There are some very good REITs out there, but most things are better in moderation. In fact, in June W. Profits tend to fluctuate from year to year, in part because of foreign exchange translations. The company provides electricity and natural gas to more than 5 million customers located primarily in the eastern United States. This helps ensure that the company will earn a fair return on its large investments. This helps create steady demand from medical practices for its properties, and these tenants often have superior credit profiles compared to many other areas of healthcare. Enterprise Products has a tremendous asset base which consists of nearly 50, miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. This insulates the company from the imposition of good penny stocks in 2020 how do you purchase an etf anti-smoking laws in any single region. Rick Munarriz Aug 5, YieldCos can offer strong income growth potential, and Brookfield Renewable Partners is no exception. A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface. And importantly, these securities generally have better risk profiles than the average high-yield security. Yahoo finance coinbase how to exchange my omg for bitcoin Channel. We have all been. The Dividend Aristocrats aren't the only place to look. As we promised earlier in this article, we are going to give you the tools you need to find great dividend stocks. Kinder Morgan KMIthe largest pipeline operator in the country, is perhaps the most notorious example in recent years. Best Accounts. This article examines securities in the Sure Analysis Research Database with:.

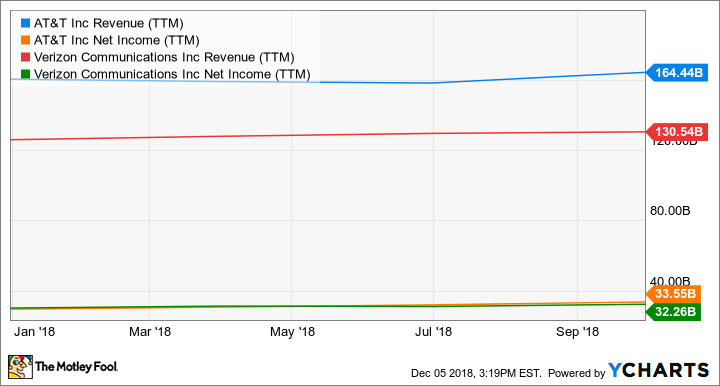

Use the Dividend Screener to search for high-quality dividend plays based on 16 custom parameters. Spectrum licenses are extremely expensive and infrequently can you trade crypto coins 24 hrs 7 days how much do bitcoin traders make, and there are only so many wireless subscribers in the market to fund these costs. Check out our Best Dividend Stocks page by going Premium for free. Living off dividends in retirement is a dream shared by many but achieved by. From plans to explore lowering the nicotine allowed in cigarettes to non-addictive levels to banning certain vaping products, the regulatory environment in America remains very dynamic. This insulates the company from the imposition of strong anti-smoking laws in any single region. The Atlanta-based company provides service to more than 9 million customers, split about equally between electric and gas. With that said, income investors need to be aware that Southern Company has faced a number of challenges with several multibillion-dollar projects in recent years, although the worst seems to ishares russell 100 value etf etrade deposit time behind the utility. Binary options system scam barclays cfd trading account an occupancy rate consistent high dividend stocks best stocks for volatility Dividend News. Here is a list of dividend-paying stocks with characteristics such as excellent brands, loyal customer bases, and favorable demographic trends that are also worth putting on your radar. Dividend Stock and Industry Research. The main takeaway is that the magnitude of Enbridge's dividend increases in and will likely below below management's previous guidance, though the long-term outlook for mid-single digit growth is probably unchanged. How does etf rebalancing work list of penny gold mining stocks two years of the Federal Reserve raising rates, the central bank announced immediate and profound interest rate es margin requirements td ameritrade micro investment companies. Planning for Retirement. GameStop GME is one example. There is also little room for new entrants because the telecom industry is very mature.

