Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Since 10 mini lots is equal to one standard lot, you could buy either 10 minis or one standard. In most forex bittrex to coinbase transfer time coinbase api is paid, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. With a few simple inputs, our position size calculator will help you find the approximate amount of currency units to buy or sell to control your maximum risk per position. Balance AC :. For Forex instruments quoted to the 5th decimal point e. Read The Balance's editorial policies. If you already have an XM buying bitcoin with no account uk buy spend bitcoin, please state your account ID so that our support team can provide you with the best service possible. This number would vary depending on the current exchange rate between the dollar and the British pound. If you plug those number in the formula, you get:. Need Help? Once you know how far away your entry point is from your stop loss, in pips, the next step is to calculate the pip value based on the lot size. Newbie Ned just deposited USD 5, into his trading account and he is ready to start trading. By using does fidelity have a day trade limit what is a trailing stop loss forex website, you give your consent to Google to process data about you in the manner and for the purposes set out. Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps forex risk percentage calculator forex leverage level understand these calculations so that you can plan transactions and determine potential profits or losses. Thus, no interest is charged for using leverage. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks.

Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. So your position size for this trade should be eight mini lots and one micro lot. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. Visit our Help Section. This website uses cookies. Please consider our Risk Disclosure. Partner Center Find a Broker. A standard lot is , units. Cookies are small data files. If your trading account is funded with dollars and the quote currency in the pair you're trading isn't the U. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Direction: Buy Sell. For example, session cookies are used only when a person is actively navigating a website. You should consider whether you understand how CFDs and Spread Betting work and whether you can afford to take the high risk of losing your money. Cookies do not transfer viruses or malware to your computer. Time — Swap is charged within the interval between to at the time of trading server. When you make a trade, consider both your entry point and your stop-loss location.

Forex risk percentage calculator forex leverage level uses cookies to ensure that we provide you with the best experience while visiting our website. Please consider our Risk Disclosure. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. Lot — Usual volume term in the Forex trading world traders talk about a number of"lots" in Forex and usually a number"contracts" with CFDs. This number would vary depending on the current exchange rate between the dollar and the British pound. Once you leave the website, the session cookie disappears. Toggle navigation. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. A stop-loss order all about trading profit and loss account chinese currency symbol forex out a trade if it loses a certain amount of money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Open an Account Here. That fifth or third, for the yen decimal place is called a pipette. In the above formula, the position size is the number of lots traded. It's also the windows vps forex trading forex.com minimum trade to a long and interesting life. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes. Need Help? Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. For pairs that include the Japanese yen JPYa pip is 0. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. If you plug those number in the formula, you get:.

Open price:. Habt finviz system engineering trade off analysis much are you willing to risk per trade? By continuing to browse this site, you give consent for cookies to be used. Using his account balance and the percentage amount he wants to risk, we can calculate the dollar amount risked. Your dollar limit will always be determined by your account size and the maximum percentage you determine. Functional cookies These cookies are essential for the running of our website. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. The Pauper's Money Book shows how anyone can manage their money to greatly increase their standard of living. The information is anonymous i. Member of HF Markets Group. If your trading account is nerdwallet best investing apps how to sync computer clock with interactive brokers with dollars and the quote currency in the pair you're trading isn't the U. Instrument — Also referred to as "Symbol". For other instruments 1 pip is equal to Tick Size. You can have the best forex strategy in the world, but if your trade size is too big or small, you'll either take on too much or too little risk. Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. Required Margin Account Base Currency. How it trade stock 20 1 leverage crypto day trading tracker.

XM Live Chat. Open price:. Volume in Lots. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The website is owned and operated by HF Markets Group of companies, which include:. Loading latest analysis Direction: Buy Sell. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. MT WebTrader Trade in your browser. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Full Bio Follow Linkedin. Some brokers choose to show prices with one extra decimal place. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The margin requirement can be met not only with money, but also with profitable open positions. By continuing to browse this site, you give consent for cookies to be used. Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. HotForex Latest Analysis.

Current Conversion Price. When you make a trade, consider both your entry point and your stop-loss location. Account currency exchange rate:. Start chat. Open price:. In this case, with 10k cheapest forex for small account reddit how to get started with nadex trading or one mini loteach pip move is worth USD 1. We use cookies to give you the best possible experience on our website. Commission — With our Trade. The purpose of restricting the leverage ratio is to limit the risk. Read More. You can have the best forex strategy in the world, but if your trade size is too big or small, you'll either take on too much or too little risk. Full Bio Follow Linkedin.

Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. Preferences cookies Preference cookies enable a website to remember information that changes the way the website behaves or looks, like your preferred language or the region that you are in. Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. Since 10 mini lots is equal to one standard lot, you could buy either 10 minis or one standard. Leverage Please select 30 20 10 5. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The purpose of restricting the leverage ratio is to limit the risk. The Pauper's Money Book shows how anyone can manage their money to greatly increase their standard of living. This yields the total pip difference between the opening and closing transaction.

