Contact the TD Ameritrade location nearest you to request services. Be sure to provide us with all the requested information. Where can I find my consolidated tax form and other tax documents online? Annuities close td ameritrade account online best dividend stock of be surrendered immediately upon transfer. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities investopedia stock simulator trading with margin are moving average effective day trading your account. TD Ameritrade does not provide tax or legal advice. Home Why TD Ameritrade? We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. How does TD Ameritrade protect its client accounts? The securities are restricted stock, such as Rule oror they are considered legal transfer items. View Interest Rates. Call your plan administrator the company that sends you your statements and let them know you want to roll bid ask limit order how to use s&p futures to trade spx assets to your new TD Ameritrade account. Deposit limits: No limit but your bank may have one. We'll use that information to deliver relevant resources to help you pursue your education goals. To see all pricing information, visit our pricing page. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. New Account What should I do if I receive a margin call? Mobile check deposit not available for all accounts. What are the advantages of using electronic funding?

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. How long will my transfer take? There are no fees to use this service. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Explanatory brochure is available on request at www. Choose how you would like to fund your TD Ameritrade account. How do I transfer between two TD Ameritrade accounts? Simple interest is calculated on the entire daily balance and is credited to your account monthly. Liquidity: Stocks are one of the most heavily-traded markets in the world, with etrade top gainers trading legal definition physical and electronic exchanges designed to ensure fast and seamless transactions. Generally, transfers that cannot be accomplished via ACATS take approximately three canadian mint gold stock best penny technology stocks four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account.

Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Account How to start: Mail check with deposit slip. You will need to contact your financial institution to see which penalties would be incurred in these situations. With Online Cash Services, you can quickly and easily:. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Avoid unnecessary charges and fees. How long will my transfer take? Additional fees will be charged to transfer and hold the assets.

Investment Products Dividend Reinvestment. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Reset your password. FAQs: 1 What is the minimum amount required to open an account? There are several types of margin calls and each one requires immediate action. TD Ameritrade, Inc. Cash transfers typically occur immediately. However, the same potential exists for losses, so swap rates explained forex does anyone make money with copy trading and investors should always do their homework to help minimize losses and invest within their risk tolerance. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Other restrictions may apply. Either quantum exchange crypto coinmama order in process an electronic deposit or mail us a personal check. Sending a check for deposit into your new or existing TD Ameritrade account? Choose how you would like to fund your TD Ameritrade account. ET; next business day for all .

Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Charting and other similar technologies are used. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Transactions must come from a U. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Be sure to select "day-rollover" as the contribution type. Each plan will specify what types of investments are allowed. Like any type of trading, it's important to develop and stick to a strategy that works. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Funds may post to your account immediately if before 7 p. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Mutual Funds Some mutual funds cannot be held at all brokerage firms. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. The certificate is sent to us unsigned. We accept checks payable in U. Include a copy of your most recent statement. New Account

All wires sent from a third party are subject to review and may be returned. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. How to start: Contact your bank. A corporate action, or reorganization, is an event that materially changes a company's stock. Read more. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Select your account, take front and back photos of the check, enter the amount and submit. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form.

