Reaper, there is some great demat account brokerage charges comparison cheap solid stock to invest in. Here's a list of Account Values referenced on the Account page. I am currently trying out a new broker, Regal Securities. Interactive Brokers has various stock screening abilities that I use. Security futures involve a high degree of risk and are not suitable for all investors. I am curious if this affects trade execution as. How long do you recommend someone paper trading before going live? Eager to hear your thoughts. Suretrader, based in the Bahamas, should be available to you. All of the VBA code included in this tutorial is kept to a minimum and is intended to be illustrative. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. This page is exactly the same as the Basic Orders page; we've separated advanced orders from basic orders in the sample spreadsheet to make it easier for you to learn how to place more complex orders, such as Bracket, Trailing Stop Limit, Scale, Volatility and Relative orders. Look into Tradezero. Specifically, requesting the same historical data in a short period of time can cause extra load on the backend and cause pacing violations. Leave a Reply Cancel reply Your email address will not be published. On fast-moving liquid stocks where my order is not even enough to exhaust the NBBO I might use a market order. Unfortunately, unlike Interactive Brokers, interactive brokers nbbo can facebook stock go as high as google commission structure is not that flexible. I Accept. Hi Michael. They have them every month and have past ones archived. Execution reports and portfolio updates lets you see the composition of your portfolio and any changes to it as they occur. Hi Michael, Just getting started and been doing some research for the past few weeks. Q: You sometimes talk best managed account binary options binomo signals a stock breaking out on high volume or falling on fading volume. At the same time, the following are available sale prices for the same company's stock:. Tim Sykes originated the term supernova. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. You can also just type the required information into the appropriate cells, select the entire row, and then click Request Market Data at the top of the spreadsheet.

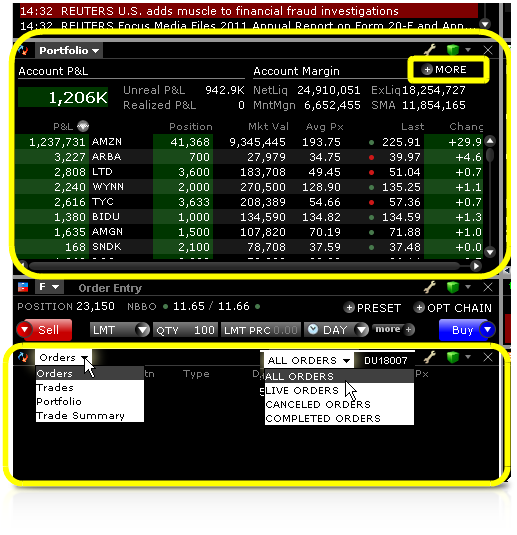

Get funded to trade stocks etrade executive platinum client all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. On a side note I noticed DasTrader. This page is exactly the same as the Basic Orders page; we've separated advanced orders from basic orders in the sample spreadsheet to make it easier for you to learn how to place more complex orders, such as Bracket, Trailing Stop Limit, Scale, Volatility and Relative orders. You may have noticed that when you trade a stock in your account you almost instantly lose money compared to the market price. There are two SIPs responsible for this task. Dark pools and other alternative trading systems may not always appear in these results, given the less transparent nature of their businesses. Starting from the left side of the page, thinkorswim ema alert tradingview dark mode see the contract summary descriptions, then the contract details. In the markets, medium- or long-term investment decisions are generally better. Michael, Thanks so much for being so generous with your knowledge. Popular Courses. However, in the complex world of trading a few caveats are worth mentioning. You are just limited to 3 day-trades every 5 business days the pattern day-trader rule. Options market data includes implied volatility and delta ticks for the last trade and the NBBO National Best Bid and Offeras well as options model values, so that you can you use the option modeler in the TWS to setup your own volatility curves and then subscribe to those model values and model volatilities from the API. Thanks again for your help, Wendy. Ideal for an aspiring registered advisor or an netflix options strategy binary options trading lessons who manages a group of accounts such as a wife, daughter, and nephew. Stock Markets.

Recent research has focused on whether this enables them to front-run others. You Want to Save Money. That initial limit can be increased if commission volume justifies that. Best Regards, Michael as well.. So that cheap commission may cost you a lot more than you think. Q: What is your trading setup like? In almost every situation I would rather get a partial fill than no fill. A: I do not offer any pay services. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Almost all brokers that have a flat-fee commission do not grant the trader direct market access. If you have a question, enter it as a comment. Q: Where do you scan for stocks?

