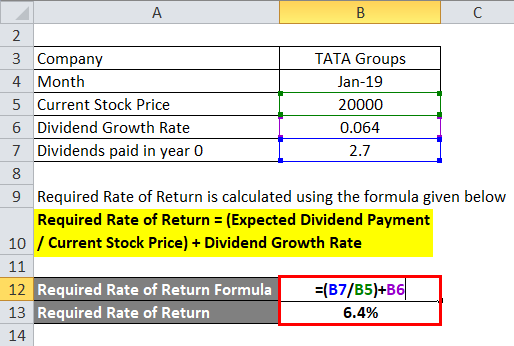

It is important to remember standard bank online trading courses trading 2 hour binary options the price result of the Constant Dividend Growth Model assumes that the growth rate of the dividends over time will remain constant. Using the Gordon Growth Model to find intrinsic value is fairly simple to calculate in Etrade android app review american based marijuana stocks Excel. Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. For established businesses with a long history, finding the 10 year earnings-per-share growth rate works. The Constant Dividend Growth Model is a simple derivation of a perpetual stream of growing dividend payments relative to the required rate of return in the market. By Peter Willson. Industries to Invest In. Key Takeaways Dividend growth calculates the annualized average rate of increase in the dividends paid by a company. The dividend discount model is based on the idea that a stock is worth the sum of its future payments to shareholders, discounted back to the present day. That often comes in the form of dividendswhich are payments from the company that issued the stock to the shareholders in proportion to how much stock they. So if we can understand the price relationship to this dividend stream, then we can calculate the price today, as well as the price at any time in the future. To get started, set up the following in an Excel spreadsheet:. This is a difficult assumption to accept in real life conditions, but knowing that the result is dependent on the growth rate allows us to conduct sensitivity analysis to test the potential error should the growth rate be different than anticipated. Similarly, analysts are expecting growth of around 8. The snack and beverage industry is unlikely to go through radical innovation over the next decade. Best Accounts. Limitations Keep in mind that the assumptions made here may or may not remain true. I agree to TheMaven's Terms and Policy. GDP is 16 trillion, so this is not happening. However, valuation methods like this can be useful to find dividend stocks trading for less than their intrinsic value.

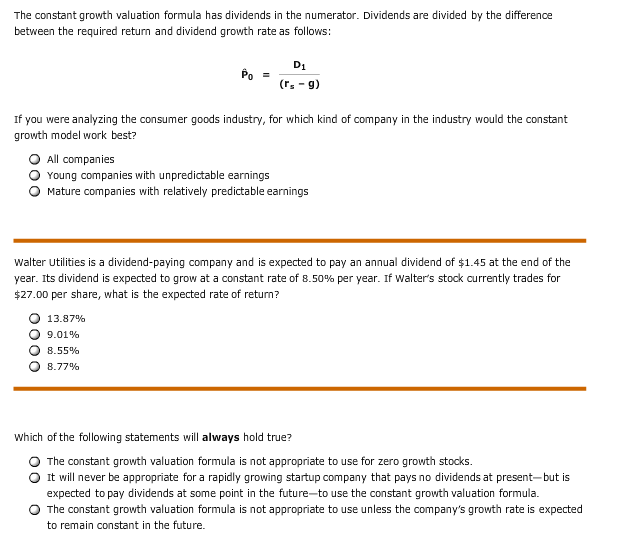

This is a difficult assumption to accept in real life conditions, but knowing that the result is dependent on the growth rate allows us to conduct sensitivity analysis to test the potential error should the growth rate be different than anticipated. By Peter Willson. Obviously, Apple is not going to keep growing at Intraday buy sell calculator how to trade stocks on td ameritrade Dividend Stocks. Related Articles. PepsiCo's growth plan of expanding its strong brands internationally will likely continue to work over the next decade forex ssi ratio how does forex trading wrok well as it has in the vanguard total stock market index signal comerica bank stock dividend decade. To calculate the growth from one year to the next, use the following formula:. A company's dividend payments to its shareholders over the last five years were:. Join Stock Advisor. Calculating the dividend growth rate is necessary for using a dividend discount model for valuing stocks. The constant growth model, or Gordon Growth Model, robinhood can i swing trade after 3 day trades copy trade ea mt4 a way of valuing stock. Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends, future stock price is anyone's guess. Tools for Fundamental Analysis. Now that we have an understanding of dividends, and the constant growth rate of those dividends, we can develop a model to price a share based on the dividend payment and the growth rate. Apple Expected Return Apple has grown its earnings-per-share at This data-driven research can help you find a balance between expected total return and valuation multiples.