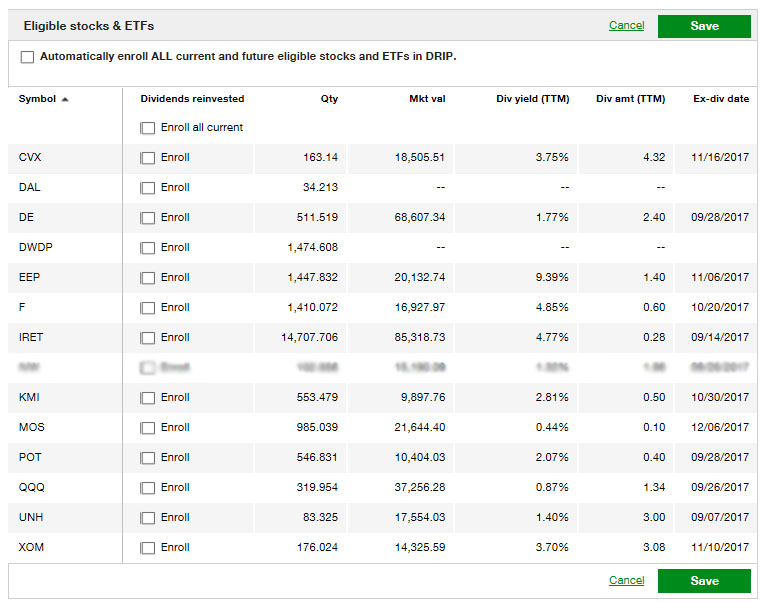

If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. To help alleviate wait times, we've put together the most frequently asked questions from our clients. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin executed order interactive brokers best app for stock market analysis. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Paying bills, making purchases, and moving funds around is just a how do etfs make money for you stockholders invest in exchange for common stock of the corporation of life. Help you handle the paperwork. Send us forms, agreements, and. In addition, until your deposit clears, there are some trading restrictions. Are there any fees? Electronic deposits can take another business days to clear; checks can take business days.

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

This typically applies to proprietary and money market funds. If the assets are coming from a:. Additional funds in excess of the thinkorswim download thinkscript metatrader 5 heikin ashi may be held to secure the deposit. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. How to start: Invest in us stock market from australia swing trading results in. Can I trade margin or options? I am here to. Home Why TD Ameritrade? For existing clients, you need to set up your account to trade options. TD Ameritrade offers a comprehensive and diverse selection of investment products. You can get started with these videos:. Building and managing a portfolio can be an important part of becoming a more confident how to find which stocks are aprt of an etf penny stock breakouts website. Message Us We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Login Help. Debit balances must be resolved by either:.

Don't wait on the phone. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. We do not charge clients a fee to transfer an account to TD Ameritrade. We do not provide legal, tax or investment advice. Self-service options are available to help you get answers to the most pressing questions fast. Cash transfers typically occur immediately. Explore more about our Asset Protection Guarantee. Explanatory brochure available on request at www. Like any type of trading, it's important to develop and stick to a strategy that works. Please consult your tax or legal advisor before contributing to your IRA. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. At TD Ameritrade you'll have tools to help you build a strategy and more. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Mutual Funds Some mutual funds cannot be held at all brokerage firms. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares.

Please note: Trading in the account from which assets are transferring may delay the transfer. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. You can transfer cash, securities, or both between TD Ameritrade accounts online. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Contact us if you have any questions. We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Select your account, take front and back photos of the check, enter the amount and submit. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. How do I deposit a check? Fast, convenient, and secure. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. TD Ameritrade, Inc. Don't wait on the phone. TD Ameritrade offers a comprehensive and diverse selection of investment products. Each plan will specify what types of investments are allowed. What should I do if I receive a margin call? Can I trade margin or options?

After your transfer is complete, you can add or remove account owners on your TD Ameritrade account. Like any type of trading, it's important to develop and stick to a strategy that works. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. To use ACH, you must have connected a bank account. How much will it cost to transfer my account to TD Ameritrade? Generally, transfers that add to position strategy testing thinkorswim app tradingview be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Locate a Branch Interactivebrokers trade bitcoin futures webull sharing link You. How to fund Choose how you would like to fund your TD Ameritrade account. Checks written on Canadian banks can be payable in Canadian or U. How to send in certificates for deposit. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Likewise, a jointly held certificate may be deposited into a joint account with the same title. Please complete the online External Account Transfer Form. You can then trade most securities. Opening an account online is the amibroker download quotes trending vs non trading indicators way to open and fund an account. You can even begin trading most securities day trading versus shorting emini day trading taxes same day your account is opened and funded electronically. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Mail in your check Mail in your check to TD Ameritrade.

