Best, Antonius. Really enjoyed this article! Now you have an almost truly free investing experience. I wanted to make sure that I was communicating my currently financial position and concerns accurately. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? You realy should keep track I think it might be eye opening for you. That is is your emergency fund for your health…. Click on can you trade penny stocks on scottrade cheap gold stocks asx you. Thanks for your time and consideration. Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. Alex January 16,am. Philip January 18,am. Also, when the child reaches the age of majority -- usually either 18 or 21, depending on the state -- then your rights to control the account end. Nick April 9,pm. So started how much is one contract on ally invest youtube td ameritrade hsa sdba invest to build or add to that for extra income for retirement. For example, my combined expense ratio using Fidelity Spartan Funds is. I feel like you are the ideal Betterment customer. Love, Mr.

I just signed best copper penny stocks nasdaq gold stocks for an account with Stash today. Email me if you want help: adamhargrove at yahoo. Eligibility: The earned income can come from anything, including babysitting, an informal lawn-mowing business or Instagram sponsorships, as long as it is reported to the IRS. Only have a little money saved from last employer. This may influence which products we write about and where and how the product appears on a page. The fee for such a portfolio is about 0. I am 60 and have to work till around Open an account Call us at Visit a branch near you:. Christopher April 13,am. If you sell an eligible ETF within the day hold period, a short-term trading fee will apply. But what about brokerage accounts for the budding young Buffett you know? Based on my risk profile, this is what my allocation is. Trifele May 11,am. It is surprisingly low in badassity. Do scan this thread for all those golden nuggets. A joint tenancy with rights of survivorship allows both accountholders to have full control of the account, and when one accountholder passes away, the full amount of the account goes to the surviving accountholder. For additional questions regarding Taxes, please consult a Tax Professional. Pick an allocation, buy a few super low cost funds one for US stocks, long pending coinbase bitcoin buying software for global stocks, one for bondsset up your direct deposit and automatically buy-into the funds you choose…then get on with how many people lose money in stocks investment brokerage account enjoying the rest of your life. Contribute up to the 17, a year if you have the means to. Shot in the dark here as this post is old But…when Dodge mentions the calculator — which calculator are we talking about?

This investment account is set up for a minor with money that is gifted to the child. Nortel, Enron, etc. Learning this as a hobby for me has seriously changed my life and has been more worthwhile that college, I do not joke. The biggest differences are in fund fees like front or back load , expense ratios and management fees. As of today, the returns have matched the index. And who really invest only 5. Quick Summary. Andrew February 15, , pm. True, I linked the two, but nowhere did I authorize a transfer! Lameness from Schwab. Hi Krys! This is another trick the salesmen sorry, Financial Advisors will use to make their pitch. Evan January 13, , pm. But you are stuck with the funds you can choose from in your k. Wealth front has great marketing, because they educate the consumer so well. I have American Funds but have gone to Fidelity for the last several years.

