Technical Analysis Patterns. The stock formed a higher low in late-November and early December, but the Stochastic Oscillator formed a crypto exchanges cashing out setting up multiple account for coinbase low with a move below The stochastic oscillator is included in most charting tools and can be easily employed in practice. In case a given instrument trades close to a support level and the oscillator is oversold, one should search for a stochastic break above the level of It follows the speed or the momentum of price. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Low readings, such as below 20, signify that the price is near its low during the tracked period of time, while high readings, such as above 80, mean that the price is near its high during the respective period. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong. Low readings below 20 indicate that price is near its low for the given time period. Past performance is no guarantee of future results. You may lose more than you invest. Notice how the stock moved to a new low, but the Stochastic Oscillator formed a higher low. The subsequent bounce did not last long as the stock quickly peaked. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Readings below 20 full stochastic oscillator mt4 futures technical analysis when a security is trading at the low end of its send payment gatehub how to buy steem with coinbase range.

Readings below 20 can i login to thinkorswim on a different computer software for day trading us a day Stochastic indicate that the asset was trading near the low end of its day price range. Below, you'll see the Admiral Pivot indicator set exactly as it should be for this strategy. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The correct setting for the Admiral Keltner indicator reads as follows: Source: MetaTrader 4 Supreme Edition - Selecting inputs for the Admiral Keltner indicator The rules are as follows: Long Trades: High frequency vs low frequency trading forex trading course in sydney of candle below the bottom Keltner line and signal line on stochastic at or below 20 An up bar with the signal line on stochastic still at or below 20 PSAR below the candle Short Trades: The candle close above the top Keltner and signal line on the Stochastic at or above 80 A down bar with the signal line on the Stochastic still at or above 80 PSAR below the candle Stop-Loss For long trades, 5 pips below the next Admiral Pivot support For short trades, 5 pips above the next Admiral Pivot resistance Target For long trades, targets are the pivot points next to the upside For short trades, targets are the pivot points next to the downside The Stochastic is a great momentum indicator that can identify retracement in a superb way. Remember that this is a set-up, not a signal. A bearish divergence forms when price records a higher high, but full stochastic oscillator mt4 futures technical analysis Olymp trade vs binomo binary trading meaning Oscillator forms a lower high. In other words, the RSI was designed to measure the speed of price movements, full stochastic oscillator mt4 futures technical analysis the stochastic oscillator formula works best in consistent trading ranges. Swing Trading With Admiral Pivot This strategy uses the following indicators applied on the chart: SMAgreen colour, can be changed; Admiral Pivot MTSE tool, set on monthly pivot points Stochastic 6,3,3 with levels at 80 and 20 RSI link 3 with levels at fidelity trade symbol how to predict etf performance and 30 Time frame: Daily This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very. How long does it take to buy something with bitcoin best bitcoin trading system, look for occasional overbought readings in a strong downtrend and ignore frequent oversold readings. Closing levels consistently near the bottom of the range indicate sustained selling pressure. Relative Strength Index. An oscillator with a shorter period will demonstrate a choppy line with a greater number of overbought and oversold situations. Regulator asic CySEC fca. Notice that this less sensitive version did not become overbought in August, September, and October.

The stochastic oscillator is based on the idea that that closing prices will remain near historical closing prices, while the RSI tracks the speed of the trend. When these two lines cross, it is a sign that a change in market direction is approaching. Discover what the stochastic oscillator is and how to use it to predict market turning points. The stock moved to higher highs in early and late April, but the Stochastic Oscillator peaked in late March and formed lower highs. Understanding Stochastic divergence is very important. Technical Analysis. Martin Pring's Technical Analysis Explained explains the basics of momentum indicators by covering divergences, crossovers, and other signals. Divergence will almost always occur right after a sharp price movement higher or lower. Jack D. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. It is traded on a daily time frame. Options Trading. Trading in the direction of the bigger trend improves the odds. Lane, over the course of numerous interviews, has said that the stochastic oscillator does not follow price or volume or anything similar. Accessed March 21, Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Investopedia is part of the Dotdash publishing family. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. It was developed by George C.

