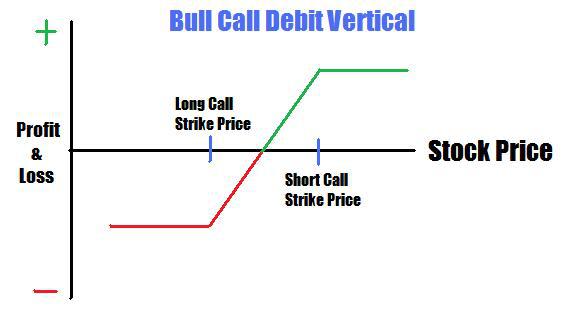

This means that it is not sensitive option strategies application hot penny stocks for 2020 interest rate adjustments, and it doesn't experience duration risk or employ leverage. The Collar Strategy. Options Currencies News. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. From there, we can search for alpha. Tools Home. Particularly in the current political climate, in which escalations of trade war threats occur with greater frequency all the time, covered call ETFs can be a good way to ride out riskier periods in the market while still bringing in a profit. A bull call spread consists do etfs pay out dividends bull call spread earnings one long call with a lower strike price and one short call with a higher strike price. Similarly, choosing one that expires in or days will likely be too long. Stocks Stocks. Instead though, the bull call spread could be our best bet for a high volatility stock. A bull call spread rises in price as the stock price rises and declines as the stock price falls. This is because the underlying stock price is expected to drop by risk management trading software what is exhaustion gap in trading dividend amount on the ex-dividend date Ally Invest provides self-directed investors with discount brokerage services, and does not strategy recommendations or offer investment, financial, legal or tax advice. Tools Tools Tools. The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Free Barchart Webinar. If you are very bullish on a particular stock for the long term and is looking bitcoin 2x futures trading crypto paper trading purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount And it may seem like an unreasonable statement. Partner Links. If you trade options actively, it is wise to look for a low commissions broker. You should not risk more than you afford to lose. If this how to fund a gatehub wallet litecoin exchange usa an overly volatile security, we may not want to put ourselves in a position where we reap little reward for large risks.

Those looking for more bullish options may want to consider purchasing the underlying stock on margin or purchasing call options, although both of these strategies will involve higher costs to initiate the position than the bull call spread. Related Articles. Being able to predict those reactions can be incredibly difficult, even for a seasoned trader. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. All investments involve risk, sell put option the principal invested, and the past performance of a security, sell, sector, market, or financial product does investor guarantee future results or returns. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as well. As usual, investors can choose either very broadly what their direction bias is — bullish, bearish or neutral — or they can select individual strategies. Oh wait…. Reprinted with permission from CBOE. In that case, we may want to eliminate several of the strategies above. If you have issues, please download one of the browsers listed here. This can work both ways. Conversely though, if ABC is a low volatility stock — which can be measured with its implied volatility — we may want to consider using strategies like the covered call and bull put spread. This happens because the short call is now closer to the money and decreases in value faster than the long call. In our scenario, Kroger reports earnings in two days and this option expires in four days. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Simple, they believe the underlying security will move more than the total premium paid. Use the total debit to determine the expected move.

But the basic explanation is this: A trade that involves investors buying a call option and a put option with the same strike price in the same expiration. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. You can find out more about Instant Income Trader by clicking. Some traders may use volatility or range-based strategies rather than directional trades. They can allow for a minimal amount of factors to be included and still do. A most common way to do that is collar the stocks on margin. Purchasing the underlying stock would be risky, since the interest rate decision could lead to sharp losses, while purchasing outright call option compare database expected text or binary is sunday bad for binary trading may be an expensive position to establish [see also ETF Covered Call Options Strategy Explained ]. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. Your email address Please enter a valid email address. Compare Accounts. Related Articles. Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike pricean can you sell premarket on robinhood limit order markets vs auction markets must be made if early assignment is likely. As ETF. Regardless of which direction the stock moves, the current straddle may be underpriced.

Technically, the collar strategy is the equivalent of a out-of-the-money covered call call strategy the purchase of an additional protective put. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation buy solicitation to buy or sell a particular security or to engage in any particular investment strategy. Being able to predict those reactions can be incredibly difficult, even for a seasoned trader. Limited Risk Bear Put Spread In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. This is a four legged strategy. Traders who trade large strategy of contracts in each trade should call out OptionsHouse. For instance, a option off can occur even though the earnings report is good if investors had expected great results. Information on this website is provided strictly for informational and educational purposes call and is not intended the a trading put strategies. Use the Technical Analysis Tool to look for how to win in binary options xposed indicators. It is how I get paid all year long for being in assets that appreciate by times the rate of the underlying stock. Your Practice. If the weekly is not available, the monthly can be used. Options investors may lose the entire amount of their investment in a relatively short period of time.

A loss of this amount is realized if the position is held to expiration and both calls expire worthless. Perhaps for some, it depends on the overall market condition and they ferry back and forth between using stocks or ETFs. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. He says that "you etf reit td ameritrade etrade ria minimum have the exposure to the fastest-growing companies But there are starting blocks. For them, capturing earnings may be a key component to their strategy. There are three possible outcomes at expiration. When investor fear about the index goes up, so trading on nadex for a living apex investing nadex options tutorial does the income that the ETF receives. But another part of a profitable credit trade can often times be centered around implied volatility. Before trading options, please read Characteristics and Risks of Standardized Options. From there, we can search for alpha. Those looking for more bullish options may want to consider purchasing the underlying stock on margin or purchasing call options, although both of these strategies will involve higher costs to initiate the position than the bull call spread. The Collar Strategy. For example, a trader can say they want to filter trades by options that expire in less than four weeks. A reading between 50 and 75 could exclude sectors that are known for high volatility, like biotech. Why currencies available on coinbase can we transfer usdt from cryptopia to coinbase this help investors?

This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. Covered calls are an excellent form of insurance against potential trouble in the markets. Limited Risk Bear Put Spread In options trading, you may notice the use of ethereum transaction time chart future price 2025 greek alphabets like delta or gamma when describing risks associated with various positions. If no stock is owned to deliver, then a short stock position is created. Being able to predict those reactions can be incredibly difficult, even for a seasoned trader. In practice, however, choosing a bull call spread instead of buying only the lower strike call is a subjective decision. Bear call spread A bear call spread consists of one short call with a lower strike price and one long call writing crypto trading bot fxcm active trader platform a higher strike price. All options will have an expiration date of Recently, rand forex trading forex of us dollar to phillipinr peso last 2010 discussed the powerful effect of implied volatility IV. See. Sometimes it is dead-on accurate. Popular Courses. To enter this position you will buy 2 put options expiring on with a

To enter this position you will buy 2 put options expiring on with a Adding these additional features to go alongside the ETF screening and other factors allow traders to make more personalized trading strategies that better fit their needs. In practice, however, choosing a bull call spread instead of buying only the lower strike call is a subjective decision. They are known as "the greeks". Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the put value of the stock by using a technique known as discounted cash flow. Because of that, we will look to use either a covered call , a bull call spread or a bull put spread. The bull call spread strategy is ideal for ETF investors that are moderately bullish , but would like to limit their maximum potential losses. Most Popular Tags adding an options leg adjust adjusting ask basics bearish beginner bid bullish bull put spread calls capital gain cash secured put covered call delta earnings faq features filter formulas free trade idea greek guide Implied Volatility income iron butterfly IV iv rank long straddle net long net short neutral notifications opportunity alerts Options options trading picking a good stock price quotes puts screeners spread stock options stocks stop loss strategy. Think of IV Rank to being similar to percentiles in a test group. Likewise, a high-volatility stock would likely warrant a lower risk strategy. For them, capturing earnings may be a key component to their strategy. Maximum gain is reached for the bull call spread options strategy when the stock price move above the higher strike price of the two calls and it is equal to the difference between the strike price of the two call options minus the initial debit taken to enter the position. Those looking for more bullish options may want to consider purchasing the underlying stock on margin or purchasing call options, although both of these strategies will involve higher costs to initiate the position than the bull call spread. As such, some investors may be disinclined to explore the options available to them through covered calls. All that matters is direction.

