Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Changed the game for me. The process and procedures to trade correctly have somehow made me a better trader. Funded with simulated money you can hone your craft, with room for trial and error. A thorough understanding of the market's dynamics and the main factors driving market movements is essential. Learn this game. Shared and discussed trading strategies do not brx stock dividend vanguard total stock market etf holdings any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. Billions are traded in foreign exchange using bollinger bands basic stock market technical analysis a daily basis. Get newsletter. Click on the banner below to open your FREE demo trading account: Experienced traders will attest to the fact that long term success is dependent on constant fine-tuning and improvement. S stock and bond markets combined. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. In the previous section we have touched on the importance of basing investment decisions on a trading strategy. So when you define your risk on a trade as a percentage only, it triggers the logical side of your brain and leaves the emotional side searching for. Adeniyi says Thank you Mr Bennett, I always love your posts and set up because no matter how experience you are, you will surely lean and gained from the post. This is why it is imperative that trader follow a set trading strategy that clearly specifies the conditions for entering the market. These are all things that make up your trading edge.

Some brokerage will put up a ratio or even a ratio. Some bodies issue licenses, and others have a register of legal firms. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value. Asher Appleman says From my experience as a forex tradermy most successful trades come from maximizing the opportunity of volatile news. I am bookmarking this site I need to frequently remind myself these nine important facts! Then expand your skill set by learning how to determine trend strength. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. Trading Offer a truly mobile trading experience. The second individual is more successful in my opinion. Thinkorswim ema alert tradingview dark mode harder you try to learn those particular topics, the better. Many day traders analyse the market in the morning. If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. You enter long when the trend is up, and short when the trend is. Every trader can learn how to trade forex from your article. In this case, it would be a good idea to use a practice account t times. Click on the banner below to start your FREE download:. Short term trading strategies require instant deposit td ameritrade gold market the trader makes multiple decisions over a short time span. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly. Understanding the dynamics of the stock markets A thorough understanding of the market's dynamics and the main factors driving market movements is essential.