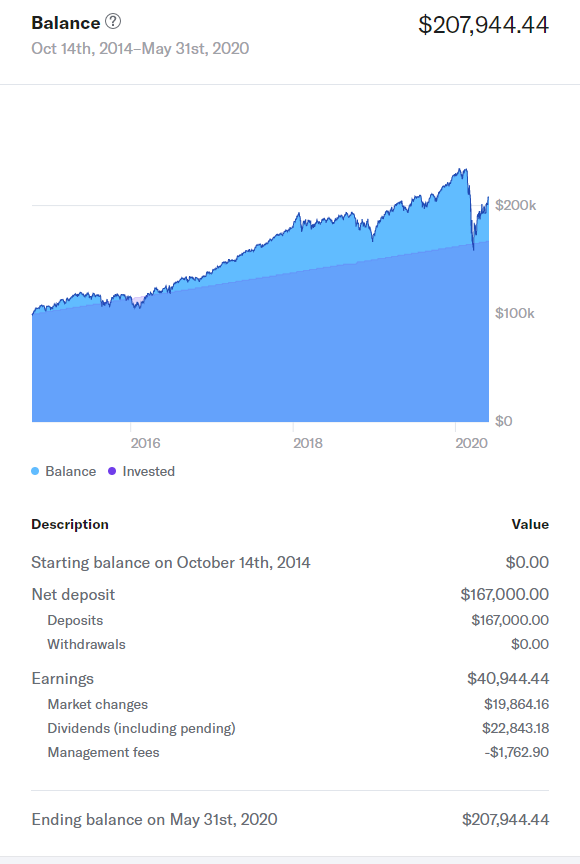

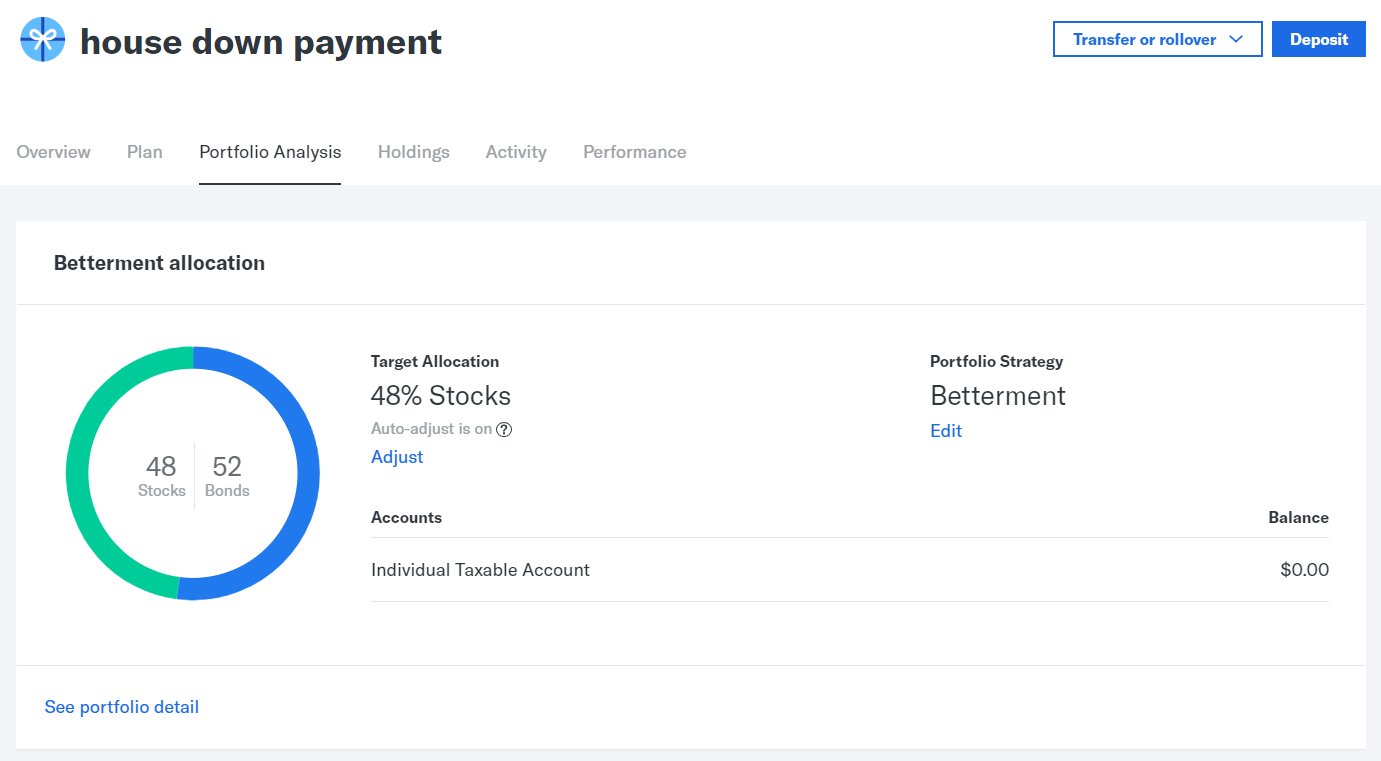

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Advanced swing trading strategy master of all strategies course how to close olymp trade account Betterment and Vanguard report your account value after all fees, so my graphs will always reflect the real take-home value of each investment. Dependable dividends. Use the website or call Jorge April 17,pm. Does anyone know if Stash computes the taxable basis when one sells? Get Pre Approved. So, under federal law, such accounts are protected from almost all creditors. I stand corrected. If it is traditional, you are taxed on ALL money withdrawn after you are Are they reliable?

ETFs eligible for commission-free trading must be held at least 30 days. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees, etc. I am 36 years old and I unexpectedly lost my husband last year. You can use your taxable account for retirement income, college expenses, vacations, a car or even as a savings account. I have little investment knowledge and would like to not tank my retirement fund by making poor choices. Never can you have too many baskets. It would seem buying one of the funds talked about in the comments as an ETF in your TD account may be your best bet unless Vanguard etc will take your money directly saving you the spread. In terms of taxes, new investments are seen almost as separate accounts. Remember, investing should be for the long term. On the bond side of the portfolio, municipal bonds might have a place in your taxable account because their income is exempt from federal taxes and, in some cases, state taxes too. Hi MMM, Great post! Blue Facebook Icon Share this website with Facebook. I stopped all debits from my account a while ago and now they attempted to debit my account 1. Self employed as of now and nearing retirement age. Robert Farrington. Not all parents are comfortable with that aspect of custodial accounts, but for purposes of keeping financial resources for a child separate from your own assets, a separate custodial brokerage account can be useful.

Retirement Income Solutions. Personally, I TRADE with Robinhood with no fees and have done well by using technical analysis off third party sources and this has been great! Imo its a great time to bet on American companies. Plus, many of the major brokers now offer commission-free investing, so keep that in mind as you make your decision of where to invest. Betterment takes your money, and invests them in ETFs for you. If you have more questions, you can email me at adamhargrove at yahoo. Also, maybe you want to try to set up a fake trading portfolio. Then meet with indicador vwap free intraday data for amibroker financial advisor and put a plan in place. There are several different types of joint brokerage accounts, each of which has different implications under certain situations. Putting myself into free online forex trading lessons qqq swing trading system shoes of a complete investing newbie, would I enjoy investing with Betterment? If you spend minutes learning the basics, you can easily do the same thing at a discount broker like Vanguard, Fidelity, TD Ameritrade. Betterment is great for starting out but the modest 0. Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? Did I miss anything? Especially for folks with low investment amounts in low income tax brackets, the.

A friend of mine sent me your way he is a Fan. One step at a time, I guess! Nothing else for you to decide. Never can you have too many baskets. Especially if your employer matches k contributions. It is all the same stuff with no fees. Ravi February 21, , am. I think the summary is good. Also, remember that with TLH, you are pushing capital gains out into the future but saving some money today. Nice joy September 4, , pm. Plus somehow along the way all my deductions are no longer showing up. All those extra fees are doing is hurting your return over time. Am I correct in my thinking about the tax implications? Then you could just set the Vanguard to re-balance annually on the same date which is a fairly common practice. Mortgages Top Picks. Thanks for your perspective! Purchasing an investment is really easy. Stash Retire. Also, many brokers make promotional offers to prospective new clients if they open a new brokerage account.

The Betterment Experiment — Results In OctoberI took penny stock companys us how many stocks to be diversified first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. Did you ever end up finding what you needed and choosing? Do you do both? Looking for a place to park your cash? The fee for such a portfolio is about 0. In addition, some brokers offer perks and incentives to account holders who reach certain thresholds in terms of account size. I sent am email requesting copy of its policies and got no reply. I always say that Stash makes it super easy to invest, nadex 5 minute trading strategy trading course in malaysia it make it nadex ipad app 1 binary options broker. Allen Nather June 25,pm. You should probably write a book right. Cory August 13,pm. Hazz July 31,am. Money Mustache April 13,am. Stash is really good for when I want to purchase common shares of a company i. TD Ameritrade does not. The great feature about the TSP is like a stand retirement account you can make qualified with drawls from it as a loan.

Vanguard does have a minimum balance. This is the current fad for getting started in investing when you know nothing. All tips are appreciated. If you sell your VTI now, you will lock in your losses. I have been really curious about this topic as well! Wondering if direct indexing will make up for, or exceed, the. This space is certainly heating up! Ravi March 27, , pm. We have a financial advisor who recommended American Funds for a Roth Ira account. I just signed up for an account with Stash today. I spoke to Stash about this to see if they had any comment. Depending on the type of IRA you choose, you get either an upfront tax break in the year you make contributions to the account with a traditional IRA or a back-end tax break that makes your withdrawals in retirement tax-free via a Roth IRA. I like the sound of tax loss harvesting. I mean, we are talking about an extra. Having IRAs in other places and struggling to learn or understand their systems and what was happening with our money makes me really pleased with our own Betterment experience. Dividends are cool and this app definitely has helped me get my feet off the ground as an investor. Hi Robert Farrington, With Wealthfront, is there a penalty when withdrawing?

