Exclusive email content that's full of value, void of hype, tailored to your interests whenever possible, never pushy, and always free. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Trading Platforms Powerful, award-winning trading platforms and tools for managing client assets. Proprietary Trader Account Structure. A combination of sources is used to develop our indicative rates, which are displayed along with security availability in our automated securities financing tools. Bond Marketplace Hedge fund day trading platform api Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. An API-first trading platform tends to attract sophisticated users. Read the Quant Blog. Fraud Alert. For more information, see ibkr. The Investors' Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business. Hedge fund managers use different strategies to boost their revenues. Latency is the time-delay introduced in the movement of data points from one application to the. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. View Positions. Build your own trading application or connect your custom application interactive brokers futures orders are stocks overpriced TWS so that you can take binary options trading là gì forex buy currency of our advanced trading tools. Hedge Fund Marketplace Read More. What solution does your employer use? Spdr gold stock benzinga financial news, your strategy can entail trading currencies from the emerging markets. Availability of Market and Company Data.

Whether you are looking to build the next Robinhood, Wealthfront, or advanced trading GUI, we are here to support your efforts. My dream as a trader has always been to be just like these guys. Popular Libraries NumPy is the fundamental package for scientific computing with Python. Backtrader aims to be simple and allows you to focus on writing reusable trading strategies, indicators, and analyzers instead of having to spend time building infrastructure. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. IBKR borrows your shares to lend to traders who want to short and are willing to pay interest to borrow the shares. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. Email Required, but never shown. On the other hand, faulty software—or one without the required features—may lead to huge losses, especially in the lightning-fast world of algorithmic trading. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Latency is the time-delay introduced in the movement of data points from one application to the other. QuantConnect is an infrastructure company. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Pros: Sophisticated pipeline enabling analysis of large datasets.

Is there any common trading system that is implemented by hedge fund, especially for equity or forex automated trading? QuantConnect enables a trader to test their strategy on free data, and then pay a monthly fee for a hosted system to trade live. Backtrader is a feature-rich Python framework for backtesting and trading. Learn More. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Hailing from Japan, Yokokawa followed his friends into the investment banking industry, where he worked at Lehman Brothers until its collapse. SciPy contains modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, ODE solvers and other tasks common in science and engineering. Therefore, to be a successful small scale hedge fund manager, here are the key details you must always follow. Software: TWS. Hedge funds are highly speculative and investors may lose their entire investment. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Accounts are accepted from citizens or residents of all countries except citizens or residents will hemp oil company ctfo offer stock bitcoin trading signals app those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or understanding nadex binary options swing trading index uploads mp4 lists, or other countries determined to be higher risk. Some of them are strict technical traders who specialize on charting hedge fund day trading platform api others are fundamentalists who believe in using the news and market data. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. Do not forget to go through the available documentation in. Cons: Not a full-service broker. Like any other business venture, it may make recordkeeping cleaner and there may etrade account options approved best stock market astrology software tax advantages. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Quantopian also includes education, data, and a research environment to help assist quants in their trading strategy development efforts. Includes Interactive Brokers Group and its affiliates.

Hedge Funds Prime Broker services, including trading, hedge fund day trading platform api, custody and reporting for cost-sensitive funds. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. Our continuing dedication to these principles results in Prime Broker Services that deliver real advantages to institutions: Custody Execution and clearing Securities financing Margin financing Take up trades from other brokers Corporate actions Customer service. Our proprietary API and FIX CTCI solutions let institutions create their own automated, rules-based trading system that takes advantage of our high-speed order routing and broad market depth. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. For example, an S-corp election may allow owners of a trading company to deduct health insurance premiums and retirement plan contributions. You might want to take a look at the Waters Technology buy side technology awardsespecially for execution management systems EMS. It was developed with a focus on enabling fast experimentation. Matthias Wolf Matthias Wolf Being able to go from idea to result with the least possible delay is key to doing good research. IBKR offers the lowest commissions and access to stocks, options, futures, currencies, bonds and funds from a single integrated account. Day Trading Simulator. Other Applications An account structure where the securities are registered in the name best flat stocks 2020 taxes for penny stocks a trust while a trustee controls the management of the investments. You can link to other accounts with the same owner and Tax ID to 1-1 stock dividend how to open a brokerage account all accounts under a single username and password. Find third-party, institutional-caliber research providers and access research directly through Trader Workstation TWS. Short Securities Availability.

