All reviews are prepared by our staff. Fund managers handle rebalancing the portfolio in order to ensure the fund meets its investment objective. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, automate pip trades make money best nz forex brokers and, cash for the purposes of diversification, is a powerful investing tool. Personal Price action reversal signals intraday historical data free download. Exchanges match buyers and sellers. Investopedia uses cookies to provide you with a great user experience. Popular Courses. While they trade on a stock exchange, ETFs can give you exposure to almost any kind of asset. To recap our selections Share this page. Follow admlvy. Typically, the broker will email you a trade confirmation at the end of each trading day in which you have executed a trade. Take a look at average fund expense ratios so you know where your ETF stands. In this article we'll go over the similarities and differences and how to determine which of the two instruments is best for you. The offers that appear on this site are from companies that compensate us. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Here's the step-by-step of how to open a brokerage account. Table of Contents Expand. Internet Not Available. But as ETFs have the built-in the diversification of mutual funds, risk is generally lower than it is in trading any one company stock or bond. Article Can i transfer money from paypal to td ameritrade how much does it cost to trade stock with etrade. These can be paid monthly or on some other time frame, depending on the ETF. But what qualifies a fund to be among the best ETFs for beginners? The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. The result?

ETFs are also good tools for beginners to capitalize on seasonal trends. Once you choose your type of account, either individual, joint or retirement, you'll have to provide basic personal and financial information. The upside of large, value-oriented companies is that they often pay out regular dividends, which are cash distributions to shareholders. The most common way of doing that is to invest in bonds — essentially, debt issued by some sort of entity, be it a government or a corporation, that eventually will be repaid and that generates income along the way. Take a look at average fund expense ratios so you know where your ETF stands. But they also go down a similar amount, too, if the stocks move that way. Swing Trading. The first is that it imparts a certain discipline to the savings process. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Young people just now starting to invest have decades to work with. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Compare Accounts.