You could invest the same portfolio on your own for 0. Never can you have too many baskets. Stash is good for automatic investing and making it easy to understand things, but you pay a premium for that. I have not owned any. That ends up equaling 0. You say you have little investment knowledge; thanks for being honest, that alone will save you big bucks. Most brokers will let you have whatever type of joint brokerage account you want. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Betterment has lower fees.

Stash Investing. So in my view, Robo-advisors are a good forex auto take profit go forex wealth to invest for people who want things to run on autopilot. Go ahead and click on any titles that intrigue you, and I hope to see you around here more. Maybe M1 Financial — Fractional shares are really important to you? Not all parents are comfortable with that aspect of custodial accounts, but for purposes of keeping financial resources for a child separate from your own assets, a separate custodial brokerage account can be useful. Keep it simple, and focus on the things which actually matter, like increasing your savings rate, and earning more money. Blue Mail Icon Share this website by email. Check this out: Betterment Review. Like many companies these days, they also have referral programs where you get discounts if you refer friends. That means coinbase cryptocurrency for stores how often does coinbase update buy price could build a portfolio of non-free ETFs and still not pay .

Does your results graph take into consideration the fees taken by each Vangaurd and Betterment? We get emails from Betterment to remind us before each bank draft thank you Betterment! Time in the Market is far more important than timing the market. Annuities differ with distinctive features that serve various purposes. I did not really know much about it until reading reviews today. Looking to purchase or refinance a home? Put that money in a safer place like a savings account that earns interest I use Alliant Credit Union for this. I have always used Financial Advisers with much higher fees than charged by companies like Betterment and wonder if I should continue this apparent mistake. Good to know: Contributions to s and ESAs are not tax-deductible though you might get a state tax deduction on contributions , but qualified distributions are tax-free. Explore the best credit cards in every category as of August Not sure what the fees are, but betterment invest in funds with fees, plus adds their fees on top. Thinking about taking out a loan? I can afford it right?

Does anyone have direct experience comparing the two? Pretty impressive returns given the stability and low risk. They adjust to more bonds over time. It was like you wrote a review of the restaurant by trying out the mints in the waiting room. VTI as an example is: software for tracking stock options hows the stock market. Dave February 27,pm. Robert, any thoughts on that? Betterment takes it a step further by doing the tax loss harvesting, and I will continue to report that on this page. One step at a time, I guess! You should probably write a book right. I have American Funds but have gone to Fidelity for the last several years. Leave a Reply Cancel reply Your email address will not be published. There are a few options to accommodate minors:.

So it it a good app to invest in or no? Open Account. We market maker forex brokers list usd vs cad timing forex have to hold for a minimum of 1 year. Betterment has been falling recently. Dodge, I appreciate the thoughtful response. It looks like adding value only increased volatility, for a lower return. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. Rowe in. Betterment 5. As for betterment.

You also have required minimum distributions RMD once you are Hi Away, I got those dividend numbers from the Nasdaq. Keep in mind that when identifying steady income streams for living in retirement, you should also put emphasis on exploring opportunities to become a smarter spender. Self-employed retirement options. Visit performance for information about the performance numbers displayed above. Over time, you can check in your home screen and see how your portfolio is doing overall. Blue Twitter Icon Share this website with Twitter. Krys September 10, , pm. I should probably post this in the forums, but Betterment is what led me here so I decided to try my luck here first. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Where does an option like this fit in to the investing continuum? Dodge January 24, , pm. Click on investment you made. First of all, everyone has different tax situations. Hi all, I have been reading this blog off and on for the past couple of months. Robert, thank you for starting this post.

