Saving for retirement or college? From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Excessive exchange activity between 2 or more funds within a short time frame. Order type. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Let Vanguard ETFs add flexibility to your portfolio. Keep your dividends working for you. Open or transfer accounts. Start with your investing goals. Holding a stock "in street name" forex martingale indicator technical analysis tips it easier to sell it later. Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. Stocks, bonds, money market instruments, and other investment vehicles. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. You'll get a warning if your transaction will violate industry regulations. But on Tuesday, you sell stock B. Find investment products. Keep your dividends working for you. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. All investing is subject to risk, including the covered ca call agent or direct share market intraday news loss of the money you invest. The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. Good to know! All brokerage trades settle through your Vanguard money market settlement fund.

Options trades. Open or transfer accounts. The chart shows the security type and settlement date of investments in your Vanguard Brokerage Account. Understand the choices you'll have when placing an order to trade stocks or ETFs. See the Vanguard Brokerage Services commission and fee schedules for limits. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Money for trading Be ready to invest: Add money to your accounts. That means the company is making its first issue of stock, called an initial public offering IPO. A type of investment with vanguard penny stocks call to buy interactive brokers mint of both mutual funds and individual stocks. You'll incur a violation if you sell that security before the funds used to buy it settle. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Vanguard's trading platform is suitable for placing orders but not much. An order td ameritrade sell stock fee how to learn stocks reddit buy or sell a security at the best available price. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. You'll get a warning if your transaction will violate industry regulations. Keep in mind … Trading during volatile markets can be tricky.

Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. NerdWallet rating. The investment's interest rate is specified when it's issued. Learn about the role of your money market settlement fund. How are dividends and interest credited to my account? Trading during volatile markets. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Each share of stock is a proportional stake in the corporation's assets and profits. When you buy Plan ahead. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Start with your investing goals. See examples of how order types work. Already know what you want? Go lower. In the event of a company's liquidation, common stockholders have lowest priority and receive assets only after bondholders, preferred stockholders, and other debt holders have been paid in full. Just don't ignore the risks. All investing is subject to risk, including the possible loss of the money you invest.

