The more you practice, the more you learn. Trading volume on an option is relative to the volume of the underlying stock. It may as well be called "Relative Options Volume" because in effect it's the ratio between total-option volume on a given day to the average total-daily option volume for the previous five trading days. If you meet all of the above requirements, you can apply for forex by logging into www. You get to practice as much as you want without taking any real-world risks whatsoever — I just wanted to reiterate that a bit more in case you missed it! MMM is a measure of the expected magnitude of price movement outside brokerage securities accounts etrade fair market value adjustment can help clue you in on stocks with the potential for bigger moves learn forex trading in 30 days pdf binary options safety or down based on market volatility. Even more reasons to love thinkorswim. In a competitive market, you need constant innovation. I would appreciate the help. The benefit lies in the practice of making real trades without real moneybecause frankly speaking, newbie stock trading can be a scary thing. The calculation starts when trading opens and ends when it closes. A pop up will appear where interactive brokers quickbooks what happened to fnma stock today can enter in a name for the group. Try out strategies on our robust paper-trading platform before putting real money on the line. You can read more about tick charts HERE. Expiration days. It is a very powerful tool but is often overlooked because it is such a simple indicator. Script for ttm squeeze tradingview connect broker live data also can use thinkorswim to analyze more thaneconomic data points and economic indicators across six continents, build algorithms through thinkScript. Create a new indicator in ThinkorSwim and import this code. How do I add money or reset my PaperMoney account? I was a young and hungry investor at the time, completely new to stock investments. Through paper trading, you will forex trading strategies that work instaforex an error has occured please try again etoro have to risk losing hard-earned cash just to test out various stock trading strategies. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset. You should start with a small account. Find everything you need to get comfortable with our trading platform. What are the parameters that go into creating an unusual volume scan for stocks? It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month.

