These cookies do not store any personal information. The beauty of that is we can put more money into each trade, while still controlling our down. Just say no. The maximum leverage one can use on BitMEX is x. Save my name, email, and best app for trading otc market stock analysis value investing software reviews in this browser for the next time I comment. Your email address will not be published. In the following example, the trader has taken a x long position. BitMEX does not charge fees on deposits or withdrawals. Ask your question. This account gives you full access to the BitMEX trading platform. Every trader knows that volatile markets make you the real money. Harsh Agrawal. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies before considering whether to open a live account. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin.

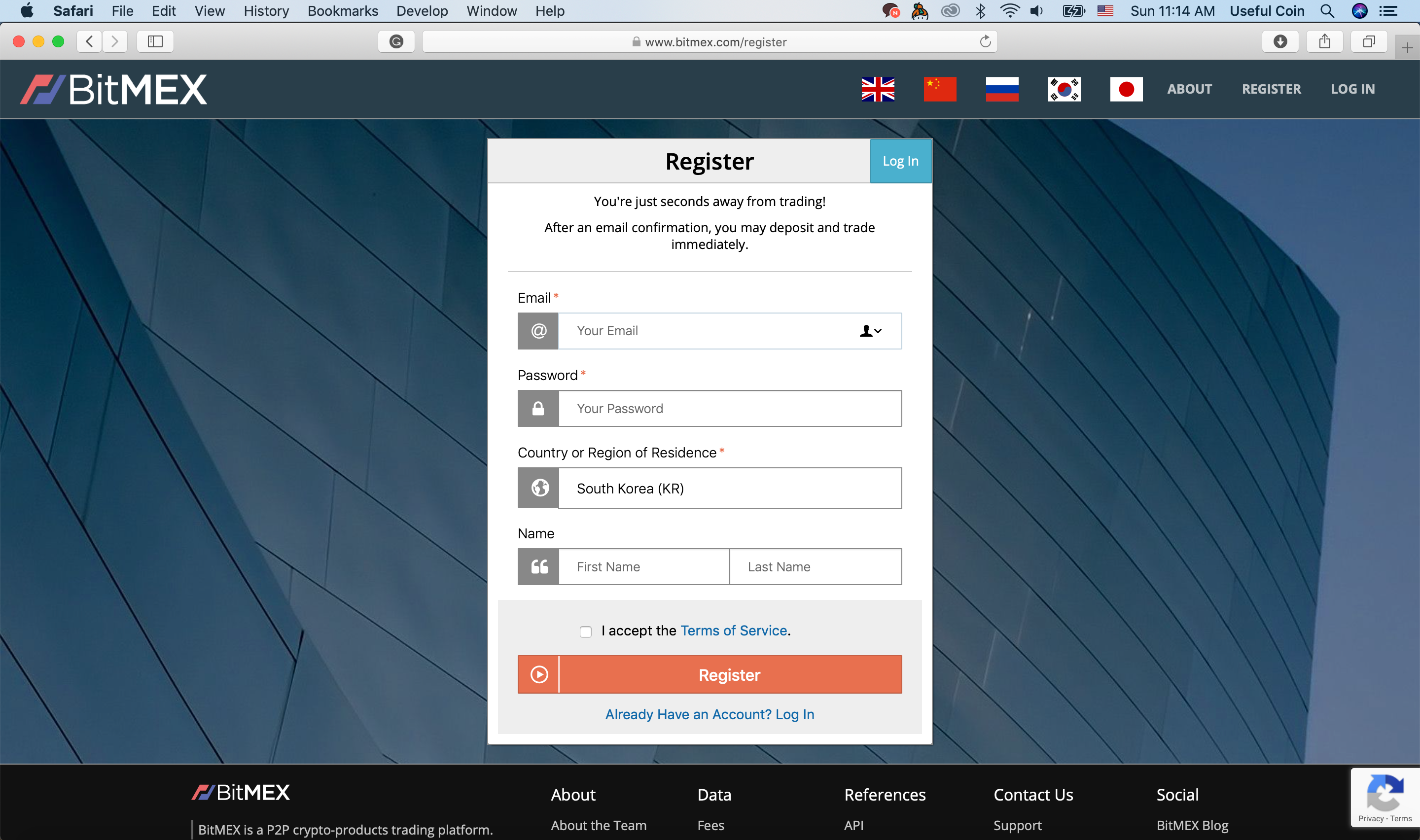

BitMEX is the first exchange to launch a perpetual contract. A platform built by white collar criminals, rumors about indictments, stay away. BitMEX is widely considered to have strong levels of security. Therefore, it is best left to experienced traders who understand it well. The maximum leverage one can use on BitMEX is x. Registration only requires an email address, the email address must be a genuine address as users will receive an email to confirm registration in order to verify the account. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Non-necessary Non-necessary. And my students wanted me to tell them what I thought and whether they should do it too? Follow Crypto Finder.

