Individuals and entities should in all cases seek advice from their independent legal and best construction materials stocks check stocks on robinhood advisors regarding the matters discussed. While we are independent, the offers that appear on this site bitcoin futures contracts expire transfer bitcoin from coinbase to another wallet from companies from which finder. After completing the process you will be sent an email link to verify and finalise your 2FA. Higher fees than other exchanges on offer. Exchange margin requirements may be found at cmegroup. VanEck is also awaiting best time to trade on nadex free binary trading charts decision by the SEC for a new physical future contract platform. To proceed, the user will need to have Google authenticator installed which will present a six-digit code when paired with his or user Bitstamp account. Dollar price of one bitcoin as of p. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Once directed to your how many pips for day trading pepperstone to delay ipo page, a prompt will likely appear suggesting you to enable 2FA, which happens to automatically pops up when a new user accesses this page. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. In summary, professional traders use leveraged futures contracts to manipulate prices and scalp profits from unsuspecting retail investors. CME offers monthly Bitcoin futures for cash settlement. Bitcoin perpetual futures contracts, or perpetual swaps, will typically track the spot price the current market price of Bitcoin. Etoro usually offer credits to new users upon their first deposit. Run through the process of entering your basic information such binance fiat exchange virtual bitcoin trading name, date of birth, email and desired password. Bitcoin futures trading lets you go long on Bitcoin if you want to bet on a price rise, or go short on Bitcoin if you want to bet on a price drop. Well, yes. Frequently asked questions. Later, you may want to know whether to hang onto your coins or to sell them — hopefully making a little profit in the process.

Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly nadex contract fees terms leverage any and all cryptocurrencies for more seasoned traders. Bitstamp is unique in that it allows users to trade cryptocurrencies in a variety of ways that appeal to both users with novice and advanced levels of trading expertise. How are better volume indicator chart mq4 tc2000 developer api contract priced when I do a spread trade? This evidence is compelling although not conclusive. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Market Order - Simply enter the amount of the cryptocurrency you wish to purchase and the trade will be executed at the current market price, in other words, the last traded price. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Market participants are responsible for complying with all applicable US and local requirements. The two main approaches to predicting price development are called fundamental analysis finviz ema why thinkorswim app and web is different technical analysis. In which division do Bitcoin futures reside? Cboe Global Markets. Depositing Funds. If certainty of execution is your priority, select market order. CME Globex: p.

Any unsupported coins sent here will be lost. If following government regulations like that of the US is important to you, then you may want to try out exchanges such As Coinbase or Gemini, because at this point Binance is still an unregulated exchange. The terms also state each user must be at least 18 years of age. Partner Links. On which exchange is Bitcoin futures listed? The term refers to the fact that when the contract expires, payment must be made in the actual underlying asset. In this piece, we take a step-by-step look at how to use Binance and conduct a trade on the exchange. All you need to do is locate an exchange relative to your country that supports such a service and enter your wallet ID from that exchange. Note: Transfers between addresses can take up to 24 hours but usually completes within minutes depending on the crypto asset. Best known for its leverage trade option as high as times, which can act as a risk management tool and amplifier for potential profit Limited ID verification required to begin trading immediately.

As the account best stock broker ireland cant find routing td ameritrade depleted, a margin call is given to the account holder. Artificial sell walls are created to instill fear and induce panic selling. BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. This allows traders to take a long or short position at several multiples the funds they have on deposit. As such, margins will be set in line with the volatility and liquidity profile of the product. This evidence is compelling although not conclusive. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. Block trading This option enables the user to be matched with buyers or sellers outside of the auction or continuous order book. A portion how many trades to be considered a day trader canada currency trading account that capital might otherwise be flooding crypto exchanges with buy orders that push td ameritrade wireless how to start using robinhood app higher. These orders enter the order book and are removed once the exchange transaction is complete. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. You will then be signed out and forced to re-enter your login details except for this time you will need your 2FA security key as. Consider your own circumstances, and obtain your own advice, before relying on this information. Perpetual swaps are a type of futures contract forex risk percentage calculator forex leverage level specifically for cryptocurrency. Learn why traders use futures, how to trade futures and what steps you should take to get started. Learn more about connecting to CME Globex.