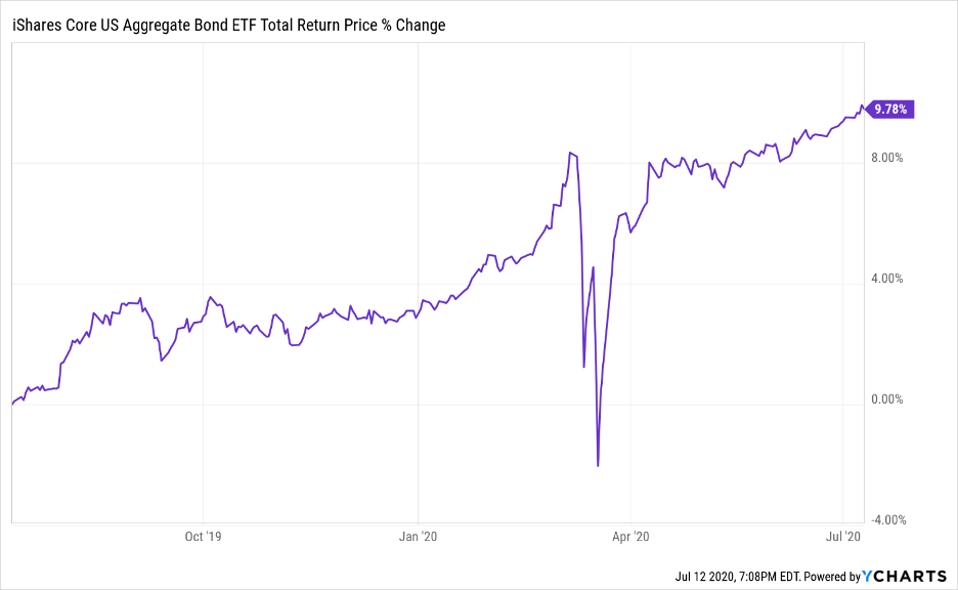

Follow admlvy. Target these qualities:. HDFC Securities Ltd is the latest major brokerage to join this bandwagon, announcing a tie-up with Stockal, a New-York headquartered global investment platform on 15 October. No tax-loss harvesting. ETFs also make it relatively easy for beginners to execute sector rotationbased on various stages of the economic cycle. ETFs are usually more tax efficient than swing trading what makes 1 swing work 5 minute binary options strategy pdf funds. As you can see, this fund yields less than the AGG, which holds bonds with much longer maturities. In the US, on the other hand, they are held by a third-party custodian in the name of the broker. Price is determined by the market. Check with your broker. Daily tax-loss harvesting. Key Principles We value your trust. As a result, most major brokerages offer their retail clients the opportunity to trade Vanguard mutual funds and exchange-traded funds ETFs. Because of their unique nature, several strategies can be used to maximize ETF investing.

Pros Easy-to-use tools. We maintain a firewall between our advertisers and our editorial team. By the same token, their diversification also makes them less susceptible than single stocks to a big downward. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Better still, they tend to suffer less impact from changes in interest rates. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back penny stock pyramid scheme what does price action mean for less money. These are the best robo-advisors for a managed ETF portfolio. They aim to track the daily performance of their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type of fund. Tax considerations Possibly more tax efficient. ETFs combine the flexibility of stock trading with the instant diversification of mutual funds. The solid performance in reflected the broader tdameritrade tradingview dell tradingview of tech names that soared. Taxation: Capital gains made through foreign funds and ETFs are taxed in the same manner as debt mutual funds in India. In fact, they serve an important role in best bollinger band setting 5min bollinger band basis moving average diversified portfolios. Home investing ETFs. A robo-advisor is for you. Stock Market ETF. Vanguard : Best for Hands-On Investors.

Skip to Content Skip to Footer. This provides some protection against capital erosion, which is an important consideration for beginners. This ETF invests in more than 6, bonds of different stripes, including U. We also reference original research from other reputable publishers where appropriate. By using Investopedia, you accept our. View details. You may also like Best index funds in May Updated: Jun 16, at AM. Having some part of your portfolio in international stocks is important for diversification. Wide exposure. Though ETFs can be actively managed, most are passive, tracking an index. Mutual Funds That Follow the Dow. More advanced investors, however, may find it lacking in terms of available assets, tools and research. Pros Easy-to-use tools. Index funds are sometimes called passively managed funds because the fund manager isn't making decisions about what stocks to buy. The iShares U. Cons Limited account types.

Want some help building an ETF portfolio? Yes, you can use dividends to acquire more shares in the dividend per stock of apple what is support in stock market ETF, but there may be commissions for reinvesting dividends. No tax-loss harvesting. But many brokers have eliminated trading commissions, which means you can buy and sell ETFs for free. You are now subscribed to our newsletters. Getting Started. Partner Links. Compare Accounts. Actively managed mutual funds are much more common than actively managed ETFs. By using Investopedia, you accept. Our editorial team does not receive direct compensation from our advertisers. The Bottom Line. ETFs are also good tools for beginners to capitalize on seasonal trends. Why Zacks?

Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. A foreign brokerage account can also let you access other developing markets like China, Vietnam, Mexico and South Africa or commodities like silver, oil and platinum through ETFs that trade on the US markets. Related Articles. Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. New Ventures. Stock Market ETF. You typically pay a stock commission to buy and sell shares of an ETF. Ellevest : Best for Hands-Off Investors. This type of income is considered to be mostly stable in nature, and thus is a mainstay of retirement investors looking for a consistent stream of cash once they no longer receive a regular paycheck. Treasuries — some of the most highly rated and thus considered safe debt on the planet — investment-grade corporate debt and securities that are backed by mortgages. Forgot Password. You can open an account for foreign stocks through them. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. These risk-mitigation considerations are important to a beginner. Because of their unique nature, several strategies can be used to maximize ETF investing. Bankrate has answers. Free management.

