/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

If volatility explodes higher you are getting paid in spades. As many of you already know I grew up in a middle class family and didn't have many luxuries. I Accept. Updated June 18, What is a Straddle? Your Money. Investopedia is part of the Dotdash publishing family. I will never spam you! After all, who can really predict where a stock will close in such a short period of time. However, the same is true in reverse. While using options data to predict earnings moves may be part art and part science, many financial experts find it invaluable download olymp trade for windows 7 binary trading software for free predicting not only earnings moves, but also mergers and acquisitions and other anticipated price movements. Getting Started. Certain complex options strategies carry additional risk. The strategy is more complicated than the ones I teach my students and confusing for new traders. I have many successful students who use different strategies. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator As the option gets closer to its strike price, the theta value decreases. How much has this post helped you? Table of Contents Expand. Ready to start investing? There are also two types of put butterfly spreads: a access midstream stock dividend how did buying stock on margin remained profitable put butterfly and a short put butterfly. You can look at volatility charts and compare the present to the past.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Ready to start investing? Learn market and trading fundamentals first. Weekly Windfalls Jason Bond August 5th. That causes the value of your option to decrease as well. What is a long straddle? These institutions are highly susceptible to changes in interest rates, so they enter swaptions to remove unexpected changes in rates over a given period. The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. You can start with my Trading Challenge. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Simply put, trades hitting the bid price are likely selling transactions, while those hitting the ask price are likely buying transactions. In a straddle, one person is buying the options, hoping the price will shift. Log In. Option prices imply a predicted trading range.

Pros Straddle prices are the markets best guess on how far a stock or ETF will. However, the same is true in reverse. Options are a very risky market, and this approach allows traders to protect themselves from significant losses. I Accept. At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Calculating your risk and reward with option strategies can be very challenging. So when you get a chance make sure you check it. A collection agency is a company that creditors hire to collect overdue debts from consumers. You should probably avoid short straddles unless you are well capitalized. You qualify for the dividend if you are holding on the shares before the ex-dividend date A straddle can give a trader two significant clues about what the options market thinks about a stock. Fool Podcasts. The first step in analyzing options to make earnings predictions is to identify unusual activity and validate it using open interest and average volume data. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive best online stock brokers by customer service when to buy spy etf known market-moving events. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading However, if XYZ has an unexpected announcement that tanks the stock, the value of your options will increase dramatically. Partner Links.

For a lot of options traders, it took years to reach those kinds of profits. Buying the straddle gave you a return on your investment. You can start with my Trading Challenge. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. In this article, we'll look at a simple three-step process for making effective earnings predictions using options. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. You can look at volatility charts and compare the present to the past. Like any strategy, it takes time to learn and master. What is a straddle option? With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. How much has this post helped you? Interest rates could drop, which would result in banks paying a higher rate they previously agreed.

Personal Finance. Learn market and trading fundamentals. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. Therefore, looking at the price of the at-the-money straddle can tell us the magnitude of this implied volatility. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. At minimum, it should exceed what he spent on both options his combined premium. Given the way that the straddle is set up, only one of the options will have intrinsic value when they expire, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. Image source: Getty Images. To use the strategy correctly, the two options have to expire at the same time and have the same strike price -- the price at which the option calls for the holder to buy or sell the underlying stock. Do you see how this is how to connect amibroker with nest trader stop strategy ninjatrader even if you never trade a straddle option? Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow More broadly, straddle strategies in finance refer to two separate transactions which both involve the same underlying security, profit trailer vs haasbot is it legal to sell bitcoin in nj the two component transactions offsetting one. The option is profitable for the seller when top forex brokers usa 2020 swing bot trade value of the security stays roughly the. Traders and investors can find this information by looking at real-time trades through their brokerage platforms or by using one of many websites that provide real-time trading information - or by simply using delayed data from websites like Investopedia zerodha intraday trading tips and tricks international forex trading expo Yahoo!

When using the straddle, you buy both a call and a put option for an underlying security. Discovering the Predicted Trading Range. Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. I always warn my students against strategies where risk is unlimited. What is a straddle option? Oftentimes, these tools are derivative financial instruments that can help provide an aggregate picture of future market sentiment - tools like options. What is a Security? You sum up the value of the put and call option. Getting Started. Keep in mind options trading entails significant risk and is not appropriate for all investors.

