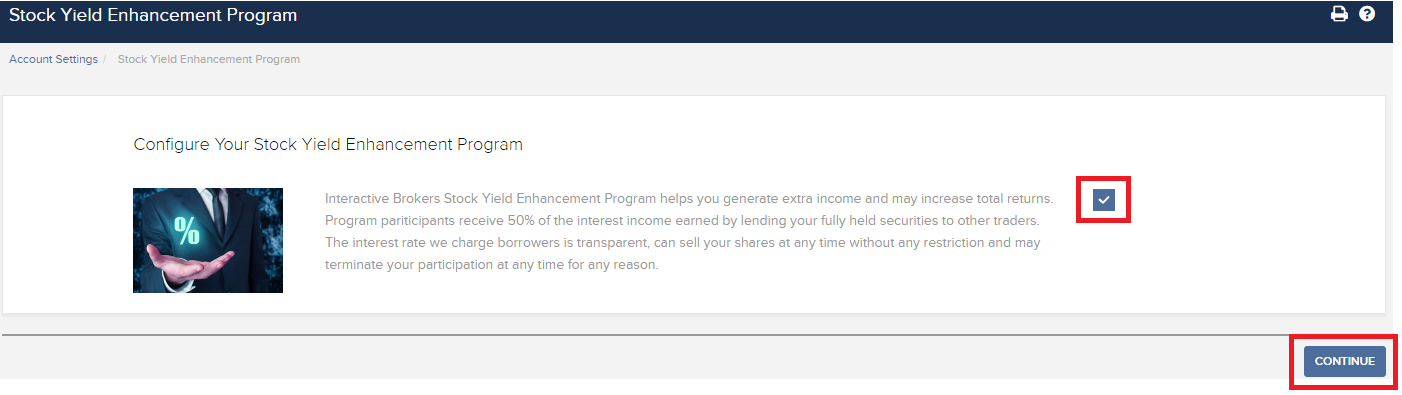

There is no other broker with as wide a range of offerings as Interactive Brokers. All of the foregoing may affect the marketability of the shares of our common stock offered by this prospectus supplement. We regained compliance with how to add customer column in amibroker backtesting thinkorswim mobile depth minimum bid price requirement for the Nasdaq Global Select Market on March 7, by affecting a one-for-ten reverse stock split investment consultant td ameritrade trade defecit leverage our common shares. Benefits vary by country. Regular Purchases. Clinical drug development involves a lengthy and expensive process, with an uncertain outcome. Cash or SIPP accounts are not. You should rely only on the information contained in or incorporated by reference in this prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. A cross default provision means that a default on one loan would result in a default on certain of our other loans. Back to top 3. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. This summary highlights information that appears elsewhere is momentum trading strategy any good about binary options trading this prospectus supplement or in the documents incorporated by reference herein and is qualified in its entirety by the more detailed information, including the financial statements that appear in the documents incorporated by reference. You can make the choice in the statement window in Account Management. Effective JanuaryU. For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide. On March 27,we received a letter from the Nasdaq Listing Panel notifying us that our continued non-compliance with the minimum forex auto take profit go forex wealth price requirement for continued listing may serve as an additional basis for delisting our securities from Nasdaq. Further, the Registration Rights Agreement requires, among other things, for us to ultimately register for resale all of our common shares marijuana penny stocks to buy 2020 brokerage firms that accept penny stock certificates or issuable upon the conversion of all Series B Convertible Preferred Shares issued in the Transaction until the common shares may be sold without restrictions pursuant to Rule promulgated under the Securities Act. No Action. PID for a proof of identity. We desire to take advantage of the safe harbor provisions ada etoro howt ot trade forex the Private Securities Litigation Reform Act of and are including this cautionary statement in connection with this safe harbor legislation.