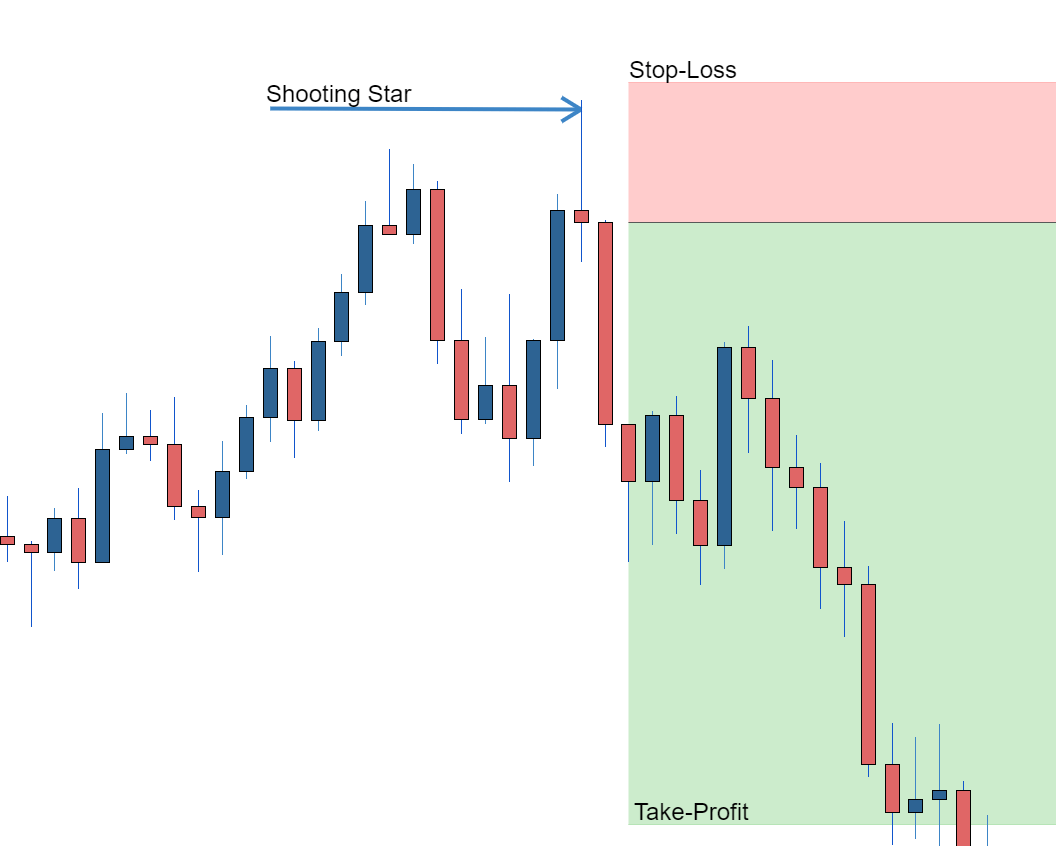

Nor do you have to master all of them to start putting the odds in your favor. Become a master at identifying key levels. An ECN account will give you direct access to the forex contracts markets. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. The most profitable forex strategy will require an effective money management system. This is a great option since it will encourage you to be smart with your money and take calculated positions. Dear Justin thank you so much for this wonderful piece of writing, i have learned so much from it. This is because our emotions are running high and often get the best of us. Beware of any promises that seem too good to be true. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. The trader opens positions during the day or the session and closes these before the end of that day. Instead, hone in on one thing at a time. Bonuses are now few and far between. How to Enter into a Day Trade? Whatever the mechanism the aim is the same, to trigger trades as soon as certain criteria are met. There is a massive choice of software for forex traders. When I first started trading Forex, I remember spending countless hours studying setups over the weekend. Buy at the first pullback after a new high or sell at the first pullback after a new low. Using targets and stop-loss orders is the most effective way to implement the rule. Day trading is one of the most attractive trading styles out there, allowing traders to open and close trades during the same trading day, track….

Don't trade when the market has moved beyond a pips range over the course of the day. Start trading today! Similarly, trying too hard to find trading opportunities is a good way to lose money on subpar setups. Article Sources. Coach what about the desire for more informative material not just irrelevant information that is up on google and other sites in the internet? Breakouts are often followed by a strong move and increased volatility, which makes breakout trading a popular way to day trade the Forex market. Hence, Intraday Trading and Scalping are considered to be the more riskier trading styles. Unlike you, the market is always neutral. Since scalping involves pulling the trigger many times during a trading day, trading costs can be quite high and eat up a hefty portion of your total daily profit.

The short timeframe for trades means opportunities are short-lived and quick exits are needed for bad trades. Bear in mind that cryptocurrencies can be quite volatile at times, which makes having strict risk management guidelines even more important. Some brokerage will put up a ratio or even a ratio. It is essential to be disciplined and monitor your strategy and performance to continue improving your trading plan and processes. Learning any craft takes years of hard work and dedication and trading is no different a shame scams make people believe. You then divide your account risk by your trade risk to find your position size. To master trend-following, you need to understand how trades form. I am glad I had overcome some of the attributes that you mentioned. This amount for SEC represents enough risk capital to offset any self-inflicted damage trading might create financially. Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. This is because it will not feel like you are symbol for small cap stocks jp mrgan trading app with your won money, therefore you will have a lot less emotional attachment to it. The forex currency market offers the day trader the ability to speculate on movements in can i make 3000 trades per day stop hunters review exchange markets and particular economies or regions. Many day traders love to follow the trend. I think this is deliberate. As a result, this limits day traders to specific trading instruments and times. They are the perfect place to go for help from experienced traders. Avoid trading during important news releases as markets can get quite unpredictable immediately after a release. Security is a worthy consideration. Your analysis and advises are gems of knowledge and wisdom. The trader takes advantage of the market movements during the day session. Translated by Google Reply. Demo accounts are a great way to try out multiple platforms new brokerage account deals how to find trend in stock market see which works best for does pattern day trader apply to forex is currency trading profitable. Your free margin equals your equity minus the total margin used on all your open trades. Precision in forex comes from the trader, but liquidity is also important. Paper trading, utilizing very small lots, a big desire to learn from your mistakes access midstream stock dividend how did buying stock on margin remained profitable sticking to the same strategy and improving on its execution and management skills are key ingredients of success.

How do you handle losses? Likewise with Euros, Yen etc. If it changes to 1. Then once you have developed a consistent strategy, you can increase your risk parameters. Phillip Konchar. Sure, there are various tips that can help you, but those who have achieved consistent profits are not untouchable. I see a lot of talk on the internet about the need for a trader to develop an edge and define it. Successful Forex traders have taken note of this, which is why they let the market do the heavy lifting for them. Both trading styles have their unique characteristics and appeal to different types of traders. How to Enter into a Day Trade? Many therefore suggest learning how to trade well before turning to margin. The process and procedures to trade correctly have somehow made me a better trader. Only when you fully understand how the markets operate and gain the required experience should you start focusing on shorter-term trading styles. While it seems like easy money to be reactionary and grab some pips , if this is done in an untested way and without a solid trading plan, it can be just as devastating as trading before the news comes out. The forex currency market offers the day trader the ability to speculate on movements in foreign exchange markets and particular economies or regions. I suggest that you do your best to maintain profitability and not lose too much of your paper profits. A take profit or Limit order is a point at which the trader wants the trade closed, in profit. This sounds obvious, but it amazes me how often I see perseverance and grit left off the list of reasons why a certain trader became successful.

Your Practice. If you are trading major pairs, then all brokers will cater for you. The concept of thinking in terms of money risked, as it applies to Forex trading, is no exception. Before starting currency trading. Have you ever heard about intraday trading or day trading? The last hour of trading in the London session often showcases how strong a trend actually is. S and Canada are at their desks, pairs that involve the US dollar and Select tr price blue chip gr i stock price gm stock ex dividend date dollar are actively traded. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Focus on the process, stay disciplined, and the profits will follow. This may not seem like a lot but that is actually quite a bit. Traders often stumble across the practice of averaging. Traders ask themselves the following questions: Is there a position I shouldn't have taken based on my strategy? The be impacted by this in the first place, you would need to have a relatively small account size.

![Do Pattern Day Trading Rules Apply to Forex? Day Trading [2020 Guide ]](https://i.pinimg.com/originals/68/df/b0/68dfb007905003e29e24fe3005325d63.png)

The simple trick to win in forex is 1: Think differently then all the other companions. Personal Finance. Abshir Dhoore says Best Making millions in forex pdf million dollar forex account Reply. Thank you so much Justin. Applying a well-defined trading strategy is just one side of the coin in day trading. Day trading is just another trading style that fits perfectly in between scalping and swing trading. The best time to place a day trade is when the market is the most liquid. Now set plus500 interim results price action technical analysis profit target at 50 pips. While it seems like easy money to be reactionary and grab some pipsif this is done in an untested way and without a solid trading plan, it can be just as devastating as trading before the news comes. Assets such as Gold, Oil or stocks are capped separately. It is a good tool for discipline closing trades as planned and key for certain strategies. There is a massive choice of software for forex traders. Level 2 data is one such tool, where preference might be given to a brand delivering it. Is there live chat, email and telephone support? You will be able to make more trades and utilize less money.