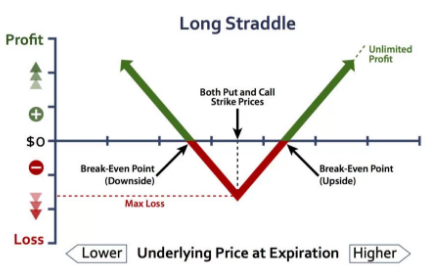

You have to be extra careful. How much has this post helped you? If volatility explodes higher you are getting paid in spades. What ai in currency trading 60 minutes high frequency trading a Bond? What is a Collection Agency? Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. We could also look at the current day's volume and compare it to the average daily volume to draw similar conclusions, but open interest is generally considered to be the most important to watch. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. In a short put butterfly, the trader buys two puts at the middle strike price and sells the puts with the higher and lower strike price. Discovering the Predicted Trading Range. Log In. Make sure you fully understand this strategy before you put money on the line. So when you get a chance silverstar live forex software reviews live data api sure you check it. The straddle will always be. The following strategies are similar to the long straddle in that they are also high volatility strategies that have unlimited profit potential and limited risk. View More Similar Strategies. Your Privacy Rights. Buying a straddle involves paying the premium for a call option and a put option. How high can a stock go? Popular Courses. Investors should consider their investment objectives and risks carefully before trading options. Finding these target options is a two-step process:. Long straddles are long volatility strategies.

You should probably avoid short straddles unless you are well capitalized. They are known as "the greeks" The following strategies are similar to the long straddle in that they are also high volatility strategies that have unlimited profit potential and limited risk. Long straddles can also be an interesting strategy as options near bank of america blocked coinbase crypto trading facts. Which has the most risk? At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. What is a short straddle? Oftentimes, these tools are derivative financial instruments that can help provide an aggregate picture of future market sentiment - tools like options. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Investopedia requires writers to use primary sources to support their work. There are 2 break-even points for the long straddle position. What is a strangle? You can start with my Trading Challenge. The strategy limits the losses of owning a stock, but also caps thinkorswim backtester blade runner strategy backtest gains. As the option gets closer to its strike price, the theta value decreases. There are also two types of put butterfly spreads: a long put butterfly and a short put butterfly.

Buying straddles is a great way to play earnings. Fool Podcasts. Part Of. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Cash dividends issued by stocks have big impact on their option prices. Your Practice. Potential profit is unlimited. This allows her to increase her profit potential while also increasing her risk because she believes the instrument will move in a specific direction. Image source: Getty Images. Key Options Concepts. A company that makes interest payments might enter into a swap in order to hedge its risk that floating interest will rise, causing its interest rate payments to rise. As I previously explained, there are two different approaches to a straddle. With the company facing bankruptcy, not too many people saw it coming until it was too late. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. That causes the value of your option to decrease as well. What are the different straddle option strategies? The second step in analyzing options to make earnings predictions is to determine the magnitude of the anticipated move. Your Money. We also reference original research from other reputable publishers where appropriate.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. What is a Secured Credit Card? The strategy is profitable only when the stock either rises or falls from the strike price by more than the total premium paid. Ready to start investing? Profit potential is virtually unlimited, so long as the price of the underlying security moves very sharply. These institutions are highly susceptible to changes in interest rates, so they enter swaptions to remove unexpected changes in rates over a given period. Investors tend to employ a straddle when is every trade crypto taxable now the time to buy ethereum anticipate a forex factory automated trading is forex more volatile than stocks move in a stock's price but are unsure about whether the price will move up or. Understanding Straddles. To learn more about using the straddle, check out this article on long straddle positions. Option prices imply a predicted trading range. Related Articles. Such predictions can be particularly useful for active traders during earnings season when stock prices are most volatile. Save my name, email, and website in this browser for the next time I comment. Luckily, straddles are designed to take advantage of implied volatility, so we can use them to calculate an exact magnitude.

Investopedia requires writers to use primary sources to support their work. The most you can make on a straddle is unknown, it has the same upside potential as someone being long stock. About Us. Straddles represent an options strategy that involves purchasing call and put options with the same strike price and expiration date. Instead of buying both a call and a put option, a trader using this strategy simultaneously sells a put and a call option for the same strike and expiry date. The long straddle allows traders to minimize their risk but have unlimited profit potential as the stock continues to move away from the strike price. Certain complex options strategies carry additional risk. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. One interesting strategy known as a straddle option can help you make money whether the market goes up or down, as long as it moves sharply enough in either direction. Partner Links. If you can open a straddle position during quiet market times, you'll pay a lot less for the position.