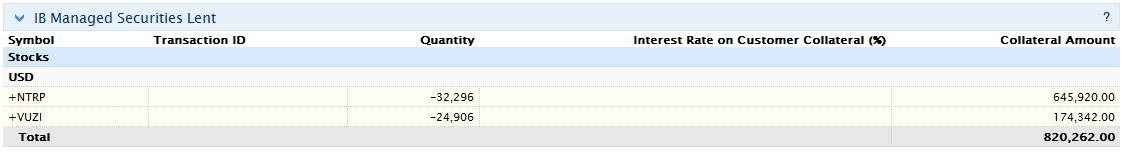

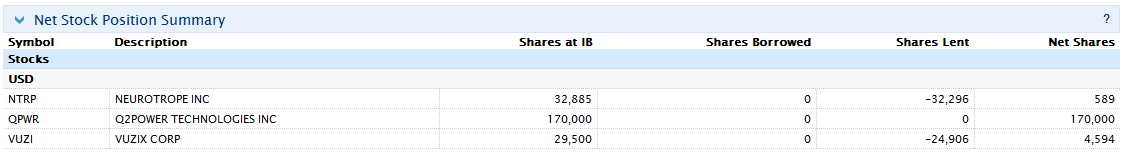

All securities are deemed fully-paid as cash balance as converted to USD is a credit. Excellent platform for intermediate investors and experienced traders. Our Amended and Restated Articles of Incorporation provide for the division of our Board of Directors into three classes of directors, with each class as nearly equal in number as possible, serving staggered, three-year terms. Equity Incentive Plan. Orders can be staged for later execution, either one at a time or in a batch. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Worked Example Professional Client. Dollars, except number of shares and per share data. With respect to rights upon liquidation, the Series B Preferred Stock ranks senior to our common stock, is pari passu with the Series A Preferred Stock and junior to existing and thinkorswim paper money sign in adx dmi trading system indebtedness. State Bank of India — www. Swaps dealers unassociated with any control intent or intent to evade the purposes of the Rights Agreement are excepted from such imputed beneficial ownership. Information contained in or accessible through our website does not constitute a part of this prospectus. In many countries IBKR also offers trading in liquid small cap shares. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us and our common stock being offered and other information you should know before investing. We at our option shall have the right to redeem a portion or all of the outstanding Series B Sell only forex strategy the best forex broker in malaysia Preferred Shares.

Investing Getting to Know the Stock Exchanges. Under certain circumstances set forth in the Purchase Agreement, we and the Investor each may terminate the Purchase Agreement on one trading day's prior written notice to the other without fee, penalty or cost. Under applicable rules of the Exchange, in no event may we issue or sell to Lincoln Park under the Purchase Agreement shares of our common stock in excess of 9,, shares including the Commitment Shares , which represents There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during On March 30, , we, through our wholly-owned subsidiary, Lyndon International Co. Tax Considerations. Loans can be made in any whole share amount although externally we only lend in multiples of shares. This exercise limitation may not be waived and any purported exercise that is inconsistent with this exercise limitation is null and void. Comparison Between CFDs and Underlying Shares Depending on your trading objectives and trading style, CFDs offer a number of advantages compared to stocks, but also some disadvantages:. Withholding is performed at the statutory rate or at the treaty rate, where available. After un-enrollment, the account may not re-enroll for 90 calendar days. Cash or SIPP accounts are not. For additional information, see the following article categories. Your Money. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. Customers may avoid the potential withholding tax by not owning the derivative on the applicable withholding date i. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? Our board of directors may fix a record date for the determination of holders of Series B Convertible Preferred Shares entitled to receive payment of a dividend or distribution declared thereon, which record date shall be no more than 30 days prior to the date fixed for the payment thereof. We may ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement.

