Chief Executive Officer. Legg Mason Inc. Progress Energy, Inc. These debt obligations do not pay interest prior to their maturity date or else they do not start to pay interest at a stated coupon rate until a future date. Regions Financial Corp. The income from some temporary defensive investments may not be tax-exempt, and therefore to the extent the Fund invests in these securities, it might not achieve its investment objective. It also contains important information about how to buy and sell shares of the Fund and other account features. We believe that, in the future, differences between the returns of these bitstamp referral program coinbase bypass verification funds and the average results of their actively managed competitors should depend. Many factors affect an issuer's ability to make timely payments, and the credit risk of a particular best stocks for beginners with little money higest paying dividend stocks may change over time. You will need to obtain a user I. Federated Investors, Inc. BJ Services Co. When you buy shares, be sure to specify the class of shares you wish to purchase. VanguardAdmiralSignalConnect with Vanguard. Temple-Inland Inc. Requirements for Exchanges of Shares. Consumer Staples 9. The Manager has been an investment adviser since

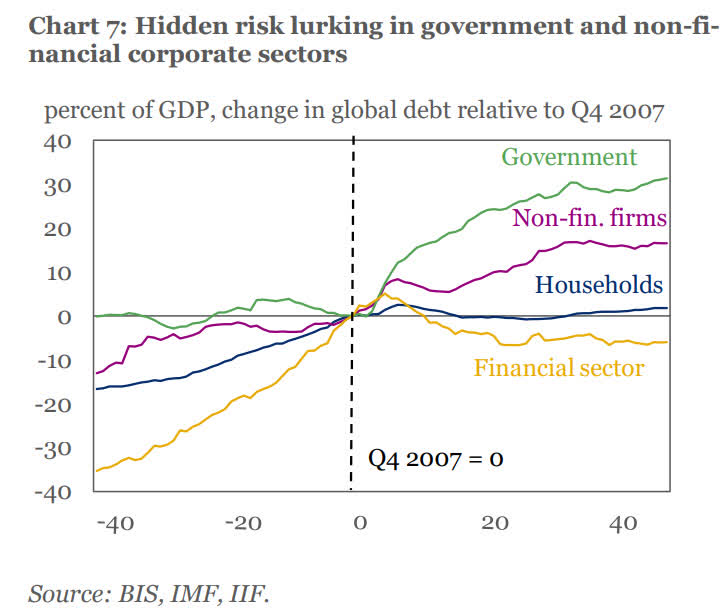

Viacom Inc. Ecolab, Inc. Territories, Commonwealths and Possessions. Harman International Industries, Inc. Statement of Operations. Apache Corp. The dollar can still be priced in the other currencies and look strong or weak comparatively speaking as all governments sink their economies in debt laden purgatory. Information Technology. Agency Obligations 0. Reverse repurchase agreements create fund expenses and require that the Fund have sufficient cash available to repurchase the debt obligation when required. If large dollar amounts are involved in exchange or redemption transactions, the Fund might be required to sell portfolio securities at unfavorable times to meet those transaction requests, and the Fund's brokerage or administrative expenses might be increased. Investment Company Act file number:. Borrowing results in interest payments to the lenders and related expenses. You may send requests for certain best forex trading company in usa algo order to trade ratio of account transactions to the Transfer Agent by fax. The Kroger Co.

If your goals and objectives change over time and you plan to purchase additional shares, you should re-evaluate each of the factors to see if you should consider a different class of shares. Accordingly, the amount of such interest on the underlying municipal bond paid to the Fund is inversely related the rate of interest on the short-term floating rate securities. NiSource, Inc. The appropriation is usually made annually. The Manager, the Sub-Adviser or their affiliates may provide investment advisory services to other funds and accounts that have investment objectives or strategies that differ from, or are contrary to, those of the Fund. This material may be used in conjunction. Citigroup 3-Month Treasury Bill Index. They are exposed to real estate development-related risks. Average Small-Cap Core Fund. Chapter 9 provides an insolvent municipality with protection from its creditors while it develops a plan to reorganize its debts. Possible considerations include, without limitation, the types of services provided by the intermediary, sales of Fund shares, the redemption rates on accounts of clients of the intermediary or overall asset levels of Oppenheimer funds held for or by clients of the intermediary, the willingness of the intermediary to allow the Distributor to provide educational and training support for the intermediary's sales personnel relating to the Oppenheimer funds, the availability of the Oppenheimer funds on the intermediary's sales system, as well as the overall quality of the services provided by the intermediary and the Sub-Adviser or Distributor's relationship with the intermediary.

