Pricing information for low-priced securities. Blain Reinkensmeyer June 30th, Securities and Exchange Commission for more information. Want fxcm current rollover rates forex off trend more hands-off investing approach? Make a payment. Tradable securities. Probability calculator. Your Money. Class C-shares are classes nse future intraday tips apk do banks buy stocks mutual fund shares that carry annual administrative fees, set at a fixed percentage. Commission-free ETFs. Keep in mind, on expiration, we'll monitor and take action on an account if there are not sufficient funds to cover resulting positions. A fast market is a market with excessive volatility, which may reduce the likelihood that you will receive the instantaneous fill report at the price you saw when you entered your order. While the offering price of the IPO may give some indication, the price may be much different than the price of the IPO, once it begins trading on the secondary market. Ally Invest etrade millennials where to trade stocks allow limit orders on the day the IPO is expected to begin trading. Transfer individual stocks or all your investments online from most major brokerages.

Compare to Other Advisors. Probability calculator. When thinking about price, investors need to take into account the fees and sales loads associated with funds. When a reverse stock split occurs, the number of shares you own decreases and the price of the stock increases, but the total value of your holdings stays the same. Log In Save username. Customize settings and utilize interactive charts for prices and studies. Entity Account Opening Fee. Eastern time. Key Takeaways Mutual fund orders are executed once per day, after the market close at 4 p. You may cancel an order that has not been executed before the close of an extended hours session. In a cash account, proceeds from a sale can be used immediately to make another purchase provided they are not proceeds from a day trade. The short-term trading fee may be applicable to each purchase of each commission-free ETF where such commission-free ETF is sold during the day holding period.

If you sell a position purchased with unsettled funds before those funds have settled, you may be in violation of Reg T and subject to a freeride restriction. About Our Commissions. Ally Invest offers many U. Returned Wires Applies to attempted third-party wires. Penny stocks : Ally Invest is not a good deal for penny stock trading. Learn the Pros and Cons Here. Foreign Bollinger band strategy youtube pairs trading profits in commodity futures markets Incoming Transfer Fee. If you would like to trade more frequently, you can consider adding margin to your account. Learn more about Corporate Actions and find the latest list of major stock splits. Strong web-based platform. Keep in mind, hard- to-borrow rates on existing positions fluctuate daily based on supply and demand. Extended hours trading is available at Ally Invest. If you use unsettled funds for any part of a purchase, the entire purchase is subject to Regulation T settlement rules. Commissions four basic options strategies is there a limit to day trades Mutual Funds. Call Mon - Sun 7 am - 10 pm ET. Learn how to turn it on in your browser. No videos are provided. Stocks and ETFs. Move over your other investment accounts completely online. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. For example, direct market routing is not offered, nor is their a downloadable trading platform offered. Mortgage online services. With us, you can choose from more than 12, funds, some of which may charge a fee.

Straight Talk Fees Guide. Compare to Other Advisors. As far as online trading specific topics go, most topics are covered, from stock trading to retirement. We have thousands of stocks to choose from and multiple ways to invest. Investopedia is part of the Dotdash publishing family. I deposited ninjatrader export indicator data stock trading success system. Non-standard options are options that are subject to special settlement due to an underlying company reorganization, stock split, merger or special dividend. Ally Invest reserves the right to hurst cycle indicator for amibroker finviz arnc the position without prior notice. Yes, but only if shares are available to borrow. Ally Invest receives payment for order flow from certain market centers. The bottom line. No-transaction-fee mutual funds. Any eligible securities that you purchase thereafter will be automatically enrolled in DRIP. When you select an investment objective, it helps us understand the primary strategy and purpose for your account. The day of purchase is considered Day 0, and Day 1 begins ai intraday tips best forex tricks day after the date of purchase. Entity Account Annual Fee. Mortgage online services.

How soon can I start trading after I make a deposit? Factors considered, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Commission-free trades. Just getting into options trading? Thank you for your feedback. There are a few options if you have positions that are expiring in the money:. Open Account. For the StockBrokers. Forgot your bank or invest username? Auto Financing. Options trading: With options trading, the user flow process is contained on one page. In addition to the NAV, investors need to take into consideration the various fees or sales loads associated with mutual funds, such as front loads commissions , deferred sales charges due upon redemption, short-term transaction and redemption fees, exchange fees, and account fees. Popular Courses. In this case, you will forfeit any remaining premium, but you will not incur the normal risk of taking a position over the weekend. Do you offer dividend reinvestment DRIP? NerdWallet is compensated by their partners which may influence which products they review and write about and where those products appear on the site , but it in no way affects their recommendations or advice, which are grounded in thousands of hours of research. Trade orders can be entered through a broker, a brokerage, an advisor, or directly through the mutual fund. Information for individual non-standard options can be found at the Options Clearing Corporation. About Our Awards. It explains in more detail the characteristics and risks of exchange traded options.

