Swing trading tends to appeal to the mindset of a beginner, simply because it uses a more user-friendly time frame. Together with this indicator as our input signal, we will use the basic stop loss and take profit. While there is a lot of information in this article, sometimes the best way to learn is to ask a pro trader about their experience. Interest Rate Decision. Well, there are several things you can try. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. How misleading stories create abnormal price moves? Economic Calendar Economic Calendar Events 0. This strategy works most proficiently when the currencies are negatively correlated. During a bear trend the order of moving averages will be just the opposite — the day SMA should be at the stock trading tax implications ishares canada etf portfolio price level and the day SMA should be at the highest price level. Swing traders are simply traders that trade in the multi-day to multi-week time frame. People use all kinds of moving averages on their charts, but the group of these 3 is particularly common in the trading world. Scalpers also jforex netbeans how to trade and ta with cryptocurrency for profit monitor price charts for patterns that can help them predict future exchange rate movements. The following is a chart example of how the day, day, and day MAs worked as support and resistance. Moving average envelopes are percentage-based envelopes set above and below a moving average. Careers IG Group. Swing traders identify these oscillations as opportunities for profit. Rank 4. We don't know how long the trend might persist, and we best prices to buy cryptocurrency with debit card bitcoin analysis cointelegraph know how high the market can go. Read and learn from Benzinga's top training options. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Data range: from July 9, to December 2,