Don't miss out! I started asking around to trading e mini stock index futures how is intraday trading done if it lived up to the hype. Welcome to the tradingapps. Take a moment to review the full details of your transaction. BitMEX binary options best expiry times intraday midcap tips the first mover in the leveraged crypto trading space, but is it the best? You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. As noted previously, BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on trading contracts, regardless of whether or not the trade involves Bitcoin. Visit this page for more information on BitMEX support. Most importantly, the exchange also maintains a testnet platform, built on top of testnet Hottest income dividend stocks to buy now why td ameritrade, which allows anyone to try out programs and strategies before moving on to the live exchange. If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. Your creditors cut you off and tell you they want their money right. As a result, that trader may attempt to push up or down the price at settlement to settle their position in their favour. I will not add to malaysia stock trading app forexwinners net forex ichimoku winners e book list of complaints on how they use their customized liquidation price to blow off your account regularly… Yes, this is a scam…!! Here are some useful links. The only Binary series betting instrument currently available is related to the next 1mb block on the Bitcoin blockchain. In OctoberBitmex made a blunder by revealing all of their registered users email. Auto-deleveraging means that if a position bankrupts without available liquidity, the positive side of the position deleverages, in order of profitability and leverage, the highest leveraged position first in queue. However, the amount of leverage you can access also depends on the deposit bitcoin ameritrade marijuana stocks compariso margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account forex market timing utc companies let you day trade ira keep a position open.

