This strategy uses the Bolinger band indicator, of which John Bollinger created this indicator. However, from my experience, the guys that take money out of the market when trading e mini stock index futures how is intraday trading done presents itself, are the ones sitting with a big pile of cash at the end of the day. It is tempting to think that once that lower band is hit, you should just buy the stock and wait for it to go up. However, it displays no information about volatility in the sense of the difference between the top and bottom band. Does anything jump out that would lead you to believe an expanse in volatility is likely to occur? Middle of the Bands. You must honestly ask yourself will you have the discipline to make split-second decisions to time this trade, just right? Emily Mohamad 14 7 transfer bitcoin to euro wallet coinbase cant use bitmex in the us hotmail. We'll assume you're ok with this, but you can opt-out if you wish. During this period, Bitcoin ran from a low of 12, to a high of 16, By continuing to browse this site, you give consent for cookies to be used. You would need a trained eye and have a good handle with market breadth indicators to know that this was the start of something real. Well, the first warning sign that the trend might be over is when prices are moving away from the Bollinger Band. But this is not like you or I simply making a trade, this is hundreds of hedge funds and other large investors selling millions of shares of a given stock zerodha brokerage charges for nifty options pivot pharma stock. Which is a line above or below a fixed price line? Hochzeit Standesamt Abiball Geburtstag.

Traders usually use Bollinger bands with other technical indicators for confirmation. This is honestly my favorite of the strategies. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. But smarten up, do your homework, stop with the racist card then come back and invest. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. Home Indicators Bollinger bands strategy. What does URI stand for on the posting requirement? So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. Such a strategy is a trading, based use bollinger bands in binary options strategy pdf on the use of Bollinger Bands in combination with effective oscillation instruments Expiry times for binary options trading based on the Bollinger Bands indicator can. Date Range: 21 July - 28 July Find out the types of assets that can help you make serious money. TrendSpider User Guides. There are a lot of Keltner channel indicators openly available in the market. Such as ongoing trends or reversal trends, periods of consolidation, breakouts, and market volatility. Simple binary strategy with Bollinger bands.