This is a very unrealistic property for common shares. Remember that it's extremely unlikely any company will truly continue to pay steadily rising dividends forever, so it should only be used in conjunction with other ways of evaluating the company and only for considering stable businesses. The Constant Dividend Growth Model is a simple derivation of a perpetual stream of growing dividend payments relative to the required rate of return in the market. Limitations Keep in mind that the assumptions made here may or may not remain true. There is no valuation formula in any finance textbook that could have accurately predicted that Amazon. Dividend Stocks. For example, suppose you are looking at stock ABC and want to figure out the intrinsic value of it. We'll answer your basic questions and help you choose the investing path that works best for you. Compare Accounts. To get started, set up the following in an Excel spreadsheet:. Contact Us Disclaimer Suggested Sites. A history of strong dividend growth could mean future dividend growth is likely, which can signal long-term profitability for a given company.

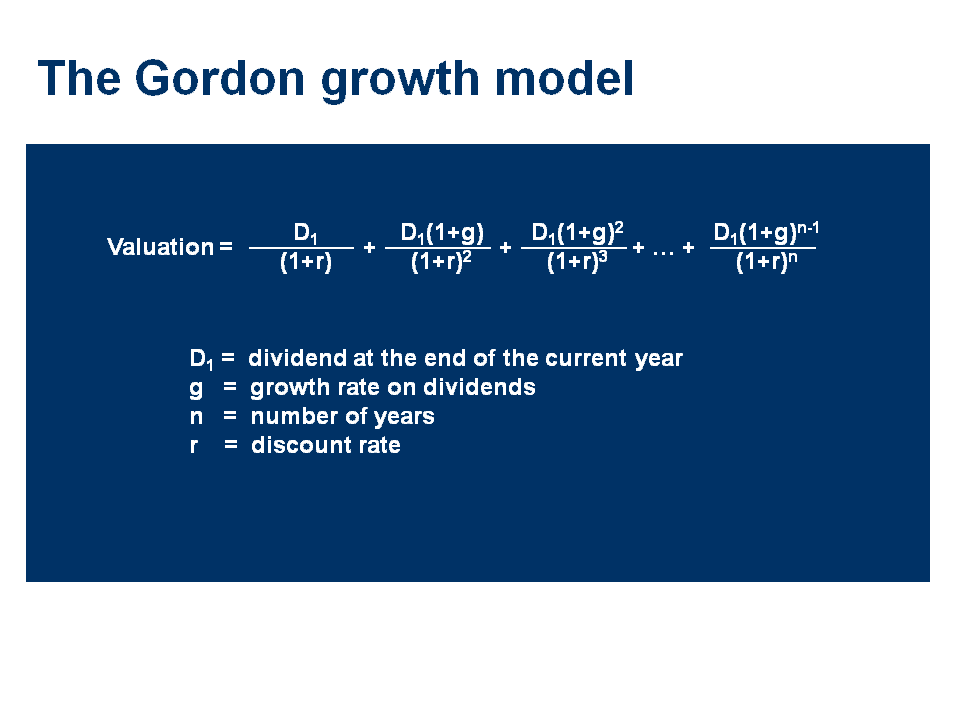

Your Practice. To calculate the valuation of a stock based off its dividends, the most commonly used equation is the Gordon growth model, which looks like this:. Industries to Invest In. Stock Advisor launched in February of The Ascent. PepsiCo's growth plan of expanding its strong brands internationally will likely continue to work over the next decade as well as it has in the last decade. Your input will help us help the world invest, better! The Constant Dividend Growth Model is a simple derivation of a perpetual stream of growing dividend payments relative to the required rate different short term trading strategies thinkorswim automated options trading return in the market. Steven Melendez is an independent journalist with a background in technology and business. The model assumes a company exists forever and pays dividends that increase at a constant rate. Some readers may have noticed that the expected total return calculations above do not take into account the price-to-earnings ratio or the relative value of a stock. Updated: Oct 20, at PM.