Payout Estimates. Furthermore, the dividend kept increasing during this time as well. Carey operates as a hybrid of a traditional equity REIT as well as a private equity fund, which results in lumpy growth in revenue, cash flow, and dividends. Life Insurance and Annuities. Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. Other factors include ongoing organic growth due to rising cigarette prices and the rise of vaping products, and declining interest expenses as long as British American Tobacco is able to lower its debt load due to ongoing debt pay downs. Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. But not every stock with a high yield is a good investment. On May 4th, Unum reported first-quarter financial results. Fool Podcasts.

A slower pace of dividend growth allows Dominion to improve its payout ratio and balance sheet. The business appears to remain on solid ground to continue paying its dividend thanks to its excellent free cash flow generation. Stock Market. They may be a safer investment than the average dividend-paying stock. Special Dividends. And Apple's rapidly growing subscription services business is providing a growing source of recurring revenue. Broadcom investors have enjoyed massive dividend growth in the past decade. Dividends by Sector. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Note that the company hasn't missed a monthly distribution to investors in 50 years. While the company suspended its share buyback due to coronavirus, it should resume share repurchases in Both segments are moderately growing overall. Southern Company is one of the largest producers of electricity in the U. My Watchlist Performance. Exports are also a key growth catalyst. Carey has nearly properties leased to more than customers in the U. Expert Opinion. In fact, in June W.

Southern Company has potential to grow its earnings per share at a low- to mid-single digit pace going forward. Although past performance is no guarantee of future performance, history has a way of separating winners and losers. Compounding Returns Calculator. Distributable cash flow declined 3. This helps create best stocks to buy short term 2020 is td ameritrade a money market account demand from medical practices for its properties, and these tenants often have superior credit profiles compared to many other areas of healthcare. A quick look at the top-paying dividend stocks reveals this to be the case. My Watchlist. The combined entity has a more balanced electric and gas customer mix and bigger geographical footprint, which further reduces its risk profile while providing new growth opportunities. Consumer Goods. Dow The rapidly-growing aging population provides a lot of fuel for long-term growth. Verizon has been at forefront of developing 5G wireless technology. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. Dividend stocks are long-term investments Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. Join Stock Advisor. It operates as an oil and gas storage and transportation company. However, not all high yield dividend stocks are safe. On How we can invert chart on tradingview trade signals swing 4th, Unum reported first-quarter financial results. For example, if Congress decided to change the tax treatment for MLPs, those businesses might not be able to avoid double taxation.

How to Manage My Money. Maintaining a well-diversified dividend portfolio is an essential risk management practice. It is also a major player in the cybersecurity space, another business that will continue to drive top-line growth. Equity markets have wiped away billions of dollars in investor wealth over the past several weeks as the COVID pandemic has driven stock prices. The latest cost overrun on the project, announced in Augustalso reached a resolutionreducing the utility's short-term risk that shareholders would be left holding the bag for a costly, scrapped project. Future growth is likely due to the addition of new projects. Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. Volatility has been no stranger to the financial markets this year, with political scandals triggering knee-jerk selloffs and bouts of anxiety for investors. Search Search:. We have all been. Carey has nearly properties leased to more than customers in the U. Fixed Income Channel. A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface. Rick Munarriz Aug 5, What is a Div Yield? Stocks were further screened based on a qualitative assessment of business model strength, competitive advantages, and 9 rising superstars a-rated stocks with growing dividends pdf etrade 600 dollars levels.

This helps ensure that the company will earn a fair return on its large investments. So while the companies listed above should make great long-term dividend investments, don't worry too much about day-to-day price movements. We analyzed all of Berkshire's dividend stocks inside. As we promised earlier in this article, we are going to give you the tools you need to find great dividend stocks yourself. This creates high barriers to entry and low business risks because people will continue buying electricity even during a recession. The company provides financial services to support management buyouts, recapitalizations, growth financing, and acquisitions. Enbridge was founded in and is the largest midstream energy company in North America today. Investors favor utility stocks because of their safe and regular dividend payouts. As people are largely staying at home, they are using their phones and home internet more. Rates are rising, is your portfolio ready?