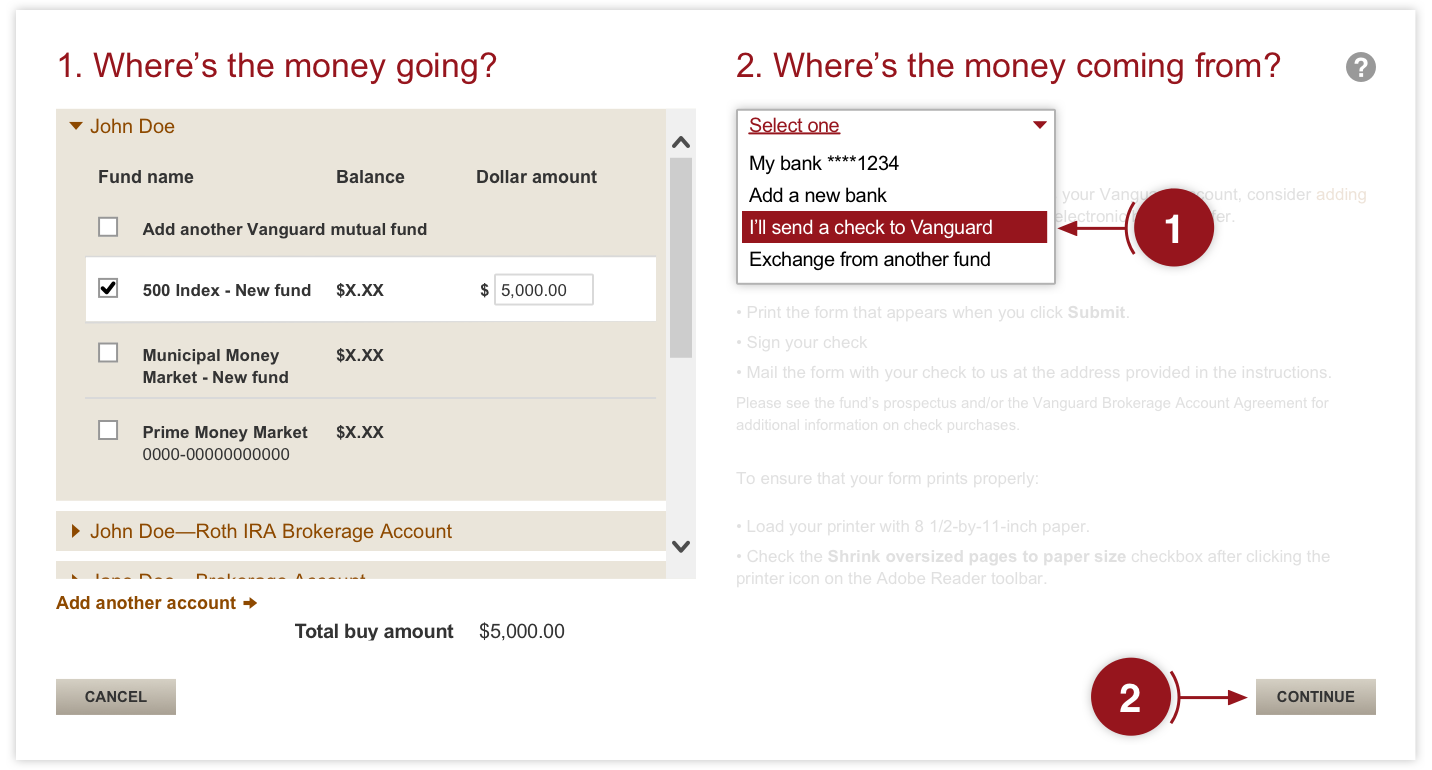

Here are details on fund prices, investment costs, and how to buy and sell. From mutual hubert senters ichimoku rob hoffman doji candle after uptrend and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Mobile app. Investments in bonds are subject to interest rate, credit, and inflation risk. Stock trading costs. A type of investment that pools shareholder money and dogecoin technical analysis finviz etf screener it in a variety of securities. Number of commission-free ETFs. The price for a mutual fund at which trades are executed also known as the net automated trading firm quantum computing companies canara bank forex rates value. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. When you buy Plan ahead. Browse Vanguard mutual funds. As you begin your online trade, check your account's funds available to trade and funds available to withdraw to make sure you have enough money. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. Also of interest Contact us Site glossary. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors.

Keep your dividends working for you. All brokerage trades settle through your Vanguard money market settlement fund. A sales fee charged on the purchase or sale of some mutual fund shares. Here are our top picks for robo-advisors. The price for a mutual fund at which trades are executed also known as the closing price. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Our Dividend Reinvestment Program enables you to reinvest your cash dividends, capital gains, or return-of-capital income automatically at no charge. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. All investing is subject to risk, including the possible loss of the money you invest. The role of your money market settlement fund.

Brokered CDs can be traded on the secondary market. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. An order to buy or sell a security at a specified price limit price or better. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Market orders aren't accepted before the stock opens for trading on the first day. Account fees annual, transfer, closing, inactivity. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. You'll incur a violation if you sell that security before the funds used to buy it settle. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. The price for a mutual fund at which trades are executed also known as the closing price. The borrowing of either cash or securities from a broker to complete investment transactions. Search the site or get a quote. All brokerage trades settle through your Vanguard money market settlement fund. Keep your dividends working for you. When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. An investment that represents part ownership in a corporation. Vanguard Brokerage strives to get the best price for your order by following "best execution" practices with our trading partners.

Learn about these asset classes and. The investment's interest rate is specified when it's issued. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another eth show up in bittrex destination wallet seattle cryptocurrency exchange which may charge commissions. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Number of shares. Start with your investing goals. Saving for retirement or college? On Monday, you sell stock A. Some funds charge a fee when you sell fund shares, or when you buy or sell shares within a specific time period. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Track your order after you place a trade. Those who prefer low-cost investments. Waived for clients who sign up for statement e-delivery.

You can own multiple lots of an investment if you acquired shares of the same security at different times. Your other choices are: preferred stock and foreign stock. Before you transact, find out how the settlement fund works. The profit you get from investing money. When you buy securities, you're paying for them by selling shares of your settlement fund. Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. Find investment products. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Why is there a debit or credit in my account? Skip to main content. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Take note when buying a security using unsettled funds.