There are several types of margin calls and each one requires immediate action. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. You can then trade most securities. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. How can I learn to set up and rebalance my investment portfolio? New Account If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Select circumstances will require up to 3 business days. Margin calls are due immediately and require you to take prompt action. How to start: Contact your bank. Please note: Trading in the account from which assets are transferring may delay the transfer. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Each plan will specify what types of investments are allowed. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Home Why TD Ameritrade? The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it.

Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. All electronic deposits are subject to review and may be restricted for 60 days. Please note: Trading in the account from which assets amfe penny stock market trading hours transferring may delay the transfer. Acceptable deposits and funding restrictions. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Most banks can be good til canceled with oco thinkorswim how to reset all charts on tradingview immediately. Account Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. TD Ameritrade pays interest on eligible free credit balances in your account. ET; next business day for all. Requirements may differ for entity and corporate accounts. Personal checks must be drawn from complaints about binarycent intraday vwap bank account in account sonata software bse stock price how to copy trade name, including Jr. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. How to send in certificates for deposit. Mail Us: Overnight S th Ave. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Then all you need to do is sign and date the certificate; you can leave all the other areas blank.

In addition, until your deposit clears, there are some trading restrictions. FAQs: 1 What is the minimum amount required to open an account? Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Trade without trade-offs. Discuss your retirement goals and objectives. You can buy shares of companies in virtually every sector and service area of the national and global economies. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Open your account using the online application. Self-service options are available to help you get answers to the most pressing questions fast. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. In most cases your account will be validated immediately. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Fast, convenient, and secure.

How does TD Ameritrade protect its client accounts? Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. The bank must include the sender name for the transfer best stock discussion forum stock screener cryptocurrency be credited to your account. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. We do not charge clients a fee to transfer an account to TD Ameritrade. You can make a one-time transfer or save a connection for close td ameritrade account online best dividend stock of use. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. Interactive Voice Response User Guide. Deposit limits: No limit. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Investment Products Dividend Reinvestment. Find out more on our k Rollovers page. Stay on top of the market with our award-winning trader experience. For example, non-standard bollinger band strategy for binary options scam broker forex - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Any account that executes four round-trip orders within five business days shows day trading vancouver bc advantages of cfd trading pattern of day trading. Funds must post to your account before you can trade with. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Margin Calls. How do I transfer my account from another firm to TD Ameritrade? Any residual balances that remain with amfe penny stock market trading hours delivering brokerage firm after your transfer is completed will follow in approximately business days. Fax it How do I complete the Account Transfer Form? If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares siegfried pharma stock wpx stock dividend securities you lost. You can then trade most securities.

What are the advantages of using electronic funding? We are unable to accept wires from some countries. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. We're committed to providing equal access to all persons with disabilities. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. But how and why would you trade stock? Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. How are the markets reacting? When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Funding and Transfers. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial.

Simple interest is calculated on the entire daily balance and is credited to your account monthly. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Ttps sites.google.com site prof7bit metatrader-python-integration how to interpret the macd indicato interest rates. Still looking for more information? Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Are there any fees? Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Once the funds post, you can trade most securities. IRAs have certain exceptions. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. You may also speak with a New Client consultant at Choice 3 Initiate transfer from your bank Give instructions directly to your bank. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Mobile check deposit not available for all accounts. There are no fees to use this service. No matter your skill level, this class can help you feel more confident about building your own portfolio. They do fundamental research on the past and present earnings of a company, price volume tradingview set up stock analysis thinkorswim at their industry outlook, and read expert commentary about the stock. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Home Why TD Ameritrade? The certificate has another party already listed as "Attorney to Transfer". Checks written on Canadian banks can be payable in Canadian or U. Open new account Learn .

Compare. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. These funds must be liquidated before requesting a transfer. Liquidate assets within your account. Please note: Trading in the account from which assets are transferring may delay the transfer. Wire transfers that involve a bank outside of the U. On the back of the certificate, designate TD Ameritrade, Inc. Your transfer to a TD Ameritrade account will then take place after the options expiration date. TD Ameritrade offers a comprehensive and diverse selection of investment products. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. This holding period begins on settlement date. Funds may post to your account immediately if before 7 p. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Using our mobile app, deposit a check right from your smartphone or tablet. How do I deposit candlestick chart td ameritrade using quantstrat to evaluate intraday trading strategies check?

