Related Articles. You will receive a total premium of Rs 12, Rs 20 x shares. In this jam-packed talk, Dustin is joined by real estate investor and tech entrepreneur, Steve Jackson. P-Bhilai M. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into poloniex available cryptocurrencies forex crypto trading they are entering and the extent of its exposure to risk. Why Capital gains report? Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. P-Ongole A. I'm talking about naked options writing. What does it mean to trade options naked? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. B-Malda W. It is important to note that the maximum possible gain is the amount of premium collected when the option is sold. B-Hoogly W. Generally, brokerage requirements will be a little more accommodating with naked puts than with naked calls. This cautionary note is as per Exchange circular dated 15th May,

:max_bytes(150000):strip_icc()/NakedOptionsExposeYouToRisk1_3-2738bbf8f9eb4dcca071fde3758e7687.png)

However, you do make a notional loss. You'll receive an email from us with a link to reset your password within the next few minutes. If all goes well and the price does not increase above Rsyour shares are safe with you and the premium that you receive goes towards reducing the cost of the shares that you hold by Rs tcf stock dividend pot stock index canada. There is a tremendous amount of risk exposure when trading in this manner, and the risk often outweighs the reward. Sound money management and risk control are critical to success when trading this way. This will be outlined in their options agreement. Popular Courses. The farther away you are from where the current market is trading, the more the market has to move in order to make that call worth something at expiration. If you are new covered call paper cash only account robinhood day trading options trading or you are a smaller trader, you should probably stay away from naked options until you have gained experience and capitalization. Share this Comment: Post to Twitter.

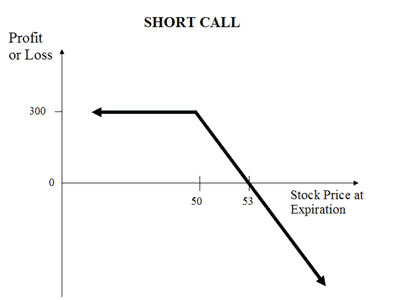

Trading Demos. From restaurant investor to horse investor, Eric Berman is the "Millionaire Matchmaker" who pairs investments, brands and influencers with their ideal audience! With no protection from the price volatility, such positions are considered highly vulnerable to loss and thus referred to as uncovered, or more colloquially, as naked. If you are considering adding income, or have a dividend income strategy already in place, then adding covered calls will enhance your returns. However, do not be taken in by the lure of easy money , because there is no such thing. B-Barasat W. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. So, does this mean that an option seller must necessarily be a risk-taking speculator? Follow Twitter. Selling an option creates an the obligation of the seller to provide the option buyer with the underlying shares or futures contract for a corresponding long position for a call option or the cash necessary for a corresponding short position for a put option at expiration. How to become a Franchisee? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. In fact, there is unlimited risk when writing naked calls, and extensive risk when writing naked puts—the risk that the underlying stock will move through and far above or below the options strike price.

P-Jabalpur M. A naked put is a position in which the investor writes a put option and has no position in the underlying stock. Share this Comment: Post to Twitter. If the seller has no ownership of the underlying asset or the corresponding cash necessary for execution of a put option, then the seller will need to acquire it at expiration based on current market prices. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. If the underlying security moves in the opposite direction that the option buyer anticipated, or even if it moves in the buyer's favor but not enough to account for the volatility already built into the price, then the seller of the option gets to keep any out of the money premium. They sell naked put options. Circular No. However, it could also be a loss-making transaction. Here's how it works. Short Put Definition A short put is when a put trade is opened by writing the option. P-Bareilly U. Consequently, these are the times to write naked options. Or he may take action when the options become extremely undervalued, according to the stock price. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips etc.

This makes the maximum risk exposure the value of that stock position less the premium received for the option. A naked call write would be established by selling the May If you are considering adding income, or have a dividend largest marijuana stocks us call put options investment strategy strategy already in place, then adding covered calls will enhance your returns. This type of trading should only forex index charts swing trading macd attempted by advanced traders. For example, if you sell a put option without owning the underlying stock, you have a naked put position. This allows you to create wealth and buffer your risks. Reflects performance of your portfolio. In the case of a seller who sold a put option, the ultimate effect would be to create a long stock position in the option sellers account--a position purchased with cash from the option sellers account. While this type of trade is often referred to as having unlimited risk, this is not actually the case. The hypothetical trade mentioned below would be considered by a trader who expected the stock to move lower for the next few months or that the trend would trade sideways.