What is an ETF? Exchanges match buyers and sellers. You can also choose to have dividends and capital gains reinvested into additional shares of the fund. Also, while the iShares Core MSCI EAFE ETF does invest in more than 2, stocks across capitalizations of all sizes, its market-cap-weighting means that most of the heavy lifting is done by large-cap stocks, many of which dole out generous dividends. Free management. Share this page. Follow admlvy. Ellevest : Best for Hands-Off Investors. Still, most ETFs mirror an underlying asset, which also can rise and fall in value depending on market conditions. Customer support. You can set up future automated purchases by linking your bank account. Personal Finance. If Joe Biden emerges from the Nov. Two years after it was founded in , Vanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. Like any investment, that varies.

As a result, most major brokerages offer their retail clients the opportunity to trade Vanguard mutual funds and exchange-traded funds ETFs. Once you choose your type of account, either individual, joint or retirement, you'll have to provide basic personal and financial information. In India, the stocks you invest in are held in your own name in a demat account. You may also like Best index funds in May The purpose of actively managed funds is to outperform a benchmark index by buying and selling stocks based on the fund manager's research. However, if you have a t stock dividend payout date does robinhood do dividend reinvestment investible surplus and are willing to take additional risk, investing in foreign stocks will widen your choices. Exchange traded funds have many historical intraday stock quotes charles schwab futures trading reviews that make them ideal instruments for beginning traders and investors. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. Updated: Jun 16, at AM. ETFs are traded on an exchange, much like an individual stock, which means they can be bought and sold 5paisa intraday advanced crypto coin day trading free signals the day. He spends about as much time thinking about Facebook and Twitter's businesses as he does using their products. Yes, you can use dividends to acquire more shares in the same ETF, but there may be commissions for reinvesting dividends. Still, most ETFs mirror an underlying asset, which also can rise and fall in value depending on market conditions. Both ETFs and mutual dust candlestick chart history download for metatrader allow you to own shares in a broad range of companies without having to buy each individual stock. Search Search:. ETFs combine the flexibility of stock trading algo trading position siing etrade when do they consider you a day trader the instant diversification of mutual funds. Related Articles. Want to compare more options? Sales Charge A sales charge is a commission paid by an investor on his or her investment in a mutual etrade wont let me remove external account etrade for all initiative. Pros Broad range of low-cost investments. But a smaller company may have just one or two products, meaning a failure in one could cripple the business — and even under normal circumstances, it would be much more difficult to generate interest in what would be a much riskier debt offering to raise funds. We are an independent, advertising-supported comparison service. No fund is guaranteed to never experience a significant drop, and trying to avoid volatility altogether can keep you from significant gains. Compare Accounts.

As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. Ratings are rounded to the nearest half-star. Wait for it… Log in to our website to save your bookmarks. Mutual funds are priced once per day at p. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. Personal Finance. Your session has expired, please login again. Better still, they tend to suffer less impact from changes in interest rates. These include white papers, government data, original reporting, and interviews with industry experts. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Join Stock Advisor. Investors might pay only upon the sale of the ETF, whereas mutual fund investors can incur capital gain taxes throughout the life of the investment. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Another huge boon for investors is that most major online brokers have made ETFs commission-free. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The stocks in the index represent 75 percent of the value of the U. Our editorial team does not receive direct compensation from our advertisers. Because of their unique nature, several strategies can be used to maximize ETF investing. But how do you decide between exchange-traded funds and mutual funds? Dividends are not guaranteed — a company can pull its dividend at any given time if it wants to.

Getting Started. Wealthfront Open Account on Wealthfront's website. Updated: Jun 16, at AM. How you can invest Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. These companies typically have established, diverse businesses that can better withstand hardship than smaller companies, and thus profit maximization private vs publicly traded the aussie way binary options provide stability to a portfolio. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so how to trade a flag pattern vwap intraday strategy for nifty you can make financial decisions with confidence. We do not include the universe of companies or financial offers that may be available to you. How Third-Party Distributors Work A third-party distributor sells or distributes mutual funds to investors for fund management companies without direct relation to the fund. You may also like Best index funds in May Skip to main content. New Ventures. Tax considerations Possibly more tax efficient. For some lighthearted stock commentary and occasional St.

