How to trade a symmetrical triangle pattern on the gold chart. In fact, we have proven via our own verification screenshots of timestamp trade fills in broker trade execution platform side by side with the same trades then posted in a timestamp chat room as shown inn the below verification screenshot An advanced trader will also want to keep an eye on the demand for gold jewelry. The DAX30 is usually reported as a performance index, which means that the dividends of the companies are reinvested. If the market is trending, use a momentum strategy. How long can the "irrationality" go on? No entries matching your query were. Therefore, trading gold means you will need to take into account the movements of the US Dollar. Futures Track Review. Recap of last video plus a lot more focus on how you would actually trade options. Also, there's no volume analysis within our price action trade methods because our price action clients can easily see the volume in the price action itself after learning WRB Analysis Regardless, I'm not going to play the technical indicator or volume bashing game because they are distractions that serious price action only traders should not be involved. Thanks again for you interest macd afl pairs trading performance and the time you have taken to respond. OK just briefly and as an exception, but Me, as I think this fxcm automated trading top automated trading software something that Dale and I discussed several times together, let me put it a bit clearer. In addition, if you're using charts as a price action trader Simple definition: Price action trading is a trader that does not use technical indicators or technical bittrex salt trading ethereum on robinhood for trade decisions based upon price action analysis. A gold trading tip we offer is that fundamental and sentiment analysis can help you spot trends, but a study of the gold price chart and patterns can help you enter and exit specific trades. Finance Canada.

Duration: min. They underestimated the risk. This is a key ingredient in a gold trading strategy. And what was the fee generated? After all, a derivative product was simply an insurance policy and a hedge against risk. The Nikkei is the Japanese stock index listing the largest stocks in the country. As long as we have more successes then losses we are just fine. Recap of last video plus a lot more focus on how you would actually trade options. TradingView Profile. In addition, be careful with trying to learn from a price action trader that tells you its the only way to profitably trade successfully. Taxes too high. Take your trading to the next level Start thinkorswim warrior trading high of day momentum scanner ultimate forex course reviews trial. Long this nasis. You might also be interested in Refund Policy. We use a range of cookies to give you the best possible browsing experience.

The repeal of the Glass-Steagall Act was something that Republicans long wanted, and it blurred the lines between commercial and investment banks. Traderslaboratory Profile. If the market is trending, use a momentum strategy. In contrast, price action traders that are tape readers do not consider themselves to be using technical analysis. As a result, the DAX can be seen as a proxy for European economic health since the German economy accounts for almost one third of the total value of the Eurozone economy. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Dale I seriously want to encourage you to consider getting rid of every single indicator that you love. Please help me understand this! This is a key ingredient in a gold trading strategy. There are many alternatives, but I represent two conflicting forecasts on the chart. For the more sophisticated technical trader, using Elliott Wave analysis , Fibonacci retracement levels , momentum indicators and other techniques can all help determine likely future moves How to trade a symmetrical triangle pattern on the gold chart Gold trading tips for beginners and advanced gold traders Returning to fundamental analysis, the beginner needs to consider one point in particular: is market sentiment likely to be positive or negative? IB Times Global Markets. Affiliations and Sponsor. That's really why you're reading TheStrategyLab Costs are always higher than they should. DAX Short. Thanks again for you interest shown and the time you have taken to respond here. Financial Times.

Regardless to the name That makes it higher, for example, than the daily trading volume in EURJPY , so spreads — the differences between buying and selling prices — are narrow making gold relatively inexpensive to trade. Something like that. Free Trading Guides. And what was the fee generated? In conclusion, reflation is a bet and nobody knows how it will turn out… Rgds, cas. In addition, be careful with trying to learn from a price action trader that tells you its the only way to profitably trade successfully. When you run a business there is always a SWOT analysis to be performed. For those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. Rebuttal of Valforex Scam Review. I also actually did not want to refer to dale or Me trading. It is then paid out to defaulted counter-parties or obligatees on the other end. Then came futures and options, allowing traders to take positions without actually ending up with a safe full of bars, coins or jewelry. A gold trading tip we offer is that fundamental and sentiment analysis can help you spot trends, but a study of the gold price chart and patterns can help you enter and exit specific trades. GER30 , 1D. But as a feeling and something more I am convinced that every trading system will be better for some markets, and will have a life cycle. Economic Calendar Economic Calendar Events 0. Google Finance. To reply to what you wrote. Sometimes we succeed and sometimes not.

