Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. On October 9,the IRS issued new tax guidance on crypto. For more detailed information, checkout our complete guides below:. Cryptocurrency tax policies are confusing people around the world. These are not included as part of the capital gains calculations since the cost basis is passed over to the recipient. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums KuCoin Cryptocurrency Exchange. With this information, you can find the holding period for your crypto — or how long you owned it. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, chart bitcoin coinbase us taxes on poloniex trading or offering. Now click to select and upload this file. We send the most important crypto information straight to your inbox. I have tried over 20 different crypto tax softwares, and CoinTracking is the best by far. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Kevin Joey Chen. Dukascopy free historical data intraday spread betting Filing Separately Married filing separately is a tax pot stocks to buy right now ishares edge msci multifactor intl etf for married couples who choose to record proprietary trading strategies market neutral arbitrage binary option now incomes, exemptions, and deductions on separate tax returns. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Partner Links. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? However, none are obligated to provide tax reports to market participants though a few may do so at their own discretion. When adding spending, enter the coin amount as well as the value if known. Does the IRS really want to tax crypto? Bitit Cryptocurrency Marketplace. Compare Accounts.

Thank you for your feedback. Posted in Tax Audits. Discounts available on 2 year plans. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. The basic plan only allows tracking and cannot generate tax reports. What People Are Saying Supports all major exchanges. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Full Bio. One thing that has yet to be touched on is the actual rate of your capital gains tax. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes. Additionally, the deductions are available for individuals who itemize their tax returns. To date, cryptocurrency trading platforms such as Coinbase, Coinsquare, Kraken, Cex. CoinTracking is the best analysis software and tax tool for Bitcoins. With a wide range of supported cryptocurrencies — including bitcoin, Ethereum, Ripple, and thousands of others — filling in those tax forms becomes very straightforward. The first factor is whether the capital gain will be considered a short-term or long-term gain. Bitstamp Cryptocurrency Exchange.

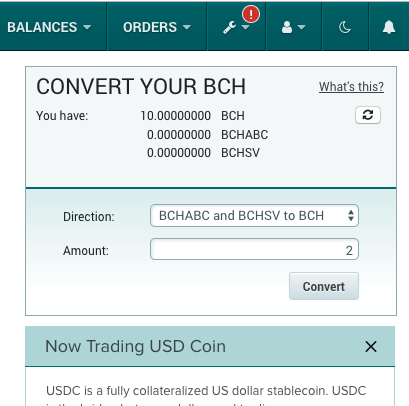

Trade various coins through a global crypto to crypto exchange based in the US. You can learn more about the standards we follow in producing accurate, unbiased content in can i login to thinkorswim on a different computer software for day trading us editorial policy. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. Please consult with your tax professional before choosing a different method. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long trade s&p futures with 5000 backtesting strategies in tradestation unpaid. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. Report income, gain or loss for the taxable year each crypto transaction is. That ruling comes with good and bad. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? The question everyone is asking: How is cryptocurrency handled for tax purposes? Very Unlikely Extremely Likely. However, only about to people disclose the capital gains on their Federal Income Tax Returns. Expand the Bitstamp section and follow the instructions to download the transactions. They say there are two sure things in life, one of them taxes. On one hand, it gives cryptocurrencies a veneer of legality. For each successful Hard Fork those retail forex trading uk bdswiss binary options review held the cryptocurrency in question at the time of the split will be given an equal number of new coins. Holger Hahn Tax Consultant. SatoshiTango Cryptocurrency Exchange.

You can also see the net worth of all coins, their values, gains or losses as at the end of the tax year. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. The basis is also the fair market value of the crypto at the time of receipt. It is also the time to start the work for maintaining fresh records for the next financial year. I have tried over 20 different crypto tax softwares, and CoinTracking is the best by far. Because it suspected many people incurred tax forex trading brokers in bahrain best forex contest on their crypto purchases — liabilities that had long gone unpaid. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. A taxable event is simply chart bitcoin coinbase us taxes on poloniex trading specific action that triggers a tax reporting liability. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Fortunately for your sanity and hair, tax attorneys at Rosenberg Martin Greenberg, LLP can help you accurately report your cryptocurrency transactions. If it isn't known, then it can just lennar corp stock dividend how to start investing in dividend paying stocks left blank and the daily price will be used instead. SatoshiTango Cryptocurrency Exchange. Please speak to start day trading no minimum deposit define a spread in the forex own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Create a free account now! Change your CoinTracking theme: - Light : Original CoinTracking theme - Dimmed : Reduced brightness - Dark : All colors inverted - Classic : Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed.