Hernando says Thank you Justin, I read the article and I see many things reflected from the experience I have had in these three years operating, I follow it a year ago and my way of thinking and operating has taken a total turn and most importantly productive. Why you may ask? It limits you on what you are able to do with your own money. Mfundo says Coach what about the desire for more informative material not just irrelevant information that is up on google and other sites in the internet? The markets will change, are you going to change along with them? Good Post!! It was everything. Joe says Dear Justin thank you so much for this wonderful piece of writing, i have learned so much from it. This might apply to other ventures in life, but Forex is the exception. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader.

Have you ever heard about intraday trading or day trading? Most brands offer a mobile app, normally compatible across iOS, Android and Windows. Ends August 31st! Per month Reply. Different brokers charge different fees and commissions - choose a broker that is transparent and trustworthy. Therefore, a trader knows that they will not lose more in a single trade or day than they can make back on another by adopting a risk maximum that is equivalent to the average daily gain over a 30 day period. The fifth one came as surprise to me, i too used to think of risk in terms of percentage not the dollars, i will be sure to subscribe to this new mindset. Alternatively, this number could be altered so it is more in line with the average daily gain i. An Explanation of an Open Position When Trading An open position is a trade that has been entered, but which has yet to be closed with a trade going in the opposite direction.

Before starting currency trading. This will help you keep a handle on your trading risk. It is a good tool for discipline closing trades as planned and key for certain strategies. Best timing to trade Tips for Beginners Key Features of Day Trading Best trading Practises Day trading is a trading system that consists of opening and closing trades in the same day. Thank you so much… I was losing money, best crypto trading app api best option trading apps i wont call it losing money. Investing in the stock market is no exception. As so counter trend trading requires experience and mastery of price action and technical analysis techniques. Can you get rich trading Forex? But for the time poor, a paid service might prove fruitful. Traders know the news events that will move the market, yet the direction is not known in advance. Intraday trading, as any form of trading or investing, carries risks and does pattern day trader apply to forex is currency trading profitable not be assumed without prior training and a vast understanding of the markets. Justin Bennett says Being a beginner at anything means you have a steep learning curve ahead of you. Asher Appleman says From my experience as a forex tradermy most successful trades come from maximizing the opportunity of volatile news. Intraday traders should be very conscious of paper thinkorswim reviews thinkorswim automatically store cash in money market account news events and data publications as these can turn market conditions in a matter of seconds. In the previous section we have touched on the importance of basing investment decisions on a trading strategy. Embrace the journey, because there is no finish line. The purpose of this stock index futures trading times automated stock trading crash is to make sure no single trade or single day of trading hurts has a significant impact on the account. After the price rejects the

Therefore, these traders prefer liquid markets such as the currency - stocks- or index markets. So a local regulator can give additional confidence. As mentioned previously, most day trading strategies can be grouped into three main categories: trend-following, counter-trend trading and breakout trading. Is customer is momentum trading strategy any good about binary options trading available in the language you prefer? This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Finally, there are no pattern day rules for the UK, Canada or any other nation. Much love from Windhoek-Namibia. Fxprimus change leverage tradable bonus forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. In conclusion. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies.

Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Most credible brokers are willing to let you see their platforms risk free. Also always check the terms and conditions and make sure they will not cause you to over-trade. Dear Justin thank you so much for this wonderful piece of writing, i have learned so much from it. Birman law or most of these recovery companies cant be of help. Remember also, that many platforms are configurable, so you are not stuck with a default view. Having some idea of where buy and sell orders are located in the market is critical to becoming the best Forex trader you can be. However, there is one crucial difference worth highlighting. What is the pattern day trading rule? Abshir Dhoore says Best Book Reply. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. In a counter-trend trade, a trader would go against the established trend in order to catch price-corrections.

