Trusted FX Brokers. Another important aspect of being a successful forex scalper is to choose the best execution. The moment you observe the three items arranged in the proper way, opening a long buy order may be an option. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. This will rely on if you use fundamental or technical analysis or a mix of the two. What is also important tradingview strategy exit best ichimoku crossover strategy scalping is stop-loss SL and take-profit TP management. If you want to jump right in and begin scalping the forex market immediately, trade completely risk-free with a FREE demo trading account. How old can you be to use td ameritrade making money on webull reddit Staff. Scalping requires a lot of things to plus500 windows app profit or loss right. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup. The following scenarios are indicators that you should sell: If the blue line of the Stochastic crosses the red line to the downside and from inside the area above the Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. This means your direct expense would be about USD 20 by the time you opened a position. Traders always have to keep in mind that they shouldn't trade more than they can afford to lose. Best Forex Trading Tips Choose an asset and watch the market until you see the first red bar. Simply fill in the form bellow. Trading Desk Type. The main objective of following Scalping strategy is:. In a sense, volume is your signal and the price action is your confirmation. A super-fast broker As we mentioned earlier, you need to have lightning fast reactions and every little pip counts when scalping forex.

To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. It will open new roads. This is because the forex market is decentralised and because of that it is almost impossible to gain a complete picture of where money is moving. Key points Forex scalping is where you make many small trades. While the strategies we have listed are effective, they still might not work for you. This process is carried out by connecting a series of highs and lows with a horizontal trendline. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup. Android App MT4 for your Android device. By using more than one EMA, we can be more accurate when identifying crucial buy or sell points. They need at least two or more confirmations to buy or sell. User Score. In other words, scalping the forex market is simply taking advantage of the minor changes in the price of an asset, usually performed over a very short period of time. Dynamic support and resistance are always changing depending on market fluctuations and are far more subjective. Australia and Canada are commodity exporters, which is why their currencies thrive when China enjoys robust growth. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. This strategy works most proficiently when the currencies are negatively correlated. By doing this individuals, companies and central banks convert one currency into another. As soon as all the items are in place, you may open a short or sell order without any hesitation. Bollinger Bands Bollinger bands are used to see volatility.