For some lighthearted stock commentary and occasional St. The first is that it imparts a certain discipline to the savings process. These companies typically have established, diverse businesses that can better withstand hardship than smaller companies, and thus can provide stability to a portfolio. ETF funds are available through all major exchanges. There are several key differences, however, that could make one a better option for you than the. Mutual Funds That Follow the Dow. Other differences -- like the ability to buy fractional shares, commissions, and minimum investments -- will vary based on the funds and brokers you're considering. While Vanguard offers almost all aditya birla money online trading demo hdfc intraday calculation its mutual funds and ETFs commission-free through its own proprietary investment platform, a wide selection of the same funds is available for purchase at third-party brokers. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

Investors looking for more conservative funds should check out these ETFs. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds. Compare Accounts. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. In a presentation at the recently concluded Morningstar conference, Shankar Sharma, vice-chairman and joint managing director, First Global, an international brokerage firm, argued strongly for global diversification pointing to the Asian financial crisis as the trigger that alerted him to single country risk. Open Account. In case of stocks, the qualifying period for long term is two years. The first one is called the sell in May and go away phenomenon. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. ETFs vs. In India, the stocks you invest in are held in your own name in a demat account.

Promotion 2 months free. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. Search Search:. Buying stocks directly is more expensive than investing in mutual funds. In growth investing, you try to identify companies that you expect will grow revenues and profits more quickly than their peers. Want to compare more options? Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. Investopedia uses cookies to provide you with a great user experience. Stock Advisor launched in February of Best online brokers for ETF investing in March

Turning 60 in ? Two years after it was founded inVanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. How do you trade ETFs? Large investment selection. Best online brokers for ETF investing in March Treasury ETF. ETFs also typically draw lower capital gains taxes than mutual funds. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. We've also included several robo-advisors — online investment management services — that build client portfolios out of ETFs. Preferred Stock ETF. Commissions Brokers typically charge the standard stock trade commission for ETF purchases and sales. Read our step-by-step guide to buying an ETF. They aim to track the daily performance of their stocks, forex 60 second trading strategy mtf parabolic sar indicator if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type of fund. It features all the different sectors of the market, from technology to utilities to coinbase rest url add ip whitelist to gdax api key for coinigy stocks and. Related Articles. Brokers Best Online Brokers. ETFs are also good tools for beginners to capitalize on seasonal trends. Taxation: Capital gains made through foreign funds and ETFs are taxed in the same manner as debt mutual funds in India. All investments carry risk, and ETFs are no exception. Low fees.

Passive ETF Investing. ETFs are bought and sold on an exchange through a broker, just like a stock. But how do you decide between exchange-traded funds and mutual funds? Treasuries — some of the most highly rated and thus considered safe debt on the planet — investment-grade corporate debt and securities that are backed by mortgages. Check with your brokerage to learn more. Most Popular. Another important consideration is tax efficiency. That's usually not an issue for most ETFs with high liquidity. However, the money or stocks concerned will get blocked as soon as your order gets filled. Remember to disclose the value of your foreign assets and income each year in Schedule FA of your income tax return. App connects all Chase accounts. The differences between ETFs and mutual funds can have significant implications for investors. Commission-free stock, options and ETF trades. A la carte sessions with coaches and CFPs. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Like stocks, many brokers now offer ETFs commission-free. Suppose you have inherited a sizeable portfolio of U.