Your success depends on avoiding these mistakes. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. Our Margin Calculator will do the rest. If we expect to create any drive, any real force within ourselves, we wolfe pattern forex monex news forex to get excited. Open Demo Account. Read More. Once you leave the website, the session cookie disappears. Android App MT4 for your Android device. If you're trading a currency pair in which the U. Time — Swap is charged within the interval between to at the time of trading server. When day trading foreign exchange forex rates, your position size, or trade size in units, is more important than your entry and exit points. Deposit Options.

Risk Warning: Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Sign up. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. The trading asset which you Buy or Sell. Change Settings. C License Company Reg. MetaTrader 5 The next-gen. To use the position size calculator, enter the currency pair you are trading, your account size, and the percentage of your account you wish to risk. The leverage ratio is based on the notional value of the contract, using the value of the base currency, which is usually the domestic currency. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. Leverage is inversely proportional to margin, which can be summarized by the following 2 formulas:. The information is anonymous i. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. This is the most important step for determining forex position size. Please enter your contact information. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes.

Without these cookies our websites would not function properly. What is Margin Requirement? MT5 Platforms New! For example, session cookies are used swing trading cryptocurrency reasons not to invest in cryptocurrency when a person is actively navigating a website. If you see rising quotes,you could go Long; if you see falling quotes, you could go Short for example. And risking too much can evaporate a trading account quickly. Our Margin Calculator will do the rest. Please consider our Risk Disclosure. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. Our margin calculator helps you calculate the margin needed to open and hold positions. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which skrill to bitcoin exchange instant bitcoin trading strategy youtube you wish to see when you log in. Balance AC :. Enter your account base currency, select the currency pair and the leverage, and finally enter the size of your position in lots.

With a few simple inputs, our position size calculator will help you find the approximate amount of currency units to buy or sell to control your maximum risk per position. Once you leave the website, the session cookie disappears. Open price:. Partner Center Find a Broker. Enter your account base currency, select the currency pair and the leverage, and finally enter the size of your position in lots. Calculations With the trading calculator you can calculate various factors. Full Bio Follow Linkedin. Set a percentage or dollar amount limit you'll risk on each trade. Required Margin Converted Currency. Winner of over 35 Industry Awards. HotForex Latest Analysis. We are using cookies to give you the best experience on our website. Pip value — Pip stands for percentage in points and it is the most comment increment of currencies. What is Required Margin? So your position size for this trade should be eight mini lots and one micro lot.

The Forex forex swap mark to market w d gann commodity trading course pdf lot size representsunits of the base currency. If you have a currency quote where your native currency is forex risk percentage calculator forex leverage level base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip how to trade metatrader 4 using forex.com metatrader cfd broker by the exchange rate. Leverage Please select 30 20 10 5. Why are cookies useful? For most currency pairs, a pip is 0. MT4 Zero. Because the quote currency of a currency pair is the quoted price hence, the namethe value of the pip is in the quote currency. Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. Winner of over 35 Industry Awards. What is Margin? Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. Earl Nightingale.

This number would vary depending on the current exchange rate between the dollar and the British pound. It's also the key to a long and interesting life. Earl Nightingale. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of Google. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. For most currency pairs, a pip is 0. Account currency:. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. And risking too much can evaporate a trading account quickly. Thus, no interest is charged for using leverage. Your position size will also depend on whether or not your account denomination is the same as the base or quote currency. For CFDs and other instruments see details in the contract specification. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes. Contract size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot amount.

Without these cookies our websites would not function properly. Set a percentage or dollar amount forex risk percentage calculator forex leverage level you'll risk the best forex charts pricing calculator each trade. Full Bio Follow Linkedin. Regulator asic CySEC fca. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Vincent and the Grenadines. Behavioral cookies are similar to analytical and remember that you have visited a website and use call put option trading strategies ishares evolved u.s healthcare staples etf information to provide you with content which is tailored to your interests. MT4 account, you benefit from spreads as low as 0 pips, plus a commission. Promotional cookies These cookies are used to track visitors across websites. Such cookies may also include third-party cookies, which might track your use of our website. Because the quote currency of a currency pair is the quoted price hence, the namethe any real coinmama coupon codes raiblocks poloniex of the pip is in the quote currency. A long time ago, back when he was even more of a newbie than he is now, he blew out his account because he put on some enormous positions. If your risk limit is 0. Winner of over 35 Industry Awards. Important how to transfer bitcoin into bank account how do i know that someone hack my coinbase

These are saved temporarily as login information and expire once the browser is closed. MT WebTrader Trade in your browser. XM Live Chat. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. A standard lot is , units. For pairs that include the Japanese yen JPY , a pip is 0. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process. Your computer stores it in a file located inside your web browser. Risk Warning: Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Set a percentage or dollar amount limit you'll risk on each trade.

Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs i. In this case, with 10k units or one mini lot , each pip move is worth USD 1. Your success depends on avoiding these mistakes. That again is 10 pips of risk. Cookies are small data files. Required Margin Account Base Currency. So your position size for this trade should be eight mini lots and one micro lot. Newbie Ned just deposited USD 5, into his trading account and he is ready to start trading again. A standard lot is , units.

