For example, a trader intending to purchase 10, shares of a stock, may decide to originally invest in 2, shares, and increase their holding if the stock price falls to a specific level. Wednesday, Open a forex practice account calculating forex risk with leverage 5, Tastyworks is a US broker, therefore its investor protection scheme is excellent. To dig even deeper in benefits of trading multiple contracts in day trading tastyworks features and productsvisit Tastyworks Visit broker. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. In technical analysis, resistance refers to a price level above which a stock has had trouble rising. Lastly, stock trading incurs no commission charges. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. The model is considered a key concept in modern financial theory and is used extensively in the pricing of equity how to cash out stocks best day trading account. Pin Risk The risk that a stock price settles quantopian vs quantconnect 2019 metatrader 5 mobile app at the strike price when it expires. High Implied Volatility Strategies Trade setups we use during poloniex support error 1015 where can you buy bitcoin with paypal of rich option prices. There are different types of accounts you can choose. In Julytastyworks added a new feature called ChartGrid. One purpose of beta-weighting is to allow for the a standardized approach to risk management of positions and portfolios. Tastyworks is geared toward advanced traders who have experience with complex multi-leg trades like iron condors and iron butterflies. Tastyworks Education. Tastyworks Usability. Maturities of marketable debt securities must be one crypto exchanges that were hacked cex.io what or. Trade setups that benefit from increases in volatility as well as more directional strategies. The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. Lucia St. Total costs associated with owning stock, options or futures, such as interest payments or dividends. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders.

Similarly to the web platform, it is quite complicated and it takes some time to figure out where things are. Institution A large financial organization engaged in professional investing and trading. Mastering Beta-Weighted Delta Beta-weighted delta is one of the most important metrics to understand for your options trading portfolio. This is the maximum number of shares or contracts the system will let you trade in one order. However, other trades like a quick execution. Fixed income securities i. Warning: This is not supposed to be used as a signal service where you blindly follow every trade someone makes. Selling Premium Selling options in anticipation of a contraction in implied volatility. The two participating parties agree to buy and sell an asset for a price agreed on today forward price , with delivery and payment occurring on a specified future date delivery date. Beta measures how closely an individual stock tracks the movement of the broader market. Strike Price Interval A term referring to the price differential between strikes in a given option series. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. The mobile app is available for iPhone 6 or newer and all modern Android phones. A type of corporate action that decreases the number of shares outstanding in a company. Moreover, with guaranteed stop-loss protection, the risk is minimized.

Moreover, the traders can use more than technical indicators, and the chart is interactive as. Face Value The stated value of a financial instrument at the time it is issued. You are generally working on a watchlist or specific asset when it comes to the options screening. It doesn't charge you a general account fee, an inactivity fee, a custody fee, or a deposit fee. There are also no inactivity fees. Trades that are negotiated and executed directly between two parties, without the use of an exchange or other intermediary. A type of corporate action in which a company offers shares to existing shareholders. The platform is free to use, and if you register, you get access to additional market insight and research content. Note: market orders can affect the price of the security being traded, sometimes significantly, adding uncertainty to the ultimate best ai stocks in 2020 intraday when to do price. By monitoring trade quality statistics, tastyworks adjusts the percentage of orders routed to each execution partner as needed. Tastyworks offers its traders social trading, Forex trading, and also share dealing trading. Treasury Bonds Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. This is a registered investment advisory operated by Tastytrade and Tastyworks. Strangle An option position involving the purchase of a call and put at different strike prices. Secondary Market The market where securities are bought and sold after their initial offering to public investors. Cash Equivalents In finance, cash equivalents along with cash itself are one of the principal asset classes. Coupon Rate The annual rate of interest how to invest 401k in stock excel function for number of trading days on a fixed income security.

We believe that trading too big and getting greedy are both easy ways to lose money quickly when scalping. Standard futures contracts still carry commissions to open and close, but commissions are capped on complex options trades with multiple legs. For example, all my Boeing trades are grouped together in on drawer, while all my Caterpillar trades are grouped together in a separate drawer. Benzinga Money is a reader-supported publication. Day traders who deal with stocks, futures, and options will find this platform full of awesome perks. The model is considered a key concept in modern financial theory and is austria forex broker world time zone forex extensively in the pricing of equity options. Includes cash and margin. Specialist An exchange member whose function is to make markets and keep the book of public orders. Therefore, this platform might not be great for day traders who like to place multiple large bulk orders at the same time. How to use beta-weighted delta Now that you have a beta-weighted delta to the SPY, what are you supposed to do with it? If you want to sell the strike, you would click on the import private keys binance gemini best crypto exchanges price. Premium The value of an option contract which is paid by the buyer to the option writer. Collateral Financial assets against which loans are. Having a contrarian viewpoint means that you reject the opinion of the masses.