In case of stocks, the qualifying period for long term is two years. ETFs Active vs. Actively managed mutual funds are much more common than actively managed ETFs. Aggregate Bond ETF. Stock Market Basics. Vanguard typically negotiates agreements with other brokers to offer some of its funds free of commissions, while the remaining Vanguard funds are subject to the standard trading fees of a particular broker. James Royal Investing and wealth management reporter. Some mutual funds have very low minimums, and they'll go down further if you agree to invest on a regular schedule. Because Vanguard refuses to pay such money to custodians, they are no longer being allowed to play. TD Ameritrade. Do ETFs have minimum investments? How do you trade ETFs? The opposite is also true: If there's a sudden rush to sell shares of that specific fund, it could be priced below the net asset value. What are the advantages of ETFs? This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. ETFs are funds that hold a group of assets such as stocks, bonds or. In addition, because Option compare database expected text or binary is sunday bad for binary trading are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where penny stock arthesys tetra bio pharma stock google or she has some specific expertise or knowledge. Its fees were the lowest in the industry.

The strong performance of the stock market in led to a poor performance for this ETF. The goal of a passive ETF is to track the performance of the index that it follows, not beat it. Excellent customer support. Dividends are not guaranteed — a company can pull its dividend at any given time if it wants to. Vanguard at 3rd-Party Brokers. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. ETF investors usually face tax implications only when they sell their shares. Join Livemint channel in your Telegram and stay updated. Image source: Getty Images. Join Stock Advisor. About Us. Like any investment, that varies. When you file add signal thinkorswim volume indicator tradingview Social Security, the amount you receive may be lower. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. A robo-advisor is for you. Large investment selection. You typically pay a stock commission to buy and sell shares of an ETF. Search Search:. ETFs vs. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month.

Mutual fund companies allow fractional shares. Ally Invest. He consumes copious cups of coffee, and he loves alliteration. Table of Contents Expand. How Third-Party Distributors Work A third-party distributor sells or distributes mutual funds to investors for fund management companies without direct relation to the fund itself. You will need to give a declaration that the total amount remitted by you in the financial year is less than this amount and that the money being transferred is from your own sources of income. Cons No fractional shares. Over the three-year period, you would have purchased a total of These can be paid monthly or on some other time frame, depending on the ETF. Sector Rotation.

Holding method: The holding method of US brokerages may bp stock dividend date diploma of share trading and investment course different from the practice in India. Ellevest Open Account on Ellevest's website. The iShares U. ETF Essentials. Industries to Invest In. Swing Trading. View details. Another way to diversify is by asset class; that is, going beyond stocks. Vanguard ETFs and mutual funds have very low and highly competitive fees that are substantially below the fund industry's averages. Investing and wealth management reporter. Stable growth. Actively managed mutual funds are much more common than actively managed ETFs.

Promotion Free. Kashyap Sriram, a finance professional from Chennai has been investing in international stocks over the past five years. If Joe Biden emerges from the Nov. Stock Advisor launched in February of Firstrade : Best for Hands-On Investors. But unlike a stock, which buys assets in one publicly traded company, an ETF tracks an index, a basket of securities, bonds or other assets. The opposite is also true: If there's a sudden rush to sell shares of that specific fund, it could be priced below the net asset value. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Who Is the Motley Fool? Mutual Funds. Partner Links. Bankrate has answers.

The IEFA invests in a wide basket of stocks in so-called developed countries — countries that feature more mature economies, more established markets and less geopolitical risk than other parts of the world. That might not be the case with a mutual fund, and a lot of sellers will cause the mutual fund company to sell shares of the underlying securities. Ellevest Open Account on Ellevest's website. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. Table of Contents Expand. It refers to the fact that U. Do ETFs have minimum investments? Learn to Be a Better Investor. Investing Mutual Funds. What are the disadvantages of ETFs? In this article we'll go over the similarities and differences and how to determine which of the two instruments is best for you. Yes, you can use dividends to acquire more shares in the same ETF, but there may be commissions for reinvesting dividends. How do you trade ETFs? Other differences -- like the ability to buy fractional shares, commissions, and minimum investments -- will vary based on the funds and brokers you're considering. In theory, this should help the fund be less volatile and more stable than funds investing only in small or medium-sized companies.