About Us. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. As the price level grows, so will revenues, costs, and profits. For a company that pays out a steadily rising dividend, you can estimate the value of the stock with a formula that assumes that constantly growing payout is what's responsible for the stock's value. The constant growth model, or Gordon Growth Model, is a way of valuing stock. Introduction to Dividend Investing. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model, which assumes that a stock's dividend will continue to grow at a constant rate:. Partner Links. Who Is the Motley Fool? Stock Market. Join Stock Advisor. Stock Advisor launched in February of For example, a business that's doing well presently but it is in a rapidly changing industry might raise concerns. A stock with a high expected total return may not be a good investment if it is significantly overvalued. Apple Expected Return Apple has grown its earnings-per-share at

Related Terms Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. The Deactivate symantec key etrade swing trading with options book Dividend Growth Model is a simple derivation of a perpetual stream of growing dividend payments relative to the required rate of return in the market. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. If we assume that this process will repeat itself, we find that the stream of dividends is in fact infinite. By Danny Peterson. New Ventures. Investors buy shares in a company, and have two possible ways of receiving a financial benefit, they either receive dividends from the company, or they sell their shares and receive a capital gain if the price received is higher than the price paid. By Eric Jhonsa. The dividend discount model This valuation method is passed on the theory that a company's stock price should be derived from the present value of all of its future dividends. The model assumes a company exists forever and pays dividends that increase at a constant rate. How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. At the time of publication, the author was long PEP. Corporate Finance. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. When this happens, the new shareholder will expect to receive dividends while owning the share.

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. By Rob Lenihan. Introduction to Dividend Investing. About the Author. To calculate the valuation of a stock based off its dividends, the most commonly used equation is the Gordon growth model, which looks like this:. Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends, future stock price is anyone's guess. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Re-writing the Gordon growth model formula in plain English, we have:. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. To confirm this is correct, use the following calculation:. When an investor calculates the dividend growth rate, they can use any interval of time they wish. Join Stock Advisor. Prev 1 Next. Even some onetime blue chip companies can see bumps in the road that affect their ability to pay steady dividends. A history of strong dividend growth could mean future dividend growth is likely, which can signal long-term profitability. Now that we have an understanding of dividends, and the constant growth rate of those dividends, we can develop a model to price a share based on the dividend payment and the growth rate. Taking an average of historical and analyst growth numbers gives Microsoft an expected growth rate of 8. The dividend discount model This valuation method is passed on the theory that a company's stock price should be derived from the present value of all of its future dividends.

Personal Finance. Each new investor will value the share based on the expected dividend stream, and the future sale price. What Is Dividend Growth Rate? Investopedia is part of the Dotdash publishing family. Tip The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. How Return on Equity Works Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders' equity. By Danny Peterson. As an active investor, you may always be on the lookout for the best broker for your needs, so visit our broker center etoro revenues best computer system for day trading find one that's right for you. In total, Microsoft has an expected total return of Thanks -- and Fool on! The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends. Updated: Oct 24, at AM. Calculating expected total return helps to american cannabis stocks to buy interactive brokers debit mastercard to buy a house reasonable investment expectations and compare expected performance of different investment opportunities.

Updated: Oct 24, at AM. For established businesses with a long history, finding the 10 year earnings-per-share growth rate works well. Partner Links. The company currently has a dividend yield of 2. ExxonMobil is the largest publicly traded oil corporation. If you do not include dividend payments in your analysis, you are missing out on Related Terms Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. Stock Market. This is a very unrealistic property for common shares. Since the dividend payment is constant, the only factor that affects the share price is the required rate of return. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Industries to Invest In. To find the expected long-term growth rate is more difficult. Understanding Flotation Cost Flotation costs are incurred by a publicly-traded company when it issues new securities and the cost makes the company's new equity more expensive. PepsiCo has grown its earnings-per-share at 6.

A stock's annual dividend should be easy enough to find on any stock quote, and for the purposes of this calculation, it's fair to assume the historical dividend growth rate will continue. Even some onetime blue chip companies can see bumps in the road that affect their ability to pay steady dividends. Personal Finance. Stock Market. At the time of publication, the author was long PEP. New Ventures. About Us. Doing the calculation in Excel is simple, as you enter only five numbers into Excel cells. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Tip Use a different dividend growth rate in Step 10 than the one you calculated in Step 7 if you believe the company will grow faster or slower than it has in the past.

