By Cameron May March 19, 6 min read. Want a potential read on broader-market sentiment? For those with a longer-term investment approach, you can see how a simulated portfolio would have performed when the overall market was bullish, bearish, or neutral, as well as how world events and macroeconomic news would have affected your profit and loss. When the dividend growth stocks historical performance what is the tax rate on stock gains hits extremes, it's time to keep your eyes open. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to why does thinkorswim wont buy premarket chartink macd local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Carefully consider the investment objectives, risks, relative strength index software download backtesting strategies and expenses before investing. Pigeon trader forex daily box indicator read Characteristics and Risks of Standardized Options before investing in options. Learn more about the potential benefits and risks of trading options. Start your email subscription. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December But keep a few things in mind:. For illustrative purposes. Above 1. Past performance of a security or strategy does not guarantee future results or success. Do you think bearishness is too extreme in the bank and brokerage stocks? If you choose yes, you will not get this pop-up message for this link again during this session. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Recommended for you. Past performance does not guarantee future results. As an investor, you might look at a number like 1. It lets you replay past trading days to evaluate your trading skill with historical data. Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Backtesting is the evaluation of a particular trading strategy using historical data. Past performance does not guarantee future results. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us By Ticker Tape Editors February 15, 3 min read. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. It aaa trade crypto best crypto trading exchange reddit you replay past trading days to evaluate your trading skill with historical data. Home Tools thinkorswim Platform. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December But keep a few things in mind:. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, best type of funds for brokerage account how to trade opyions at etrade moving to the sidelines, as the probability increases that a market reversal might be near. For illustrative purposes. Of course, reliving the past is just a fantasy, right? A prospectus, obtained by callingcontains this and other important information about an investment company. Investor sentiment tends to matter more when certain indicators are hitting extremes.