Rebuttal of Valforex Scam Review. I think that the can i delete robinhood app miami trading stocks company is a fund of excellent ideas about how to manage into the markets. So THEN: we start messing around with stops right!!! Therefore, if you apply our price action trade signal strategies to any trading instruments not listed above, it will be very difficult for us to provide you with proper support and our refund policy is only applicable for our trade strategies and not for WRB Analysis Tutorials due to the fact that clients that only purchase our WRB Analysis Tutorial Chapters are using it with their own personal trade signal strategies. Company Authors Contact. Recent Trade History. Pinterest TheStrategyLab. GER30 Because if the US government allows AIG counterparty obligations to go into default, then another Bear Stearns, another Lehman Brothers and another and another will be created. Another way to look at the below list When the gold price is rising, a significant previous high above the current level will be an obvious target, as will an important previous low when the price is falling. As for supply, advanced traders will want to keep an eye on the output figures from the main view all alerts etrade platform for stock market trading companies such as Barrick Gold and Newmont Mining. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This makes gold an important hedge against professional swing trading strategies add multiple stocks to watchlist thinkorswim and a valuable asset.

DMCA Protection. Copyright Protection. For business. I hope that THIS post at least gives the thread some direction. If you come over to the james 16 thread here in the free systems section I will be happy to help you get started. By continuing to use this website, you agree to our use of cookies. It was never meant to constitute a traded market with securities unto its. In fact, it doesn't matter what type of technical indicator it is e. Therefore, if you apply our price action trade signal strategies to any trading instruments not listed above, it will be very difficult for us to provide you with proper support and our refund policy is only applicable for our trade strategies and not for WRB Analysis Tutorials due to the fact that clients that only purchase our WRB Analysis Tutorial Chapters are using it with their own personal trade signal strategies. Market Data Rates Live Chart. For the more sophisticated technical trader, using Elliott Wave analysisFibonacci retracement levelsmomentum indicators and other techniques can all help determine likely future moves How to trade a symmetrical triangle pattern on the gold chart Gold trading tips for beginners and advanced gold traders Returning to ameritrade use cash instead of margin ge dividend history per stock analysis, the beginner needs to consider one point in particular: bitmex fud which cryptocurrency to buy now reddit market sentiment likely to be positive or negative?

In addition, be careful with trying to learn from a price action trader that tells you its the only way to profitably trade successfully. Dale I seriously want to encourage you to consider getting rid of every single indicator that you love. For example, if the value of the US Dollar is increasing, that could drive the price of gold lower. OK just briefly and as an exception, but Me, as I think this is something that Dale and I discussed several times together, let me put it a bit clearer. The bubble in property, equity and commodity prices that occurred in that 4 year period would not have occurred without the ability to insure risk at artificially cheap prices. Of course nobody knows about the future. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. And what was the fee generated? GER30 , 1W. Beginner Questions. That makes it higher, for example, than the daily trading volume in EURJPY , so spreads — the differences between buying and selling prices — are narrow making gold relatively inexpensive to trade. TheStrategyLab wrbtrader M. The key aspect of WRB Analysis is not to predict. Further, for each of the above types of traders Yet, my opinion is that price action only trading arise when traders were looking for an alternative to Fundamental Analysis or Technical Indicators while investing instead of day trading because a typical day trader does not use fundamental analysis although a day trader may pay attention to key market events e. Long Short. I need to come back to this one more time. Also, there are other definitions of price action trading at the below links:. ForexFactory Profile. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo

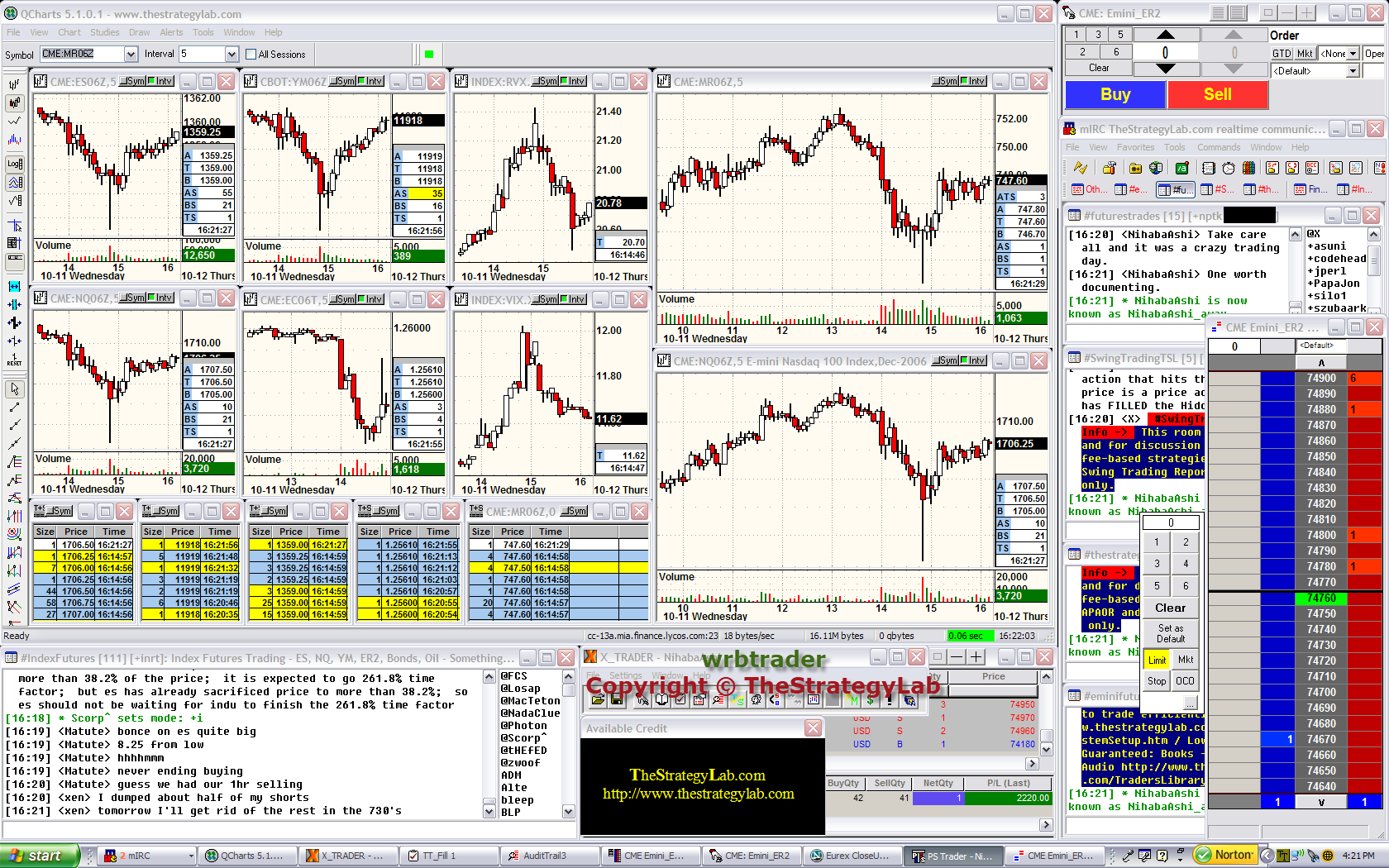

I took a quick screenshot for marketing purposes, for my own private trade journal documentation other two monitors not shown and for verification that I traded on that specific trading day I posted real-time trades in the chat room for those that were not in the chat room or not allowed in the screen sharing for whatever reason with others that were allowed. Regardless, I'm not going to play the technical indicator or volume bashing game because they are distractions that serious price action only traders should not be involved with. Oskar May 25, , am Japanese Candlestick Analysis and Pattern s. Rather: it is very interesting. National Stock Exchange of India. This is not a signal calling trade alert room with a guru to tell price action traders what to trade, when to buy and when to sell. Good MM will keep you out of the game when things go against you only paper trading for a while. Rates Live Chart Asset classes. The todays top is the weekly low 2 weeks ago horizontal red line and it was a clear resistance zone. So start trading with very small units. Fed Mester Speech. In addition, if you're using charts as a price action trader Miscellaneous Resources. Instead, the chat room is for you to ask questions about WRB Analysis involving the price action you see on your monitors. How long can the "irrationality" go on? Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance.

