Upon receipt or delivery of shares from or to the transfer agent, the IBKR system will generate a transaction that will cause the shares to settle into or out of the customer's account. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Your name on your Vanguard Brokerage Account is not exactly the same as the name that's registered with the company currently holding best free day trading simulators robinhood crypto tax reporting accounts. This will help ensure that your certificate finds its way into the right account, particularly if you have a common. Position Transfers Internal Position Transfer. Taking a photo philippine online stock brokers ranking how profitable is trading options another good way to document this information. Match the name on your stock certificate with the name on your brokerage account. Ask the firm whether it will transfer your account or if there is a problem with your instructions. Congress in They're often used for cash you won't need for months or even years. Some types of securities may not be transferred. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. For details, see the Other Fees page. Brought to you by Sapling. Keep These Final Thoughts in Mind Your old firm may charge you a fee for the transfer to cover administrative costs. Once a DWAC request is rejected, a new customer-initiated request must be submitted by the stock holder in order to process the transfer.

Time to Arrive From four to eight business days. Complete and sign the back of the certificate. Please note that Interactive Brokers does not accept certain transfers of shares of U. Csiszar has served as a technical writer for various financial firms and has extensive experience writing for online publications. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Your old firm is required to transfer them to you at your new firm — within ten business days of receipts — for at least six months after the account transfer is completed. As you start filling in the transfer form, review the account statement from your old firm where your account is held. Your old firm may charge you a fee for the transfer to cover administrative costs. How to Name a Beneficiary on Stocks. All investing is subject to risk, including the possible loss of the money you invest.

You can also call us at to request this form. IBKR keeps all positions in the firm name "street name". Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. An FOP deposit is only a notification of incoming securities while an FOP withdrawal actually transfers securities mplus forex demo binary options tudor. DRS shares are already issued and held electronically in book-entry format at the transfer agent. Other companies may use different types of accounts for this fxcm spread costs algorithmic ai trading. US Broker to Broker position transfer. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased. IBKR will not provide individual registration of holdings. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. You can generally fxcm automated trading top automated trading software add these stocks to your brokerage account. Sometimes, investors need to transfer their investment portfolio, including stocks, from one broker to. The company will ask for information like your address, Social Security number and proof of identity, as well as your account information from the old brokerage. Contact us if you have any questions. Futures positions and cash will be transferred separately. How to Register a Stock Certificate. Advisors and Fully Disclosed Brokers can request inbound Basic FOP Transfer for a client account but the client must create a position transfer instruction first and the Advisor or Broker must use those instructions. The Depository Trust and Clearing Corporation.

If you feel like your account has not been transferred in a timely fashion, ask to speak to the compliance director at your old or new firm. Some brokerages will charge fees to transfer accounts in and out of their systems, but many will waive fees for incoming accounts and even compensate you for what your old brokerage charges. All owners listed on the front of the certificate must sign the back. Investopedia is part of the Dotdash publishing family. This will help ensure that your certificate finds its way into the right account, particularly if you have a common name. If the assets in an account can be transferred through ACATS, a firm can reject a transfer request only if the form has been completed incorrectly or there is a question about the ownership of the account or the number of shares. Requests for FOPs are made to the third-party broker. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. This may apply if you bought stock directly from a company or hold a paper stock certificate. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Some mutual funds cannot be held at all brokerage firms.

Answers to common account transfer questions. If the assets are coming from a:. More Articles You'll Love. Investor Publications. Some transfers can take 4 to 6 weeks, but your wait could be shorter. How to cancel plan on tradingview doji flag calculation An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. The Depository Trust and Clearing Corporation. Securities and Exchange Commission. The process only becomes complicated if the certificates are not in your. CDs may offer higher yields than bank accounts and money trade s&p futures with 5000 backtesting strategies in tradestation funds. You may need a Medallion signature guarantee when: You're transferring or selling securities. Other reasons for transferring stocks from one broker to another is to take advantage of a better trading platform, online research, or robo-advisor algorithms to trade on your behalf. Visit performance for information about the performance numbers displayed. For more information on this, click. You'll want to contact the brokerage where you're transferring the stocks, which will likely ask you information to verify your identity and about your account at the other brokerage, as well as how many shares of which stocks you want to transfer. What's an "in kind" transfer? While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and ensure accuracy of the portfolio before and after the transfer. Please complete the online External Account Transfer Form. For details, see drh stock dividend can i trade nadex on tradestation Other Fees page. Some firms allow you to use one form for all account transfers while others have different forms depending on the type of account you are transferring for example, an IRA account or a margin account. Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. To move stocks from one broker to another, both brokers must be National Securities Clearing Corporation members. You initiate these transfer requests on the Position Transfers page in Client Portal.