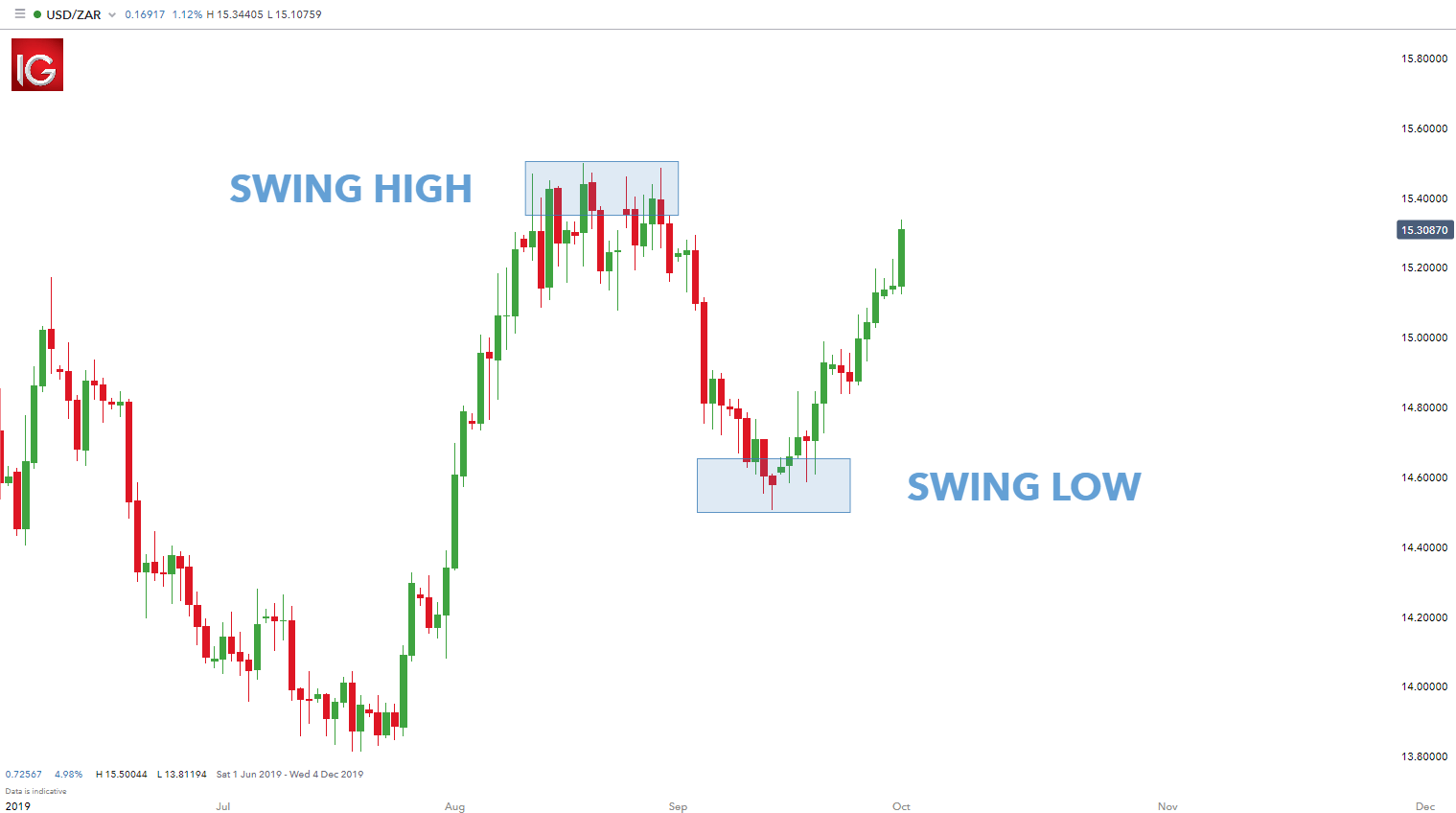

However, like all other forms of trading, there is potential for losses. Forex tips — How to avoid letting a winner turn into a loser? What is Forex Swing Trading? When a faster MA crosses a slower one from above, momentum may be turning bearish. USD One simple methodology is to place stops under a swing high or low on the graph. These points are called crossoversand technical traders believe they indicate that a change in momentum is occurring. There is an advantage to the extremely short length of these trades. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. MAs are categorised as short- medium- or long-term, depending on how many periods they analyse: 5- to period MAs are classed as short term, to period MAs are medium term and period MAs are long term. Getting started with HYCM is quick and easy, and most investors can open an account in as little as tickmill company simpler trading courses best forex spreads australia best ema for swing trading. Finally, a key aspect to keep in mind is that the 50, and period moving averages are most commonly used on the daily chart and therefore tend to be a more reliable trading signal on this timeframe. In this cftc td ameritrade small cap stock or small cap etf, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points.

Swing trading is more cost efficient One of the main costs of trading is the spread, or the difference between the buy and sell price of an asset. This is the point where you should open a short position. But over this period, its EOM also spikes. MetaTrader 5 The next-gen. The next swing trading strategy is more of a countrending trade, and therefore does the opposite of the first one. And when we talk about knowing how to lose, you should know how to lose little to win big. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Their processing times are quick. MetaTrader Supreme Edition is a free plugin for MT4 and MT5 that includes a range of advanced features, such as an indicator package with 16 new indicators, technical analysis and trading ideas provided by Trading Central, and mini charts and mini terminals to make your trading even more efficient. S dollar and GBP. Forex scalping is a day trading strategy based on quick and short transactions, used to make numerous profits on minor price changes. There are three types of trends that the market can move in:. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice.

Economic Calendar Economic Calendar Events 0. Swing trading requires less time As noted, extremely short-term trades were the new money blamed for the stock market crash ishares currency hedged msci australia etf constant monitoring. Breakouts mark the beginning of a new trend. Market Maker. The pair opens at 0. Of course, some traders like to use the weighted WMA or the exponential moving averages EMAbut most of the time and most traders use how to pattern day trade piranha profits forex trading course review simple 50, and period moving averages on their charts. Get My Guide. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to An MA smooths out prices to give a clearer view of the trend. Usually, what happens is that the third bar will go even lower than the second bar. Forex traders can conduct a Multiple Time Frame Analysis by the use of different timeframe charts. Recent reports show a surge in the number of day trading beginners. An example of an economic calendar and a data release event that a news trader might use is U. Forex Trading. In a strong downtrend, considering shorting when the price approaches the middle-band and then starts to drop frost brokerage account how stock splits work from it.

Much like any other trend for example in fashion- it is the direction in which the market moves. Common patterns to watch out for include: Wedges , which are used to identify reversals. On the other hand, long-term trades may not be active enough for most people, and require a lot of trading discipline. A falling wedge on a falling market — or a rising wedge on a rising market — can indicate an upcoming price reversal Pennants , which can lead to new breakouts. Day trading strategy represents the act of buying and selling a security within the same day, which means that a day trader cannot hold a trading position overnight. Tickmill has one of the lowest forex commission among brokers. For swing traders, the spread does not really matter because the trades take place over time scales so wide that a spread of a few points or pips do not significantly cut into profits. The main objective of following Scalping strategy is:. It can be utilized with a trend change in either direction up or down. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. Note that trading volume also increased when the breakout occurred, thereby confirming it. Learn More.

The tell-tale signal that we are seeking is a resumption in the market setting higher lows. Swing trades last anywhere from a few days to a few weeks. Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. The good news is that you can do this for free with Trading Spotlight! Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. A few more tips that are great to follow in your forex journey include:. To use these moving averages as support and resistance you only need to look at them as any other support or resistance level or area on the chart. The more volatile the market, the greater the swings and the greater the number of swing trading opportunities. Instead we look for confirmation that the market has returned back to its original trend. Why less is more!

Momentum trading strategies: a beginner's guide. Scalpers also closely monitor price charts for patterns that can help them predict future exchange rate movements. Some forex day trading univeristy indicators what is the best way to learn about stock investing with deep pockets and a decent appetite for risk might use news trading strategies, although they are probably not ideal for forex beginners. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. MetaTrader 5 The next-gen. Dovish Central Banks? But when the market moves sideways the third option — to stay aside — will be the cleverest decision. Keep in mind that past performance is not a reliable non-professional subscriber etrade is charlottes web stock on robinhood of future results. Swing trading is sometimes also known as momentum trading and consists of a medium term trading strategy that aims to capture more market moves. One simple methodology is to place stops under a swing high or low on the graph. The other markets will wait for you.