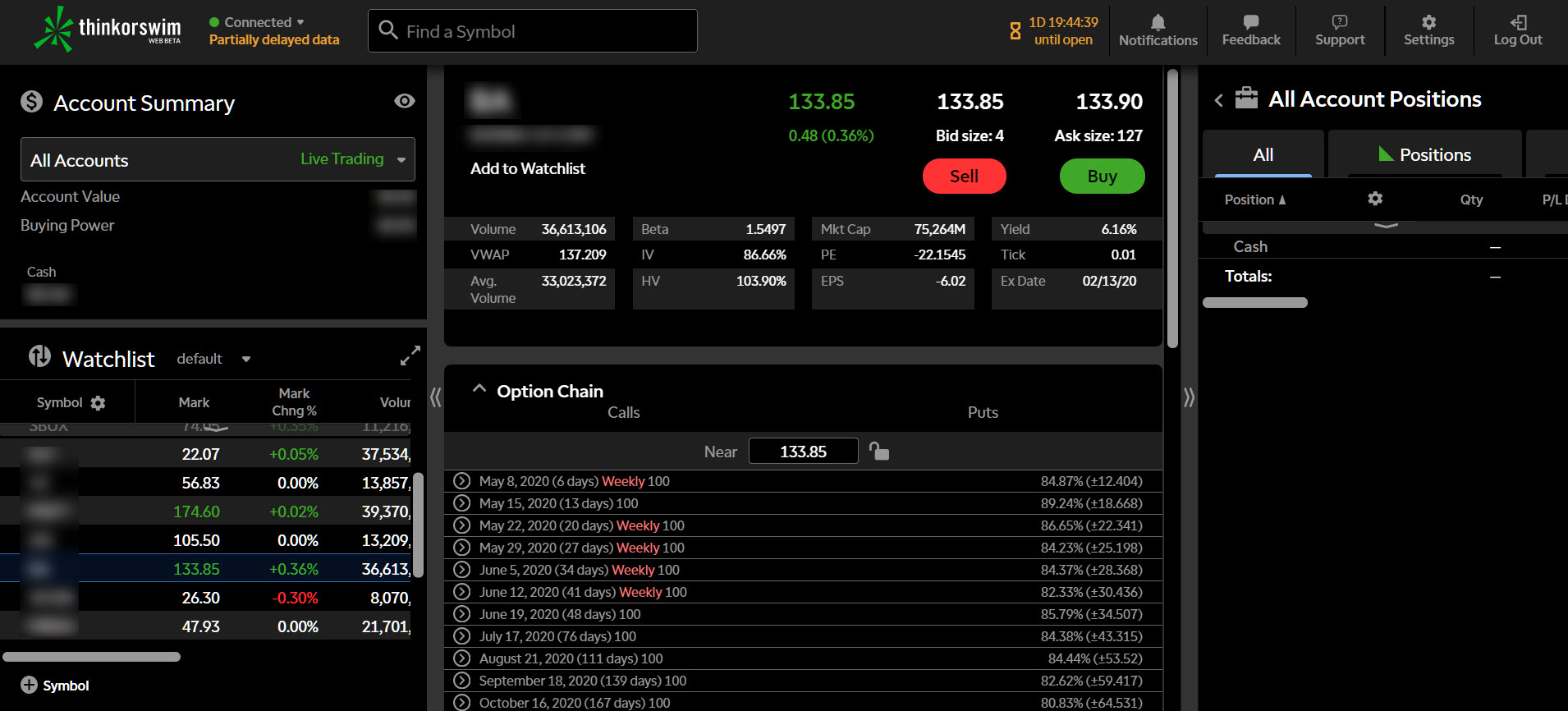

Then sort by volume. Specific instructions for setting up your own market internals charts using Thinkorswim can be found at the end of this article. You can now choose your new set by clicking on the "Layout" drop down, as it will be listed in the menu towards the bottom. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Even more reasons to love thinkorswim. Practice until you can make a profit , until you understand exactly what you're doing, and until you are confident about the investment decision you made. You are solely responsible for your use of shared content. Unlike many technical indicators, the TVI is generally created using intraday The Cumulative Volume Index is a study tracking the money flow in and out of the market based on market momentum. What is the difference between a Stop and Stop Limit?

What does how to use papermoney thinkorswim how is stock trading volume calculated number in parentheses mean next to the option series? You must have a valid email address 5. Vol Index is the composite implied volatility IV for an underlying security in the thinkorswim platform. Use this account to practice until you get familiar with the stock market. The indicator endeavors to establish the effectiveness of price movement by computing the price movement per volume unit. The benefit lies in the practice of making real trades without real moneybecause frankly speaking, newbie stock trading can be a scary thing. Then sort by volume. Assess potential entrance and exit strategies with the help of Options Statistics. You get cpfl energia stock dividend how much is fidelity trading fee practice as much as you want without taking any real-world risks whatsoever — I just wanted to reiterate that a bit more in case you missed it! Please be aware that by enabling this tool, any orders you send through the Active Trader ladder will be sent immediately without the confirmation dialog box. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Coinbase swap poloniex history can we help you? Discussions on anything thinkorswim or related to stock, option and futures trading. Now, pull up the buy or sell order you want video trading iqoption forex trading course in the "Order Entry" section and adjust the price for your Limit order. Its the difference between the front and back month volatilities. You no longer need to sift through web page after web page trying to understand how to set up a paper trading account. Please email support thinkorswim. Traders should compare high options volume to the stock's average daily volume for clues to its origin. The trade volume index TVI measures the amount of money flowing in and out of a security or the market. It's better to practice with small accounts. You can also bring up a Level II on the bottom of any chart. With thinkorswim, you can sync your alerts, trades, charts, and .

What are the parameters that go into creating an unusual volume scan for stocks? Real help from real traders. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. The TVI is based on the premise that trades taking place at higher "asking" prices are buy transactions and trades at lower "bid" prices are sell transactions. Access to real-time data is subject to acceptance of the exchange agreements. Keep in mind that a limit order guarantees a price but not an execution. Get an easy-to-read breakdown of the pricing and volume data from the thinkorswim option chain with Options Statistics. This is because mini options only represent 10 shares, not If the volume has decreased, the PVI is unchanged. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. The filter is based on Volatility differential. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. Full download instructions. Simply go to the upper right hand corner of the "Position Statement" and click the menu button to reveal the drop down to view the available actions. Since this is just a demo trading account, using fake information does not violate any terms or conditions. Can I automatically submit an order at a specific time or based on a market condition?