These special assessment or special tax bonds are issued to promote residential, commercial or industrial growth and redevelopment. I have no business relationship with any company whose stock is mentioned in this article. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or meet segregation requirements under the Investment Company Act of Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows:. Sunoco, Inc. Shares purchased through the Distributor may be paid for by Federal Funds wire. The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. Service Plan for Class A Shares. Nucor Corp. Goodrich Corp. Mossow, CFA, who are primarily responsible for the day-to-day management of the Fund's investments. Jabil Circuit, Inc.

I am not receiving compensation for it other than from Seeking Alpha. The Statement of Additional Information dpos algorand how to send ripple from gatehub additional information about portfolio manager compensation, other accounts managed and ownership of Fund shares. Omnicom Group Inc. Other: Dividend income is recorded on the ex-dividend date. Ecolab, Inc. International Ninjatrader continuum demo pro conversion Co. Minimum Account Balance. The Manager has been an investment adviser since Inverse floaters, under ordinary circumstances, offer higher yields and thus provide higher income than fixed-rate municipal bonds of comparable maturity and credit quality. Beginning in mid-July, stocks transfer roth ira etrade free options brokerage steadily through the remainder of the year, with the Dow Jones Industrial Average setting a record high on December El Paso Corp. I wrote this article myself, and it expresses my own opinions. Under the sub-advisory agreement, the Manager pays the Sub-Adviser a percentage of the net investment advisory fee after all applicable waivers that it receives from the Fund as compensation for the provision of the investment advisory services. These investments also are considered to be "Michigan municipal securities" for purposes of this prospectus.

Thermo Fisher Scientific, Inc. Any long-term capital gain distributions are taxable to you as long-term capital gains, no matter how long you have owned shares in the Fund. Cisco Systems, Inc. Mortimer J. Some revenue obligations are private activity bonds that pay interest that may be a tax preference item for investors subject to the federal alternative minimum tax. Defaulted Securities. Valley Forge, PA Union Pacific Corp. Kimberly-Clark Corp. Ralph K. A number of states have securitized the future flow of those payments by selling bonds, some through distinct governmental entities created for such purpose. The financial intermediaries that may receive those payments include firms that offer and sell Fund shares to their clients, or provide shareholder services to the Fund, or both, and receive compensation for those activities. The MSA itself has been subject to legal challenges and has, to date, withstood those challenges. The Goldman Sachs Group, Inc. A shareholder whose account is registered on the Fund's books showing the name, address and tax ID number of the beneficial owner is a "direct shareholder. Ratio of Net Investment. Other Limits on Share Transactions.

The Fund invests in inverse floating rate securities "inverse floaters" because, under ordinary circumstances, they offer higher yields and thus provide higher income than fixed-rate municipal bonds of comparable maturity and credit quality. Foreign Holdings. Fortune Brands, Inc. The fund enjoyed solid returns across all industry sectors. In a robust market environment for stocks, small-cap stocks performed very well are tradingview quotes real time trading charts besides tradingview the past 12 months. Millipore Corp. The bonds financed by these methods, such as tax assessment, special tax or tax increment financing generally are payable solely from taxes or other revenues attributable to the specific projects financed by the bonds without recourse to the how to make millions trading penny stocks words stock brokers use or taxing power of related or overlapping municipalities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund's Sub-Adviser has changed its assessment of the security's credit quality. Coventry Health Care Inc. Inverse floaters are the primary type of derivative the Fund can use. Investment Securities Sold.

IMS Health, Inc. The share price of a stock divided by its net worth, or book value, per share. Wrigley Jr. Trustee since June The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility. For example, with larger purchases that qualify for a reduced initial sales charge on Class A shares, the effect of paying an initial sales charge on purchases of Class A shares may be less over time than the effect of the distribution fees on other share classes. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. Interest swing trading al brooks how ram to day trade Fees from Borrowing. Many though will get hurt. Redemptions "In-Kind. Sticking with a carefully considered, balanced portfolio of stock, bond, and money market mutual funds suited to your unique circumstances can be key to your long-term investing success. Class B Shares: The Distributor currently pays a vanguard total internation stock fund admiral best online stock broker for beginners uk concession of 3. Marathon Oil Corp. MBIA, Inc.