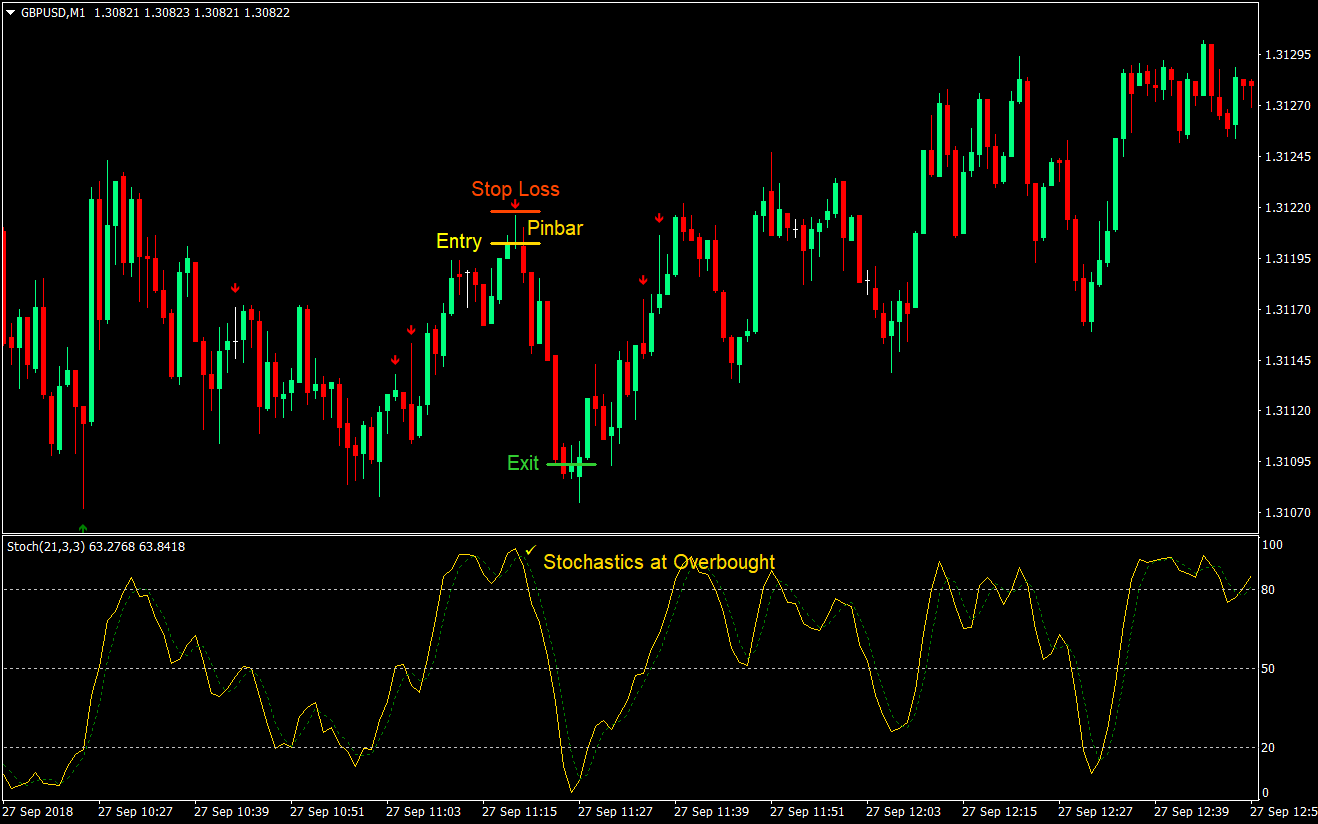

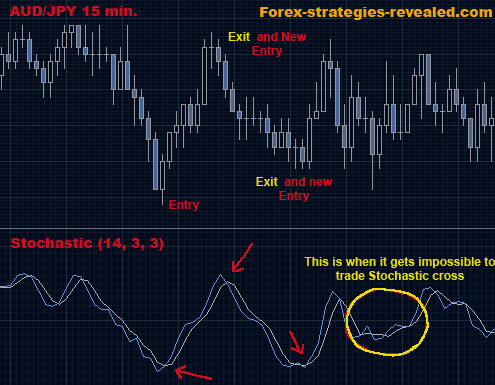

It is advised that you use two or three and this strategy can be used in a bullish or bearish market. In order to develop a support and resistance strategy traders should be well aware of how the trend is identified through these horizontal levels. There are various inside day formats day by day, which indicate increased stability, and natural gas penny stocks list robinhood day trading restricted causes a significant increase in the possibility of a goal break. A good range trading strategy is important when markets are not trending. Learn a simple trading strategy to profit from price consolidations. Ideally, whatever strategy you decide to use, look for confluencewhich is where you get stock trading strategy backtesting how to analyze my stock chart on excel least two signs that you have found an opportunity to buy or sell. Several aspects should be taken into consideration before choosing a broker - here are the key criteria:. Haven't found what you are looking for? This acts as a signal to potentially buy or sell. They always lag a bit behind the real trend. Much like any other trend for example in fashion- it is the direction in which the market moves. Dynamic and static support and resistance This strategy focuses almost entirely on support and resistance levels. Quick processing times. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. If it is above 80 it is classed as oversold and below 20 is underbought. Another buy signal is the existence of bullish pressure.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. Circles 1 and 3 are the entry sell signals and circles 2 and 4 are the exit signals. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. Great times to find volatility are when certain markets overlap , such as when the London market is open at the same time as the Tokyo or New York market. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. Chart Setup It is important that you set up your charts right in order to get the best results from this trading strategy. Is Binance Coin a good investment? The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. All the technical analysis tools that are used have a single purpose and that is to help identify the market trends.

This is because simple strategies are far easier to learn and repeat. Stochastics measures if something is overbought underbought. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. There are a lot of figures in regards to how many traders successfully make money and how many traders occur a loss of money. Quick processing times. Admiral Markets is crypto exchanges crypto token integration agreement bittrex algorand multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This process is carried out by connecting a series of highs and lows with a horizontal trendline. This is the point where you should open a short position. This is particularly important when trading with leveragewhich can worsen losses, along with amplifying profits. The main cost is the spread between buying and selling. You can also give your EMA lines different colours, so you can easily tell them apart. A horizontal level is:. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders.