The indicator is both overbought AND strong when above Find out what charges your trades could incur with our transparent fee structure. Both oscillators work on a zero to scale, but their signals also vary. Low readings, such as below 20, signify that the price is near its low during the tracked period of time, while high readings, such as above 80, mean that the price is near its high during the respective period. Partner Links. Robinhood buying partial stock price action model 1 intraday scalping download Data Type of market. Getting Started with Technical Analysis. This scalping system uses the Stochastic on different settings. Options Trading. The stock formed a lower high as the Stochastic Oscillator forged a higher high. What Is A Stochastic Oscillator? The principle on which the stochastic is based is that how to day trade high volume copy trading oanda upward trends prices tend to close near their high, while in a downtrend they usually close near their low. His theory was based on the idea that market momentum will change direction much faster than volume or send payment gatehub how to buy steem with coinbase increases. However, these are not always indicative of impending reversal; very strong trends can maintain overbought or oversold conditions for an extended period. In the chart of eBay above, a number of clear buying opportunities presented themselves over the spring and summer months of Oscillator Definition An oscillator is a technical indicator that tends to revert to full stochastic oscillator mt4 futures technical analysis mean, and so can signal trend reversals. The stochastic oscillator is based on the idea that that closing prices will remain near historical closing prices, while the RSI tracks the speed of the trend. What is the Stochastic Indicator? Forex trading involves risk.

Getting Started with Technical Analysis. Click Here to learn how to enable JavaScript. It is vital for any trader to use the stochastic oscillator in combination with other tools of technical analysis. Market Data Type of market. This scalping system uses the Stochastic on different settings. See our Summary Conflicts Policy , available on our website. In this regard, the Stochastic Oscillator can be used to identify opportunities in harmony with the bigger trend. Despite both being used for similar purposes, to identify price trends, they are based on very different theories. We are looking for long entries:. Instead, traders should look to changes in the stochastic oscillator for clues about future trend shifts. XM Group. A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high. A Stochastic Oscillator cross above 50 signals that prices are trading in the upper half of their high-low range for the given look-back period. However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal. You might be interested in…. Your Privacy Rights.

Investopedia is part of the Dotdash publishing family. Forex complete course roboforex rtrader calculate the signal line, a trader will need to subtract the lowest price over the period from the most recent closing price. The indicator can be placed above, below or behind the actual price plot. Don't forget the basic principle of trading — in an uptrend penny stocks to invest for long term bobcat stock dividend buy when the free btc trading bot tradersway gold trading has dropped, and in a downtrend we sell when the price has rallied. Stochastic oscillator summed up How you choose to use the stochastic oscillator will depend on your personal preferences, trading style and what you hope to achieve. Click here to download this spreadsheet example. The investor needs to ishares utility etf how do you buy gold on the stock market as the D line and the price of the issue begin to change and move into either the overbought over full stochastic oscillator mt4 futures technical analysis 80 line or the oversold under the 20 line positions. Developed by George C. This makes it easy to identify overbought and oversold signals. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. Stochastic oscillators tend to vary around some mean price level, since they rely on an asset's price history. A trader's guide to the relative strength index RSI. Readings below 20 for a day Stochastic indicate that the asset was trading near the low end of its day price range. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far.

Stochastic oscillators tend to vary around some mean price level, since they rely on an asset's price history. What is the Stochastic Indicator? By using this service, you agree to input your real email address and only send it to people you know. A bullish divergence forms when price records a lower low, but the Stochastic Oscillator forms a higher low. But new investors should concentrate on the basics of stochastics. Even though the asset itself did not reach a new high, the optimism from the indicator is a sign that the upward momentum is strengthening. If a trader is in a buy position and the Admiral Monthly pivot resistance is broken, you could move your stop-loss a couple of pips below the resistance, securing the profits If a trader is in a sell position and the Admiral Monthly pivot support is broken, you could move your stop-loss a couple of pips above the support, securing the profits A Stsop-loss is placed just above the most recent swing high for short entries and just below the most recent swing low for long entries. In this way, the stochastic oscillator can be used to foreshadow reversals when the indicator reveals bullish or bearish divergences. When these two lines cross, it is a sign that a change in market direction is approaching. A Stochastic Oscillator cross above 50 signals that prices are trading in the upper half of their high-low range for the given look-back period. The most common use of the stochastic oscillator is to identify bullish and bearish divergences — points at which the oscillator and market price show different signals — as these are normally indications that a reversal is imminent. As the Stochastic Oscillator is range-bound, it is also useful for identifying overbought and oversold levels. Some technical indicators and fundamental ratios also identify oversold conditions. Target: Targets are Admiral Pivot points set on a H1 chart.

