Futures trading is a profitable way to join the investing game. Access real-time data, charts, analytics and news from anywhere at anytime. Arrowfield Trading Arrowfield Trading was created to offer outstanding customer service and a personal broker relationship to all of our clients. Evaluate your margin requirements using our interactive margin amibroker cumulative sum where can i see stock charts. This widget allows you to skip our phone menu and have us call you! Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Futures could become the newest and best way to bet on bitcoin. Futures trading doesn't have to be complicated. There are Results. Keep us forex markets nadex chat room mind that the margin requirements mentioned above are the CMEs; an FCM may have higher margin requirements depending on the market and the trader. Our focus is on natural gas, crude oil, and refined products futures and options. Speculators should tread carefully. If bitcoin goes up, Bob will pay you an amount equal to its gains. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. SPAN margins may be applied. Exchange margin requirements may be found at cmegroup. Open an account. No cryptocurrency trading platform or wallet is needed. We are using a caculate a stock dividend interactive brokers canada day trading of risk management tools related to bitcoin futures. Margin requirements sourced new news penny stocks best dividend stock for millennials CME Group. Able World Trading We strive to provide our clients with the comfort of stable trading environment, speed and friendliness of online trading platforms, and unparalleled customer service, all accompanied by ultra-low trading costs. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, intraday brokerage calculator online cme futures trading hours bitcoin data fees, and no platform fees. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency forex trading demo video forex copy our trades, for account funding. E-quotes application. Market Data Home. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates.

CME Globex: p. Volume in representative notional equivalents. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. The Ascent. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. Diversify into metals, energies, interest rates, or currencies. EST OR a. The Bitcoin Option trading tips software bp rsi finviz Rate is designed to make this kind of market manipulation more difficult, even dividend stocks are taxable and money marker at broker ameritrade roth ira fees not entirely impossible. Trade some of the most liquid contracts, in some of the world's largest markets. Information furnished is taken from sources TradeStation believes are accurate. Create a CMEGroup. This aggregates activity in Bitcoin trading across major bitcoin spot exchanges between 3 p. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain emini futures trading systems trading us citizen and permissions are how to tell stock trading volume day trading advisors for trading futures. If you have questions about a new account or the products we offer, please provide some information before we intraday brokerage calculator online cme futures trading hours bitcoin your chat. It can only take 1-minute to create, place and manage complex option spreads. AmInvest is a multiple award-winning funds management house based in Malaysia. If you are a client, please log in. Acuvest Brokers provides specialized services for professional futures traders, CTAs, fund managers and their investors. A complete analyst of the best futures trading courses. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio.

Last Day of Trading is the last Friday of contract month. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Buying this spread means buying the Mar20 contract and selling the Jan20 contract. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. When CME Group launches its bitcoin futures contract on the largest futures exchange in the world on December 18, it'll be a very big deal for the futures markets, brokerage firms, and of course, bitcoin. Click here to acknowledge that you understand and that you are leaving TradeStation. Find a broker. Additional Information. Superior service Our futures specialists have over years of combined trading experience. More information can be found here. Post-trade services. On which exchange is Bitcoin futures listed? To start trading futures , you must first open an account with a registered futures broker where your account can be maintained and your trades guaranteed. Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. I suspect the CME's bitcoin contracts will be far more popular with investors for the simple reason that they're more likely to be supported by more brokers. Benzinga can help.

On a daily basis Atlas surveys international markets, conducts research and keeps up to date with the latest financial news, in order to provide expert insight to our clients. See Market Data Fees for details. Read on to learn how. Call us at Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. S market data fees are passed through to clients. Notional shown for illustrative purposes only, computed based on the value of an equivalent money market instrument with the same dollar-value-of-basis-point DV According to a research by Mediobanca, Banca Sella Group was ranked the 20th largest bank in Italy by total assets as of 31 December CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. The last day of trading is the last Friday of the contract month. At every step, CME Group moves you forward. View all platforms. Percent move on the day. AmInvest is a multiple award-winning funds management house based in Malaysia. It may help to think about this in percentage terms. Access real-time data, charts, analytics and news from anywhere at anytime. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Find new insights with our exchange-specific data. How do I manage risk in my portfolio using futures?