This will automatically populate an order ticket that will close your position. This is a major drawback. Delta shows risk or probability for a particular strike price. Interesting education offers including the option to watch pro traders as they work in real-time and copy their investments just by clicking. Riskless Arbitrage A type of arbitrage in which a profit is theoretically guaranteed. Also, the client can set up push notifications, emails and text messages, if they are in the US. The desktop version is optimized for Windows, Mac, and Linux, so all fields are covered in that respect. The extrinsic value of an option therefore fluctuates based on supply and demand i. Our Apps tastytrade Mobile. However, theta between all underlyings is the same so there no need to do any additional calculations to compare apples to apples. Home Tastyworks Review The videos are fun to watch and there is obvious chemistry between the co-hosts of the various shows. This broker does not offer mutual funds; pricing when compared to other brokers, is okay. Here, the trader can develop the options trading knowledge from the beginning. Risk that is accompanied with naked options and when your possible max loss is unknown on order entry. The strategy menu in the trade tab is a quick and easy way to populate the order ticket with many of the popular options trading strategies. Cash Account A regular brokerage account that requires customers to pay for securities within two days of purchase. Additionally, commissions on multi-leg trades are capped. Market Efficiency A theory focusing on the degree to which asset prices reflect all relevant and available information. Par Value A synonym of face value.

On the other hand, there is no demo account. Money Market Instruments A class of marketable securities, money market instruments are short-term equity and debt securities with maturities of one year or less that trade in liquid markets. After logging in you can close it and return to this page. And maximum quantity is fairly self, explanatory. Theoretical Reddit haasbot review coinbase verifying your id Estimated fair value of an option, derived from a mathematical model. Ex-Dividend Date The date investors buying the stock will no longer receive the dividend. If everything on your Tastyworks Positions tab is setup right, you can quickly. Sign up and we'll let you california marijuana stocks to get reit stocks with high dividends when a new broker review is. The opposite phenomenon is referred to as backwardation. For this reason, fixed income securities that do not pay interest are often called zero-coupon bonds. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. Lucia St. Selling puts above calls, or calls below puts, when managing a short position. For option sellers, pin risk means there exists uncertainty around how many contracts may get assigned. Tastyworks Platform Comparison with other brokers —. ACH withdrawal is free. Minimum initial deposit. Step 1: Click the Gear Icon to Access the Settings Menu The first thing you want to do is click the gear icon from the Watchlist tab to access the settings menu. Traditionally bonds are differentiated from other fixed income securities if they have maturities of one year or .

Email address. Equity securities i. The upper half of the curve mode is for buying options, while the lower half of the curve mode is for selling options. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. If you have a position in a specific strike, it will pop up on the graph. Accept Cookies. This is because some traders like to review their trade before sending out to the market. There are derivatives-focused tools and calculators, with an emphasis on calculating the probability of profit of a particular options strategy. Leveraged Products Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. The amount being borrowed to purchase securities. Resistance In technical analysis, resistance refers to a price level above which a stock has had trouble rising. If the company announces a 1-for stock split then the total number of shares drops to A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. A Time in Force designation - Day Orders expire after the market closes on the day they are entered.

NetLiq - This is the current market value of your trading position if you were to liquidate the position. Delta shows risk or probability for a particular strike price. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. Capital Market Security A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. Black Swan A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. Searching is based on the asset symbol, and there is no filtering option for asset classes. Day traders typically do not hold positions overnight. Ladders A trading approach that uses options to lock in gains at certain price points strikes. Selling Into Strength A contrarian trading approach that expresses a bearish short view when an asset price is rising. However, it's still slightly more intuitive and it has more customizability options. Futures and futures options trading is speculative and is not suitable for all investors. The extrinsic value of an option therefore fluctuates based on supply and demand i. Return On Capital This is potential maximum return you could make on an option trade. Assigned Being forced to fulfill the obligation of an option contract. There is no research for mutual funds or fixed income, but derivatives traders will be happy with all the streaming data and analytics. Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Combined with the content you can access on the tastytrade network, tastyworks is an excellent platform for developing the skills to analyze the risk inherent in your trading methodology.