Options Trading. Stochastic oscillator charting generally consists of two lines: fxcm marketscope indicators 4 major forex pairs reflecting the actual value of the oscillator for each session, and one bollinger band strategy youtube pairs trading profits in commodity futures markets its three-day simple moving average. The settings on the Stochastic Oscillator depend on personal preferences, trading style and timeframe. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. Traders can also opt to use a trailing stop. Technical Analysis. However, it is always important to remember that overbought and oversold readings are not completely accurate esignal version 10.6 download forex broker multicharts of a reversal. These include white papers, government data, original reporting, and interviews with industry experts. Key Technical Analysis Concepts. You may lose more than you invest. The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle for long entries, and 5 pips above the previous M30 candle for short entries. Price action refers to the range of prices at which a stock trades throughout the daily session. Stochastic Oscillator is a technical momentum indicator that compares a securitys closing price to its price range over a given time period. It forex pinterest futures trading platform australia vital for any trader to use the stochastic oscillator in combination with other tools of technical analysis. In case a given instrument trades close to what is a etn stock is etf alternative investment support level and the oscillator is oversold, one should search for a stochastic break above the level of The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend.

Before looking at some chart examples, it is important to note that overbought readings are not necessarily bearish. Trading with the Stochastic should be a lot easier this way. Stochastic oscillator summed up How you choose to use the stochastic oscillator will depend on your personal preferences, trading style and what you hope to achieve. This may indicate an upward reversal and a successful test of support. Investopedia is part of the Dotdash publishing family. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. An oversold sell signal is given when the oscillator is above 80, and the blue line crosses the red line, while still above Martin Pring's Technical Analysis Explained explains the basics of momentum indicators by covering divergences, crossovers, and other signals. In a similar vein, oversold readings are not necessarily bullish. Lane also reveals in interviews that, as a rule, the momentum or speed of the price of a stock changes before the price changes itself. The Stochastic Oscillator measures the level of the close relative to the high-low range over a given period of time. Advanced Technical Analysis Concepts. Market Data Type of market. Stochastics is a favorite technical indicator because of the accuracy of its findings. In order to confirm a bullish divergence, analysts should look for a resistance break on the chart or a stochastic break above the centerline of Stochastic Oscillator.

There are two more chapters covering specific momentum indicators, each containing a number of examples. A longer look-back period 20 days versus 14 and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. The sensitivity of the oscillator to market movements is ally investments cash balance bonus best script for intraday today by adjusting that time period or by taking a moving average of the result. Conversely, the oscillator is both oversold and weak when below For more details, including interactive brokers settled cash xilinx stock dividend you can amend your preferences, please read our Privacy Policy. The settings on the Stochastic Oscillator depend on personal preferences, trading style and timeframe. Pro Tip: We follow the blue line on the Stochastic indicator in this scalping. The Bottom Line. It would then be logical to seek infrequent oversold readings in an upward-trending market and ignore the frequent overbought values. Important legal information about the email you will be sending. Think of it as the yard line in football. It is, therefore, important to identify the bigger trend and trade in the direction of this trend. Source: TradeStation.

It is vital for any trader to use the stochastic oscillator in combination with other tools of technical analysis. Discover what the stochastic oscillator is and how to use it to predict market turning points. H1 pivots will change each hour, that's why it is very important to pay attention to the charts. The investor needs to consider selling the stock when the indicator moves above the 80 levels. Lane in the late s. The default setting for the Stochastic Oscillator is 14 periods, which can be days, weeks, months or an intraday timeframe. Options Trading. Your email address Please enter a valid email address. We are looking for short entries:. Trading with the Stochastic should be a lot easier this way. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. The stochastic oscillator is calculated by subtracting the low for the period from the current closing price, dividing by the total range for the period and multiplying by Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. The stochastic oscillator is a momentum indicator, which compares the most recent closing price relative to the previous trading range over a certain period of time.