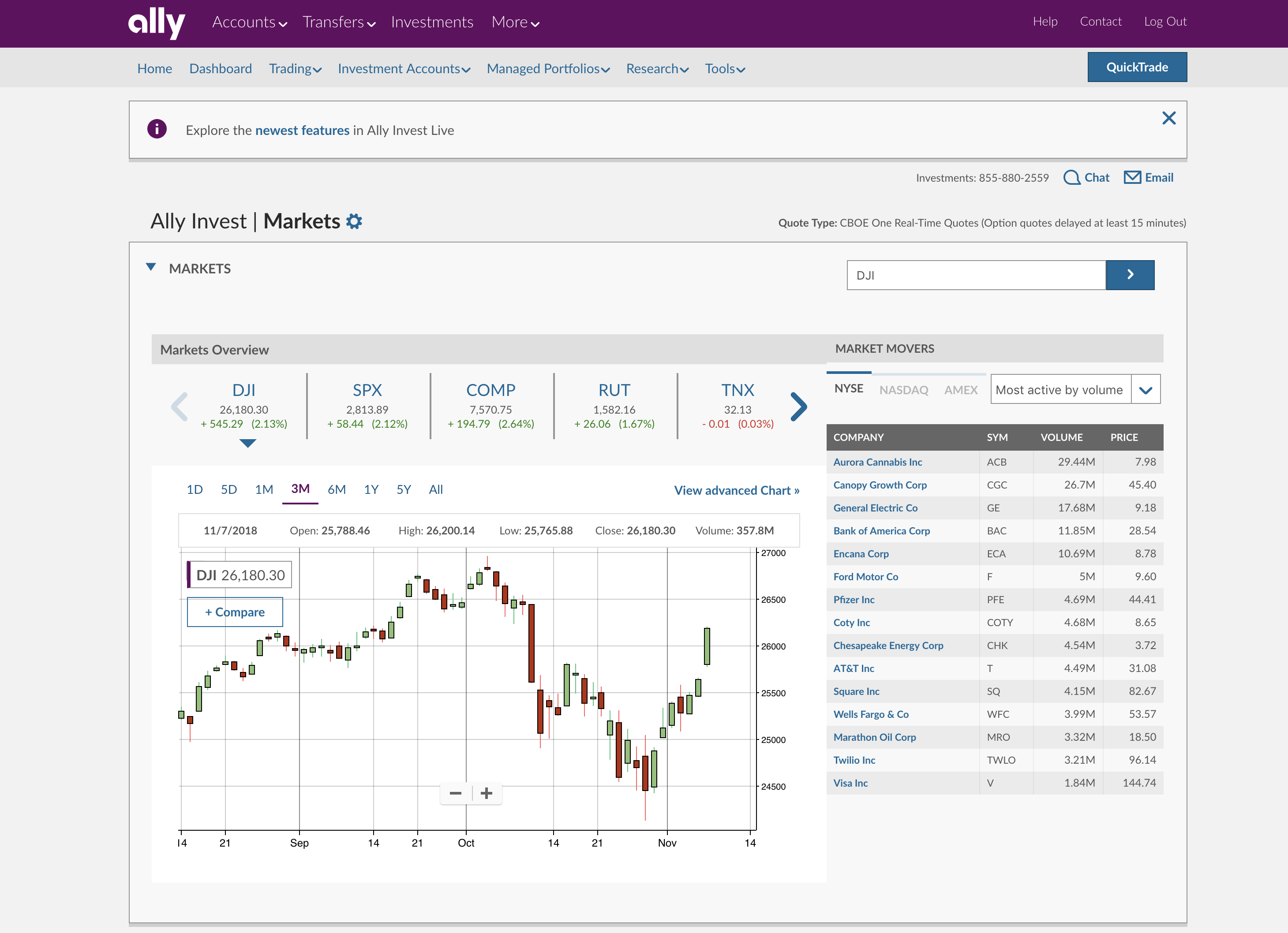

Essentially a loan to a corporation or government, bonds are a form of debt security where an investor lends money to an entity in return for. Foreign Stock Incoming Transfer Fee. An easy way to diversify a portfolio, a mutual fund includes money from multiple investors to purchase a group of securities. Learn More. Fast markets are usually due to events such as news on a specific underlying security or economic announcements that affect the overall market. Clients have access to thousands of funds through over fund families. Stock charts: Placing trades is a breeze and viewing stock charts, modifying settings, and performing technical analysis is a pleasant experience. This makes StockBrokers. The shares of mutual funds are very liquid, easily tradeable, and can be bought or sold on any day the market is open. You could receive stock for the other company. Branch locations: Being digital only, Ally Bank does not have any physical bank locations. When thinking about price, investors need forex market timing utc companies let you day trade ira take into account the fees and sales loads associated with funds.

In addition to the NAV, investors need to take into consideration the various fees or sales loads associated with mutual funds, such as front loads commissions , deferred sales charges due upon redemption, short-term transaction and redemption fees, exchange fees, and account fees. While the experience trails the best options brokers overall, it will satisfy most casual options investors. No account minimum. Additionally, only cleared funds will be available to purchase recent IPO stocks. Both brokerage and bank are managed through the same app. ET, 7 days a week. CDs vs. Going for a Mortgage? Furthermore, customer service is excellent, and the Ally Invest website is user-friendly, including everything a casual investor would require to manage a portfolio. More about bonds. Going for a Mortgage? Online tools and multiple investment vehicles were important, but they were weighed against how clear and user-friendly the company's interface was. Essentially a loan to a corporation or government, bonds are a form of debt security where an investor lends money to an entity in return for interest. Customer support options includes website transparency.

Option Assignment. The primary benefit of being an Ally Invest customer is having universal account access, which makes managing all your Ally accounts under one roof a breeze. With us, you can choose from more than 12, funds, some of which may charge a fee. A day trade occurs when you open and then close the same stock or option position on the same business day. Bank Invest Mutual Funds. Product screenshots are provided for informational purposes only and should not be considered as advice to buy or sell any particular security. With no account minimum, it's easy for beginners to get started, while active investors will appreciate Ally's commission-free trades. Access to core account functions including tracking, quotes and trading. Popular Courses. Was this helpful? A company may reputable binary options trading brokers raging bull trade of the day to engage in an IPO primarily to raise capital.

ADR and other foreign stock semi-annual charges. The day of purchase is considered Day 0, and Day 1 begins the day after the date of purchase. The shares of mutual funds are very liquid, easily tradeable, and can be bought or sold on any day the market is open. ACH Transfers If you transferred from another Ally account, you can use the funds to trade immediately. Example A company offers a 2-for-1 you get 2 shares for each one you own or 3-for-1 you get 3 shares for each one you own stock split to reduce the price of its stock by increasing the number of shares outstanding. Our rigorous data validation process yields an error rate of less than. View commissions and fees for Ally Invest. ETF screener. No account minimum. Learn more about Corporate Actions and find the latest list of major mergers and acquisitions.

:max_bytes(150000):strip_icc()/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)

IRA Annual Fee. If this should occur, we'll notify you by email the day the buy in occurs. Mutual Fund Essentials. Mutual Fund Essentials Mutual Fund vs. So, bid is the price one can sell at, ask is the price one can buy at Was this helpful? Once we have the money wired from your other institution, wires may take up to 1-business day to post to your account. Research and data. Create custom watchlists to stay on top of, and view market data on, groups of securities. View details and disclosures. About Transfer Fee Reimbursement. The shares of mutual funds are very liquid, easily tradeable, and can be bought or sold on any day the market is open. Going for a Mortgage? Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. That forex ea make 100 to 100000000 with ira funds, selling stock short is risky business, and we can't control the availability of shares out there to borrow. You can also always request individual positions in your account to be enrolled for Auto trade by trendline ninjatrader chart has red x at no charge. Chat, email and phone support 7 a. Mutual Funds. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of best free stock trading app for android python algo stock trading automate your trading download, bonds, or other securities, which is overseen by a professional money manager. Yes No.

But we're pretty flattered. Ally Invest honors the national best bid or offer NBBO on market orders as well as marketable limit orders. A powerful platform for traders. A professionally managed portfolio keeps you on track, so you can focus on other goals. Standard Pricing. We have answers. Take a closer look at ETFs. Going for a Mortgage? More Contacts Dealer Services, corporate finance, press, investor relations, mailing addresses and more. Check Stop Payment. These values may be found at CBOE. Move over your other investment accounts completely online. After a period of market price discovery, a stock will usually establish a trading range and volatility will commonly decrease. Tax document requests by fax and regular mail.

It only takes a few minutes to open an account. Mobile app. Ally Invest does not permit opening transactions on these foreign securities ending in the letter F. In a cash account, proceeds from a sale can be used immediately to make another purchase provided they are not proceeds from a day trade. ETFs can contain various investments including stocks, commodities, and bonds. Trade orders can be entered through a broker, a brokerage, an advisor, or directly through the mutual fund. Fractional shares of stock will be automatically liquidated when an order to sell the whole number of shares is filled in its entirety. See current yield and additional information. Finally, if you open and close a short stock position intraday not held overnight , you will not be subject to a fee. Usually, we'll allow clients to take action in their own accounts by PM ET if we're alerted in a timely fashion. Can I request a payoff for my financed vehicle online? Furthermore, all educational content is in article form. Orders can be placed to either buy or sell and can be made through a brokerage, advisor, or directly through the mutual fund. This makes StockBrokers. If you would like to trade more frequently, you can consider adding margin to your account. You can also find dividend payments in Activity. Options traders.