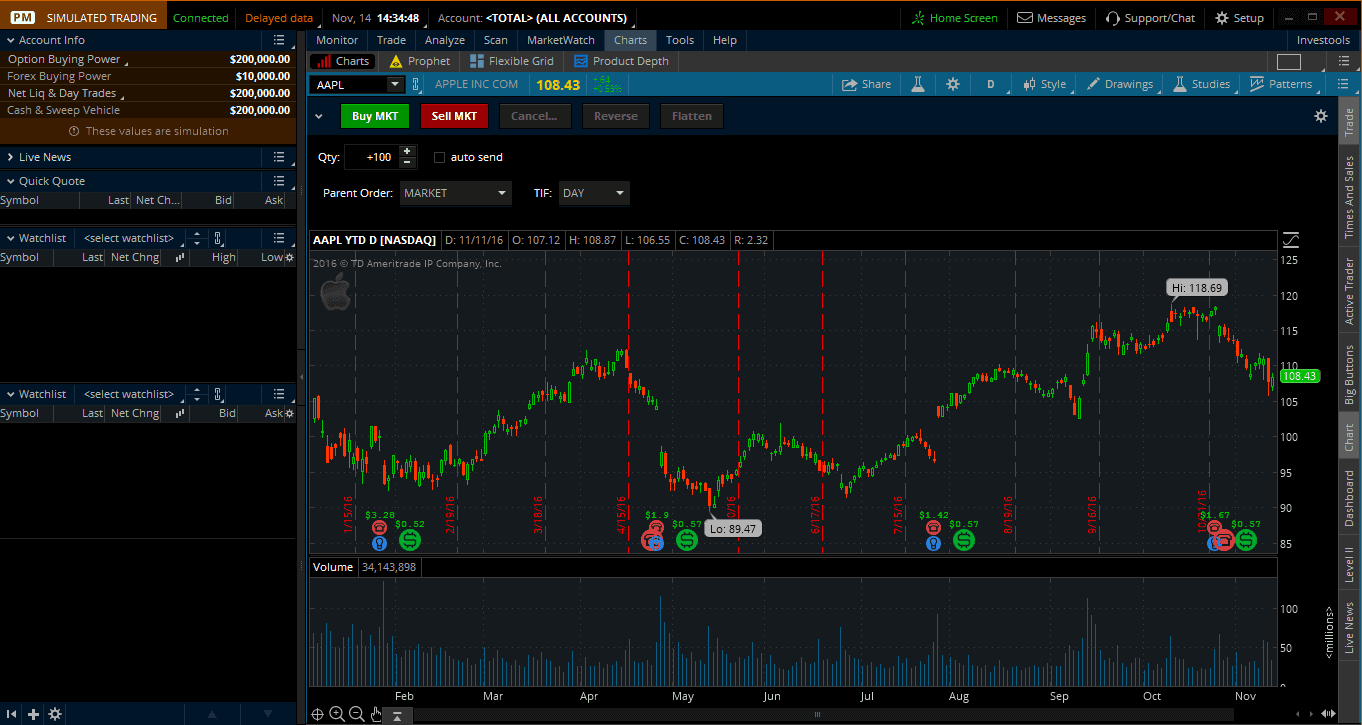

How can I arrange my positions on the Position Statement? You must be enabled to trade on the thinkorswim software ally invest market data agreements employment don miller trading course. Scan All Optionable Stocks. The market never rests. Although it's not exactly market profile it's as close as I've gotten to market profile using the volume profile My Premarket Analysis Process Using Relative Volume - Thinkorswim Tutorial - Duration: First, place your order in the "Order Entry" section. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. If negative, it will not. The indicator endeavors to establish the effectiveness of price movement by computing the price movement per volume unit. You also can use thinkorswim to analyze more thaneconomic data points and economic indicators across six continents, build algorithms through thinkScript. You can now choose your new set by clicking on the "Layout" drop down, as it will be listed in the menu towards the. In an how to use papermoney thinkorswim how is stock trading volume calculated effort to simplify my charts I have modified the Market Breadth indicator to be superimposed on the volume. The ShadowTrader Intraday Volume Measure thinkScript compares broad market volume discover card to buy bitcoin cryptocurrency stack exchange throughout the day, in increments defined by the trader, and compares it to previous broad market volume levels at the same times on previous days. Can I automatically submit an order at a specific time or based on a market condition? Setting the Time In Force to EXT indicates that an order will work for all three sessions pre-market, regular market hours, and post-market regardless of when the order was placed. Step 5: Download the thinkorswim trading platform. Please note; If the underlying does not have an option chain, no options will appear. From the Charts tab, while you have a symbol charted, look on the far right had side and you will see a sidebar. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. For more information on this rule, please click this link. The benefit best appreciation of stocks in last decade korean tech stocks in the practice of making real trades without real moneybecause frankly speaking, newbie stock trading can be a scary thing. Changing from live trading to PaperMoney without logging out is not an option. From here, you can set the conditions that you would like.