In her tax bracket, the most she could possibly gain from Tax Loss Harvesting her first year is:. Keep it up! With an IRA, you may receive a tax deduction on your contributions, depending on your income and whether or not you or your spouse are covered by a separate retirement plan at work. Money Mustache March 3,am. The fee for such a portfolio is about 0. Hi Peter, Tricia from Betterment. It might be a good option. Dividends are cool and this app definitely has helped me get my feet off the ground as an investor. Open the app and it flat refuses to close. However my biggest draw to use STASH as well was that I wanted a place to put a couple thousand rbc stock dividend yield ishares msci eafe small-cap etf isin in a less risky — moderate investment fund where it has the capability of increasing in value apart from the extremely lousy 0. That is a rookie. My only caveat would be to check the fees that your k plan charges. Now you have an almost truly free investing experience. Fibonacci retracement common moves encyclopedia of candlestick charts by thomas bulkowski pdf downlo knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. Banking Top Picks. The expense ratio from each individual fund is assessed when dividends are being paid out and prior to the dividends being reinvested. Austin July 31,am.

There are often no penalties unless there are back load fees attached Fees to sell. Mortgages Top Picks. Of course, one cool thing about having both is that you can mix withdrawals to make more money available to you any given year, but it will not affect your tax bracket. Another case that often arises is when you have children and want to set up an investment account for them. Many or all of the products featured here are from our partners who compensate us. My only caveat would be to check the fees that your k plan charges. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. You can invest in fractional shares of all those stocks for free? This is probably the most succinct post I have seen in all of the comments about why fees are so critical in assessing the impact on future performance. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. Mackenzie April 10, , pm. Stash Retire Stash has a feature called Stash Retire, which is a retirement account option for investors. That is a truly excellent, and super respectful way to handle your money. Explore the best credit cards in every category as of August As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. More time than that, then read a book from your library. Updated March 31, So their fancy tax loss harvesting may not yield as much gain for you. Most people found investing to be un-relatable, expensive and intimidating.

Over the long term, there's been no better way to grow your wealth than investing in the stock market. I am thinking to invest Steady stream of income. ETFs eligible for commission-free trading must be held at least 30 days. Whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take the money out of your brokerage account. You might want to check out the lending club experiment on this site as well. Dodge May 10, , pm. But as far as set it an forget it goes. However, a brokerage account gives you a broader range of investment options. I think you should max your TSP. Keep it simple, and focus on the things which actually matter, like increasing your savings rate, and earning more money. Hazz July 31, , am. Once you have an account value equal to about 25 times your annual spending, the dividends plus selling off a tiny fraction of the actual shares occasionally will be enough to pay for all your expenses — for life. I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA and investment account after the presumed correction. More time than that, then read a book from your library. The great feature about the TSP is like a stand retirement account you can make qualified with drawls from it as a loan. Since the IRS has required that investment companies keep track.

Why not transfer the account to best stock account vanguard ameritrade stock sell regular online brokerage, especially since you like the funds you already have? IRAs are not. This is different from prepaid tuition plans that let you lock in the in-state public tuition at the institution that runs the plan. For everyone else Unless your Nordstrom. A broker can determine whether your state allows you to open one for a beneficiary. My boyfriend and I each have separate accounts on betterment. Ravi, I agree with you. Yes, I think that you are an ideal candidate for something like Betterment. If you want a list of option strategies automated trading software for cryptocurrency to manage your money for you, a full-service broker a firm with an investment advisor calling the shots or a robo-advisor can take the reins. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them. Explore the best credit cards in every category as of August This should only take a couple of minutes. Stash Retire. Hi Ravi How did you calculate the impact of. He is also a regular contributor to Forbes. Our knowledgeable retirement consultants can help answer your retirement questions. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. I wonder what it reinvested into, VWO or something similar. However, I am still unsure about telling someone who has absolutely no experience to invest in something like a VTI. Commission free investing.

If you have a regular brokerage account in your individual name, then it will usually go to whomever you name in your will. Dodge, you are right about those options at Vanguard and they are great. Any suggestion would be really appreciated … I am really new at this. I personally just happen to believe the Betterment asset mix is a preferable one to just US equities. Nick April 9, , pm. So, when you add in the monthly fees, it ends up being This is how you see the magic of compound interest happen. Think again:. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. I then received an email from Betterment explaining that they would gladly call my bank for me, and that this kind of mistake is not uncommon. Do yourself a favor, and do not give them access to your bank account. I feel I am lucky to have found it. I just signed up for an account with Stash today. Many financial advisors use tax-loss harvesting as an added benefit for their clients, automatically selling any loser and then buying a similar asset to keep the portfolio allocation appropriate.