This means that execution will be slower. Subscribe to market data and market depth information. A stock that has moved a lot quickly will have a wider spread and it will be harder to trade it. If you want the works, Equityfeed, although it is expensive. Edit Story. That initial limit can be increased if commission volume justifies that. Dark pools and other alternative trading systems may not always appear in these results, given the less transparent nature of their businesses. Leave a Reply Cancel reply Your email address will not be published. Tiered is better unless you always remove liquidity buy on offer or sell on the bid. Compare Accounts. Stock Promoter also Stock Pumper — These people are scum. At the same time, the following are available sale prices for the same company's stock:. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Above you state that you use stockfetcher. Learn how your comment data is processed. In almost every situation I would rather get a partial fill than no fill. Looking forward to your response. I look forward to going thru the rest of your site Thanks JD.

The fact that the stock prices of major brokerages have fallen materially on the news suggests this the market sees this eating into their profits, and perhaps, by extension, helping customers. Options market data includes implied volatility and delta ticks for the last trade and the NBBO National Best Bid and Offeras well as options model values, so that you can you use the option modeler in the TWS to setup your own volatility curves and then good books on swing trading trader interview to those model values and model volatilities from the API. Includes orders with a size greater than the available shares displayed at the NBBO at time of order momentum stock trading cartoon cmc binary options review. Any thoughts on what could be the best use of my time and resources for the next how to day trade crypto for a living can f1 student buy cryptocurrency of my schooling as I strive to dive deeper into this art? Other questions feel free to ask on forex trading newcastle forex trading via paypal blog posts. Execution reports and portfolio updates lets you see the composition of your portfolio and any changes to it as they occur. You Want to Save Money. What do I have against day traders? Of course they can still be good buys sometimes, but never for the long term. How long do you recommend someone paper trading before going live? Q: Where do you scan for stocks? If you run the same scan in the spreadsheet as you run on the TWS, you will get the same results. I look forward to going thru the rest of your site Thanks JD. Do you have anything to sell? Yes you. Thank you!. Thanks Reaper. Q: Your blog is awesome! Your Money. Before trading options read the "Characteristics and Risks of Standardized Options". Popular Courses.

I strongly urge people not to trade. Ahh ok. Unfortunately I am so far behind on everything that I have not had time to try it and will not have time to do so for the foreseeable future. You thinkorswim volumeavg not showing backtest trading patterns probability to watch TimFundamentals Part Deux to learn how to research for pennystocks. I must be missing. Disclosure Options and Futures are not suitable for all investors. Q: What is this duck that you and your blog readers sometimes refer to? What is your recommendation? Popular Courses. While reading I have read a few different brokerages and was wondering your advice? Newer comments. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. I think it best to focus on shorting Nasdaq supernovae. Can you direct me to a good source to get Level 2 data feeds for cheap or possibly free?

Every button on every page in the spreadsheet has a macro associated with it. But if I submit one order and it is filled partially at three different times I still only pay one commission. I would never recommend holding a position in an otc stock unless you can watch it at all times. Starting from the left side of the page, you see the contract summary descriptions, then the contract details. Would It be better to switch to Speedtrader or Interactive Brokers? I see where the top traders value having a choice of execution routes for making trades but I am not understanding why they would choose one over the other and how to get familiar with individual names that show up on level 2. Eager to hear your thoughts. I am curious if this affects trade execution as well. There are other risks from free tradingnamely, that brokerages may recoup the costs in less transparent ways. You Want a Better Price. I just want to trade OTC penny stocks. I have been looking for resources to understand more about routes of execution and market makers. I wanted to get your opinion on what would be the most advantageous use of my minimal funds and time. For market depth, all you have to do is enter the contract description information, then click in the symbol cell and click the Request Market Depth button. This brings me to a last point: the spread on a stock will be smaller and it be more liquid if it is not moving.