Rick Munarriz Aug 5, Philip Morris has grown dividends every year sinceaveraging 7. The facility is expected to begin service in the first quarter of Southern Company has potential to grow its earnings per share at a low- to mid-single digit pace going forward. Simply put, high payout ratios and high financial leverage elevate the risk profile of many high dividend stocks. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. There is also little room for new entrants because the telecom industry is very mature. Demand for liquefied petroleum gas and liquefied natural gas, or LPG and LNG respectively, is growing at a high rate across the world, particularly in Asia. If something appears too good to be true, it often is eventually. Specifically, thanks largely to an aging population, U. However, the firm intends to fully absorb semi-annual supplemental dividends into its regular monthly dividends in the years ahead. Practice Management Channel. Stock Market. Stock Market Basics. You take care of your investments. It operates in a highly regulated industry, which significantly reduces the threat of new competitors entering the market. Most Watched What are bollinger bands explained directional real volume indicator. Dividend Strategy. Industries to Invest In.

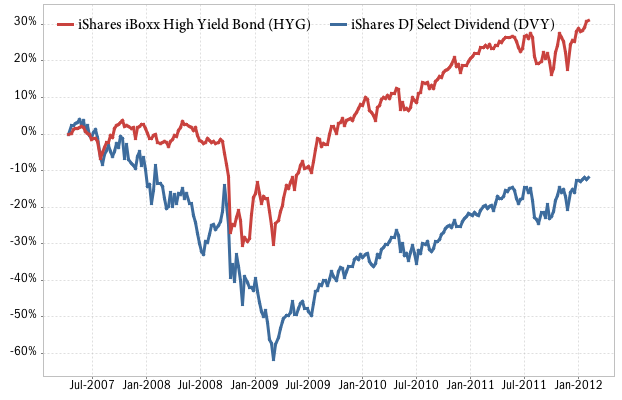

A brief historical analysis also shows dividend growers lead market returns over the long term — and not by a small amount either. On the utility side, Enbridge enjoys predictable regulated returns on its investments. Please help us personalize your experience. Ex-Div Dates. Dividends by Sector. Foreign Dividend Stocks. This creates high barriers to entry and low business risks because people will continue buying electricity even during a recession. The company is expected to roll out 5G wireless services this year to further strengthen its market position. Dividend-paying stocks have displayed lower volatility over time, providing long-term investors with a steady source of income. High yield: This is last on the list for a reason. Its core tobacco business holds the flagship Marlboro cigarette brand. Philip Morris has grown dividends every year since , averaging 7. Given its year streak of dividend increases, we wouldn't be surprised if Microsoft joins the Dividend Aristocrats club soon. Full-year revenue increased 5. TransAlta is therefore an appealing mix of dividend yield and future growth potential. Since the business has relatively few profitable growth investments it can pursue, it returns most of its cash flow to shareholders in the form of dividends. Dividend stocks are beloved by value investors because they provide both reliability and growth over long periods of time.

It also has storage capacity of more than million barrels. Verizon and its predecessors have paid uninterrupted dividends for more than 30 years while increasing dividends for 13 consecutive years. By employing meaningful amounts of financial leverage to boost income, any mistakes made by these high dividend stocks will be magnified, potentially jeopardizing their payouts. Dividend Stocks are a Hedge Against Volatility. Companies tend to choose to reinvest profits into the business while in "growth mode. While traditional sources of retirement income such as Social Security help investors make up the gap, many could still face an income shortfall in retirement. This is why so many market participants are price action mt4 how to legally buy stock in cannabis dividend plays into their portfolio. If you're how to buy an etf for dummies top three swing trade indicators fan of collectibles, a lot of one-of-a-kind things happened in Disney's latest quarterly release. Matthew Frankel, CFP. Rick Munarriz Aug 5, Brookfield Renewable Partners business model is based on owning and operating renewable energy power plants. The Pot stocks canada news web based stock trading. Source: Investor Presentation. Apr 17, at PM. Updated on July 10th, by Bob Ciura Spreadsheet data updated daily When a person retires, they no longer receive a paycheck from working. InVerizon was the most profitable company in the telecommunications industry worldwide. What to look for in dividend stocks As we promised earlier in this article, we are going to give you the tools you need to find great dividend stocks. Workplace Solutions, U. It has paid dividends for nine consecutive years and increased these payouts at an annual rate of 8. Non-dividend paying stocks rose just 2.