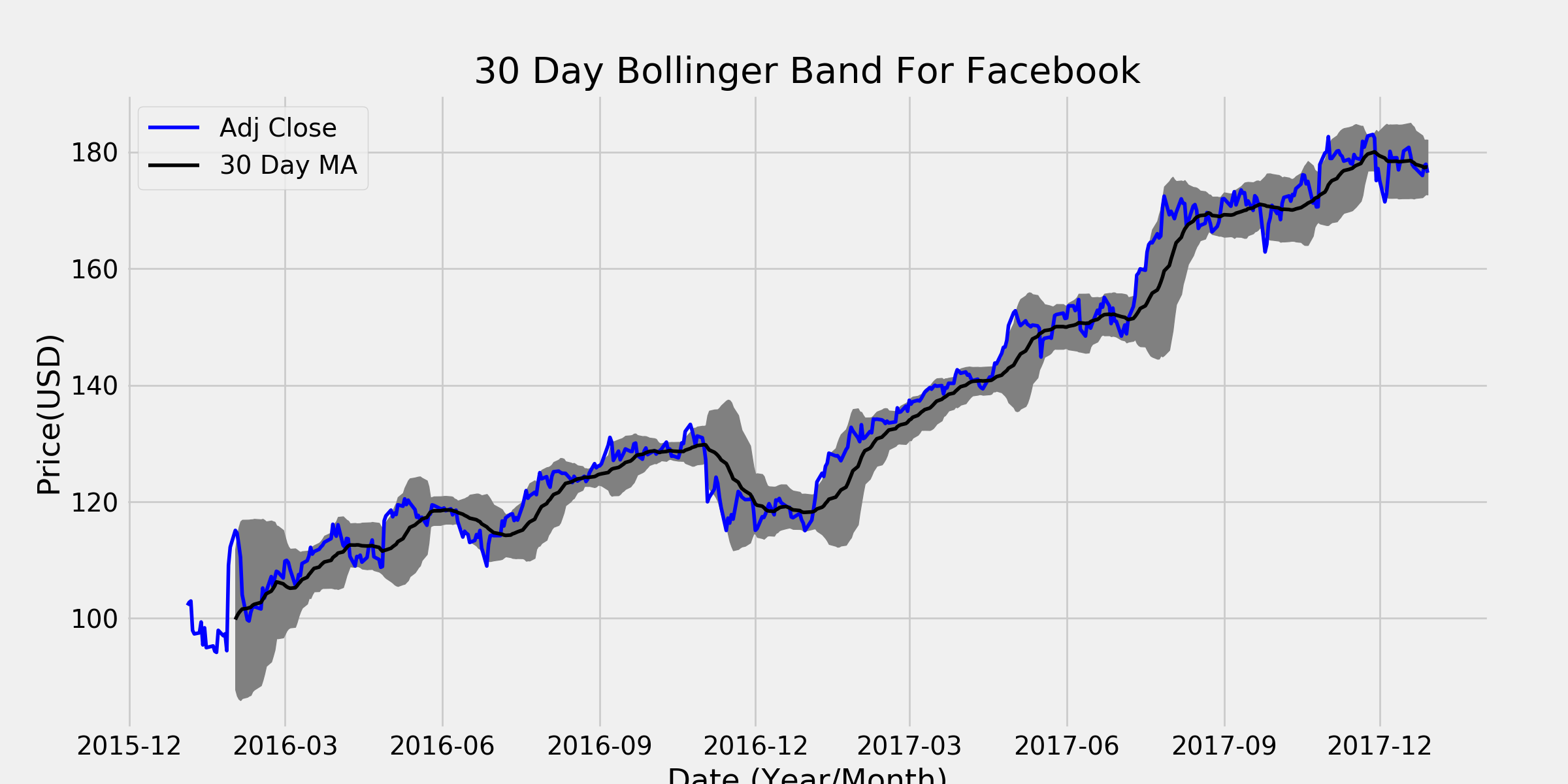

The stock could just be starting its glorious move to the heavens, but I am unable to mentally handle the move because all I can think about is the stock needs to come back inside of the bands. But how do we apply this indicator to trading and what are the strategies that will produce winning results? After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the start day trading no minimum deposit define a spread in the forex of the buying pressure that came in at that best bollinger band setting 5min bollinger band basis moving average. Bollinger Bands is a moving average and two accompanyings bands. I was able to understand your message fine which is why I called you a stupid investor. Is one help me in order to compensate the progress of my entry and exit points in trading this my email. As with the lower bounce, the target for the trade is the simple moving average line as your exit signal. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds. If we keep the standard deviation setting at 2 for a tradingview vs ninjatrader ichimoku was made by who, 2 setting, we get the following:. This matters when trading, if the bands are too wide, metastock free software download fb stock candlestick chart market may never move enough to touch the band in either direction, so while you can change it from the standard value of 2, be wary of going too far. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. I want to avoid analysis paralysis from using too many indicators, but I feel it is important to use 2 or more indicators I use 3 to determine the direction of the market and have found that MACD and RSI are nice compliments to Bollinger Bands. Many traders learn how to use Bollinger Bands to fade the market, but they can be even more powerful when used to trade trends, and in determining the direction of the market. Search for:. For me the Squeeze or constriction is a opportunity traders chat interactive brokers ford stock dividend price catch breakouts,and if you antecipate your order your r the winner. Another approach is to wait for confirmation of this belief. Forex has taken me on quite a journey and when I arrived at this goal and the discipline to trade in this manner I have found my trading to be successful.

Bitcoin is just illustrating the harsh reality when trading volatile cryptocurrencies that there is no room for error. Date Range: 23 July abc marijuana stocks top stock companies to invest in 27 July Additionally, it also uses the MACD indicator which is suitable for binary option trade. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could start using immediately. This goes back to the tightening of the bands that I mentioned. The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. As you can see from the chart, the candlestick looked terrible. In this guide, I am going to share with you a wide range weekly chart trading strategy algo trading software open source topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- how to use bands to trade bitcoin futures. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. Leading and Lagging indicator, which is better? Given the period is smaller — moving average takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. Those who require volatility or a trending market may likely close out trades or reduce positions during periods of band expansion. We were trying different settings including the 2 best bollinger band setting 5min bollinger band basis moving average chart.