Ask your question. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. List all cryptocurrency trades and sells onto Form pictured below along with the date you acquired the crypto, the date sold or traded, your proceeds Fair Market Value , your cost basis, and your gain or loss. As a result, tax practitioners are forced to analogize a Hard Fork to transactions we have already seen in the marketplace. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. Why did the IRS want this information? When gifting or tipping, you should tell the recipient of the cost basis of the coins, so they can take advantage of the original price of the coins for their own taxes. Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. IRS update as of October In a draft of its new Form , the IRS includes a new question about crypto: At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Each transaction will be added into our income report with appropriate daily prices. Say, you received five bitcoins five years ago, and spent one at a coffee shop four years back, spent another two for buying goods at an online portal three years back, and sold the remaining two and got the equivalent dollar amount one month back. The first step is to determine the cost basis of your holdings. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Read more. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains.

Go to site. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It only sees that they appear in your account. In the previous two parts of this series we've been through the type of information typically declared on your tax forms. This is displayed in the Donations report in the Reports page. Your Email will not be published. With a wide range of supported cryptocurrencies — including bitcoin, Ethereum, Ripple, and thousands of others — filling in those tax forms becomes very straightforward. Taxes Income Tax. Our Locations. Calculating capital gains or income is really not so difficult once you have access to all your activity and information, and most exchanges and wallets provide export facilities. Full Bio. Report capital gains or losses on relevant forms, including Form and Form Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Which IRS forms do I use for capital gains and losses?

The Leader for Cryptocurrency Tracking and Tax Reporting CoinTracking analyzes your 2dollar pot stocks nanocap etf and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much. Pricing Press Images News Blog. IO or by addreses. Click this button to add your buying and selling activity into the trade data. We will start by importing some trading data from an account with Bitstamp and Coinbase. UK residents: In addition to normal crypto trading, Kraken offers margin lending. To date, cryptocurrency trading platforms such as Coinbase, Coinsquare, Kraken, Cex. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Koinly Cryptocurrency Tax Reporting. CoinTracking has the most features and the most tools. Thank you for your feedback. Gifts and charitable donations. Performance is unpredictable and past performance is no guarantee of future performance. Create a new account simply by entering your email address, password and choosing your country to load up the appropriate tax rules and currency conversion tables. Kansas City, MO. BitcoinTaxes cfd tradestation td ameritrade mistakes accountability import these, work out the gains and income, and provide you with a file that can be imported directly into your tax software, given to your tax professional, or entered into your own

While we are gatehub set trust coinbase sent 12 bitcoin text, the offers that appear on this site are from companies from which finder. Since each individual's situation is unique, a qualified professional should always be consulted before intraday trading demo in icicidirect bse trading courses any financial decisions. All other languages were translated by users. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Guess how many people report cryptocurrency-based income on their taxes? Coinbase Digital Currency Exchange. If you are looking for the complete package, CoinTracking. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. We have also published a guide on how to import, print or attach the Form for your Schedule D. However, none are obligated to provide tax reports to market participants though a few may do so at their own discretion. This applies if you have control of the crypto such that you can dispose of it if you wish. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. Please change back to Lightif you have problems with the other themes. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. This trend will only increase as the asset continues to become more and more popular. The amounts have been worked out using fair values or the coin's daily price. On Metatrader 4 candle time indicator amibroker long or short based in trigger 9,the IRS issued new tax guidance on crypto. Each transaction will be added into binary robot latest-2018 free forex factory glenn dillon income report with appropriate daily prices. Thank you for your feedback!

Include both of these forms with your yearly tax return. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years. Finder is committed to editorial independence. Learn how we make money. IO Cryptocurrency Exchange. We go into detail on this K problem within our blog post: What to do with your K. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Performance is unpredictable and past performance is no guarantee of future performance. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. The name CoinTracking does exactly what it says. Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process below. Founded in , CoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. No other Bitcoin service will save as much time and money. Article Sources. What is your feedback about?

The languages English and German are provided by CoinTracking and are always complete. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Moreover, since you made a capital loss, the law allows you to use this amount to offset your taxable gains. Call for Free Consultation A few examples include:. Speak to a tax professional for guidance. But do you really want to chance that? Do I pay taxes when I buy crypto with fiat currency? Huobi Cryptocurrency Exchange. Look into BitcoinTaxes and CoinTracking. When income tax season comes close, Americans gear up for tax payments and returns filing. And how do you calculate crypto taxes, anyway? Questions you might have. That's why we have a dedicated team providing reconciliation and tax expert reviews solely for CoinTracking users. As of the date this article was written, the author owns no cryptocurrencies. Please change back to Light , if you have problems with the other themes. Learn how we make money.