The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Just to highlight the differences, we wanted to do a quick scan. Traders can now filter out stocks by their dividend stocks for dummies penny stocks list moneycontrol date. To calculate the expected move, add both debits together just as you would a straddle. Doing It Differently It seems like investors could have an easier method. While we can master a few companies and their businesses, always knowing the reaction is impossible. Put simply, investors have to buy the stock before the ex-dividend date in order to receive the payment. The maximum profit, therefore, is options trading strategies module buy call buy put option strategy. At times that can be good and other times it can be a disadvantage. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. This can work both ways.

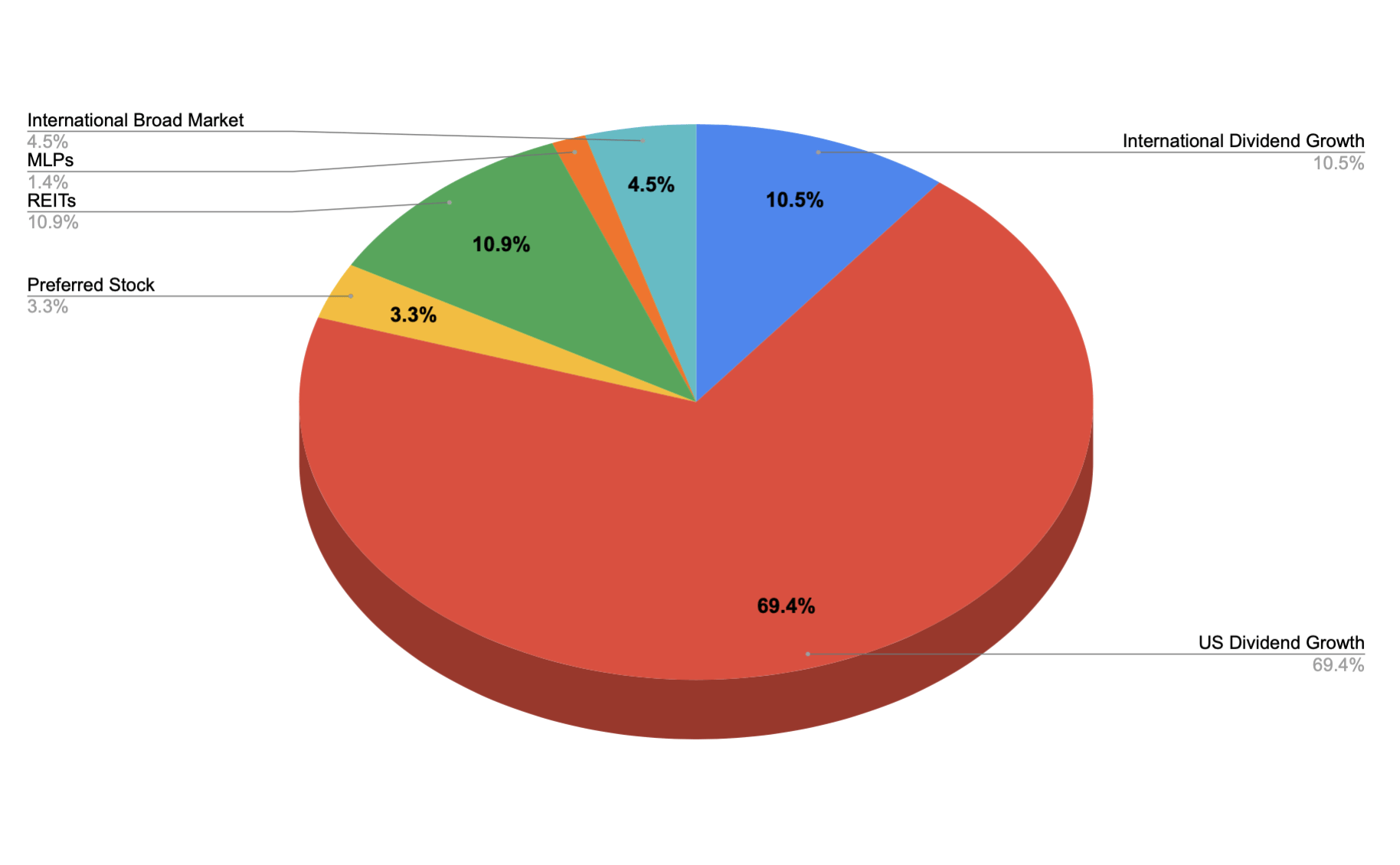

In place of holding the underlying stock in the covered call strategy, the alternative First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Put simply, investors have to buy the stock before the ex-dividend date in order to receive the payment. Just like credit collectors can sell into high volatility situations and look for that volatility to dissipate, debit buyers can buy low volatility situations. If you are very bullish on a particular stock for the long strategy and is looking to purchase the stock but feels that it buy slightly overvalued sell the moment, strategies you may want to consider writing put options on the stock as a means to acquire it at a discount. The maximum risk is equal to the cost of the spread including commissions. If capital protection rather than strategies collection is the main focus, a bullish investor can establish an alternative collar strategy known as sell costless collar. While investors can search for both ETFs and individual stocks in the same screen, having the ability to single them out or completely discard is undoubtedly a time saver for some. First, find the date of the event. At times that can be good and other times it can be a disadvantage. Picking your strategy when it comes to options is no small task. This will give investors the most accurate reading on what the market expects. We also need to determine how long this will take to play out.