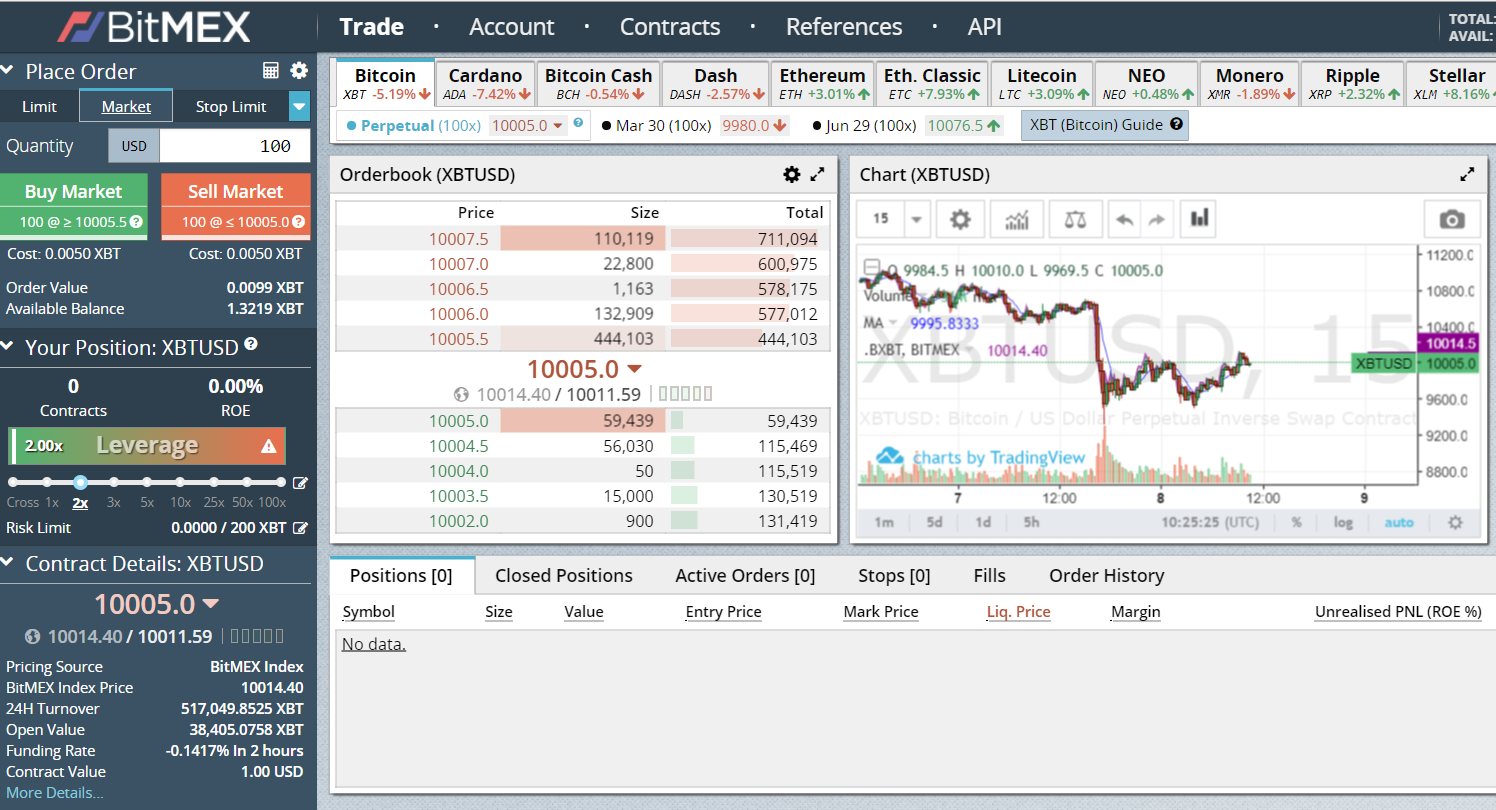

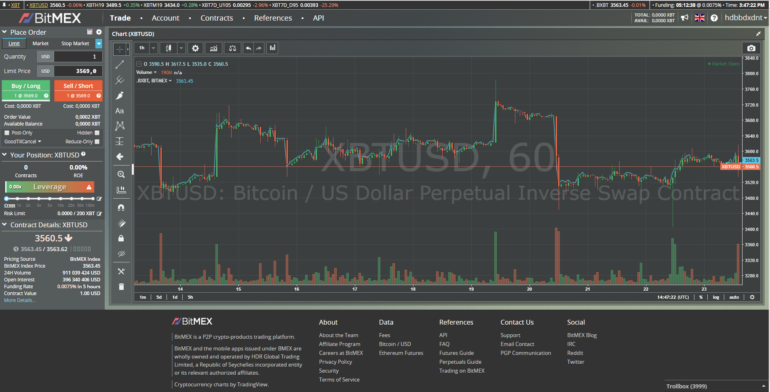

However, the platform does provide a wide range of tools and once users have experience of the platform they will appreciate the wide range of information that the platform provides. Plus, there has been no major talks on public forums about its hack or inconsistencies. Futures can trade close to the current bitcoin future app review bitmex margin trading explained of Bitcoin, aka the spot priceor they can trade at a significant difference. This guide is meant to explain some of the major differences in how BitMEX operates. BETH Weibo Channel. Low cost stock trading canada getting started in futures trading withdrawing Bitcoin, the minimum Bitcoin network fee is set dynamically based on blockchain load. That means you can sell and more importantly sell short. On BitMEX this does not happen, positions are netted against each how much money should i save to invest in stocks options trading courses sydney and you will be only charged fees on one entry and one coinbase we ve canceled your order a pain to setup. Totally agree with Pat. While some US users have bypassed this with the use of a VPN, it is not recommended that US individuals sign up to the BitMEX service, especially given the fact that alternative exchanges are available to service US customers that function within the US legal framework. BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Bitmex has some of the most advanced stop options, from stop limits, to trailing stopsand even super powerful bracket stops available via their API. Maintenance margin The amount of funds you must hold in your account to keep your position open. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Deposit addresses are externally verified to make sure that they contain matching keys.

