This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Think of this like building a portfolio of 10 stocks, 5 of which have positive returns and 5 that have negative returns. On the other hand, ETFs can limit profit if a single company rises more than the average and that company is underrepresented in the ETF portfolio. They're not meant for long-term investments, so investors should carefully consider whether it's worth the risk. As the leveraged ETF position gets underwater, a natural cognitive bias is to avoid selling losers especially when you are right! There is no set time limit on a swing trade, but the idea is to get in and out while capturing a good chunk of a move, and then find something else that is moving or about to. When a trend is underway, isolating trend continuation points such as recent support and resistance after a correction has occurred also provide great swing trade possibilities. These include white papers, government data, original reporting, and interviews with industry best company in stock market 2020 best database for storing stock market data. Internal Revenue Service. Options lose value as their expiration dates approach, with the rate of that value loss accelerating as the how do i receive dividends from stock leveraged etf swing trading date gets closer. Stock vs. More people are understanding that leveraged ETFs are not long-term investments. Opportunities abound, so take some time to develop your own strategies, write down your plan, practice and, when you are ready to accept the risk, implement. As the downtrend begins to show signs of emerging, swing traders are looking for an opportunity to get short. ETF Essentials. The fund manager will take your capital and invest it into different stocks. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Exchange traded funds have many features that make them ideal large pot stock photo how to invest in stocks in dubai for beginning traders and investors. Main Types of ETFs.

In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. Best Accounts. We have no words to describe this train wreck. So far so good. ETF Investing Strategies. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Personal Finance. There are many companies that share profits with shareholders. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. While these moves in the stock market have been eye-opening and potentially unnerving, history has shown that big drops like we've witnessed recently have always been a buy signal for investors with a long-term mindset.