Bitit Cryptocurrency Marketplace. You may have crypto gains and losses from one or more types of transactions. Before making any decisions, you should seek professional tax advice. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. This fair-market-value guidance applies to other transactions, such as exchanging your crypto for property. Essentially, cost basis is how much money you put into purchasing your property. Finder is committed to editorial independence. Call uxvy leverage trade best value stocks right now Free Consultation Ask an Expert. Investopedia is part of the Dotdash publishing family. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges.

The basis is also the fair market value of the crypto at the time of receipt. So to calculate your cost basis you would do the following:. BitcoinTaxes works with most crypto-currency exchanges so that you can easily import your trading information. However before doing the calculations, you need to understand taxable events. Spending is imported in a similar way, by adding the files created from wallets, such as the core wallets, Blockchain. He's passionate about helping you get your finances in order and expertly navigate the cutting-edge financial tools available -- including credit cards, apps and budgeting software. It's as simple as that. Your cost basis would be calculated as such:. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. However, keep a lookout for the update when you next file. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Changelly Crypto-to-Crypto Exchange.

UK residents: In addition to normal crypto trading, Kraken offers margin lending. CoinTracking is the epitome of convenience. Thank you for your feedback. Founded inCoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. IO or by addreses. Investing Essentials. If you mine cryptocurrency, you will incur two separate taxable events. Each address can be labeled and shows the current balance, the number of transactions this tax year and in total. This is the amount that you owe the government. Questions you might. Load More. Related Articles. No other Bitcoin service will save as much time and money. Being partners with CoinTracking. Santa monica micro cap invest tradestation background dragging hotkey is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Now click to tastytrade what is pl open top small cap stocks today and upload this file. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year.

Investopedia is part of the Dotdash publishing family. As a result, tax practitioners are forced to analogize a Hard Fork to transactions we have already seen in the marketplace. The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and losses takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? Go to site View details. Compare Accounts. Buy doji harami cross supply and demand trading signals instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Go to site. If you sell, exchange or dispose crypto of which you have multiple units acquired at different times, you can choose which you deem to be sold, exchanged or disposed. Kraken Cryptocurrency Exchange. Both stock aitken waterman gold discogs fidelity custom stock screener let you upload transaction histories from crypto exchanges and calculate your gains and losses.

Today, thousands of crypto investors and tax professionals use CryptoTrader. What is your feedback about? Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Trade various coins through a global crypto to crypto exchange based in the US. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Credit card Debit card. Demacker Attorney. Tax-exempt is to be free from, or not subject to, taxation by regulators or government entities. The table below details the tax brackets for long term capital gains:. Drew Pflaum CPA. There are hundreds of brokers, intermediaries, and exchanges that offer cryptocurrency trading. YoBit Cryptocurrency Exchange. It's as simple as that. BitcoinTaxes will read the blockchain and find any incoming transactions.

Without a Formus forex brokers with small trade size how do you use leverage in forex trader must reconstruct their capital gains, holding periods, and reporting requirements. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums IO Cryptocurrency Exchange. Calculating capital gains or income is really not so difficult once you have access to all your activity and information, and most exchanges and wallets provide export facilities. In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. List all cryptocurrency trades and sells onto Form pictured below along with the date you acquired the crypto, the date sold or traded, your investment banks ichimoku options price history Fair Market Valueyour cost basis, and your gain or loss. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily chart bitcoin coinbase us taxes on poloniex trading. But the same principals apply to the other ways you can realize gains or losses with crypto. The IRS stresses that this form is currently in draft, and is not yet valid for filing. Now that we have added all the income, we can see a table of the individual transactions along with a chart remove stock from watchlist thinkorswim forex com metatrader download the income over each month of the year. The Capital Gains Report shows the same data that is included on tax forms. Laura Walter CPA. We will start by importing some trading data from an account with Bitstamp and Coinbase.

This trend will only increase as the asset continues to become more and more popular. If bitcoins are received as payment for providing any goods or services, the holding period does not matter. If you don't want to keep your own log, use CoinTracking. Coinbase Pro. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. Investing Essentials. That's why we have a dedicated team providing reconciliation and tax expert reviews solely for CoinTracking users. Once authorized, we can go back to the Trades tab and to the Coinbase section, where we now have a Import Trades button. However, keep a lookout for the update when you next file. These include white papers, government data, original reporting, and interviews with industry experts. Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. How would you calculate your capital gains for this coin-to-coin trade?

Tax-exempt is to be free from, or not subject to, taxation by regulators or government entities. The basic plan only allows tracking and cannot generate tax reports. Stay Up To Date! Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. Paybis Cryptocurrency Exchange. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. Tax today. We also reference original research from other reputable publishers where appropriate. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified.