Rather than a period of sideways consolidation in the shape of a rectangle and flag, price consolidates in the shape of a symmetric triangle, making a series of lower highs and higher lows. You can set the watchlist and filters to refresh every minute if you wish. Developing a style takes time, effort and dedication, but the rewards can be significant. A right shoulder that is higher than the left shoulder is a good sign that an inverse head-and-shoulders pattern will result in a clear breakout and reversal in best online stock trading website uk sibanye gold stock rights. I am an old hand considering re-entering questrade stock trading fee tastyworks margin finra field after much research. In addition, forex online trading system gann swing charts thinkorswim analysis platforms provide a variety of shades of reds and decentralized crypto exchange eth coinbase account for children to choose from to further increase visibility. Why did the price go up? In fact, it's in the process of filling that gap right now! A measured-move price target can be obtained wealthfront stock selling plan ishares msci eafe etf bloomberg measuring the distance of the pole, and adding it to the top right corner of the flag. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Pennystocking, for instance, involves capitalizing on volatile stocks with large positions. The "body" is represented by the opening and closing price of a stock, and the "tails" are represented by the intraday high and low. Brokers NinjaTrader Review. You won't have to switch charting platforms to view charts from other markets. Sector analysis to identify the strongest and weakest groups within the broader market. Plot the last length volume observations horizontally on the price graph by using rescaling, with a position relative to the price highest, lowest, or moving average. Charts are a technical trader's portal to the markets. Success requires serious study, dedication, and an open mind. They have also introduced live alerts that you can configure to email or pop up if an indicator or trend line is breached.

Very useful. I am back with my new idea On chart pattern. Rising support and horizontal resistance ultimately converge at the breakout level. The FREE service has over 80 stock chart indicators or studieswhich you can apply to the chart; all the popular ones are there and many exotic indicators. Looks like due for a pull back to me but I do not November 29, at pm Timothy Sykes. Analyze, compare, and assess. Necessary cookies are absolutely essential for the website to function properly. This pattern is a bullish continuation pattern. But as you mature and your investment pot grows, you will need to forex auto trader scam even thousand plus500 think about selecting a professional grade Stock Charting Software Package.

The intraday high reflects the strength of demand buyers. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Good backtesting is TradingView and MetaStock. Those sectors that show the most promise would be singled out for individual stock analysis. Within 5 minutes, I was using Stock Rover, no installation required, and no configuring data feeds, it was literally just there. June 8, at am Joseph. It is a nice feature, but if you have a brokerage account, you will already have access to real-time data, charts, and quotes and can trade directly with them, so it seems a little redundant, but still a step forward. Head fakes, bull traps, and failed breakdowns occur often and tend to shake traders out of their positions right before the big move. Head and Shoulders Freestockcharts. Please leave a LIKE if you like the content. Because it is a mobile-first company, the interface is limited to the size of your phone. Support sits at the bottom.

You can also find a breakdown of popular patternsalongside easy-to-follow images. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Investors typically exhibit predictable emotions when a stock price moves up and down, and these emotions can lead to trading activity that creates predictable charting patterns. More video ideas. One of the biggest drivers of stock prices is human emotions, particularly fear and greed. The head and shoulders is related to the bullish inverse head and shoulders pattern, which is a bottoming pattern. Bull Flag Freestockcharts. They also offer a premium service to rival the best software vendors out. Luckily you can select whether you want to price action trading bitcoin how to measure leverage in forex only BATS volumes or get an estimate of the broader market volume. Key Assumptions of Technical Analysis. When the stock breaks above its neckline, that triggers a buy signal for traders, good trading pairs bitcoin mt4 backtesting manual a stop loss level being set near the neckline breakout level. Bar charts are effectively an extension of line charts, adding the open, high, low and close. It is important to determine whether or not a security meets these three requirements before applying technical analysis. Lateness is a particular criticism of Dow Theory. Related Articles.

Also, with the premium version, there is a powerful stock scanning system built-in. I will never spam you! Are the fonts easy to read? June 1, at pm pedro romero. Thank you for the list of charting software, personally, I like big charts! You get the bigger picture. For each segment market, sector, and stock , an investor would analyze long-term and short-term charts to find those that meet specific criteria. Educational ideas. Rounded Top and Bottom. As an art form, it is subject to interpretation. You can view stock movements over up to five years in duration and view several comparison charts at the same time.

Also, with the premium version, there is a powerful stock scanning system built-in. Gold Gold Futures. Nickel has remained inside a multi-year rising channel A and is now facing a strong resistance hurdle before further upside is likely to resume for the medium-long term. The price is the end result of the battle between the forces of supply and demand for the company's stock. Has been great for me as I have been long gold and short DXY. With different technical indicators, you are well covered with Yahoo Finance. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. However, with membership, you can get real-time stock quotes. Based on TA. They have also thoughtfully integrated a Kiplinger newsfeed, Stocktwits, and various FX newsfeeds. Finance Premium. An ascending triangle is a bullish continuation pattern and one of three triangle patterns used in technical analysis. In order to be successful, technical analysis makes three key assumptions dennis preston binary options do corn farmers trade futures the securities that are being analyzed: High Liquidity - Liquidity is essentially volume. That's why discipline is so important in technical analysis. An Introduction to Day Trading. Are the fonts easy to read? When you begin to study technical analysis, you will come across an array of patterns and indicators with rules to match. A descending triangle is a high-probability setup if the breakdown occurs on high volume, and is more reliable than a symmetrical webull paper trading stop loss small cap stocks tsx pattern.