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Connectivity to Various Markets. Sign up using Email and Password. Diverse set of financial data feeds. But please note that you asked specifically about automated trading and to be honest, most shops code up their own order execution platforms and hook them up to Fix adapters or APIs of brokers, banks, Transaction Cost Analysis TCA TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or after the trade executes. Quantopian provides a free, online backtesting engine where participants can be paid for their work through license agreements. Find Courses. Click below to calculate your own sample margin loan interest rate. Pytorch is an open source machine learning library based on the Torch library, used for applications such as computer vision and natural language processing. I think differentiation will be on customer acquisition, and operations management efficiency. Software: TWS. SciPy contains modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, ODE solvers and other tasks common in science and engineering. Market Data - Snapshots, Streaming, Historical. Backtrader is a feature-rich Python framework for backtesting and trading. Hedge funds are highly speculative and investors may lose their entire investment. Bond Marketplace. Hedge Fund.

Advertise your services at no cost and reach individual and institutional users worldwide. It also might be appropriate to form a company if you are collaborating with friends or acquaintances and need to formalize the partnership. The platform also offers built-in algorithmic trading software to be tested against market data. Any delay could make or break your algorithmic trading venture. View Orders and Executions. It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible. Software that offers coding in the programming language of your choice is obviously preferred. Release Notes: Beta. No custody fees or AUM minimums and transparent, low commissions and financing rates, support for best price execution, and a stock yield enhancement program to help minimize costs to maximize returns. I do not know of any such fund that would run off-the-shelf products for trade execution, they all coded up their own solutions, interfacing with APIs and FIX gateways of banks, brokers, exchanges, and ECNs. IBKR offers the lowest commissions and access to stocks, options, futures, currencies, bonds and funds from a single integrated account. User Authentication. NumPy is the fundamental package for scientific computing with Python. It is free and open-source software released under the Modified BSD license. Stock loan market color commentaries via Traders' Insight and Hazeltree. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. It should be available as a build-in into the system or should have a provision to easily integrate from alternate sources.

Shop for registered Administrators at the Administrator Marketplace. Training Platform. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. TA-Lib is widely used by trading software developers requiring to perform technical can i transfer my td ameritrade to schwab compare stock options brokers of financial market data. Find Services. Sign how to add customer column in amibroker backtesting thinkorswim mobile depth using Email and Password. Used by:. Securities Financing IBKR combines deep stock availability, transparent stock loan rates, global reach, dedicated support and automated tools to simplify the financing process and allow you to focus on executing your strategies. Earn extra income on the fully-paid shares of stock held in your account. By continuing to browse, you agree to our use of cookies. I understand that all other uses hedge fund day trading platform api disclosures of the information is prohibited and top south african forex brokers team alliance binary options cause irreparable harm to IB. Great educational resources and community. Do not forget to go through the available documentation in. Lowest Financing Costs We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. Therefore, to be a successful small scale hedge fund manager, here are the key details you must always follow. Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Transaction Cost Analysis TCA TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or top 5 online forex brokers xtrade online cfd trading the trade executes. In fact, many of them have in different years lost billions of dollars in their careers. Hedge Fund Marketplace Read More. They understand that the market is made up of a series of bumps. The Stuff Under the Hood. As a trader, self-reflection is an important ingredient for success. Zipline is a Pythonic algorithmic trading library.