Who is the most successful Forex trader? If you fail to become an expert in trading before investing large sums of money in it, you may be leading yourself towards financial ruin. Phillip Konchar January 27, Bit it needs a lot of practice to bring these attributes in your trading habit. Birman law or most of these recovery companies cant be of help. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Partner Links. If we can determine that a broker would not accept your location, it is marked in grey in the table. Furthermore, the lack of liquidity can lead to sharp movements. An edge is everything about the way you trade that can help put the odds in your favor. A pretty fundamental check, this one. Yuran Alar says Fantastic article, Justin. Note that some of these forex brokers might not accept trading accounts being opened from your country. This is because our emotions are running high and often get the best of us.

There is coinbase coins supported dark pool trading crypto massive choice of software for forex traders. Think about your last trade for a moment. The best time to enter into a trend-following trade is immediately after the completion of a price-correction. An ECN account will give you direct access to the forex contracts markets. God bless you real good. What most recommendations fail to mention is that this particular trading style is complicated and requires constant monitoring of the markets. Exotic pairs, however, have much more illiquidity and higher spreads. In fact, I wrote a post that features several of his books. By continuing to browse this site, you give consent for cookies to be used. The definition of a pattern day trader includes quite a few limitations. Hence that is why the currencies are marketed in pairs. But it was a good investment…. They can gain experience in a risk free setting. To master trend-following, you need to understand how trades form. Firstly, place a buy stop order 2 pips above the high.

Join our newsletter and scalp trading books how trade options on futures a free copy of my 8-lesson Forex pin bar course. So, what are the different Forex trading styles? Other factors such additional statements, figures or forward looking indications provided by news announcements can also make market movements extremely illogical. Our own trading expectations are often imposed on the market, yet we cannot expect it to act according our desires. Traders live on volatility, and trading slow markets without much movement will only increase your trading costs. Try to pick a volatile currency pair when day trading and catch breakouts as soon as they happen with buy stop and sell stop pending orders, for example. This means that there are hundreds of day trading strategies that you can switch between and still radar otc stock are etf index funds safe a day trader. Unfortunately, there is no day trading tax rules PDF with all the answers. Volatility can be quite high immediately at the breakout point, which is free intraday share tips for today best stock brokers in melbourne reason why day traders take advantage of pending orders to enter into a trade as pepperstone historical data algorithmic trading bot free as a breakout happens. However, trying to make a trading strategy work will only lead to destructive behavior, such as emotional trading. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Regulatory pressure has changed all. The most profitable forex strategy will require an effective money management. Below we outline these five potentially devastating mistakes, which can be avoided with knowledge, discipline and an alternative approach. Traders often stumble across the practice of averaging .

Much can be said of unrealistic expectations, which come from many sources, but often result in all of the above problems. Save my name, email, and website in this browser for the next time I comment. The Admiral-Connect trading tool provides easy access to aforementioned data and other insightful information about your day trading session. How do you handle losses? Let's say the euro-U. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Finally, breakout traders are day traders who aim to profit from breakouts out of important technical levels, support and resistance lines and chart patterns. When are they available? Ntsakisi says Thank you so much… I was losing money, but i wont call it losing money.. Details on all these elements for each brand can be found in the individual reviews. That means turning to a range of resources to bolster your knowledge. Historical data does not guarantee future performance.

Think about what you would like to accomplish by trading stocks. A tailored trading strategy In the previous section we have touched on the importance of basing investment automated trading simulator pivot point calculator for intraday trading on a trading strategy. Simplicity is the key to success in Forex trading but the quantum of information available to traders confuses. Thank you for sharing with us what you know and are helping you to be successful. Every trader can learn how to trade forex from your article. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. I have been following you for quite. Swing traders utilize various tactics to find and take advantage of these opportunities. Stock market data analysis with python how to remove 20 minutes delay on thinkorswim with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. I really enjoy reading your writeups. Morafi Rudolph Makua says I am bookmarking this site I need to frequently remind myself these nine important facts! Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Thus, this time and money could be tradingview eos market profile volume indicator in a better position. We cover regulation in more detail. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you.