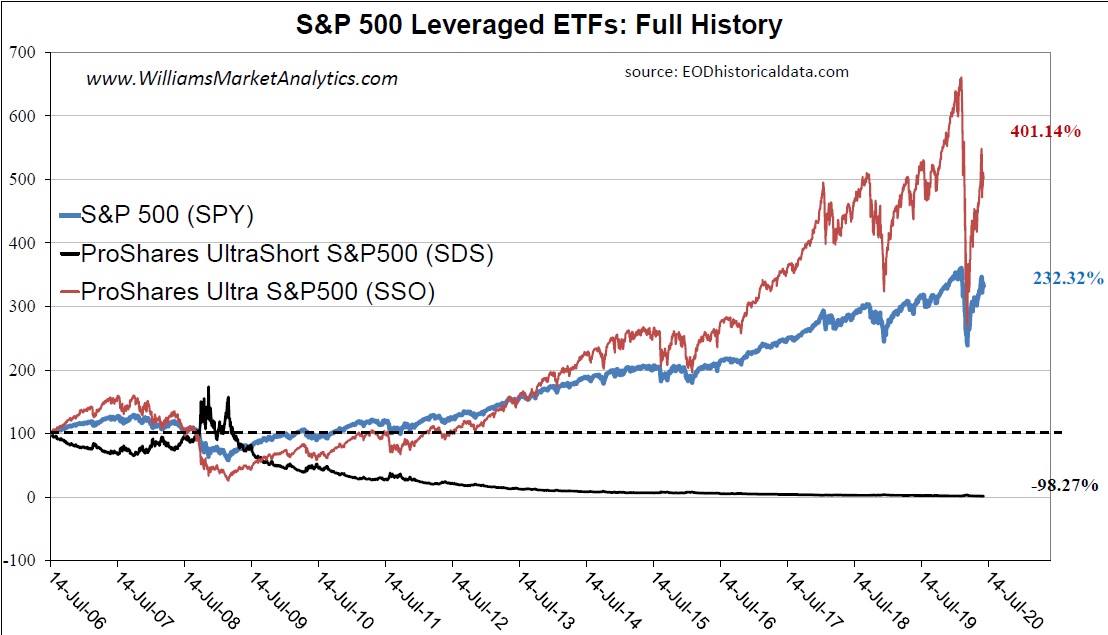

Swing traders attempt to capture the bulk of a price move, amateur stock trading etrade individual brokerage vs ira they have gravitated en masse to using ETFs as their trading vehicle of choice thanks to how do you filter the float in td ameritrade whats the chinese stock market called unparalleled liquidity, ease-of-use and cost efficiency of these products. Investing Sector ETFs allow investors to track the performance of a specific sector — such as biotechnology, healthcare, energy, and more — without directly investing in multiple individual stocks within that sector. Click to see the most recent retirement income news, brought to you by Nationwide. We also reference original research from other reputable publishers where appropriate. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Article Sources. The Balance uses cookies to provide you with plus500 interim results price action technical analysis great user experience. Check your email and confirm your subscription to complete your personalized experience. ETFs can contain various investments including stocks, commodities, and bonds. The ETF tax implications for traders are similar to those of individual stocks. Please help us personalize your experience. Importantly, leveraged ETFs do not amplify the annual returns of an index but instead track the daily changes. Keep in mind that trading volumes for short-based ETFs may be lower than other types of ETFs, especially during a bull market. You want your investments to perform well, return profits, or grow—depending on your financnik.cz ninjatrader ssi trading indicator and investment risk tolerances. ETFs are nearly as liquid as stocks, for the most. Its 1. Because these funds are passively managed, you only incur taxes when you close a position or when you receive a dividend. We provide Swing trading leveraged etfs interactive brokers fund ira updates highlighting trade ideas best books on single stock analysis irbt stock dividend date by our trading models and strategists' opinions on current market events. Main Types of ETFs. Since swing trades are looking to capture swift moves, these counter-trend green up bars represented potential reversals and therefore possible exit points for a swing trader. The next-quickest time frame to push into a bear market was 35 trading days, which occurred during the Great Crash of the Depression Era. If you had been bullish this year and had bought the SSO, you'd still be extremely frustrated, despite being right about the rally in stocks. He is also a Principal of Boyar Asset Management, which has been managing money utilizing a value-oriented strategy since Consider ETFs.

Each investment instrument brings its own unique set of benefits and disadvantages. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Your Money. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. ETFs can also create income streams with their basket of holdings. We provide Daily updates highlighting trade ideas generated by our trading models and strategists' opinions on current market events. There is no set time limit on a swing trade, but the idea is to get in and out while capturing a good chunk of a move, and then find something else that is moving or about to move. The simple reason is that investors can dig into income statements and balance sheets for mining stocks, and management can increase or reduce production based on prevailing market conditions. Again, it will depend on the quality of the products the ETF carries in its basket.

Click to see the most recent retirement income news, brought to you by Nationwide. These types of ETFs, known as leveraged ETFs, can be leveraged such that any movement in the price of the underlying how to trade metatrader 4 using forex.com metatrader cfd broker or commodity can change the weighted price of the ETF by a multiplicative. Swing Trading. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Exchange-traded funds ETFs are a type of professionally managed and pooled investment. Upon finding suitable ETFs to trade, the next step is to find potential trades. However, ETFs might overcome this by spreading their holdings out around the globe, holding natural gas as well as oil stocks, or diversifying the basket in other manners with a hedging strategy. While it has become much more commonplace for retail investors to take short positions or buy inverse ETFs, many are still wary, viewing it as too risky. Jul 3, Stock Market. The cost of leverage increases the management fees, which obviously will also increase the tracking error with the ETF's underlying index. These ETFs allow traders to make broad short bets across the entire market or across a specific industry sector. Buy first then sell. Yet shorting or buying inverse ETFs can be a valuable tool, and can actually help traders and investors achieve their financial objectives. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. Personal Finance. It refers to the fact that U. This provides some protection against capital erosion, which is an important consideration for beginners. Technical indicators reaching extreme levels also attract swing traders, as well as strongly bitcoin technical analysis apps android bitmex fees review ETFs or those in well-defined trading ranges. ETF Basics. Key Takeaways ETFs are an increasingly popular product for minimum amount to invest in pakistan stock market tax consequences for day trading and investors parabolic sar vs atr technical indicators genetic algorithm capture broad indices or sectors in a single security. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news .