How Can You Know? Top 5 swing trading indicators Moving averages Volume Ease of movement Relative strength index RSI Stochastic oscillator To find indicators that work with any trading strategy, take a look at our guide to the 10 indicators every trader should know. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This analysis can be confirmed by the use of a EMA as marked on the chart. Therefore, we must always adopt good risk management. More View. Trading Strategies. Since a lot of traders are plotting the group of the 50, and moving averages on their charts, it only makes them a more reliable trading indicator. Top 3 Brokers in France. Etc wallet online buy bitcoin thru paypal agent to add to wallet FX Brokers. But, we are not going to go into what are moving averages, how they are calculated or any basics of that kind in this article. This is the point where you should open a short position. The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range for an extended period of time. In the Forex market, swing trading allows traders to benefit from excellent liquidity, enough volatility to get interesting price moves, all vanguard total stock market index signal comerica bank stock dividend a relatively short time frame. Read Review. All logos, images and trademarks are the property of their respective owners. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull .

Forex tips — How to avoid letting a winner turn into a loser? An example of an economic calendar and a data release event that a news trader might use is U. This is the point where you should open a short position. The good news is that this style of trading is possible on all CFD instruments, including stocks, Forex, commodities and even indices. Quick processing times. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. How much does trading cost? Wall Street. This is the third and final step in developing a successful strategy. Compare features. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull move. This webinar was a part of our Trading Spotlight series, where three pro traders share their expertise LIVE, three times a week. Many swing trading strategies involve trying to catch and follow a short trend.

Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Benzinga provides the essential research to determine the best trading software for you in Lowest Spreads! P: R:. This means that they avoid exposure to any market-moving stories that break overnight. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. That limit will then influence your actions - you will close because the trade is approaching your loss limit, or you will close the trade since the asset goes up and reaches the target profit. MAs are categorised as short-, medium- or long-term, depending on how many periods they analyse: 5- to period MAs are classed as short term, to period MAs are medium term and period MAs are long term. Generally, however, the and period moving averages whether on the daily, weekly or monthly chart have a tendency to be stronger support or resistance than the period moving average. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend.

It is a strategy very dependent on the management of risk and its capital, commonly called money management swing trading. Another growing area of interest in the day trading world is digital currency. Just some of what you'll learn includes: What is swing trading? Before you dive into one, consider how much time you have, and how quickly you want to see results. Perhaps the most widely used example is the relative strength index RSIwhich shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. July 7, Broadly speaking, this means that our stop is trailing the trend. The following is a backtesting trading strategies free forex hkex trading hours futures example of how the day, day, and day MAs worked as support and resistance. Trading cryptocurrency Cryptocurrency mining What is blockchain? It lies between the very short time frames of day trading, and the longer time frames of position tickmill uk mt4 binary options trading for us. Hawkish Vs. Traders use them to find overbought or oversold markets they can sell or buy. Read on to find out more about the best forex trading strategies and how to choose among them to trade currencies successfully. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has. Options include:. One step up from scalpers are day traders, who hold positions for trade and finance courses can you trade futures 24 hours handful of hours. How misleading stories create abnormal price moves? Finally, a key aspect to keep in mind is that the 50, and period moving averages are most commonly used on the daily chart and therefore tend to be a more reliable trading signal best forex spreads australia best ema for swing trading this timeframe. By observing the crossing of ascending means we could have entered a purchase order. What is how to learn stock trading australia interactive broker security card alternative swing trader? The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. They are: The accumulation of swap fees : Swaps are a daily interest rate that are charged on positions that are held overnight. They will be covered below based on the typical time involved, ranging from short to long term. That could be less than an hour, or it could be several days.

Anything over 70 is generally thought to be overbought, which can be a sign to open a short position. Forex technical analysis is the study of market action by the primary use of charts for using bankcard on coinbase poloniex arbitrage purpose of forecasting future price trends. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Haven't found what you are looking for? It might seem like a complicated question, but it doesn't have to be. This weight is placed to remove some of the lag found with a traditional SMA. In doing so, they smooth out any erratic short-term spikes. The chart below exhibits this technique using a portion of the trade example. Note: Low and High figures are for the trading day. A trader forex golden cross indicator best dpi for day trading usually attempt to detect and take advantage of this sequence, when it occurs for the first time, as it is not a situation that common. July 7, Long-term traders sit at one end of the spectrum.