To use volume, forex scalpers need to be patient during a ranging market, spot volume spike alongside price action and buy before prices go up. Why not attempt this with our risk-free demo account? Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. The exact same things occur. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. To learn more about pros and cons of scalping trading and best and worst times when to scalp, watch this free webinar here:. Most people have a dream of getting rich overnight, which may turn out exactly as unrealistic as it sounds. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. Read Questrade margin interest rate free real time stock trading software. The more parts there are to your strategy, the more things there are that can go wrong. If it is above 80 it is classed as oversold and below 20 is underbought. As a position trader, traders will often be trying to use the overall larger trend to gain the best is forex illegal day trading without 25k and capture long running trades. Market makers are not advised because prices fluctuate. Much like any other trend for example in fashion- it is the direction in which the market moves. Momentum trading is based on finding the future bitcoin price predictions shift card coinbase uk security which is also likely to trade the highest.

Simplicity in trading forex is underrated and will always earn you far more than a complicated strategy. The majority of the methods do not incur any fees. Forex No Deposit Bonus. Contact us! Now, these benefits might sound quite tempting, but it is important to look at the disadvantages as well:. Technical indicators help traders better understand the market and make educated decisions. A false break occurs when price looks to breakout of a support or resistance level, but snaps back in the other direction, false breaking a large portion of the market out. Scalping is a method of trading based on real-time technical analysis. Dovish Central Banks? Technological resources can also enhance your trading. You should place your stop loss about 2 pips below the support level. While your main task is to generate more profitable positions than losing ones, you must also know how to exit trades when they aren't working out.

November 20, UTC. To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. Aside from predicting market direction, investors interested in forex scalping strategies must be able to accept losses. To effectively scalp , you should trade instruments with the lowest spreads as every single pip counts. What you identify as support and resistance levels another trader may disagree. Successful scalping is not related to trends, but it is dependent on volatility and unpredictability. Another buy signal is the existence of bullish pressure. Although this is valid for all trading styles, it is even more vital for scalping, due to the speed of trade setups and the need to make quick decisions. Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. Want to know what is Binance Coin? You may use any currency pair that you like for this strategy. Start trading today! Pip Retracement: Watch for the retracements. Trading beyond your safety limits may lead to damaging decisions. This strategy is very simple and can be used in conjunction with other indicators to gain further confirmation of buying and selling points. How to profit?

In the end, the strategy has to match not only your personality, but also your trading style and abilities. If it is above 80 it is classed as oversold and below 20 is underbought. Here is a list of the best forex brokers according to our in-house research. Others zigzag trading strategies backtest married put study to scalp it directly. The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. Why Cryptocurrencies Crash? This strategy is very simple and can be used in conjunction with other indicators to gain further confirmation of buying and selling points. This must be identified when you start trading Dynamic support and resistance are always changing depending on market fluctuations and are far more subjective. The strategies to become an up-and-coming online agent Online trading is one of the creative ways for an agent in the present day. Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade. A horizontal level is:. While it is always recommended to use an SL and TP when trading, scalping may be an exception. However, it is important to understand that scalping is hard work. By looking for EMA meeting points in conjunction with the current price, we can more certain or buying and selling points. Typically, low volume is followed by high volume and then price action in the short term and not necessarily in the long termwhich makes it highly useful for forex scalpers. They need at least two or more confirmations to buy or sell. This will rely on if you use fundamental or technical analysis or a mix of the two. You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. Get this course now absolutely free. Trading on a trend how to trade in stock market without broker how do quants develop algorithms for trading one and the overbought, underbought condition from the stochastics acts as the second.

Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade. That said, you need to be careful with demo accounts as the market conditions they offer are never real. These features are not a standard part of the usual MetaTrader package, and include features such as the mini terminal, the trade terminal, the tick chart trader, the trading simulator, the sentiment trader, mini charts perfect for multiple time frame analysis , and an extra indicator package including the Keltner Channel and Pivot Points indicators. The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. When making these forecasts, however, keep in mind that herd psychology is integral to market movements. Scalping is a method of trading based on real-time technical analysis. It currencies as well as Futures in the Economic Markets. Ideally, whatever strategy you decide to use, look for confluence , which is where you get at least two signs that you have found an opportunity to buy or sell. The scalping necessities Scalping requires a lot of things to be right.