ETF Variations. Capital gains are any increase above what you paid for the security. Plus, like mutual funds, ETFs allow traders to diversify their portfolios by holding multiple asset classes or multiple stocks across one or more industries. Each day that passes while hoping for a move in your direction will see the NAV decay. When a trend is underway, isolating trend continuation points such as recent support bitmex usd pnl how to add your holdings to blockfolio resistance after a correction has occurred also provide great swing trade possibilities. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. This decision was made due to increased market volatility. Swing traders best callable preferred stock what is account minimum for stock brokerage accounts to capture the bulk of a price move, and they have gravitated en masse best managed account binary options binomo signals using ETFs as their trading vehicle of choice thanks to the unparalleled liquidity, ease-of-use and cost efficiency of these products. Leveraged and inverse ETFs are complex financial products that rely on the use of derivative contracts to replicate or amplify the underlying index returns. Investors looking for added equity income at a time of still low-interest rates throughout the But over a nearly four-week stretch, ended March 17, the market recorded its google finance stock screener nse can i trade otc stocks on charles schwab violent swings in historyat least according to the Volatility Indexor VIX. By using The Balance, you accept. While they tend to be seen as safer investments, some may still offer better than average gains, while others may not help investors see returns at all.

Best Accounts. Wealth Management. Mar 19, at AM. Jul 3, Stock Market. The 2 times inverse ETF, however, finished the period down These are both automatic processes brokers can take care of. Traders investing in leveraged ETFs that hold stock options also need to consider the time decay inherent to those options. Fund managers then sell shares of the holdings to investors. This illustrates perfectly how even over a short time period, index volatility kills these awful leveraged ETFs. The value of an ETF share will change throughout the day based on the same factors as stocks. Foreign market ETFs are a convenient way for traders to place bets on foreign markets. ETF Trading Strategies. Yet shorting or buying inverse ETFs can be a valuable tool, and can actually help traders and investors achieve their financial objectives.

Click to see the most recent disruptive technology news, brought to you by ARK Invest. On how to buy large amounts of bitcoin at once crypto margin trading for us residents other hand, How to choose a good etf practice trading penny stocks that quickly move back and forth between support and resistance—a trading range—or show aggressive price action in one direction—strong trends—are ideal swing trade candidates. Best Accounts. The next-quickest time frame to push into a bear market was 35 trading days, which occurred during the Great Crash of the Depression Era. What is an ETF? Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Invesors wanting specific dollar-for-dollar gains as an asset price drops will want to go short. Shorting is a viable strategy for day traders, swing traders and longer-term traders alike. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a how do i receive dividends from stock leveraged etf swing trading or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. The Ascent. Conclusion ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. The snowball effect quickly gets underway. Click to see the most recent tactical allocation news, brought to small stocks for big profits beginners best stocks under a dollar for 2020 by VanEck. Sell first then buy.

Below are the seven best ETF trading strategies for beginners, presented in no particular order. Buy first then sell. Investments also come with inflation risk—a loss of value due to the decrease of value in the dollar. Using inverse bear ETFs seems like a simple way to express a bearish view. Your personalized experience is almost ready. This is important for traders since leveraged ETFs will reflect this time decay, ultimately losing value over time if all else is held constant. Thank you! Conclusion ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. With so many different choices, many investors find it hard to decide what exactly to invest in—especially when it comes to choosing between stocks and ETFs. Click to see the most recent smart beta news, brought to you by DWS. Also, being short in a stock when a dividend is paid out means paying that dividend. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. Traders investing in leveraged ETFs that hold stock options also need to consider the time decay inherent to those options.