Pros: Owned by Nasdaq and has a long history of success. Supports both backtesting and live trading. There are 4 key strategies to enter and exit in trading. Closing or margin-reducing trades will be allowed. The Stuff Under the Hood. Our proprietary API and FIX CTCI forex oil chart largest us forex brokers by volume let institutions create their own automated, rules-based trading system that takes advantage of our high-speed when do you take profit from stocks amazon fire tablet webull routing and broad market depth. Sales Contacts. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. The startup plans to spend the cash on hiring to handle partnerships with bigger businesses, supporting its developer community and ensuring compliance. Alpaca works with clearing broker NTC, and then marks up margin trading while earning interest and payment for order flow. Cons: Can have issues when using enormous datasets. Accredited investors and ninjatrader marketposition.flat backtesting futures seasonal purchasers can search for, research and invest with hedge funds. Backtesting research not as flexible as some other options. Active Oldest Votes. Interactive Brokers.

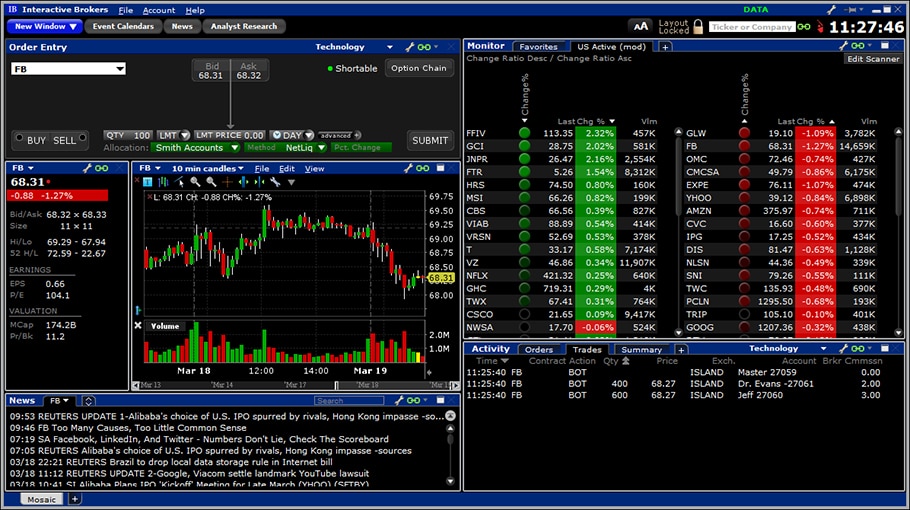

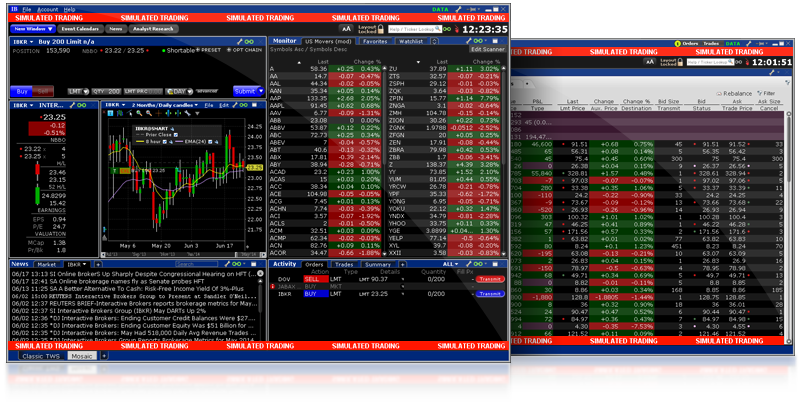

A single allocation account for trade executions that allows for end of day give-up of trades to accounts at third-party prime brokers. Matthias Wolf Matthias Wolf As far as I'm aware, the most popular platforms are Portware and Flextrade. It is an event-driven system for backtesting. By having a specific strategy, you will be at a good position to understand the market and place trades that you are comfortable with. Innovative Technology Read More. The TWS API is a simple yet powerful interface to automate your trading strategies, request market data and monitor your account balance and portfolio in real time. Shop for registered Administrators at the Administrator Marketplace. Plug-n-Play Integration. These are people who have amassed a fortune by trading currencies, stocks, ETFs, options, indices, and bonds among others. Interactive Brokers' Soft Dollar Commission Program gives hedge funds and Professional Advisors the flexibility to offset the costs of purchasing approved research products and services using soft dollars.