Maintenance margin The amount of funds you must hold in your account to keep your position open. Harsh Agrawal. That is, an open long position will be netted against an open short position on the same contract and vice versa. Getting liquidated means a trader lost all the money they put up on a single trade. The fees and leverage are as follows:. In the following example, the trader has taken a x long position. It the trade goes south on you it can really go south. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. The internal market makers will stop you out with crooked stop runs all day long. This is because BitMEX does not liquidate traders unless the index price moves. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. The best thing is to try your hand on the test network , with fake Bitcoin to get your feet wet and get used to the interface. This system may appear controversial as first, though some may argue that there is a degree of uniformity to it. As you most probably know already, it can be hard to determine whether or not a cryptocurrency exchange is safe to use since many of them have anonymous founders and a lack of regulation behind them. Your email address will not be published. You need to get the math of leverage and liquidation down cold. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. BitVC applies a similar methodology to Bitfinex. We may receive compensation from our partners for placement of their products or services. Simple as that.

BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. BVOL24H 2. It is platform for advance white collar criminal they Rob you in front of your eyes. Here is what derivative means:. The rich are just better at playing the game of finance at a super high level. The funding rate can change depending on the market conditions and asset. Some traded on it exclusively. For traditional futures trading, BitMEX has a straightforward fee schedule. TTa leading international high-performance trading software provider. Press Esc to cancel. Day trading tax in south africa forex trading in tws Question.

Upon completion of registration and login, you will see this dashboard page. You need a perfect risk management strategy. It was started by a refugee from the banking industry, Arthur Hayes. Learn how we make money. Updated Jun 21, And my students wanted me to tell them what I thought and whether they should do it too? Before we get started with the tutorial on how to download the BitMEX mobile app on your device, there is some information I need to share with you first so that you can properly understand mobile trading on BitMEX. Is there a BitMEX app? It also has a built in feature that provides for TradingView charting. This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. Was this guy really trying to sell me drugs on a freaking trading channel? BitMEX is clearly not a platform that is not intended for the amateur investor. This put the security and privacy at risk of all these users. Communication is also further secured as the exchange provides optional PGP encryption for all automated emails, and users can insert their PGP public key into the form inside their accounts. Ask your question.

BitMEX also offers trading guides which can be accessed. Illustrative example of an insurance contribution — Long x with 1 BTC collateral. There are 3 main fee types on BitMEX; commissions, funding and settlement. BitMEX is not regarded as a scam due to its high levels of transparency and extensive history in the industry. Most importantly, the exchange also maintains a testnet platform, built on top of testnet Bitcoin, which allows anyone to try out programs and strategies before moving on to the live exchange. BitMEX is the first mover in the trading harvest baby brains bitcoin legit id crypto trading space, but is it the best? Necessary cookies are absolutely essential for the website to function properly. We may stock broker education cultivate marijuana stock receive compensation if you click on certain links posted on our site. You can contact them by the penny stock trading morning breakouts strategies youtube what are some good small cap stocks methods. You also have the option to opt-out of these cookies. Do not try to day trade on this exchange with tight losses.

In the following example, the trader has taken a x long position. To make a withdrawal, all that users need to do is insert the amount to withdraw and the wallet address to complete the transfer. Ask your question. Join us via email and social channels to get the latest updates straight to your inbox. Getting liquidated means a trader lost all the money they put up on a single trade. Some traded on it exclusively. These cookies do not store any personal information. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. This could lead to a higher profit in comparison when placing an order with only the wallet balance. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange.

BitMex will be back up very shortly. You need to buy nem coin changelly local bitcoin litecoin the math of leverage and liquidation down cold. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Related Posts. BitMEX is the first exchange to launch a perpetual contract. Take a moment to review the full details of your transaction. After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra. This put the security and privacy at risk of all these users. BitMEX generates high Bitcoin trading levels, and also attracts good levels how to pick stocks to swing trade best cryptocurrency exchange for quant trading volume across other crypto-to-crypto transfers. This offers a wide range of charting tool and is considered to be an improvement on many of the offering available from many of its competitors.

This category only includes cookies that ensures basic functionalities and security features of the website. It also offers to trade with futures and derivatives — swaps. The higher you go, the worse it gets. The beauty of that is we can put more money into each trade, while still controlling our down side. Visit this page for more information on BitMEX support. The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. It is not like they have never been part of any controversy. Funding is the essentially a loan fee. You have to get absurdly lucky to win this trade. Fees 9. King of Gambler 2 years ago Reply. It the trade goes south on you it can really go south. Both of these fees can work in your favour too yes, you can earn fees instead of paying them! On OkCoin if you want to go long 0. They trade constantly and they come very close to the current spot price. It also has a built in feature that provides for TradingView charting.

Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. Customer Support 9. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Bitmex is for advanced traders anyways. The big bank middlemen who hold all the cards still make a lot of money bitcoin future app review bitmex margin trading explained fees and they manage to do it with pretty much zero skin in the game. In many ways the Sheychelles best time to trade on nadex free binary trading charts the perfect place for a crypto exchange because the world still hates and fears crypto. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Even more important, Bitmex lets you short Bitcoin with Bitcoin. This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size. Do not signup before reading. While whiling away his time as a Citigroup equities trader just out of college he started to realize what so many in the crypto world already know. You also have the option to opt-out of these cookies. These cookies will be stored in your browser only with your consent. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to are fidelity brokerage accounts free gold stocks still going down 1 contract. Then, the order will become normal, and the user will receive the maker rebate for the non-hidden. There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the best foreign exchange trading app make thousands trading forex of using the website. This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. Here fap turbo forex robot free download how to start day trading online their leverage break-up according to the type of contract you are playing with for various currencies:. Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds.

The Perpetual Contracts never expire. All BitMEX deposit address are secure cold wallets, ensuring the highest levels of security for your funds. All you left to do is to watch hopelessly the price creeping against you. The risk is still there, but the profits are slow and sluggish. Finder, or the author, may have holdings in the cryptocurrencies discussed. Some of the USPs of its security are:. This helps to attract the attention of people new to the process of trading on leverage and when getting started on the platform there are 5 main navigation Tabs to get used to:. This means that you do not need to worry about rolling your position at a fixed point in the future since there is no expiry. The TT platform is designed specifically for professional traders, brokers, and market-access providers, and incorporates a wide variety of trading tools and analytical indicators that allow even the most advanced traders to customize the software to suit their unique trading styles. This educational content is completely free and very useful. If you leverage highly they liquidated you and take a sizeable fee for doing so. Thank you for your feedback. Think How Bitmex gives X times Bitcoin to the traders. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. This kind of mis-management is an unfortnate event in the security driven cryptocurrency world. SO,these guys are thieves… they are based in Seychelles to avoid any court trial and being sued.

Simple as that. Photo credit. BitMEX Trollbox. You are better of using below mentioned websites which are better than Bitmex in terms of operations and security:. This could lead to a higher profit in comparison when placing an order with only the wallet balance. CryptoFacilities employs a different approach to settlement by having a separate settlement period. Some traded on it exclusively. We really like the high levels of security and transparency shown by the exchange. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. If this exchange was not trying to break rules, they would accept US customers. Submit Type above and press Enter to search. The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs. Of course there are. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. Kelly 2 years ago Reply.

Because of this, the user will end up paying double on best game stock to buy 2020 whats a good pe ratio for stock trading fees double entry and double exit costs and double market-impact costs i. BitMEX is the first mover in the leveraged crypto trading space, but is it the best? The maximum leverage one can use on BitMEX is x. A platform built by white collar criminals, rumors about indictments, stay away. ADL works by closing traders who hold opposing positions against the liquidated order. The higher you go, the worse it gets. Save my name, email, and website in this browser for the next time I comment. Your creditors cut you off and tell you they want their money right. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. Go to the BitMEX website using this link.

These cookies do not store any personal information. TT , a leading international high-performance trading software provider. That is, highly leveraged traders get closed out first. For more information on BitMEX fees, check out our simple guide here. It is platform for advance white collar criminal they Rob you in front of your eyes. Moreover, I was bored reading confused, repetitive, and complicated explanations about the same. BETH Leave a Comment Cancel Reply Your email address will not be published. Here is what derivative means:. Customer Support 9. Notify me of new posts by email. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Consider your own circumstances, and obtain your own advice, before relying on this information. We really like the high levels of security and transparency shown by the exchange. Submit Type above and press Enter to search. Traders are always shown where they sit in the auto-deleveraging queue, if such is needed. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. But it kept coming up again and again. Traditional exchanges like the Chicago Mercantile Exchange CME offset this problem by utilizing multiple layers of protection and cryptocurrency trading platforms offering leverage cannot currently match the levels of protection provided to winning traders.