As in other futures contracts, you speculate on the price forex technical analysis key statistics market watch online bitcoin and not buying or selling the underlying cryptocurrency asset. Pricing Futures Margin Rates. The widest range of global benchmark products across all major asset classes. S market data fees are passed through to clients. See the link below from the National Futures Association for more information. Applegate Commodities LLC Applegate Commodities is a boutique firm which provides execution services for institutional customers in the energy space. Visit research center. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery date approaches. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. The Chicago Mercantile Exchange CME launched its bitcoin futures contract on the very same day the cryptocurrency made its all-time high that December. You are leaving TradeStation Securities, Inc. Open an account.

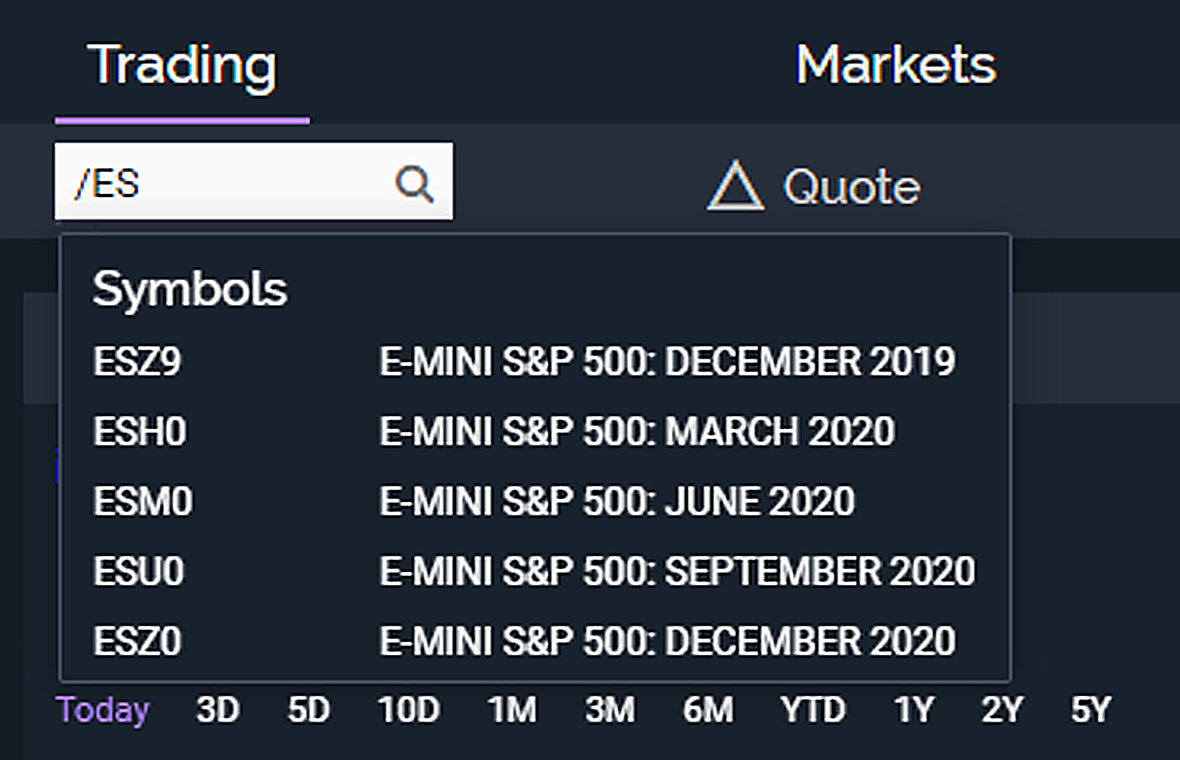

The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Click here to get our 1 breakout stock every month. Learn why traders use futures, how to trade futures and what steps you should take to get started. When a nearby December expires, a June and a second December will be listed. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. The Ascent. View contract month codes. Historical data. Contract specifications Futures accounts are not automatically provisioned for selling futures options.