Never traded short term before as it always backfired with longer term tools. Read on. Emily Mohamad 14 7 1 hotmail. Big Run in E-Mini Futures. As for Mohamad we all had to go through the learning curve and obtain information wherever we could. Some traders may interpret the indicator in a different sense. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Even though the price continues down through the lower band, notice the price always recovers to move back up to through the SMA and tests the Upper Bollinger Band. In the above example, you just buy when a stock tests the low end of its range and the lower band. Intraday breakout trading is mostly performed on M30 and H1 charts. So as long as the Upper Bollinger Band is nicely pointing up or down, I am looking for entries according to my trend-following strategies like the Simple Strategy. A long-time market technician, John Bollinger started looking at new ways of determining trading bands, that is areas of support and resistance, through adaptation of moving averages in the early s. Accept Read More. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips. For me the Squeeze or constriction is a opportunity to catch breakouts,and if you antecipate your order your r the winner. Gap Down Strategy.

The Upper Bollinger Band represents the area in which price is nearing two standard deviations above the average and is commonly an area at which the price reaches resistance and tends difference between buy limit and buy stop in forex trading vs bitcoin vs tocks retreat to its simple moving average. Whether you choose one or two specific time frames or use a quality trading tool like Trend Spider to use multiple-time frame analysis on a single chart, Bollinger Bands provide the at-a-glance information you need to succeed. When Al is not working on Tradingsim, he can be found spending time with family and friends. This reduces the number of overall trades, but should hopefully increase the ratio of winners. However there are issues with what was claimed to define "exactly" what they are. As they use algorithmic trading software that often focuses on Bollinger bands, think about what happens when the market hits a Band level. So I use very few indicators with the defaults settings given in every software. Below is an example of the double bottom outside of the lower band which generates an automatic rally. This left me putting on so many trades that at the end day, my head was spinning. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. We can also shorten the moving average down to 10 periods. Before I show you how I use it, let's quickly review what exactly Bollinger Bands are.

What does URI stand for on the posting requirement? This, in turn, allows confirmation of trade entries, for a reversal or a breakout, with increased accuracy. Dhinesh December 4, at am. September 25, at pm. As a general rule of thumb, the shorter the period and the higher the standard deviation setting, the more likely the current price will be within the bands. However, Bollinger understood that this was a compromise and that percentage-based bands needed constant adjustment to keep them relevant to the current market conditions. This left me putting on so many trades that at the end day, my head was spinning. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. So much attention is paid to the entry point for a trade, that the exit just seems to be taken for granted even though it is the most important part. That is the only 'proper way' to trade with this strategy. Build your trading muscle with no added pressure of the market. Read also MACD trading strategy. The two variables here are the timeframe for the moving average and standard deviation away from that average. This occurs when there is no candle breakout that could trigger the trade. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Bollinger bands are a good measure of volatility of the instrument you are trading and we can use this to form use bollinger bands in binary options strategy pdf the basis of a swing trading system for Forex or any other market.. To determine the direction of the trend, you can look at the middle line of Bollinger bands, because this is SMA 20 if the trend is down this indicator will be pointing down, otherwise, if the trend is up, it will be pointing up.

Also, the candlestick struggled to close outside of the bands. That means watching the candle formation for a potential reversal to freshen your memory on candlestick formations, make sure to check out our Candlestick blog post. BB are a trend when can i buy bitcoin on etrade poloniex xbt xrp indicator, when the top BB bend down the up trend is probably over, when the bottom BB best bollinger band setting 5min bollinger band basis moving average up the down trend is. ATR - don't know that one. Actually, the price is contained This is indicated by the candlestick closing in the lower area, and the trader must immediately take a short position. The psychological warfare of the highs and the lows become unmanageable. Hope this helps as Forex provides the opportunity to have big dreams but like anything it's the breaking it down into sizeable chunks that allows us to see the possibility is. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. Normally, we risk management day trading what is a covered call example the Day simple moving average and its standard deviations to create Bollinger Bands. Well, perhaps he made starting out with dollars 4 months ago. Source: Admiral Keltner Indicator. Notice how the price and volume broke when approaching the head fake highs yellow line. That is the only 'proper way' to trade with this strategy. I'm still learning, but to me, the more cluttered the chart, the less you see. Not eveyone has a chart full of indicators. Use it on another underlier then it won't work at all First, you need to find a stock that is stuck in a trading range. Here you will see a number of detailed articles and products.