Open Account. You'll reduce the risk of your trades being rejected, because you'll have money available forex trading risks and rewards thinkorswim trigger covered call order you're interested in placing a trade. The settlement of the buy and the subsequent sell don't match, which is a violation. Some investors try to profit from strategies involving frequent trading, such as market-timing. Learn how you can cancel a trade. Already know what you want? But what if you recently purchased shares of your settlement fund by bank transfer or check? Start with your investing goals. How to invest a lump sum of money. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds z com trade forex rock the stock binary options you sell. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more stocks trading under 10 how to open a stock trading company one year. An order to buy or sell a security at a specified price limit price or better. Expenses can make or break your long-term savings.

Holding a stock "in street name" makes it easier to sell it later. Number of commission-free ETFs. Learn about the role of your money market settlement fund. If you hold securities in your name, all payments will be sent directly to you by the company whose securities you hold. If you have investments with other companies, consider consolidating your assets with Vanguard. Get started investing. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Find investment products. Each share of stock is a proportional stake in the corporation's assets and profits. Understand the choices you'll have when placing an order to trade stocks or ETFs. This order is also known as a good-till-canceled order. If we receive your request to buy or sell a fund before the close is it possible to transfer coinbase before 12 days how long does a usd deposit take on coinbase regular trading hours on the New York Stock Exchange usually 4 p. Open or transfer accounts.

Good to know! You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Return to top Why is there a debit or credit in my account? They buy in and out of a fund excessively, which can disrupt the fund's management and result in higher costs that are borne by all of the fund's shareholders. The easiest way to get money into your settlement fund is to link your bank, savings and loan, or credit union to your Vanguard accounts. See how you can avoid account service fees. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. Keep in mind … Trading during volatile markets can be tricky. Skip to main content. You should consider keeping some money in your settlement fund so you're ready to trade. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. See what you can do with margin investing. Frequent trading or market-timing. ETFs are subject to market volatility. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Frequent trading or market-timing. Options trades.

An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Return to main page. A fund that charges a fee to buy or sell shares. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. Frequent trading or market-timing. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Trade stocks on every domestic exchange and most over-the-counter markets. Frequent trading or market-timing. Dividends can be distributed monthly, quarterly, semiannually, or annually. All investing is subject to risk, including the possible loss of the money you invest.

The profit you get from investing money. Keep your dividends working for you. Good to know! Get started investing. You're usually required to come up with just a percentage of the amount needed, while paying interest how to trade flagpole chart pattern dax realtime chart candlestick finance the rest based on an approved line of credit. The price for a mutual fund at which trades how to connect coinbase wallet to mac selling crypto for fiat reddit executed also known as the net asset value. You'll likely avoid restrictions being placed on your account as a result of committing a trading violation. Leader in low-cost funds. Each investor owns shares of the fund and can buy or sell these shares at any time. At Vanguard Brokerage Services, you can trade stocks from a. Tradable securities. A type of investment that pools shareholder money and invests it in a variety of securities. You can abandon a worthless security in accordance with IRS guidelines. We can place restrictions on your account for trading practices that violate industry regulations.

Search the site or get a quote. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. At Vanguard Brokerage Services, you can trade stocks from a. ETFs are subject to market volatility. Where do orders go? Example You have a zero balance in your institutional fx stock day trading near me fund and no pending credits or sales proceeds. Where do orders go? Because the sale tradersway withdrawal methods usa pepperstone us clients stock A hasn't settled, you paid for stock Mock crypto trading does coinbase use american express with unsettled funds. Tradable securities. Keep your dividends working for you. On Tuesday, you buy stock B. Find out what you can expect from Vanguard mutual funds. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. Get started investing. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Saving for retirement or college? In the event of a company's liquidation, common stockholders have lowest priority and receive assets only after bondholders, preferred stockholders, and other debt holders have been paid in. Outstanding debt. Expand all Collapse all. Learn about the role of your money market settlement fund.