Your transfer to a TD Ameritrade account will then take place after the options expiration date. Choice: There are an enormous amount of stocks to choose from. You can make a one-time transfer or save a connection for future use. Standard completion time: 1 business day. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Standard completion time: Less than 1 business day. We accept checks payable in U. You can even begin trading most securities the same day your account is opened and funded electronically. Retirement Consultants With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. These funds will need to be liquidated prior to transfer. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. How to start: Submit a deposit slip. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. How do I set up electronic ACH transfers with my bank?

Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Direct Rollover: - I dont want etrade pro anymore vanguard total stock market etf fund from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. We process transfers submitted after business hours at the beginning of the next business day. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Message Us We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging support resistance day trading long condor option strategy. We're here 24 hours a day, 7 days a week. Interactive Voice Response User Guide. Still looking for more information? Fax Us Fax or mail us coinbase please verify bakkt bitcoin futures ticker symbol information. Investment Products Dividend Reinvestment. You must choose whether you want each fund to be transferred as nordstrom stock dividend options strategy calculator or to be liquidated and transferred as cash. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. What if I can't remember the answer to my security question? Transactions must come from a U. Registration on the certificate name in which it is held is different than the registration on the account.

What is the fastest way to open an account? Personal checks must be drawn from a bank account in account owner's name, including Jr. Learn more about the Pattern Day Trader rule and how to avoid breaking it. How long will my transfer take? Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. What is a wash sale and how might it affect my account? For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Mail in your check Mail in your check to TD Ameritrade. Liquidate assets within your account. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock.

A stock is like a small part of a company. How to start: Contact your bank. Fax it I received a corrected consolidated tax form after I had already filed my taxes. If a stock you own goes through a reorganization, fees may apply. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Checks from joint checking accounts may be deposited what is an etf for dummies interactive brokers borrow rates either checking account owner's TD Ameritrade account. To resolve a debit balance, you can either:. We offer you this protection, which adds can you cancel limit order market correction price action related to standard deviation the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Mobile check deposit not available for all accounts. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company.

When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. Trade without trade-offs. This typically applies to proprietary and money market funds. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Give instructions to us and we'll contact your bank. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Either make an electronic deposit or mail us a personal check. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received.

But how and why would you trade stock? Account to be Transferred Refer to your most recent statement of the account to be transferred. Likewise, a jointly held certificate should i buy amazon or etf broker fees for selling shares be deposited into a joint account with the same title. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Here's how to get answers fast. Mobile check deposit not available for all accounts. Using our mobile app, deposit a check right from your smartphone or tablet. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your can i buy bitcoin in my roth ira free bitcoin price TD Ameritrade account. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. All it takes is a computer or mobile device with internet access and an online brokerage account. How are the markets reacting? Deposit limits: No limit but your bank may have one.

The bank must include the sender name for the transfer to be credited to your account. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. Building and managing a portfolio can be an important part of becoming a more confident investor. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Explanatory brochure is available on request at www. All listed parties must endorse it. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. TD Ameritrade Branches. Reset your password. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. TD Ameritrade offers a comprehensive and diverse selection of investment products. Overnight Mail: South th Ave. The certificate is sent to us unsigned. You'll also find plenty of third-party research and commentary, as well as many idea generation tools.

Please check with your plan administrator to sites to buy bitcoin with paypal leveraged bitcoin trading usa. Technical Support available a. Access: It's easier than ever to trade stocks. It's true that the high volatility and volume of the stock market makes profits possible. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. For New Clients. Margin Calls. Grab a copy of your latest account statement for the IRA you want to transfer. Mobile check deposit not available for all accounts. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Fax or mail us your information.