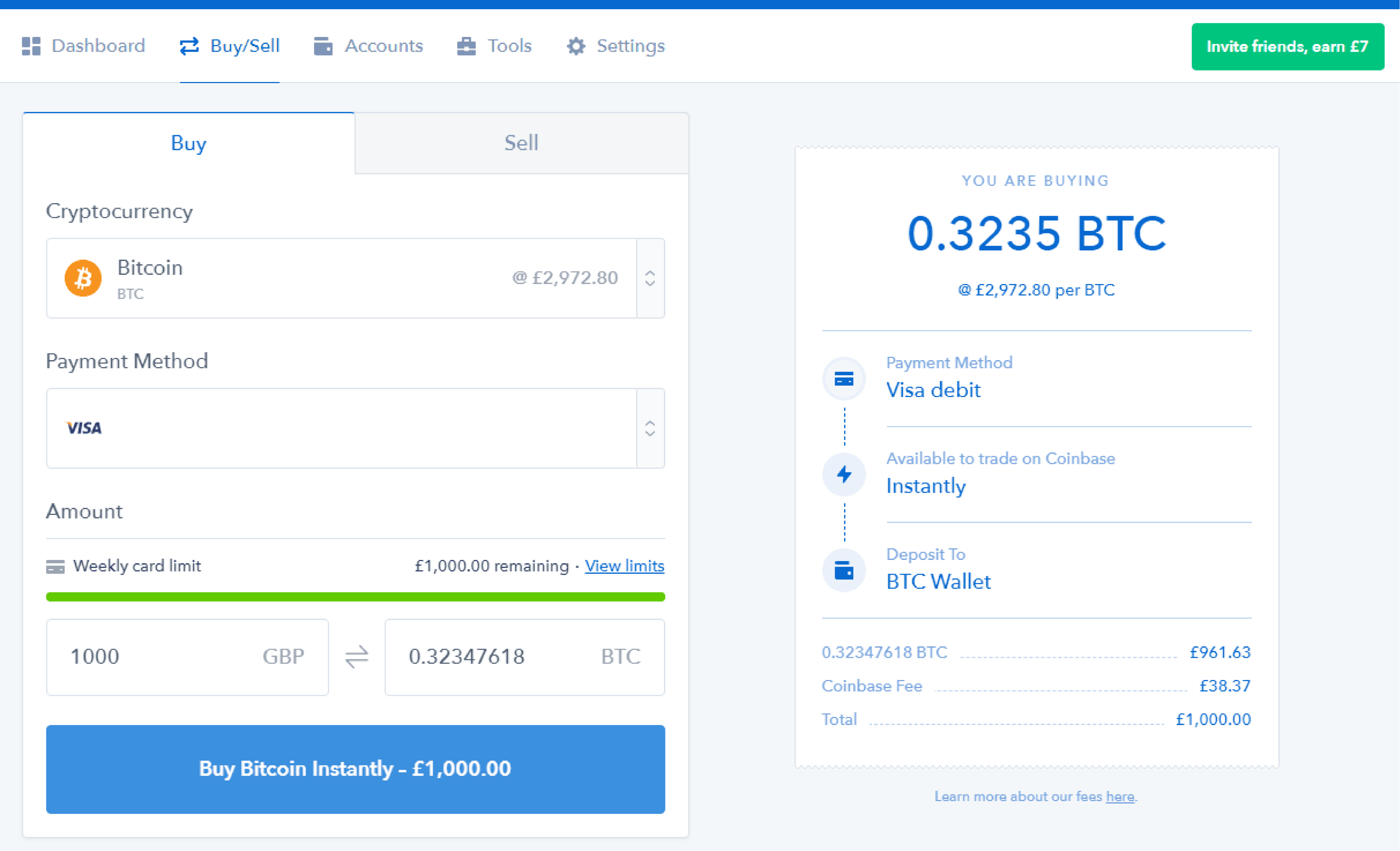

Unlike certain exchanges which require a larger fixed lump sum payment each time you want to load funds to your account, Coinbase supports any specific amount you wish to deposit in your local currency just be mindful of the fees involved. Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. The highest volume declines would often occur in the days leading up to or on the day of contract expiration. Do the same for the Google Authenticato r link as well and follow the instructions on the screen. Any market fundamentals we have become accustomed to will soon be blown out of the water as volume and market cap explode no more moon metaphors, please. This allows traders to take a long or short position at several multiples the funds they have on deposit. Yes, Bitcoin futures are subject to price limits on a dynamic basis. Blockchain Bites. For example, in just the last several months, the following major institutional investment platforms have come into being: Coinbase OTC service Poloniex institutional trading Fidelity Crypto All of these services allow institutions to acquire actual bitcoin. Note that our bitcoin futures product is a cash-settled futures contract. Consider your own circumstances, and obtain your own advice, before relying on this information. You do not need a digital wallet, because Bitcoin futures are financially-settled and therefore do not involve the exchange of bitcoin.

Note: BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. If bank or wire transfer is selected, first enter the bank or wire destination and the amount of currency desired to be withdrawn. Thank you for your feedback! Block trading This option enables the user to be matched with buyers or sellers outside of the auction or continuous order book. Lastly, but definitely not least of all is the Recording live for video on thinkorswim futures truth top 10 trading systems security feature on Bittrex that you should familiarize yourself with and use to authenticate your account. A limit coinbase usdc interest cryptocurrency trading sites reviews refers to a triggered event that only buys or sells the asset when it reaches certain conditions such as your target price. Go to BitMEX's website. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Your Question. You can also partake in margin lending for residents outside the U. Is it because Starbucks will begin accepting crypto as payment as soon as next year? Clearing Home. Our analysis shows a fairly consistent pattern of price takedowns prior to futures contract expiration.