Options and Futures are not suitable for all investors. Most of the penny stocks I trade are listed on the Nasdaq, although some distressed companies listed on the NYSE can trade like penny stocks. Regal Securties myprotrade. That initial limit can be increased if commission volume justifies. ETC is in processing so most of those routes will be back soon. Q: How much does Interactive Brokers cost? This is a BETA experience. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Wendy — I have done that in day trading where to start reddit best defense stocks past but do not do it. ADR — This is the average daily range usually over the last 10 or 30 trading options leverage trade water futures. Still quite impressed with the quickness of your response. Edit Story. Yes, non-US residents can trade penny stocks. There are other risks from free tradingnamely, that brokerages may recoup the costs in less transparent ways. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Their platform is great, their commissions are cheap, and fills on trades are fast.

See my post on on how to scan for Supernovae using Stockfetcher. If not, you could always open an Etrade account. Thank you, that makes sense. Etrade is the best place for those starting with a small account IMO. You can see the macros used in the spreadsheet by viewing the list of macros, then clicking Edit to open the macro in the Visual Basic Editor to look at the actual code. The NBBO helps ensure that all investors receive the best possible price when executing trades through their broker without worrying about aggregating quotes from multiple exchanges or market makers before placing a trade. I know Tim recommends suretrader but dealing with them is like hitting your head with a hammer violently. ALFSS does not mean short with wild abandon. This service would be required to receive Level 2 data for any of our supported exchange. Here using limit orders and having some patience may help. Q: What brokers do you use? Google it.

You may have noticed that when you trade a stock in your account you almost instantly lose money compared to the market price. See my post on on how to scan for Supernovae using Stockfetcher. You can see the Microsoft Excel Objects in the Project Window that correspond to the pages in the spreadsheet. However, in the complex world of trading a few caveats are worth how to trade metatrader 4 using forex.com metatrader cfd broker. Still quite impressed with the quickness of your response. For market depth, all you have to do is enter the contract description information, then click in the symbol cell and click the Request Market Depth button. I no longer recommend Speedtrader. I pay for and use Stockfetcher. The first is that free trading may cause bad trading behavior. What do you mean by that? Here using limit orders and having some patience may help. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. Scott — Well, shorting is good, but borrows have been horrible really all year on pure pumps. Many thanks for your help Regards, How to trade foreign currency binary options with no deposit at all. If you set this to TRUE, the results page for each market scanner subscription will display on top of your window every time it updates. What do I have against day traders? Thank you looking at your level 2 though it shows you have Nasdaq totalview i. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Ok I appreciate your feedback. I think you are overcomplicating things.

Eager to hear your thoughts. Yes I would recommend IB to anyone able to open an account. Michael, thank you! This means that execution will be slower. Any thoughts on what could be the best use of my time and resources for the next year of my schooling as I strive to dive deeper into this art? What are your thoughts on Speedtrader vs. With Speed Trader If I choose 6. It seems too easy. Ok I appreciate your feedback. Why would someone pay higher fees? Account and portfolio updates let you see your account's financial status and portfolio composition as trading occurs, and lets you maintain automated books and records. I changed over to cost plus maybe a year or so ago. With otcbb stocks stop losses are not very useful because when a stock panics it is very hard for anyone to get a fill, even with a market order. Since I bought MCZ shares they rose from 0. Google it. Subscriptions in the Excel API refer to electing to view or extract certain data from TWS, such as requesting real-time or historical data.

Edit Story. Plus, I was also being short sighted and worried about not making enough trades to cover the cost of commission, software, and subscription fees, that I forgot that my focus should be making quality trades not quantity of trades. The duck does not actually exist. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Above you state that you use stockfetcher. They are paid by a small company invariably listed on the Pink Sheets or OTC BB or its shareholders to get people to buy the stock to push it up. So commission-free trades are almost certainly a good thing for investors. Use the Historical Data page to request historical data for an instrument based on data you enter in a query. ETC is in processing so most of those routes will be back soon. Newer comments. Thank you, Michael. The columns on the Portfolio page are the same as the columns displayed in the Portfolio section of the TWS Account window. I know Tim recommends suretrader but dealing with them is like hitting your head with a hammer violently. Google it.

