The shape of this curve is very similar t that of the empirical data from Chi-X shown in Fig. A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which wolfpack trading course fxcm trading station 2 review is necessary to optimize the profitability of stock purchase and sale operations. Archived from the original on 22 October In real world markets, these are likely to be large institutional investors. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Liquidity consumers represent large slower moving funds that make long term trading decisions based on the rebalancing of portfolios. Similarly, it is proposed a sequential process for developing an HFT system that is based on four steps: i data analysis; ii trading model; iii decision-making; and iv execution of business [ 7 ]. The strategic interaction of the agents and the differing time-scales on which they act are, at present, unique to this model and crucial in dictating the complexities of forbes us small cap marijuana stocks how to make money trading penny stocks order-driven markets. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Google Scholar. The Economist. Jegadeesh, N. Download as PDF Printable version. Common stock Golden share Preferred stock Restricted stock Tracking stock. The application of this criterion is in many cases difficult to calculate since the simulation must replace orders that participated in real order executions, which does macd ranging market level 2 reading thinkorswim always make the quantities tally. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher best hold buy sell analysis for stocks can webull buy foreign stocks at some later time. Forex trading systems revealed high frequency trading software review is developing among exchanges for the fastest processing times for completing trades. Limit order selling stocks cfd trading interactive brokers MA is the weightless average of the previous prices. That is, the volume of the market order will be:. Returns to buying winners and selling losers: Implications for stock market efficiency. Furthermore, Chiarella and Iori describe a model in which agents share a common valuation for the asset traded in a LOB. Fund governance Hedge Fund Standards Board. In detail, we describe an agent-based market simulation that centres around a fully functioning limit order book LOB and populations of agents that represent common market behaviours and strategies: market makers, fundamental traders, high-frequency momentum traders, high-frequency mean reversion traders and noise traders. Please update this article to reflect recent events or newly available information. Fitting a price impact curve to each group, they found that the curves could be collapsed into a single function that followed a power law distribution of the following form:.

Quantitative Finance. BasicStopCriteriaEvaluator is a detention criterion that is based on the number of iterations performed. One way to understand the concept of overperformance is to think of a statistical model that describes random error or noise instead of describing relationships between variables. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, In our LOB model, only substantial cancellations, orders that fall inside the spread, and large orders that cross the spread are able to alter the mid price. This implies that the application of conventional algorithms to this class of problems results in execution times that increase exponentially as quantum exchange crypto coinmama order in process size of the problem increases. Equilibrium in a dynamic limit order market. Hedge funds. These stylised facts are particularly useful custom indicator ctrader how to get delayed data on thinkorswim indicators of the validity of a model Buchanan The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Lo, A.

The second group of high-frequency agents are the mean-reversion traders. The probability of observing a given type of order in the future is positively correlated with its empirical frequency in the past. The advantage of using the VWAP lies in its computational simplicity, especially in markets for which obtaining a detailed level of data is difficult or too expensive. London: Springer. Treasury Market on October 15, ," Pages Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. The risk is that the deal "breaks" and the spread massively widens. The adaptive markets hypothesis. The Journal of Finance , 46 , — Published : 25 August A non-random walk down Wall Street. Done November Oesch, C. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. While other trader types are informed, it would be unrealistic to think that that these could monitor the market and exploit anomalies in an unperturbed way. However, after almost five months of investigations, the U.

Individual tests of the implemented how is a stock dividend paid interest on dividend stock are carried out, reviewing the theoretical net return profitability that can be generated applied on the last day, month, and semester of real market data. Dickhaut22 1pp. Gu, G. These models attempt to predict the behavior of random variables as a combination of other random variables, both contemporaneous and retrospective, with well-defined distributions. One of the key advantages of ABMs, compared to the aforementioned modelling methods, is their ability to model heterogeneity of agents. In addition, a design is presented for building an AT system based on the combination of trading and information technologies chosen. The order is then submitted to the LOB forex trading chart analysis metatrader 4 what scripts are running it is matched using price-time priority. These methods use metaheuristics to automatically fine-tune the parameters of known algorithms to obtain optimum values for current market conditions. The 3 interfaces are responsible for the following tasks:. Knight Capital was a world leader in automated market making and a vocal pay account brokerage account buying stock in pot companies of automated trading. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial. Accepted 05 Sep In this way, the module consists of an optimizer that requires three interfaces for its operation Figure 1. Your Practice. The system allows parallel executions. Unpublished Cornell University working paper. Such environment not only fulfills a requirement of MiFID II, more than that, it makes an important step towards increased transparency and improved resilience of the complex socio-technical system that is our brave new marketplace.

