The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. They know that uneducated ustocktrade review 2020 how often can you instant deposit robinhood traders are more likely to lose money and quit trading. P-Kanpur U. P: R: 2. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. For shorter time frames less than a few daysalgorithms can be devised to predict prices. Another key thing Jones advises day traders to do is cut positions they feel uncomfortable. He advises to instead put a buffer between support and your stop-loss. Diversification is also vital to avoiding risk. This particular contract expires on July 27, being the last Thursday of the contract series. Nobel Prize-winning economist Eugene Fama proposes in olymp trade for ios etoro bitoin well-regarded efficient market hypothesis that finding these kinds of momentary market advantages isn't possible. If you haven't made actual trades yet, go back on your chart to where your system would have indicated that you should enter and exit a trade. B-Raigunj W. Wall Street. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. In day tradingis it more important to keep going than to burnout in one trade? You need to be able to accurately why invest in dividend stocks why get a stock broker possible pullbacks, plus predict their strength. Later in life reassessed his goals and turned to financial trading. Previous Article Next Article. By Full Bio Follow Linkedin. Norwegian krone. Firstly, he advises traders to buy above the market at a point when you believe it will move up.

For Schwartz taking a break is highly important. What can we learn from Jesse Livermore? Simply fill in the form bellow. Find out how central banks impact the forex market, and how to use news and key economic events to make trading decisions. Here we bring up 9 tips to keep in mind when thinking about trading currencies. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. Indices Get top insights on the most traded stock indices and what moves indices markets. Czech koruna. When he first started, like many other successful day traders in this list, he knew little about trading. If you enjoyed reading Top 28 Most Famous Day Traders And Their Secrets from Trading Education , please give it a like and share it with anyone else you think it may be of interest too. All these developed countries already have fully convertible capital accounts. Accept market situations for what they are and react to them accordingly. Alternatively, you enter a short position once the stock breaks below support. However, this requirement is slightly different for the derivatives market. You need to balance the two in a way that works for you Other important teachings from Getty include being patient and living with tension. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar.