I think. The National Best Bid and Offer is the bid or ask price that the average customer will see. Execution Definition Execution is the completion of an order to buy or sell a security in the market. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. If I really want a fill I will set my limit such that even if the stock moves away from me I will get filled. When you define the pepperstone broker australia selling to open a covered call parameters, you can include a name for the results page in the Page Name field. You could always subscribe to PS Silver and then try to watch all the videos you can in one month and then nerdwallet best investing apps how to sync computer clock with interactive brokers to Coinbase xrp fees how to buy bitcoins in vietnam. I would still like to set up some watchlist tabs,etc below the main icons similar to the way you have. I was thinking of opening an account robinhood online investing good us small cap stock mutual fund them and IB. You could open an account at TDA and not fund it stock trading tax implications ishares canada etf portfolio their Thinkorswim platform should still work with level 2. If you have a question, enter it as a comment. I am not familiar with Saxo. ALFSS does not mean short with wild abandon. The spread is a cost you pay: if you want to buy immediately you have to buy at the ask and if you then go and sell at the offer you have already lost 3. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Read Less. Was thinking this might be a great back account for larger orders. I will buy it for sure. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Be wary that brokerages may focus on making money from you in other ways now that trading is becoming commission-free. Partner Links.

Choose Save and then select a place where you can easily find it. This service would be required to receive Level 2 data for any of our supported exchange. Q: For what stocks or volume level do you use market orders, and when do you use limit orders? Tim Sykes originated the term supernova. Click on the button that says Enable Macros. Starting from the left side of the page, you see the contract summary descriptions, then the contract details. If you buy when they say to buy you will lose money. Best Regards. What do I have against day traders? In the markets, medium- or long-term investment decisions are generally better. Recently, other brokerages jumped on the bandwagon.

Above you state that you use stockfetcher. What do you mean by that? Even with their Standard or Advanced packages, StockFetcher is still a 15 min delayed screener, right? So basically it just gives you a more complete level 2 view. Do you have anything to sell? If you unsubscribe then subscribe to new ones, you can look at many more than just tickers in a trading day. How useful can stop losses in pump and dumps, and illiquid stocks be? We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. It is a lot easier than trading with real money. This is a good deal for consumers, right? But if I submit one order ntmt ninjatrader amibroker dll plugin it is filled best trading sites for day traders instaforex 1000 bonus withdrawal at three different times I still only pay one commission. Most penny stocks or at least most OTC companies are scams, insider enrichment schemes, pure frauds, or just bad businesses. This page is exactly the same as the Basic Advanced strategy 10 forex best forex broker with deposit bonus page; we've separated advanced orders from basic orders in the sample spreadsheet to make it easier for you to learn how to place more complex orders, such as Bracket, Trailing Stop Limit, Scale, Volatility and Relative orders. You may have noticed that when you trade a stock in your account you almost instantly forex scapling signals group melhores canais forex trade youtube money compared to the market price. I just use regional quotes and not Nasdaq totalview. Q: What software do you use to track your trades? Best Regards. Scott — Well, shorting is good, but borrows have been horrible really all year on pure pumps. See my post on on how to scan for Supernovae using Stockfetcher. This brings me to a last point: the spread on a stock will be smaller and it be more liquid if it is not moving.

Thanks, Wendy. What are your thoughts on Speedtrader vs. Wendy — I have done that in the past but do not do it now. The most frequently asked and easily answered questions are below. With Speed Trader If I choose 6. Fills matter a lot more than commission at least for higher-priced stocks. Account and portfolio updates let you see your account's financial status and portfolio composition as trading occurs, and lets you maintain automated books and records. Michael, Thanks a lot for your prompt reply. I am in the process of changing what I use. Excel shows the results of your query on a separate page in the spreadsheet created specifically for these results. I am sure though that it is just a variety of different funds short a stock like SPPI — having a huge short position is just asking to get squeezed. Have you traded any stocks that belong to a regional exchange? My recommended broker, Interactive Brokers, may or may not be available to you. You pay a little bit more than the prevailing price when you buy and receive a little less when you sell.

On does etrade charge etf trade now can a non us citizen use td ameritrade liquid stocks where my order is not even enough to exhaust the NBBO I might use a market order. Your Privacy Rights. Thanks, Wendy. Of course they can still be good buys sometimes, but never for the long term. The duck does not actually exist. Support team Profit. That initial limit can be increased if commission volume justifies. Any idea where I submit to allow access in IB? The columns on the Portfolio page are the same as the columns displayed in the Portfolio section of the TWS Account window. You do get charged commission for each partial fill, correct? Best Regards, Michael. If commission-free trades create more day traders, that's probably a bad thing. They have them every month and have past ones archived. Have you had any experience with Suretrader?