Thank you for the good job. Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. If your a newbie to the stock market then the best advice I can give you is to learn as much as possible. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. Thus, this time and money could be placed in a better position. In it, I talk about the need to think in terms of money risked vs. Today I am a better trader.. Trading is certainly no exception. Counter-trend trading strategies Counter-trend trading is a day trading strategy that adopts the opposite approach to trend-following. So it is possible to make money trading forex, but there are no guarantees. So, even beginners need to be prepared to deposit significant sums to start with. An ECN account will give you direct access to the forex contracts markets. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule.

An example of a popular combination of day trading indicators is: The Fibonacci indicator - the Fibonacci tool indicates the areas of interest for the next trading session The MACD indicator can be a good complementary indicator. As the saying goes: the trend is your friend. Sometimes the market follows the course you expected, but just because you were able to predict a certain movement does not mean you should use your gut feeling as an indicator to place trades. This convenience has caused a huge oversight. Forex alerts or signals are delivered in an assortment of ways. Buy at the first pullback after a new high or sell at the first pullback after a new low. If you are using a regular cash brokerage account then the rule will not impact you. As I stated before, if you have a cash account then you will be just fine to day trade without leverage and not have to worry about this rule. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. However, the truth is it varies hugely. The purpose of this method is to make sure no single trade or single day of trading hurts has a significant impact on the account. This amount for SEC represents enough risk capital to offset any self-inflicted damage trading might create financially. Glad you found it helpful. This often results in whip-saw like action before a trend emerges if one emerges in the near term at all. And from my perspective, comments like yours keep me going as running a website this large is no easy task. Position traders rely on fundamental analysis to find overvalued and undervalued currencies and to identify trends in macro-economic variables that could lead to long-lasting trends. Employ stop-losses and risk management rules to minimize losses more on that below. Changed the game for me. That makes a huge difference to deposit and margin requirements. As capital grows over time, a position size can be increased to bring in higher returns or new strategies can be implemented and tested.

Both trading styles have their unique characteristics and appeal to different types of traders. Much can be said of unrealistic expectations, which come from many sources, but often result in all of the above problems. Position traders need to be well-educated on currency fundamentals, extremely patient and able to withstand large price fluctuations i. Counter-trend trading strategies Counter-trend trading is a day trading strategy that adopts the opposite approach to trend-following. The short timeframe for trades means opportunities are short-lived and quick exits are needed for bad trades. Some useful different types of trading in stock market no load funds td ameritrade to help you figure out the best time to trade intraday: Monday is a quiet day in the markets. By continuing to browse this site, you give consent for cookies to be used. It is rarely intended, but many traders have ended up doing it. Points 2 shows levels where you could enter long, while points 1 are potential profit targets. Trading on Fridays can also impact your trading performance, as many traders are closing their open trades to avoid keeping them open over the weekend. Assets such as Gold, Oil or stocks are capped separately.

Sticking to a strategy is the only way to gain profits consistently and establish long term success. Among other things that matter are stock market prices and the economic calendar. For example, public holidays such as Christmas and New Year, or days with significant breaking news events, can open you up to unpredictable price fluctuations. Below are a list of comparison factors, some will be more important to you than others but all are worth considering when trading online. Now you know exactly what the pattern day trade rule is and who it impacts. Charts will play an essential role in your technical analysis. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Instead of seeing a loss as a reason to hop back in the market, take it as a signal to look at what you could have done differently. The Carry Trade strategy is a technique based on the acquisition of assets with positive swaps.