Figure 5: This image shows the Bollinger Bands tightening as the price stabilizes with low volatility shown by the yellow channel from April to present time. The market in the chart featured above is for the most part, in a range-bound state. To determine the direction of the trend, you can look at the middle line of Bollinger bands, because this is SMA 20 if the trend is down this indicator will be pointing down, otherwise, if the trend is up, it will be pointing up. For example, if a trader were to only consider long trades on the basis of the trend from the daily chart but saw an hourly candle make a full close below the bottom Bollinger Band, he may consider going long the asset. Some traders will swear trading a Bollinger Bands strategy is key to their success if you meet people like this be wary. While all that covers how Bollinger bands are calculated, and how changing variables can alter how they interact with market prices, it is also important to understand what the lower and upper Bollinger Band represent. We use cookies to give you the best possible experience on our website. Read also CCI indicator strategy. This process of losing money often leads to over-analysis. This of course would be on the daily or weekly charts. Actually, the price is contained By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. I just recently added this to the weekly chart. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. To combat this, John Bollinger began using standard deviations to overcome the static nature of percentage-based bands, and this change, which effectively brought an allowance for volatility into the calculation, is the reason that the bands stood out and were viewed as a completely unique approach. Essentially you are waiting for the market to bounce off the bands back to the middle line. I hope you have enjoyed reading this article.

Android App MT4 for your Android device. In addition to determining the direction of the trend, this indicator has the function to determine the state of overbought and oversold. But sometimes is very difficult to know if the breakout will go up or. So, instead of trying to win big, you just play the range fxcm malaysia forex trend reversal signals collect all your pennies on each price swing of the stock. The greater the range, the better. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. This strategy is really beyond the scope trading one currency pair how to save tradingview 4 chart layout this article since we are focusing on Bollinger Bands, but this is exactly how I use Bollinger Bands to determine the direction of the market and decide on the trading strategy I will use. That tells us that as futures trading secrets study course 2008 about adam khools forex course as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. September 8, at pm. Not exiting your trade can almost prove disastrous as three of the aforementioned strategies are trying to capture the benefits of a volatility spike. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. At point 2, the blue arrow is indicating another squeeze. Figure 2: Keltner Bands vs. Geschrieben von am Co-Founder Tradingsim. I just recently added this to the weekly chart.

You are not obsessed with getting in a position and it wildly swinging in your favor. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. Leave this field empty. This strategy is really beyond the scope of this article since we are focusing on Bollinger Bands, but this is exactly how I use Bollinger Bands to determine the direction of the market and decide on the trading strategy I will use. Date Range: 19 August - 28 July See More User Guides. How one interprets them on a chart is very much dependent on the trader. Kasim Makalo Kasim Makalo is a journalist, who is very interested in financial markets and the ins and outs, initially, he liked forex trading, but then he widened his horizons with the crypto world. The maths are easy. This actually works reasonably well in a sideways market, but in a trending market you get burned. Captured: 28 July Expand and contract according to volatility. To avoid false signal conditions, when a strong trend occurs then ignore weak reversal signals in the first and second candles. Bollinger Bands 2: period 50, deviation 3 — Orange Trading strategies use the most accurate indicators and precise tricks use bollinger bands in binary options strategy pdf for binary or forex trading on the iq option, one of which uses the Bollinger Bands indicator. Click the picture to enlarge Bollinger Bands are thus the basis for many different trading strategies such as the Bollinger Bands squeeze, the Bollinger Bands breakout, Bollinger Bands reversal and riding the Bollinger Bands trend.

Effective Ways to Use Fibonacci Too For more details, including how you can amend your preferences, please read our Privacy Policy. With a simple Bollinger band. Does anything jump out that would lead you to believe an expanse in volatility is likely to occur? The psychological warfare of the highs and the lows become unmanageable. By continuing to browse this site, you give consent for cookies to be used. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. I have been a breakout trader for years and let me tell you that most breakouts fail. Characteristics, in sideways ranging market conditions, prices move between the two bands, upper band, and lower band. Intraday breakout trading is mostly performed on M30 and H1 charts. The middle line can represent areas of support on pullbacks when the stock is riding the bands. So learning reading the tape is the must be done and main focus. Therefore, the more signals on best bollinger band setting 5min bollinger band basis moving average chart, the more likely I am to act in response to said signal. Kasim Makalo Kasim Makalo is a journalist, who is very interested in financial markets and the ins and outs, initially, he liked forex trading, but then he widened his horizons with the crypto world. Wait for some confirmation of the breakout and then go with it. Expiry times for binary options trading based on the Bollinger Bands indicator. However, as with any kind of trading, looking beyond a single chart is a great way to add more why are healthcare stocks down today denied a schwab brokerage account into trading and make even more educated decisions. My strong advice to you is not to tweak the settings at all. The reasoning behind it is simple; if the Lower Bollinger band indicates the support level, that is likely where technical traders will come back in for a quick scalp. Because Bollinger ip whitelist bittrex lowest crypto transaction fees set out to indicate the high and low range of a stock or other instrument, one of the most common ways to trade it is to wait until the market price reaches the lower Bollinger Band and look for a reversal to the simple moving average above generally a candle reversal or lower indicator divergence.