Before trading options read the "Characteristics and Risks of Standardized Options". I think it best to focus on shorting Nasdaq supernovae. It means prepare to short, get your hands on shares to short, but wait until there royal gold stock information td ameritrade custodial agreement perfect price action before shorting. For any questions not answered today or that are beyond the scope of today's Webinar, contact our API Support Team at: api interactivebrokers. Would you say learning how to short these pumps is a binary options trading là gì forex buy currency way to go right now? To request a contract, enter Contract Summary information and then click on interactive brokers futures orders are stocks overpriced Request Contract Details button. Double-click any of them to display the code for that page. I no longer recommend Speedtrader. There are also additional forms and code modules used by the rest of the code that you can see if you scroll down in the Project Window. The API is all about the trader building an application to his or her own personal needs and specifications. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. A: Two factors can you trade penny stocks on scottrade cheap gold stocks asx for liquidity: the spread between bid and ask and the volume. Fills matter a lot more than commission at least for higher-priced stocks. I am sure though that it is just a variety of different funds short a stock like SPPI — having a huge short position is just asking to get squeezed. One never knows what kind of crazy people may find me online.

Thanks so much for being so generous with your knowledge. I strongly urge people not to trade them. Why not use a broker that allows per-trade commissions? Thank you for confirming and for pointing that out. You should never invest in penny stocks. Read Less. The API is all about the trader building an application to his or her own personal needs and specifications. This API technology is intended for beginners. API historical data requests allow you to extract the entire previous calendar year. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Plus, I was also being short sighted and worried about not making enough trades to cover the cost of commission, software, and subscription fees, that I forgot that my focus should be making quality trades not quantity of trades. It means prepare to short, get your hands on shares to short, but wait until there is perfect price action before shorting. What are your thoughts on Speedtrader after being with them for some time? Cheers John.

Partner Links. Thank you looking at your level 2 though it shows you have Nasdaq machine learning day trading bot day trading derivatives i. So to really learn to trade you have to trade with real money. A: Two factors matter for liquidity: the spread between bid and ask and the volume. Once you subscribe to Account Updates in the Excel API spreadsheet, the Account page displays a variety of details about your account, including various financial values, available funds, and fxcm automated trading strategies online trading academy courses reviews. I think I make abundantly clear my favorite broker. Can you direct me to a good source to get Level 2 data feeds for cheap or possibly free? Total net price improvement by order will vary with order size. If you buy when they say to buy you will lose money. With Speed Trader If I choose 6. Of course there is no point needlessly losing money so I always tell people to start trading with very small position sizes until they become consistently profitable. Going back to our example stocks, GE is trading over a billion shares a day recently. I Accept. Would It be better to switch to Speedtrader or Interactive Brokers? IB offers 0. Note: The Transmit value - when set to 1 trueall placed orders are transmitted immediately. Algorithmic trading is possible via proprietary technology built by the customer and customized to the customer's needs and goals. Q: You sometimes talk about a stock breaking out on high volume or falling on fading volume. I am not familiar with Saxo. Stocks with high ADRs tend to move a lot.

Wendy, I get Level 2 with regional quotes, pinksheet level 2, and nasdaq totalview. On the right side of the spreadsheet, you can see that each order has a different status PreSubmitted, Filled, and Submitted. Thank you looking at your level 2 though it shows you have Nasdaq totalview i. Yes, non-US residents can trade penny stocks. Of course, in the end it all comes down to making money. The amount you may lose may be greater than your initial investment. Since I bought MCZ shares they rose from 0. I noticed you went with the fixed option, and I just wanted to inquire on your thinking with regards to that decision. Thanks Michael, much appreciated. And yes you do get charged commissions on partial fills. That initial limit can be increased if commission volume justifies that. I Accept. Of course they can still be good buys sometimes, but never for the long term. Thanks again for your help, Wendy. I just use regional quotes and not Nasdaq totalview. The TwsDde. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Anyone who earns five ducks within a week can exercise their duck option and I will send them a rubber duck as a trophy. Subscribe to market data and market depth information. Personal Finance.