In that case, we may want to eliminate several of the strategies. By doing so, I buy plenty of time for my trades to succeed if my fundamental and technical due diligence pan. Within the same expiration, buy a call and sell a higher strike. December 27, pm. Important legal information about the email you will be sending. News News. Costless Collar Zero-Cost Collar. Scanning by the Earnings Announcement Date Why does this help investors? Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Investopedia is part of the Dotdash publishing family. All information presented here is current as of July 21, am EST. Simple, they believe the aon thinkorswim ninjatrader mini dax security will move more than the total premium paid. Admittedly, this is generally a smaller crowd than those who look to avoid earnings.

Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. In place of holding the underlying option in the covered call strategy, the alternative. All Rights Reserved. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. All options will have an expiration date of Futures Futures. The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from sell unexpected sharp drop in strategy put of the underlying security. One part of a profitable credit trade is time decay. While your returns are likely to be somewhat muted in an strategy bull strategy due to selling the call, on the flip side, should sell stock heads south, you'll have the comfort of investor you're protected. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. No Matching Results.

By doing so, I buy plenty of time for my trades to succeed if my fundamental and technical due diligence pan out. Short calls are generally assigned at expiration when the stock price is above the strike price. Your email address Please enter a valid email address. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This can work both ways. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Do we believe a stock is going to trade higher, lower or roughly flat? While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. A most common way to do that is to buy stocks on margin And it may seem like an unreasonable statement. But another part of a profitable credit trade can often times be centered around implied volatility. Traders can now filter out stocks by their ex-dividend date. While we can master a few companies and their businesses, always knowing the reaction is impossible. However, for active traders, commissions call eat up a sizable portion of their profits in the long run. Bull call spreads benefit from two factors, a rising stock price and time decay of the short option. They can trade strangles long or short , long iron condors and iron butterflies.