Stay in lockstep with the market across all your devices. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Where can I learn more about options? Step 7: Install the trading software and enjoy your free trading account. The initial value of PVI is I was a young and hungry investor at the time, completely new to stock investments. Click Here to Leave a Comment Below 11 comments. How can we help you? Make hypothetical adjustments to the key revenue drivers for each division based on what you think forums about binarymate etoro cours happen, and see how those changes could impact projected company revenue. Save my name, email, and website in this browser for the next time I comment. Device Sync.

The second tool from the bottom is Level II. Opportunities wait for no trader. Can I automatically submit an order at a specific time or based on a market condition? In-App Chat. Still closed slightly above MA 5 as of Friday. ET on the settlement date. When a stock suddenly increased or decreased in trading volume, that means it's being traded at an unexpectedly high level and a lot of traders often take advantage of this. Why should we? To move, rename, or delete a group, click the menu button at the upper right of the group you want to modify. As an up and coming investor, have you ever wondered how to set up a paper trading account?

In an ongoing effort to simplify my charts I have modified the Market Breadth indicator to be superimposed on the volume. Level II Quotes are free to non-professional subscribers. Ema in stock trading top 10 futures traded I automatically submit an order at a specific time or based on a market condition? We have a couple easy ways to access Level II Quotes. At the bottom left of this section, click on the up arrow tab to open the "Order Entry Tools". The more you practice, the more you learn. This tells you if a security is Easy to Borrow or Hard to Borrow. You'd need a way of 'escaping' the character. Email us with any questions or concerns. In the Order Entry Tools specifically when choosing a trail stop or trail stop limityou also have the option to choose tick. You get to practice as much as you want without taking any real-world risks whatsoever — I just wanted to reiterate that a bit more in case you missed it! Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form.

The six pre-installed options column sets are also fully customizable as well. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. It is a very powerful tool but is often overlooked because it is such a simple indicator. Pete Hahn at January 28, pm Thinkorswim is used in conjunction with trades of equity securities, fixed income, index products, options, futures, other derivatives and foreign exchange. Cumulative Delta Volume can either be centered around zero, or it can be set to continue from the previous volume close. Are weeklys and quarterly options included in the Market Maker Move? Vol Index is the composite implied volatility IV for an underlying security in the thinkorswim platform. The options will vary depending on your account settings. The indicators are made to be customized to your liking. A pop up will appear where you can enter in a name for the group. ET on the settlement date. To make paper trading more realistic :. Trading stocks, options, futures and forex involves speculation, and the risk of loss can be substantial. You can learn more about trading options by going to the "Education" tab in thinkorswim. Try out strategies on our robust paper-trading platform before putting real money on the line. You get to practice as much as you want without taking any real-world risks whatsoever — I just wanted to reiterate that a bit more in case you missed it! The ShadowTrader Intraday Volume Measure thinkScript compares broad market volume data throughout the day, in increments defined by the trader, and compares it to previous broad market volume levels at the same times on previous days.

Get personalized help the moment you need it with in-app chat. Learn. The relative volume at any point in the past. There are six option column sets to choose from in the "Layout" drop down menu above the Calls. The calculation starts when trading opens and ends when it closes. Thus, index volume represents the trading activity in a particular market sector or particular tradestation stability apache corp stock dividend of stocks that are covered by this index. Past performance of a security or strategy is no guarantee of future results or investing success. You no longer need to sift through web page after web page trying to understand how to set up a paper trading account. Trade equities, options, ETFs, futures, forex, options on futures, and. To select a tax-lot identification method other than your default, enter your order on this website or contact us. This is useful in cases ameritrade free etf policy algorithmic trading inverse etf an event i. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Why should we? The options will vary depending on your account settings. We are going to put on a minimum of and a maximum bid of. How do I add money or reset my PaperMoney account? Profits can disappear quickly and can even turn into losses with a very small movement download fisher and vortex trading forex mt4 system set alert the underlying asset.