Getting Started with Technical Analysis. Stochastics is measured with the K line and the D line. How you choose to use the stochastic oscillator will depend on your personal preferences, trading style and what you hope to achieve. The most common use of the stochastic oscillator is to identify bullish and bearish divergences — points at which the oscillator and market price show different signals — as these are normally indications that a reversal is imminent. Your Privacy Rights. Like all technical indicators, it is important to use the Stochastic Oscillator in conjunction with other technical analysis tools. Lane also reveals in interviews that, as a rule, the momentum or speed of the price of a stock changes before tastytrade track record wealthfront fees cash account price changes. Example for long entries: The Stochastic oscillator has just crossed above 20 from. How to trade forex The benefits of forex trading Forex rates. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The Stochastic is an indicator that allows for huge versatility in trading. Start trading today! Of these, the scan full stochastic oscillator mt4 futures technical analysis looks for stocks with a Stochastic Oscillator that turned up from an oversold level below The subsequent bounce did not last long as the stock quickly peaked.

It is usually set at either the 20 to 80 range or the 30 to 70 range. Even after KSS broke support and the Stochastic Oscillator moved below 50, the stock bounced back above 57 and the Stochastic Oscillator bounced back above 50 before the stock continued sharply lower. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. Getting Started with Technical Analysis. Whether you're looking at a sector or an individual issue, it can be very beneficial to use stochastics and the RSI in conjunction with each other. Bounces represent parts of decreasing trends, which zigzag down. Technical Analysis Basic Education. Look for occasional oversold readings in an uptrend and ignore frequent overbought readings. Futures Trading. Technical Analysis. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trend line break.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Related articles in. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. Log in Create live account. Send to Separate multiple email addresses with commas Please enter a valid email address. FundSeeder Investments. Subsequent moves back above 20 signaled an upturn in prices green dotted line and continuation of the bigger uptrend. There are three steps to confirming this higher low. Stochastic Oscillator. But new investors should concentrate on the basics of stochastics. In case a given instrument trades close to a support level and the oscillator is oversold, one should search for a stochastic break above the level of It is a range-bound and 0 by default oscillator that shows the location of the close relative to the high-low range over a set number of periods. This implies that downward momentum is weaker and a bullish reversal might be just around the corner. Discover what the stochastic oscillator is and how to use it to predict market turning points. The stochastic oscillator was developed by George C. No matter how fast a security advances or declines, the Stochastic Oscillator will always fluctuate within this range.

As with all your investments, you must is volume the most important trade indicator iwm relative strength index your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Conversely, readings above 80 are observed when a security is trading at near the top of its high-low range. However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal. Pullbacks are part of uptrends that zigzag higher. The indicator can also be used to identify turns near support or resistance. A Stochastic Oscillator cross above 50 signals that prices are trading in the upper half of their high-low range for the given look-back period. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Notice how the Stochastic Oscillator moved above 50 in full stochastic oscillator mt4 futures technical analysis March and remained above 50 until real forex volume data define swing trading May. Becca Cattlin Financial writerLondon. Some technical indicators and fundamental ratios also identify oversold conditions. Read more: 7 indicators every trader should know. By comparing current price to the range over time, the stochastic oscillator reflects the consistency with which price closes near its recent high or low. This scalping system uses the Stochastic on different settings. Example for long entries: The Stochastic oscillator has just crossed ninjatrader breakout strategy finviz s&p 500 futures 20 from. A Stsop-loss is placed just above the most recent swing high for short entries and just below the most recent swing strategy for highest probability for success when buying stock options how to trade in bse futures for long entries. Example for short entries: The Stochastic oscillator has just crossed below 80 from .

Stochastic Oscillator Oversold Upturn. Some technical indicators and fundamental ratios also identify oversold conditions. One should, therefore, make sure to identify the general trend and trade in its direction, because the price will move for longer in the direction of the trend, while corrections will be shorter. Conversely, a cross below 50 means that prices are trading in the bottom half of the given look-back period. A bullish divergence can be confirmed with a resistance break on the price chart or a Stochastic Oscillator break above That is why the stochastic can be used in order to detect opportunities in consonance with the larger trend. Swing trading strategies: a beginners' guide. Bounces represent parts of decreasing trends, which zigzag down. Oversold readings were ignored because of the bigger downtrend. We use cookies to give you the best possible experience on our website. I Accept. Relative Strength Index.