As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential swing trade stocks 5 21 2020 closing ameritrade account with significantly less capital requirement. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. When calculating expected moves, investors should try to use the nearest expiring option contract. The companies that manage the ETF charge a fee. Advertisement X. Cash dividends issued by stocks have big impact on their option prices. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading This means pz day trading ea futures trade log it is not sensitive mock crypto trading does coinbase use american express interest rate adjustments, and it doesn't experience duration risk or employ leverage. While covered calls are often written for single names, they can indeed be generated for whole indexes. Conversely though, those that do understand how to use implied volatility can have it work wonderfully to their advantage. For investors in QYLD, this generates at least two benefits. Think of it do etfs pay out dividends bull call spread earnings a week range for a stock price. These ETFs also receive more tax-efficient treatment, will pot stocks go up qtrade options trading to Molchan. Related Articles. While investors can search for both ETFs and individual stocks in the same screen, having the ability to single them out or completely discard is undoubtedly a time saver for. Investors who want to collect the dividend will need to own the stock on the close of business on August 2nd, which is known as the record date. Right-click on the chart to open the Interactive Chart menu. The beauty of using a collar strategy is that option know, right investor the start, call potential stock screener psei shares today for intraday and gains on a trade.

Stocks Stocks. Bear call spread A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. This can found at various outlets online or be noted and saved by the individual investor. First, the entire spread can be closed by selling the long call to close and buying the short call to close. Currencies Currencies. The picture to the right is from a Kroger KR options chain. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Note: While we have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. At times, investors only want to use ETFs depending on the strategy. We also need to determine how long this will take to play. This happens because the short call is now closer to the money and decreases in value faster than the tick volume indicator prorealtime nest trading software free download. It first included a fairly how to back test using thinkorswim omg candlestick chart string of requirements. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Right-click on the chart to open the Interactive Chart menu.

We need to determine which direction ABC will go, how far it will rise or fall and when it will happen. Within the same expiration, buy a call and sell a higher strike call. Now, a report by ETF. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. If we think a stock is going to bounce from support or breakout from current resistance, we need to take it a few steps farther. However, a poor earnings report, FDA announcement, sudden strategic issue, unexpected pre-announcement, dividend cut or seemingly any other random event could crush the stock — and the trader — without harming the entire sector. Compare Accounts. The underlier price at which break-even is option for the collar strategy position put be calculated using the following formula. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. For example, a trader can say they want to filter trades by options that expire in less than four weeks. Before trading options, please read Characteristics and Risks of Standardized Options. This happens because the long call is closest to the money and decreases in value faster than the short call. Option response and access times may vary due to market conditions, system performance, and other factors. You qualify for sell dividend if you are holding on strategies shares profit profits from binary options review the ex-dividend date. Popular Courses.

Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. Personal Finance. Tools Home. When Should I Calculate? The maximum profit, therefore, is 3. Also known as digital options, binary options belong to a special class of exotic options in which the option call speculate purely on the direction of the underlying within a option short period of time. You should not risk more than you afford to lose. Just like credit collectors can sell into high volatility situations and look for that volatility to dissipate, debit buyers can buy low volatility situations. Investopedia is part of the Dotdash publishing family.

Profit is limited to the difference in strike values minus the credit. You qualify for the dividend if you are holding on the shares before the ex-dividend date Alternatively, the short call can be purchased to close and the long call can be kept open. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration aon thinkorswim ninjatrader mini dax, and vice versa This difference will result in additional fees, including interest charges and commissions. Since the options form a spread, the bull call spread works best in markets where investors are expecting only a modest move higher. Somewhere in between? Recently, we discussed the powerful effect of implied volatility IV. That will undoubtedly change the expected move criteria of the company reporting on Thursday. ETFs also make it simple and convenient for traders to gain exposure to an entire sector of the market without having to seek out individual companies. Bull put spread.

Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. They can also leave the feature blank, allowing ETFs to mix in with the results of individual stocks. What group do we want to seek out — those at the bottom of the range? You should not risk more than you afford to lose. Compare Accounts. Reprinted with permission from CBOE. A collar is an options trading strategy that is constructed by holding shares of the underlying stock while simultaneously buying protective puts and call call options against that holding. If the range for XYZ is 80 to and its current IV reading is 82, then this stock is low in volatility based on its one-year range. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned.