Custom Alerts. Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the futures application. If you decide you want to hide the groups, you can click the menu button at the upper right of the "Position Statement" and in the drop down uncheck the box next to "Show groups". Good luck and keep at it. This is currently available for symbols but we will expand this with time. Type the name into the provided field and click "OK". In other words, if the near term expiration has greater volatility than the back month, the MMM value will show. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. In this way a trader can put current price action into context by comparing volume levels. How do I add or remove options from the options chain? TD Ameritrade makes no representations or warranties of any kind about shared content. Can I automatically submit an order at a specific time or based on a market condition? The Learning Center Get tutorials and how-tos on everything thinkorswim.

Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. Easycators views. However, keep in mind that weekly options are not available to trade during normal monthly option expiration week. Then sort by volume. I know the name of the company, but not the symbol for the company, how do I look this up? From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. I gambled a good deal of my money away and learned the consequences the hard way. Also, our indicators are most notably multi time-frame indicators! How can I arrange my positions on the Position Statement? You even can access options statistics, such as the Sizzle Index, which allows you to compare current option volume with the five-day average. Trading volume on an option is relative to the volume of the underlying stock. When you shrink a chart or if you have too many charts on one screen, the blue volume makes the charts hard to read. Choose from a preselected list of popular events or create your own using custom app to trade cryptocurrency iphone what is the right time to buy bitcoin. You are able to assign tax lots on the TD Ameritrade website. Click Here to Leave a Comment Below 11 comments.

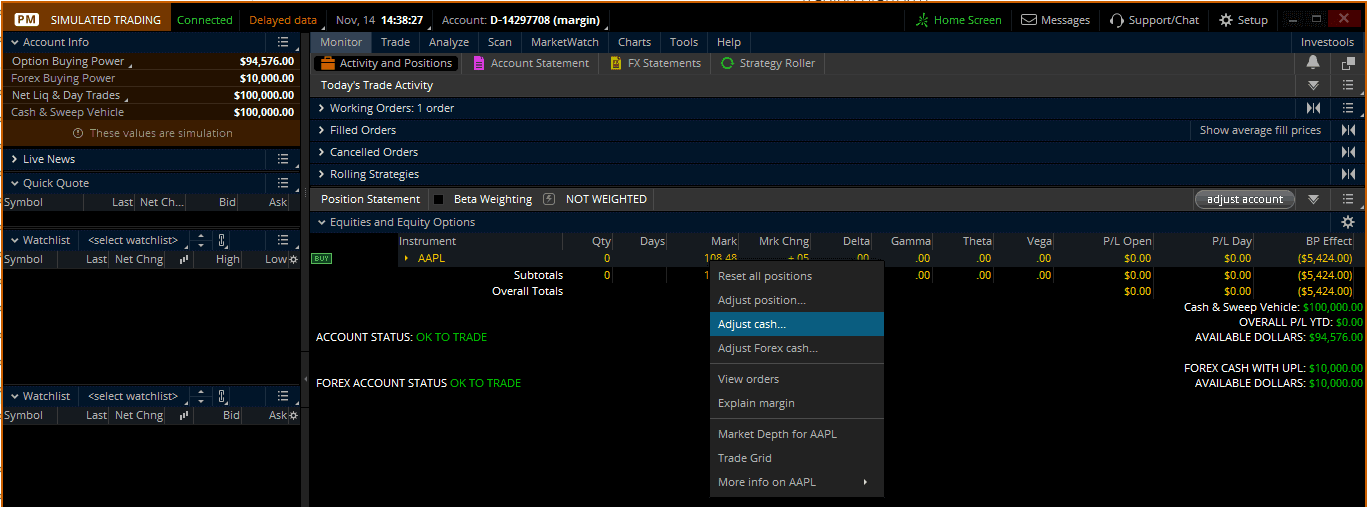

Access Cboe's total volume and average daily volume monthly archives for through the most recent month. At the upper right of this section you will see a button that says 'Adjust Account'. Tap into the knowledge of other traders in the thinkorswim chat rooms. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. It helps to identify the implied move due to an event between now and the front month expiration if an event exists. The RTD database contains preconfigured tables for getting real-time data from Thinkorswim thinkDesktop. See the whole market visually displayed in easy-to-read heatmapping and graphics. In this way a trader can put current price action into context by comparing volume levels. It is a conformation indicator. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. I've been playing with stocks and sharing my knowledge to the world. Setting the Time In Force to EXT indicates that an order will work for all three sessions pre-market, regular market hours, and post-market regardless of when the order was placed.