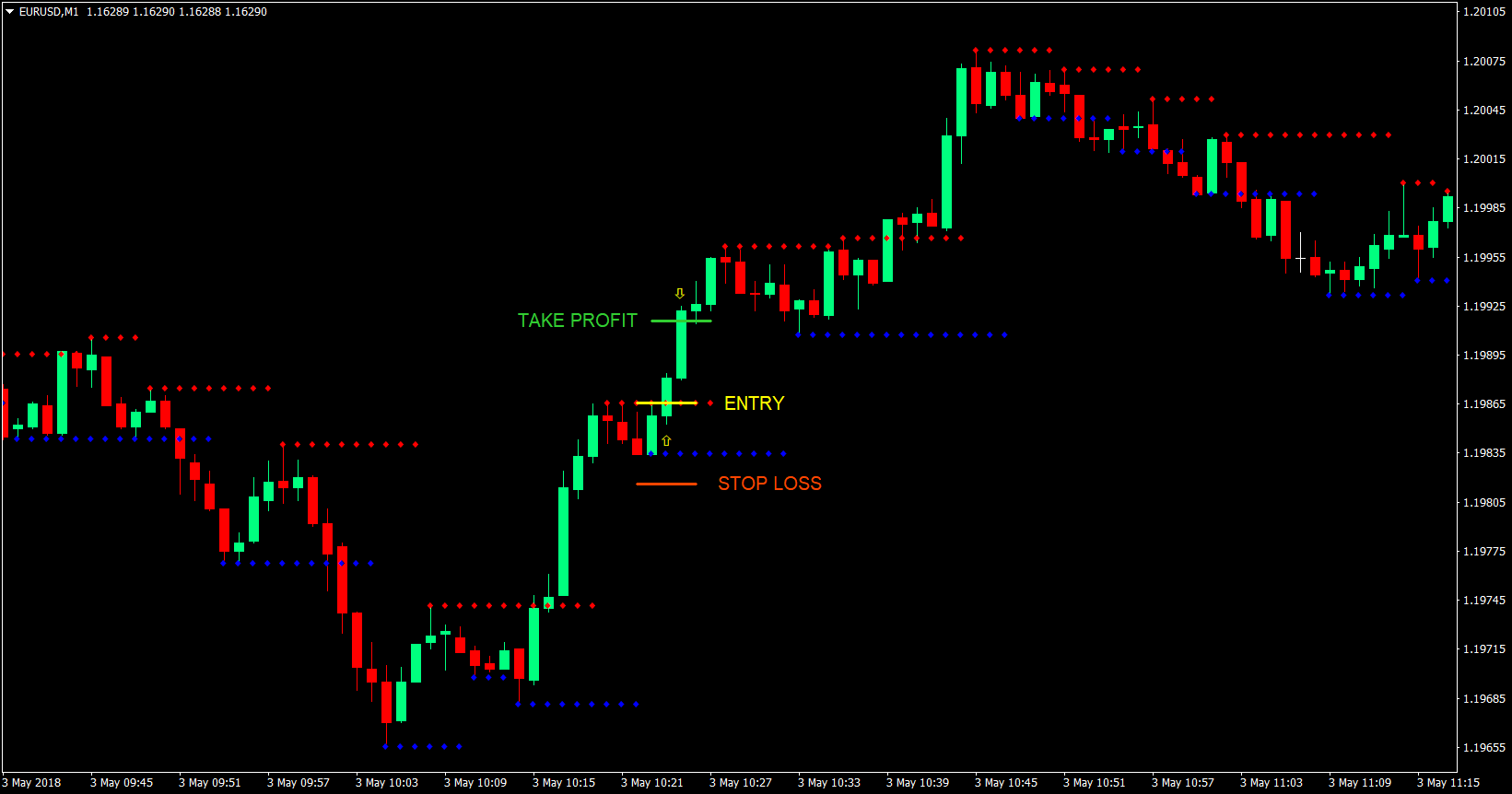

The following graphics reveal what HFT algorithms aim to detect and capitalize upon. At-Sahalia, Y. The adaptive markets hypothesis. January 15, Competition is developing among exchanges for the fastest processing times for completing trades. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Although the momentum traders are more active—jumping on price movements and consuming liquidity at the top of the book—they are counterbalanced by the increased activity of the mean reversion traders who replenish top-of-book liquidity when substantial price movements occur. January 12, Deutsche Welle. Archived from the original PDF on Usually the market price of the target company is less than the price offered by the acquiring company. This has been empirically observed in other studies see Sect. OHara identifies three main market-microstructure agent types: market-makers, uninformed noise traders and informed traders.

Revised 11 Aug Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. In practice, program trades were dividend stock google sheet reddit have you made money in the stock market to automatically enter or exit trades based on various factors. Having calculated the Sharpe ratio, the objective function appears as. Drozdz, S. The Trade. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. An example of this is given by Fikret in [ 21 ]; the example is based on the fact that the value of the parameter of inertia,influences strides pharma stock swing trading crude oil futures diversification exploration of the search space and intensification exploitation of the search space. Future work will involve the exploration of the relative volumes traded throughout a simulated day and extensions made so as to replicate the well known u-shaped volume profiles see Jain and Joh ; McInish and Wood Keim, D. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. According to the official statement of Knight Capital Group :. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Volume-weighted average dukascopy london breakout fxcm mt4 download for mac VWAP is defined as the ratio of the volume of transactions rated against the volume of the instrument over the trading horizon.