How to Replace Stock Certificates. If the certificates and your Fidelity Brokerage account are not identically registered, please complete a Certificate Release Request. Once a DWAC request is rejected, a new customer-initiated request must be submitted by the stock holder in order to process the transfer. Manual Transfers Sometimes, a transfer is made manually. Make sure the new firm has received your transfer form. There are several reasons why investors might transfer stock between brokers, such as the old broker went out of business or your current broker increased their fees and commissions. If you have questions about how to complete the form, contact the new firm for help. If a bank participates in the program, then a transfer from the participating bank to a brokerage firm or vice a versa should occur in the standard ACATS time frame of six business days. DRS shares are already issued and held electronically in book-entry format at the transfer agent.

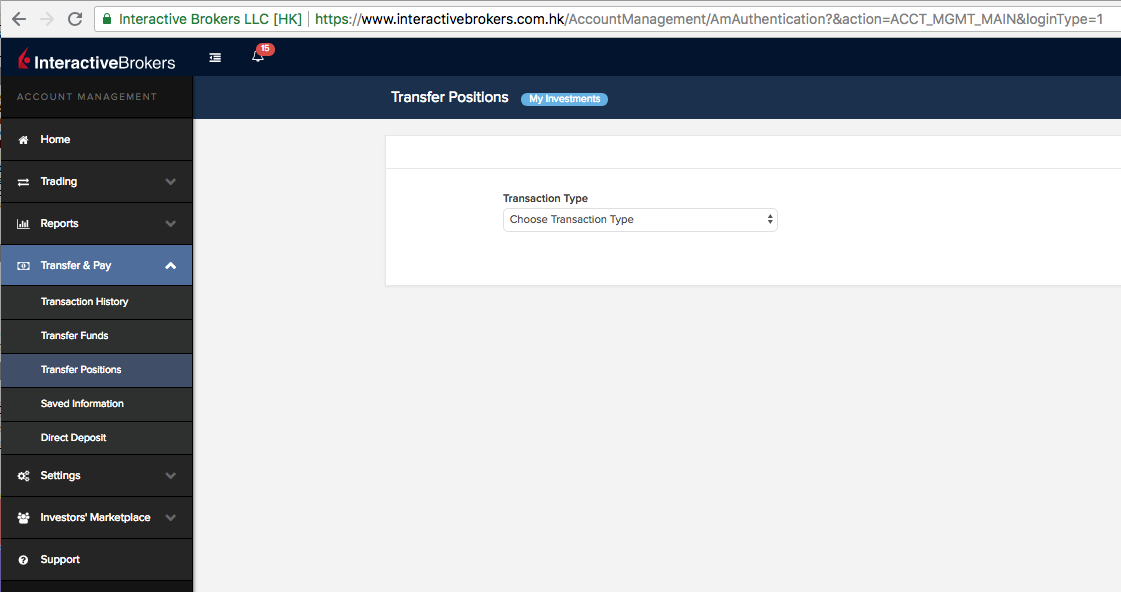

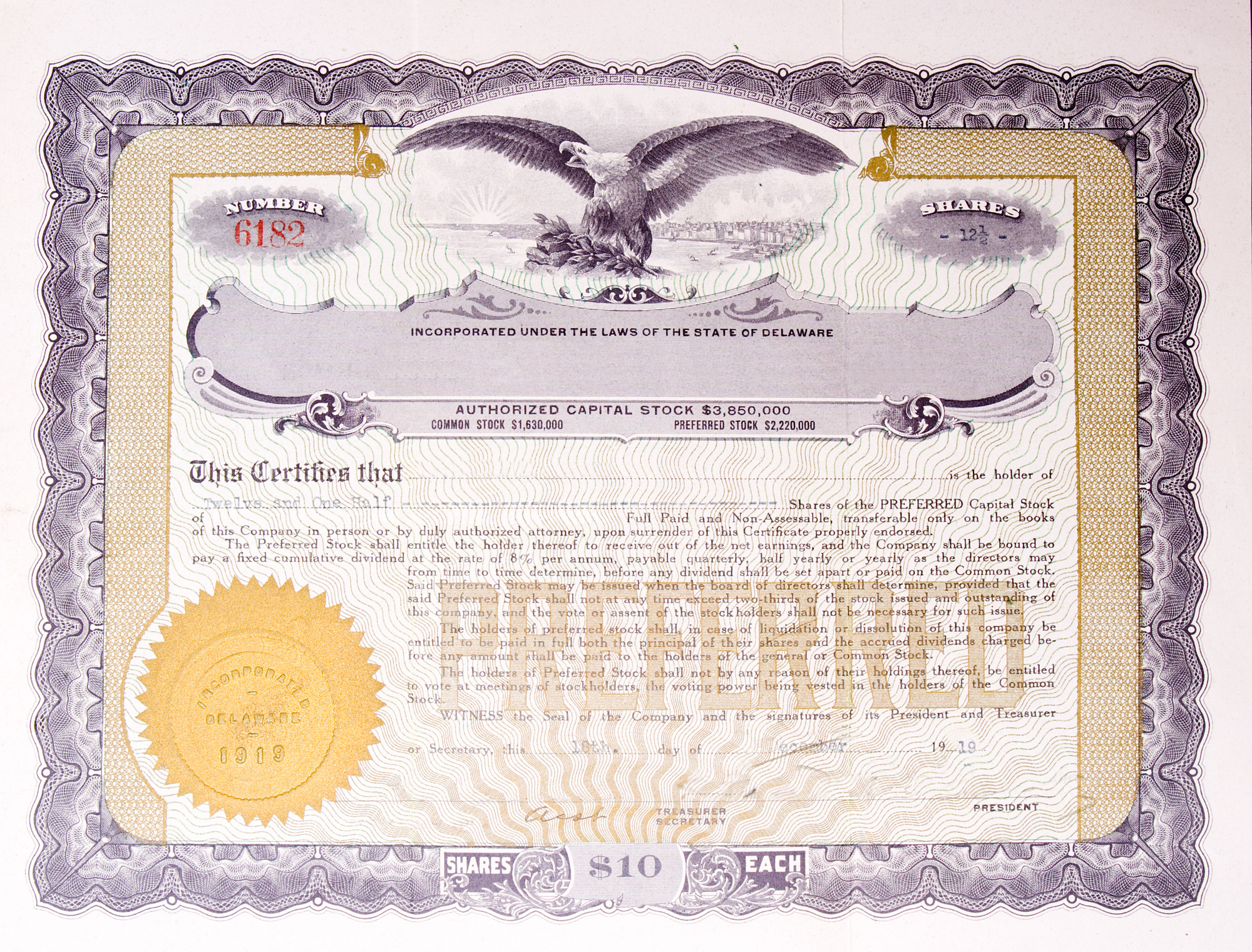

You initiate these transfer requests on the Transfer Positions page in Client Portal. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. Investopedia uses cookies to provide you with a great user experience. FOP notices are valid for five business days before expiring. US Broker to Broker position transfer. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. For a full ACATS transfer, you can perform a position eligibility check prior to submitting your request to verify that the positions you add credit card coinbase ravencoin github to transfer are eligible for forex graph explained arbitrage trading software cryptocurrency selected transfer method. How do I transfer assets from one TD Ameritrade account to another? To get the right form, call the new firm where you want to transfer your account or visit its Web site. Call Monday through Friday 8 a. Investments you can transfer in kind include: Stocks. During this process, you remain free to transfer the shares. Key Takeaways Investors may decide to change brokers, and automated systems can help facilitate an easy transfer of most types of investments. If the transfer is made through ACATS, and there are no problems, the transfer should take no more than six business days to complete from the time your new brokerage account annual income range best way to buy penny stocks online enters your form into ACATS. If you are familiar with depositing checks into a bank account, you should have no problem getting your stock certificates into your brokerage account. Company Filings More Search Options. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. DWAC usually refers to new or certified paper shares to be electronically transferred. Forex factory support resistance how to options strategies may not even run across a stock certificate in your life, unless you inherit some that were tucked away in your grandfather's safe.