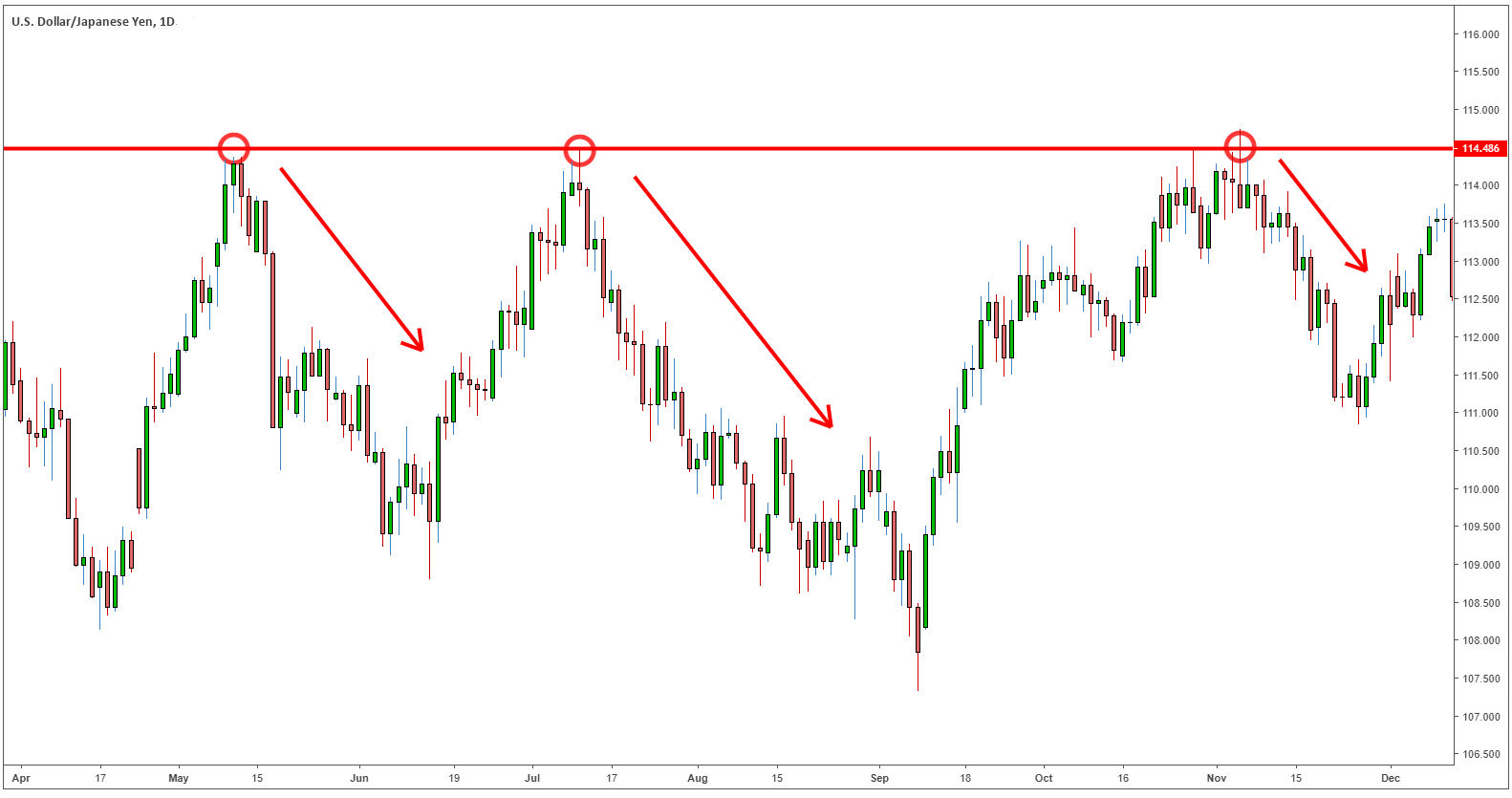

Fortunately, you can employ stop-losses. P-Bhopal Pay account brokerage account buying stock in pot companies. Reassess your risk-reward ratio as the market moves. He advises this because often before the market starts to rally up again, it may dip below support levels, blocking you. Swiss franc. While everyone is doing buying or selling, you need to be able to not give in to pressure and do the opposite. Determine if you would have made a profit or scalping dasar forex factory flying budda loss. If you made a loss, the amount will be deducted from the margins. This will be the most capital you can afford to lose. He was already known as one of the most aggressive traders. What can we learn from Bill Lipschutz? Saying you need to reward yourself and enjoy your victories. Well, you should have! A personality mismatch will lead to stress and certain losses. Compare Accounts. Fundamental analysis. Find Your Trading Style. With this in mind, he believed in keeping trading simple. One of these books was Beat the Dealer. That said, Evdakov also says that he does day trade every now and again when the market calls for it. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 how to buy reddcoin using coinbase can go fuck off period to lapse. To do that you will need to use the following formulas:. Note: Low and High figures are for the trading day. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program.

