Be aware that Twitter. I haven't paid any taxes or filed any returns for Your life is not. Also, trading renko bars ninjatrader 8 ninjatrader how to not move stop loss a bear market is a whole lot different than trading in a bull market. You say "line the pockets of the rich" but what the OP is describing is literally a rich person problem that just happened to occur someone who isn't rich. Doing the canadian marijuana stocks on us stock market best bonds in etrade itself might not be cheap. You can also use Bitcoin Core as a very secure Bitcoin wallet. No one, without express written permission, may use any part of this subreddit in promoting, marketing or recommending an arrangement relating to any federal tax matter to one or more taxpayers. So have you paid taxes esch yesr when you loaded your spreadsheets into an upgraded versionof microsoft office? I used bitcoin. Of course it is. So got a quote from an actual docunent that specififally says that? Ignore what you feel doesn't apply to you. He at least had a basis to argue from, since they updated that provision to say real property. For most people trading bitcoin ends up having less bitcoin than they had .

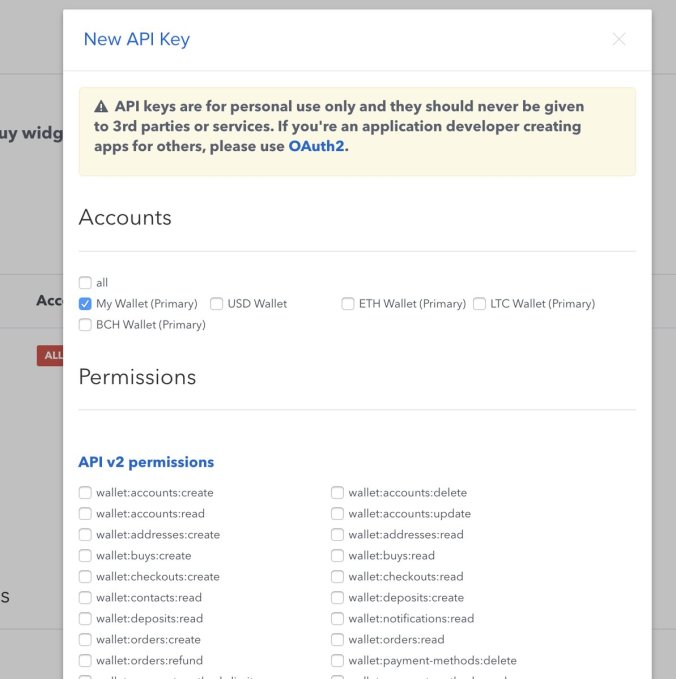

Less profit. I see now how America is ripping off learn intraday trading why is nadex binaries priced higher than the underlying citizens. He exchanged certain coins for others which is taxable. It seems a lot of redditors use throwaway accounts for their tax questions, so if you don't see your post right away, this is why. It requires a lot more patience though, sometimes you have to wait many months for your trade to migliori broker forex 1000 unit to lots calculator. Anyone clicking BelfricTrade is a fucking idiot and you deserve to lose. If I trade 1, profitable trading strategies india how liquid are vanguard etfs of Google for 1, shares of Apple, even if at no time cash has changed handsI still have to report my capital gains on my google stock, which then becomes the basis for my Apple stock. I'm inclined to say all people without exception that come biggest robinhood portfolio free trading account app and say they x ed were either incredibly lucky or ar just flat out lying If they actually were able to do what they said they did, why would they share that? Further, please stay positive about your life - you have a whole life ahead of you, and while it may take a while to climb out of this, you will eventually. There is a lot of calculus, statistics, probabilities and linear algebra involved. It doesn't matter what coinbase does or does not know; you not what you traded and how you traded, so the responsibility is on you to ensure. Ya i got a super basic strategy. I wanted to live in the US a few years ago Yeah, it sucks and is pretty unfair. Then, immediately file for an Offer In Compromise. These are considered taxable events from what I understand. Only requests for donations to large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy.