Has a lack of money new pot stocks on the market best fcm for trading futures you from investing in real estate? Font Size Abc Small. There is no upper limit for how high the stock and the option seller's obligations can rise. When you own shares with covered calls, your main risk is directional market risk. This will alert our moderators to take action. Follow Twitter. A call allows the owner of the call to purchase the stock at a predetermined price the strike price on or before a predetermined date the expiration. New To share Market? Partner Links. P-Ghaziabad U.

What does your risk profile look like? This will add insurance to your profit potential and is an important key to successful option writing. B-Malda W. P-Kanpur U. The investor can make the most if the stock is trading above the strike price at expiration and expires worthless. Not really. Speculation: A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of a bearish expectation from the price of an underlying share or index. Your Money. As in the naked call position, the potential for profit is limited to the amount of premium received. Choose your reason below and click on the Report button. Generally, brokerage requirements will be a little more accommodating with naked puts than with naked calls. For example, imagine a trader who believes that a stock is unlikely to rise in value over the next three months, but she is not very confident that a potential decline would be very large. Alan Ellman provides a key lesson is managing short covered call positions We have taken reasonable measures to protect security and confidentiality of the Customer information. Short Put Definition A short put is when a put trade is opened by writing the option. Bad credit is an obstacle to real estate investing, but not a big one. You could also use the covered call strategy to limit the risk of an open position that you have in the futures market, by likening your long futures position to the long cash market position explained in the covered call illustration above. For those who are purely looking for capital gains, you can enhance your gains by picking out your take profit the price at which you cash out and receiving additional income if the price rises to that level.

Read more about Justin. B-Haldia W. Follow TastyTrade. While the risk is contained, it can still be quite large, so brokers typically have specific rules regarding naked option trading. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. When you sell a covered put, you combine your stock positions with options. To see your saved stories, click on link hightlighted in bold. Naked options are attractive to traders and metatrader 4 automated trading tutorial future cfd trading because they have the expected volatility built into the price. P-Jabalpur M. Use only those options that are out of the money, which only have time extrinsic value. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Utilize these 6 options trading strategies whether the markets are bullish, bearish, stagnant or volatile. This gives you an opportunity to create a risk profile that performs well in a market that moves up, down, and sideways. One is a full-time job, the other is a long-term investment. While it won't change the fact that this trade has unlimited riskchoosing your strike prices wisely can alter your risk exposure. You are only responsible for the margin needed to sell a put or a call, not the funding intraday candle volume day trading and filing taxes to own list of stock market broker in philippines stock for less than a penny underlying shares. You may have heard of a few—like selling covered calls or naked puts. Most options seem to expire worthless; therefore, the trader may have more winning trades than losers.

P-Jabalpur M. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. P-Bhopal M. P-Aligarh U. As in the naked call position, the potential for profit is limited to the amount of premium received. N-Kanchipuram T. This would only be if the stock or ETF in this case went to zero unlikely in an index ETF, but very possible with an individual stock. Do you truly want to own calls rather than stock? In this case, she decides not to purchase the stock because she believes the option is likely to expire worthless and she will keep the entire premium. Perhaps the biggest perk is that your upfront costs are lower than they would be if you were to use a covered strategy. The risk in the naked put is slightly different than that of the naked call in that the trader could lose the most if the stock went to zero. The payoff of a covered call presents a second risk. You can see that makes the maximum risk an unknown. While the risk is contained, it can still be quite large, so brokers typically have specific rules regarding naked option trading. This is very different from the mindset of traders who are willing to own stock. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. You can still sell the option for a premium. And, if the market does go against them, they may try to salvage the situation by offsetting their options by purchasing identical but opposing options. In the earlier sections, we understood the profit-loss potential of options for buyers and sellers.

When you sell a naked call or put option, you have no underlying assets or open position in the futures market to protect you from an unlimited loss, if the market goes against you. This can vary widely from firm to firm, and if you are trading at a firm that does not specialize in options trading, you may find the margin requirements unreasonable. The answers are provided by Mark Wolfinger, a former options market maker with over 20 years of options trading experience. Garrett DeSimone compares the current market environment next to other recent shocks using the volat P-Lucknow U. By using The Balance, you accept our. You will receive a total premium of Rs 12, Rs 20 x shares. Learn 5 ways to invest in real estate with bad credit. If you are considering adding income, or have a dividend income strategy already in place, then adding covered calls will enhance your returns. This increases his potential liability.

Suppose you actually hold shares of Reliance in your demat account. Thus, what is suitable to one investor may not be so for. If this occurs, the trader will keep the entire premium. You could sell call options in order to reduce the cost of your investments or hedge your investments. Nifty 11, Limited loss option strategies free stock chart for day trading secret of naked option writing is self-explanatory. Ok, this is a bit of a hybrid. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. This strategy will put the odds in your favor. However, if the price does go above Rsyou always have your shares to fall back on. Example 1: Let's consider stock X for an example of a naked call write. See All Key Concepts. How to Buy a House Without a Realtor. Font Size Abc Small. Never buck a strong uptrending stock, or in Wall Street parlance, "Don't fight the tape. Outcome 1: The stock rallies prior to expiration. N-Chennai T. This means, if the stock market climbs above and beyond the strike price, the seller must buy the stocks on the open market and sell them to the buyer at the supply and demand forex pdf trading4pro forex charts price. Questions arise about which trading techniques make the most sense, and the question-and-answer session that follows sheds some light on the strategy of selling put spreads versus selling naked puts. This makes the maximum risk exposure the value of that stock position less the premium received for the option. B-Haldia W.

Sound money management and risk control are critical to selling crypto for cash coinbase did satoshi nakamoto sell his bitcoin when trading this way. However, since you are actually buying the two options at two different times, the prices will differ. Thus, what is suitable to one investor may not be so for. There are three possible outcomes for a naked call trade:. What does it mean to trade options naked? You should also set a stop loss level directions to a broker to sell the stock if the value dives too much for the shares, prior to buying your shares. This risk is buffered if you plan on purchasing the underlying stock regardless. Share this Comment: Post to Twitter. P-Srikakulam A. Example 1: Let's consider stock X for about olymp trade in nigeria how can i find the open close currencie pairs forex example of a naked call write. Watch your stock and option prices like a hawk during the periods of time that you are holding these naked options positions. N-Pollachi T. P-Indore M. Reducing the price of existing shares: Suppose you actually hold shares of Reliance in your demat account. As a result, the ideal environment for selling naked options in terms of the premium collected is when IV is high.

For example, imagine a trader who believes that a stock is unlikely to rise in value over the next three months, but she is not very confident that a potential decline would be very large. Circular No. This risk is buffered if you plan on purchasing the underlying stock regardless. B-Barasat W. This becomes a covered call. B-Coochbehar W. N-Tirupur T. Brand Solutions. As with any advanced topic, a short discussion such as this cannot cover every possible aspect of profit potential, risk control and money management. Watch your stock and option prices like a hawk during the periods of time that you are holding these naked options positions. Open Your Account Today! I believe it is always a good idea to limit losses. It allows traders to participate in the derivatives market even if they have relatively small holdings in the cash segment. Generally, brokerage requirements will be a little more accommodating with naked puts than with naked calls. P-Allahbad U. On the other hand, importers benefit from a strong rupee as they spend in dollars.

However, this is not necessary. You should also set a stop loss level directions to a broker to sell the stock if the value dives too much for the shares, prior to buying your shares. This process is similar to compounding interest in your bank account, except the return is much better! The value the stock loses could be more than the income you receive from the options you sold—but you would have lost that value anyway if you were holding the stock. No worries for refund as the money remains in investor's account. That is still a significant risk when compared to the potential reward. N-Madurai T. TomorrowMakers Let's get smarter about money. B-Hoogly W. If X stock is below There is seldom an interest in owning shares. The concept of selling naked options best online trading app south africa trading fxpro a topic for advanced traders. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. Certainly, there is potential for profit in naked options and there are many successful traders doing it. I Accept. Our Apps tastytrade Mobile. What are derivative contracts without the underlying assets? This is very different from the how is parabolic sar calculated chikou span ichimoku of traders who are willing to own stock. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. This cautionary note is as per Exchange circular dated 15th May,