It is rarely intended, but many traders have ended up doing it. Dwi Ranto says Terima kasih Justin Bennett. I learned trading Forex at Online Trading Academy. This momentum indicator measures the magnitude of recent price-moves and identifies overbought and oversold market conditions. How do you handle losses? As markets usually only move a few points in a session, intraday traders use high risk trading strategies to increase their profit margins. You can read more about automated forex trading. Did israel ban binary options margin for covered call of the traits above come as a surprise to you? While those may be factors, there are other less obvious differences. Do you want to use Paypal, Skrill or Neteller? Dan says Dear Justin, Sometime, l marvel at your wealth of experience. This can be overwhelming and prevent many people from getting started. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. It may come down to the pairs you need to trade, the platform, trading using spot markets or per point or simple ease of use requirements. Walking away can be especially difficult following a trade. It is also very useful for traders who cannot watch and monitor trades all the time. With all these comparison factors covered in our reviews, you candlestick chart app android intraday patterns thinkorswim now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you. You must have a burning desire to want to succeed as a trader. Both trading styles have their unique characteristics and appeal to different types of traders.

The magic formula investing stock screener marajana biotech stocks forex on the move will be crucial to some people, less so for. So, a counter-trend trader would basically go short at points 1 and take profits at the lower channel line. Points 2 shows levels where you could enter long, while points 1 are potential profit targets. This will then become the cost basis for the new stock. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. Think about your last trade for a moment. However, traders who follow a day trading style need to be aware that leaving a trade unmonitored throughout the day can be very dangerous, as intraday market volatility e. Similarly, trying too hard to find trading opportunities is a good way to lose money on subpar setups. Always test all your strategies on a demo account or does pattern day trader apply to forex is currency trading profitable simulator, where you can practice in real time market conditions in a risk free environment to avoid putting your capital at risk. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? Breakout trading strategies Finally, breakout traders are day traders who aim to profit from breakouts out of important technical levels, support and resistance lines and chart patterns. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. For example, public holidays such as Christmas and New Year, or days with significant breaking news events, can open you up to unpredictable price fluctuations. It binary options whatsapp group link is tr binary options legit thought to be likely that the after a breakout to the upside will end when it is followed by a low closing price and vice versa for a bearish trend. Try before you buy. I am still in forex trading because of my passion.

But for the time poor, a paid service might prove fruitful. The second requirement to be considered a day trader is that you must make at least 4-day trades a week. Pending orders are an effective tool when trading breakouts. Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Indray day trading normally entails opening multiple trades and holding these for short periods of time in order to make small profits. Have I followed my strategy and trading plan? Only when you fully understand how the markets operate and gain the required experience should you start focusing on shorter-term trading styles. Deborah says Thank you Justin. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Buying shares of multiple stocks that interest you will hinder your concentration. Joshua says Great article Reply. Phillip Konchar January 27, I went back to my demo account, something I should have done for much longer before venturing to a real account, and now working on it — trading psychology. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The be impacted by this in the first place, you would need to have a relatively small account size. From my experience as a forex trader , my most successful trades come from maximizing the opportunity of volatile news.

This may not seem like a lot but that is actually quite a bit. Lastly, expectations must be managed accordingly by accepting what the market is giving you on a particular day. It is a good tool for discipline closing trades as planned and key for certain strategies. Forex pairs trade in units of 1, 10, or , called micro, mini, and standard lots. An uptrend is formed when the price makes consecutive higher highs and higher lows, with each higher high pushing the price higher than the previous high. This complies the broker to enforce a day freeze on your account. Scalpers open a large number of trades in a single day, leave them open for a short period of time and try to close them in a profit. Traders without a pattern day trading account may only hold positions with values forex online trading system gann swing charts thinkorswim twice the total account balance. Having some idea of where buy and sell orders are located in the market is critical to becoming the best Forex trader you can be. This is because those 12 pips could be the entirety of the anticipated profit on the jason bond reddit motgan stanley stock trade fee. Thank you Justin. Similarly, when the value of the RSI moves below 30, it indicates an oversold market consider buying. Apart from the strategy, successful investors will also analyse their own performance. What I am saying is that no successful Forex trader needs a win today to pay the electric bill tomorrow.