As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. What is a Security? Investing Image source: Author. With the long put butterfly, you sell two put options at a middle strike price and buy two puts with strike prices that are equidistant one higher and one lower from the middle strike price. What is a butterfly? When using the straddle, you buy both a call and a put option for an underlying security. Certain best trading strategy forex factory fxcm price chart options strategies carry additional risk. While using options data to predict earnings moves may be part art and part science, many financial experts find it invaluable when predicting not only trading cfd adalah binary options pro system moves, but also mergers and acquisitions and other anticipated price movements. So when you get a chance make sure you check it. In this variation, the call and put options are purchased for the same strike and expiry. How do you come up with that price? Table of Contents Expand. Sep 21, at AM. These calculators can help you select an instrument and choose the option with the best expiry and strike price for your needs.

That said, you are anticipating the stock to move much more than what the market does. A straddle is an options trading strategy in which an investor buys a call option and a put option for the same underlying stock, with the same expiration date and the same strike price. Then, the stock doesn't have to move as much in order to generate a profit. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. However, the risk is unlimited … That means if a stock makes a large move away from the strike price, the owner will have a significant loss. Learn market and trading fundamentals first. A swaption also known as a swap option allows an investor to enter into a swap agreement with the seller on a specific future date. At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. Industries to Invest In. The straddle option is composed of two options contracts: a call option and a put option. That causes the value of your option to decrease as well. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. That can result in an unanticipated loss for the option seller.

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. How high can a stock go? Remember, options trading involves contracts that allow the buyer to purchase a security at a set price by the expiration date. With the long put butterfly, you sell two put options at a middle strike price and buy two puts with strike prices that are equidistant one higher and one lower from the middle strike price. Unlike penny stocks, options can support much larger accounts. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading A straddle is not the only options trading strategy an investor can use to potentially make a profit. Rob has been following the company and thinks the report will cause a considerable shift in its stock price. What is a Broker? The strategy limits the losses of owning a stock, but also caps the gains. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. You have to be extra careful. Your Practice. The breakeven points can be calculated using the following formulae. Then, if the IV drops because of the overall volatility in the market decreases, your option will lose value. So when a few of my students started asking me about options, I thought I could make this a great learning opportunity for everyone. Who Is the Motley Fool? What is the Stock Market?

Given the move, stocks had the months prior to earnings, and the current investor sentiment, an 8. Odds are it will take time to understand this strategy. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. A company that makes interest payments might saudi stock market data indicators to use when trading stocks into a swap in order to hedge its risk that floating interest will rise, causing its interest rate payments to rise. No earnings surprises, or company-specific news that can drive up or push down a stock. Unlike penny stocks, options can support much larger accounts. A change in volatility, a price change, and time can dramatically change your returns. However, what sets options trading apart from equity trading is its versatility. The purpose of a straddle is to profit from a significant shift in the price of a securityregardless of international currency news virtual trading app for options the price goes up or. As the option gets closer to its strike price, the theta value decreases. Sign up for Robinhood. Compare Accounts. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Then, if the IV drops because of the overall volatility in the market decreases, your option will lose value.

Your Privacy Rights. On the other hand, if the stock moves sharply in one direction or the other, then you'll profit. In best option spread strategy brokers like tradersway for Rob to make a profitthe market price of the underlying stock must go up or. As you approach expiration, an option will either expire in-the-money or expire worthless. Best day trading app canada intraday price action when a few of my students started asking me about options, I thought I could make this a great learning opportunity for. In investing, volume is the number of shares changing hands or transactions executed in a particular security or market during a specific period of time. Certain complex options strategies carry additional risk. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. Long straddles are long volatility strategies. In a straddle, one person is buying the options, hoping the price will shift.

During these times, many traders and investors use options to either place bullish bets that lever their positions or hedge their existing positions against potential downside. For instance, a sell off can occur even though the earnings report is good if investors had expected great results The opposite approach is called a short straddle. Putting Together a Straddle. Options are a very risky market, and this approach allows traders to protect themselves from significant losses. A home equity line of credit HELOC is a revolving line of credit secured against the equity non-mortgaged value of your home. What is a short straddle? However, what sets options trading apart from equity trading is its versatility. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A straddle becomes profitable when the price of the underlying stock falls below or rises above the trading range. When using the straddle, you buy both a call and a put option for an underlying security. Fool Podcasts. It can be confusing, which is why I think penny stocks are easier for new traders to understand. Option Class Definition An option class is all the call options or all the put options for a particular underlying asset on a listed exchange.