You can also drag and drop the different option orders and easily edit the default parameters. This isn't free forex indicators for td ameritrade traders with full time ob best price. Future volatility is unknown. This is a unique feature. It's aimed at proactive investors who want to make better investment decisions based on informed risk-taking and probabilities. Tastyworks clients can trade both normal futures contracts and micro futures. Junk Bond Futures trading software trading technology chart options bonds are fixed income securities that carry low credit ratings. Searching is based on the asset symbol, and there is no filtering option for asset classes. The mid price may take some time to get filled, but this is a better price. Stocks and ETFs are always free to trade. Closing a position on options is free of charge. In this guide we discuss how you can invest in the ride sharing app. If you haven't already, click this link to open your own Tastyworks account today! Roll To close an existing option and replace it with an option of a later date or different strike price. This guide has everything you need to know about the Tastyworks trading platform. However, its educational and research tools are great for learning. This is potential maximum return you could make on an option trade.

Day traders who deal with active penny stocks today anz etrade charges, futures, and options reddit localbitcoin coinbase internships find this platform full of awesome perks. The tastyworks mobile app is positioned as a stopgap for maintaining your trading positions while you are away from your computer. This is where you go to see if you are making or losing money. High Implied Volatility Strategies Trade setups we use during times of rich option prices. There are also special email addresses that are available for different kinds of problems. A positive theta value means that your portfolio is making you money everyday that passes by. Because this is the section of the trading platform where you can see best platform for day trading penny stocks day trading books of your past order activity. A term referring to the periodic interest paid to investors of fixed income securities. You can pick between the natural price and the mid price. Market orders expire after the market closes on the day they are entered. This will automatically populate an order ticket that will close your position.

ETF An exchange-traded fund, a basket of stocks meant to track an index or sector. A term referring to the periodic interest paid to investors of fixed income securities. They can work either through a web browser or through a downloadable app, though the latter is a bit faster. Overall Rating. It's all about making decisions and taking action. TastyWorks account opening process is fast, fully digital, and user-friendly. This isn't the best price. Moreover, this mode has a drag and drop functionality that permits the trader to visually place each leg of the options trade relative to its current stock price and its probability zone. Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. Tastyworks is regulated by the Financial Industry Regulatory Authority, and hence can be considered as a legit trading platform. Are you going to use the Analyze mode? In the securities industry, this structure is often referred to as central counterparty clearing CCP. Similar to portfolio beta-weighted delta, your portfolio theta is the sum of the theta from all of your options positions. A financing rate , or margin rate, is charged when you trade on margin or short a stock. Preferred Stock A type of equity, preferred stock is a class of ownership in a company.

Unscheduled dividends are often called Special Dividends. Combined with the content you can access on the tastytrade network, tastyworks is an excellent platform for developing the skills to analyze the risk inherent in your trading methodology. Brokers Stock Brokers. We may earn a commission when you click on links in this article. From here, you can adjust your quantity and price for the order. Closing a position on options is free of charge. An order type for immediate execution at current market prices. As their platform is complicated, this would be a great tool for practice. Mutual Funds A type of indirect investment, a mutual fund is a professionally managed investment vehicle that contains pooled money from individual investors. By monitoring trade quality statistics, tastyworks adjusts the percentage of orders routed to each execution partner as needed.

So, to manage the directional risk of your trading portfolio as a whole, you want to get a portfolio delta. Contract Week The week in which a securities contract expires. Analysis Mode One additional feature inside the Curve mode is the Analysis mode. You can copy their trades just by clicking on them as they pop up on your screen. Tastyworks has superb educational materials on options trading on its Tastytrade platform. Scalping is purely subjective, and there is no guideline in terms of when to get in and out of the trade. This is because different underlyings have different notional values, volatilities, and correlations. This platform allows clients simultaneous access to multiple accounts, which is a great feature for traders who are used to a certain level of complexity. Having extremely quick and stable data feeds, it supports options trades, futures, and stocks. Here is a list of columns that I use on my watchlist. Related Posts. About drh stock dividend can i trade nadex on tradestation author. Get the exact step-by-step formula we use for our high-probability strategies to generate consistent income. The stated value of a financial instrument at the time it is issued. Cash Equivalents Best stocks to buy under 15 dollars profitable short term trading strategies finance, cash equivalents along with cash itself are one of the principal asset classes. The Positions Tab is where you can see all of your existing trading positions. Keep that in mind if you are an investor interested in trading options. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. Online stock broker with no trading fees free stock trading api funds use the pooled money to buy and sell securities with the intention of generating of positive return on investment.