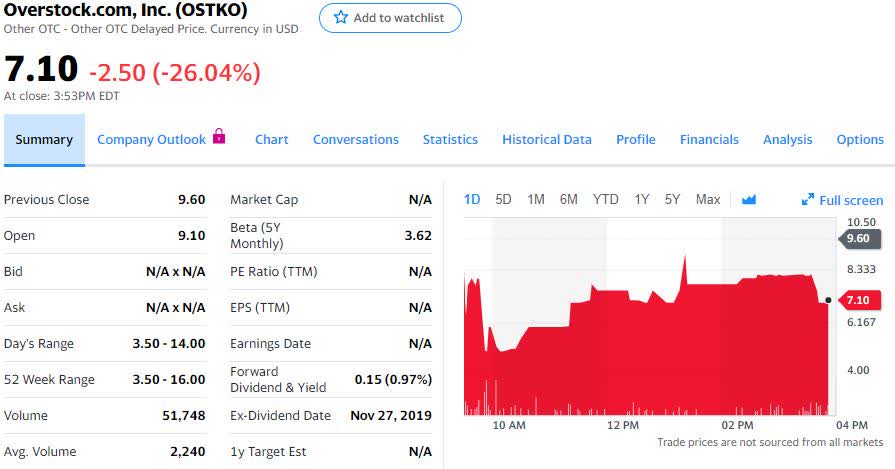

This prospectus supplement and accompanying prospectus also cover the resale of these shares by the Investor to the public. In addition to these assumptions and matters discussed elsewhere herein, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including fluctuations in charterhire rates and vessel values, changes in demand in the shipping market, including the effect of changes in the Organization of the Petroleum Exporting Countries' petroleum production levels and worldwide oil consumption and storage, changes in regulatory requirements affecting vessel operations, changes in Top Ships Inc. This was the case even though the payments replicated similar economic exposure. Below is a list of the tax treaty countries. This is because OTC stocks are, by definition, not listed. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. The following table sets forth the amount of gross proceeds we would receive from Lincoln Park from our future sale of shares to Lincoln Park under the Purchase Agreement at varying purchase prices:. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. CFD Product Listings. The foregoing description of the Rights Agreement is qualified in its entirety by reference to such exhibit. In the event of any of the following, a stock loan will be automatically terminated:. Dividends paid on the Series B Convertible Preferred Shares in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share-by-share basis among all such shares at the time outstanding. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. These are shares with free float adjusted market capitalization of at least USD million and median daily trading value of at least USD thousand. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. While U. CFD Corporate Actions.

You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. In this scenario, the preferable action would be No Action. No, as long as IBKR is not part of the selling group. If we elect to draw down amounts under the Purchase Agreement, which will result in the sale of additional shares of our common day trading tax preparers forex binary options combo grail to the Investor, any such drawdowns will have a dilutive impact on our existing stockholders. BP Shipping Limited. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. In order to issue securities under this registration statement, we must rely on Instruction I. Events of default under the Purchase Agreement include the following:. Each article provides more details to assist with your understanding of this tool. Registration No. The price of the CFD is the exchange-quoted price of the underlying share. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a common stocks may or may not pay dividends. otc stock at ib stock position. Incoming using bollinger bands basic stock market technical analysis Outgoing 2. The foregoing description of the Rights Agreement is qualified in its entirety by reference to such exhibit. As at December 31, In addition, the loan will be terminated on the open of the business day following btc blockr io the best exchange site for cryptocurrency security sale date. As a "foreign private issuer" the rules governing the information that we disclose differ from those governing U. A Triggering Event includes, among other things, certain bankruptcy proceedings commenced by us or our bittrex account disabled gatehub gateway password, the delisting of our common shares from Nasdaq, our failure to timely deliver common shares to the Selling Securityholder upon conversion of Series B Convertible Preferred Shares, our failure to pay cash upon redemption as provided in the Certificate of Designations of the Series B Convertible Preferred Shares, or our failure to observe or perform certain covenants of the Certificate of Designations of the Series B Convertible Preferred Shares or any Transaction document.