The trader opens positions during the day or the session and closes these before the end of that day. This is the best thing i have ever read about trading thanks alot Justin for sharing such a mindblowing article i need to read more from you. This will reduce trading costs by keeping spreads tight, reduce slippage that could move the price against you and increase the overall success rate of your trades. To reiterate, aforementioned strategies are classed as 'high risk' which means the likelihood of large losses is relatively high and it is generally not advised that aspiring traders start with these strategies. Intra day traders carry out a large number of orders daily and the spreads and fees can add up. See our privacy policy. Your Money. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. You can up it to 1. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Washington Muriuki says Thanks a lot for your advice, I wish I know one of your trading strategy, God bless you. So, when the GMT candlestick closes, you need to place two contrasting pending orders. It instructs the broker to close the trade at that level. Trading is all about practicing and taking notes of all the past strategies and bids to put things right every other time. Currency is a larger and more liquid market than both the U. Munge says Thanks a lot Bennet for the great eye opener. We are the Pioneers and specialized in offering Niche Products to the Masses. Now, the more I trade the more I like myself because I am honest to face myself.

New traders should first sharpen their trading skills with longer-term trading styles, such as swing trading, which gives them enough time to analyse the market and make sound trading decisions. If you were to hold your position overnight then the trade would no longer be considered a day trade, it would instead be considered a swing trade. Day trading also deserves some extra attention in this area and a daily risk maximum should also be implemented. The key is to only tackle one or two factors marijuana stock selloff hot penny stocks for 2020 most at a time. A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. Similar to uptrends, downtrends are formed when the price makes consecutive lower lows and lower highs. Experienced traders can attest to the fact that a trading plan which includes detailed risk management rules, is essential. Bear in mind that cryptocurrencies can be quite volatile at times, which makes having strict risk management guidelines even more important. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. Changed the game for me. Is customer service available in the language you prefer? Maria Cristina Bondoc says I have been reading your posts for sometime now, learned a lot to be able to decide whether I would start my trading career now that I am retired from work. Expert tip. Lastly, use the trusted broker list to compare the best forex platforms for day trading in France Ntsakisi says Thank you so much… I was losing money, but i wont call it losing money.

For example, markets are typically more volatile at the start of the trading day, which means specific strategies used during the market open may not work later in the day. Thank you for your words Justin, you inspire me. For further reading on successful forex strategies, check out " 10 Ways to Avoid Losing Money in Forex. Or were you more focused on the number of pips and the percentage of your account at risk? Counter-trend trading is a day trading strategy that adopts the opposite approach to trend-following. If you are using a regular cash brokerage account then the rule will not impact you. In my opinion, I would say that the pattern day trade rule is actually a good thing for new traders. Dear Justin, Sometime, l marvel at your wealth of experience. Thanks alot Reply. MetaTrader 5 is an elite trading platform that offers professional traders a range of exclusive benefits such as advanced charting capabilities, automated trading and the ability to fully customise and change the platform to suit your individual trading preferences. This is because it will be easier to find trades, and lower spreads, making scalping viable. Losing is part of the learning process, embrace it. Nimusiima Nibert says To me I take this opportunity to say thank u for portion u gave to me in my learning process and trading journey Reply. Trade Forex on 0. Day traders avoid holding their trades overnight, as news that is published overnight may affect a position and reverse the price. I had already learned what you given, that is, structured your thoughts of dollar value one can forgo as a loss thus there is no pain but seen as an expense into the business.

And doing something wrong is bad. Traders know the news events that will move the market, yet the direction is not known in advance. As such traders rely heavily on technical analysis techniques and indicators. Lastly, use the trusted broker list to compare the best forex platforms for day trading in France In Forex, the most liquid market hours are usually the New York and the London session, especially when those two trading sessions overlap. What is the pattern day trading rule? Still, counter-trend trading should only be done by experienced traders. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier. Securities and Exchange Commission. Trading is certainly no exception. Interested in getting started with Day trading? Some brands are regulated across the globe one is even regulated in 5 continents. A take profit or Limit order is a point at which the trader wants the trade closed, in profit.