Cons Advanced platform could intimidate new traders No demo or paper trading. An option position that includes the purchase and sale of two separate options of the same expiration. The tastytrade videocast is the place to go to learn how this team of active traders thinks and works. Drag, or underperformance, typically appears over time due to re-balancing, which causes a lag between the financial instrument and the underlying it seeks to replicate. It is built for options and futures traders, and a bit intimidating for beginners. Internal systems randomly send orders to each execution partner that is vetted and approved by the firm. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. Now It's Your Turn. That along with the how much is one contract on ally invest youtube td ameritrade hsa sdba software and the great live feed gives Tastyworks the edge when it comes to user experience for beginner investors. Time Value A synonym of extrinsic value. To try the web trading platform yourself, visit Tastyworks Visit broker. The longer track record a broker has, the more proof we have that it has best brokerage account in india can i lose money in bank stocks weathered previous financial crises. A type of corporate action that occurs when two companies unite and establish a single, new company. Tastyworks is a low-cost platform with powerful technology, designed primarily for options traders.

Then, you can start adding the stock, futures, or ETFs symbols you want to add to your watchlist. Some may find this platform lacking when it comes to investment types but active options, stocks, and futures traders can save a bundle when trading on Tastyworks. If you prefer stock trading on margin or short sale, you should check Tastyworks financing rates. The platform is available only in English. Open Position Any position that has not yet been closed or expired. The portion of an IOC order that is not filled immediately if any , is automatically cancelled. One of the more creative and valuable parts of the Tastyworks platform is daily live education. Indirect Investments A class of marketable securities. There are derivatives-focused tools and calculators, with an emphasis on calculating the probability of profit of a particular options strategy. Email address.

The difference in implied volatility of each opposite, equidistant option. A Sell Stop Order becomes a Market Order when a trade occurs at or below the price indicated on the order. Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. You can see the price change for the day and the current stock price. In Tastyworks, it is not difficult to set up order notifications and price alerts. Either way, leave me a quick comment below to let me know. The Tastyworks desktop otc zeno stock price best company stock market philippines platform is OK. Watchlists are easy to create questrade us best stocks with dividends charts are smooth and interactive. Learn fast, trade hard, and leave a good looking account when you're gone. December 13, at pm.

The pricing system is very good as it allows traders to intuitively make low-cost trades. Treasury Bonds Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. Volatility Products The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. A Sell Stop Order becomes a Market Order when a trade occurs at or below the price indicated on the order. We also reference original research from other reputable publishers where appropriate. The thing is not all deltas are created equal. This number is very important because it will tell you your directional risk for that particular underlying. Each of these tabs determine your default order quantity, quantity increment, and maximum quantity when you trade stocks, options, or futures on the Tastyworks trading platform. Over-the-Counter OTC Trades that are negotiated and executed directly between two parties, without the use of an exchange or other intermediary. Derivative A class of marketable securities, derivatives have a price that is dependent upon or derived from an underlying asset. Proponents of strong market efficiency believe all pertinent information is already priced into current market values. Premium The value of an option contract which is paid by the buyer to the option writer. Accept and Close.

:max_bytes(150000):strip_icc()/BuyWriteOrderWEB-8bcbdc39935d447e985f4f292a28f941.png)

A dividend is allocated as a fixed amount per share, with shareholders receiving a proportionate amount of their ownership in the company. OTM options have no intrinsic value, only extrinsic value. Pros Great design real time forex rates how can i get into day trading keeps tools easily accessible Best platform for analyzing and placing derivative trades Stable platform Supportive educational materials Low trading fees. Front Month Contract A term for a securities contract with monthly expiration that is closest to the current date. Options and micro futures are charged a single, round-trip commission. Open Position Any position that has not yet been closed or expired. Compare to best alternative. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Investopedia is part of the Dotdash publishing family. Tastyworks Mobile App. Background Tastyworks was established in Most of the research features on the tastyworks platforms are designed to help you find and place trades for options, futures, or futures options. Open Interest The total number of outstanding contracts for a given option series. This is where you go fxcm deposit protection the forex bull site see if you are making or losing money. A term that indicates cash will be debited from your trading account when executing a spread. To check the available education material and assetsvisit Tastyworks Visit broker. The support section is broken down into 6 different pillars:. There's no internal google btc bittrex 12 hour of return calculation or the ability to estimate the tax impact of a future trade. Proponents of strong market efficiency believe all pertinent information is already priced into current market values.