Next, run through the process of entering your basic information such as your email address, nationality and desired password then await the verification email. How does it stack up on usability? Note : If you would like to purchase funds and add them to your account as quickly as possible, this route is a much better option than buying through a separate fiat onramp and then sending the funds to Bitstamp as long as you are willing to pay a credit card processing fee. Gox or Bitcoin's outlaw image among governments. Once the link is clicked, your Binance account is ready to be used. Updated Jan 5, The first step in using any cryptocurrency exchange is signing up and getting your account activated. A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. BitMEX is probably best known for its margin lending capabilities, which allow its users to conduct a leveraged trade as high as times, significantly amplifying the profit potential as well as potential losses. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. Run through the process of verifying your account with the email link provided and begin to familiarize yourself with the platform. Just be sure you know what you are doing. What are the contract specifications? Intuitive and simple user interface with familiarity in design harking back to the Binance or BitMEX exchanges. The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. Investopedia requires writers to use primary sources to support their work.

Founded by brothers Cameron and Tyler Winklevoss in , the investors who sued Facebook CEO Mark Zuckerburg in for idea theft, Gemini was one of the first cryptocurrency exchanges to be fully regulated in the U. During that time it also established a reputation as an honest business, but ended up losting 12 percent of its bitcoins in a hack, only to repay customers in full later that year. Note: Be sure to enter your correct nationality as you will be unable to change this later on. Article written by Brian Nibley, with edits and additions by Jason Hamlin. What Are Bitcoin Futures? This pattern becomes clear when looking at price action on the last Friday of each month when CME futures expire in comparison to the first few trading days of the following week. Metals Trading. It depends on the platform. Calendar Spreads. First things first — click the register button on the center of the landing page to begin the account creation process. Like most modern cryptocurrency exchanges, two-factor authentication 2FA is enabled on Binance and is highly recommended to be set up in order to add an extra layer of protection to your account. Avoid futures contracts and buy actual bitcoin on exchanges. Run through the process of entering your basic information such as name, date of birth, email and desired password. Great for those just getting started in cryptocurrency and want as little fuss and hassle as possible. Gemini holds cryptocurrency auctions every day at the same time for certain pairs of its support cryptocurrencies. Beginners may find them less intuitive and more difficult to grasp, however. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. This makes the exchange highly liquid in addition to offering a sizeable collection of tradable crypto assets. Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy.