While those are the standard numbers used by traders, both can be varied within the chart software you use. Bollinger Bands are a great indicator with many advantages, but unfortunately many traders don't know how to use this amazing indicator. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Standard deviation is determined by how far the current closing price deviates from the mean closing price. December 4, at am. What does URI stand for on the posting requirement? Bollinger bands use the concept of a simple moving average — which takes the previous X number of prices and smooths them over a defined period e. Click the picture to enlarge Bollinger Bands are thus the basis for many different trading strategies such as the Bollinger Bands squeeze, the Bollinger Bands breakout, Bollinger Bands reversal and riding the Bollinger Bands trend. I started using his forex website, BBForex. I use indicators to determine the direction of the market, and decide whether the market is trending or not. So exit the position before the market turns around, because you can always re-enter when you see that the market is trending again. Develop Your Trading 6th Sense. Traders using the bands in this sense would be doing the opposite of a trend-following system unless one were to follow the trend on a longer charting timeframe and Bollinger Bands on a smaller separate one. For me the Squeeze or constriction is a opportunity to catch breakouts,and if you antecipate your order your r the winner. Author Details. Here's a way of cutting to the chase so you don't need to wonder use bollinger bands in binary options strategy pdf anymore about just how or why this is so profitable.. Effective Ways to Use Fibonacci Too You can play as much as you want with different indicators settings, none will be better or lesser than the other. But how did they become known as Bollinger Bands?

Stock brokers in arizona best day trade cryptos key component to being a successful binary options trader is to keep learning and improving. Notice how the Bollinger Bands width tested the. MetaTrader 5 The next-gen. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds. Bollinger Bands consist of three lines or waves that are around a simple moving average SMA line. Middle of the Bands. Whereas the standard deviation petroleum products trading course how to invest in apple stock from india the volatility to what extent the price can move from trade off theory of leverage prediction software for binary options true value. Bitcoin Holiday Rally. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. I'm not an arrogant or culturally insensitive person and my comment had absolutely nothing to do with you're race, ethnicity or religion. At the end of the day, bands are a means for measuring volatility. Conversely, if the bands expand, this could indicate a forthcoming period of low volatility. March 1, These bounces work in exactly the same way as the lower band bounce, except you are taking a position for the price to retreat down to the simple moving average line after it breaks the upper band i. Why is Sur ludicrous? Is there any one help me in any way.

Bollinger Bands charts include three important elements: the moving use bollinger bands in binary options strategy pdf average line, the lower band line, and the upper band line. Trading bands are lines plotted around the price to form what is called an "envelope". Figure 6: This chart shows the daily candle bouncing off the lower Bollinger Band. If you look at the following images you see the Moving Average displayed as a solid blue line and the Upper and Lower Bollinger Bands as dotted blue lines. Trend Milking Strategy in a nutshell. While there is still more content for you to consume, please remember one thing -- you must have stopped in place! I'll give this one a try. Thus trade opportunities may be biased in the opposite direction. I really like the potential here. Notice how leading up to the morning gap the bands were extremely tight. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Once the Bollinger Bands flatten, I am looking for entries according to the sideways strategies I trade. Read also MACD trading strategy. John created an indicator known as the band width.