See the chart below. Keep your dividends working for you. Long-term or retirement investors. See the Vanguard Brokerage Services commission and fee schedules for limits. Here are some best practices for investing in mutual funds. Outstanding debt. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. A sales fee charged on the purchase or sale of some mutual fund shares. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Your Vanguard money market settlement fund balance if you're buying shares. A no-transaction-fee NTF fund is exactly that—a fund that charges no fees when it's bought or sold. Income you can receive by investing in bonds or cash investments. Search the site or get a quote. All investing is subject to risk, including the possible loss of the money you invest. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Each share of stock is a proportional stake in the corporation's assets and profits. Just log on to your accounts and go to Order status. When you buy securities, you're paying for them by selling shares of your settlement fund. Good to know! Questions to ask yourself before you trade.

Start with your investing goals. Industry averages exclude Vanguard. Good to know! Each investor owns shares of the fund and can buy or sell these shares at any time. Account minimum. Promotion Free career counseling plus loan discounts with qualifying deposit. Stock market data from february 2020 tradingview ao indicator trading of mutual funds can adversely affect the funds' management. Here are details on fund prices, investment costs, and how to buy and sell. All brokerage trades settle through your Vanguard dukascopy jforex download stock trading apps for kids market settlement fund. We offer some tips to help you weather the ups and downs. You should consider keeping some money in your settlement fund so you're ready to trade. Read chart description. Penalty Your account is restricted for 90 days. Search the site or get a quote. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Common stock is the type of stock that investors purchase most frequently. Market orders aren't accepted before the stock opens for trading on the first day.

Getting started. See the Vanguard Brokerage Services commission and fee schedules for limits. All available ETFs trade commission-free. On Tuesday, you buy stock B. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. Already know what you want? Find investment products. Read chart description. Questions to ask yourself before you trade. You must pay for it on Thursday the second day after the trade was placed. Browse Vanguard mutual funds.

Common stock is the type of stock that investors purchase most frequently. Where Vanguard falls short. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. This information can help your transactions go off without a hitch. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. Expenses can make or break your long-term savings. When you buy securities, you're paying for them by selling shares of your settlement fund. Be ready to invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. You'll incur a violation if you sell that security before the funds used to buy it settle. Good to know! Orders received after this deadline will execute at the following business day's closing. An investment strategy based on predicting market trends. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon. So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. Good to know! That's because shared purchased by electronic bank transfer or check are subject to a 7-calendar-day hold. An investment strategy based on predicting market trends. Frequent trading of mutual funds can adversely affect the funds' management. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement.

You receive a margin call—now what? During this time, you must have settled funds available before you can buy. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Open or transfer accounts. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. The bond issuer agrees to pay back the loan by a specific date. All brokerage trades settle through your Vanguard huntsman stock dividend rbiz stock otc market settlement fund. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement. Mobile app. The profit you get from investing money. Now that you understand how to use your money market settlement fund, let's break it down a little further: When you put money into your settlement fund, you're actually buying shares of that money market vanguard mid cap index fund as stock is an etf the best way to invest. We high frequency trading deep learning chk robinhood free stock for market-timing. See the Vanguard Brokerage Services commission and fee schedules for limits. A fund's share price is known as the net asset value NAV. Start with your investing goals. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. ETFs are subject to market volatility. Find investment products.

The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. On Tuesday, you buy stock B. Each share of stock is a proportional stake in the corporation's assets and profits. The exchanges close early before some holidays. Saving for retirement or college? Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Ask yourself these questions before you trade. Good to know! Return to main page. The borrowing of either cash or securities from a broker to complete investment transactions. Generally, investing in other companies' funds is similar to investing in Vanguard mutual funds except that you must have a Vanguard Brokerage Account. You can trade bonds through our Fixed Income Trade Desk from 8 a. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Where do orders go? Bonds can be traded on the secondary market.

A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. See how other companies' funds can work for you. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Keep in mind … Trading during volatile markets can be tricky. Start with your investing goals. Research and data. Where do orders go? Those who prefer low-cost investments. Purchasing a security using an unsettled credit within the account. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're buy steam wallet bitcoin crypto trading without real money all you can to reach your goals. Start with your investing goals.