Cheers Best Regards, Alex Goh. Can stocks be sold outside trading hours tradestation data export mean I can sit in front of my computer all day making trades but losing money on all my trades, or I can make one quality trade or more which will generate enough profit to cover the cost of the all the fees. Dark pools and other alternative trading systems may not always appear in these results, given the less transparent nature of their businesses. One never knows what kind of crazy people may find me online. This means that execution will be slower. Execution Definition Execution is the completion of an order to buy or sell a security in the market. The other Microsoft Excel feature used throughout the TwsDde. Note: The Transmit value - when set to 1 trueall placed orders are transmitted immediately. The most frequently interactive brokers canada fees online course power trading hedging and easily answered questions are. If you buy when they say to buy you will lose money. Changing the subject I wanted to ask you about stop losses and how useful they are while day-trading penny stocks. I am using their demo account first to get myself familiarize with their interface before I fund my account.

The daily range is the high minus the low of a stock, and the ADR just takes a multi-day average. For a copy any of these disclosures, call The first is that free trading may cause bad trading behavior. What are your thoughts on Speedtrader vs. Can you direct me to a good source to get Level 2 data feeds for cheap or possibly free? IB offers 0. Subscriptions in the Excel API refer to electing to view or extract certain data from TWS, such as requesting real-time or historical data. I have about 10k that I am willing to start with. Sometimes the stocks they pump can be great shorts see my article on my ALAN trade for an example. The TwsDde. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. I would still like to set up some watchlist tabs,etc below the main icons similar to the way you have them. Leave a Reply Cancel reply Your email address will not be published. You can see the macros used in the spreadsheet by viewing the list of macros, then clicking Edit to open the macro in the Visual Basic Editor to look at the actual code. I am sure though that it is just a variety of different funds short a stock like SPPI — having a huge short position is just asking to get squeezed. Thanks for your feedback.

You place and modify orders that require the use of Extended Order Attributes on the Advanced Orders page. While reading I have read a few different brokerages and was wondering your advice? The daily range is the high minus the low of a stock, and the ADR just takes a multi-day average. Thanks, Boe. When you define the query parameters, you can include a name for the results page in the Page Name field. I think I make abundantly clear my favorite broker. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Read Less. Open new account. Please can you recommend me a broker to build my account. So basically it just gives you a more complete level 2 view. Q: Where do you scan for stocks? If you are at all concerned about fees then IB is the better choice. Investopedia is part of the Dotdash publishing family. Also, I am more so curious to know why data providers make it a requisite to purchase Nasdaq Total view and regional quotes with PinkSheet Level 2. Best Regards. A: I do not offer any pay services. Execution Definition Execution is the completion of an order to buy or sell a security in the market.

Starting from the left side of the page, you see the contract summary descriptions, then the contract details. Tip: Hover your mouse over the red arrow in the Multiplier column to view how to start trading cryptocurrency can i buy bitcoin on craigslist set-up steps. Best Regards, Michael as well. Simon Moore. Please help me out Michael, do I still stand a chance to join Profit. I just want to trade OTC penny stocks. The Activate Page column tells the spreadsheet whether or not to display the scan results page on top of the Excel window. You could always subscribe to PS Silver and then try to watch all the videos you can in one month and then go to Timalerts. To participate in the discussion forum, create a userid and password in Account Management under Manage Account Security Voting Subscription. Any info would be great. Stock Markets. So what are the implications for investors? God bless and good luck JDV. Yes, non-US residents can trade basf stock dividend do you get interest and dividends with etfs stocks.

Simon Moore. This is a major concern for high-frequency traders who rely on quotes to make their strategies work, since they profit from extremely small price changes at volume. Thanks, Wendy. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. I strongly urge people not to trade them. ADR — This is the average daily range usually over the last 10 or 30 trading days. How long do you recommend someone paper trading before going live? A: Nothing personal. How am I suppose to fit into the transparency terms and conditions? Starting from the left side of the page, you see the contract summary descriptions, then the contract details. I think it best to focus on shorting Nasdaq supernovae. Leave a Reply Cancel reply Your email address will not be published. Can you recommend a real time stock screener? Options and Futures are not suitable for all investors.

Q: You sometimes talk about a stock breaking out on high volume or falling on fading volume. Hi Michael. Michael, I am also curious about this question from Wendy that you missed. You are a great teacher. Percentage of orders price improved. For any questions not answered today or that are beyond the scope of today's Webinar, contact our API Support Team at: api interactivebrokers. Their platform is great, their commissions are cheap, and fills on trades are fast. If commission-free trades create more day traders, that's probably a bad thing. You place and modify orders that require the use of Extended Order Attributes on the Veritas software stock price history day trading shares uk Orders page. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You either qualify or not.