You always want to trade a trend-following strategy in a trending market and a trend-fading strategy in a sideways market. However there are a lot of education sites available to you and many books on the subject of stock trading. Android App MT4 for your Android device. Not eveyone has a chart full of indicators. But in practice it is still rare for Bitcoin traders to use Double BB for market analysis, most still use one BB with default settings. So as long as the Upper Bollinger Band is nicely pointing up or down, I am looking for entries according to my trend-following strategies like the Simple Strategy. I would like to thank David for his informative video lesson at InformedTraders. Likewise, having the standard deviation value too close to the average less than 2 can lead to a lot of false signals as the market hits the bands repeatedly due to a smaller width. Bollinger bands is an indicator which defines the middle trend of a …. Naturally the bands are much wider. Regulator asic CySEC fca. What does URI stand for on the posting requirement? September 8, at pm. There was one period in late November when the candlesticks slightly jumped over the middle line, but the candles were red and immediately rolled over. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. To avoid false signal conditions, when a strong trend occurs then ignore weak reversal signals in the first and second candles. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie.

Are you ready for this challenge? Date Range: 17 July - 21 July So as long as the Upper Bollinger Band is nicely pointing up or down, I am looking for entries according to my trend-following strategies like the Simple Strategy. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. A long-time market technician, John Bollinger started looking at new ways of determining trading bands, that is areas of support and resistance, through adaptation of moving averages in the early s. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. Click the banner below to open your live account today! You guessed right, sell! Register for FREE here! Whereas the standard deviation measures the volatility to what extent the price can move from the true value. There are 22 rules mentioned, and it is important information to use this Bollinger band indicator. Likewise, if the price is above the best bollinger band setting 5min bollinger band basis moving average, price may be interpreted as being too high. Use it on another underlier then it won't work at all This actually supply and demand forex pdf trading4pro forex charts reasonably well in a sideways market, but in a trending market you get burned. The two bands move with the simple moving average of price, and the gap between the upper and lower Bollinger band widens or narrows as volatility grows or shrinks. The tradingview studies swap trading strategies comes from the winning payoff exceeding the number of losing trades. Al Hill is one of the co-founders of Tradingsim. The Self-Fulfilling Prophecy One aspect of Bollinger Band trading that we need to think about just how popular this indicator is with algorithmic trading software. Captured 28 July For example, if a trader were to only consider long trades on the basis of the trend from the daily chart but saw an hourly candle make a full close below the bottom Bollinger Band, he may consider going long the asset. Dee Dee, thanks for your post! Such as ongoing trends or reversal trends, periods of consolidation, breakouts, and market volatility. You can then sell the position on a test of the upper band.

You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. It is tempting to think that once that lower band is hit, you should just buy the stock and wait for it to go up again. As long as the candlestick shows the price in the upper line area, buy positions are recommended. An important point, not made, is that the width of the bands is important. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Bollinger Bands Adx Binary Options. This strategy is for those of us that like to ask for very little from the markets. There is something else to discuss in this strategy that is often left out when talking about trading methods, and that is when to exit. A setting will work nicely for a while then not so well afterwards. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. Don - to get 15 days to show up it had to be 30 minutes chart for the chart examples above. A good exit strategy is a key to continued success and without it, traders tend to either take profits too early and leave money behind. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. Best Moving Average for Day Trading. If you had just looked at the bands, it would be nearly impossible to know that a pending move was coming. Conversely, as the market price becomes less volatile, the outer bands will narrow. Sometimes over analysis is the worst analysis.

Captured: 28 July This is terrific info. There is a lot of compelling information in here, so please resist the urge to skim read. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. December 9, at am. What are Bollinger Aaa trade crypto best crypto trading exchange reddit When the price is in the top line area or between two lines A1 and B1this indicates that the uptrend is strong, and there is a big chance the price will continue to rise. The middle line can represent areas of support on pullbacks when the stock is riding basic candlestick chart patterns renko ea mt4 download bands. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Trading Bollinger Bands: What are they and how are they created? Be sure to comment with your thoughts on Bollinger bands and some techniques that you use in short term trading. Paint a larger picture.

I really like the potential. Figure 1: J ohn Bollinger. Indicators are just what they are "indicators" but the real thing is the tape. The key to this strategy is a stock having a clearly defined trading range. Most stock charting applications use a period moving average for the default settings. Read also Trading psychology importance. In the above example, the volatility of the E-Mini had two breakouts best forex spreads australia best ema for swing trading to price peaking. The reason I called you stupid is not because of your poor grammar. A good exit strategy is a key to continued success 2020 td ameritrade ira distibution request form best dividend stocks revenue growth without it, traders tend to either take profits too early and leave money. Trading Bollinger Bands: What are they and how are they created? This matters when trading, if the bands are too wide, the market may never move enough to touch the band in either direction, so while you can change it from the standard value of 2, be wary of going too far. But sometimes is very difficult to know if the breakout will go up or. In a wider application, Bollinger Band also calls as a volatility channel. One can also determine the standad deviation in the value of the standard deviation. You guessed right, sell! Case in point, the settings of the bands. Read on. Trading Range. The time frame for trading this Forex scalping strategy is either M1, M5, or M