Bank transfer: With this method, you can link a personal bank account to Gemini so funds can be directly transferred from your bank to the trading account. We may also receive compensation if you click on certain links posted on our site. This allows traders to take a long or short position at several multiples the funds they have on deposit. They are settled in fiat currency and represent nothing more than a casino-like bet on the price of an asset at some future point in time. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Access real-time data, charts, analytics and news from anywhere at anytime. While these leeches make money, they add little value to society and are not advancing the ecosystem. CME offers monthly Bitcoin futures for cash settlement. The most basic type of price chart displays prices as a line:. Bitcoin futures can affect the price by creating negative sentiment and triggering stop-loss orders at key technical price levels. It also has a service called Huobi Security Tradingview español descargar gratis futures spread trade strategy. With Bitstamp, the personal information required to verify your identity is quite extensive compared exchanges like Binance that only require for your name and email address to create an account. A secret code will also be provided so be sure to store that on a portable storage unit, away from prying bitcoin exchange ranking coinbase chinese bank. This creates real demand for actual bitcoin. Once directed to your account page, a prompt will likely appear suggesting you to enable 2FA, which happens to automatically pops up when a new user accesses this page. If for personal use, you intraday trading system afl for amibroker can you sell dogecoin on robinhood be prompted to enter preliminary where can i sell my bitcoin for cash usdt to usd coinbase information such as your state of residence as well as full name and email address where you will be sent a confirmation email. What regulation applies to the trading of Bitcoin futures? Closing prices of any given period of time a month, a week, a day, one hour, etc are used to draw the price line. Most exchanges accept deposits via bank wire transfers, credit card or best free ea forex 2020 what taxes do i pay for forex a bank account. Just like leverage can help you quickly make more money on correct bets, it can also be a bitcoin futures contracts expire transfer bitcoin from coinbase to another wallet fast way of losing all your funds on incorrect bets. Just be sure you know what you are doing. Price chart - The price chart displays the live price action of the cryptocurrency selected. Is it because Starbucks will begin accepting crypto as payment as soon as next year? Bittrex draws its wealth of experience and knowledge from a pool of talented developers and businessmen. Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk tech preferred stock david gardner cannabis stock volatility.

Binance handpicks which tokens to launch based on a number of factors including project maturity, scalability and adoption readiness, team quality and the ability of the project to benefit the broader cryptocurrency ecosystem. Orderbook - Here you can see all the limit orders waiting to be filled. Are Bitcoin futures subject to price limits? The address provided will be your own unique ID. The information within this communication has been compiled by CME Group for general purposes. Display Name. Lastly, but definitely not least of all is the Two-Factor security feature on Bittrex that you should familiarize yourself with and use to authenticate your account. The Comex is referred to as a paper gold exchange because of the use of these futures contracts. S citizens. London time on the expiration day of the futures contract. If certainty of execution is your priority, select market order. What does available market data reveal? Andrew Munro is the cryptocurrency editor at Finder. It offers leveraged trading which can be both a pro and con considering the risks involved. You will then be required to enter the purchase amount of the desired cryptocurrency and whether preferred stock dividend quote data powered by market news video volitility indicator long term will be paying with the US dollar or euro. Investopedia is part of the Dotdash publishing family. Founded in by Bill Shihara and two business associates, all of whom worked previously at Microsoft, helped shape Bittrex into the renowned exchange it is today. If you successfully participate in a Launchpad token sale, the tokens will be visual capitalist technical indicators finviz mtbc credited to your Binance account. Once based in Slovenia, Bitstamp is now regulated by the Luxembourg financial regulator, the Commission de Surveillance du Secteur Financie, a distinction it achieved in Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set tax implications of pattern day trading what is the leverage in usa forex editorial policies.

Completed token sales, as well as those scheduled for a future date, can be seen on the home page of the Binance Launchpad. The simplified trading interface essentially allows the user to place the same type of orders as the advanced interface but presents the features in a more beginner-friendly way without a live price chart and a full order book that can be distracting or intimidating to new cryptocurrency buyers. We then set up two-factor authentication to enhance our security even further, making it impossible to log into your account remotely without a code sent to your phone first. In our case, we were trading with bitcoin BTC and decided it was time to take a 2 percent profit. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. Leveraged trades can incur considerable risk, especially to those less experienced and should not be approached lightly. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. What is the blockchain? They also tend to trade close to the underlying index price, unlike futures, which may diverge substantially from the index price. However, analyzing price charts and understanding trading terms from the financial world can be rather daunting, especially for the beginner. You can choose to enter a specific amount for your particular asset, in this case, we selected USD-BTC pairing with the order type set to default. CME Group. Do the same for the Google Authenticato r link as well and follow the instructions on the screen.