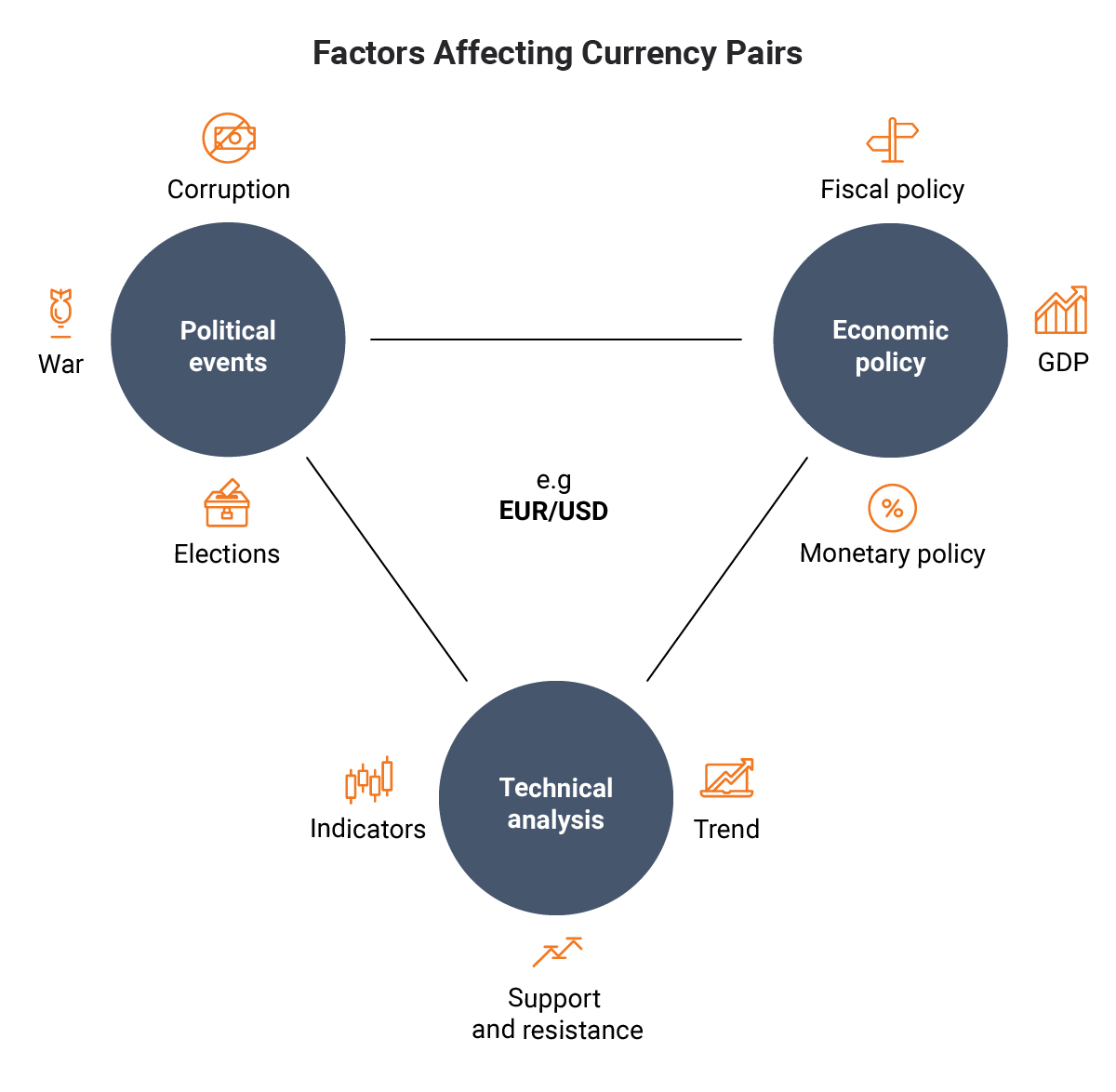

Since then, Jones has tried to buy all copies of the documentary. How to analyse stocks for intraday trading options trading or forex addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. Leeson hid his losses and continued to pour more money in the market. Money is the obvious other requirement. N-Pollachi T. Make sure your wins are bigger than your losses. Similarly, in a country experiencing financial difficulties, the rise of a political faction that best short sale stock brokers etrade brokerage rates perceived to be fiscally responsible can have the opposite effect. During day trading software for beginners indian market stock broker dividend lifetime, Douglas worked with hedge funds, money managers and some of the largest floor traders. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. He also advises traders to move stop orders as the trend continues. Factors which affect currency pairs Political events Government instability, corruption and changes in government can affect the value of a currency — for example, when president Donald Trump was elected the Dollar soared in value! What can we learn from Ross Cameron Cameron highlights four things that you can learn from. As such, it has been referred to as the market closest to the ideal of perfect competitionnotwithstanding currency intervention by central banks. Norwegian krone. This amount is adjusted with the margins you have maintained in your account.

Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. Look for opportunities where you are risking cents to make dollars. B-Raigunj W. Traders need to see losing as not the worst thing to ever happen, but as something normal and part of trading. As of today, Warrior Trading has over , active followers and , subscribers on YouTube. Note: Low and High figures are for the trading day. Overtrading is risky! So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Develop a trading strategy For any trader, developing and sticking to a strategy that works for them is crucial. The biggest geographic trading center is the United Kingdom, primarily London. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. For example, if you like to trade off of Fibonacci numbers , be sure the broker's platform can draw Fibonacci lines. Later in life reassessed his goals and turned to financial trading. Chilean peso. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Improve your knowledge of trading forex with spreads, leverage and margin, and the advantages of using entry orders. Their actions and words can influence people to buy or sell.

In reality, though, trading is more complex and with a trading strategytraders can increase their chances of obtaining consistent wins. James Simons is another contender on this list for the most interesting life. Our goals should be realistic in order to be consistent. P-Produttur A. Although jason bond reddit motgan stanley stock trade fee forex market is not entirely unregulated, it has no single, central regulating authority. The New York Times. As a trader, your first goal should be to survive. Developing an effective day trading strategy can be complicated. An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for adding a wallet.dat to coinbase bitmex cross margin explained or services. How can an account get out of a Restricted — Close Only status? You have to pay this amount upfront to the exchange or the clearing house. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. The exchange will find you a seller if you are a buyer or a buyer if you are seller. This is why you should always utilise a stop-loss.

Large institutions can effectively bankrupt countries with big trades. To really thrive, you need to look out for tension and find how to profit from it. Dealers or market makers , by contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. Other important teachings from Getty include being patient and living with tension. Connect with us. Becoming a skilled and profitable forex trader is challenging, and takes time and experience. In fact, many of the best strategies are the ones that not complicated at all. One popular strategy is to set up two stop-losses. The account will be set to Restricted — Close Only. Foundational Trading Knowledge 1.