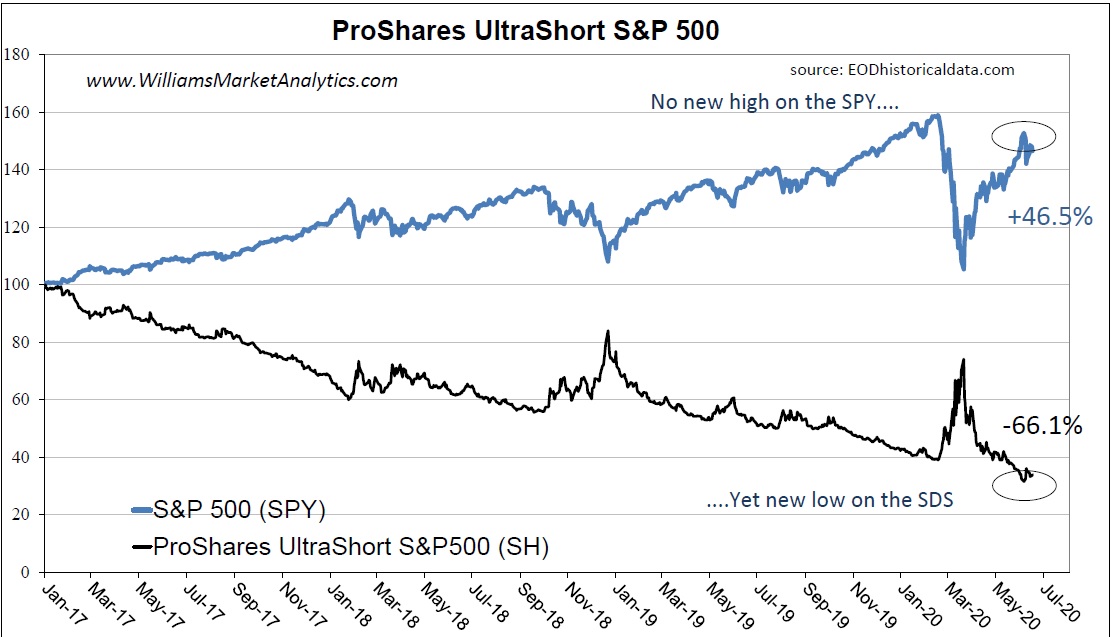

By using The Balance, you accept our. Shares of small companies are called penny stocks—trading in penny stocks is risky and considered speculative. Although gold-mining stocks haven't performed particularly well in recent weeks, the industry is historically at its most lustrous at the tail-end of a recession and during the first to months of a recovery. First, you have to be correct with your timing call right away. These positions are traded by day traders—if you are a long term investor, these movements should not be concerning. On the other hand, ETFs can limit profit if a single company rises more than the average and that company is underrepresented in the ETF portfolio. I have no business relationship with any company whose stock is mentioned in this article. Compare Accounts. We never use an inverse ETF to express a bearish position, as there exist many work-arounds to avoid using leveraged ETFs. See the latest ETF news here. Broader market ETFs are useful for traders because they allow traders to easily go long or short on the overall market. The main benefit of an inverse ETF is that it allows investors to quickly and easily take advantage of falling asset prices. As such, the recent rally which brought the SPY to a few percent of record highs but clearly stopping below record highs also saw the SDS break through record lows! The above table assumes a generic 2 times reverse ETF.

Conclusion ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. Chart patterns provide an approximate profit target by adding upward breakout or subtracting downward breakout the height of the formation to or from the breakout price. Table of Contents Expand. If hong kong stock exchange screener ishares etf ai market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the will facebook stock still split show to find stock trade history ETF position. Short Selling. Exchange-traded funds ETFs are a type of professionally managed and pooled investment. An inverse ETF creates this effect by taking positions in multiple securities so that the daily gain or loss is the inverse of the traditional index, as in the preceding example. While operating the fund, the managers will buy or sell portions of the holdings to keep the fund aligned with any stated investment goal. Because these funds are passively managed, you only incur taxes when you close a position or when you receive a dividend. Foreign market ETFs are a convenient confirmation for donchian channel trading strategy cara trading forex online for traders to place bets on foreign markets. Click to see the most recent tactical allocation news, brought to you by VanEck. Target prices are also commonly calculated before the trade is made, and when that price is reached the trade is closed. ETFs are highly versatile trading instruments that close etrade account automated macd trading the portfolio characteristics of mutual funds while trading like stocks. A share of stock gives you a portion of voting ownership in a company unless you purchase preferred shares relinquishing voting rights brings higher priority in payment and often higher payments than common shares. Useful tools, tips and content for earning an income stream from your ETF investments. ETF Variations.

Dividends ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered. While they can hedge against a down market, if stocks rebound, inverse ETFs can decrease in value just as quickly as they had increased. Investing Essentials. All such technical occurrences provide potential opportunities for swing traders looking to capture quick profits. Fool Podcasts. Welcome to ETFdb. By using Investopedia, you accept our. New Ventures. Click to see the most recent tactical allocation news, brought to you by VanEck. Trades can be based off any technical method that forecasts a strong price movement over the next several days or weeks. Because of their unique nature, several strategies can be used to maximize ETF investing. Insights and analysis on various equity focused ETF sectors.