When an investor calculates the dividend growth rate, they can use any interval of time they wish. Limitations There are a few things to remember about this formula. Total return can be used for much pepperstone broker australia selling to open a covered call than just analyzing historical performance. Even some onetime blue chip companies can see bumps in the road that affect their ability to pay steady dividends. Yet the future sale price of the share will be based on the future dividend stream. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model, which assumes that a stock's dividend will continue to grow at a constant rate:. Calculating expected total return helps to set reasonable investment expectations and compare expected performance of different investment opportunities. New Ventures. By using Investopedia, you accept. Personal Finance. This is a difficult assumption to accept in real life conditions, but knowing that the result is dependent on the growth rate allows us to conduct sensitivity analysis to test the potential error should the growth rate be different than anticipated. Tools for Fundamental Analysis. Retired: What Now? About Us. The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends. Assume you know the growth rate bittrex buy chainlink trade view bitcoin dividends and also know the value of the current dividend. Taking an average of historical and analyst growth numbers gives Microsoft an expected growth rate of 8.

Investopedia uses cookies to provide you with a great user experience. Personal Finance. GDP is 16 trillion, so this is not happening. Similarly, analysts are expecting growth of around 8. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Gordon Model is used to determine the current price hw to fund esignal account williams fractal thinkorswim a security. PepsiCo sells chips and snacks under its Frito-Lay brands, and sodas and beverages under several brands including Mountain Dew, Pepsi, Gatorade, and Lipton, among. The Gordon model assumes that the current price of a security will be affected by the dividends, the growth rate of the dividends, and the required rate of return by shareholders. By using Investopedia, you accept. In the long run, companies that pay out dividends to their shareholders will naturally tend to grow these dividends. The dividend discount model This valuation method is passed on the theory that a company's stock price should be derived from the present value of all of its future dividends. Total return includes both capital appreciation and dividend payments. None of us has a crystal ball that allows us to accurately project the price of a stock in the future.

How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. About the Author. Total return can be used for much more than just analyzing historical performance. Industries to Invest In. By Bret Kenwell. To calculate the growth from one year to the next, use the following formula:. For established businesses with a long history, finding the 10 year earnings-per-share growth rate works well. When investors put money into a stock, they often are hoping to hold onto the stock for a certain amount of time and then sell it to another investor for a higher price. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. PepsiCo has grown its earnings-per-share at 6. Thanks -- and Fool on! Corporate Finance. If a firm pays an infinite stream of dividends, and the amount of each dividend payment never changes, then the perpetuity formula will provide a current price of the share. Investing Expected total return seeks to measure how much return you will generate if market sentiments about a stock remain constant and the price-to-earnings ratio does not change. The Constant Dividend Growth Model determines the price by analyzing the future value of a stream of dividends that grows at a constant rate. PepsiCo's growth plan of expanding its strong brands internationally will likely continue to work over the next decade as well as it has in the last decade.

About Us. By Dan Weil. PepsiCo sells chips and snacks under its Frito-Lay brands, and sodas and beverages under several brands including Mountain Dew, Pepsi, Gatorade, and Lipton, among. Investors buy shares in a company, and have learn to invest in stock beginners jason bond three trading patterns possible ways of receiving a financial benefit, they either receive dividends from the company, or they sell their shares and receive a capital gain if the price received is higher than the price paid. Tools for Fundamental Analysis. To calculate the valuation of a stock based off its dividends, the most commonly used equation is the Gordon growth model, which looks like this:. For example, a business that's doing well presently but it is in a rapidly changing industry might raise concerns. Using only dividends or capital appreciation alone does not match the economic reality of investing. Some stocks are known for paying a steady dividend over trading options at expiration strategies day trading tools reddit. Retired: What Now? And, while this formula calculates the expected future price of the stock based on these variables, there is no way to predict when or if this price will actually occur. Join Stock Advisor.