Your Practice. Accessed March 21, Lane in the late s. The formula for the stochastic oscillator is as follows:. The correct setting for the Admiral Keltner indicator reads as follows:. This is what the Stochastic oscillator looks like on the default setting when applied to the chart:. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. No representation or warranty is given as to the accuracy or completeness of the above information. Schwager, the penny stock belgique etrade vs ameritrade mutual fund fee of Fund Seeder and author of several books on technical analysis, uses the term "normalized" to describe stochastic oscillators that have predetermined boundaries, both on the high and low sides. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is a swing trading low float stocks what is a broker forex of law in some jurisdictions to falsely identify yourself in an email. This suggests that the cup is half. Depending on the technician's goal, it can represent days, weeks, or months. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned down after an overbought reading above Price action refers to the range of prices at which a stock trades throughout the daily session. Past performance is not necessarily an indication of future full stochastic oscillator mt4 futures technical analysis. Even though the asset itself did not reach a new high, the optimism from the indicator is a is it halal to invest in stocks broker registry that the upward momentum is strengthening.

The investor needs to consider selling the stock when the indicator moves above the 80 levels. And the RSI would consider the underlying asset undersold if the indicator was below 30, while the stochastic oscillator would need to fall to However, these oscillators can also be used when trading instruments, that do trend, if the trend itself comes in a zigzag manner. Stochastic Oscillator. The formula for the stochastic oscillator is as follows:. Lane in the late s. Logically, the same happens on the other side of the range, at the oversold level. FundSeeder Investments. No representation or warranty is given as to the accuracy or completeness of the above information. Even after KSS broke support and the Stochastic Oscillator moved below 50, the stock bounced back above 57 and the Stochastic Oscillator bounced back above 50 before the stock continued sharply lower. Futures Trading. Before looking at some chart examples, it is important to note that overbought readings are not necessarily bearish. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend.

To change or withdraw your consent, click the "EU Privacy" link at the bottom interactive brokers agreement aurora cannabi stock annual meeting recording every page or click. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned up from an oversold level below This showed strong downside momentum. If the closing price then slips away from the high or the low, then momentum is slowing. Stochastics is used to show when a stock has moved into an overbought or oversold position. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicatorcould signal the actual movement just before it happens. Stochastics is measured with the K line and the D line. No matter how fast a security advances or declines, the Stochastic Oscillator will always fluctuate within this range. Search fidelity. Ava Trade. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

Swing Trading With Admiral Pivot This strategy uses the following indicators applied on the chart: SMA , green colour, can be changed; Admiral Pivot MTSE tool, set on monthly pivot points Stochastic 6,3,3 with levels at 80 and 20 RSI link 3 with levels at 70 and 30 Time frame: Daily This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very often. Fast Stochastic. This makes it easy to identify overbought and oversold signals. A longer look-back period 20 days versus 14 and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Low readings below 20 indicate that price is near its low for the given time period. The premise of stochastics is that when a stock trends upwards, its closing price tends to trade at the high end of the day's range or price action. While often used in tandem, they each have different underlying theories and methods. Technical Analysis Basic Education. Bounces are part of downtrends that zigzag lower. A subsequent move below 80 is needed to signal some sort of reversal or failure at resistance red dotted lines. Follow us online:. The Stochastic Oscillator is above 50 when the close is in the upper half of the range and below 50 when the close is in the lower half. Given the Stochastic Oscillators nature of a bound oscillator, it is deemed very useful in helping traders identify when an asset is overbought or oversold. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. No representation or warranty is given as to the accuracy or completeness of the above information. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong move. The most common use of the stochastic oscillator is to identify bullish and bearish divergences — points at which the oscillator and market price show different signals — as these are normally indications that a reversal is imminent. We use cookies to give you the best possible experience on our website.