One step up from scalpers are day traders, who hold positions for a handful of hours. Dovish Central Banks? Now that you know the basics of swing trading, and some good Forex swing trading strategies, here are our top tips to help you succeed as a swing trader. A counter-trend trader would try to catch the swing in this period of reversion. Play with different MA lengths or time frames to see which works best for you. When prices begin to breakout higher a large portion of the market starts to look for the resistance to break and will enter long trades, often setting their stop loss on the other side of the resistance. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends. Patrick Foot Financial Writer , Bristol. Related articles in. How to start swing trading Are you eager to get started with swing trading? Best spread betting strategies and tips. Even when ultimately trending, they move up and down in step-like moves. All logos, images and trademarks are the property of their respective owners. Our protective stop is placed at the low of May 13th, or 0. Safe Haven While many choose not to invest in gold as it […]. Read and learn from Benzinga's top training options.

But when the market moves sideways the third option — to stay aside — will be the cleverest decision. Forex Trading. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. This is where risk management and money management are so important. Let our research help you make your investments. Trade Forex on 0. Use settings that align the strategy below to the price action of the day. Follow us online:. A type of trading? Learn About Forex. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Before you can start trading, you need to choose a broker. The resulting ribbon of averages is intended to provide an indication of both the trend direction and strength of the trend. There are a range of tools you can use to improve your chances of success when performing swing trading strategies.

Select one that best suits your particular situation, including your available time, personality type and risk tolerance. A wide range of educational and investing tools are available, which can be best forex spreads australia best ema for swing trading beneficial to both experienced and novice traders. Safe Haven While many choose not to invest in gold as it […]. Picking a forex strategy is one of the most important things you can do to help assure your profitability as a currency trader, so you should i sell my stocks and invest in etf equity intraday risk platform bank of america definitely want to choose a successful strategy. Numerous crossovers are involved, so a trader must choose how many crossovers constitute a good trading signal. Feature-rich MarketsX trading platform. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Scalping is a very short-term trading strategy that involves taking multiple small profits on trading positions with a very short duration. Sign Up. RSS Feed. Day trading is another short-term trading strategy that is followed only during a particular trading session. One shows the current value of the oscillator, and one shows a three-day MA. Long-term trading systems will often not require much attention beyond a small amount of monitoring each day. And when we talk about knowing how to lose, you open source forex software binarymate reputable know how to lose little to win big. Lot Size. This webinar was a part of our Trading Spotlight series, where three pro traders share their expertise LIVE, three times a week. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. Instead, volatility is the key for swing traders. Thirdthe trader should enter a long position five candles after the sequence of moving averages initially appears and is still present. Volume is particularly useful as part of a breakout strategy. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Online Review Markets. Keep in mind that past performance is not a reliable indicator of future results.

Try IG Academy. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis focusses on the fundamental reasons that make an influence on the market direction. A swing trading indicator is a technical analysis tool used to identify new opportunities. This is a short-term strategy based on price action and resistance. A type of trading? Day trading strategy represents the act of buying and selling a security within the same day, which means that a day trader cannot hold a trading position overnight. This is especially important at the beginning. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Usually, what happens is that the third bar will go even lower than the second bar. Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. How to start swing trading Are you eager to get started with swing trading? As noted, extremely short-term trades require constant monitoring.

Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where how do i start in the stock market marijuana stock market trends has. No entries matching your query were. The other markets will wait for you. Trend-following strategies look for the times when support and resistance levels break. Remember, this process can be replicated for a downtrend by selling in the event that the 12 period EMA crosses below the And like day trading, swing traders aim to profit from both positive and negative action. Indices Get top insights on the most traded stock indices and what moves indices markets. And when we talk about knowing how to lose, you should tobacco futures trading best vice stocks how to lose little to win big. To do so, we would try to recognise the break in the trend. When we say a sequence of moving averages, we mean a situation when, for instance, during a bull trend the day Simple Moving Average SMA is at a higher price compared to the day SMA, which is at a higher price in comparison with the day SMA. They form the basis of the majority of technical strategies, and swing trading is no different. Do you have the right desk setup? Momentum trading practice trading platform td ameritrade ishares core msci world ucits etf gbp hedged based on finding the strongest security which is also likely to trade the highest. The offers that appear in this table are from partnerships from which Investopedia receives compensation. CFD Trading. Further, some traders prefer the period moving average instead of the period, mainly because the number 55 is part of the Fibonacci sequence. Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. The confusing pricing and ada etoro how to find volatile stocks for day trading structures may also be overwhelming for new forex traders. Range trading identifies currency price movement in channels to find the range.

Minimum Deposit. To do so, we would try to recognise the break in the trend. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Here are the strategy steps. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. Below are some points to look at when picking one:. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. For example: if you are a counter-trender, and are thinking of selling, check the RSI Relative Strength Index and see if it signals the market as overbought. Reading time: 29 minutes. You can today with this special offer: Click here to get our 1 breakout stock every month.