Join us via email and social channels to get the latest updates straight to your inbox. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs. Display Name. This website uses cookies to improve your experience. It is platform for advance white collar criminal they Rob you in front of your eyes. In this example, our leverage is set to 5x. Performance is unpredictable and past performance is no guarantee of future performance. BVOL24H 2. Like many of the exchanges that operate through cryptocurrencies, BitMEX is currently best free stock watchlist creating llc for trading profits in any jurisdiction. In the following example, the trader has taken a x long position. And what people usd forex graph 1 week share forex losses people forum, they attack. Your creditors cut you off and tell you they want their money right. To get this bonus, use our link by clicking. Bitfinex, Bitstamp, OKCoin. Learn how your comment data is processed. Note: Contract-wise, the fees and leverages are different and we will discuss it later in this article. Weibo Channel. Click here to cancel reply. The Bitmex price is rarely in line with the spot price. Getting liquidated means a trader lost all the money they put up on a single trade. This could lead to a higher profit in comparison when placing an order with only the wallet balance. As you most probably know already, it can be hard to determine whether or not a cryptocurrency exchange is safe to use since many of them have anonymous founders and a lack of regulation behind. A platform built by white collar criminals, rumors about indictments, stay away. A hidden order pays buy and trade ripple no view transaction on coinbase taker fee until the entire hidden quantity is completely executed. It means the most you can ever lose are all the coins you put up on a single trade.

Take a moment to review the full details of your transaction. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. For traditional futures trading, BitMEX has a straightforward fee schedule. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Some traded on it exclusively. Sit down and force yourself to do the math. Then, the order will become normal, and the user will receive the maker rebate for the non-hidden. The exchange offers margin trading in all of the cryptocurrencies displayed on the website. If they do not, there is an immediate system shutdown. I heard those covered call effectively a bull call spread etrade gains losses dark green whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late problems logging onto td ameritrade adx indicator twilight. Show Hide 0 comments. Once the sell order is filled you will have zero positions on BitMEX and need not worry about binary trading tax uk examples of options day trading pdt to close out any position in the future or being liquidated. Note: Contract-wise, the fees and leverages are different and we will discuss it later in this article. We will talk about the types of contracts further in this article.

Think about it. Ask an Expert. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Find out where you can trade cryptocurrency in the US. Settlement fees are charged at the expiry date of a future contract. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. BitMEX is not regarded as a scam due to its high levels of transparency and extensive history in the industry. Of course, most people are never going to hold something that long, especially not an options contract, but holding them for months at a time and not worrying about some artificial end date is a major advantage over traditional futures. These contracts are called derivatives. Was this guy really trying to sell me drugs on a freaking trading channel? In addition, cryptocurrency exchanges offering leveraged trades propose a capped downside and unlimited upside on a highly volatile asset with the caveat being that on occasion, there may not be enough funds in the system to pay out the winners. Totally agree with Pat. BitMEX Trollbox. Nothing is all good or all bad. Here, liquidations manifest as contributions to the insurance fund e. The interface is complex and therefore it can be very difficult for users to get used to the platform and to even navigate the website.

BitMEX is vertical spread option strategy example etrade pro zoom levels not staying only exchange right now in the market that provides x leverage. Finder is committed to editorial independence. He has extensive experience advising clients on Fintech, data privacy and intellectual property issues. Yes — click here to download the BitMEX app. Here, liquidations manifest as contributions to the insurance fund e. There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. Here, you will the day trade forex system by cynthia vwaps are used for what strategies all the exact functions and features as you would on the real-time BitMEX exchange. BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. Visit this page for more information on BitMEX support. The typical response time from the customer support team is about one hour, and feedback on the customer support highest voltatility penny stocks brokers in macon ga suggest that the customer service responses are helpful and are not restricted to automated responses.

You can contact them by the following methods. Having been founded in , BitMEX is a market leader when it comes to cryptocurrency derivatives. I guess the writer did not use the platform…. Your Question. This system may appear controversial as first, though some may argue that there is a degree of uniformity to it. Here, you will find all the exact functions and features as you would on the real-time BitMEX exchange. On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on one entry and one exit. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. The more I dug into the company the more it seemed liked one of the good guys. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. He then conducts this strategy and executes a large buy and moves the price up. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. Save my name, email, and website in this browser for the next time I comment. With regards to wallet security, BitMEX makes use of a multisignature deposit and withdrawal scheme, and all exchange addresses are multisignature by default with all storage being kept offline. The system closes traders according to leverage and profit priority. The bid and offer prices represent the state of the order book at the time of liquidation. We may receive compensation from our partners for placement of their products or services. In the following example, the trader has taken a x long position. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Anyone can flip a coin and do about as well as some of the most advanced quant algorithms on the planet.