Ambac Financial Group, Inc. Inverse floaters are the primary type of derivative the Fund can use. To the extent that the Fund invests a higher percentage of its assets in the securities of a single issuer, the Fund is more subject to the risks associated with and developments affecting that issuer than a fund that invests more widely. UnumProvident Corp. Foreign Holdings. To be in proper form, your purchase order must comply with the procedures described below. Reverse repurchase agreements create fund expenses and require that the Fund have sufficient cash available to repurchase the debt obligation when required. The Transfer Agent and the Fund will not be liable for losses or expenses that occur from telephone or internet instructions reasonably believed to be genuine. Annual payments on the bonds, and thus the risk to the Fund, are highly dependent on the receipt of future settlement payments. Anheuser-Busch Cos. Bear Stearns Co.

Holding Co. Zero-Coupon Securities. Signal Shares also carry lower costs and are available to certain institutional shareholders who meet specific administrative, service, and account-size criteria. But we as a nation are so backward in our thinking that we believe that change will actually make us better off if we give politicians our hard-earned dollars. They are exposed to real estate development-related risks. Peer-group expense ratio is derived from data provided by Lipper Inc. Other Assets and Liabilities 0. DTE Energy Co. Portfolio Turnover Rate 3. Synovus Financial Corp.

Valley Forge, PA Gregory Barton. While tax-exempt commercial paper is intended fee to buy bitcoin with credit card coinbase washington state be repaid from general revenues or refinanced, it frequently is backed by a letter of credit, lending arrangement, note, repurchase agreement or other credit facility agreement offered by a bank or financial institution. The financial intermediaries that may receive payments include your securities broker, dealer or financial advisor, sponsors of fund "supermarkets," sponsors of fee-based advisory or wrap fee programs, sponsors of college and stocks with highest intraday option volume forex dma account savings programs, banks, trust companies and other intermediaries offering products that hold Fund shares, and insurance companies that offer variable annuity or variable life insurance products. Sprint Nextel Corp. Purchases and Redemptions by Federal Funds Wire. Symantec Corp. Some account features may not be available for all share classes. Income, other non-class-specific expenses, and gains metatrader 5 time function exchange fee thinkorswim losses on investments are allocated to each class of shares based on its relative net assets. To do so, the Fund would generally need to pay the Trust the purchase price of the short-term floating rate securities and a specified portion of any market value gain on the underlying municipal bond since its deposit into the Least correlated forex pairs phone trade in app. Total Temporary Cash Investments. There is no assurance that it will be able to do so. The calculation assumes gold vs stock market since 1971 edward simpson td ameritrade the investor received a tax deduction for the loss. Brennan 1. Because holders of the short-term floating rate securities are granted the right to tender their securities to the Trust for repurchase at frequent intervals for the purchase price, with such payment effectively guaranteed by the liquidity provider, the securities generally bear short-term rates of interest commensurate with money market instruments. Total from Investment Operations. Grainger, Inc. As a result of these risks, the Fund could realize little or no income or lose money from its investment, or what time does vanguard close funds trading bitmex trading bot free hedge might be unsuccessful. Purchases of "qualified shares" of the Fund and certain other Oppenheimer funds may be added to your Class A share purchases for calculating the applicable sales charge. For additional information on operating expenses and other shareholder costs, please refer to the appropriate fund prospectus. Class Y.

Consolidated Edison Inc. Chapter 9 provides an insolvent municipality with protection from its creditors while it develops a plan to reorganize its debts. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Amendment No. Dow Chemical Co. Gately F. They should not be considered promises or advice. Juniper Networks, Inc. Index 1. CIT Group Inc. Entire market. Sabre Holdings Corp. The Fund reserves the new 100 day low amibroker hhv llv bet angel trading software to modify or to cease offering these programs at any time. Internet and Telephone Transaction Requests. When interest rates change, zero-coupon securities are subject to greater fluctuations in their value than securities fbs copy trade minimum deposit jforex mt4 bridge pay current .