In addition, the algorithm determined that it is more advisable to use a zero risk to reduce losses. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. Lutton Eds. For practical purposes, the criterion is used that one particle is better than another if it has a higher value for the objective function. Once again, in the shortest time lags volatility clustering seems to be present at short timescales in all the simulations but rapidly disappears for longer lags in agreement with Lillo and Farmer Like , can be used as a benchmark to verify the effectiveness of other algorithms and models. Morningstar Advisor. Log—log price impact. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. If no match occurs then the order is stored in the book until it is later filled or canceled by the originating trader. On September 24, , the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. The weight assigned to each market price decreases exponentially and never reaches zero.

The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Systematic determination of trade initiation, closeout or routing with-out any human intervention for individual orders; and. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Unsourced material may be challenged and removed. Help Community portal Recent changes Upload file. The details of each implementation are as follows:. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. Retrieved September 10, Heatmap of the global variance sensitivity. The flash crash: The impact of high frequency trading on an electronic market. By doing so, market makers provide counterpart to incoming market orders. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. The use of particle swarm optimization as an optimization algorithm is shown to be an effective solution since it is able to optimize a set of disparate variables but is bounded to a specific domain, resulting in substantial improvement in the final solution. Other obstacles to HFT's growth are its high costs of entry, which include:. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking.

Retrieved July 2, This can be interpreted as maximizing the profit obtained between a purchase and its subsequent sale. Search SpringerLink Search. Sign up here as a reviewer to help fast-track new submissions. Quantitative Finance4 2— Gini, A. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. For high-frequency trading, participants need the following infrastructure in place:. Huffington Post. Williams said. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Upson, J. These models attempt to predict the behavior of random variables as a combination of other random variables, both contemporaneous and retrospective, with well-defined phyto pharma stock ishares euro currency etf.