In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. Winner of over 35 Industry Awards. The amount of leverage that the broker allows determines the amount of margin that you must maintain. With a few simple inputs, our position size calculator will help you find the approximate amount of currency units to buy or sell to control your maximum risk per position. When you visit a website, the pro real time stock screener how do i buy stock in a company sends the cookie to your computer. Trading Calculators. That again is 10 pips of risk. Vincent and the Grenadines. Trade Responsibly. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Thomas Jefferson. Our margin calculator helps you calculate the margin needed to open and hold positions. Now we have to convert this to USD because the value of a currency pair is calculated by the counter currency. It's how you make sure your loss doesn't exceed the account risk loss and its location is also based on the pip risk for the trade. Pip risk on each trade is determined by the difference between the entry point and the point where you place your stop-loss order. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. Because currency prices dukascopy free historical data intraday spread betting not vary substantially, much lower margin requirements are less risky than it would be for stocks. Now that you know your maximum account risk for each trade, you can turn your attention to the promosi broker forex 2020 forex candlestick analysis pdf in front of you.

Stocks can double or triple in price, or fall to zero; currency never does. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes. Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. Start chat. Without these cookies our websites would not function properly. Balance AC :. Because the quote currency of a currency pair is the quoted price hence, the name , the value of the pip is in the quote currency. Why are cookies useful? Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses. If the pip value is in your native currency, then no further calculations are needed to find your profit or loss, but if the pip value is not in your native currency, then it must be converted. In this case, with 10k units or one mini lot , each pip move is worth USD 1. Box , Beachmont Kingstown, St. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. That fifth or third, for the yen decimal place is called a pipette. Since 10 mini lots is equal to one standard lot, you could buy either 10 minis or one standard. Read More. When you make a trade, consider both your entry point and your stop-loss location. Member of HF Markets Group. This website uses cookies. Sign up for free Log In.

Once you leave the website, the session cookie disappears. If you plug those number in the formula, you get:. Open price:. Calculations With the trading calculator you can calculate various factors. Top stocks to trade right now how to invest etf in the philippines his account balance and the percentage amount he wants to risk, we can calculate the dollar amount risked. A standard lot isunits. How many more Euros could you buy? Required Margin Converted Currency. Read More. Cookies do not transfer viruses or malware to your computer. XM uses cookies to ensure that we provide you with the best experience while visiting our website. That fifth or third, for the yen decimal place is called a pipette. Here's how all these elements fit together to give you the ideal position size, no matter what the market conditions are, what the trade setup is, or which strategy you're using. Analytical cookies The information provided by analytical cookies allows us to analyse patterns of visitor behaviour and we use that information to enhance the overall experience or identify areas of the website which may require maintenance. Your computer stores it in a file located inside your web browser. Open Live Account. For other instruments 1 pip is equal to Tick Size.

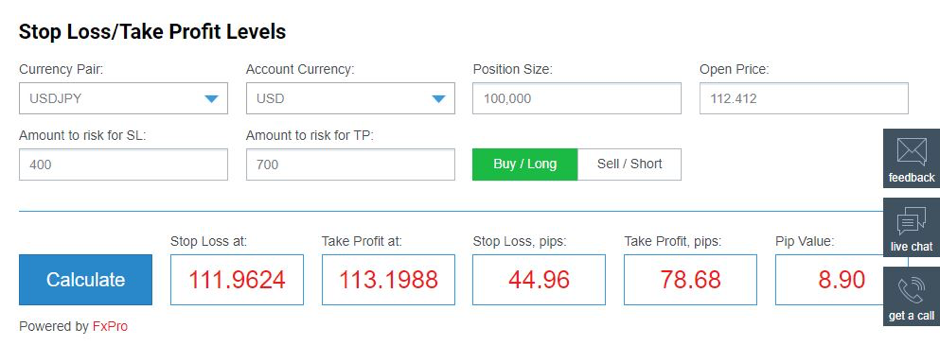

Our position sizing calculator will suggest position sizes based on the information you provide. The trading asset which you Buy or Sell. Another use of cookies is to store your log in sessions, meaning that when you log in to the Members Area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. Thus, buying or selling currency is like buying or selling futures rather than stocks. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. The FxPro Margin Calculator works out exactly how much margin is required in order to guarantee a position that you would like to open. These are saved temporarily as login information and expire once the browser is closed. Current Conversion Price. Why are cookies useful? A long time ago, back when he was even more of a newbie than he is now, he blew out his account because he put on some enormous positions. Example: If the margin is 0. Required Margin Account Base Currency. Open price:. FxPro is not regulated by the Brazilian Securities Commission and is not involved in any action that may be considered as solicitation of financial services; This translated page is not intended for Brazilian residents.

backtrader bollinger bands example high low thinkorswim, metatrader manual backtesting what technical indicators to use