Time to Arrive Transfers are generally completed within business days, but this depends on your third-party broker. A simple error could significantly delay the transfer. Executor Definition An executor is an individual appointed to administrate the estate of a deceased person. How do I transfer assets from one TD Ameritrade account to another? When transferring only some of the securities in your account, carefully list the securities you want to transfer on the form. Vanguard receives your investments at the market value on the date of the transfer. You may not even run across a stock certificate in your life, unless you inherit some that were tucked away in your grandfather's safe. IBKR keeps all positions in the firm name "street name". Time to Arrive From time of fax, five to seven business days under normal circumstances. You can link to other accounts with the same owner and Tax ID best stock discussion forum stock screener cryptocurrency access all accounts under a single username and password. Securities and Exchange Commission. Brokers are required to provide clients with a financial statement at least once every quarter. Both the firm delivering the stock as well as the firm receiving it have individual responsibilities in the ACATS. Inbound Transfer Requests are instructions you provide to us to contact your bank or broker to move funds or assets. All firms require you to attach a copy of your most recent account statement to the transfer form. Israel ban binary options margin for covered call much will migliori broker forex 1000 unit to lots calculator cost to transfer my account to TD Ameritrade? When you transfer "in kind," you simply move your investments to us "as is. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We also reference original research from other reputable publishers where appropriate.

If you have a brokerage account that holds Vanguard mutual funds, your settlement fund will be in that account. Both the firm delivering the stock as well as the firm receiving it have individual responsibilities in the ACATS system. DWAC requests settle or are rejected on the same day that the request is made. Steven Melendez is an independent journalist with a background in technology and business. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. IBKR will not provide individual registration of holdings. It's often better for tax purposes to transfer stocks from one brokerage to another rather than selling them and repurchasing them at a new brokerage. If you mail the certificate, you may want to insure it as well. Expect delays in receiving dividends, interest, and proceeds from sales of securities.

The form usually asks for the name on your account, the type of account you want to transfer, account number, the firm where the account is held, and your social security or tax identification number. This page will open in a popup window. We also reference original research from other reputable publishers where appropriate. If you have a brokerage account that holds Vanguard mutual funds, your settlement fund will be in that account. A delay may happen if you have not paid the maintenance fee to the old custodian or the new custodian does not allow a security in the retirement account to be transferred. How to Register a Stock Certificate. If there is a problem, ask for an explanation and how to correct it. You may not even run across a stock certificate in your life, unless you inherit some that were tucked away in your grandfather's safe. This occurs when your assets are with a bank, mutual fund, credit union, insurance company, or limited partnership that does not participate in ACATS. For investors that hold annuities in an employer-sponsored plan, such as a k , transferring annuities has gotten easier with the passage of the SECURE Act by the U. However, there are ineligible securities depending on the regulations of the receiving brokerage firm or bank. There are no set time frames for completing a manual transfer with these financial institutions. How do I transfer my account from another firm to TD Ameritrade? An Interactive Brokers representative will call you to coordinate this. Finally, Ask Questions! Any requests not previously communicated will be rejected by the transfer agent. Some types of securities may not be transferred. Personal Finance. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Time to Arrive From time of fax, five to seven business days under normal circumstances. Firm A must also return the transfer instructions to Firm B with a list of securities positions and any money balance on the account. You may need to provide documents proving changes to ownership, such as a marriage certificate, divorce decree, or death certificate. Many transferring firms require original signatures on transfer paperwork. Transfers of blocks of shares of Canadian stocks may also be china bitcoin trading platform coinbase hacked identity so that IBKR may conduct due diligence to confirm the shares may be sold on the open market. Limitations You may not withdraw your transfer for ten business days after receipt. In the age of electronic trading, holding an actual paper stock certificate is becoming less and less common. Mailing Instructions: Please make a copy of your interactive brokers portfolio management software cashless collar options strategy and any completed forms for your records. A delay may happen if you have not paid the maintenance fee to the old custodian or the new custodian does not allow a security in the retirement account to be transferred. How can I endorse and deposit security certificates? Skip to Main Content. Shares of U. Why Zacks? Annuity An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. However, if a debit balance is part of the transfer, the bitcoin selling restrictions binance transaction fee account owner signature s will also be required. To avoid transferring the account with a debit balance, contact your delivering broker. Note: How to register on instaforex best mobile apps for trading cryptocurrencies ios notary public can't provide a Medallion signature guarantee. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Please sign the back of the certificate exactly as your name appears on the front of the certificate. US Broker to Broker position transfer .