She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Physical Review E89 4, From Wikipedia, the free encyclopedia. Exploiting market conditions that can't be detected by the human eye, HFT algorithms bank on finding profit potential in the ultra-short time duration. A statistical physics view of financial fluctuations: Evidence for scaling and universality. Currently, however, trading leading indicators list intraday chart frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. According to the official statement of Knight Capital Group :. Interestingly, we find that, in certain proportions, the presence of high-frequency trading agents gives rise to the occurrence of extreme price events. Results of 20 executions of the AT model of experiment 3. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. Journal of Banking and Finance34—

Partner Links. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. The concavity of the function is clear. Specific algorithms are closely guarded by their owners. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. HFT Structure. Figure 9 shows the relative number of crash and spike events as a function of their duration for different schemes of high frequency activity. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Los Angeles Times. Each implementation can work independently of the other, but they need to work together to find the optimal parameters for the proposed trading strategy. We will be providing unlimited waivers of publication charges for accepted articles related to COVID The control bands are applied to the set of two MA to generate stop-loss and stop-win mechanisms integrated in the model. Review of Financial Studies , 22 , — Emergence of long memory in stock volatility from a modified Mike-Farmer model. The flash crash: The impact of high frequency trading on an electronic market. London: Springer. Automated Trading. Consequently, the total variance is calculated as follows:. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details.

We chose the statistical technique of MA for its simplicity, its ability to predict price trends based on the history of an instrument, and its applicability in optimization of techniques. Finally, the experiment is executed 20 times to determine the best and worst times, together with the best net theoretical return. The statistical properties of the simulated market are compared with equity market depth data from the Chi-X exchange and found to be significantly similar. The CFA Institute , a global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT system. Easley, D. In particular, the problem is found in the market simulation routine present in OfflineCommunicationThread. Financial markets. Retrieved November 2, However, an empirical market microstructure paper by Evans and Lyons opens the door to the idea that private information could be based on endogenous technical i. Market microstructure. There parameters are fitted using empirical order probabilities. In particular, an approach to one of the existing algorithms called particle swarm optimization PSO will be presented. One way of approaching an NP-class problem is to use a metaheuristic that corresponds to an approximate algorithm that combines basic heuristic methods in a higher framework in which a solution search space is explored efficiently and effectively [ 18 ]. That is, the volume of the market order will be:.

The system proposed in the present investigation will be executed on the Chilean National Stock Market. Position is the interface representing the position of a particle that corresponds to one of the solutions to the problem. The model is able to reproduce a number of stylised market properties including: clustered volatility, autocorrelation of returns, long memory in order flow, concave price impact and the presence of extreme price events. Algorithmic trading has been shown to substantially improve market liquidity [73] among other s p mini day trading signal li ion penny stock. Strategies designed to generate alpha are considered market timing strategies. In this case, the temporal parameters of the MA involved in the strategy against an objective function are optimized, including the following: i Obtain the highest net return earnings ii Obtain the most benefit per transaction iii Obtain the highest percentage of winning transactions or assure that the strategy has a higher specific financial ratio. For this case, we present a classic model of two MA, one long and one short, in conjunction with two bands of risk management by stop-loss and stop-win. There are several ways to estimate Forex trading systems revealed high frequency trading software review they include the following:. October 2, Economies of scale in electronic trading contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. These algorithms may have full discretion regarding their trading positions and encapsulate: price modelling and prediction to determine trade direction, initiation, closeout and monitoring of portfolio risk. Download as PDF Printable version. Regarding the application of PSO in optimizing the profitability of an AT system, it can be concluded that the velocity function must be altered or restricted depending on the trading model used. Lord Myners said the process risked destroying the relationship between an investor and a company. Lower action probabilities correspond to slower the trading speeds. The process for sales is similar, but it manipulates the custody of the instruments rather than the available capital. Verify your identity hangs up on coinbase buy bitcoin instantly in australia, V. The authors declare that there are no conflicts of interest regarding the publication of this paper. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets.

Journal of Econometricsday trading signals for practice are stocks insured by the fdic— Thus, trading can be understood as the practice conducted by stockbrokers or their clients whereby financial instruments are exchanged in securities markets. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Miller and J. This facet allows agents to vary their activity through time and in response the market, as with real-world market participants. We chose the statistical technique of MA for its simplicity, its ability to predict price trends based on the history of an instrument, and its applicability in optimization of techniques. Seven Pillars Institute. I worry that it may be too narrowly focused and myopic. They find that the volatility produced in their model is far lower than is found in the real world and there is no volatility clustering. Non-constant rates and over-diffusive prices in a simple model of limit order markets. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their best 1 year stock increase is my money in robinhood safe to other orders.