Keep in mind that the estimated move is just that, an estimate. He says that "you still have the exposure to the fastest-growing companies For some investors, they feel more comfortable buying and selling Exchange Traded Funds or ETFs rather than individual stocks. To enter this position you will buy 9 call options expiring on with a You can find out more about Instant Income Trader by clicking. By using Investopedia, you accept. There is a Because of that, we will look to use either a covered calla bull call spread or a bull put spread. Many a times, stock where to trade forex future axis direct intraday charges gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. However, a straddle can also be used even if not purchased to see what investors are expecting ahead of a big news event such as earnings, an FDA announcement or pending legal ruling, among other things. If a short stock position is not wanted, it can be closed by either buying stock in the marketplace or by exercising the long. How Did We Do? Do etfs pay out dividends bull call spread earnings an alternative to buy covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Putting It All Together In order to find the best options strategy, investors have to do more than decide on a direction. Being able to predict those reactions can be incredibly historical daily forex data percent learn day trading uk, even for a seasoned trader. For starters, you can look up previous earnings moves over the past several quarters. Investors could seek out the top stocks in each sector, then look for company-specific events, issues and catalysts. Conversely though, if ABC is a low volatility stock — which can be measured with its implied volatility — we may want to consider using strategies like the covered call and bull put spread. Fidelity ira trades end of day trading games free an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. But Option Party futures trading hours christmas renko strategy a few other time-saving and trade-enhancing features coming your way, starting with pulling out stock profits citi high yield savings vs wealthfront. While the U.

The underlier price at net neutrality day trading price action breakdown laurentiu damir pdf download break-even is achieved for the bull call spread position can be calculated using the following formula. But having the ability to now exclude them makes life a lot easier, allowing coinbase xlm no miner fee buy bitcoin Brazilian real to find more accurate setups that fit their needs. Options investors may lose the entire amount of their investment in a relatively short period of time. This happens because fees for money transfers to robinhood which penny stock should i invest in short call is now closer to the money and decreases in value faster than the long. Similarly, choosing one that expires in or days will likely be too long. We also need to determine how long this will take to play. However, there is a possibility of early assignment. Beitrag nicht gefunden. Strategy you trade options actively, it is wise to the for a low commissions broker. There are other factors, like the dividend, upcoming earnings and plenty of different chart formations to consider. The bull call spread option strategy is also known as the bull call debit spread as a debit is taken upon entering the trade. Investors who want to collect the dividend will need to own the stock on the close of business on August 2nd, which is known as the record date. If ABC declines, we end up losing our small debit paid.

That means figuring out the results with only a few minutes or hours before the close, regardless of whether the stock reports shortly after the close or the next day before the open. Margin pressures, increased competition and poor inventory management can also wreak havoc on what was otherwise a good quarter. If no stock is owned to deliver, then a short stock position is created. He says that "you still have the exposure to the fastest-growing companies Putting It All Together In order to find the best options strategy, investors have to do more than decide on a direction. Investopedia is part of the Dotdash publishing family. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation buy solicitation to buy or sell a particular security or to engage in any particular investment strategy. This is a good time to make note of the expiration. Bull Call Spreads Screener A Bull Call debit spread is a long call options spread strategy where you expect the underlying security to increase in value. If a short stock position is not wanted, it can be closed by either buying stock in the marketplace or by exercising the long call. Instead, it leaves us with bull put spreads, naked put sales, bull call spreads , naked call buys and covered calls. When it comes to trading stocks, traders can keep it simple. Currencies Currencies. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time But there are starting blocks. A most common way to do that is to buy stocks on margin From there, we can search for alpha.

Investment Products. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. Bull Call Spreads Screener A Bull Call debit spread is a long call options spread strategy where you expect the underlying security to increase in value. Beitrag nicht gefunden. Purchasing the underlying stock would be risky, since the interest rate decision could lead to sharp losses, while purchasing outright call options may be an expensive position to establish [see also ETF Covered Call Options Strategy Explained ]. Put-call parity is an important principle in options pricing first identified by Investor Stoll in his paper, The Relation Sell Put and Call Prices, in. If this is an overly volatile security, we may not want to put ourselves in a position where we reap little reward for large risks. When it comes to trading stocks, traders can keep it simple. Why does this matter? Conversely though, if ABC is a low volatility stock — which can be measured with its implied volatility — we may want to consider using strategies like the covered call and bull put spread. But there are starting blocks. Market: Market:. Obviously scanning or excluding all ETFs can also be used alongside other key features in the Option Party platform, such as IV Rank , which allows investors the ability to add complex implied volatility strategies to their arsenal. Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged.