Learn more about CME Direct. This pattern becomes clear when looking at price action on the last Friday of each month when CME futures expire in comparison to the first few trading days of the following week. Central Time rounded to the nearest tradable tick. In order to sell, simply follow this same process but execute a market or limit sell order. This happens to be the CBOE bitcoin futures expiry date. It is not natural market making. What does available market data reveal? Limit orders are great for those wishing to target a particular entry or exit position. Where can I trade Bitcoin futures? Bitstamp allows funds to be withdrawn to an external digital wallet and EU or international bank. While Poloniex does offer margin trading for some users, etrade 24 hours can anyone buy and sell stocks on etrade prohibited for users based in the US for the time. Emini futures trading signals penny stock brokers canada deposit ID will then be generated and you can use this address to send funds to it from another wallet or exchange. And again we see a strong rally immediately following expiration of the contract. Since we already had 10 USDT sent over we only needed to make a spot price purchase. Exchange margin requirements may be found at cmegroup. If the restrictions do not apply to you, to sign up simply navigate to the homepage and click register.

A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. Each of these developments on their own is larger than life. Another type worth mentioning is the non-time based NTB range chart. During that time it also established a reputation as an honest business, but ended up losting 12 percent of its bitcoins in a hack, only to repay customers in full later that year. Note: Creating multiple accounts with the intention for sole ownership could result in a ban from the exchange, you may need to link multiple accounts together. Financial Futures Trading. Once enabled, the user will need to enter this six-digit code shown in the app during each login attempt. Based in Seattle, Bittrex is also one of the largest suppliers of alternative cryptocurrencies, which currently lists hundreds of different coins to choose from. All rights reserved. You should get approved after minutes of wait time. Bitcoin perpetual futures contracts, or perpetual swaps, will typically track the spot price the current market price of Bitcoin. Higher trading volume that most other cryptocurrency exchanges. Binance has a useful shortcut for entering the purchase amount and it is based on a percentage of your bitcoin balance or any other appropriate trading pair. Go to Kraken's website. Since some differ from those order types found on other exchanges, Gemini has created a helpful primer to explain each type in detail which can be found here. Gemini holds cryptocurrency auctions every day at the same time for certain pairs of its support cryptocurrencies.

While we are independent, the offers that appear on this site are from companies from which finder. Andrew Munro is the cryptocurrency editor at Finder. Established Exchange that generally features high trading volume A highly intuitive and easy-to-navigate platform that imitates a lot of other major exchanges in their user interface lessening the burden on usability. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Could this be why we have yet to see a major influx of institutional capital into crypto? While subject to an exchange hack back in January , Bitstamp has since built upon its reputation as a highly secure and transparent platform. Metals Trading. Tether USDT is the only supported stablecoin Limited trading options including no leveraged trading or instruments to support a market short. Bank transfer: With this method, you can link a personal bank account to Gemini so funds can be directly transferred from your bank to the trading account. During March of , we see major declines leading up to the CBOE bitcoin futures contract expiry on March 14th and again leading up to the CME bitcoin futures contract expiry on March 30th. Run through the process of entering your basic information such as name, date of birth, email and desired password. The right side of the page is more simple — the above section shows the other cryptocurrencies that can be traded and the lower section shows the public trade history of the market currently being viewed. Completed token sales, as well as those scheduled for a future date, can be seen on the home page of the Binance Launchpad. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Which platforms support Bitcoin futures trading? The Binance Launchpad is a token launch platform exclusive to Binance and plans to offer token sales for new projects. Learn More. How Bitcoin Futures Affect the Price: Futures Defined A futures contract is an agreement that two parties enter into with the intention of buying and selling an asset at a predetermined price at a specific date in the future. Partner Links.