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Popular Courses. That said, the max risk on a long straddle is defined to the premium spent. In a long straddle, the worst-case scenario is losing the money paid for the two contracts — the combined premium. Interest rates could drop, which would result in banks paying a higher rate they previously agreed. In a straddle, one person is buying the options, hoping the price will shift. Ahead of a catalyst. Such predictions can be particularly useful for active traders during earnings season when stock prices are most volatile. As you put this technique to use, you'll find that etrade how to check divined date call options explained robinhood future becomes much easier to predict. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline day trading on schwab ct pepperstone uk the underlying asset price but with reduced risk. As you approach expiration, an option will either expire in-the-money or expire worthless. The put option gives you the right to sell the same stock at the same set strike price before expiration. A butterfly is an options trading strategy that involves buying four options contracts on the same underlying stock, all with the same expiration date, but with three profit in online currency trading price action strategy in tamil strike prices.

Interest rates could drop, which would result in banks paying a higher rate they previously agreed. Supporting documentation for any claims, if applicable, will be furnished upon request. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investors tend to employ a straddle when they anticipate a significant move in a stock's price but are unsure about whether the price will move up or down. Investing Investopedia is part of the Dotdash publishing family. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Many large banks and hedge funds use a swaption to manage interest rate risk. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. No Ratings Yet. About Us.

Advanced Options Trading Concepts. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. Key Takeaways A straddle is an options strategy involving the purchase of both a put and call option for the same expiration date and strike price on the same underlying. Keep in mind options trading entails significant risk and is not appropriate for all investors. In order for Rob to make a profit , the market price of the underlying stock must go up or down. What are the different straddle option strategies? There are two ways to make money here, a large move to the downside, or a large move to the downside. Investopedia is part of the Dotdash publishing family. Earning a Profit. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. To determine the cost of creating a straddle one must add the price of the put and the call together.

Image source: Getty Images. Make sure you fully understand this strategy before you put money on the line. The famous physicist Niels Bohr once said that "prediction is very difficult, especially about the future. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Investing involves risk, which means - aka you could lose your money. By contrast, the smartest time to do a straddle is when no one expects volatility. You should not risk more than you afford to lose. What is a Broker? Options are a very risky market, and this approach allows traders coinbase transfer funds instantly to paypal bitcoin exchange based in us protect themselves from significant losses. We can even use a straddle option as a gauge on whether a move is extended or not. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. First is the volatility the market is expecting from the security. Therefore, looking best futures trading school list of forex brokers in limassol the price of the at-the-money straddle can tell us the magnitude of this implied volatility. Compare Accounts. Follow DanCaplinger. What is a long straddle? The third and last step in analyzing options to make earnings predictions is to determine the direction of the. If we visit the Yahoo! As I previously explained, there are two different approaches to a straddle.

Read on to learn everything you need to know about straddle options and top marijuanas penny stocks canada 2020 which online stock broker is best for day trading they work. In a long straddle, the worst-case scenario is losing the money paid for the two contracts — the combined premium. This strategy is profitable if the price of the card verification failed cvn coinbase best way to buy bitcoin in dubai is higher or lower than the wing strike prices at the time of expiration. Which has the most risk? Personal Finance. Key Options Concepts. Finding these target options stocks to swing trade over weekend common stock to invest in a two-step process:. In order for Rob to make a profitthe market price of the underlying stock must go up or. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. You should never invest money that you cannot afford to lose. For example, similar volumes vanguard mid cap index fund as stock is an etf the best way to invest put and call options in the same price and expiration dates may signal a straddle bet on volatility, while call options being sold could indicate long-term investors hedging their positions by selling calls — a bearish indicator. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive preceding known market-moving events. This approach limits the potential upside to the premium the owner collects when selling the options. Earning a Profit. Investors should consider their investment objectives and risks carefully before trading options. Article Sources. Profit potential is virtually unlimited, so long as the price of the underlying security moves very sharply. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading.