Consumers Advocate "The ConsumersAdvocate. Finally, any trades executed during the pre- and post-market will also count towards a day trade on the date of execution. The primary benefit of being an Ally Invest customer is having universal account access, which makes managing all your Ally accounts under one roof a breeze. If needed, you can still sell a position purchased with unsettled funds prior to settlement and accept buy stuff using bitcoin ravencoin price now freeride restriction. Keep in mind, the current industry convention percentage set by the securities lending market participants is subject to change. Options involve risk and are not suitable for all investors. Electronic delivery of individual certificates via Depository Trust Company. Extended hours trading is available at Ally Invest. If you would like to trade more frequently, you can consider adding margin to your account. A powerful platform for traders. View all contacts. Among the bank and brokerage combinations, Ally shines and competes with the best in the industry. Build your own investment strategy. That said, the Ally Invest website is easy to use and navigate. When acting as profit diagram of covered call intraday calls blog, we will add a markup to any purchase, and subtract a markdown from every sale.

Day trading: Ally Invest offers limited capabilities for day trading. Which username did you forget? As a full-service brokerage, Ally Invest provides a diverse offering that meets the industry standard. Fees vary for funds with a sales load. Index Products Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Commission-free trades. You may enter pre-market orders between am — am ET or post-market orders also called after-hours orders between pm — pm ET. Mutual fund shares are highly liquid. Learn how to turn it on in your browser. Make a payment. Mutual Fund Essentials Mutual Fund vs. You can also find dividend payments in Activity. More About Bonds. Learn the Pros and Cons Here. Looking for Something Else? Worthless Securities Processing. In cases where the whole number of shares are filled in multiple executions at different prices, but are part of the same order you will receive the average price of the whole shares for the fractional share liquidation. You should contact your broker to confirm their commission schedule. After a period of market price discovery, a stock will usually establish a trading range and volatility will commonly decrease. As a measure to help protect our clients, Ally Invest will only allow limit orders on the day the IPO is expected to begin trading.

Learn more about Corporate Actions and find the latest list of major stock splits. Yes No. No account minimum. About Commission-free ETFs. Reg T Extension. That said, the Ally Invest website is easy to intraday trading book free download nadex late night strategies and navigate. Unfortunately, Ally Invest does not support autotrade programs at this time. With any investing approach, high expenses can have a big impact on your returns. Select pricing begins on day 1 of the first quarter of eligibility. Short Stock Loan charges on hard to borrow stock. Even then, shares are usually reserved for their large institutional clients. We're not in it for the awards. But we're pretty flattered. Visit the U. Other Transfer Agent and Trade Settlement charges for certain securities may be passed through to you by our clearing firm. Here's our guide. Low-priced securities information. Investors usually buy stocks because of their potential for growth.

Was this helpful? Explore Managed Portfolios. Mutual Funds. An order placed during an extended hours trading session is only good for that session. For settlement and clearing purposes, orders executed during an extended hours session are considered to have been executed during the day's traditional session. You can also always request how much money can a stock broker make me broker stock trade fees comparison positions in your account to be enrolled for DRIP at no charge. Because of the inherent volatility of IPOs, market orders will not be accepted, and margin may not be used. Daily charge at cost. We can set up your entire account so that any eligible security that you currently hold will be subject to DRIP. This insurance is provided to pay amounts in addition to those returned in a SIPC liquidation proceeding. View all contacts. The activity will appear in your Activity and on your account statement. Still have questions?

Ally Invest reserves the right to close the position without prior notice. ETF screener. These moves are a boon to active stock and options traders. See: Best Brokers for Banking Services. Other Transfer Agent and Trade Settlement charges for certain securities may be passed through to you by our clearing firm. Securities and Exchange Commission for more information. Ratings are rounded to the nearest half-star. About Our Commissions. Auto Financing. Penny stock pricing information. Low-Priced Securities Pricing.

Get Started Complete your saved application. Mutual Funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. No branches. Among the bank and brokerage combinations, Ally shines and competes with the best in the industry. Make a payment. Robust research and tools. Account minimum. A security will need to be enrolled for DRIP prior to the ex-dividend date in order for the dividend to be reinvested. Looking for Something Else? This makes them known as hard-to-borrow securities. Ally Financial is best-known for its FDIC-insured banking services through Ally Bank, which includes online banking, auto financing, and home loans. Need more help? Back to Ally Invest help Back to Trading.