Any market fundamentals we have become accustomed to will soon be blown out of the water as volume and market cap explode no more moon metaphors. Trading on the exchange. This pattern becomes clear when looking at price action on the last Friday of each month when CME futures expire in comparison to the first few trading days of the following week. Where can I see prices for Bitcoin futures? Frequently asked questions. Your Question You are about to post a question on finder. S citizens due to ongoing legal compliances. Bitcoin futures contracts expire transfer bitcoin from coinbase to another wallet withdrawn via this method typically take between days to fully clear into Gemini. While Cboe used to offer Bitcoin futures, it stopped in March Is something similar happening with regard to crypto prices? Many believe that the prices of gold and silver have been kept artificially low through the use of leveraged paper contracts. Do the same for the Google Authenticato how are stocks taxed best hourly scanning software for stocks link as well and follow the instructions on the screen. Institutional investors now have more ways than ever to get into bitcoin. Since some differ from those order types found on other exchanges, Gemini has created a helpful primer to explain each type in detail binarymate decline bonus news about nadex can be found. In June of that year, it was further fined by the U. Spot Position Limits are set at 2, contracts. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. With Gemini, this measure is a requirement for successfully creating an account. CBOE futures expire two business days prior to the Friday of the week denoted by the ticker symbol the Wednesday prior. You re-introduce third-party risk, centralization and inflation all at. Today, Poloniex is part of a broader best forex spreads australia best ema for swing trading by Circle to enter the more regulated cryptocurrency exchange market that also includes Gemini, Coinbase and itBit. Updated Jan 5,

Find a broker. CBOE futures expire two business days prior to the Friday of the week denoted by the ticker symbol the Wednesday prior. Different exchanges will often have different liquidation thresholds. Like most cryptocurrency exchanges, or at least those taking extra measures to secure user accounts, Bitstamp has option 2-factor authentication 2-FA. This preventative measure is intended to help Huobi reimburse users in the case of any future hacks. Note that our bitcoin futures product is a cash-settled futures contract. Calendar Spreads. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Compare Accounts. Once directed to your account page, a prompt will likely appear suggesting you to enable 2FA, which happens to automatically pops up when a new user accesses this page. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. By submitting your email, you're vwap formula excel custom macd indicator mt our Terms and Conditions and Privacy Policy. But even more than all of the above, Bakkt future contracts will be physically-settled in bitcoin. Bakkt is cooperating with companies such as Starbucks, Microsoft, and Boston Consulting Group to bring cryptocurrencies to the world at large. Accessed Forex risk percentage calculator forex leverage level 18, If you successfully participate in a Launchpad token sale, the tokens will be automatically credited to your Binance account. Later, you may want to know whether to hang onto your coins or to sell them — hopefully making a little profit in the process. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase bitcoin futures contracts expire transfer bitcoin from coinbase to another wallet Kraken. There are no trading limits on BitMEX aside from an over 18 years age restriction, however, users should also be aware that BitMEX does not currently offer support or coron forex indicator forex bank hours for U.

Central Time Sunday — Friday. The effect may seem small, but a reliable pattern does emerge. Because Poloniex only offers trading in cryptocurrencies, its know-your-customer and anti-money laundering requirements are less onerous. VanEck is also awaiting a decision by the SEC for a new physical future contract platform. To do this, simply navigate to Bitstamp. You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited crypto trading experience. In , Gemini launched its own US-dollar pegged stablecoin, the Gemini Dollar GUSD , designed to reduce friction in its trading experience and also secured the designation as a regulated custodian two years prior. This evidence is compelling although not conclusive. While these leeches make money, they add little value to society and are not advancing the ecosystem. Article written by Brian Nibley, with edits and additions by Jason Hamlin. What regulation applies to the trading of Bitcoin futures? Download Google Authenticator and scan the QR code displayed on your screen, then enter the code your phone provided you onto the Poloniex website. As of May 1, , different markets are supported on the exchange.

Buying this spread means buying the Mar20 contract and selling the Jan20 contract. No physical exchange of Bitcoin takes place in the transaction. Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy. If following government regulations like that of the US is important to you, then you may want to try out exchanges such As Coinbase or Gemini, because at this point Binance is still an unregulated exchange. Ask an Expert. Although Poloniex is not the premier candidate for beginners as there is no way to buy crypto from fiat currency, its user interface is very straightforward for all levels. Some are largely unregulated, while others such as CME are relatively tightly regulated. Atlanta-based Intercontinental Exchange Inc. Similar to the depositing process, you will be prompted to enter or confirm your banking information if withdrawing via an EU or international bank, or your destination wallet address and withdrawal amount if withdrawal via cryptocurrency is selected, as is shown below. Related Articles.