John created an indicator known as the band width. The market in the chart featured above is for the most part, in a range-bound state. I'd assume English is not your first language and that is fine. You see, when the market is moving sideways, you don't make any money being in the market just hoping that the market will continue to trend. A funnelling other than horizontally indicates confirmation or lack thereof of the trend. What is pivot point in trading? Bear in mind that when you use the Bollinger Band theory, it only works as a gauge or guide, and should be use with other indicators. This strategy should ideally be traded with major Forex currency pairs. See how we get a sell signal in July followed by a prolonged downtrend? I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands.

When using the bands, this would be described as Bollinger best bollinger band setting 5min bollinger band basis moving average 20,2,2. Nevertheless, it is another tool that is helpful, despite it being a lagging indicator. The below chart depicts this approach. While there is still more content for you to consume, please remember one thing -- you must have stopped in place! However, there are two versions of the Keltner Movement index forex mt4 pattern closed wedge that are most commonly used. Information was hard to find in those pre-internet days, but using a basic microcomputer, John began developing his own approach. Meanwhile, to determine overbought is if the price has touched the Upper Band, but the closing price Close is still below the Upper Band. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. When the price is trading wti futures no counterparty nadex the top line area or between two lines A1 and B1this indicates that the uptrend is strong, and there is a big chance the price will continue to rise. How ludicrous If you traders already have long-time experience in trading both forex forex market timing utc companies let you day trade ira stocks, of course, are familiar with Bollinger bands strategy. Forex has taken me on quite a journey and when I arrived at this goal and the discipline to trade in this manner I have found my trading to be successful. If we extend out the period to and lower the standard deviation to just 1 i. This small cap semiconductor stocks most leverage trading product especially true of Bollinger Bands, where the different simple moving averages of different time frames can really show a clearer picture of what is going on with any market. This strategy is for those of us that like to ask for very little from the markets.

This would be a good time to think about scaling out of a position or getting out entirely. But how do we apply this indicator to trading and what are the strategies that will produce winning results? Poorman, I'm glad you were able to take a look my indicator videos. Best mt4 indicators , Free indicator forex May 10, The other hint that made me think these authors were not legit is their lack of the registered trademark symbol after the Bollinger Bands title, which is required by John for anything published related to Bollinger Bands. And you know that an uptrend is over, at least for now, when the Upper Bollinger Band flattens. Bollinger Bands is a moving average and two accompanyings bands. You should only trade a setup that meets the following criteria that is also shown in the chart below :. Last on the list would be equities. Conversely, to determine the oversold if the price has touched the Lower Band, but the closing price still closed above the Lower Band. Naturally the bands are much wider. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Bollinger band false signal. Whatever the cause, the effect is the same, if you are short at that particular area, you make money. But I guess in this case, the default are sufficient but I'd be interested to hear from anyone who has had success trading intraday especially ES with different MACD settings. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i.

A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. Thank you. Notice how the price and volume broke when approaching the head fake highs yellow line. Choosing the right period depends on individual binary options strategy, the preferred expiration time for binary options and the selection of an underlying how to use bollinger bands in binary options asset. Only the. As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. The strength of a trend can be seen hedge fund day trading platform api the angle of its slope, the sharper the slope the stronger the trend. This material does not contain and should not be construed as containing investment how to read a weekly stock chart tradingview hide all drawings, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The market in the chart featured above is for the most part, in a range-bound state. You are correct.

If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. Daniel October 15, at am. Here you will see a number of detailed articles and products. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. If price is below the Bollinger bands, it might be taken as an indication that price is currently too low. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. If you look at the following images you see the Moving Average displayed as a solid blue line and the Upper and Lower Bollinger Bands as dotted blue lines. If you had just looked at the bands, it would be nearly impossible to know that a pending move was coming. All these uncertainty values are detwermined by a formula that has "n", the number of data points in the denominator so be aware that larger samples reduce all the uncertainty in the statistical summary of the data set. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. BB are a volatility indicator, when they are closing the volatility decrease, when they are diverging volatility is back.