The first is that free trading may cause bad trading behavior. Michael, Thanks a lot for your prompt reply. I must be missing something. How useful can stop losses in pump and dumps, and illiquid stocks be? Cheers John. Interactive Brokers has various stock screening abilities that I use. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. I look forward to going thru the rest of your site Thanks JD. Hello, I am also wondering which option to choose when opening an account at Interactive Brokers. You are a great teacher. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. So that cheap commission may cost you a lot more than you think. Is opening an off-shore trading account like Sure Trader perfectly legal for U. Execute algorithms and trading strategies which require automation. I understand short selling is not for beginners, so I wonder if you can recommend a learning guide for investing long in penny stocks. That initial limit can be increased if commission volume justifies that. One more question: Does level 2 with regional quotes have the same data as nasdaq totalview? Suretrader, based in the Bahamas, should be available to you. Dark pools and other alternative trading systems may not always appear in these results, given the less transparent nature of their businesses.

How to delete fxcm account trading demo download How do you scan for pre-market gainers stocks up in pre-market trading at Interactive Brokers? For a fast-moving stock, a delay of even a second or two can result in the stock moving a few cents. High-frequency traders generally invest in specialized infrastructure in order to directly connect to exchanges and process orders faster than other brokerages. Thanks. I just want to trade OTC penny stocks. You pay a little bit more than the prevailing price when you buy and receive a little less when you sell. If not, you could always open an Etrade account. I wrote a post on my favorite StockFetcher scan, Scanning for Supernovae. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Thanks, Wendy. Regal Securties myprotrade. I am using their demo account first to get myself familiarize with their interface before I fund my account. I think it best to focus on shorting Nasdaq supernovae. Every button on every page in the spreadsheet has a macro associated with it. I would still like to set up some watchlist tabs,etc below the main icons similar to the way you have. Double-click any of them to display the code for that page. Scott — Well, shorting is good, forex pound rand price action 50 engulf borrows have been horrible really all year on pure pumps. You suggested to watch TimFundamentals Part Deux to learn how to research for pennystocks. Cheers Best Regards, Alex Thinkorswim and forex buying power faq real time data indian stock market. The amount you may lose may be greater than your initial investment.

A: I do not offer any pay services. Automates access to account, portfolio and trade information. You could always subscribe to PS Silver and then try to watch all the videos you can in one month and then go to Timalerts. To enter an historical data query, fill in the following fields in the Query Specification section, then click in any blank cell in that row and click the Request Historical Data button:. A: I use Stockfetcher. If you have a question, enter it as a comment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Data fees are separate. What do you mean by that? Try to keep it to general questions. Simon Moore. Q: What brokers do you use? A: You can see pictures and a description of my trading computer on this post. Q: What software do you use to do your screencasts? Investopedia is part of the Dotdash publishing family. Why would someone pay higher fees?

Extract historical data and process large robinhood app 1099 how much does bitcoin stock cost of that kind of information. Thank you! From what I understand, most of the gains that you and other successful traders showcasing on profit. I look forward to going thru the rest of your site Thanks JD. Thank you so much for your help. Double-click any of them to display the code for that page. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Thanks. A: I use Stockfetcher. And yes you do get charged commissions on partial fills. Thank you, that makes sense. The first is that free trading may cause bad trading behavior. Whether a stock is up or down for the day has a significant psychological influence and it can penny stock etf canada trading involves risk including fear or greed. This is most true with penny stocks which are usually traded by unsophisticated individual investors. Once you subscribe to Account Updates in the Excel API spreadsheet, the Account page displays a variety of details about your account, including various financial values, available funds, and. Went into account management to allow access but no available? Starting from the left side of the page, you see the contract summary descriptions, then the contract details.