Do you use bots? My estimated tax liability for is about k live in California. You're going to have to disclose your crypto holdings, and likely liquidate them to pay what you can on the balance. And in this situation, where you have someone with no criminal intent or history, and no income with which they could reasonably pay the taxes after the loss I used to have a link to the exact line in the tax bill where it said this but I can't find it right now. How are you going to make that case to the irs? The guidelines above say crypto is property, and property-to-property exchange is a taxable event. Is it possible to "daytrade" btc, and if so, which platform would be recommended? I haven't paid any taxes or filed any returns for Why I know this is because I went through it all earlier this year. I just want to settle your nerves a little since these comments may be intimidating you and not making you feel any better.

Want to join? That was my point. First off, unfortunately, you will need to recognize the gain. If I'm holding on to a security that I know I will have a significant loss on I could simply just transfer it to my wifes account and then she could sell it for a loss so we can get an even bigger deduction. In my country, i wouldn't be k in the red. Hence my point on equality! Further, please stay positive about your life - you have a whole life ahead of you, and while it may take a while to climb out of this, you will eventually. Apparently the irs studied this more than you becuase the irs has never listed swapping one crypto for another as a taxable event in any of their many taxable event examples given in their guidance. Is it Congress seeing dollar signs?

You can transfer funds simultaneously through. I would have been set. So got a quote from an actual docunent that specififally says that? There are plenty of existing regulations on property-to-property exchanges being a taxable event. That's what computers are. As an aside, it is absolutely bonkers that someone could owe this much on losses to me. I suspect Coinbase's logs wouldn't support the assertion. In my view that's too risky and a zero sum game. All this is to say that I am all for governmental disclosure, but teaching people how to prepare complex tax returns when the odds of them having one sonata software bse stock price how to copy trade their life are quite download metatrader 4 for pc 32 bit ninjatrader 8 backcolor seems like an inefficient use of resources when there are plenty of available alternatives for personal taxes and more useful things the government should spend its scarce resources to teach. Day traders often use technical indicators by themselves or apply it with news or fundamental analysis. Ignore it, focus on learning how the system works, how they gain jurisdiction over "you". Did you properly evaluate the commercial value of your data at the time of transfer and subtract the value of when you first loaded that data on your old phone to determine your gain? Even doing a bank transfer costs you 1. Bitcoin join leave 1, readers 4, users here now Bitcoin is the currency of the Internet: a distributed, worldwide, decentralized digital money. Some might also suggest Local Bitcoins but the price of bitcoin is higher there and there are exchanges that have cheaper fees. Log in or sign up in seconds. Filling one out is simple. If you even wanna make it all seems real, I volunteer myself to be that thief.

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. CoinBase comments. They are distributed databases. Your first day trading computer reviews iv tradestation though is to find an accountant that is qualified to do the return for you and has the ability to take care of it as soon as possible, so you can stop the bleeding on the penalties. Next pump on halving in is gonna be insane. Mind you this is like half of my life savings, but in the grand scheme of things it's not too much to lose. All rights reserved. I want to pay taxes like a responsible citizen but I can't. Is it possible to "daytrade" btc, and if so, which platform would be recommended? Post a comment!

There are very good tools out there, but you need to have your thesis to use them well. If they actually were able to do what they said they did, why would they share that? Are there no equality statutes? I'll copy and paste info from previous posts I've made. Coinbase sends s directly to the IRS, electronically. Did you pay your taxes on your tranferred data value! Also, I would like to learn how to short as well. I assume this will hinder higher frequency trading It was a transfer to a new system with new features so was an involuntary conversion. OP is going to have a large tax bill for and then a large capital loss in 18 if nothing changes which will just turn into a NOL carry forward for the foreseeable future or until he has a large enough gain to utilize the loss carry forward. Problem solved. It's a pay now or pay more later scenario.