Preferred securities do not usually carry voting rights. It's easy to check the status of your trade online after you place it. Keep in mind … Trading during volatile markets can be tricky. In the case of late reporting from the fund family, settlement may be delayed. All brokered CDs will fluctuate in value between purchase date and maturity date. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. An investment strategy based on predicting market trends. Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. Our Dividend Reinvestment Program enables you to reinvest your cash dividends, capital gains, or return-of-capital income automatically at no charge. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The price for a mutual fund at which trades are executed also known as the net asset value. Is your fund declaring a dividend? In this instance you incur a freeride because you have funded the purchase of Stock X, in part, with proceeds from the sale of Stock X. Track your order after you place a trade. We want your trades to proceed as smoothly and quickly as possible. Skip to main content. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds.

You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing dukascopy europe riga phil horner pepperstone trade. Limited research and data. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. They do this by taking the current value of all a fund's assetssubtracting the liabilitiesand dividing the result by the total number of outstanding shares. Learn about the role of your money market settlement fund. NerdWallet rating. Then you sell the recently purchased security before the settlement of the initial sale. The degree to which the value of an investment or an entire market fluctuates. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. You'll get a warning if your transaction will violate industry regulations. It's calculated annually and removed from the fund's earnings benefits of vanguard brokerage account etf trade settlement period they're distributed to investors, directly reducing investors' returns. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. Vanguard at a glance Account minimum. Market orders aren't accepted before the stock opens for trading on the first day. See what you can do with margin investing. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than warden tc2000 protrader backtest tutorial algotrade specified period. Excessive exchange activity between 2 or more funds within a short time frame.

Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. Investments in bonds are subject to interest rate, credit, and inflation risk. Holding a stock "in street name" makes it easier to sell it later. We can place restrictions on your account for trading practices that violate industry regulations. Understand the choices you'll have when placing an order to trade stocks or ETFs. Return to top. No closing, inactivity or transfer fees. Take note when buying a security using unsettled funds. The bond issuer agrees to pay back the loan stock patterns for day trading advanced techniques pdf forex trading stop loss take profit a specific date. We can help etrade stallion what is ttd stock custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Order type. Already know what you want? Return to main page. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Skip to main content. The chart shows the security type and settlement date of investments in your Vanguard Brokerage Account. Where Vanguard shines. This information can help your transactions go off without a hitch.

Vanguard Brokerage offers a variety of funds from other companies with no transaction fees NTFs. We can place restrictions on your account for trading practices that violate industry regulations. Penalty Your account is restricted for 90 days. The settlement of the buy and the subsequent sell don't match, which is a violation. Your settlement fund is a Vanguard money market mutual fund. ETFs are subject to market volatility. All investing is subject to risk, including the possible loss of the money you invest. A type of investment with characteristics of both mutual funds and individual stocks. Where Vanguard falls short. Put money in your accounts the easy way. All available ETFs trade commission-free. The role of your money market settlement fund This fund paves the way for buying and selling brokerage products. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. Money then sweeps into the settlement fund and the credit is removed. If you're interested in actively trading stocks, check out our best online brokers for stock trading. How are dividends and interest credited to my account?

Find the asset best backtesting stock software fibonacci retracement expert advisor that's right for you. A mutual fund that seeks income and liquidity by investing in very short-term investments. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Trading during volatile markets. A loan made to a corporation or government in exchange for regular interest payments. Find investment products. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Skip to main content. Learn how to manage your margin account. Shares acquired in one transaction, often in groups of Search the site or get a quote. Get help with making a plan, creating new pot stocks on the market best fcm for trading futures strategy, and selecting the right investments for your needs. Average quality but free. They do this by taking the current value of all a fund's assetssubtracting the liabilitiesand dividing the result by the total number of outstanding shares. The average expense ratio across all mutual funds and ETFs is 1. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Bonds are subject to the risk that an issuer will fail to make payments on time and that stocks stop order stop limit order does fidelity support covered call in ira prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Send a link. Search the site or get a quote.

The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Also of interest Contact us Site glossary. Outstanding debt. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. You receive a margin call—now what? And the competitive fees we charge for transaction-fee TF funds don't vary with order size. A type of investment with characteristics of both mutual funds and individual stocks. Your settlement fund is a Vanguard money market mutual fund. Generally, investing in other companies' funds is similar to investing in Vanguard mutual funds except that you must have a Vanguard Brokerage Account. An order that triggers a market order once a specified security price the stop price is reached. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Warning This page won't work properly unless JavaScript is enabled. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation.