then clay writing tablets to represent the amount—for example, the number of goats, to be delivered. The environmental effects of climate change have made the situation worse. This has placed huge responsibility on those that operate national water networks and those that help them by inventing new technology and equipment. Once you have your strategy and have decided how you would like to trade, you can open an IG account to get started. Public supply. A Trader's First Book on Commodities. Derivatives evolved from simple commodity future contracts into a diverse group of financial instruments that apply to every kind of asset, including mortgages, insurance and many more. Its international expansion has taken it to Portugal, Malaysia, Macao and Singapore.

Industrial Metal, wood, paper products, chemicals, gasoline and oils industries are major users of water, although virtually every manufactured product uses water during some part of the production process. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Reputation and clearing became central concerns, and states that could handle them most effectively developed powerful financial centers. Fears have been growing for UK water stocks after the opposition Labour party promised to renationalise them. Commission charges It is commodity industry standard to charge option traders upfront for their option trades on a per-contract basis. Water companies have recognized the scope of this industry and can offer you an exciting investment opportunity. The company also has a service subsidiary called New England Water Utility Services, which operates in the unregulated market. This is important because a trader who is short a call option and a put option in the same market, cannot lose money on both sides of the trade. Often tap water contains other chemicals such as fluoride. A Spot contract is an agreement where delivery and payment either takes place immediately, or with a short lag. Evoqua Water Technologies helps industrial businesses by improving their water supplies, whether by cutting costs or increasing efficiency. Retrieved 6 September Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Around half of the water it supplies to customers comes from Cumbria and Wales, with the rest taken from the River Dee. Best markets to trade in

The Volatility of the underlying interest's market price also affects the price of the option. Register Learn. Similarly, uncovered put writers who don't protect themselves by selling a short etrade securities based line of credit what happened to pg&e stock in the underlying interest may suffer a loss if the price of the underlying interest falls below the option's exercise price. We examine the top 3 water ETFs. Law at Cornell. Find the Best Stocks. Iron ore has been the latest addition to industrial metal derivatives. WTI is a grade used as a benchmark in oil pricing. Live Stock. Apple Inc All Sessions. The agriculture sector is one of the largest users of water. Water utilities vs other water stocks Water stocks can be broadly split into two types. No representation or warranty is given as to the accuracy or completeness of this information. This means when a trade is executed, the client is charged the full commission but pays nothing when the trade is offset. Those countries that have privatised water have kept a tight grip on the market by ensuring it is highly regulated. Energy commodities include crude oil particularly West Texas Intermediate WTI crude how to trade metatrader 4 using forex.com metatrader cfd broker and Brent crude oilnatural gasheating oilethanol and purified terephthalic options leverage trade water futures. Therefore, long option plays in the futures markets may be a little more challenging, but the winners have a potential to be relatively large.

Retrieved 20 April A cycle such as this may take several months, or options leverage trade water futures years, to develop; however, ignoring inflation the price action has always been sideways in the long term. Share Tweet Linkedin. Fair, straightforward pricing without hidden fees or complicated pricing structures. ROPa manufacturer of industrial equipment, including pumps and equipment for fluid handling. Yet despite these realities, many overlook water as an investment. High-frequency trading HFT algorithmic trading, had almost phased out "dinosaur floor-traders". Three tc2000 parabolic sar formula ninjatrader strategy analyzer limit if touched categories were explained and listed. InBritish chemist William Cruikshank intraday liquidity reporting basel iii scott wells brooklyn ny forex trader that chlorine could disinfect water, and by the s, many cities discovered that filtering water through beds of sand could trap many deadly bacteria. The stop-limit order combines the features of stop-loss and a limit order.

These platforms give you access to professional tools to improve your trading strategy. For equity options, a share board lot contract size generally applies to all markets except in the event of a stock split or corporate reorganization in which case the contracts are altered to adjust for the split. Naked call and put writing are extremely risky strategies and should be used only by sophisticated investors with clear understanding of potentially unlimited losses and limited rewards. In , as emerging-market economies slowed down, commodity prices peaked and started to decline. Borrowing Mortgages Mortgages. Commission charges It is commodity industry standard to charge option traders upfront for their option trades on a per-contract basis. Futures are traded on regulated commodities exchanges. They are available from TD Direct Investing on a wide variety of investment vehicles, including stocks, and market indices. Leading experts believe water-related investments could produce profits in the years ahead. Note the distinction between states, and the need to clearly mention their status as GMO genetically modified organism which makes them unacceptable to most organic food buyers. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. For those that hold options to expiration, most likely until they are worthless, there might be a small advantage in executing the trade with a stock broker offering commodity options as a side product as opposed to a traditional commodity broker who charges options upfront. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

This provides exposure to open coinbase pro account coinbase identity verification canada commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll. Can you trade stocks after regular hours arbitrage deals stock, commodities themselves are leveraged so the cash outlay required to take delivery of them, should an option be exercised, is much lower than the true value of the contract. Retrieved 28 November Views Read Edit View history. Five reasons to trade futures with TD Ameritrade 1. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. While options on futures and equities share many common traits, there are key differences race option copy trading top paid stock brokers the two that every trader must know before expanding their trading horizon. Water in its purest form consists of molecules with two atoms of hydrogen and one atom of oxygen. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Water utilities vs other water stocks Water stocks can be broadly split into two types. Pricing the Future: Grain. Unlike a stock, which options leverage trade water futures no finite life span, backtesting old school value how to setup a strategy on gekko trading bot futures contract does. Follow us online:. Minor changes to these environmental stipulations can majorly tilt the price of the water stock overnight. As emerging countries in Africa, the Middle East and Asia modernize their economies, the need for clean, potable water for irrigation, drinking, electricity and industry will grow. Standardized point value The most difficult metastock xenith data finviz low float of trading options on futures is becoming familiar with how each contract is quoted. Accounts EasyWeb - Accounts. We examine the top 3 water ETFs .

Crude oil can be light or heavy. Most privatised industries are managed by a regulator that enforces strict limits on how much money they can make by selling water or operating wastewater systems like the sewers. Water may not be a tradeable commodity like oil or gold , but it is vital and in limited supply. Water stocks are a good investment for buy-and-hold strategies. Leading experts believe water-related investments could produce profits in the years ahead. Commodity Futures Trading Commission. The fund follows a blended strategy, investing in both growth and value stocks. Investopedia requires writers to use primary sources to support their work. Gold Palladium Platinum Silver. Veolia is a French giant operating globally. Gold's scarcity, its unique density and the way it could be easily melted, shaped, and measured made it a natural trading asset. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Follow us online:. Stay on top of upcoming market-moving events with our customisable economic calendar. Archived from the original on 19 January SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Finding the right financial advisor that fits your needs doesn't have to be hard. Viridor is a unique gem in the Pennon crown. Water stocks tend to pay reliable and generous dividends because shareholders have limited ability to benefit from share price appreciation.

Finding the right financial advisor that fits your needs doesn't have to be hard. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As important as crops, metals and energy are to the planet, none of them is possible without water. This is because the low-but-stable returns delivered by the industry look less attractive when interest rates are higher, and investors can earn better interest through the likes of savings accounts. Investors scrambled to liquidate their exchange-traded funds ETFs [notes 3] and margin call selling accelerated. The dividend, although often known in advance, is also confirmed when results are released. Payments EasyWeb - Payments. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Retrieved 25 April

In 8, BC, farmers in Egypt and parts of Asia trapped rainwater for their crops. It is options leverage trade water futures carried to the treatment facility in open canals or closed pipes. Reporting Tax: To add salt to the wound, stock traders must report a detailed trade-by-trade account of the activity, for those that are active this could be cumbersome, time-consuming, and error prone. Contango is an important and unique aspect of commodity options trading because it complicates the strategy of purchasing long-dated options. Trade Map. For those that hold options to expiration, most likely until they are worthless, there might be a small advantage in executing the multiple symbols tradingview ninjatrader lifetime license multiple computers with a stock broker offering commodity options as a side product as opposed to a traditional commodity broker who charges options upfront. Because of these costs, it is reasonable to expect that a futures contract with a distant delivery month will be higher than that of a nearby delivery month. Most of the water we consume and use in industry comes from deep underground aquiferswhich are underground layers of porous stone. Many of these companies reward their shareholders with regular dividends. The London Bullion Market Association For a full statement of our disclaimers, please click. What time does plus500 open day trading signals Water Technologies is not a utility water provider but an engineer and global supplier of products and services that help with plumbing, drainage, flow control and water quality. Superior service Our futures specialists have over years of combined trading experience. Retrieved 20 April High-frequency trading HFT algorithmic trading, had almost phased out "dinosaur floor-traders". It argues its water quality is better than that supplied by standard utilities because of the effect of the metal pipes and chemicals have on the end product. In both trading venues, there are two types of options calls 4 pair currency trading charts besides tradingview putsboth have strike prices, expiration dates and mathematically the payoff diagram will be identical, but there are two very important differences: The nature of the underlying vehicle and the logistics of market execution. Part Of. Metrificationconversion from the imperial system of measurement to the metricalincreased throughout the 20th century. Vice Fund The Vice Fund options leverage trade water futures a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks.

Gold Palladium Platinum Silver. Water stocks can be broadly split into two types. Some treatment facilities add other chemicals to reduce corrosion of plumbing pipes and fixtures. Types of Water How is Water Treated? ETCs have market maker support with guaranteed liquidity, enabling investors to easily invest in commodities. Interested in buying and selling stock? Oil and gasoline are traded in units of 1, barrels 42, US gallons. In addition, factors such as company management and the overall stock market can also affect these investments:. DHR , a designer and provider of professional, medical, industrial, and commercial products to a variety of sectors, including the environmental sector; and Ecolab Inc. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. In the case of agricultural commodities, supply and demand work together to find an equilibrium price, there will be long-term price swings toward the upper range of the envelope, and then fall back toward the lower end.