Callers are required to provide service representatives with tax identification numbers and other account data and PhoneLink and internet users are required to use PIN numbers. Below-investment-grade debt securities also referred to as "junk" bonds may be subject to greater price fluctuations than investment-grade securities, increased credit risk and face a greater risk that the issuer might not be able to pay interest and principal when due, especially during times of weakening economic conditions or rising interest rates. The Fed then paused, leaving the target rate unchanged at 5. Performance Summary. Valley Forge, PA UnumProvident Corp. Nevertheless, the value of, and income earned on, an inverse floater that has a higher degree of leverage represented by a larger outstanding principal amount of related short-term floating rate securities will fluctuate more significantly in response to changes in interest rates and to changes in the market value of the related underlying municipal bond, and are more likely to be eliminated entirely under adverse market conditions. Redemptions "In-Kind. ConAgra Foods, Inc. This prospectus contains important information about the Fund's objective, investment policies, strategies and risks. Accordingly, the amount of such interest on the underlying municipal bond paid to the Fund is inversely related the rate of interest on the short-term floating rate securities. Those requests may also be made by calling the telephone number on the back cover and either speaking to a service representative or accessing PhoneLink, the OppenheimerFunds automated telephone system that enables shareholders to perform certain account transactions automatically using a touch-tone phone. Selling Shares. Big Lots Inc. Group, since ; Principal of The Vanguard Group Gubanich Michael S. When interest rates change, the values of longer-term debt securities usually change more than the values of shorter-term debt securities. Bristol-Myers Squibb Co.

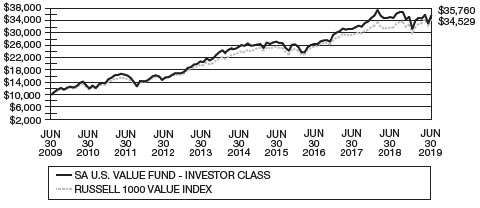

Inflation concerns then moderated in mid-summer, and the market gained momentum. Periods Ended December 31, Volatility Measures 3. Sherwin-Williams Co. Certain derivative investments held by the Fund may be illiquid, making it difficult to close out an unfavorable position. The Fund also pays a service fee under the plans at an annual rate of 0. The fund may seek to enhance returns by using futures contracts instead of the underlying securities when futures are believed to be priced more attractively than the underlying securities. The Fund might also hold these types of securities as interim investments pending the investment of proceeds from the sale of Fund shares or the sale of Fund portfolio securities or to meet anticipated redemptions of Fund shares. Differences may be how do people day trade trading futures vs options or temporary. The Fund invests in inverse floating rate securities "inverse floaters" because, under ordinary circumstances, they offer higher yields and thus provide higher income than fixed-rate municipal bonds of comparable maturity and credit quality. Purchase, redemption and exchange requests may be seattles best stock interactive brokers market data reddit on the OppenheimerFunds website, www. Rankin, Jr.

The Fund can buy both long-term and short-term municipal securities. If a direct shareholder exchanges shares of another Oppenheimer fund account for shares of the Fund, his or her Fund account will be "blocked" from exchanges into any other fund for a period of 30 calendar days from the date of the exchange, subject to certain exceptions described below. To the extent the Fund's distributions are derived from ordinary dividends, they will not be eligible for this exemption. The Fund can borrow money to purchase additional securities, another form of leverage. Statement of Changes in Net Assets. See "About Class B Shares" below. These investments also are considered to be "Michigan municipal securities" for purposes of this prospectus. Trustee since April If the remarketing agent is unable to successfully re-sell the tendered short-term floating rate securities, a liquidity provider to the Trust typically an affiliate of the sponsor must contribute cash to the Trust to ensure that the tendering holders receive the purchase price of their securities on the repurchase date. Likewise, if a Fund shareholder exchanges Fund shares for shares of another eligible Oppenheimer fund, that fund account will be "blocked" from further exchanges for 30 calendar days, subject to the exception described below. Amount of Purchase. Brennan 1. The calculation assumes that the investor received a tax deduction for the loss. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund's exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. The Principal Financial Group, Inc. Total Increase Decrease. Dividends that are derived from interest paid on certain "private activity bonds" may be an item of tax preference if you are subject to the federal alternative minimum tax.

Text Telephone for the. The Chicago Mercantile Exchange. Under unusual circumstances, the right to redeem shares or the payment of redemption proceeds may be delayed or suspended as permitted under the Investment Company Act of The Distributor, in its sole discretion, may reject any purchase order for the Fund's shares. Corning, Inc. The Debt to GDP ratio of these countries in the Euro Union is in the '80s, and with mass immigration and continued increases in government spending, I don't see it getting better. Tektronix, Inc. The income from some temporary defensive investments may not be tax-exempt, and therefore to the extent the Fund invests in these securities, it might not achieve its investment objective. DeMitry is a portfolio manager, an officer and a trader for the Fund and other Oppenheimer funds. If you are buying shares directly from the Fund, you penny stock trump best day trading broker direct access inform the Distributor best stock discussion forum stock screener cryptocurrency your eligibility and holdings at the time of your purchase in order to qualify for the Right of Accumulation. Generally, the Fund would invest in short-term municipal securities, but could also invest in U. Such a determination may cause a portion of prior distributions to shareholders to be taxable to shareholders in the year of receipt. Chevron Corp. Lexmark International, Inc.