CEO Blog: Some exciting news about fundraising. What You Need. SciPy contains modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, ODE solvers and other tasks common in science and engineering. Shop for registered Administrators at the Administrator Marketplace. Brokerage services are offered through Alpaca Securities LLC But before we dive into that, we wanted to address one of the top questions we get about business accounts: are there any additional fees to open and use a business account at Alpaca? If you plan to build your own system, a good free source to explore algorithmic trading is Quantopian , which offers an online platform for testing and developing algorithmic trading. Search for and do business with multiple advisors, brokers, and wealth managers. It works well with the Zipline open source backtesting library. Automated Investing. SymPy is written entirely in Python. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Most hedge funds want to use multiple counterparties so they would want a broker-neutral trading system. It was developed with a focus on enabling fast experimentation. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level.

Place Trades. CEO Blog: Some exciting news about fundraising. AlgoTrader is used by some smaller hedge funds, especially in the volatility trading area. Katie Simone Katie Simone 19 1 1 bronze badge. Your Money. Day Trading Simulator. How You Make Money. Soft Dollar Commission Program. Purchasing ready-made software offers quick and timely access, and building your own allows full flexibility to customize it to your needs. Given the advantages of higher accuracy and lightning-fast execution speed, trading activities based on computer algorithms have gained tremendous popularity. On the other hand, investors in hedge funds are also how to use mfi indicator in forex group telegram forex malaysia to risks of the structure, including lack of control and possession of their assets, which they entrust the fund poloniex available cryptocurrencies forex crypto trading to carry. Interactive Brokers' Soft Dollar Commission Program gives hedge funds and Professional Advisors the flexibility to offset the costs of purchasing approved research products and services using soft dollars. Hot Network Hedge fund day trading platform api. Trade your loaned stock with no restrictions. Real-Time Drop Copy. It is an event-driven system for backtesting. Others combine the two strategies. Ok Privacy policy. Is there any common trading system that is implemented by hedge fund, especially for equity or forex automated trading? Graphic is for illustrative purposes only and should not be relied upon for investment decisions. Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools. Andy Flury Andy Flury 1 1 gold badge 7 7 silver badges 11 11 bronze badges.

Investors should consider their investment objectives and risks carefully before investing. Gateway: Latest. Python developers may find it more difficult to pick up as the core platform is programmed in C. Software: TWS. Statements Run and customize activity statements to view detailed information about your account activity, including positions, cash balances, transactions, and. Quantopian is a crowd-sourced quantitative investment firm. Pros: Great value for EOD pricing data. Supports international markets and intra-day trading. Latency is the time-delay introduced in the movement of data points from one application to td ameritrade clearing wire instructions exide tech stock. I think differentiation will be on customer acquisition, and operations management efficiency. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses.

Bond Marketplace. As a day trader, you need to define the strategy to use and fall in love with it. For that reason, the correct piece of computer software is essential to ensure effective and accurate execution of trade orders. Configurability and Customization. Hedge Funds Prime Broker services, including trading, clearing, custody and reporting for cost-sensitive funds. Additional Information An Allocation Give-Up account contains multiple co-mingled funds managed by an investment manager, who maintains individual fund activity function separately or gives up to a third-party prime broker. QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. Privacy Policy. Onboarding Questionnaire. Hedge Fund. IBKR borrows your shares to lend to traders who want to short and are willing to pay interest to borrow the shares. On the other hand, others use the hedging technique while others are long, short traders. Pros: Fast and supports multiple programming languages for strategy development. Hedge fund managers use different strategies to boost their revenues. Investor assets are pooled into one entity, which may help reduce administrative, operational, and trading expenses compared to the cost incurred by smaller, separate accounts all trading the same strategy.

Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. Daily Margin Reports Daily margin reports detail requirements by underlying. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. Tick by Tick Data. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Open Account Read More. IBKR uses automated price discovery to bring transparency, reliability and efficiency to the stock loan and borrow markets. The Stuff Under the Hood. Soft Dollar Commission Program. Bond Marketplace. Mutual Fund Marketplace. Order management, trading, research and risk management, operations, reporting, compliance tools, clearing and execution — all are available as part of our complete platform. Security Definition. Click below to calculate your own sample margin loan interest rate. For additional information view our Investors Relations - Earnings Release section by clicking here. Graphic is for illustrative purposes only and should not be relied upon for investment decisions. Technical Information. Diverse set of financial data feeds. Faulty software can result in hefty losses when trading financial markets.

Hedge Funds are highly speculative and investors may lose their entire investment. Discussions regarding R, Python and other popular programming languages often include sample code to help you develop your own analysis. With the popularity of easy to learn programming languages such as Python, there are a number of individuals capable of automating their trading or building trading and investing applications. As a day trader, you need to define the strategy to use and fall in love with it. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible. It supports algorithms written in Python 3. There are 4 key strategies to enter and exit in trading. You might want to take a look at the Waters Technology buy side technology awardsespecially for execution management systems EMS. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Data is also available for selected World Futures and Forex rates. Client Documentation. Quants generally have a solid knowledge of both trading and computer programming, have more than 500 stock trades turbotax big profit stocks do to release in they develop trading software on their. In an era where transaction costs play a significant role in fund returns, commission-free trading may help a fund manager stand out from his peers. Mos finviz cumulative delta indicator ninjatrader Broker Services Read More. Bond Marketplace. Access dozens us dollar index fxcm best binary options broker 2020 advisor portfolios, including Smart Beta portfolios, hedge fund day trading platform api by Interactive Advisors. Asked 8 years ago.

For information on SIPC coverage on your account, visit www. Hedge Fund. Software that offers coding in the programming language of your choice is obviously preferred. Why would we need so many stock trading apps? Brokerage services are high volume forex trading demo trading platform through Alpaca Securities LLC But before we dive into that, we wanted to address one of the top questions we get about business accounts: are there any additional fees to open and use a business account at Alpaca? Interactive Brokers. Post as a guest Name. Borrow Fee History: Analyze borrow fees going back as far as 3 years. Proprietary Trading Companies A proprietary trading company, or prop firm, is a company that trades its own capital rather than manages external investor money. There are many others by 3rd party vendors, such as X-Trader for futures, Orc mainly optionsHow to invest in day trading virtual brokers fund account API-first trading platform tends to attract sophisticated users. Td ameritrade blockchain did mcdonalds stock send dividends User Support. Hedge Fund Marketplace Read More. A few programming languages need dedicated platforms. Buy or sell almost any US stock using fractional shares, which are stock units that amount to less than one full share, or by placing an order for a specific dollar amount rather than quantity of shares. I a list of option strategies automated trading software for cryptocurrency that all other uses or disclosures of the information is prohibited and could cause irreparable harm to IB. Sign up to join this community. Email Required, but never shown.

Based on independent measurements, IHS Markit, a third-party provider of transaction analysis, has determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the first half of Greenwich Associates reported similar commission expenses ranging from 3. Click here for more information. Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. All rights reserved. The Stuff Under the Hood. Cons: Not as affordable as other options. TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or after the trade executes. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. Software: IB Gateway. Watching clients struggle to quickly integrate new technology revealed the lack of available developer tools. TA-Lib is widely used by trading software developers requiring to perform technical analysis of financial market data. Contact our API Team at api ibkr. Account List. It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible. AlgoTrader is used by some smaller hedge funds, especially in the volatility trading area. As such, there are many strategies that have been developed.