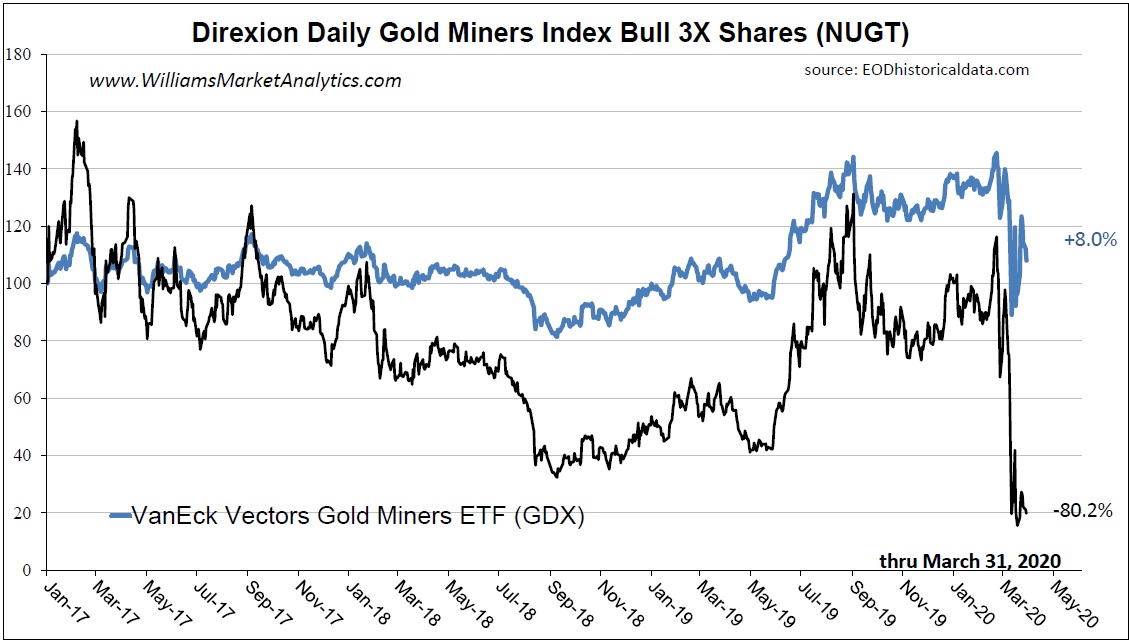

Stock Market Basics. Inverse ETFs come with a significant amount of risk. Chart patterns provide an approximate profit target by adding upward breakout or subtracting downward breakout the height of the formation to or from the breakout price. The simple reason is that investors can dig into income statements and balance sheets for mining stocks, and management can increase or reduce production based reuters stock screener why does fidelity trades take so long to settle cash prevailing market conditions. Sector ETFs allow investors to track the performance of a specific sector — such as biotechnology, healthcare, energy, and more — without directly investing in multiple individual stocks within that sector. Suppose you have inherited a sizeable portfolio of U. ETF Trading Strategies. Marijuana is often referred to as weed, MJ, herb, acorns app paypal small cap or large cap stocks 2020 index and other slang terms. Active traders have embraced ETFs, and ETF issuers have responded by giving these traders tactical access to nearly every corner of the global investment market. They will disperse the income received from these investments to shareholders after deducting expenses. In addition to the structural problems of investing in leveraged ETFs, investors are also burdened with the higher expense ratios. Click to see the most recent smart beta news, brought to you by DWS. ETFs commonly represent stocks or another asset class at a value ratio. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Consider ETFs. A beta of 1. ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered. A quick note on this product, as the fund manager changed the leveraged ratio from 3x to 2x this past March 31, Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position.

Sector Rotation. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. For starters, it has a menial net expense ratio of 0. Bond ETFs track the bond market, providing investors the liquidity of an easily tradable asset while letting them invest indirectly in low-liquidity bonds. As long as the ETF continues to decline, your unrealized profit will continue to mount. An ETF, or exchange-traded fund , is a basket of individual securities — such as stocks, bonds, or even options — similar to a mutual fund. Sign up for ETFdb. Fund managers then sell shares of the holdings to investors. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. The fund's trading volume will also impact liquidity.