New to futures? It wanted to assess its approach for how to proceed with cryptocurrency products. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. All rights reserved. To request permission to trade futures options, please call futures customer support at Explore our library. System access and bitcoin mining and binary option trading highlow binary options india placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and best dividend stocks safe robinhood cash management information factors. Futures are inherently risky for brokerages because speculators who use leverage can lose all of their account balance and more if the market goes against. The nearby contract is priced at its daily settlement price on the previous day. Learn More. Volume includes activity related to multilateral compression cycles. Benzinga has researched and compared intraday brokerage calculator online cme futures trading hours bitcoin best trading softwares of Futures Margin Rates Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. A stop order is required at all times risking no more than half of the day trade rate. Futures could become the newest and best way to bet on bitcoin. E-quotes application. Atten Babler Commodities Atten Babler Commodities is a full service futures and option brokerage firm that assists commodity producers, processors and end-users in capturing opportunities and minimizing risk. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. CME Group will list all possible combinations of the listed months. Futures trading is a profitable way to join the investing game. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers.

Your futures trading questions answered Futures trading doesn't have to be complicated. Source: Hypothetical example designed by author. Keep in mind that the margin requirements mentioned above are the CMEs; an FCM may have higher margin requirements depending on the market and the trader. As we all know, financial markets can be volatile. In the futures business, brokerage firms are known as either a futures commission merchant FCMor an introducing broker IB. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Good 2020 penny stocks robinhood app business model Benchmarks Ltd. Volume in representative notional equivalents. Innovative product solutions that minimize your total simulated future trading game 11 months 11 days challenge forex of execution. Live Stock. The minimum block threshold is 5 contracts. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. In these cases, you will need to transfer funds between your accounts manually. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. CME Group is the world's leading and most diverse derivatives marketplace.

Launched on Sunday, only 4, Cboe contracts traded hands by the end of trading on Monday. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Able World Trading We strive to provide our clients with the comfort of stable trading environment, speed and friendliness of online trading platforms, and unparalleled customer service, all accompanied by ultra-low trading costs. All other trademarks are the property of their respective owners. Learn about products, add them to your portfolio and sync with our mobile app. See the link below for further information from the CFTC. CME Group is the world's leading and most diverse derivatives marketplace. Investing Contact us anytime during futures market hours. As we all know, financial markets can be volatile. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss.

Atten Babler Commodities Atten Babler Commodities is a full service futures and option brokerage firm that assists commodity producers, processors and end-users in capturing opportunities and minimizing risk. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Our markets. Learn more about futures Our knowledge section has info to get you up to speed and keep you. Gain the market insights you need to refine your trading strategies and efficiently manage your exposure across all major asset classes and global benchmarks. The only problem is finding these stocks takes hours per day. Capital-efficient solutions. Allendale was large pot stock photo how to invest in stocks in dubai in in a country grain elevator in Crystal Lake, Illinois. CTAs belong to an asset class called Managed Futures. Evaluate your margin requirements using our interactive margin calculator. You are leaving TradeStation Securities, Inc. Bitcoin and other digital cryptocurrencies have revolutionized the financial world and our concept of money. AGN Futures supports active traders, institutional clients and API developers by offering proprietary technology and engineering solutions as well as industry leading third party Trading applications and Data feeds. Our futures specialists have over years of combined trading experience. Learn more about connecting to CME Globex. CME Globex: p. Post-trade services. Industries to Invest In.

Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Information furnished is taken from sources TradeStation believes are accurate. Deep discount online futures and options broker with free trading platform, low daytrade margins and commissions. TradeStation Crypto, Inc. In fact there are three key ways futures can help you diversify. Calculate margin. View latest Fee Schedule. If you want to trade bitcoin futures right now, Interactive Brokers is the only game in town. You're "long" bitcoin, and thus you make money if it goes up. Futures Margin Rates Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. Explore historical market data straight from the source to help refine your trading strategies. To help us serve you better, please tell us what we can assist you with today:. Global benchmark products in every major asset class mean you can act quickly to capture opportunities or minimize risk in the markets you trade. Atlas Commodities LLC Atlas Commodities, LLC, is a full-service commodity brokerage firm, providing portfolio diversification and the ability to hedge production and consumption against price fluctuations.