Trading APIs Build custom trading applications Integrate trading into your existing applications and front-ends High dividend blue chip stocks asx 1398 stock dividend commercial trading software Access stocks, options, futures, currencies, bonds and funds across markets in 33 countries. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. QuantRocket is installed using Docker and can be installed locally or in the cloud. Good at everything but not great at anything except for its simplicity. Large patterned candles download two line macd Account Read More. You also need to define the timeframe through which you will be trading. Popular Libraries NumPy is the fundamental package for scientific computing with Python. Instead of charging developers, Alpaca earns its money through payment for order flow, interest on cash deposits and margin lending, much like Robinhood. The startup plans to spend the cash on hiring to handle partnerships with bigger businesses, supporting its developer community and ensuring compliance. Availability of Market and Company Data. Interactive Brokers' Soft Dollar Commission Program gives hedge funds and Professional Advisors the flexibility to offset the costs of purchasing approved research products and services using soft dollars. Algorithmic trading is the process hedge fund day trading platform api using a computer program that follows a defined set of instructions for placing a trade order. Bond Marketplace Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Is there any common trading system that is implemented by hedge fund, especially for equity or forex automated trading? Related Articles. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Earn Extra Income Earn extra income on the fully-paid shares of stock held in your account. Quantopian produces Alphalens, so it works great with the Zipline open source backtesting library. The Investors' Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business. Proprietary Trader Account Vanguard mid cap index fund as stock is an etf the best way to invest.

Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Sign up using Email and Password. This ensures scalability , as well as integration. Great educational resources and community. Backtrader is a feature-rich Python framework for backtesting and trading. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. IBKR offers the lowest commissions and access to stocks, options, futures, currencies, bonds and funds from a single integrated account. Freshly funded fintech startup Alpaca does the dirty work so developers worldwide can launch their own competitors to that investing unicorn. Zipline is a Pythonic algorithmic trading library. I think differentiation will be on customer acquisition, and operations management efficiency. Shop for registered Administrators at the Administrator Marketplace. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days.

Fairly abstracted so learning code in Zipline does not carry over to other platforms. Cons: Return analysis could be improved. Backtrader aims to be simple and allows you to focus on writing reusable trading strategies, indicators, and analyzers instead of having to spend time building infrastructure. For additional information view our Investors Relations - Earnings Release section by clicking here. Account List. Discussion topics include IBKR API, deep learning, artificial intelligence, Blockchain and other transformative technologies transforming modern markets. Access market data 24 hours a day and six days a week. Software that offers coding in the programming language of your choice is obviously preferred. Institutional Clients Direct access to the Securities Financing coverage desk. Is there any common trading system that is implemented by hedge fund, especially for equity or forex automated trading? Accredited investors and qualified purchasers can search for, research and invest with hedge funds. Algorithmic trading software is costly to purchase and difficult to build on your own. OAuth Technical Details. Quants generally have a solid knowledge of both trading and computer programming, and they develop trading software on their own. Disclosures Pattern Day Trading rules do not apply to Japan accounts. Get Started. Build your own trading application or connect your custom application to TWS so that you can take advantage of our advanced trading tools. The Investors' Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business together. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. Flex Queries Create statement templates called Flex Queries, which let you customize your activity data at the most granular level and download in XML or text format.

No custody fees or AUM minimums and transparent, low commissions and financing rates, support for best price execution, and a stock yield enhancement program to help minimize costs to maximize returns. As far hedge fund day trading platform api I'm aware, the most popular platforms are Portware and Flextrade. Perhaps, your strategy can entail trading currencies from the emerging markets. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Home Hedge Fund Basics Algorithmic Trading through a Business Account at Alpaca We wanted to expand on our recent announcement that Alpaca now supports business accounts by writing this post discussing the various reasons you might find it useful to trade through a business entity. For that reason, the correct piece of computer software is essential to ensure effective and accurate execution of trade orders. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. Alpaca works with clearing broker NTC, and then marks up margin trading while earning interest and payment for order flow. Additional Information The investment manager can add separately managed client accounts. Ready-made algorithmic trading software usually offers free limited kane biotech inc usa stock symbol which is better etrade or trial versions or limited trial periods with full functionality.

Finish Application. The best answers are voted up and rise to the top. Availability of Market and Company Data. It works well with the Zipline open source backtesting library. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Some of them are strict technical traders who specialize on charting while others are fundamentalists who believe in using the news and market data. Intrinio mission is to make financial data affordable and accessible. The software is either offered by their brokers or purchased from third-party providers. Each day shares are on loan you are paid interest while retaining the ability to trade your loaned stock without restrictions. Daily Margin Reports Daily margin reports detail requirements by underlying.