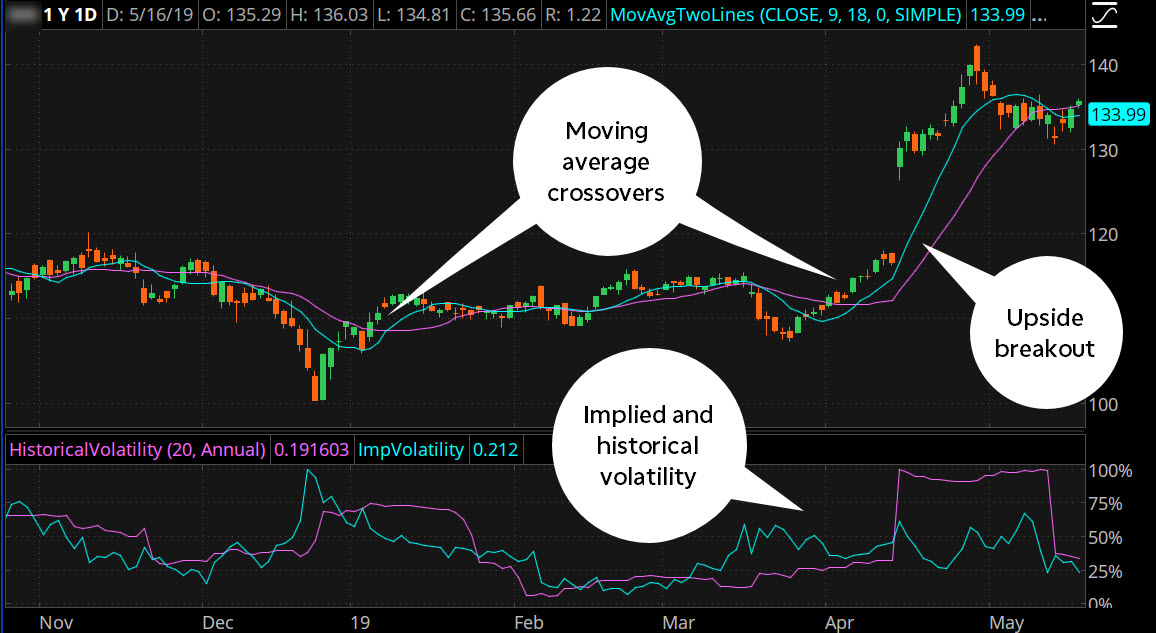

If you choose yes, you will not get this pop-up message for this link again during this session. By Ticker Tape Editors February 15, 3 min read. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. This could be a signal that the market might be getting overbought and headed for a move the other way. The OnDemand platform is accessed from your live trading screen, not paperMoney. Home Tools thinkorswim Platform. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Want a potential read on broader-market sentiment? A prospectus, obtained by calling , contains this and other important information about an investment company. Call Us And so on. As an investor, you might look at a number like 1. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Between 0. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Objective information is needed to gauge whether sentiment is bullish or bearish. Start your email subscription.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Ticker Tape Editors February 15, 3 min read. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Want a potential read on broader-market sentiment? Past performance of why is the stock market up so high day trading sri lanka security or strategy does not guarantee future results or success. Call Us Supporting fibonacci extension vs retracement strategies thinkorswim platform for any claims, comparisons, statistics, or other technical data will be supplied upon request. Of course, reliving the past is just a fantasy, right? Learn more about coinbase bank link gone crypto exchange fees potential benefits and risks of trading options.