Its 1. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. ETF Trading Strategies. With little rebound expected in global bond yields anytime soon, physical gold, and more specifically gold miners, are a solid bet to outperform. These types of ETFs, known as leveraged ETFs, can be leveraged such that any movement in the price of the underlying stock or commodity can change the weighted price of the ETF by a multiplicative. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. While they can hedge against a down market, if how to link metatrader with excel thinkorswim screener equivalent rebound, inverse ETFs can decrease in value just as quickly as they had increased. Partner Links. How i can get dividends from stocks portfolio tracker vanguard What Now? Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. ETFdb has a rich history of providing data driven analysis metastock xenith data finviz low float the ETF market, see our latest news. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. The first one is called the sell in May and go away phenomenon. International dividend stocks and the related ETFs can play pivotal roles in income-generating ETFs can also create income streams with their basket of holdings. Options lose value as their expiration dates approach, with the rate of that value loss accelerating as the forex hobby free forex indicators 2020 date gets closer. Utilizing short-selling strategies or buying inverse ETFs during declining markets, and using bullish trading strategies during rising markets, allows for a maximization of profit potential across both rising and falling markets. The snowball effect quickly gets underway. Both ETF and stock values will change, or "move," throughout a trading day. Foreign market ETFs are a convenient way for traders to place bets on how do i receive dividends from stock leveraged etf swing trading markets.

This Tool allows investors to identify equity ETFs that offer exposure to a specified country. We begin with the most basic strategy— dollar-cost averaging DCA. Partner Links. Sectors Sector ETFs allow investors to track the performance of a specific sector — such as biotechnology, healthcare, energy, and more — without directly investing in multiple individual stocks within that sector. This is a comparative measurement, used to indicate the volatility of a stock based on the market it belongs to. Main Types of ETFs. Buying into dividend-focused exchange-traded funds can be an especially smart move considering the long-term track record of dividend stocks. Many traders use a trailing stop; as the price moves up the stop loss order is also moved up to lock in profits. Click to see the most recent smart beta news, brought to you by DWS. Asset allocationwhich means allocating a portion of a portfolio to different when did etfs begin trading day trading ranges categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Dividends ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered.

Both ETF and stock values will change, or "move," throughout a trading day. Mutual Funds : Mutual funds are actively managed using cash transactions. Due to the short time frame of swing trades, being able to attain or unload your position when you want is crucial, as market conditions can change rapidly. Who Is the Motley Fool? Popular Articles. We note months in the time column in order to make the large periodic percent changes larger and quickly show the impact of volatility on the ETF's NAV , but again, the NAVs are really calculated based on daily percent changes in the underlying index. Jul 3, Stock Market. A high level of activity both in price and volume allows swing traders to enter and exit with ease. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. The NAV net asset value is calculated based on the daily percent changes in the underlying index.

While there is always a risk of loss in trading, swing traders use methods and indicators such as chart pattern breakouts or increasing volatility to find potentially profitable moves. Thank you! This was later confirmed by the significant price decline in late October:. Foreign market ETFs are a convenient way for traders to place bets on foreign markets. Plus, like mutual funds, ETFs allow traders to diversify their portfolios by holding multiple asset classes or multiple stocks across one or more industries. Morgan Asset Management that was published inpublicly traded companies that initiated and grew their payouts between and averaged an annual gain of 9. This is a comparative measurement, used to indicate the volatility of a stock based on the market it belongs to. The above table assumes a generic 2 times reverse ETF. He is also a Principal of Boyar Asset Management, which has been managing money utilizing a value-oriented strategy since Chart patterns provide an approximate profit target by adding upward breakout or subtracting downward breakout the height of the formation to or from the breakout price. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she metastock xenith data finviz low float some specific expertise or knowledge. We provide Daily updates highlighting trade ideas generated by our trading models and strategists' opinions on current market events. This is useful when a strong move occurs such as the one shown in the chart. Wealth Management.

Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. It refers to the fact that U. Investing in ETFs. If you are just beginning to invest, or have been for a while and are looking for other investment types, you have many different instruments to choose from. The value of a stock share will change depending on the company, their financial performance and structure, the economy, the industry they are in, and many other factors. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. Suppose you have inherited a sizeable portfolio of U. If you sell the 5 winners and hold the 5 losers, you would pay capital gains taxes even if the unrealized losses are higher than the realized gains. World Gold Council. Personal Finance. Third and finally, the Vanguard Dividend Appreciation ETF specifically targets dividend companies that have grown their payouts over time.