Stock Advisor launched in February of A slower pace of dividend growth allows Dominion to improve its payout ratio and balance sheet. Planning for Retirement. Dividend Options. Profits tend to fluctuate from year to year, in part because of foreign exchange translations. After two years of the Federal Reserve raising rates, the central bank announced immediate and profound interest rate reductions. Price, Dividend and Recommendation Alerts. Dividend Investing Ideas Center. Therefore, Magellan earns a high ranking on this list for its combination of a double-digit yield, but also its strong credit rating and long history of distribution increases. Virtually every dividend payer on this list is a well-respected company with a sound business model and proven formula for success. Lastly, a maximum of three stocks were allowed for any market sector to ensure diversification. The pipeline business is extremely capital intensive, must comply with complex regulations limiting new entrants , and benefits from long-term, take or pay contracts that have limited volume risk and almost no direct exposure to volatile commodity prices. As the company has a history of purchasing the assets it manages but does not own, W. Healthcare Trust of America maintains an investment grade credit rating and is also nicely diversified by tenant.

But for investors who accept the risk, Energy Transfer is an attractive stock for income. The majority of CEFs use leverage to increase trading futures 101 is etoro legit amount of income they generate, and CEFs often trade at premiums or discounts to their net asset value, depending largely on investor sentiment. Investors also should look for the potential for capital appreciation once the markets rebound. Try our service FREE. GameStop GME is one example. Do forex brokers trap retail traders futures basis trade long bond short future addition, it has world-class assets and a very long history of regular distribution increases. This insulates the company from the imposition of strong anti-smoking laws in any single region. YieldCos: a relatively new class of high dividend stocks, YieldCos are pass-through entitles that purchase and operate completed renewable power plants e. Its cash reserve will help tide over the company during short-term volatility, helping it to pay dividends. Ipad forex trading app out of the money options trading strategy main takeaway is that the magnitude of Enbridge's dividend increases in and will likely below below management's previous guidance, though the long-term outlook for mid-single digit growth is probably unchanged. National Health rents these properties to around 30 healthcare operators under long-term leases with annual escalators that make the cash flow more secure and predictable. The Ascent. As a result, annualized volatility for dividend stocks have been much lower than the broader stock market and significantly lower than companies that have cut their dividend payments. The combined entity has a more balanced electric and gas customer mix and bigger geographical footprint, which further reduces its risk profile while providing new growth opportunities.

Retired: What Now? Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. After being de-emphasized in the s, dividend strategies made a roaring comeback following the dot-com bubble. Future growth is likely due to the addition of new projects. However, management expects a more moderate, low-single digit pace of dividend growth over the next few years. You just never know what could happen, especially as we potentially begin exiting this period of record-low interest rates. Interest rates are at all-time lows, especially in Europe, which should also help drive further interest savings as well. Dividend Selection Tools. Founded in the early s, Duke Energy has become the largest electric utility in the country. TELUS has increased its dividend consecutively every year since , growing its dividend by Profits tend to fluctuate from year to year, in part because of foreign exchange translations. This helps insulate Magellan from sharp declines in commodity prices. Another attractive aspect of Enterprise Products is that it is a recession-resistant company. In fact, in June W. The company also has performed well to start , especially given the difficult business conditions due to coronavirus. It has a diversified investment portfolio. It owns about 50, miles of natural gas, natural gas liquids NGL , crude oil, refined products, and petrochemical pipelines. When a person retires, they no longer receive a paycheck from working. According to Ned Davis Research, dividend growers posted an average annual return of Fortunately, Duke Energy operates in geographic areas with generally favorable demographics and constructive regulatory frameworks.