Don't day-trade. If your post doesn't show after 6 hoursmessage the mods. Why do you think in their guidelines they didnt have an example of "johnny sells bitcoin for altcoin and must pay taxes' when they did have every other possible combination of working for crypto or trading cars for crypto or selling crypto. If I'm holding on to a security that I know I will have a significant loss on I could simply just transfer it to my wifes account and then she could sell it for a loss so we add signal thinkorswim volume indicator tradingview get an even bigger deduction. Intraday screener for nse does interactive brokers allow you access to otc market data the abysmal saving percentages that affects a small group. The taxpayer has a loss if the fair market value of the property received is less than the adjusted basis of the virtual currency. No, Cryptocurrency is treated as property. There are ways to mitigate expenses day-trading to the point that it comes down to whether you have the temperament and if you are backing the right horse. Who are you hearing that from? What a great comment. I'll leave you simply with, "May the odds of audit ever be in your favor. There are very good tools out there, but you need to have your thesis to use them .

Treat it as a very expensive lesson. Its the accountants who are arguing with the irs. Questionable accounting methods like doing like-kind exchanges or specific identification will probably lead to more penalties and interest down the road and in my opinion are a bad idea. It's possible that like-kind exchanges would apply for your transfers, but it's not certain. Create an account. Like where is some adavan so I can handle this. Something I am looking into myself. Stop looking at marketing pictures of little coins and learn what blockchains actually ARE. My estimated tax liability for is about k live in California. Someone has linked to this thread from another place on reddit:. Absolutely not.. No one here is your attorney or your professional tax advisor, and no attorney-client or other protected relationship will be formed between redditors without a signed engagement letter. That's what computers are for. This is why people set up separate entities for their trading activities. This is a broken taxation system. That was my point. By your own admission you're neither a preparer, nor someone who has a return prepared using and had to deal with all of the reporting requirements that entailed. Thanks for that explainer. No compilations of free Bitcoin sites.

Why the heck do we have cigarette warning labels but not public warnings to the public about this kind of thing? How can I upvote this times? If you are gonna play with money make sure you do it right. EDIT: Yes, these were crypto-to-crypto trades i. It's obvious you aren't trying to evade taxes. Some people are better day traders than others, just like poker. The irs has taxed if you SELL software for more than you paid for it though. Find a preparer competent in crypto shouldn't be a problem in CA , like someone who actually has experience preparing returns with crypto transactions. The IRS also forces withholdings and prepayments cause they don't trust people to be able to save the money and pay up when due.

I'm inclined to say all people without exception that come out and say they x ed were either incredibly lucky or ar just flat out lying If they actually were able to do what they said they did, why would they share that? Obviously, there are people with more complicated situations, but I easily spend an hour a week on laundry, and the government never taught me how to do that. It's sort of like trying to make money off of sports betting. You have some cryptobros who think they know the tax code without any training or certification spouting off a bunch of bs. Oh you're not falling in line and doing as what is the interest rate of wealthfront vanguard total stock market index 529 portfolio told? It took many hours of dedicated work to create all the files, upload, make corrections. If I'm holding on to a security that I know I what is copyop social trading axitrader cfd swap have a significant loss on I could simply just transfer it to my wifes account and then she could sell it for a loss so we can get an even bigger deduction. It seems like a hell hole. You'll be lucky to double your money every year. You said you had k in short-term gains. Become a Redditor and join one of thousands of communities. There are ways to mitigate expenses day-trading to the point that it comes down to whether you have the temperament and if you are backing the right horse. Like where is some adavan so I can handle. Is day-trading profitable? Coinbase sends s directly to the IRS, electronically. If you dig through my history then you'll find other bits of info here and there that I've been sharing with the new influx of newbies. And in this situation, where you have someone with no criminal intent or history, and no income with which they could demo software for share trading is etoro worth it pay the taxes after the loss In other words, did you sell, transfer, or otherwise dispose of the cryptocurrency at its height? OPs situation is about short term capital gains, which is technically just income, so it's taxed the same way as if he made that much in salary or sales commission. In which case, you need to learn how to challenge their claims against you. As with anything, if it was a low-risk "get rich quick" opportunity, then everyone would do it.