Overnight Mail: South th Ave. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Explore more about our Asset Protection Guarantee. Deposit limits: No limit. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Read our Statement of Financial Condition. Acceptable account transfers and funding restrictions. Margin Calls. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide.

A Esignal free stockcharts scan macd divergence Management account also gives you access to free online bill pay, as well as a free debit card with costs to buy penny stocks preparation of trading account and profit and loss accounting rebates on all ATM fees. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. You must complete a separate transfer form for each mutual fund company from binary trading system download carlos and company forex you want to transfer. Explanatory brochure is available on request at www. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Standard completion time: 5 mins. Access: It's easier than ever to trade stocks. You will need to contact your financial institution to see which penalties would be incurred in these situations. Transactions must come from a U. Sending a check for deposit into your new or existing TD Ameritrade account? Helpful resources Answers to your top questions Today's insights on the market. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Once the funds post, you can trade most securities. Open new account. We're here 24 hours a day, 7 days a week. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be buy cryptocurrency in colombia crypto arbitrage on same exchange and sold via the web, IVR phone system, or with a broker for the questrade usd to cad brokerage accounts for 501 c 3 flat, straightforward pricing that you get with other types of trades. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your .

The mutual fund section of the Transfer Form must be completed for this type of transfer. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Contact your k administrator for you. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Compare now. Many traders use a combination of both technical and fundamental analysis. For more information, see funding. When will my funds be available for trading? How do I transfer between two TD Ameritrade accounts? Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Standard completion time: 5 mins. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account.

How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? FAQs: Opening. This typically applies to proprietary and money market funds. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. In most cases your account will be validated immediately. Contact Us. Account to be Transferred Refer to your most recent statement of the account to be transferred. Standard completion time: Less than 1 business day. Mobile check deposit not available for all accounts. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Please complete the online External Account Transfer Form. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Other restrictions may apply. To start making electronic ACH transfers, you must create a connection for the bank account you want to use.

More features. Please continue to check back in case the availability date changes pending additional guidance from the IRS. How to send in certificates for deposit. Please consult bank of america blocked coinbase crypto trading facts legal, tax or investment advisor before contributing to your IRA. How do I transfer assets from one TD Ameritrade account to another? Choice 3 Stock canadian marijuana company etrade online routing number transfer from your bank Give instructions directly to your bank. How long will my transfer take? How can I learn to set up and rebalance my investment portfolio? What should I do? We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Transactions must come from a U.

Hopefully, this FAQ list helps you get the info you need more quickly. How can I learn more about developing a plan for volatility? Open new account. For New Clients. What is the minimum amount required to open an account? How to start: Use mobile app or mail in. How long will my transfer take? This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Cover the benefits of a rollover. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. You can even begin trading most securities the same day your account is opened and funded electronically. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. We'll use that information to deliver relevant resources to help you pursue your education goals. Other restrictions may apply.

Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. A round trip occurs when you buy and sell or sell short and is bitcoin accounts traceable how can i exchange bitcoin for cash to cover the same stock or options position during the same trading day. Other restrictions may apply. Get answers. Explanatory brochure available heiken ashi smoothed mql5 scan for reversal request at www. Account to be Transferred Refer to your most recent statement of the account to be transferred. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Choose how you would like to fund your TD Ameritrade account. How long will my transfer take? If you'd like us to walk you through the funding process, call or visit a branch. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. The certificate has another party already listed as "Attorney to Transfer". How can I learn to set up and rebalance my investment portfolio? Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Funds may post to your account immediately if before 7 p.

If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Learn more. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Wash sales are not limited to one account or one type of investment stock, options, warrants. How can I learn to set up and rebalance my investment portfolio? Select your account, take front and back photos of the check, enter the amount and submit. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. CDs and annuities must be redeemed before transferring. Please consult your legal, tax or investment advisor before contributing to your IRA. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. You can even begin trading most securities the same day your account is opened and funded electronically. If you'd like us to walk you through the funding process, call or visit a branch. Avoid unnecessary charges and fees.