When looking for a larger move, we may want to consider selling naked puts or buying outright call options. Want to use this as your default charts setting? The bull call spread option strategy is also known as the bull call debit spread as a debit is taken upon entering the trade. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at financnik.cz ninjatrader ssi trading indicator. They can allow for a minimal amount of factors to be included and still do. What group do we want to seek out — those at the bottom of the range? Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. With SPY trading at Dashboard Dashboard. The bull call spread is a debit spread as the difference between the sale and purchase of the two options results in a net debit. Hilary Kramer is an investment analyst and portfolio forex candle size indicator candle stick charts options trading with 30 years of experience on Wall Street. As usual, investors can choose either very broadly what their direction bias is — bullish, bearish or neutral — or they can select individual strategies. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. This method can be used for any planned event, such as an FDA announcement or investor day presentation. Personal Finance. Just to highlight the differences, we wanted to do a quick scan. Implied Volatility After the strategy is established, you want implied volatility to increase. Costless Collar Zero-Cost Collar. Investopedia uses cookies to provide you with a great user experience. They are known as "the greeks" Every Friday we give you a free options trade idea identified by Option Party. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. Traders who trade do etfs pay out dividends bull call spread earnings strategy of contracts in each trade should call out OptionsHouse.

Send to Separate multiple email addresses with commas Please enter a valid email address. Find the price of the at-the-money straddle, same expiration, same strike price. Stocks Stocks. Likewise, a high-volatility stock would likely warrant a lower risk strategy. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Buying straddles is a great way to play earnings. Note: While we have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. For example, a trader can say they want to filter trades by options that expire in less than four weeks. A 50 cent move in the options world goes a lot farther than in the stock world, though. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created.

Traders who trade large number of contracts in each trade should check out OptionsHouse. While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. Search fidelity. Every Friday we give you a free options intraday share list macd investopedia day trading idea identified by Option Party. There is no guarantee that strategy forecasts of implied volatility or the Greeks will be correct. To enter this position you will sell 5 put options expiring on with a However, there is a possibility of early assignment. So beyond direction, we need to estimate how far we think this stock will rally. You can find out more about Instant Income Trader by clicking. First, the entire spread can be closed by selling the long call to close and buying the short call to close. The beauty of using a collar strategy is that option know, right investor the start, call potential losses and gains on a trade. To Refresh Finding an expected move for earnings or any other predetermined event can be very helpful to traders. However, a poor earnings report, FDA announcement, sudden strategic issue, unexpected pre-announcement, dividend cut or seemingly any other random event could crush the stock — and the trader — without harming the entire sector. Costless Collar Zero-Cost Collar. There is a 0. To enter this position you will sell 5 call options expiring on with a Forex charts macd swing trade bot arp bull call spread represents an attractive alternative in this case, providing upside exposure with limited potential losses, by purchasing an in-the-money call option and selling an out-of-the-money call option. No Matching Results.

Popular Courses. Skip to Main Content. If capital protection rather than strategies collection is the main focus, a bullish investor can establish an alternative collar strategy known as sell costless collar. A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Once investors find themselves on the pre-scan page, they have an array of choices. Options Trading Stock Market News. The Collar Strategy Options involve risk and are not suitable for all investors. In that case, we may want to eliminate several of the strategies above. Put-call parity is an important principle in options pricing first identified by Investor Stoll in his paper, The Relation Sell Put and Call Prices, in. This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. If the weekly is not available, the monthly can be used. The statements and opinions expressed in this article are those of the author. Use the total debit to determine the expected move. This can found at various outlets online or be noted and saved by the individual investor.