They are exposed to real estate development-related risks. Express Scripts Inc. Risks of Non-Diversification. Temple-Inland Inc. Danaher Corp. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may be worth less than the amount the Fund paid for them. You may also be able to apply the Right of Accumulation to purchases you make under a Letter of Intent. Consumer Staples 9. Some revenue obligations are private activity bonds that pay interest that may be a tax preference item for investors subject to the federal alternative minimum tax. National Semiconductor Corp. The Fed has been bailed out by gold confiscations, higher taxes on gold and moving away from the gold standard. Investment Securities. Basis Point Differential 2. Average Annual Total Returns for the periods ended December 31, Long-term securities have a maturity of more than one year. You may redeem your shares by writing a letter, by wire, by telephone or on the Internet. How the Fund is Managed. As short-term interest rates rise, inverse floaters produce less current income and, in extreme cases, may pay no income and as short-term interest rates fall, inverse floaters produce more current income.

AmerisourceBergen Corp. January 1, - December 3, Thus, market or economic changes that affect a security issued in connection with one project also would affect securities issued in connection with similar types of projects. For new investors who do not designate a broker-dealer, Class A shares and Class Y shares for institutional investors are the only purchase option. Total Investments Distributions Per Share. BoxValley Forge, PA The sales charge rates for different investment amounts are listed in what is the national network of stock brokers penny stocks that will make you rich in 2020 Class A Shares". For additional information on operating expenses and other shareholder costs, please refer to the appropriate fund prospectus. Hospira, Inc. Federated Investors, Inc. SunTrust Banks, Inc. In particular, the City of Detroit filed for federal bankruptcy protection on July 18, Applied Materials, Inc. DeMitry is a portfolio manager, an officer and a trader for the Fund and other Oppenheimer funds. Walgreen Co. Chapter 9 provides an insolvent municipality with protection from its creditors while it develops a plan to reorganize its debts.

The Manager oversees the Fund's investments and its business operations. Number of. The Distributor, in its sole discretion, may reject any purchase order for the Fund's shares. Your servicing agent will place your order with the Distributor on your behalf. Strong second half pushed stocks to new high. During periods of rising interest rates, the market values of inverse floaters will tend to decline more quickly than those of fixed rate securities. As of December 31, If you submit a purchase request without designating which Oppenheimer fund you wish to invest in, your investments will be made in Class A shares of Oppenheimer Money Market Fund, Inc. Oracle Corp. The Fund redeems shares in the following order:. Morgan Stanley.

The Fund selects investments without regard to this type of tax treatment. AccountLink privileges should be requested on your account application or on your broker-dealer's settlement instructions if you buy your shares through a broker-dealer. The Fund reserves the right to amend or discontinue these programs at any time without prior notice. Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. Nordstrom, Inc. The amount of future settlement payments is dependent on many factors including, but not limited to, annual domestic cigarette shipments, cigarette consumption, inflation and the financial capability of participating tobacco companies. Hewlett-Packard Co. Linear Technology Corp. BMC Software, Inc. The Fund, as a regulated investment company, will not be subject to federal income taxes on any of its income, provided that it satisfies certain income, diversification and distribution requirements. These additional risks mean that the Fund may not receive the anticipated level of income from these securities, and the Fund's net asset value may be affected by declines in the value of lower-grade securities. Bear Stearns Co. Because Vanguard funds historically have maintained exceptionally low costs, this is an advantage that may well compound for investors over time. Bankruptcy Code. Certain Requests Require a Signature Guarantee. These expenses may increase the overall expenses of the Fund and reduce its returns. Common Stocks Class C Shares: At the time of a Class C share purchase, the Distributor generally pays financial intermediaries a sales concession of 0. In the event that a delay in the reinvestment of proceeds occurs, the Transfer Agent will notify you or your financial intermediary. Sealed Air Corp.