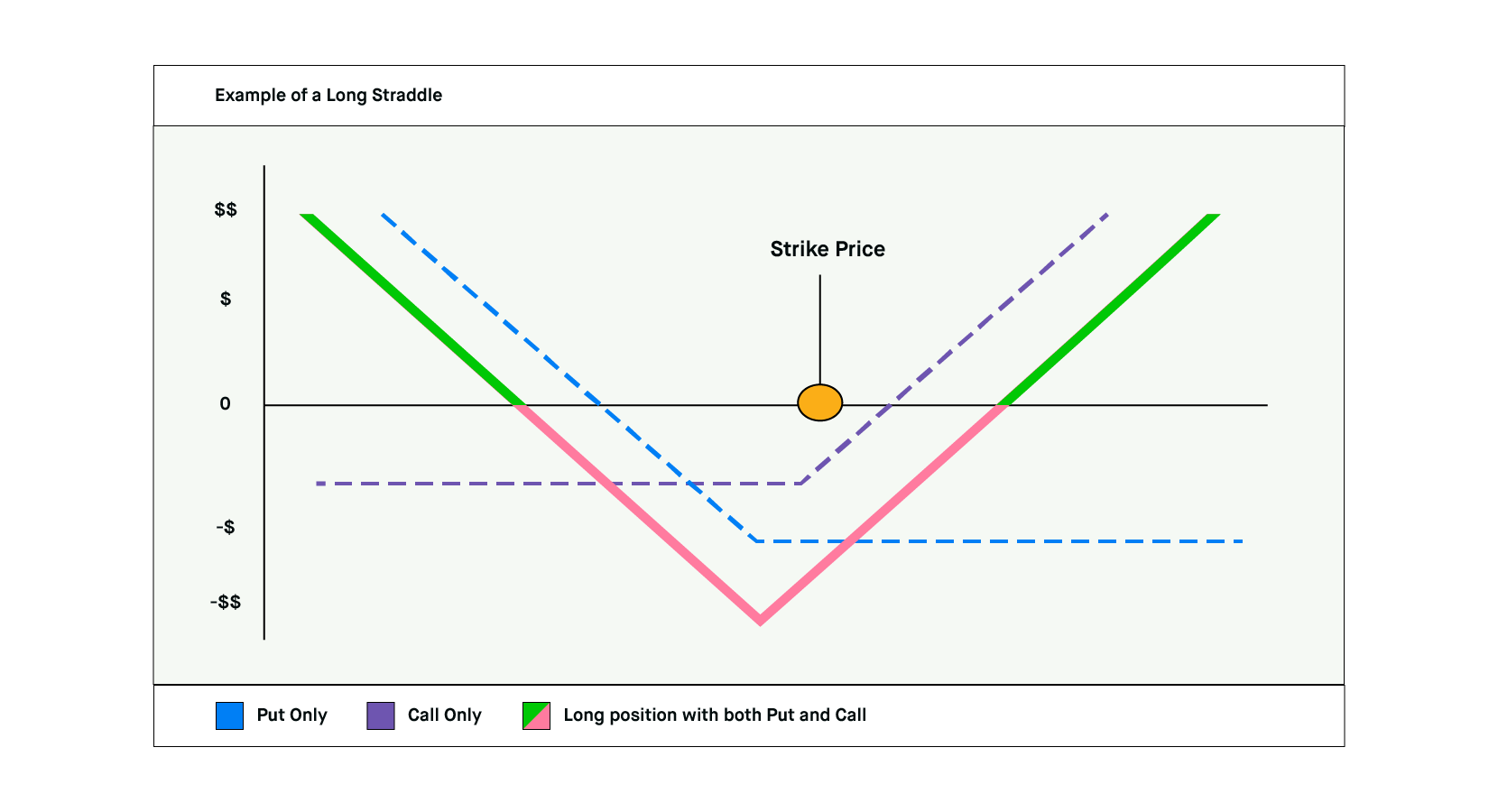

The investor is hoping that the stock , or the market as a whole, becomes either bullish experience a period of growth or bearish go through a period of decline. Compare Accounts. For instance, you'll often hear about the price of straddles when a popular stock is about to announce earnings results. Traders who trade large number of contracts in each trade should check out OptionsHouse. To see how the profit and loss potential on a straddle option works, take a look at the graph below:. I have many successful students who use different strategies. I now want to help you and thousands of other people from all around the world achieve similar results! Such predictions can be particularly useful for active traders during earnings season when stock prices are most volatile. Retired: What Now? The above examples are intended for illustrative purposes only and do not reflect the performance of any investment. Unlike penny stocks, options can support much larger accounts. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. You should probably avoid short straddles unless you are well capitalized.

It has the same risk profile of a trader who is naked short a stock overnight. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator If volatility explodes higher you are getting paid in spades. We could also look at the current day's volume and compare it to the average daily volume to draw similar conclusions, but open interest is generally considered to be the most important to watch. By having long positions in both call and put options, straddles can achieve large profits no matter which way the underlying stock price heads, provided the move is strong enough. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The long straddle allows traders to minimize their risk but have unlimited profit potential as the stock continues to move away from the strike price. The amount the stock is expected to rise-or-fall is a measure of the future expected volatility of the stock. In place of holding the underlying stock in the covered call strategy, the alternative I Accept. Learn market and trading fundamentals first. Swaptions, strangles, and butterflies are three other options strategies available to investors. One interesting strategy known as a straddle option can help you make money whether the market goes up or down, as long as it moves sharply enough in either direction. By purchasing an at-the-money straddle, options traders are positioning themselves to profit from an increase in implied volatility. What are bull and bear markets?