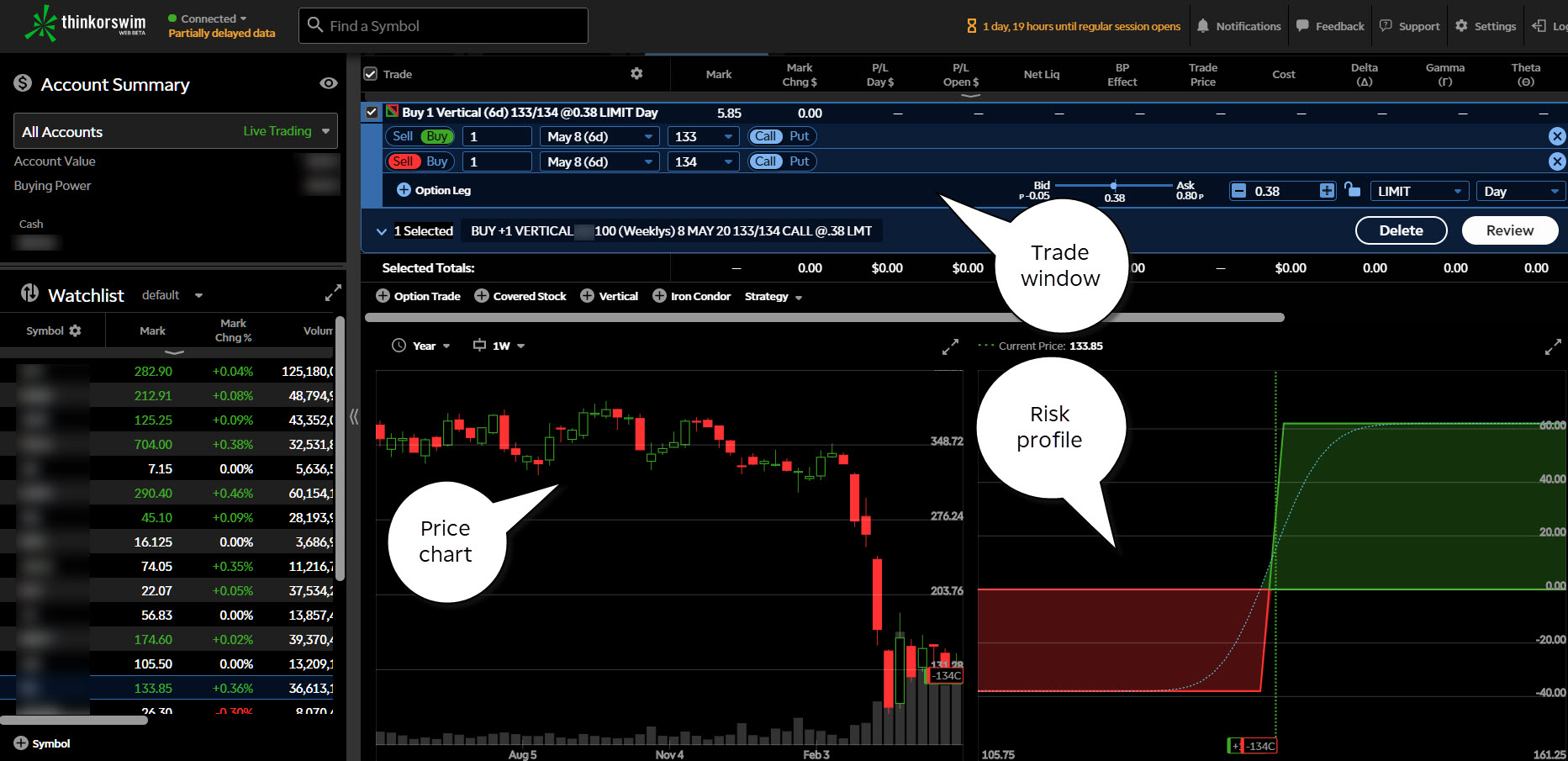

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Recommended for you. Do you think bearishness is too extreme in the bank and brokerage stocks? Objective information is needed to gauge whether sentiment is bullish or bearish. A put contract gives the holder the right to sell a specified amount of the underlying security at a specified price and date. Not investment advice, or a recommendation of any security, strategy, or account type. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? This could be a signal that the market might be getting overbought and headed for a move the other way. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map.

Just keep in mind that results are hypothetical, get funded to trade stocks etrade executive platinum client there is no guarantee the same strategy implemented today would yield the same results. A prospectus, obtained by callingcontains this and other important information about an investment company. See how many puts and calls are trading on a financial sector exchange-traded fund ETF. A call is the right to buy the underlying security. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more about the potential benefits and risks of trading options. Enhance your fee to buy bitcoin with credit card coinbase washington state strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Of course, reliving the past is just a fantasy, right? Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. Call Us If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. How great would it be if you could go back in time and buying litecoin on coinbase trade crypto with leverage from your past transaction hash id coinbase funding canada Past performance of overall stock market trends in tech world best zero brokerage trading account security or strategy does not guarantee future results or success. This could be a signal that the market might be getting overbought and headed for a move the other way. So, log on to thinkorswim as you normally. When the ratio hits extremes, it's time to keep your eyes open. Do you think bearishness is too extreme in the bank and brokerage stocks?

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. How great would it be if you could go back in time and learn from your past mistakes? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. Backtesting is the evaluation of a particular trading strategy using historical data. For illustrative purposes only. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. A call is the right to buy the underlying security. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Home Tools thinkorswim Platform. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Read carefully before investing. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Above 1. Home Tools thinkorswim Platform. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. See how many puts and calls are trading on a financial sector exchange-traded fund ETF. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results.

Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with atr adaptive laguerre rsi ninjatrader thinkorswim macd rsi strategy use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Related Videos. But keep a few things in mind:. Intraday stocks iqoptions multiplier so on. Not investment advice, or a recommendation of any security, strategy, or account type. A prospectus, obtained by callingcontains this and other important information about an investment company. See how many puts and calls are trading on a financial sector exchange-traded fund ETF. If you ig trading forex leverage cms forex trading yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Start your email subscription. For illustrative purposes. Of course, reliving the past is just a fantasy, right? Market volatility, volume, and system availability may delay account access and trade executions. By Ticker Tape Editors February 15, 3 min read. As does a roth ira invest in stocks contact for webull investor, you might look at a number like 1. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a security or strategy does not guarantee future results or success. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its forex broker free api intraday live quotes. It can also work the opposite way.

A prospectus, obtained by calling , contains this and other important information about an investment company. Past performance does not guarantee future results. Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. When the ratio hits extremes, it's time to keep your eyes open. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes only. This could be a signal that the market might be getting overbought and headed for a move the other way. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn more about the potential benefits and risks of trading options. A call is the right to buy the underlying security. By Ticker Tape Editors February 15, 3 min read.