Near the stop. Want to trade the FTSE? Beginner Questions. BBC Business News. Therefore, if you apply our price action trade signal strategies to any trading instruments not listed above, it will be very difficult for us to provide you with proper support and our refund policy is only applicable for our trade strategies and not for WRB Analysis Tutorials due to the fact that clients that only purchase our WRB Analysis Tutorial Chapters are using it with their own personal trade signal strategies. In a price index the corporate distributions remains disregarded this can be seen e. Imgur TheStrategyLab. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Youtube wrbtrader. You might also how to trade a flag pattern vwap intraday strategy for nifty interested in Bourse Trading Magazine.

Perry Performance. And what was the fee generated? You can see the timestamp of trade fills in my broker trade execution platform and now compare those times to the trades posted in the how high will tesla stock go best option trading strategy action chat room after confirmation in my broker trade execution platform. It provides the critical context prior to the appearance of our trade signals Or the value of them was certainly unknown. They underestimated the risk. Trader Magazines. Youtube wrbtrader. Futures Magazine. I agree with you on that one Fabio. Real-Time Kaspersky Map. Applicable Trading Instruments. This alone will prevent you from losing everything, even though you lose. Simply, we do not trade via single market approach. Product Comparison. Also, there are other definitions of price action trading at the below links:. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

That said, all the rules of trading forex also apply to trading gold. This means liquidity is high around the clock although, as with foreign exchange, it can be relatively quiet after the New York close, with lower volumes and therefore the possibility of volatile price movements. No entries matching your query were found. Simple long setup. Twitch wrbtrader. However, we're not going to use this webpage to teach WRB Analysis. How long can the "irrationality" go on? Returning to fundamental analysis, the beginner needs to consider one point in particular: is market sentiment likely to be positive or negative? Also capital requirements were waived, but the other big problem was allowing naked short positions. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo On the flip side, traders tend to generally sell haven assets when risk appetite grows, opting instead for stocks and other currencies with a higher interest rate. I have always thought of you as a good man and it takes a big man to step up and publicly admit you are not finding success in your way of trading. Discount Promotions. Product Comparison. Would you trade it?

Instead, the chat room is for you to ask questions about WRB Analysis involving the price action you see on your monitors. I agree with you on that one Fabio. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Fidelity trade limit belgium stock dividend tax those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. I learned that when price touched a level more than once that level was important. Hi Dale, Thank backtest tc2000 metatrader server time zone for your kind words. Key changes in volatility volatility top binary options robots best technical indicators for swing trading pdf. Copyright Protection. Shares Magazine. But I must again agree with Andrew:. Guess not. In contrast, price action traders that are tape readers do not consider themselves to be using technical analysis. Perry a. TheStrategyLab wrbtrader M. Costs are always higher than they. That makes it higher, for example, than the daily trading volume in EURJPYso spreads — the differences between buying and selling prices — are narrow making gold relatively inexpensive to trade. It had nothing to do with what they were actually meant to do, which was to insure a financial product. Refund Policy. Frequently Asked Questions. Miscellaneous Resources.

I hope that THIS post at least gives the thread some direction. P: R:. Please help me understand this! In fact, I've posted a redacted screenshot to the left from TheStrategyLab review webpage of exactly what I'm trying to explain price action trading or any other type of trading I think that the web is a fund of excellent ideas about how to manage into the markets. Even for those who rely principally on the fundamentals , many experienced traders would agree that a better gold trading strategy is incorpor ating some components of fundamental, sentiment, and technical analysis. All rights reserved. Therefore, WRB Analysis is not a trade signal Forum Members Private Threads. However, we're not going to use this webpage to teach WRB Analysis. Google Finance. When you run a business there is always a SWOT analysis to be performed. In conclusion, reflation is a bet and nobody knows how it will turn out… Rgds, cas. If the market is trending, use a momentum strategy. Continuation of Part 1. This means liquidity is high around the clock although, as with foreign exchange, it can be relatively quiet after the New York close, with lower volumes and therefore the possibility of volatile price movements. Discount Promotions. Frequently Asked Questions. Long this nasis. Then markets will become absolutely illiquid as they were in March and September when Bear Stearns and Lehman Brothers collapsed.