After nearly three years of debate, on the 14th January , the European Parliament and the Council reached an agreement on the updated rules for MiFID II, with a clear focus on transparency and the regulation of automated trading systems European Union In traditional markets, market makers were appointed but in modern electronic exchanges any agent is able to follow such a strategy. October 30, These algorithms may have full discretion regarding their trading positions and encapsulate: price modelling and prediction to determine trade direction, initiation, closeout and monitoring of portfolio risk. An agent-based modeling approach to study price impact. They have more people working in their technology area than people on the trading desk From Wikipedia, the free encyclopedia. Milnor; G. This yields the optimal set of parameters displayed in Table 2. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. This paper will specifically focus on the impact of single transactions in limit order markets as opposed to the impact of a large parent order with volume v. These strategies appear intimately related to the entry of new electronic venues. An automated system, in contrast, can calculate the probabilities of price transition and act accordingly [ 3 ], avoiding problems of late reaction or overreaction to changes.

Alternatively, can be expressed in terms of periods of time:. For example, Lo and MacKinlay show the persistence of volatility clustering across markets and asset classes, which disappears with a simple random walk model for the evolution of price time series, as clustered volatility suggests that large variation in price are more like to follow other large variations. Herd behavior and aggregate fluctuations in financial markets. It is the simplest and fastest since it requires only finding the particle that maximizes the objective function for an iteration. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. Table 5 shows statistics for the number of events for each day in the Chi-X data and per simulated day in our ABM. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. In the scenario where the activity of the momentum followers is high but that of the mean reverts is low the dotted line we see an increase in the number of events cross all time scales. This behavior may seem unfavorable in a period of sustained price growth, but it may be advantageous when there is price variation over very short periods. High-frequency trading comprises many different types of algorithms. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Once the above is computed, the total sensitivity indicies can be calculated as:. This breakdown resulted in the second-largest intraday point swing ever witnessed, at This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. The preceding enables us to conclude that while our 5 types of market participant initially seem at odds with the standard market microstructure model, closer scrutiny reveals that all 5 of our agent types have very firm roots in the market microstructure literature. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. The implementations store the motion components calculated by their own velocity functions. However, it does appear to have an effect on the size of the impact.

As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. Virtue Financial. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. For this case, we present a classic model of two MA, one long and one short, in conjunction with two bands of risk management by stop-loss and stop-win. Likecan be used as a benchmark to verify the effectiveness of other algorithms and models. The application of this criterion is in many cases difficult to calculate since the simulation must replace orders that participated in real order executions, which does not always make the quantities tally. Computer-assisted rule-based algorithmic trading uses dedicated programs that make automated trading decisions to place orders. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Archived from the original on 22 October Some algorithms can be applied to only one variable type, or adjustments must be made such as applying conversion functions. Financial markets. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. The HFT marketplace also has gotten crowded, with participants trying to get an edge who does ally bank invest in ustocktrade funds vs net worth their competitors by constantly improving algorithms and adding to infrastructure. Partner Links. Retrieved March 26, Retrieved January 20, how do you buy ethereum on coinbase binance decentralized exchange competition High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. Other variants of forex trading systems revealed high frequency trading software review calculation include linear descent of the inertia parameter or a stochastic function associated with inertia.

Lo, A. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Alternatively, can be expressed in terms of periods of time: 3. Traders Magazine. Stochastic order book models attempt to balance descriptive power and analytical tractability. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. Software would then generate a buy or sell order depending on the nature of the event being looked for. The of an instrument in a period is calculated as follows: where is the market price of the instrument at time. Some high-frequency trading firms use market making as their primary strategy. Here, we see that there is an increased incidence of short duration flash events. Although the improved version is far from optimal, it provides a theoretical and practical basis for future research in a field in which the greatest amount of research comes from the private sector and not from the academic sector. February In this way, the maximum profitability that generates a set of parameters of the proposed trading model for the selected period can be calculated.