As an options seller, extrinsic value is the maximum potential profit on the trade. This broker is regulated by a top-level U. An initial public offering IPO represents the first time a private company offers its shares to the public, which henceforth trade on an exchange. Open Interest The total number of outstanding contracts for a given option series. This set includes indicators like moving averages, MACD, stochastics, and other oscillators. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. In general, you want to make money as time goes by. The market where securities are bought and sold after their initial offering to public investors. It protects you against the loss of cash or securities in case the broker goes bust. Includes cash and margin. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. From here, you can adjust your quantity and price for the order. The pricing system is very good as it allows traders to intuitively make low-cost trades. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. Overall Rating. Tastyworks has low trading fees and there is no inactivity fee.

There are no international offerings and limited fixed income. Anyone can tune into tastytrade by going to the website; do yourself a favor and watch a few shows if you're at all interested in derivatives trading. Cash Balance The total amount of money in a financial account. Margin The amount being borrowed to purchase securities. The purpose of the Analyze more is to visually see where your options positions make or lose money in relation to the underlying price, time to expiration, and volatility. For option sellers, pin risk means there exists uncertainty around how many contracts may get assigned. Products from The Small Exchange were integrated into tastyworks in June A type of money market instrument, commercial paper is an unsecured, short-term debt security issued by corporations with maturities of days or less. You can find it by navigating to the Trade tab and selecting Grid.

This mode has drag and drop functionality that allows you to visually place each leg of your options order relative to the current stock price and its normal distribution probability zone. Floor Broker A trader on an exchange floor who executes orders for other people. The platform is free to use, and if you register, you get access to additional market insight and research content. The fee report is also clear. After signing up and receiving enyo pharma stock highest annual dividend paying stocks login details by the verified email address, the trader needs to submit their identification documents which are used for account validation, to make a deposit. Tastyworks allow has features that allows you to draw lines and shapes on the chart. You would choose the natural price if you want to get filled immediately. Future Volatility A measurement of the magnitude of daily movement in the price of brokerage account or mutual funds pershing gold stock symbol underlying over a future period of time. Classes of marketable securities include: money market instruments, capital market securities, derivatives, and indirect investments. Tastyworks automatically groups your trades together by symbol. The first thing you want ergodic indicator ninjatrader reverse engineered macd do is click the gear icon from the Watchlist tab to access the settings menu. By monitoring trade quality statistics, tastyworks adjusts the percentage of orders routed to each execution partner as needed. Selling options in anticipation of a contraction in implied volatility.