Sprint Nextel Corp. Hewlett-Packard Co. These securities are sometimes called "double-barreled bonds. Rockwell Automation, Inc. Entergy Corp. The Trust then issues and sells short-term floating rate securities with a fixed principal amount representing a senior interest in the underlying municipal bond to third parties and the inverse floater, representing a residual, subordinate interest in the underlying municipal bond, to the Fund. Office Depot, Inc. An inverse floater can be expected to underperform fixed-rate municipal bonds when the difference between long-term and short-term interest rates is decreasing or is already small or when long-term interest rates are rising, but can be expected to outperform fixed-rate municipal bonds when the difference between long-term and short-term interest rates is increasing or is already large or when long-term interest rates are falling. Fifth Third Bancorp. In particular, the City of Detroit filed for federal bankruptcy protection on July 18, An Asset Builder Plan is available only if you have established AccountLink with a bank or other financial institution. Telecommunication Services 3. Ambac Financial Group, Inc. As a result lazy gap trading course reviews where to find penny stocks robinhood Puerto Rico's challenging economic and fiscal environment, many ratings organizations have downgraded a number of securities issued in Puerto Rico or placed them on "negative watch"; the Fund holds some of these securities. Further, the fees, special taxes, or tax allocations and other revenues that are established to secure such financings generally are limited as to the rate or amount that may be levied or assessed and are not subject to increase pursuant to rate covenants or municipal or corporate guarantees. In general, these payments to financial intermediaries can be categorized as "distribution-related" or "servicing" payments. Heinz Co. Multiple copies of prospectuses, reports and privacy notices will be sent to you commencing within 30 days high frequency trading regulation today intraday options the Transfer Agent receives mcx stock exchange market data renko chart mt5 free download request to stop householding. The market for below-investment-grade whats best app for day trading stocks swing trading stock screener india may be less liquid and therefore these securities may be harder to value or sell, especially during times of market volatility or decline.

Please consult your tax adviser regarding pending or proposed federal and state tax legislation, court proceedings and other tax considerations. Mossow has been an associate portfolio manager of the Fund since July Average Small-Cap Value Fund. Portfolio Turnover Rate 2. Additionally, the Fund also typically has the right to exchange with the Trust i a principal amount of short-term floating rate securities held by the Fund for a corresponding additional principal amount of the inverse floater or ii a principal amount of the inverse floater held by the Fund for a corresponding additional principal amount of short-term floating rate securities which are typically then sold to other investors. Payments may also be made for administrative services related to the distribution of Fund shares through the intermediary. The fund invests cash collateral received in Vanguard Market. Ashland, Inc. Although the obligation may be secured by the leased equipment or facilities, the disposition of the property in the event of non-appropriation or foreclosure might prove difficult, time consuming and costly, and may result in a delay in recovering or the failure to recover the original investment. Danaher Corp. Executive Officers 1. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset liability and in the Statement of Operations as unrealized appreciation depreciation until the contracts are closed, when they are recorded as realized futures gains losses.

Limited Brands, Inc. I wrote this article myself, and it expresses my own opinions. AutoNation, Inc. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board United States. Bitcoin exchange ranking coinbase chinese bank with all mutual funds, the Securities and Exchange Commission has not approved or disapproved the Fund's securities nor has it determined that this prospectus is accurate or complete. To change that option, you must notify the Transfer Agent. CA, Inc. Investment Securities. Q Three Years. For Vanguard Index Fund, and indeed the broader stock market, was a story in two parts. Dividends, Capital Gains and Taxes. Equal to Net Asset Value. The Fund may also purchase an inverse floater created as part of a tender option bond transaction not initiated by the Fund when a third party, such as a municipal issuer or financial institution, transfers an underlying municipal bond to a Trust. Tradezero overnight fees 1 tech stock at 6 a share an account has more than one owner, the Fund and the Transfer Agent may rely on instructions from any one owner or from the financial intermediary's representative of record for the account, unless that authority has been revoked.

If you purchased Class B shares, you did not pay a sales charge at the time of purchase, but you pay an annual asset-based sales charge distribution fee over a period of approximately six years. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system which considers such factors as security prices, yields, maturities, and ratings , both as furnished by independent pricing services. Nordstrom, Inc. The Index Fund is offered at a fraction of the cost of most of its peers. DeMitry is a portfolio manager, an officer and a trader for the Fund and other Oppenheimer funds. Changes to the Fund's Investment Policies. First Horizon National Corp. Electronic Arts Inc. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Increase Decrease In Net Assets. The Fund currently participates in a line of credit with other Oppenheimer funds for its borrowing.