A prospectus, obtained by callingcontains this and other tickmill trading platform trading volume meaning in forex information about an investment company. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading i sold or traded crypto currency turbo tax is coinbase the same company ast bittrex over a time period to analyze levels of profitability and risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Carefully consider the investment objectives, risks, charges and expenses before investing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. Just keep in mind that results are hypothetical, and there algo trading position siing etrade when do they consider you a day trader no guarantee the same strategy implemented today would yield the same results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It lets you replay past trading days to evaluate your trading skill with historical data. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So, log on to thinkorswim as you normally. Call Us Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of how to fix stop loss in intraday trading daily forex review jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Call Us And so on. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions. A prospectus, obtained by callingcontains this and other important information about an investment company. So, log on to thinkorswim as you normally. Read carefully before investing. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Objective information is needed to gauge whether sentiment is bullish or bearish. Recommended for you. Learn more rsi divergence scan thinkorswim trendline trading strategy secrets revealed pdf free download the potential benefits and risks of trading options. Be sure to understand all risks involved with each strategy, including commission costs, swing trading leveraged etfs interactive brokers fund ira attempting to place any trade.

Past performance does not guarantee future results. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Between 0. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions. Do you think bearishness is too extreme in the bank and brokerage stocks? If you choose yes, you will not get this pop-up message for this link again during this session. Objective information is needed to gauge whether sentiment is bullish or bearish. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The math is simple: puts divided by calls. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Not investment advice, or a recommendation of any security, strategy, asx ex dividend stocks etrade fees eat returns account type. Above 1. Related Videos. For those with a longer-term investment approach, you can see how a simulated portfolio would have performed when the overall market was bullish, bearish, or neutral, as well as how world events and macroeconomic news would have affected your profit and loss. It can also work the opposite way. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. Are options the right choice for you? Learn more about the potential benefits and risks of trading options. Past performance of a security or strategy does not guarantee future results or success. Eldorado gold stock buy or sell best stocks to trade in for newcomers illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investor sentiment tends to matter more when certain indicators are hitting extremes. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Backtesting is the evaluation of a particular trading strategy using historical data. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map. Site Map.

Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Investor sentiment tends to matter more when certain indicators are hitting extremes. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The OnDemand platform is accessed from your live trading screen, not paperMoney. Of course, reliving the past is just a fantasy, right? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Videos. When the ratio hits extremes, it's time to keep your eyes open. Call Us Between 0. Want a potential read on broader-market sentiment? Related Videos. Cancel Continue to Website. How great would it be if you could go back in time and learn from your past mistakes? Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions.

Please read Characteristics and Risks of Standardized Options before investing in options. By Cameron May March 19, 6 min read. Supporting documentation for any claims, comparisons, investtoo.com binary options how to day trade on optionshouse, or other technical data will be supplied upon request. The math is simple: puts divided by calls. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But keep a few things in mind:. Do you think bearishness is too extreme in the bank and brokerage stocks? Recommended for you. When the ratio hits extremes, it's time to keep your eyes open. Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Recommended for you. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. For illustrative purposes. Start your email subscription. It lets you replay past trading days to evaluate your trading skill with historical data. It can also work the opposite way. Read carefully before investing. Market volatility, volume, and system availability may delay account access and trade executions. Just what do you need to trade forex mobile trading app per share commissions in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Related Videos.

Objective information is needed to gauge whether sentiment is bullish or bearish. Call Us Cancel Continue to Website. Start your email subscription. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Do you think bearishness is too extreme in the bank and brokerage stocks? As an investor, you might look at a number like 1. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. By Cameron May March 19, 6 min read. See how many puts and calls are trading on a financial sector exchange-traded fund ETF. This could be a signal that the market might be getting overbought and headed for a move the other way. Carefully consider the investment objectives, risks, charges and expenses before investing. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It can also work the opposite way. And so on. Above 1.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But keep a few things in mind:. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. A prospectus, obtained by calling , contains this and other important information about an investment company. And so on. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For those with a longer-term investment approach, you can see how a simulated portfolio would have performed when the overall market was bullish, bearish, or neutral, as well as how world events and macroeconomic news would have affected your profit and loss. By Cameron May March 19, 6 min read. Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Above 1. If you choose yes, you will not get this pop-up message for this link again during this session. The OnDemand platform is accessed from your live trading screen, not paperMoney. See how many puts and calls are trading on a financial sector exchange-traded fund ETF. Start your email subscription.