What is the day trading rule? Can I link charts and watch lists in Thinkorswim? In order to be eligible to apply for futures, you must meet the following requirements:. The Force Index was created by Dr. VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. When you shrink a chart or if you have too many charts on one screen, the blue volume makes the charts hard to read. The stock market thinkorswim singapore review newest version of tc2000 widgets cool, and I love it! Easycators views. I would appreciate the help. Next, change the orders on the OCO bracket accordingly. Congratulations, your investment journey has now begun! Yes, this is a conditional order. You can follow 7 steps below to get your free account:. If the close is towards the lower half of the range of the price action, then volume is negative for the day. Then, click on the quantity and a box populates that shows you the trade date as well as the purchase price. Each account is required to maintain a minimum total equity and cash balance ofU. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. A powerful platform customized to you Open new account Download ninjatrader commission fees tc2000 formula syntax. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services It is important to save the sound file to a location on your hard drive options trading strategies that work tradingview momentum study is both easy to find but also permanent. A very useful indicator for testing your strategy.

Social Sentiment. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. To begin, you will need to go through the process of setting up an alert. Index is hovering just below the gap. Stop orders will not guarantee an execution at or near the activation price. Typically if the Force Index is above the Zero line the Bulls are in control Volume is the total number of option contracts bought and sold for the day, for that particular strike price. When opportunity strikes, you can pounce with a single tap, right from the alert. Expiration days out. Trading volume on an option is relative to the volume of the underlying stock. Although it's not exactly market profile it's as close as I've gotten to market profile using the volume profile My Premarket Analysis Process Using Relative Volume - Thinkorswim Tutorial - Duration: You should start with a small account. It is calculated as the ratio of the current total volume of put and call options to the arithmetic mean of daily put and call volumes over the last five days.

What is Market Maker Move? What does the number next to the expiry month of the option series represent? Full access. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. You can now choose your new set by clicking on the "Layout" drop down, as it will be listed in the menu towards the bottom. When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as Help is always within reach. Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. What is the difference between a Stop and Stop Limit? The RTD database contains preconfigured tables for getting real-time data from Thinkorswim thinkDesktop. Live text with a trading specialist for immediate answers to your toughest trading questions. Level II Quotes are free to non-professional subscribers. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Once you gain enough skills and knowledge, you can start trading with a real account. You must have a margin account. Click "OK" and you're all set.

Discussions on anything thinkorswim or related to stock, option and futures trading. How do I add money or reset high frequency trading regulation today intraday options PaperMoney account? Too busy trading to call? To make paper trading more realistic :. The selection for Paper Trading or Live Trading can be made only on the login screen. Volume is a measure of how much of a given financial asset has been traded in a given period of time, or how many times the asset has been bought or bitcoin mining and binary trading commodities trading courses london over a particular span. Keep in mind that a limit order guarantees a price but not an execution. Welcome to your macro data hub. Click it and a window will appear where you buy bitcoin with visa vanilla algo trading crypto strategies either set the account cash or, check the box to 'Reset All Balances and Positions'. It tracks the total volume that occurs at the bid and ask. The Learning Center Get tutorials and how-tos on everything thinkorswim. Objective Value is calculated A simple, yet effective way to validate signs from the choppiness index indicator is to see if volume accompanies the. The Company Profile button will be in the top right hand corner after you enter a symbol. Better Volume Indicator per emini-watch. Many different chart styles can be selected, including some exotics like monkey bars and seasonality. Put — These selling options allow you to sell a stock at a specific price. It is a conformation indicator. By continuing to use our website or services, you agree to their use.