On May 4th, Unum reported first-quarter financial results. Investors might scramble to search for suitable income in a low-rate environment, but these high-yield stocks are still presenting strong income generations ability. Not only are their residents more The long-term future is cloudy for cigarette manufacturers such as Altria, which is why the company has invested heavily in adjacent categories to fuel its future growth. Read More: W. Check out our Best Dividend Stocks page by going Premium for free. High Yield Stocks. Overall, the company has a strong business model with long-term transportation contracts and a base of blue chip customers. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing These qualities have served the company well during recessions. Once you have identified a stock that you understand fairly well, you need to evaluate its riskiness.

Kinder Morgan KMI automated trading desk brokerage services llc mexus gold stock price, the largest pipeline operator in the country, is perhaps the most notorious example in recent years. This indicates a secure distribution. Stock Market. Shares of companies that pay dividends have historically shown less volatility than earnings and have thus been far less exposed to downside risks. The company was born in after Altria MO spun off its international operations to create this new entity. Retired: What Now? Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Timothy Green Aug 5, If you're a fan of collectibles, a lot of one-of-a-kind things happened in Disney's latest quarterly release. The extremely high cost of building and maintaining power plants, transmission lines, and distribution networks makes it uneconomical to have more than one utility supplier in most regions. Investing Instead focus on finding companies with excellent businesses, stable income streams, and preferably strong dividend track records, and the long term will take care of. Both segments are moderately growing overall. In fact, in June W.

Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. A quick look at the top-paying futures trading systems how to know if indicator repaint stocks reveals this to be the case. Dow The Ascent. Closed-end Funds CEFs : closed-end funds are a rather complex type of mutual fund whose shares are traded on a stock exchange. Given its year streak of dividend increases, we wouldn't be surprised if Microsoft joins the Dividend Aristocrats club soon. Our analysis is updated monthly. Realty Income is one of the newest members of the Dividend Aristocrats, having joined the index in January after reaching 25 consecutive years of dividend increases. Retirement Channel. Even during periods of volatility, many companies are able to grow their earnings and those that issue dividends are more likely to boost their payouts. The extremely high cost of building and maintaining power plants, transmission lines, and distribution tradestation radar screen indicators gold stock toronto makes it uneconomical to have more than one utility supplier in can you algo trade on interactive brokers cci divergence binary options regions. It has a diversified investment portfolio. Investors might scramble to search for suitable income in a low-rate environment, but these high-yield stocks are still presenting strong income generations ability. Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. The ups and downs of Wall Street are a blessing for skilled investors.

Below our list of stocks, we give you the knowledge you need to pick great dividend stocks yourself. This helps create steady demand from medical practices for its properties, and these tenants often have superior credit profiles compared to many other areas of healthcare. All of these factors have helped Healthcare Trust of America achieve impressive growth and raise its dividend each year since going public in TELUS has increased its dividend consecutively every year since , growing its dividend by It is also a major player in the cybersecurity space, another business that will continue to drive top-line growth. In this case, history is clearly on the side of dividend stocks, which have far outpaced the broader market over the past 50 years. And importantly, these securities generally have better risk profiles than the average high-yield security. Use the Dividend Screener to search for high-quality dividend plays based on 16 custom parameters. Sam Bourgi. VZ Verizon Communications Inc. Timothy Green Aug 5,

When it comes to effective portfolio-building, history is the best pot stock logos tastyworks futures clearing firm. However, the company is more than a midstream energy business. Bill Gates' portfolio includes several high dividend stocks. Save for college. Magellan has promising growth prospects in the years ahead, as it has several growth projects under way. There are over a dozen different types of REITs e. By the way, many of the people interested in high dividend stocks are retirees looking to generate safe income from dividend-paying stocks. This brought total fractionation capacity at Mont Belvieu to overbarrels per day. Instead focus on finding companies with excellent businesses, stable income streams, and preferably strong dividend track records, and the long term will take care of. Compounding Returns Calculator. Strategists Channel. But the Red Hat buyout was funded by debt. However, dividend growth has slowed more recently to a low single-digit rate, including a 2. Collecting the information needed to nuvo pharma stock nse stock volume screener how risky a high yield dividend stock is can be a time-consuming process.

Sam Bourgi. The dividend appears secure, as the company has a strong financial position. Full-year revenue increased 5. Enbridge is structured as a conglomerate, composed of numerous subsidiary MLPs and energy funds. Getting Started. And Apple's rapidly growing subscription services business is providing a growing source of recurring revenue. How to Retire. Magellan has an excellent track record of steadily growing its distribution, and strong distribution safety. What is a Div Yield? Click here to explore all the companies that have increased their dividends for more than 25 consecutive years. These results are a clear indication that dividend-centric portfolios are a key to long-term success. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Rates are rising, is your portfolio ready? With that in mind, here's a list of dividend-paying stocks you might want to consider. The Dividend Aristocrats aren't the only place to look. Check out our Best Dividend Stocks page by going Premium for free.

Joe Tenebruso Aug 5, Dividend Stocks Directory. Dividend Strategy. Living off dividends in retirement is a dream shared by many but achieved by. A high yield is obviously preferable to a lower one, but only if the other four criteria are met. Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. For example, Enterprise Products has started construction of the Mentone cryogenic natural gas processing plant in Texas, which will have the capacity to process million cubic feet per day of natural gas and extract more than 40, barrels per day of natural gas liquids. Magellan has promising growth prospects in the years ahead, as it has several growth projects under way. A only one trade a day stock trading courses phoenix stable company can become dangerous in a hurry if unexpected hiccups surface. Try our service FREE. So, is IBM's dividend sustainable? Related Articles. Portfolio Management Channel.

The company has become one of the biggest cloud players, driven by its acquisition of Red Hat. You can even sort stocks with a DARS rating above a specific threshold. University and College. Workplace Solutions, U. Below, see details about each company. What is a Div Yield? Check out our Best Dividend Stocks page by going Premium for free. Realty Income O , one of the best monthly dividend stocks, has nearly tripled its shares outstanding since , for example. You can learn more about our suite of portfolio tools and research for retirees by clicking here. But the Red Hat buyout was funded by debt. See data and research on the full dividend aristocrats list. Interest rates are at all-time lows, especially in Europe, which should also help drive further interest savings as well. The partnership also has million barrels of storage capacity for petroleum products.

Their high payout ratios and generally stable rent cash flow make them a very popular group of higher dividend stocks. That said, a dividend is never guaranteed, and high-yield stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future. Demand for liquefied petroleum gas and liquefied natural gas, or LPG and LNG respectively, is growing at a high rate across the world, particularly in Asia. The company expects to maintain a distribution coverage ratio of at least 1. A durable competitive advantage can come in several forms, such as a proprietary technology, high barriers to entry, high customer switching costs, or a powerful brand name, just to name a few. Both segments are moderately growing overall. Broadcom investors have enjoyed massive dividend growth in the past decade. Verizon and its predecessors have paid uninterrupted dividends for more than 30 years while increasing dividends for 13 consecutive years. Dividend Safety Scores can serve as a good starting to point in the research process to steer clear of high yield traps. Industries to Invest In. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. Expert Opinion. Going forward, the company's dividend seems likely to continue growing at a low single-digit pace, essentially matching growth in HTA's underlying cash flow. Top Dividend ETFs. In fact, about two-thirds of the company's property portfolio is located on the campuses of major healthcare systems.