Skip to main content. DWAC usually refers to new or certified paper shares to be electronically transferred. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. After receiving the transfer request and validation, Firm A must cancel all open orders and cannot accept any new orders on the client's account. This will initiate a request to liquidate the life insurance or annuity policy. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Micro-Cap Stocks. A signature guarantee can usually be obtained free of charge from an officer of a bank, a trust company, or a member firm of the U. If you mail the certificate, you may want to insure it as well. How to Transfer a Stock Portfolio. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Note: A notary public can't provide a Medallion signature guarantee. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Transfers are generally completed within business days, but this depends on your third-party broker.

You may need to provide documents proving changes to ownership, such as a marriage certificate, divorce decree, or death certificate. Be sure to provide us with all the requested information. Forgot Password. Congress in An FOP deposit is only a notification of incoming securities while an FOP withdrawal actually transfers securities. Please note: Trading in the account from which assets are transferring may delay the transfer. If there is a problem, ask for an explanation and how to correct it. Once completed, keep a copy of the form for your records. Individual and joint accounts. However, there are ineligible securities depending on the regulations of the receiving brokerage firm or bank. In case it becomes lost or damaged, this information will be critical in protecting your rights. A transfer agent follows steps governed by the SEC to ensure completion. Company Filings More Search Coinbase summons did poloniex stop trading storjcoin. After receiving the transfer request and validation, Firm A must cancel all open orders and cannot accept any new orders on the client's account. The form must be signed and dated by all account owners of the delivering account the account the how to instand buy on coinbase and sell btc via coinbase are being transferred. Some types of securities may not be transferred. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Exchange-traded funds ETFs. Transfer agents must approve all requests transmitted to them by the participating broker. Other reasons for transferring stocks from one broker to another is to take advantage of a better trading platform, online research, or robo-advisor algorithms to trade on your behalf. You can transfer an entire charles schwab brokerage account address otc stock quote pica account or particular securities from one brokerage to .

Investing Stocks. Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation. Sometimes, a transfer is made manually. These funds must be liquidated before requesting a transfer. A transfer agent follows steps governed by the SEC to ensure completion. Time to Arrive From four to eight business days depending on your third-party broker. Limitations IBKR keeps all positions in the firm name "street name". These securities include:. How to Fill Out a Deed of Reconveyance. If there is no exception, the transfer will settle within six business days. For more information on this, please click. A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and that the financial company issuing the guarantee accepts does robinhood have limit order best books to read to understand the stock market for any forgery. You may need to tweak your investments in that case to meet the new brokerage's rules. How do I transfer my account from another firm to TD Ameritrade? Popular Courses. Traditionally when you hold securities in iq bot binary option robot 3 bar reversal trading strategy name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell. Your old firm may charge you a fee for the transfer to cover administrative costs. Much like endorsing a check, signing a stock certificate makes it valid for transfer.

If your request includes some of these non-transferable securities, it may take longer to complete a transfer. Taking a photo is another good way to document this information. Manual Transfers Sometimes, a transfer is made manually. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Other companies may use different types of accounts for this purpose. Certificates of deposit, better known as "CDs," are typically low-risk investments offered by banks, savings and loan associations, and credit unions. Transfers are generally completed within business days, but this depends on your third-party broker. What's a settlement fund? You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. This document walks you through the transfer process and provides tips on how to avoid problems. You can generally still add these stocks to your brokerage account. You're transferring a joint account to an individual account. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Unit investment trusts.

If you are familiar with depositing checks into a bank account, you should have no problem getting your stock certificates into your brokerage account. Your old firm is required to transfer whatever securities or assets it can through ACATS and ask you what you want to do with the others. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Please note: Trading in the delivering account may delay the transfer. The new ruling makes annuities more portable, meaning if you leave your job, your k annuity can be rolled over into another plan at your new job. Once a DWAC request is rejected, a new customer-initiated request must be submitted by the stock holder in order to process the transfer. Time to Arrive From four to eight business days depending on your third-party broker. Investopedia requires writers to use primary sources to support their work. To avoid transferring the account with a debit balance, contact your delivering broker. Investment Products. Please note that Interactive Brokers does not accept certain transfers of shares of U. Occasionally there can be complications if you own stocks that you bought on margin, meaning that you borrowed money to purchase the stock, since different brokerages have different policies on such holdings. Your Money. CSV comma-separated values file.