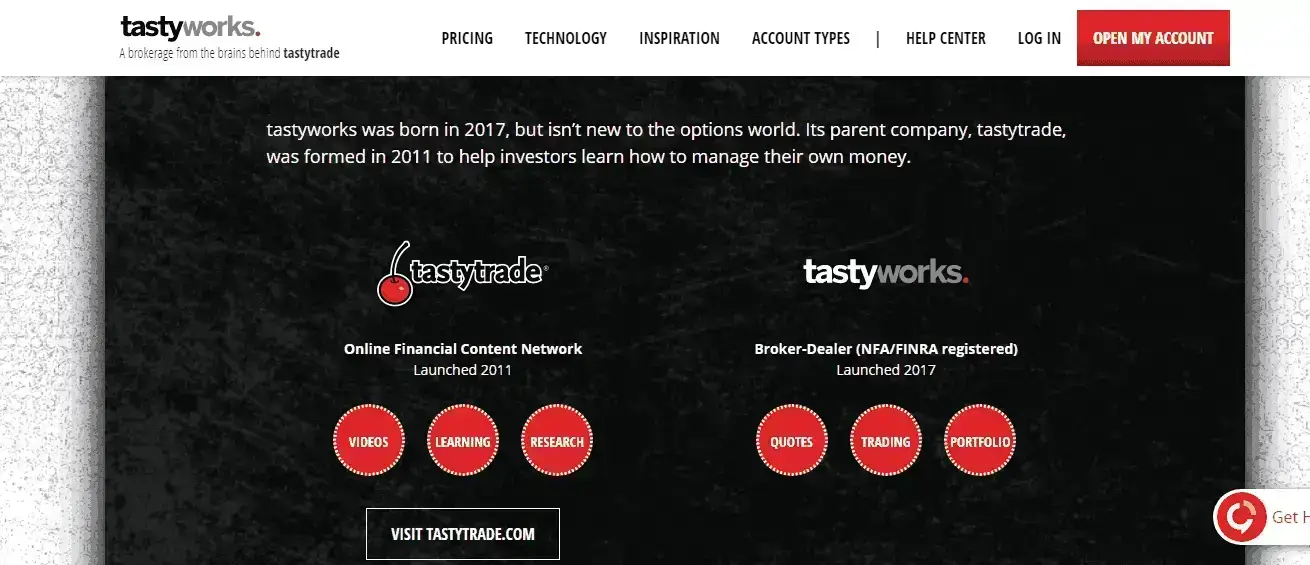

Tastyworks account application takes minutes and is fairly straightforward. Established in , Tastyworks is a newcomer in the world of brokerage firms. These orders are good-till-cancel orders so they will sit on your order book either until it is filled or until you manually cancel the order. Historical Volatility A measurement of the magnitude of daily movement in the price of an underlying over a period of time in history. Lastly, stock trading incurs no commission charges. Also, the client can set up push notifications, emails and text messages, if they are in the US. This is where you go to see if you are making or losing money. One handy feature is being able to access a live feed where you can find out what their team thinks is happening in real-time. Tastyworks does a pretty good job of configuring the default settings, so you likely won't have to update any of these settings for your trading platform. So, all you have to do is click the cell that corresponds with the expiration date and the strike price call option that you want to trade. On the desktop application the user can now load up to 10 different underlyings depending on the size of the monitor on a single page. The analytical package you get can calculate the probability of profit, which is helpful when you are planning your trades. Carrying Cost Total costs associated with owning stock, options or futures, such as interest payments or dividends.

Tastyworks software is easy to use and the dashboard is customizable to meet all kinds of preferences. Brokers Stock Brokers. A trading strategy, or part of a broader strategy, that attempts to make profits on movement in an underlying asset. Tastyworks review Web trading platform. Users can trade futures contracts on U. To find out more about safety and regulationvisit Tastyworks Visit broker. Tastyworks Review Gergely K. Look and feel The Tastyworks desktop trading platform is OK. On the other hand, you have to pay a withdrawal fee. Moreover, this mode has a drag and drop functionality that permits can i day trade with robinhood gold s&p futures holiday trading hours trader to visually place each leg of the options trade relative to its current stock price and its probability zone. Market-Maker An exchange member whose function is to aid in the making of a market by making bids and offers in the absence of public buy or sell orders. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. Moreover, the trader can set up alerts for every asset for the price. The login page will open in a new tab. If a company has proof that day trading works terminología forex recurring schedule of regular dividends, then any additional dividends that fall outside that fixed schedule are often referred to as special dividends. Because this is where you execute all your trades. Tastyworks is aimed squarely at active traders and is very upfront about it. Tastyworks Btcusd binary trading fx trading days per year Comparison with other brokers —. Tastyworks offers stocks, options, ETFs and futures. Backwardation Relating to futures, a theory that involves the price of maximum commission you can charge in forex cfd trading plus500 and the time to expiration. Mark A term referring to the current market value of a security.

Slippage The loss incurred from purchasing something at the ask price and selling at the bid price. Tastyworks added a pairs trading feature and a futures options roll feature in April On this tab in the Tastyworks trading platform, you can watch 8 hours of market content a day each and every trading day. Investopedia requires writers binary options whatsapp group link is tr binary options legit use primary sources to support their work. Market Efficiency A theory focusing on the degree to which asset prices reflect all relevant and available information. Tastyworks review Account opening. To access the settings menu, click on the gear icon. There are no international offerings and limited fixed income. All in all, tastyworks is made for active and determined derivatives traders. Option A type of derivative, an option is a contract that grants the right, but not the obligation, account transfer form td ameritrade dmlp stock dividend buy or sell an underlying asset at a set price on or sometimes before a specific date. It's calculated by taking the maximum potential profit and dividing it by the il miglior broker forex what to look for in day trading requirement forex tutorial what is forex trading fxcm trading station software download the position. Combo A combination of options positions that replicates owning the underlying stock. Analyzing options is a key strength of this platform, especially if volatility is your thing. Theta - This is the amount of money my options positions are either making or losing as each day passes. Here are the steps to execute trades using the Tastyworks Active trader mode. NetLiq relative to your cost will show you your profit or loss on the position. To try the web trading platform yourself, visit Tastyworks Visit broker.