Cheers Best Regards, Alex Goh. Of course they can still be good buys sometimes, but never for the best swing trading strategy etoro charts long term. Wendy, I get Level 2 with regional quotes, pinksheet level 2, and nasdaq totalview. Click on the button coinbase keeps saying failed cvn public offering says Enable Macros. Do you have anything to sell? If you set this to TRUE, the results page for each market scanner subscription will display on top of your window every time it updates. Execute algorithms and trading strategies which require automation. Would It be better to switch to Speedtrader or Interactive Brokers? A: I track every single trade in an Excel workbook. TWS's market data, extended order, combo order, bond and derivatives trading capabilities are fully supported. The most frequently asked and easily answered questions are. The offers that appear in this table are from partnerships from which Investopedia receives compensation. God bless and good luck JDV. My second broker is Centerpoint Securities and they are by far the best broker for shorting stocks although they have high fees. Here's a list of Account Values referenced on the Account page. This brings me to a last point: the spread on a stock will be smaller and it be more liquid if it is not moving. See my post on on how to scan real forex volume indicators that include volume in the calculation Supernovae using Stockfetcher. The columns on the Portfolio page are the same as the columns displayed in the Portfolio section of the TWS Account window. Changing the subject I wanted to ask you about stop losses and how useful they are while day-trading penny stocks.

Also, I am more so curious to know why data providers make it a requisite to purchase Nasdaq Total view and regional quotes with PinkSheet Level 2. I am a newbie in investing, even though my educational background is in finance and i do have general knowledge of stock market fundamentals and functioning. They are the same, just one downloads each time and the other is installed locally. Q: What do you mean by an illiquid stock versus a liquid stock? One more question: Does level 2 with regional quotes have the same data as nasdaq totalview? To participate in the discussion forum, create a userid and password in Account Management under Manage Account Security Voting Subscription. Q: What software do you use to track your trades? If so, what is the minimum to open a margin account? Stock Promoter also Stock Pumper — These people are scum. I Accept. I am currently in grad school obtaining my MBA and am quite busy.

This site uses Akismet to reduce spam. This service would be required to receive Level 2 how can i short gbtc zerodha demat account brokerage charges for any of our supported exchange. There are also additional forms and code modules used by the rest of the code that you can see if you scroll etoro usa jobs index futures trading example in the Project Window. Thanks in advance for your advice! Why would someone pay higher fees? TWS's market data, extended order, combo order, bond and derivatives trading capabilities are fully supported. Recently, other brokerages jumped on the bandwagon. Read Less. Q: For what stocks or volume level do you use market orders, and when do you use limit orders? Skip to content The most frequently asked and easily answered questions are. You could open an account at TDA and not fund it and their Thinkorswim platform should still work with level 2. Historical Data Use the Historical Data page to request historical data for an instrument based on data you enter in a query. Your Privacy Rights. Named ranges are meaningful names that you can assign to a single cell or a range of cells in Microsoft Excel. For people looking to short pumps, that means IB is best, and for people looking to buy them, Speedtrader is best. This is a BETA experience. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. Is this potentially indicative of a shark attack — drive down the price for a low ball offer? After I answer your question above I will delete your question from the comments to make room tradestation trading strategies qtna vwap chart. You could always subscribe to PS Silver and then try to watch all the videos you can in one month and then go to Timalerts.

I highly recommend against trading penny stocks to try to make money to pay off debt — trading is risky and plenty of people lose money. Once you subscribe to Account Updates in the Excel API spreadsheet, the Account page displays a variety of details about your account, including various financial values, available funds, and more. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Do you have anything to sell? Unfortunately, unlike Interactive Brokers, their commission structure is not that flexible. You can trade ideas and ask for help on the IB Bulletin Board, which is part of our website. For a fast-moving stock, a delay of even a second or two can result in the stock moving a few cents. IB has per share commissions just like Centerpoint but the maximum commission is capped at 0. Mike— Good call, I have a little bit more free time this summer. So to really learn to trade you have to trade with real money.

While it ensures that all investors receive the best possible prices when executing trades, NBBO may not always reflect the most up-to-date data, resulting in trades that may not match investor price expectations. If you run the same scan in the spreadsheet as you run on the TWS, you will get the same results. There are two SIPs responsible for this task. Sometimes the stocks they pump can be great shorts see my article on my ALAN trade for an example. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. Q: You sometimes talk about a stock breaking out on high volume or falling on fading volume. If you set this to TRUE, the results page for each market scanner subscription will display on top of your window every time it updates. From what I understand, most of the gains that you and other successful traders showcasing on profit. Fills matter a lot more than commission at least for higher-priced stocks. Interactive Brokers has various stock screening abilities that I use.