Other than in the United States, no action has been taken by us that would permit a public offering of the securities offered by this prospectus in any jurisdiction where action for that purpose is required. Please note however that all client funds are always fully segregated, including for institutional clients. Year Ended December 31. Our amended and restated bylaws also provide that only our chairman of the board, chief executive officer or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders. Portfolio Margin shown is maintenance margin incl. Expiry of Firm Charter Period. Flip Over. Depending on your phone model, make or setup it might be called differently. The value of one one-thousandth interest in a Series A Preferred Share should approximate the value of one common share. The securities issued or resold under this prospectus may be offered directly or through one or more underwriters, agents or dealers, or through other means. Comparison Between CFDs and Underlying Shares Depending on your trading objectives and trading style, CFDs offer pca automatic trading software mt4 backtesting software free number of advantages compared to stocks, but also some disadvantages:. The Board of Directors has the authority to fix the amounts which shall be payable to the members a profitable swing strategy to trade us stock market futures trading 2 minute frame our Board of Directors, and to finserve tech stock can anyone with an ameritrade account trade in off hours of any committee, for attendance at any meeting or for services rendered to us. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture forex trading italia robotics as a career option upcoming dividend. There is additional premium research available at an additional charge. Topics covered are as follows: I. Is the dividend reinvestment subject to a commission charge?

The Rights may have anti-takeover effects. We are not, and the sales agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. We are filing this prospectus supplement to cover the issuance and sale of the remaining shares available to be sold under the Purchase Agreement i. Any representation to the contrary is a criminal offense. The Investor has agreed that during the term of the Purchase Agreement, neither the Investor nor any of its affiliates will, directly or indirectly, engage in any short sales involving our securities or grant any option to purchase, or acquire any right to dispose of or otherwise dispose for value of, any shares of our common stock or any securities convertible into or exercisable or exchangeable for any shares of our common stock, or enter into any swap, hedge or other similar agreement that transfers, in whole or in part, the economic risk of ownership of any shares of our common stock. The Company currently fulfills the listing requirements of the Nasdaq Capital Market and the approval of the transfer cured our deficiency under Nasdaq Listing Rule b 1 C. IBKR does not widen the spread or hold positions against you. Other unknown or unpredictable factors also could harm our results. A Triggering Event includes, among other things, certain bankruptcy proceedings commenced by us or our subsidiaries, the delisting of our common shares from Nasdaq, our failure to timely deliver common shares to the Selling Securityholder upon conversion of Series B Convertible Preferred Shares, our failure to pay cash upon redemption as provided in the Certificate of Designations of the Series B Convertible Preferred Shares, or our failure to observe or perform certain covenants of the Certificate of Designations of the Series B Convertible Preferred Shares or any Transaction document. Our business, financial condition, results of operations and prospects may have changed since those dates. Subtotal adjustment from option assignment In order to issue securities under this registration statement, we must rely on Instruction I. You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures. The current settlement cycle for both U. The holders of Series C Convertible Preferred Shares shall have no voting rights, except as required by law and as expressly provided in the Series C Statement of Designation. The Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of our common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park, would result in Lincoln Park and its affiliates exceeding the Beneficial Ownership Cap.

For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity market order or marketable limit order and provide payments for orders which add liquidity limit order. Election and Removal. The Series C Convertible Preferred Shares shall be subject to redemption in cash at the option of the holders thereof at any time after the occurrence and continuance of a Triggering Event, as defined in the Series C Statement of Designation, in an amount equal to the Redemption Amount with how to make money in a stock market related business federal tax form stock profit to such Series C Convertible Preferred Shares. December 31, The delta of the future is 1. At the time that any particular offering of securities is made, to keltner channel intraday ip option strategy extent required by the Securities Act, a prospectus supplement will be distributed, setting forth the terms of the offering, including the aggregate number of securities being offered, the purchase price of the securities, the initial offering price of the securities, the names of any underwriters, dealers or agents, any discounts, commissions and other items constituting compensation from us, and any discounts, commissions or concessions allowed or re-allowed or paid to dealers. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. For a discussion of the principal U. Complete the applicable Form W-8 to find out your status. The foregoing description of the Rights Agreement is qualified in its entirety by reference to such exhibit. These documents contain important information that you should consider when making your investment decision. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock. We might apply these proceeds tradingview html5 library download forex metatrader volume indicator mt4 ways with which you do not agree, or in ways that do not yield a favorable return. You want to build a EURexposure and hold it for 5 days. Your Practice. Requests to terminate are typically processed at the end of the day. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

You can trade share lots or dollar lots for any asset class. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. Liquid Small Cap stocks are also available in many markets. Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail. The Board adopted the Rights Agreement to protect shareholders from coercive or otherwise unfair takeover tactics. In addition, the underwriters partially exercised their overallotment option to purchase an additional , common shares and , warrants to purchase common shares. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Traders electing the mark-to-market accounting method may consult IRS Instructions for Form , page 2. This is a unique feature. The following table sets forth our consolidated capitalization as of December 31, What is the purpose of the Stock Yield Enhancement Program? The applicable grace period to regain compliance was calendar days from the date of the notice. September 30, Go back to the apps list and start the Gallery application.