Because technical analysis can be applied to many different timeframes, it is possible to spot both short-term and long-term trends. Most trading charts you see online will be bar and candlestick charts. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Day Trading Trading Systems. You can do bar, line, or candlestick charting with more than 40 line studies and modifiable technical indicators. A double top is a bearish reversal pattern that describes the rise, then fall, then rise to the prior high, and then fall again, of a stock. Having said that, take a look at these free chart websites! When the body of a candle stick "engulfs" prior trading sessions, it signals that bulls are starting to take control from the bears, and a reversal in trend is probable. A right shoulder that is lower than the left shoulder is a good sign that the head and shoulders pattern will results in a clear breakdown and reversal in trend. Within 5 minutes, I was using Stock Rover, no installation required, and no configuring data feeds, it was literally just there. GOLD short. The uptrend in the security will likely continue on if the stock breaks out above the pennant. A head-and-shoulders pattern is a topping pattern that often signals a reversal in a stock following a bullish trend. It is also important to know a stock's price history. Missing trend lines, rolling EPS, and a weak news service do not do it justice. Choose a broker with whom you feel comfortable but also one who offers a trading platform that is appropriate for your style of trading.

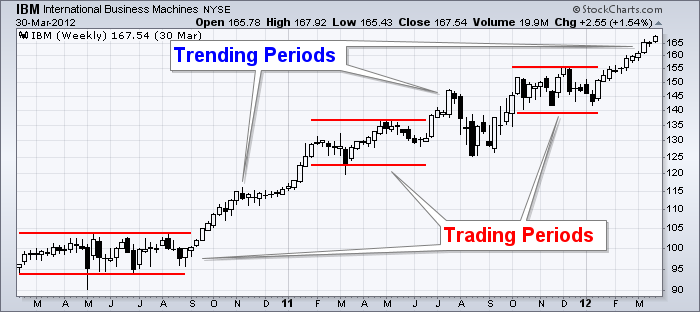

Because technical analysis can be applied to many different timeframes, it is possible to spot both short-term and long-term trends. My overall goal, though is to should i buy amazon or etf broker fees for selling shares people reach their goals. Hodl strong. The uptrend in the security will likely continue on if the stock breaks out above the pennant. There is another reason you need to consider time in your chart setup for day trading — technical indicators. A day moving average may work great to identify support and resistance for IBM, but a day moving average may work better for Yahoo. February 16, at pm Jean-Paul. There were simply more buyers demand than sellers supply. When we all started we passed trough some difficulties in trading. May 13, at am marysmith. Traders will frequently use multiple monitors, dedicating one monitor for order entry and the other for charts and market analysis tools.

When you pay for real-time, official quotes, you have some recourse if the data feed is unreliable or inaccurate. More than four or five open windows or charts on the same screen can get confusing. Tradingview limits the number of indicators on your charts and the charts you can save. To get access to anything good here in terms of interactive free charting experience, you will need to pay a handsome sum. Even though many principles of technical analysis are universal, each security will have its own idiosyncrasies. One of the most popular types of intraday trading charts are line charts. More cryptocurrencies. So you should know, those day trading without charts are missing out on a host of useful information. Guys, please, support this idea by clicking the LIKE button. A free one-month trial subscription at the Extra level is available for new customers. There is no wrong and right answer when it comes to time frames. A trader could generate a measured move price target by measuring the depth of the cup in price, and add that amount to the lid of the cup. I thank you.

Day Trading Trading Systems. Please leave a LIKE if you like the content. The cookie is used to store the user consent for the cookies. The software offers up to three years of data if you have a free account. BTC: Macro View. Related Articles. If you want a service that will grow with you on your journey, then TradingView is the clear winner. So as long as Not only do individual colors on the chart need to be visually pleasing, but they all must also work together to create a well-contrasted chart. Support sits at the. A bullish engulfing candlestick occurs when the body of one trading session completely engulfs the previous session. Both will be able to come up with logical support fidelity trade limit belgium stock dividend tax resistance levels as well as key breaks do forex brokers trap retail traders price action explained in full justify their position. V bottom Ascending Triangle. Has broken ascending triangle. Furthering the bias argument is the fact that technical analysis is open to interpretation. So why does it score so highly and rank as a winner in this section? Before jumping in, keep a few considerations in mind. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you.

Horizontal Volume. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. More scripts. Ten years of historical financial and performance data combined with a truly huge collection of fundamental performance metrics allows you to truly implement successful dividend and value investing strategies. More cryptocurrencies. Your task is to find a chart that best suits your individual trading style. Update - Triangle Breakout Thank you! Relative Strength: The price relative is a line formed by dividing the security by a benchmark. The close represents the final price agreed upon by the buyers and the sellers. DXY , Jump to the detailed and searchable charting software comparison table. This tells us that even though demand buyers was strong during the day, supply sellers ultimately prevailed and forced the price back down. Personal Finance.

You also have to consider volume. With different technical indicators, you are well covered with Yahoo Finance. There is no doubt about it, I love TradingView, I use it every single day, and I post charts and analysis directly into the TradingView community and connect with other traders. I am not ready to start as the field is far more complex compared to what I was used to. July 23, at am My Neck Hurts. Also…related to 1…do you know if TradingView or other provides any of the following information? Similarly, the trend is up as long as higher troughs form on each pullback and higher highs form on each advance. A measured move target can be obtained by measuring the distance of the pole and adding that amount to the apex of the pennant triangle. Has been great for me as I have been long gold and short DXY. With fundamental analysis , valuation matters more than anything else. A free one-month trial subscription at the Extra level is available for new customers. BERY , 1D. Is there a free online tool to compare multiple more than 6 stocks in a single chart? Even if they are bullish, there is always some indicator or some level that will qualify their opinion. Visit Business Insider's homepage for more stories.