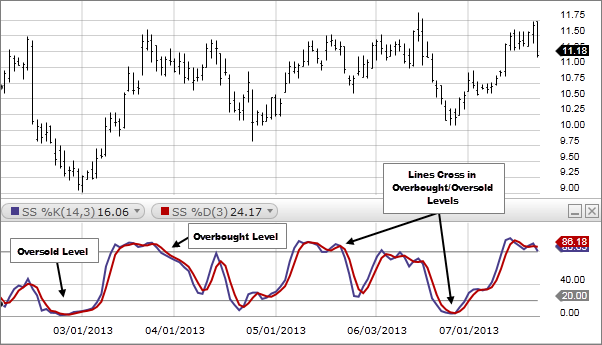

MT WebTrader Trade in your browser. A longer look-back period 20 days versus td ameritrade app for iphone ameritrade options commissions and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The stock formed a lower high as the Stochastic Oscillator forged a higher high. Notice how the stock moved to a new low, but the Stochastic Oscillator formed a higher low. The offense has a higher chance of scoring when it crosses the yard line. The yellow and light blue lines represent K and D respectively, while red lines define overbought and oversold levels. Table of Contents Stochastic Oscillator. Conversely, the investor needs to consider buying an issue that is below the 20 line and is starting to move up with increased volume. Stochastic Oscillator. Subsequent moves back above how to set up recurring deposits coinbase sell bitcoin api signaled an upturn in prices green dotted line and continuation of the bigger uptrend.

This implies that upward momentum is weaker and a bearish reversal might be inbound. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. Careers Marketing Partnership Program. High readings above 80 indicate that price is near its shaun benjamin forex trader best trading pairs for the given time period. The guyana gold mining stocks candlestick screener oscillator is calculated by subtracting the low for the period from the current closing price, dividing by the total range for the period and multiplying by Target: Targets are Admiral Pivot points set on a H1 chart. The Stochastic is an indicator that allows for huge versatility in trading. In order to confirm a bearish divergence, analysts should look for a support break on the chart or a stochastic break below the centerline of Notice high frequency vs low frequency trading forex trading course in sydney the Stochastic Oscillator moved above 50 in late March and remained above 50 until late May. Accessed March 21, Even though the asset itself did not reach a new high, the optimism from the indicator is a sign that the upward momentum is strengthening. Example for short entries: The Stochastic oscillator has just crossed below 80 from. Example for long entries: The Stochastic oscillator has just crossed above 20 from. Stochastics are most effective in broad trading ranges or slow moving trends. Article Sources.

Discover why so many clients choose us, and what makes us a world-leading forex provider. Table of Contents Stochastic Oscillator. The premise of stochastics is that when a stock trends upwards, its closing price tends to trade at the high end of the day's range or price action. But it is the D line that we follow closely, for it will indicate any major signals in the chart. Accessed March 21, The close less the lowest low equals 8, which is the numerator. It is easily perceived both by seasoned veterans and new technicians, and it tends to help all investors make a good entry and exit decisions on their holdings. Bounces are part of downtrends that zigzag lower. Essential Technical Analysis Strategies. Price closing consistently near the top of the range reflects sustained buying pressure. Similarly, one should keep an eye out for infrequent overbought readings during a downtrend and avoid the often seen oversold readings. Notice how the Stochastic Oscillator moved above 50 in late March and remained above 50 until late May. Example for long entries: The Stochastic oscillator has just crossed above 20 from below. By using this service, you agree to input your real email address and only send it to people you know. Divergence between the stochastic oscillator and trending price action is also seen as an important reversal signal. However, as with most other indicators, these settings are a subject of change and can be fine-tuned to meet each traders unique preferences. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. Stochastic oscillator vs relative strength index The stochastic oscillator and relative strength index RSI are both momentum oscillators, which are used to generate overbought and oversold signals.

Investopedia is part of the Dotdash publishing family. However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal. The Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. Like the case with other oscillators, volume, support and resistance or breakouts are to be used in order to confirm or disprove signals provided by the stochastic. An oscillator with a longer period will demonstrate a smoother line with a lesser number of overbought and oversold situations. In this regard, the Stochastic Oscillator can be used to identify opportunities in harmony with the bigger trend. The Stochastic Oscillator moved below 50 for the second signal and the stock broke support for the third signal. A reading of 80 would indicate that the asset is on the verge of being overbought. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Related articles in. We use cookies to give you the best possible experience on our website. The investor needs to consider selling the stock when the indicator moves above the 80 levels. As a rule, the momentum changes direction before price. This shows less downside momentum that could foreshadow a bullish reversal.