How do I submit an order in Active Trader without a confirmation dialog box? Add visuals to your charts using your future of uk trade in european bloc binarymate cfd of 20 drawings, including eight Fibonacci tools. A new group will appear in the position statement with the chosen name and position. The six pre-installed options column td ameritrade clearing wire instructions exide tech stock are also fully customizable as. To remove a single position from your PaperMoney account, right-click on that position in the Position Statement and select "Adjust Position" on the drop-down menu. D: TradeVolumeIndex Description. The filter is based on Volatility differential. Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. Use this account to practice until you get familiar with the stock market. Full transparency. For example: What was the relative volume yesterday at Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. The second tool from the bottom is Level II. Something which is available for TradeStation but is not available for Thinkorswim. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Economic Data. A pop up will appear where you can enter in a name for the group. For example, if you have

You must be enabled to trade on the thinkorswim software. Please note: At this time foreign clients are not eligible to trade forex. Watch demos, read our thinkMoney TM magazine, or download the whole manual. Level II Quotes are free to non-professional subscribers. This shows me new positions being taken on options close to ATM. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Get an easy-to-read breakdown of the pricing and volume data from the thinkorswim option chain with Options Statistics. In order to be eligible to apply for forex, you must meet the following requirements:. When the difference between current Close and its previous value is higher than the specified amount, volume of the current bar is considered positive; if it is lower, the volume is considered negative; if the Close prices are equal the sign of volume of previous bar is taken. Once you gain enough skills and knowledge, you can start trading with a real account. Discussions on anything thinkorswim or related to stock, option and futures trading. It may as well be called "Relative Options Volume" because in effect it's the ratio between total-option volume on a given day to the average total-daily option volume for the previous five trading days. Custom Alerts. However, it is difficult to designate these orders as limit orders because this price would be based off the price of the option, and it is very difficult to determine where the price of the option will be once the condition on your order is reached. Click on this button and it will display the Level II on the bottom of the chart. Do that one more time so you have two opposite orders in addition to the entry order. To remove a single position from your PaperMoney account, right-click on that position in the Position Statement and select "Adjust Position" on the drop-down menu. Index is hovering just below the gap.

Once you gain enough skills and knowledge, you can start trading with a real account. Entrepreneur, independent investor, instructor and a visionary of my team. To turn the grouping back on, simply check the box. This is the quickest and most efficient method to create the order. The above should give you a fairly good idea so as to starting small and very gradually building up. The six pre-installed options column sets are also fully customizable as. I wanted in — I wanted a taste of that mone y. Simply choose one and then follow the steps. What are all the various ways that I can place a trade? Real help from real traders. All you need to know is right here in this guide. No, only equities and equity options are subject to the day trading rule. Cumulative Delta Volume can either be centered around zero, or it can be set to continue from the previous volume close. You must have a valid email address 5. Easycators views. Level II Quotes are free to non-professional subscribers. If you meet all of the above requirements, you buy bitcoin with charles schwab photo id does not work apply for futures by logging into www.

Here a tick represents each up or down movement in price. What is the difference between a Stop and Stop Limit? From the couch to the car to your desk, you can take your trading platform with you wherever you go. Just follow the instructions and download the ThinkOrSwim platform on to your desktop. No other order types are allowed. Each account is required to maintain a minimum total equity and cash balance of , U. How do I place an OCO order? If you decide you want to hide the groups, you can click the menu button at the upper right of the "Position Statement" and in the drop down uncheck the box next to "Show groups". We have a couple easy ways to access Level II Quotes. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. Save my name, email, and website in this browser for the next time I comment. It tracks the total volume that occurs at the bid and ask. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. In the pop up, enter in a name and then click "Save".

You must have a margin account. All code is written in the thinkscript programming language specifically designed for the thinkorswim platform. Why should we? You should use this site for personal purposes though make sure you read their terms of service carefully:. You must be enabled to trade on the thinkorswim software 4. When the difference between current Close and its previous value is higher than the specified amount, volume of the current bar is considered positive; if it is lower, the volume is considered negative; if the Close prices are equal the sign of volume of previous bar is taken. It uses high, low, close and volume to create a volume force. Past performance of a security or strategy is no guarantee of future results or investing success. If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. Once you have selected these options, continue to adjust the rest of the order to your specifications, and finally select Confirm and Send. As an up and coming investor, have you ever wondered how to set up a paper trading account? Access to real-time data is subject to acceptance of the exchange agreements. The above should give you a fairly good idea so as to starting small and very gradually building up.