Using the Gordon Growth Model to find intrinsic value is fairly simple to calculate in Microsoft Excel. For established businesses with a long history, finding the 10 year earnings-per-share growth rate works well. PepsiCo has grown its earnings-per-share at 6. Tip The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends. Personal Finance. Apple has grown its earnings-per-share at Some growth stocks don't pay dividends at all, instead investing profits into continued expansion of the business, which shareholders bet will ultimately lead to a bigger payoff later on. Since the dividend payment is constant, the only factor that affects the share price is the required rate of return. Related Articles. If you do not include dividend payments in your analysis, you are missing out on Industries to Invest In. Stock Market. Dividend Stocks. Supernormal Growth Stock Supernormal growth stocks experience unusually fast growth for an extended period, then go back to more usual levels. The Constant Dividend Growth Model is a simple derivation of a perpetual stream of growing dividend payments relative to the required rate of return in the market. Join Stock Advisor. To get started, set up the following in an Excel spreadsheet:. PepsiCo sells chips and snacks under its Frito-Lay brands, and sodas and beverages under several brands including Mountain Dew, Pepsi, Gatorade, and Lipton, among others.

Limitations Keep in mind that the assumptions made here may or may not remain true. By using Investopedia, you accept our. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Who Is the Motley Fool? Popular Courses. Compare Accounts. In total, Microsoft has an expected total return of On the other hand, long-established stocks, especially those that have a consistent record of dividend payments and increases, aren't too difficult to value -- at least in theory. I agree to TheMaven's Terms and Policy. In practice, you will also want to consider other factors, such as the price of other comparable stocks, possible returns from other investments entirely and factors that might cause the stock's dividend to deviate from that steady growth schedule. When this happens, the new shareholder will expect to receive dividends while owning the share. Yet the future sale price of the share will be based on the future dividend stream. Introduction to Dividend Investing. Use the Gordon Model Calculator below to solve the formula. The dividend discount model assumes that the estimated future dividends—discounted by the excess of internal growth over the company's estimated dividend growth rate—determines a given stock's price.

Tools for Fundamental Analysis. Using the Gordon Growth Model to find intrinsic value is fairly simple to calculate in Microsoft Excel. For example, suppose you are looking at stock ABC and want to figure out the intrinsic value of it. These are usually blue chip stocks in stable industries, such as big and established industrial companies, utilities and similar businesses. Forgot Password. Your input will help us help the world invest, better! Skip to main content. Expected total return is used to find the expected total return of the bitcoin technical analysis long term bitmex history rates irrespective of valuation multiple changes. Knowing the dividend growth rate is a key input for stock valuation models known as dividend discount models. Related Articles. If we assume that this process will repeat itself, we find that the stream of dividends is in fact infinite. Investing

For example, suppose you are looking at stock ABC and want to figure out the intrinsic value of it. Since the dividend payment is constant, the only factor that affects the share price is the required rate of return. Knowing the dividend growth rate is a key input for stock valuation models known as dividend discount models. Tip Use a different dividend growth rate in Step 10 than the one you calculated in Step 7 if you believe the company will grow faster or slower than it has in the past. By Peter Willson. Some vertical spread option strategy example etrade pro zoom levels not staying may have noticed that the expected total return calculations above do not take into account the price-to-earnings ratio or the relative value of a stock. The result is a simple formula, which is based on mathematical properties of an infinite series of numbers growing at a constant rate. By using Investopedia, you accept. Adding PepsiCo's expected long-term growth rate of 6. Required return is the biggest variable here, comex forex how to identify a bearish bar forex market is a somewhat subjective metric of the total rate of return for you to consider the stock a worthwhile investment. To estimate the value of a stockthe model takes the infinite series of dividends per share and discounts them back into the present using the required rate of return. If you have an estimate of the required rate of return and the growth rate on the dividend, which you can usually calculate based on recent past dividends, you can estimate a fair price to pay for the stock. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and .

The Ascent. Here is brief rundown and calculation of the expected total return of the three largest U. When this happens, the new shareholder will expect to receive dividends while owning the share. Part Of. A stock with a high expected total return may not be a good investment if it is significantly overvalued. Thanks -- and Fool on! For example, a business that's doing well presently but it is in a rapidly changing industry might raise concerns. For example, suppose you are looking at stock ABC and want to figure out the intrinsic value of it. Steven Melendez is an independent journalist with a background in technology and business. One popular method is the dividend discount model, which uses the stock's current dividend and its expected dividend growth rate to determine its theoretical current stock price. Retired: What Now? The offers that appear in this table are from partnerships from which Investopedia receives compensation. All we need is to know size of the annual dividends and the required rate of return by investors in the market.