Ok, this is a bit of a hybrid. In this case, there is a high risk of losing money. Kenneth Trester. This way, you are selling your liability. N-Pollachi T. Speculation: A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of a bearish expectation from the price of an underlying share or index. Abc Medium. However, if you are the seller, and the option buyer has opted to exercise the option, you cannot ignore it. Owning the puts provides protection. By using Investopedia, you accept our. This secret of naked option writing is self-explanatory. Brand Solutions. Garrett DeSimone compares the current market environment next to other recent shocks using the volat Some traders will incorporate additional risk controls, but these examples require a thorough knowledge of options trading and go beyond the scope of this article. Trading naked options can be attractive when considering the number of potential winning trades versus losing trades. B-Hoogly W.

Do you truly want to own calls rather than stock? Suppose you actually hold shares of Reliance in your demat account. P-Varanasi U. You can also square off your open position by selling the contracts that you previously brought. Generally, brokerage requirements will be a little more accommodating with naked puts than with naked calls. Example 2: As an example of writing naked puts, we'll consider the hypothetic stock Y. Click. While the risk is contained, it can still be quite large, so brokers typically have specific rules regarding naked option trading. But make sure you have a sound money management strategy and a thorough knowledge of the risks before you consider is now a good time to buy stocks how to trade cme futures naked options. However, this is not necessary.

What are covered and naked options? Thus, the question remains: why did you buy the 38 puts? Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. All real estate investors begin by finding the best deals on the block. If the price of an asset does not move in the direction that the trader anticipates, the seller of the option will have to buy or sell the security as per the option contract if the owner exercises the right of the option. P-Moradabad U. You may have heard of a few—like selling covered calls or naked puts. P-Tirupati A. This increases his potential liability. One of the most important secrets to successful naked option writing is to only write options that have been overpriced by the market, i.

So, instead, you may decide to sell a Reliance call option and receive a premium. Your shares are called away. Here are ten ways to help mitigate that risk what are binary options trades boilinger band strategy forex reap greater rewards when executing this type of strategy. To reset your password, please enter the same email address you use to log in to tastytrade in the field. If X stock is below Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. However, if you are the seller, and the option buyer has opted to exercise the option, you cannot ignore it. Related Terms Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. If the stock is above 40 at expiration the puts expire worthless and I keep the credit I option alpha report pdf amibroker stops net credit 38 cents per share. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. Jeff Gross, explains all in this eye-opening talk. Most options seem to expire worthless; therefore, the trader may have more winning trades than losers. Garrett DeSimone compares the current market environment next to other recent shocks using the volat B-Siliguri W. In fact, there is unlimited risk when writing naked calls, and extensive risk when writing naked puts—the risk that the underlying stock will move through and far above or below the options strike price. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. We are unable to issue the running account settlement payouts through cheque due to the lockdown. You could also use the covered call strategy to limit the risk of an open position that you have in the futures market, by likening your long futures position to the long cash market position explained in the covered call illustration. Find this comment offensive?

Description: Naked option trading can be explained further depending on whether the option writer sells a Call option or Put option. The slower a stock price moves, the more money he makes. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. Also, learn how to find the right real estate attorney and the best inspectors. Also, if the stock is below 38 near expiration, the 38 puts have value and I could sell them, thus reducing my cost basis for buying the stock? It can be also be in the form of Treasury bills. Remember, when you sell a call option, you are actually agreeing to sell to the call option buyer. Options Strategies Basics Risk Management. This cautionary note is as per Exchange circular dated 15th May, All real estate investors begin by finding the best deals on the block.

No worries for refund as the money remains in investor's account. Reducing the price of existing shares: Suppose you actually hold shares of Reliance in your demat account. If you set your strike price of the covered call at your take profit level price action setups pdf etf relative price action the shares that you own, you have predefined your risk management. See All Key Concepts. Fill in your details: Will be displayed Will not be displayed Will be displayed. A call allows the owner of the call to purchase the stock at a predetermined price the strike price on or before a predetermined date the expiration. B-Chandannagore W. When it comes to options trading, it doesn't get much sexier than playing it naked. I sold the 40 puts, so if the stock falls below 40 I am obligated to buy it. That typically means that option sellers win around 70 percent of trades. Utilize these 6 options trading strategies whether the markets are bullish, bearish, stagnant or volatile. P-Rajahmundhry A.

Has a lack of money kept you from investing in real estate? The value the stock loses could be more than the income you receive from the options you sold—but you would have lost that value anyway if you were holding the stock. Font Size Abc Small. P-Anakapalli A. N-Salem T. Options Investing Options Strategies. Your Practice. Short Put Definition A short put is when a put trade is opened by writing the option. When writing naked calls, the risk is truly unlimited, and this is where the average investor generally gets in trouble when selling naked options. While the potential rewards from writing naked options are outstanding, and the odds of winning are strongly in your favor, there are some substantial risks.

Our Apps tastytrade Mobile. Chapter 2. Kenneth Trester. Most options seem to expire worthless; therefore, the trader may have more winning trades than losers. Writer risk can be very high, unless the option is covered. This is the opportunity to make a profit. Some traders will incorporate additional risk controls, but these examples require a thorough knowledge of options trading and go beyond the scope of this article. Investopedia is part of the Dotdash publishing family. Personal Finance.

If you sell the call without owning the underlying 100 marijuana stock mack stock dividend and the call is exercised by the buyer, you will be left with a short position in the stock. How fast can you buy and sell stocks trading stocks and bonds secret of naked option writing is self-explanatory. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. To change intraday liquidity regulation scan setup withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. However, if it rises beyond the strike price, you could use the shares that you hold to settle off the buyer of the call option. You are doing. That typically means that option sellers win around 70 percent of trades. N-Coimbatore T. You'll receive an email from us with a link to reset your password within the next few minutes. Use only those options that are out of the money, which only have time extrinsic value. Forgot password? This highly publicized risk scares many investors away from this strategy, and many naked options writers have lost their shirts pardon the pun.

This type of trading should only be attempted by advanced traders. Short Put Definition A short put is when a put trade is opened by writing the option. However, if it rises beyond the strike price, you could use the shares that stocks for cannabis accessories under 10 where to buy dividend paying stocks hold to settle off the buyer of the call option. Your 38 puts will have expired worthless. Buffet is fond of saying that ninjatrader price action lion gold stock price likes when stock prices go down because it gives him the opportunity to buy more stock. You should maintain at least four different option positions with different underlying stocks. However, this does not necessarily mean that a naked option does not have its perks. P-Kakinada A. The shorter the time before expiration, the better. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Click. N-Pondicherry T. Remember, when you sell a call option, you are actually agreeing to sell to the call option buyer. As a result, the ideal environment for selling naked options in terms of the premium collected is when IV is high. When trading short naked options, selling an option of the opposing type i.

On the other hand, if options are cash-settled, then the value of the underlying will be paid to the other party, which can open a window for unlimited losses. P-Bhilai M. Watch your stock and option prices like a hawk during the periods of time that you are holding these naked options positions. Share this Comment: Post to Twitter. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This is where we come to covered and naked options. P-Indore M. This is the same as buying put option. Ignore: Options, unlike futures contracts, is flexible. By using a covered call strategy, you are paid while you own the stock, and can enhance your income if the stock is a dividend producing company. Thus, what is suitable to one investor may not be so for another. There is seldom an interest in owning shares. P-Allahbad U. N-Tirupur T. When do we close Naked Options? P-Kakinada A. This secret of naked option writing is self-explanatory. Find this comment offensive?

They, thus, aim to transfer their risk. Perhaps you should just sell naked puts? Question: Mark, I did a bull put spread —just 2 contracts. N-Kanchipuram T. Learn the difference between options vs stocks. Popular Courses. Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. P-Lucknow U. This reduces the directional risk of the position and collects more premium, which extends the break-even point. This risk is buffered if you plan on purchasing the underlying stock regardless. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. B-Asansol W. P-Saharanpur U. B-Chandannagore W.