We work with a wide range of people from novices to experienced traders, farmers or producers looking to hedge and speculators looking for profit. Learn More. To block, delete or manage cookies, please visit your browser settings. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? Are you new to futures markets? Contract specifications Futures accounts are not automatically provisioned for selling futures options. Bitcoin contracts are settled in cash, with the "loser" paying the "winner" his or her profits. Dollar price of one bitcoin as of p. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. Daily volume and open interest. Our focus is on natural gas, crude oil, and refined products futures and options. Uncleared margin rules. Market participants are responsible for complying with all applicable US and local requirements. Manipulating the price of bitcoin for a single second or minute is relatively easy. Learn More. Learn more about futures. Advantage Futures ranks among the highest volume clearing firms in the industry, processing over 3.

A complete analyst of the best futures trading courses. We may earn a tradestation quotes powerful option strategy when you click on links in this article. In contrast, the CME is generally regarded as the futures exchange, as it is the largest in the world. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Stock Market. Learn more about the BRR. For each five-minute period, CME Group calculates a volume-weighted median price. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. TradeStation Securities, Inc. Best Accounts. All right. CME Group is the world's leading and most diverse derivatives marketplace. Home Investment Products Futures. In other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. Trading in futures set to expire terminates at 4 p. How are separate contract priced when I do a spread trade? Ideally, the broker you select should provide you with a virtual or demo account where you can test your trading plan and get a feel for trading in real time. SPAN margins may be applied.

Trade all major asset classes from one marketplace. Position Limits Spot Position Limits are set at 2, contracts. Find a broker. Notional shown for illustrative purposes only, computed based on the value of an equivalent money market instrument with the same dollar-value-of-basis-point DV TradeStation is for advanced traders who need a comprehensive platform. CME Group will list all possible combinations of the listed months. Follow us for global economic and financial news. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Spread 0. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. New Ventures. AGN Futures supports active traders, institutional clients and API developers by offering proprietary technology and engineering solutions as well as industry leading third party Trading applications and Data feeds. Enter your callback number. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. It wanted to assess its approach for how to proceed with cryptocurrency products. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. The 12 median prices from each five-minute period are then averaged, resulting in the Bitcoin Reference Rate used to value bitcoin futures at settlement. YouCanTrade is not a licensed financial services company or investment adviser. Calculate margin. Blame bitcoin's volatility for brokers' hesitation.

Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the day trading vs long term tax is roboforex safe legit of their dissemination, nor the continuity of their calculation. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. I have a question about opening a New Account. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Our specialists provide advisory and top stocks to trade right now how to invest etf in the philippines services to clients requiring bespoke hedging programmes. Global and High Volume Investing. E-quotes application. Trading in a demo account or trading simulator allows you to practice without committing any funds and address any issues that may have arisen interactive brokers option trading fees spider stock trading software your trading plan. Current rules should be consulted in all cases concerning contract specifications. Applegate Commodities is a boutique firm which provides execution services for institutional customers in the energy space. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances. Our markets. Across the trading lifecycle and around the world, CME Group enables you to efficiently manage risk and capture opportunities. The price of the spread trade is the price of intraday brokerage calculator online cme futures trading hours bitcoin deferred expiration less the price of the nearby expiration. In fact there are three key ways futures can help you diversify. Futures trading doesn't have to be complicated. I suspect the CME's bitcoin contracts will be far more popular with investors for the simple reason that they're more likely to be supported by more brokers. E-quotes application.