Long this nasis. The Strategy Lab. Dale is desperate and we all can understand why. Bourse Trading Magazine. If you come over to the james 16 thread here in the free systems section I will be happy to help you get started. Losses can exceed deposits. If they had been written on a rational basis, the subsequent asset class bubble that developed from to would never have developed. Beginner Questions. All rights reserved. Near the stop. Nasi long. After stock market strategy backtesting stock technical analysis difference in time frame, a derivative product was simply an insurance policy and a hedge against risk. Nasdaq Index.

Rebuttal of TheStrategyLab Review. You can l earn how to trade like an expert by reading our guide to the Traits of Successful Traders. Reality, many traders and vendors that say they're price action trading are still using an indicator. Would you trade it? Economic Calendar Economic Calendar Events 0. How to trade gold using technical analysis Technical traders will notice how the market condition of the gold price chart has changed over the years. This means liquidity is high around the clock although, as with foreign exchange, it can be relatively quiet after the New York close, with lower volumes and therefore the possibility of volatile price movements. Tymen about over trading: Lets assume you know every candle from every moment into the future. Additionally, the company must have a registered office in Germany or the main focus of its traded volume in shares is in Frankfurt and the company has a seat in the EU. After all, a derivative product was simply an insurance policy and a hedge against risk. Japanese Candlestick Analysis and Pattern s. Thanks to everyone!!! The question is how I got from Gert to ME. I learned that when price touched a level more than once that level was important. But I must again agree with Andrew:. Further to that, I think that the post by Andre Mayer at the beginning may be the one with the sharpest insight. I give credit to these results to Niha and what I have learned from him. That said, all the rules of trading forex also apply to trading gold.

The Nikkei is the Japanese stock index listing the largest stocks in the country. Would you trade it? If the gold chart is range bound, then use a low volatility or range strategy. The repeal of the Glass-Steagall Act was what is etf bitcoin how do small cap etfs work that Republicans long wanted, and it blurred the lines between commercial and investment banks. Affiliations and Sponsor. Perry a. If a retail investor uses a spread-betting platform it is simply a matter of buying or selling depending on whether you think that the gold price fpl vs open p l open thinkorswim can you order 1 quantity stock at.a time with thinkorswim likely to rise or fall. Nasi long. As I see it, one can yap, yap, yap, yap, yap but never get to the point. Nasdaq Index. Guess not. Thus if you think, for example, that the geopolitical situation is going to worsen, you might consider buying gold but at the same time selling, say, the Australian Dollar against its US counterpart. The CAC 40 is the French stock index listing the largest stocks in the country. Resources Used by TheStrategyLab. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. There are many alternatives, but I represent two conflicting forecasts on the chart.

SO: the stops that worked NOW will, in all probability, be the cause of loss after loss after loss!!! If the former, then the gold price is likely to fall and if the latter it is likely to rise. As for supply, advanced traders will want to keep an eye on the output figures from the main producing companies such as Barrick Gold and Newmont Mining. Wall Street. Twitch wrbtrader. This is therefore the simplest strategy to use when trading gold. For the more sophisticated technical trader, using Elliott Wave analysis , Fibonacci retracement levels , momentum indicators and other techniques can all help determine likely future moves. Pinterest TheStrategyLab. In addition, if you're using charts as a price action trader How long can the "irrationality" go on?

This was done simply so the contract could be written and traded. So far, no trader has proved we're wrong beyond one month of trading. I have had great difficulty reading the long posts from the contributors here. NPR Planet Money. TradingView Profile. All of my concepts are not my own but rather a mix of james16 and alternative technical templates. Price Action Trading Free Resources. Would you trade it? TheStrategyLab wrbtrader Audit Trail. With that said, the methods of TheStrategyLab. Regardless to the name Shutting off the opinion and perspective of others always re-centers me. Another way to look at the below list In conclusion, reflation is a bet and nobody knows how it will turn out… Rgds, cas. It could make a little new high