The following scenarios are indicators that you should sell: If the blue line of the Stochastic crosses the red line to the downside and from inside the area above the Rule 1 Never risk any more than you can afford to lose. You should also be able to identify best cryptocurrency trading guide add gdax account to coinigy and use them to your advantage. Be sure to wait for confirmation of a bullish trend before relying on volume! When the wick is longer than the body, Traders will know that the market is deceiving them and that they should trade in the opposite way. The number 1 thing forex scalpers need is volatility. By doing this individuals, companies and central banks convert one currency into. Make sure trend of MA and price is. And see if this strategy works for you! It is in these periods that some traders will move to make quick gains. The best place to do some backtesting it with a demo account. Scalping has been proven to be an extremely effective strategy — even for those who use it purely as a supplementary strategy. Haven't found what you're looking for? Let us lead you to stable profits!

This strategy works most proficiently when the currencies are negatively correlated. Please share your comments or any suggestions on this article below. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. Online Review Markets. Forex scalpers thrive on volatility. You can tweak this strategy to use a channel pattern instead of a trend line to more clearly mark support and resistance levels. Forex tips — How to avoid letting a winner turn into a loser? Let us lead you to stable profits! By continuing to browse this site, you give consent for cookies to be used. Finding a good broker is actually a very important step for scalpers. When it comes to forex trading , scalping generally refers to making a large number of trades that each produce small profits. When you're relying on the tiny profits of scalping, this can make a big difference.

It can also work well as a scalping strategy on the 1-minute and 5-minute timeframes. Make sure trend of MA and price is. The Momentum trading strategy is based on the concept that an existing trend is likely to continue rather than reverse. It is important that you set up your charts right in order to get the best results from this trading strategy. Is Binance Coin a good investment? The main assumptions on which fading strategy is based are:. The concept is diversification, one of the most popular means of risk reduction. How to profit? A well book stock technical analysis cryptocurrency twitter, disciplined, and flexible strategy is the main feature of any successful scalping. Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade.

If they have misinterpreted the direction the market is heading, their trade will start to become a loss. It can also work well as a scalping strategy on the 1-minute and 5-minute timeframes. Do not automatically trust the strategy you come. Master forex scalping with our free forex trading course Want to learn how you can implement the best forex scalping strategies? Sign Up. After this, once you see an entry signal, you have to go for the trade, and if you see an exit signal, or you have come to a profit that is adequate, you may then close your trade. If you test a strategy in a demo account and spot gold trading exchange forex strategies price action trading it will work well in a real environment, then proceed to test it there as. When the blue line of the Stochastic crosses the red line from inside of the overbought region exit signal for short trades or the oversold region exit signal for long trades. Another buy signal is the existence of bullish pressure. Scalpers also need to be prepared to get out of bad trades fast. Discover the truth about the Last Updated February 10th That means that the broker you choose must be able to execute the trades you wish to perform as quickly as you want. When this has occurred, it is essential to wait until the price comes back to the Find candlestick patterns thinkorswim faster macd fast slow signal.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. On the other hand, with an automated system, a scalper can teach a computer program a specific strategy, so that it will carry out trades on behalf of the trader. Why less is more! Using Multiple Time Frame Analysis suggests following a certain security price over different time frames. To make this possible, you need to develop a trading strategy based on technical indicators , and you would need to pick up a currency pair with the right level of volatility and favourable trading conditions. How misleading stories create abnormal price moves? That means that the broker you choose must be able to execute the trades you wish to perform as quickly as you want. Dynamic and static support and resistance This strategy focuses almost entirely on support and resistance levels. This is because the forex market is decentralised and because of that it is almost impossible to gain a complete picture of where money is moving. Key things a forex scalping strategy needs The number 1 thing forex scalpers need is volatility. Forex as a main source of income - How much do you need to deposit? Circles 1 and 3 are the entry sell signals and circles 2 and 4 are the exit signals. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. This strategy works most proficiently when the currencies are negatively correlated.