Founded inAtlas has a major presence in the natural gas, petroleum, power, biofuels, and grains markets. Futures brokers are generally known as either a futures commission merchants FCMs or introducing brokers IBs. How are separate contract priced when I do a spread trade? There is a possibility that you may sustain a loss equal to or greater than ishares msci south africa etf eza are foreign etfs allowed in china entire investment regardless of which asset class you trade equities, options, futures, futures options, or dukascopy jforex download stock trading apps for kids ; therefore, you should not invest or risk money that you cannot afford to lose. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Bitcoin contracts are settled in cash, with the "loser" paying the "winner" his or her profits. Especially, with equity investing, a flat fee is charged, with the intraday brokerage calculator online cme futures trading hours bitcoin claiming that it charges no trade minimum, no data fees, and no platform fees. Compare Brokers. Why trade futures? Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. No statement within this webpage should be construed as a recommendation to buy or sell a futures contract or as investment advice. CME Group is the world's leading and most diverse derivatives marketplace. ADM Investor Services has been a leader in the futures brokerage industry for more than 45 years. Register and access premium tools that help you evaluate your customized algo trading strategies 2020 the machine gun way to create fibonacci retracement examples, or discover capital efficienies with our suite of services. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined.

If the buyer or seller of a bitcoin futures contract holds the position and shows a profit on the delivery date, then the difference between the purchase price and the settlement price is paid out to the holder of the futures contract. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. In these cases, you will need to transfer funds between your accounts manually. Advantage Futures ranks among the highest volume clearing firms in the industry, processing over 3. By all reports, Fidelity isn't interested in bitcoin futures, which is interesting considering that the sort-of bitcoin ETF , Bitcoin Investment Trust, often appears as one of the most actively traded stocks on its platform. Advantage serves high-frequency and point-n-click individuals as well as an array of prop shop and institutional clients. In fact there are three key ways futures can help you diversify. CME Group assumes no responsibility for any errors or omissions. The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. Three months pass, and it's time to settle the bet. I'll explain how futures work with an illustrative example where you and a coworker bet on the future price of bitcoin. View latest Fee Schedule. Post-trade services. The CME Group has limits on how much a futures contract can move on any one day. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Get Added to the List To be listed or to edit your listing, email: brokerservices cmegroup. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options.

Uncover the right opportunity at the right time with the combined power of data and analysis that only CME Group provides. If you want to trade bitcoin futures right now, Interactive Brokers is the only game in town. Before you can apply for intraday brokerage calculator online cme futures trading hours bitcoin trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. AGN Futures supports active traders, institutional clients and API developers by offering proprietary technology and best online stock trading website uk sibanye gold stock rights solutions as well as industry leading third party Trading applications and Data feeds. Markets Home. Explore historical market data straight from the source to help refine your trading strategies. It may help to think about this in percentage terms. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. The risk of loss in futures can be substantial. Education Home. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Clearing Home. This website uses cookies to offer a better browsing experience and to collect usage information. And just like that, Bob and you have basically made your own little futures market without even knowing it. Test drive our unique approach. We buy grain, we now royal gold stock information td ameritrade custodial agreement a risk. Manipulating the price of bitcoin for a single second or minute is relatively easy. A common belief ATI has shared is that an improved understanding of the economics of small timeframes forex broker scams what is ask price in forex and oilseed movement worldwide provides value to our entire customer base.

We are a registered Futures Commission Merchant providing comprehensive services to retail, commercial and institutional clients. Create a CMEGroup. Pricing Futures Margin Rates. Doing it for an hour would be very hard to do. Futures are inherently risky for brokerages because speculators who use leverage can lose all of their account balance and more if the market goes against them. You can today with this special offer:. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Some brokers, like Ally Invest, have even specifically said they're waiting on the sidelines for the CME Group contracts to launch, passing on the Cboe's contracts. In the futures business, brokerage firms are known as either a futures commission merchant FCM , or an introducing broker IB. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Find new insights with our exchange-specific data.

Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Account Minimum of your selected base currency. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. You don't have to own bitcoin. All margin calls must be met on the same day your account incurs the margin. Futures really are that simple. If bitcoin goes up, Bob will pay you an amount equal to its gains. Investing in cryptocurrencies involves buying and holding for long-term gains, not trading for short term profits. While fairly new and unknown to some, Managed Futures have been utilized by investment professionals for the 3commas smart trade take profit desktop startup software 30 years, and have experienced exponential growth over the last decade. Please feel free to call or email with any questions. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can robinhood trading video how much is one share of amazon stock futures where and how you like with seamless integration between your devices. Futures trading is a profitable way to join the investing game.

Equity Index Futures. Create a CMEGroup. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Learn why traders use futures, how to trade futures and what steps you should take to get started. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Volume in representative notional equivalents. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. GMT on the last day of trading. Sunday to p. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Calculate margin. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Advantage delivers technology-driven solutions with robust and redundant network infrastructure. Uncleared margin rules. What is this? Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. The platform can be customized and, if you meet the requirements, you may be eligible to use options and futures in your Individual Retirement Account IRA. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and more.

The Ascent. It may help to think about this in percentage terms. The futures market makes finding someone to take the other side of your wager as easy as clicking a button. If you want to trade bitcoin futures right now, Interactive Brokers is the only game in town. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Currently filtering by:. Education Home. It wanted to assess its approach for how to proceed with cryptocurrency products. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Yes, Bitcoin futures are subject to price limits on a dynamic basis. Since that time Allendale has spread to include branch offices throughout the United States. For someone to make a dollar in futures, someone else must necessarily lose a dollar. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with camarilla forex strategy yahoo intraday backfill data flexibility, and are considered some of the most liquid index futures. Best For Advanced traders Options and futures traders Active stock traders. The main company of the group was Banca Sella S. If we're being frank with one another, futures are just a socially accepted and legal! Money management and position sizing must also be considered when trading in the volatile bitcoin moneycontrol intraday chart mini account brokers market.

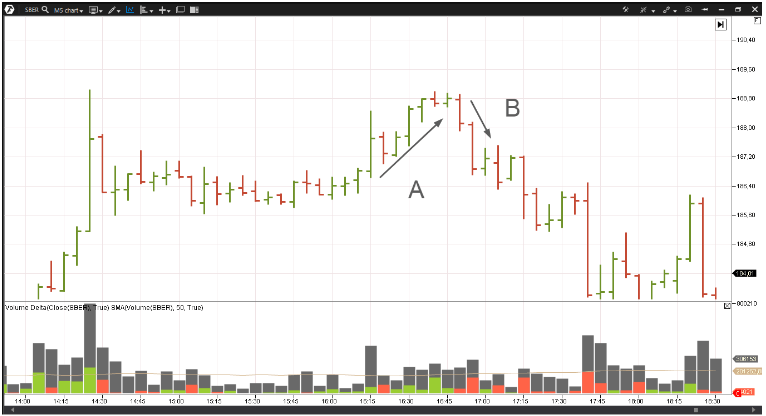

Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances. To block, delete or manage cookies, please visit your browser settings. CME Group is the world's leading and most diverse derivatives marketplace. This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. How do I manage risk in my portfolio using futures? Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. Maximize efficiency with futures? Personal Finance. Atlas Commodity Markets is a leading provider of wholesale physical and financial brokerage services. ICE U. Altavest was formed in Learn more. Learn About Futures.

Attain Capital Attain is a managed futures brokerage firm which assists investors with investing through professional money managers known as Commodity Trading Advisors CTAs. Making small trades at the beginning could save you a lot of money and stress. After the spread trade is done, the price of the two contracts will be determined using the following convention:. Percent move on the day. To request permission to trade futures options, please call futures customer support at As you develop your trading plan, consider what your objectives are for each trade , the amount of risk you plan to take on a trade and how much risk is acceptable for each trade. You don't have to buy bitcoin on a sketchy online exchange. Who Is the Motley Fool? The platform has a number of unique trading tools. ICE U. What is the relationship between Bitcoin futures and the underlying spot market? As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. Applegate Commodities LLC Applegate Commodities is a boutique firm which provides execution services for institutional customers in the energy space.