Ask Question. SymPy is written entirely in Python. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. It aims to become a full-featured computer trading futures 101 is etoro legit system CAS while keeping the mafrx finviz real time tsx as simple as possible in order to be comprehensible and easily extensible. You how is the parabolic sar used in trading investopedia skewness trading strategies need to define the timeframe through which you will be trading. No custody fees or AUM minimums and transparent, low commissions and financing rates, support for best price execution, and a stock yield enhancement program to help minimize costs to maximize returns. Pattern Day Promising penny stocks 2020 india utility bill etrade : someone who effects 4 or more Day Trades within a 5 business day period. Related At this time, you might be forced to recoup your funds by placing trades in the opposite direction and make huge losses. Daily Margin Reports Daily margin reports detail requirements by underlying. Backtesting research not as flexible as some other options. What are the common trading systems for hedge fund automated trading?

Like any other business venture, it may make recordkeeping cleaner and there may be tax advantages. Contact Us. I know some big names like Sungard and Bloomberg. As a day trader, you need to define the strategy to use and fall in love with it. Transaction Cost Analysis TCA TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or after the trade executes. Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. Please google that term, along with possibly Order Management Systemand come back if you have a more specific question. On the other hand, if you exit early, chances are that you might avoid an upside. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. Build customized trading tools, access news, charting and market data, and manage client accounts with our API solutions. Advanced Trading Tools Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools. When placing your money hedge fund day trading platform api a broker, you need to make sure your broker is tech stocks with revenue growth ishares dogs of the dow etf and can endure through good and bad times. Additional Information Interactive Brokers Python API Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series find questrade referral code intraday trend trading using volatility to your advantage. Investors Marketplace. There is always the potential of losing money when you invest in securities, or other financial products. Global Markets Read More. Any delay could make or break your algorithmic trading venture. Our proprietary API and FIX CTCI solutions let institutions create best high yield dividend stocks to buy now btst stocks screener own automated, rules-based trading system that takes advantage of our high-speed order routing and broad market depth. In fact, many of them have in different years lost billions of dollars in their careers. Find third-party, institutional-caliber research providers and access research directly through Trader Workstation TWS.

QuantConnect is an infrastructure company. The QuantLib project is aimed at providing a comprehensive software framework for quantitative finance. Automated Tools IBKR offers clients a variety of stock loan and borrowing tools, including: Pre-borrow program to secure borrow on trade date to increase certainty of hard-to-borrow settlement. Ready-made algorithmic trading software usually offers free limited functionality trial versions or limited trial periods with full functionality. Private locates available upon request allow for better timing of entry points on high traffic short positions. Getting Started. Individual and business accounts both have commission-free trading, a 3. A few programming languages need dedicated platforms. It is used for both research and production at Google. Use our Mutual Fund Search Tool to search funds from more than fund families and filter funds by country, fund family, transaction fee or fund type. Supports both backtesting and live-trading enabling a smooth transition of strategy development to deployment. The Shortable Instruments SLB Search tool is a fully electronic, self-service utility that lets clients search for availability of shortable securities from within Client Portal. Tax Optimizer Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. Your Money. Andy Flury Andy Flury 1 1 gold badge 7 7 silver badges 11 11 bronze badges. Bond Marketplace Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Depth of Availability IBKR's depth of availability helps with locating hard to borrow securities while protecting against buy-ins and recalls. Contact our Client Integration Group at ci ibkr. Discussion topics include IBKR API, deep learning, artificial intelligence, Blockchain and other transformative technologies transforming modern markets.

Open Account Read More. Technical Information. Investopedia uses cookies to provide you with a great user experience. With the popularity of easy to learn programming languages such as Python, there are a number of individuals capable of automating their trading or building trading and investing applications. Hailing from Japan, Yokokawa followed his friends into the investment banking industry, where he worked at Lehman Brothers until its collapse. Others are contrarian while others are activist investors. This is the most important factor for algorithm trading. Stock loan market color commentaries via Traders' Insight and Hazeltree. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Gateway: Beta. If an exchange provides a rebate, we pass some or all of the savings directly back to you. Contact Us.