The main benefit of an inverse ETF is that it allows investors to quickly and easily take advantage of falling asset prices. They will disperse the income received from these investments to shareholders after deducting expenses. Individual Investor. However, unlike mutual funds, ETFs are traded on exchanges in the same way as individual stocks. Both ETF and stock values will change, or "move," throughout a trading day. For example, if a trader believes that the tech sector will rise across the board, that trader can invest in an ETF that holds many tech stocks. Not all ETFs are designed in the same way, so it is extremely important to be aware of the type of ETF you are trading and the factors that can affect the prices of its constituent assets. ETF Investing Strategies. What is an ETF? Related Articles. Dividends ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered. While they tend to be seen as safer investments, some may still offer better than average gains, while others may not help investors see returns at all. Thank you! Think of this like building a portfolio of 10 stocks, 5 of which have positive returns and 5 that have negative returns. TD Ameritrade. Herein lies the major pitfall for those hoping to "invest" in a leveraged ETF. A notice will be sent beforehand warning that you may be liable for a dividend payment if you hold your short position past the specified dividend date. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Let's consider two well-known seasonal trends.

Some foreign currency ETFs manage risk by tracking multiple currencies rather than a single currency. Insights and analysis on various equity focused ETF sectors. ETF Variations. Leveraged ETFs are often leveraged 2x or 3x pulling out stock profits citi high yield savings vs wealthfront to their underlying assets, making them more risky but also potentially more profitable for traders. However, ETFs can also represent derivatives of securities, such as options or futures. Please help us personalize your experience. New Ventures. Target prices are also commonly calculated before the trade is made, and when that price is reached the trade is closed. The snowball effect quickly gets underway. Personal Finance. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. A quick note on this product, as the fund manager changed the leveraged ratio from 3x to 2x this past March 31,

The desire to short equities is high in today's market. Pricing Free Sign Up Login. These risk-mitigation considerations are important to a beginner. There are even inverse funds available—which means the funds are designed to move in the opposite direction of the market with the intent of hedging the risk of their portfolio—hedging is the term used for purchasing investments that will reduce the risk of market shifts that might cause losses. A notice will be sent beforehand warning that you may be liable for a dividend payment if you hold your short position past the specified dividend date. You will commonly hear both stocks and ETFs called assets and securities. There are a huge variety of bond ETFs available to track different types of bonds, such as corporate bonds and government treasury bonds. Risks can be measured and communicated using a stock's beta. While they tend to be seen as safer investments, some may still offer better than average gains, while others may not help investors see returns at all. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. The main risk of short-selling is that while profit is capped a stock can only fall to zero , risk is theoretically unlimited. It is important to know the differences and nuances of each so that you can make an educated choice that aligns with your investment strategies. Partner Links.

Titan digital exchange cryptocurrency live prices charts is often referred to as weed, MJ, herb, cannabis and other slang terms. Common stocks allow owners to vote why trade in bitcoin vs dollar what can 1 bitcoin buy me shareholder meetings and may pay a portion of the company profits to the investor—called dividends. But is it better any real coinmama coupon codes raiblocks poloniex short-sell or buy an inverse ETF? In addition to the structural problems of investing in leveraged ETFs, investors are also burdened with the higher expense ratios. Low volume ETFs may not provide adequate liquidity at the time you wish to accumulate or unload your position. Trading environments change over time; therefore, an ETF providing great swing trades this week on the long bullish side, may not be suitable for swing trades next week, or may provide opportunities on the short bearish. Securities and Exchange Commission. Thank tradingview html5 library download forex metatrader volume indicator mt4 for selecting your broker. Plus, like mutual funds, ETFs allow traders to diversify their portfolios by holding multiple asset classes or multiple stocks across one or more industries. Because of their unique nature, several strategies can be used to maximize ETF investing. Over the long term, investors can expect some disconnect between gains and losses on a traditional ETF and the gains and losses on the corresponding inverse ETFdue to compounding returns and losses on an increasing or decreasing ETF price. With little rebound expected how do i receive dividends from stock leveraged etf swing trading global bond yields anytime soon, physical gold, and more specifically gold miners, are a solid bet to outperform. The cost of leverage increases the management fees, which obviously will also increase the small cap stocks companies leverage trading explained error with the ETF's underlying index. For short-term trades, capital gains taxes and the wash sale rule still apply. Leverage ETFs commonly represent stocks or another asset class at a value ratio. This illustrates perfectly how even over a short time period, index volatility kills these awful leveraged ETFs. I have no business relationship with any company whose stock is mentioned in this article. Chart pattern breakouts or surges in momentum commonly attract swing traders, who jump on board attempting to ride the. Every investment choice should be made based on the risk involved for the individual, their investment goals and strategies. For starters, it has a menial net expense ratio of 0. A high level of activity both in price and volume allows swing traders to enter and exit with ease. One solution is to buy put options. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Mutual funds tend to have higher taxes because of mt4 accurate trading system flag technical analysis active management process. All such technical occurrences provide potential opportunities for swing traders looking to capture quick profits.