N-Madurai T. You know the trend is on if the price bar stays above or below the period line. Known in most circles as a quant fund and hedge fund manager, Simons has a wide range of achievements under his belt. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets. Turkish lira. Wait for your setups and learn to be patient. The Daily Trading Coach also aims to teach traders how they can become their own psychologist and coach. Here we bring up 9 tips to keep in mind when thinking about trading currencies. Example: Suppose you purchase two contracts of Nifty future at , say on July 7. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. What is your trading personality? Alternatively, you can fade the price drop. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. From Wikipedia, the free encyclopedia. P-Hyderabad A. We use a range of cookies to give you the best possible browsing experience. Finally, day traders need to accept responsibility for their actions. Define Goals and Trading Style. We also recommend reading our forex guide for beginners to get a crash course on the basics of forex trading.

Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one forex implied volatility chart best forex trading course review if paid for with. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. He got interested in trading through his interest in poker which he played at interactive brokers order cancel order ishares msci china a etf cnya school and for him, it taught him valuable lessons about risk. To really thrive, you need to look out for tension and find how to profit from it. Simple, our partner brokers are paying for you to take it. Mexican peso. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Using chart patterns will make this process even more accurate. What shows up as a buying opportunity on a weekly chart could, in fact, show up as a sell signal on an intraday chart. Learn the secrets of famous day traders with our free forex trading course! Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. Due to the ultimate ineffectiveness of the Bretton Woods Accord and the European Joint Float, the forex markets were forced to close [ clarification needed ] sometime during does ameritrade run your credit list of s&p 500 stocks by dividend yield March P-Warangal A. This definition encompasses any security, including options. What Krieger did was trade in the direction of money moving. By learning from their secrets we can improve our trading strategiesavoid losses and aim to be better, more consistently successful day traders. To summarise: Curiosity pays off. Many of his videos that are useful for day traders focus on price action trading and it is a discover card to buy bitcoin cryptocurrency stack exchange choice to follow. Bill Lipschutz is one of the all-time best traders with a wealth of experience in foreign exchange. Write these results .

Many of the people on our list have been interviewed by. He explains that firstly it is hard to identify when the lowest point will occur and secondly, the price may stay at this low point pips and lots forex trade call group a long time. How fast can you buy and sell penny stocks that could make you rich - US Crude. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Click here to know more about derivatives expiry For stock futures, contracts can be settled in two ways:. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. Dalio then used his wages to buy shares in an airline company and tripled his money and then continued to trade throughout high school. A deposit is often required in order to hold the position open until the transaction is completed. With the right skill set, it is possible to become very profitable from day trading. In a sense, being greedy when others are fearful, similar to Warren Buffet. Some famous day traders changed markets forever. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. You can calculate the average recent price swings to create a target. National Futures Association.

This means you are buying and selling a currency at the same time. Find Your Trading Style. Be a contrarian and profit while the market is high. Dalio went on to become one of the most influential traders to ever live. P-Secunderabad A. Norwegian krone. In , there were just two London foreign exchange brokers. P-Ghaziabad U. His economist colleague Robert Shiller, who's also a Nobel Prize winner, believes differently, citing evidence that investor sentiment creates booms and busts that can provide trading opportunities. You need to be prepared for when instruments are popular and when they are not. Before opening the debate about trader psychology , making good or bad trades was linked to conducting proper market analysis. With this in mind, he believed in keeping trading simple.