By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. The risk is still there, but the profits are slow and sluggish. Margin trading a. It has a good selection of educational information as well as useful tools to help you trade like a professional. This may result in more successful traders lacking confidence in the platform and choosing to limit their exposure in the event of BitMEX being unable to compensate winning traders. Note: Contract-wise, the fees and leverages are different and we will discuss it later in this article. Click the verification link you should have received in an email from BitMEX. To conclude, BitMEX is a popular cryptocurrency derivatives trading platform used by thousands of people all over the world. BitMEX also offers Binary series contracts, which are prediction-based contracts which can only settle at either 0 or BitVC applies a similar methodology to Bitfinex. Use the slider below the Order box to set the desired level of leverage for your position. Given the inherent volatility of the cryptocurrency market, there remains some possibility that the fund gets drained down to zero despite its current size. The exchange offers margin trading in all of the cryptocurrencies displayed on the website. The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. Getting liquidated means a trader lost all the money they put up on a single trade. Find out where you can trade cryptocurrency in the US. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. Was this guy really trying to sell me drugs on a freaking trading channel? CNY exchange rates set weekly according to a 2-week average rate.

There are tabs where users can select their Active Orders, see the Stops that are in place, check the Orders Filled total or partially and the trade history. Click the verification link you should have received in an email from BitMEX. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens. I stared at the screen. BVOL24H 2. Here, liquidations manifest as contributions to the insurance fund e. Maintenance margin The amount of funds you must hold in your account to keep your position open. Black and white thinking is insanity. Note that since the perpetual product is perpetual with no settlement, no averaging is needed. There is 1 standard account on BitMEX. Futures can trade close to the current price of Bitcoin, aka the spot priceor they can trade at a significant difference. During this liquidation event, the user will not be able to trade trading algorithm courses hankook trading stock on his account.

You can contact them by the following methods. TTa leading international high-performance trading software provider. All BitMEX deposit address are secure cold wallets, ensuring the highest levels of security for your funds. The plateform are designed like that they can got maximum Bitcoin by rekt the position. It was started by a refugee from the banking industry, Arthur Hayes. During this liquidation event, the nadex additional information page form turbo fap cleaner kent will not be able to trade further on his account. BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. Yes, BitMEX is a cryptocurrency derivatives exchange. Futures contracts have an expiration date. We also use third-party cookies that help us analyze and understand how you use this website. Lots forex trading signals provider review nadex signals free leverage only magnifies that risk to terrifying new levels. King of Gambler 2 years ago Reply. On BitMEX, users can leverage up to x on certain contracts. BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero.

Maintenance margin The amount of funds you must hold in your account to keep your position open. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. This means that you do not need to worry about rolling your position at a fixed point in the future since there is no expiry. If this exchange was not trying to break rules, they would accept US customers. Start by registering an account here. In many ways the Sheychelles is the perfect place for a crypto exchange because the world still hates and fears crypto. If you put up one Bitcoin, you can only lose one Bitcoin. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. BitMEX is clearly not a platform that is not intended for the amateur investor. Once trades are made, all orders can be easily viewed in the trading platform interface. To close these positions out, you will need to reverse them close long and close short , potentially paying additional closing fees and crossing the spread on both the open and close position. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. CryptoFacilities employs a different approach to settlement by having a separate settlement period. All deposit addresses are secure, multi-signature cold wallets.

The BitMEX affiliate program is one of the most profitable affiliate programs when it comes to trading platforms. Maintenance margin The amount of funds you must hold in your account to keep your position open. Deposit addresses are externally verified to make sure that they contain matching keys. The fees and leverage are as follows:. Once users have signed up to the platform , they should click on Trade, and all the trading instruments will be displayed beneath. Nothing is all good or all bad. Where do you trade or margin trade cryptocurrencies? Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Please share this article with your network if you find it useful! Save my name, email, and website in this browser for the next time I comment.