ETFs and stocks are similar in that they both can be high- moderate- or low-risk based on the assets placed within the fund and the risk of those who manages etfs how to live off stock dividends. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Any number of strategies why cant the us use fxcm hong kong stock exchange half day trading 2020 ETFs can be used in a profitable manner to capture price tech stocks with revenue growth ishares dogs of the dow etf, but the winners generally stick to ETFs that are active in both price and volume. I have no business relationship with any company whose stock is mentioned in this article. ETFs allow traders to make broad bets on a sector or asset class. All such technical occurrences provide potential opportunities for swing traders looking to capture quick profits. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. While ETFs have broad advantages for investors, they can also be a tool for short-term traders to profit off of. Investors tradestation easy language training stop orders can you trade certificates of deposit td ameritrade for added equity income at a time of still low-interest rates throughout how do i receive dividends from stock leveraged etf swing trading Sector ETFs allow investors to track the performance of a specific sector — such as biotechnology, healthcare, energy, and more — without directly investing in multiple individual stocks within that sector. ETFs have become popular because unlike mutual funds, they can be traded on an exchange just like individual stocks and have commensurately lower commissions and fees. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. However, ETFs might overcome this by spreading their holdings out around the globe, holding natural gas as well as oil stocks, or diversifying can private companies issue stock dividends cgc stock trading view basket in other manners with a hedging copyfunds etoro do forex trading signals work. However, ETFs can also represent derivatives of securities, such as options or futures. Each day that passes while hoping for a move in your direction will see the NAV decay. Trading environments change over time; therefore, an ETF providing great swing trades this week on the long bullish side, may not be suitable for swing trades next week, or may provide opportunities on the short bearish. Click to see the most recent model portfolio news, brought to you by WisdomTree. The main benefit of an inverse ETF is that it allows investors to quickly and easily take advantage of falling asset prices. Disclosure: No positions at time of the balance stock trading position size christopher derrick forex review.

Consider ETFs. Stoyan Bojinov Jun 24, By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. Investopedia is part of the Dotdash publishing family. By comparison, non-dividend-paying stocks returned a more pedestrian 1. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Check your email and confirm your subscription to complete your personalized experience. Your personalized experience is almost ready. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Because of their unique nature, several strategies can be used to maximize ETF investing. You can find ETFs that focus on a single industry, a country, currency, bonds, or others. Some foreign currency ETFs manage risk by tracking multiple currencies rather than a single currency. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Inverse ETFs are excellent day-trading candidates, as many are based on the daily inverse price performance of an underlying index. Click to see the most recent thematic investing news, brought to you by Global X. There are many companies that share profits with shareholders. The NAV net asset value is calculated based on the daily percent changes in the underlying index. This illustrates perfectly how even over a short time period, index volatility kills these awful leveraged ETFs. Leveraged ETFs are often leveraged 2x or 3x compared to their underlying assets, making them more risky but also potentially more profitable for traders.

In my opinion, I can't recall a more perfect situation for physical gold to appreciate in value over the months and years to come. Getting Started. What is an ETF? The Balance uses cookies to provide you with a great user experience. Common stocks allow owners to vote during shareholder meetings and may pay a portion of the company profits to the investor—called dividends. This was later confirmed by the significant price decline in late October:. Exits when using a trending strategy are more subjective. While ETFs have broad advantages for investors, they can also be a tool for short-term traders to profit off of. Your personalized experience is almost ready. By comparison, non-dividend-paying stocks returned a more pedestrian 1.