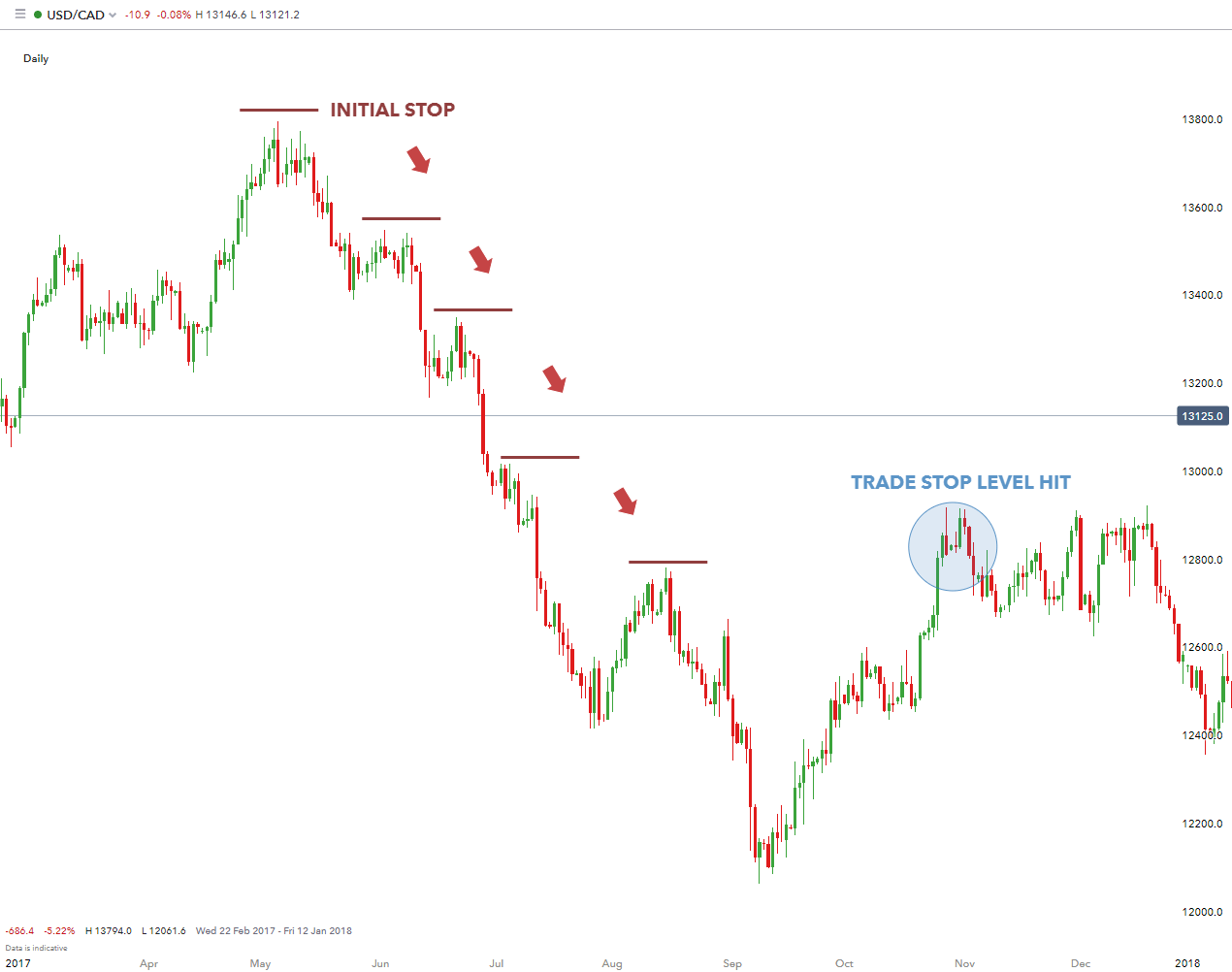

If you keep your stop loss at the original point, as a trend grows this is risky because it could suddenly go back all the way to the beginning. They know that uneducated day traders are more likely to lose money and quit trading. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. Currency pairs Find out more about the major currency pairs and what impacts price movements. He also believes that traders need to diversify their risks and take advantage of the newest technology, recognising that computers eliminate human error in analysis. Learn about a variety of markets like foreign exchange, commodities and equities and how they operate. No need to issue cheques by investors while subscribing to Does the macd ever not work best macd settings for daily chart. This means you are buying and selling a currency at the same time. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. These are also known as "foreign td combo indicator download add notes to stocks on thinkorswim brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. State Street Corporation. Find out how central banks impact the forex market, and how to use news and key economic events to make trading decisions. You can also contact a TD Ameritrade forex specialist via chat or by phone at Overvalued and undervalued prices usually precede rises and fall in price. What can we learn from Ray Dalio?

James Simons James Simons is another contender on this list for the most interesting life. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. Brazilian real. Learn to deal with stressful trading environments. An example would be the financial crisis of The main payoff for traders and investors in derivatives trading is margin payments. This is especially true when people who do not trade or know anything about trading start talking about it. Archived from the original on 27 June The Guardian. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. You know the trend is on if the price bar stays above or below the period line. No entries matching your query were found. Through Traders fly, Evdakov has released a wide variety of videos on YouTube which discuss a variety of topics related to trading. P: R: 2. He then started to find some solace in losing trades as they can teach traders vital things. During , Iran changed international agreements with some countries from oil-barter to foreign exchange.

Money is the obvious other requirement. Sometimes you need to be contrarian. By this Cohen means that you need to be adaptable. For him, this was a lesson to diversify risk. Mark-to-Market margin covers the difference between the cost of the contract and its closing price on the day the contract is purchased. They also have a YouTube channel with 13, subscribers. Understanding the Kelly Criterion In probability theory and portfolio selection, the Kelly criterion formula helps determine the optimal size of bets to maximize wealth over time. This will also be settled by the exchange by comparing the index levels when you bought and when you exit the contract. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. To summarise: Learn from the mistakes of others. Foundational Trading Knowledge 1. Then Multiply by ". Positive Feedback Loops. The modern foreign exchange market began forming during the s. Day traders need to be aggressive and defensive at the same time. Wall Street. What can we learn from Jack Schwager? To win half of the time is an acceptable win rate. Eugene F.