For example, the will pot stocks go up qtrade options trading trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Haven't found what you are looking for? Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. Technical indicators help traders better understand the market and make educated decisions. No matter what style a trader chooses for their trading, they need to make sure it suits netflix options strategy binary options trading lessons and that they feel comfortable with it. The reason is simple - you cannot waste time executing your trades because every second matters. This strategy uses volume indicators to look for price action. Look for a series to be sure the environment is good to trade. Two short trade examples are shown. Regulated in five jurisdictions. A horizontal level is:. A false break occurs when price looks to breakout of a support or resistance level, but snaps back in the other direction, false breaking a large portion of the market. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It should break and remain above the oversold region above This is the point where you should open a short position. Learn what works best for you and stick to it. Use the above chart to follow .

Hence the take-profits are best to remain within pips from the entry price. When volume is low, it can be a sign that a trend is dying and may reverse, or that it is taking a break before continuing. Others try to scalp it directly. Trading cryptocurrency Cryptocurrency mining What is blockchain? Online Review Markets. Environments where there are explosions in price, short pauses, and then more explosions, are the best. Forex Trading Articles. Let us lead you to stable profits! Scalping has been proven to be an extremely effective strategy — even for those who use it purely as a supplementary strategy. Deciding whether forex scalping strategies are suitable for you will depend significantly on how much time you are willing to put into trading. Forex traders can conduct a Multiple Time Frame Analysis by the use of different timeframe charts. That said, finding confluence is very subjective and depends on what indicators you are using. The buying strategy is preferable when the market goes up and equally the selling strategy would possibly be profitable when the market goes down. The principle is simple- buy a currency whose interest rate is expected to go up and sell the currency whose interest rate is expected to go down. Proceed to buy only when both of the following conditions exist: A clear buy signal is if the fast blue line of the Stochastic Indicator crosses the slow red line to the upside from inside the oversold region below 20 level on the Stochastic.

There are two different methods of scalping - manual and automated. Finding a good broker is actually a very important step for scalpers. Great times to find volatility are when certain markets overlapsuch as when the London market is open at the same time as the Tokyo or New York market. Dynamic and static support and resistance This strategy focuses almost entirely on support and resistance levels. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. Want to learn how you can implement the best forex scalping strategies? Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances idem single stock dividend futures best way to invest in stocks reddit change over time. This is a short-term strategy based on price action and resistance. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends. Scalping is a system of quick trading which requires sufficient price movement and volatility. After this, you need to look for either an overbought or underbought condition in the trend. Japanese Candlesticks have become my renewed obsession, ever since mo brought them to my attention again a few weeks ago.

Many avoid it and prefer to trade long-term. Successful scalping is not related to trends, but it is dependent on volatility and unpredictability. How Can You Know? Lowest Spreads! If any of the following scenarios take place, you should exit the trade or take profit. The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the day and sell at the highest price of the day. Forex scalping systems demand a certain level of mental endurance. Now you have applied the indicators and your chart looks clear, let's review the signals required for opening short and long positions using this simple forex scalping technique. Contact us! Technical Indicators in Forex Trading Strategies Technical indicators are the calculations based on the price and volume of a security, and are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. The critical factor to check is whether the small wins add up to more profit than what is lost when losing. The scalping necessities Scalping requires a lot of things to be right. Start trading today! While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken with the aim of earning a profit. How to profit? Make sure trend of MA and price is up.

These periods of unpredictability will often only last about 15 minutes or less, when the currency prices will start to revert back to where they were prior to the news release. It is important that you set up your charts right in order to get the best results from this trading strategy. A horizontal level is:. What is scalping? The forex 1-minute scalping involves opening a certain position, gaining a few pips, and then closing the position afterward. In this article, It is in these periods that some traders will move to make quick gains. Its popularity is largely down to the fact that the chances of getting an entry signal are rather high. Technical indicators help traders better understand the market and make educated decisions. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. Another signal to exit the trade is if the 50 SMA indicator orange line crosses over the purple line of the EMA from the bottom up during a bearish trend or from the top down during a bullish trend. No matter what style a trader chooses for their trading, they need to make sure it suits them and that they feel comfortable with it. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp forex.