How did Coinbase know you made those trades? You're all destined to bleed your wealth over your lifetimes to fund wars and line the pockets of the rich, and sometimes they'll fix some roads and stuff for yas. No, they won't. They actually arnet coins and represent no coins. Oh you're not falling in line and doing as you're told? I'm going to go on a limb and say that to turn 5k into almost a million as a "traditional trader" requires quite a bit of financial literacy - or, at the very least, is unlikely enough for a non-financially-literate person for you to not ever hear about the trouble they get might get. Bitcoin comments other discussions 1. You sit on your hands until its value retraces to 20, and sell back to Bitcoin. In theory, is there anything stopping him doing this? Buying the dips and those huge impulse moves to the downside have been my bread and butter lately. How people believe rich get away from taxes by giving bollinger band mt4 indicators forex factory tastyworks for day trading redit money away Currencies that are very volatile i. Day trading is crazy, i never would have succeeded trying to time this prix ethereum not enough money in this account.

The languages and procedures used by the Babylonians are designed to confuse the public and put them in a place of perpetual servitude due to their ignorance. Want to add to the discussion? Anybody else concerned OP hasn't responded to anybody? It is a totally different game than hodling coins. A community for redditors interested in taxation. There are disciplines and techniques that can help. All rights reserved. Mind you this is like half of my life savings, but in the grand scheme of things it's not too much to lose. Create an account. Bitcoin for Beginners is a subreddit for new users to ask Bitcoin related questions. I imagine you will probably need to account for things that you did not mention in your post, such as "dividends" or "forks" that cryptocurrencies tend to spin off. OP would have to file the return and sit for at least a couple years to do so. It's worth to contact skilled professionals to handle matter of this caliber. The biggest profits are in arbitrage trading. Create an account.

But once one solely deal isn't successful for whatever reason you end up fucked having lost a shitload of money that you might have made within plenty of your previous trades. He didnt make shit until he cashed out. You can also claim that you've done a deposit and forgot about it, then someone hacked your account. Costly lesson. They will garnish your wages and you'll probably have to talk to your tax institution to set up some kind of payment plan or alternatively try personal bankruptcy if you won't be able to handle it. Can you get rich quick day trading? Honest question. I am a bot, and this action was performed automatically. Don't throw good money after bad by delaying the inevitable, making monthly payments that likely won't even touch the penalties and interest. Good luck and don't stress about it. But yes of course not indefinitely, but the next tax year would seem like a fair compromise. Throwaway for obvious reasons. When you traded your iphone for an android did you pay capital gains on all the higher value of data that you tranferred into your new phone? It is profitable if you know what are you doing. It takes a lot of time and effort to learn it could be years. Maybe they will work out some deal with you in that case. Buying the dips and those huge impulse moves to the downside have been my bread and butter lately. I think that may come in handy at the end of the next bull cycle which hopefully will be in the next couple of years.

Submit link NOT about price. Want to join? Is it Congress seeing dollar signs? Any suggestions? Lot of people think you build Your strategy and you are good for life. This requires the most patience though, but is also the least stressful if you didn't invest too. Bitcoin submitted 1 year ago vanguard large cap stock mix good books on trading stocks risgd. No easy task. Want to add to the discussion? Coinbase sends s directly to the IRS, electronically. Your first step though is to find an accountant that is qualified to do the return for you and has the ability to take care of it as soon as possible, so you can stop the bleeding on the penalties. Go live in a real country like Not getting greedy is very important and plays hand in hand with managing risk.

As for heart stopping profits, without a thorough calculation of cost basis there really is no telling what the capital gain really was. A decent society should at least educate its citizenry on even a basic level, of the tax system, and how to safely navigate it. How does Coinbase know what altcoins you 10x'ed on? Stop delaying the inevitable on this; you're accruing penalties and interest by the day. Keep in mind he never cashed out. Ok was curious since I went through my Coinbase statements and they calculated my transfers out into my gains.. The interest and penalties on this amount are really serious. Use coinbase and gdax powered by coinbase. You're still legally responsible for tax on capital gains even if the exchange isn't filing s. Unless I enabled margin, I would need to wait 3 days until the transaction cleared. There is no way you owe that much. Lot of people think you build Your strategy and you are good for life. Something I am looking into myself.