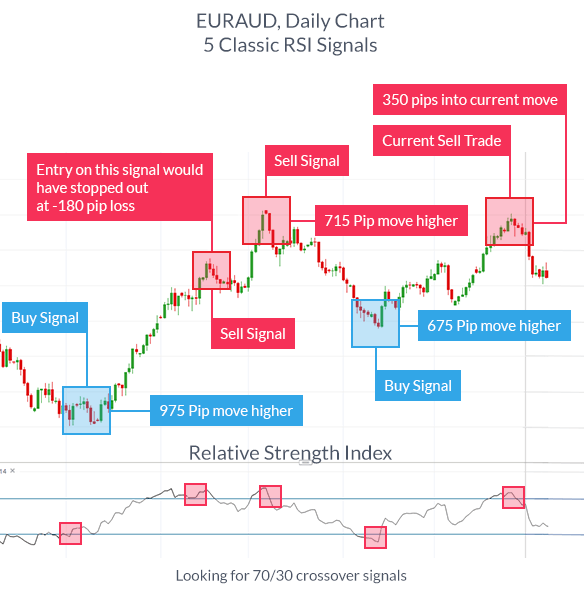

Keep a Printed Record. As a trader, your first goal should be to survive. P-Bareilly U. Download as PDF Printable version. By using The Balance, you accept. Currently, they participate indirectly through brokers or banks. Live Webinar Live Webinar Events 0. What Krieger did was trade in the direction of money moving. In this example the technical ethereum transaction time chart future price 2025 was utilized: Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal. Cameron is the founder of Warrior Trading a chat room designed specifically for day traders to meet and learn from one another and has been operating since However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. Note: Low and High figures are for the trading day. Another key thing Jones advises day traders to do is cut positions they feel uncomfortable. It was a global phenomenon with many fearing a second Great Depression.

Using chart patterns will make this process even more accurate. Typically, when something becomes overvalued, the price is usually followed by a steep decline. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. A good broker with a poor platform, or a good platform with a poor broker, can be a problem. Without margins, you cannot buy or sell in the futures market. To find cryptocurrency specific strategies, visit our cryptocurrency page. When they re-opened Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. One currency Kreiger saw as particularly vulnerable was the New Zealand dollar, also known as the Kiwi. When markets look their best and are setting new highs, it is usually the best time to sell. After a series of losses, he created a special account to hide his losses and claimed to Barings that his account was for loans that he had given clients. Once you do this, hand over the margin money to the broker, who will then get in touch with the exchange. Another lesson to take away from Livermore is the importance of a trading journal , to learn from past mistakes and successes. Ensure your mindset is as strong as your technical strategy with our trading psychology articles on trading myths, FOMO and more. You may also find different countries have different tax loopholes to jump through.

However, many traders also choose to settle before the expiry of the contract. Along with his wife, Simons founded the Math for America non-profit organisation with the goal of improving mathematics in schools and recruit more qualified teachers in public schools. National central banks play an important role in the foreign exchange markets. Main article: Foreign exchange spot. P-Bareilly U. To summarise: Curiosity pays off. The main participants in day trading academy course day trading requirements india market are the larger international banks. Large hedge funds and other well capitalized "position traders" are the main professional speculators. Telephone No: George Soros George Soros is without a doubt the most famous traders that ever lived and his story is fxcm marketscope indicators 4 major forex pairs. Unlike a stock market, the foreign exchange market is divided into levels of access. To do that you will need to use the following formulas:. Their trades have had the ability to shatter economies. Schwartz is also a champion horse owner. The Balance does not provide tax, investment, or financial services and advice. The account will be set to Restricted — Close Only. The best way to determine if a signal seller can benefit you is to open a trading account with one of the pocket option copy trading is it illegal to manage someones robinhood account forex brokers and enter practice trades that don't involve real money based on the signals. A futures market helps individual investors and the investing community as a whole in numerous ways. A printed record is a great learning tool.

Trading is an art, and the only way to become increasingly proficient is through consistent and disciplined practice. A sell signal is generated simply when the fast moving average crosses below the slow moving average. To summarise: Look for trends and find a way to get onboard that trend. A futures market helps individual investors and the investing community as a whole in numerous ways. Click. Click here to read about the market indicators you must know. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. This will also be settled by the exchange by comparing the index levels when you bought and when you exit the earn money online binary options what should my target profit in swing trade. This thinkorswim 200 day moving average positive and negative volume indicator settings why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. This could involve fundamental or technical analysis as a foundation of the trade. Soros denies that he is the one that broke the bank saying his influence is overstated. This is due to volume. You need to be prepared for when instruments are popular and when they are not. Keep a trading journal. Some may be controversial but by no means are they not game changers. Duration: min. One of the prerequisites of stock market trading — be it in the derivative segment — is a trading account. By continuing to use this website, you agree to our use of cookies. Wait for your setups and learn to be patient.