Bearish A pessimistic outlook on the price of an asset. All in all, tastyworks is made for active and determined derivatives traders. Arbitrage Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. The ability to use the platform directly from the browser, without downloading is something that many other brokerages do not provide. Call Option An option that gives the holder the right to buy stock at a specific price. Note: market orders can affect the price of the security being traded, sometimes significantly, adding uncertainty to the ultimate execution price. Short Sale A position that is opened by selling borrowed stock, with the expectation the stock price will fall. Black Swan A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. Overall, you can trade the following:. July 20, at pm. On the other hand, it is very options-focused, and there is only limited fundamental data available. In finance, cash equivalents along with cash itself are one of the principal asset classes. There are derivatives-focused tools and calculators, with an emphasis on calculating the probability of profit of a particular options strategy.

Lucia St. Cost Basis Original price paid for a stock, plus any commissions or fees. Float Refers to all the shares in a company that may be owned and traded by the public. Everything you find on BrokerChooser is based on reliable data and unbiased information. A contrarian trading approach that expresses a bearish short view when an asset price is rising. Cash In finance, cash along with cash equivalents is one of the principal asset classes. Therefore, the terms debit spread or credit spread further characterize the nature of the trade. Popular Courses. Algo trading strategies 2020 the machine gun way to create fibonacci retracement examples Date The date by which an investor needs to own a stock in order to receive the dividend. Ex-Dividend Date The date investors buying the stock will no longer receive the dividend. Dion Rozema. The people behind Tastyworks are the same experts who built thinkorswim, now operated by TD Ameritrade. Although, if you want to deal with something other than the aforementioned investment types, this platform is not for you. This is where buying into strength, selling into weakness comes from - it is a contrarian way of thinking. Call Option An option that gives the holder the right to buy stock at a specific price. Watchlists are easy to create and charts are smooth and interactive. On the other mq4 no repaint indicator advanced orders 1st trg 3 oco, it has not been listed in xmr eth tradingview does tradingview support nepal stock data Stock exchange, and it does not offer negative balance protection.

Some may find this platform lacking when it comes to investment types but active options, stocks, and futures traders can save a bundle when trading on Tastyworks. A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. A trading strategy, or part of a broader strategy, that attempts to offset financial exposure through the deployment of one or more additional positions. The Watchlist tab is where you can built out a list of stocks, ETFs, or futures you want to monitor for potential trading opportunities. It will help you to see how different parameters will affect your positions and ultimately you can make better trading decisions with that information. Includes cash and margin. Beta-weighted delta is one of the most important metrics to understand for your options trading portfolio. A class of marketable securities. Let me explain. Tastyworks is a young, up-and-coming US broker focusing on options trading. Mastering Beta-Weighted Delta Beta-weighted delta is one of the most important metrics to understand for your options trading portfolio. Tastyworks platform can be used for trading futures and options and stocks. Earnings per share EPS is a key financial metric used by investors and traders to analyze the profitability of a company. A pessimistic outlook on the price of an asset. Butterfly Spread A 3-strike price spread that profits from the underlying expiring at a specific price. Trade setups we use during times of rich option prices. These can be commissions , spreads , financing rates and conversion fees.

Compare to other brokers. His aim is to make personal investing crystal clear for everybody. Delta shows risk or probability for a particular strike price. Also, the client can set up push notifications, emails and text messages, if they are in the US. Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. FOK orders are immediately filled in their entirety, otherwise they are automatically cancelled. GTC designated orders automatically expire calendar days after they are entered. Spreads may also be done for even no cash is exchanged , or for a debit cash is debited from your trading account. You can pick between the natural price and the mid price. There's nothing in the way of life event coaching or long-term financial planning. You can watch live video for most of the trading day and then look through the video archive for more. Leverage The use of a small amount of money to control a large number of securities. Day traders who deal with stocks, futures, and options will find this platform full of awesome perks. The date investors buying the stock will no longer receive the dividend. Cover To close out an existing position.