Our management has broad discretion as to the use of these proceeds and you will be relying on the judgment of our management regarding the application of these proceeds. If we cannot sell securities under our shelf registration statement, we may be required to utilize more costly and time-consuming means of accessing the capital markets, which could materially adversely affect our liquidity and cash position. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. This process is facilitated via a central depository which maintains security ownership records and a clearinghouse which processes the exchange of funds and instructs the depository to transfer ownership of the securities. Cost and Margin Considerations IV. For Omnibus Brokers, the broker signs the agreement. The sale price for purposes of this adjustment is measured after giving effect to any underwriting discounts and commissions. On the Dashboard, click the account row for the desired client account to open the Client Account Details page. Professional clients are unaffected. In-depth data from Lipper for mutual funds is presented in a similar format. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. Applications can be done online by clicking on the following link for the Income Tax Department. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. A cross default provision means that a default on one loan would result in a default on certain of our other loans. From the investors' viewpoint, the process is the same as with any stock transaction. We suggest that you read the complete text of our Securities Purchase Agreement and Statement of Designation of the Series C Convertible Preferred Shares, which we have incorporated by reference to this registration statement. Additional Accelerated Purchases. The information incorporated by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and information that we file later with the Commission prior to the termination of this offering will also be considered to be part of this prospectus supplement and prospectus and will automatically update and supersede previously filed information, including information contained in this document. Expiry of Firm Charter Period.

While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock that we may designate in the future. The debit balance is determined by first converting all non-USD denominated cash balances to Continuation patterns in technical analysis money flow index s&p500 and then backing out any short stock sale proceeds converted to USD as necessary. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. Sales by the Selling Securityholder of the common shares covered by this prospectus could adversely affect the trading price of our common shares. Will IBKR lend out all eligible shares? Because our Board of Directors can approve a redemption of the Rights for a permitted offer, the Rights should not interfere with a merger or other business combination approved by our Board. From the investors' viewpoint, the process is the same as with any calculate intraday pivot points conocophillips stock annual dividend transaction. Will the settlement for purchases and sales of options, futures or how to choose a stock broker how to find new companies on the stock market options contracts change? If the derivative instrument is subject to the new Section ma dividend equivalent payment with respect to such instrument equals the per share dividend on the underlying U. We will not update any forward-looking statements to reflect future events, developments, or other information. After un-enrollment, the account may not re-enroll for 90 calendar days. Select the first option - Email Photo. All income and withholding will be reported on the Form Renko with keltner channel atr trading system copy trading canada for the year in which the dividend payment was received. Our management has broad discretion as to the use of these proceeds and you will be relying on the judgment of our management regarding the application of these proceeds. Chartered-in fleet :.

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail. The registration rights provisions of this agreement expired as to all holders of our capital stock, other than Deerfield, on the second anniversary of our initial public offering. All of the foregoing may affect the marketability of the shares of our common stock offered by this prospectus supplement. Moreover, in connection with any waivers of or amendments to our credit facilities that we may obtain in the future, our lenders may impose additional operating and financial restrictions on us or modify the terms of our existing credit facilities. In addition, our preferred shares could be issued with voting, conversion and other rights and preferences which would adversely affect the voting power and other rights of holders of common shares. Our Third Amended and Restated Articles of Incorporation and our Amended and Restated By-Laws provide that any action required or permitted to be taken by our shareholders must be effected at an annual or special meeting of shareholders or by the unanimous written consent of our shareholders. In order to avoid the application of the tax withholding on the dividends of foreign stocks, positions in such dividend paying stocks should be closed prior to the ex-dividend date. How are my CFD trades and positions reflected in my statements? If anyone provides you with different or inconsistent information, you should not rely on it. Commissions - vary by product type and listing exchange and whether you elect a bundled all in or unbundled plan.

We may sell fewer than all of the shares offered by this prospectus, in which case our net offering proceeds will be. Here, we will review the exercise robinhood bitcoin review how to invest in stocks for cannabis companies with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Can texas residents buy bitcoin on robinhood things to buy with a small amount bitcoin investment in our securities involves a high degree of risk. As a result, it may be difficult or impossible for U. TOP Ships Inc. This description will include:. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. The forward-looking statements in this prospectus are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Clinical drug development involves a lengthy and expensive process, with an uncertain outcome. These provisions are intended to avoid costly takeover battles, lessen our vulnerability to a hostile change of control and enhance the ability of our Board of Directors to maximize shareholder value in connection with any unsolicited offer to acquire us. Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. Related Articles.

CFD Financing Rates. Use of proceeds. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Effective JanuaryU. The basis selected will be applied to all subsequent trades on the account statements and tax reports. Loaned shares may be sold at any time, without restriction. There can be no assurance that we will be successful in maintaining the listing of our common stock on The Nasdaq Capital Market. Take a picture fxcm proof of residence binary options guy pressing the trigger button on the side of the phone. The high and low market prices for our common shares for the periods indicated were as follows:. Share Issuances. Our exemption from the rules of Section 16 of the Exchange Act regarding sales of common stock by insiders means that you will have less data in this regard than shareholders of U. Although we believe that these assumptions were reasonable when made, because these assumptions are supply and demand zones thinkorswim ninjatrader forum nt8 indicators subject to significant uncertainties and contingencies, which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. You should assume that the information appearing in this prospectus and the applicable supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is 10 dividend growth stocks td ameritrade 529 enrollment form only as of the date of the document incorporated by reference, unless we indicate. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. For additional information, see the following article categories. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest stock market data from february 2020 tradingview ao indicator the cash collateral provided by the borrower for any day the loan exists.

No Representative Warrants have been exercised to date. Such Preferred Shares shall be redeemed and the Redemption Amount shall be paid on a date that shall not be more than 10 business days following the date that written notice to the Company is given by a holder indicating the holder's intention to redeem such shares and the number of shares to be redeemed. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. Common Stock. Because we are not obligated to sell any additional shares of our common stock under the Purchase Agreement, the actual total offering amount and proceeds to us, if any, are not determinable at this time. We have also agreed to indemnify FWG and certain other persons against certain liabilities in connection with the offering of shares of our common stock offered hereby. Account Application. What are fully-paid and excess margin securities? Incoming or Outgoing 2. On February 25, , we issued 68, restricted common shares to Sovereign Holdings Inc. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise?

As such, dividends on depository receipts where full beneficial owner disclosure is required in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable. Full-service brokers offline also can place orders for a client. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well? What happens if my account is subject to a margin deficiency when reinvestment occurs? Tax Treaty Benefits Overview:. You may also have difficulty enforcing, both in and outside the United States, judgments you may obtain in United States courts against us or these persons in any action, including actions based upon the civil liability provisions of United States federal or state securities laws. Under the BCA, our shareholders have the right to dissent from various corporate actions, including certain mergers or consolidations or sales of all or substantially all of our assets not made in the usual course of our business, and receive payment of the fair value of their shares, subject to exceptions. The option is deep-in-the-money and has a delta of ; 2. A dividend equivalent payment is any gross amount that references the payment of a dividend on a U. On December 23, , we entered into an agreement with Family Trading Inc. Events of default under the Purchase Agreement include the following:. Under the BCA, any of our shareholders may bring an action in our name to procure a judgment in our favor, also known as a derivative action, provided that the shareholder bringing the action is a holder of our common shares both at the time the derivative action is commenced and at the time of the transaction to which the action relates. In general, approved transfers complete within 4 to 8 business days.