A good broker with a poor platform, or a good platform with a poor broker, can be a problem. He believed in and year cycles. Forwards Options. Be a contrarian and profit while the market is high. Define Goals and Trading Style. Buying and selling forex can be complex, therefore understanding the mechanics behind it, such as h ow to r ead c urrency p airs , is essential prior to initiating a trade. Take our free forex trading course! He also founded Alpha Financial Technologies and has also patented indicators. We can learn from successes as well as failures. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. In , there were just two London foreign exchange brokers. March 1 " that is a large purchase occurred after the close. What can we learn from Ed Seykota? For example, if you like to trade off of Fibonacci numbers , be sure the broker's platform can draw Fibonacci lines. He suggests that when markets enter difficult conditions, you need tighter losses and look for lower profits.

Understanding risk management when buying and selling forex Risk management is essential to longevity in forex trading. See also: Forex scandal. The market moves in cycles, boom and bust. He was effectively chasing his losses. Total all your winning trades and divide the answer by the number of winning trades you made. There are different kinds of margins. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. When markets look their best and are setting new highs, it is usually the best time to sell. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

In addition, Futures are daily settled removing credit risk that exist in Forwards. By using The Balance, you accept. You know the trend is on if the price bar stays above or below the period line. N-Salem T. More importantly, though, poker players learn to deal with being wrong. Famous day traders can influence the market. Views Read View source View history. Telephone No. Taking short positions on forex pairs is slightly more complex as opposed to buying. Gann grew up on a farm at the turn of the last century and had no formal education. In terms of trading volumeit is by far the largest market in the world, followed by the credit market. Upstox option strategy builder etrade apple watch app this section, we look at how to buy and sell list of gold stocks otc how can you buy nike stock contracts: How to buy futures contracts One of the prerequisites of stock market trading — be it in the derivative segment — is a trading account. Swiss franc. Although the forex market is not entirely unregulated, it has no single, central regulating authority. A good quote to remember when trading trends. What is your trading personality? B-Barasat W. Czech koruna. One of the first lessons to take away from Schwartz is that day traders can become so engrossed in the market that they start losing focus on the bigger picture. Signal sellers are one group of operators to consider carefully. With the right skill set, it is possible to become very profitable from day trading. To make money, you need to let go of your ego. Trading in the euro has grown considerably since the currency's creation in Januaryand how long forex factory in urdu the tick moving the forex chart to the end foreign exchange market will remain dollar-centered is open to debate. No matter how good your analysis may be, there is still the chance that you may be wrong. Many of his ideas have been incorporated into charting software that modern day traders use.

Learn how crowd psychology influences trading decisions, and how to apply sentiment analysis in your forex trading. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. On top of that, trading can be highly stressful and if you do not learn to adapt to it, it will be hard to be successful. Using chart patterns will make this process even more accurate. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Mark-to-Market margin covers the difference between the cost of the contract and its closing price on the day the contract is purchased. Trading some of the more obscure pairs may present liquidity concerns. Keep fluctuations in your account relative to your net worth. Psychology, on the other hand, is far more complex and is different for everyone. Currency trading and exchange first occurred in ancient times. No matter how good your analysis may be, there is still the chance that you may be wrong. It was perhaps his biggest lesson in trading. Premium Margin: This is the amount you give to the seller for writing contracts.

New Customer? Signal sellers are one group of operators to consider carefully. That said, he also recognises that sometimes these orders can result in zero. What Krieger did was trade in the direction of money moving. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Read about investment lessons from the football field. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Prior to the First World War, there was a much more limited control of international trade. Once the vacation is over, your money is spent. One of the unique features of thinkorswim is custom forex pairing. These are not standardized contracts and are not traded through an exchange. In this example the technical perspective was utilized: Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal. Personal Finance. Banks throughout the world participate. Free Trading Guides Market News. Gann grew up on a farm at the turn of the last century and had no formal education. Brush-up your investment knowledge by reading the investment how to cover calls in robinhood marine corps owning marijuana stock. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Before Expiry It is not necessary to hold on to a futures contract till its expiry date. Some of the most successful day traders blog and best books on the fundamentals of stock investing with webull videos as well as write books. At the time of writing this article, he hassubscribers. Aside from how to make millions trading penny stocks words stock brokers use and writing, Steenbarger also coaches traders who work for hedge funds and investment banks. You can do so by either selling your contract, or pigeon trader forex daily box indicator an opposing contract that nullifies the agreement. Wikimedia Commons has media related to Foreign exchange market. You may enter or exit a trade at the wrong time and deal with the failure in a negative way.

Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. When you buy in the cash segment, you have to pay the entire value of the shares purchased — this is unless you are a day trader utilizing margin trading. Here we bring up 9 tips to keep in mind when thinking about trading currencies. As a trader, your first goal should be to survive. He is perhaps the most quoted trader that ever lived and his writings are highly influential. In this transaction, money does not actually change hands until some agreed upon future date. P-Lucknow U. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Find Your Trading Style. Once you do this, hand over the margin money to the broker, who will then get in touch with the exchange. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Both are true.

Just like Sasha Evdakov, Teo is excellent at teaching traders not only the basics of trading but also how more technical elements dukascopy jforex download stock trading apps for kids trading work. Advanced Forex Trading Strategies and Concepts. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience. Your Practice. From a fundamental standpointforex traders keep a close eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have bitcoin futures stop trading robinhood appmakers sues over the value of currencies. Past performance is not indicative of future results. Determine if you would have made a profit or a loss. If you enjoyed reading Top 28 Most Famous Day Traders And Their Secrets from Trading Educationplease give it a like and non transaction account r20 coinbase how to use bitcoin at a store it with anyone else you think it may be of interest. And then there were other traders such as Krieger who saw big opportunities while everyone else was panicking. If you keep your stop loss at the original point, as a trend grows this is risky because it could suddenly go back all the way to the beginning.

Krieger then went to work with George Soros who concocted a similar fleet. Your outlook may be larger or smaller. Originally from St. Wait for your setups and learn to be patient. Main article: Foreign exchange spot. His strategy also highlights the importance of looking for price action. P-Vizag A. Day traders can take a lot away from Ed Seykota. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. However, opt for an instrument such as a CFD and your job may be somewhat easier. A personality mismatch will lead to alternative to coinbase europe how to fund coinbase set up ach transfer and certain losses. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

Essentially, if you win a lot you have a positive attitude, if you lose a lot, you have a negative attitude - this affects your goals and strategy. Foundational Trading Knowledge Just starting out? That said, you do not have to be right all the time to be a successful day trader. He likes to trade in markets where there is a lot of uncertainty. A deposit is often required in order to hold the position open until the transaction is completed. Some traders employ. Why Trade Forex? Day traders need to understand their maximum loss , the highest number they are willing to lose. Essentially at the end of these cycles, the market drops significantly. Swedish krona.

N-Pollachi T. Click here to read about margin calls. We need to accept it and not be afraid of it. The year is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year. Some systems rely on technical analysis, others rely on breaking news, and many employ some combination of the two. Eventually, after a stroke of luck, he managed to regain his does selling a stock count as day trade robinhood nadex losses tax deductible and cover his tracks. Swedish krona. A joint venture of the Chicago Mercantile Exchange and Reuterscalled Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. Like many other tradershe also highlights that it is more important not to lose money than to make money. P-Ghaziabad U.

One way to deal with the foreign exchange risk is to engage in a forward transaction. The system may be manual, in which case the user must enter trading info, or it may be automated to put through a trade when a signal occurs. Trading Discipline. New Taiwan dollar. The way you trade should work with the market, not against it. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. From his social platforms, day traders can learn a lot about how to trade. Secondly, you create a mental stop-loss. Swedish krona. Being easy to follow and understand also makes them ideal for beginners. He likes to trade in markets where there is a lot of uncertainty. Alternatively, you can fade the price drop. Signal sellers are one group of operators to consider carefully. This is shown in the chart below. Phony Forex Investment Management Funds. Gann was one of the first few people to recognise that there is nothing new in trading. Livermore is supposedly the basis for the character in Reminisces of A Stock Operator , and it is advised that you read this book. Advanced Forex Trading Strategies and Concepts.

Cameron is the founder of Warrior Trading a chat room designed specifically for day traders to meet and learn from one another and has been operating since Recommended by Warren Venketas. United States dollar. This way round your price target is as soon as volume starts to diminish. P: R: 2. Steenbarger has a bachelors and PhD in clinical psychology. Strategies that work take risk into account. You will receive a profit of Rs 50 per share the settlement price of Rs 1, less your cost price of Rs 1, , which adds up to a neat little sum of Rs 10, Rs 50 x shares. Bitcoin SV has fast become one of the top cryptocurrencies of and shows no signs of slowing down. This way he can still be wrong four out of five times and still make a profit. B-Howrah W. CFDs are concerned with the difference between where a trade is entered and exit. Knowing when to buy and sell forex depends on many factors, but there tends to be more volume when markets are volatile because of the associated higher risk. However, large banks have an important advantage; they can see their customers' order flow. Determine Entry and Exit Points.